Key Insights

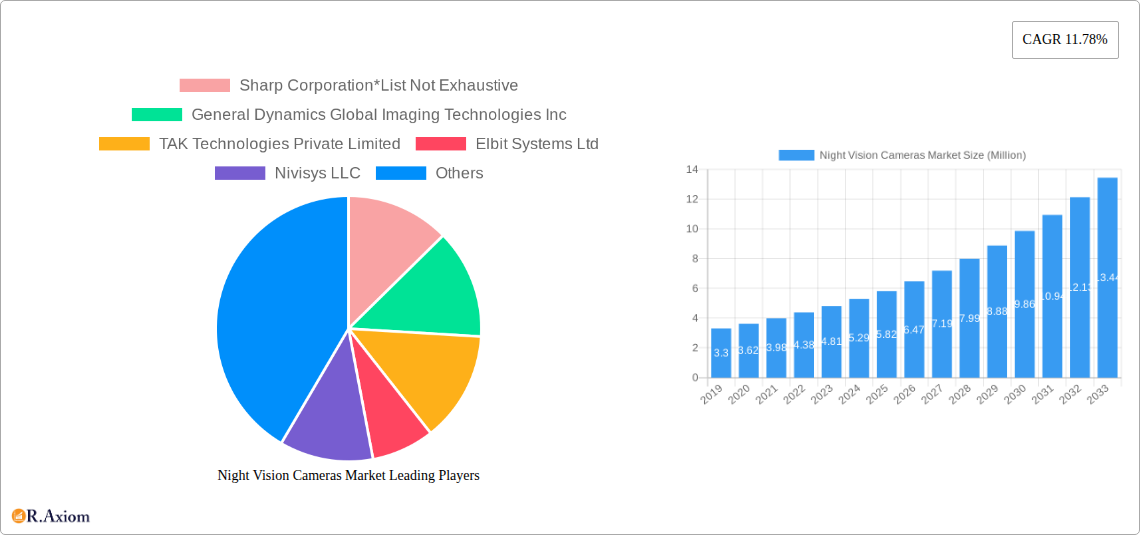

The global Night Vision Cameras Market is poised for significant expansion, with a projected market size of USD 5.82 billion in 2025, expected to surge to approximately USD 11.08 billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 11.78%. This impressive growth is fueled by escalating demand for enhanced surveillance and security solutions across various sectors, including military and defense, industrial operations, and public infrastructure. The increasing adoption of advanced technologies like thermal imaging and image intensification within night vision systems is a key catalyst. Furthermore, the growing threat landscape and the need for round-the-clock operational capabilities in challenging environments are propelling market penetration. Innovations in sensor technology, miniaturization of devices, and integration with AI and IoT are expected to further boost market adoption and create new revenue streams. The military and defense segment, driven by national security imperatives and ongoing geopolitical developments, is anticipated to remain a dominant force. However, the industrial sector, leveraging night vision for improved safety and efficiency in areas like manufacturing, mining, and infrastructure inspection, will also contribute substantially to market growth.

Night Vision Cameras Market Market Size (In Million)

Despite the promising outlook, certain factors may influence the market's trajectory. The high initial cost of sophisticated night vision systems and the need for specialized training for effective deployment could present challenges. Moreover, evolving regulatory frameworks and the development of alternative surveillance technologies might introduce competitive pressures. Nevertheless, the undeniable benefits of night vision capabilities in low-light and no-light conditions, spanning enhanced situational awareness, improved decision-making, and increased operational effectiveness, are expected to outweigh these restraints. The market is characterized by continuous research and development efforts aimed at improving image quality, reducing power consumption, and enhancing user-friendliness. Strategic collaborations and mergers and acquisitions among key players are also shaping the competitive landscape, as companies strive to broaden their product portfolios and expand their global reach. The increasing focus on homeland security and border surveillance, coupled with the growing application of night vision in automotive safety and wildlife monitoring, are emerging trends that will further fuel market expansion in the forecast period.

Night Vision Cameras Market Company Market Share

Night Vision Cameras Market Market Concentration & Innovation

The night vision cameras market exhibits a moderate level of concentration, with a blend of established defense contractors and emerging technology companies vying for market share. Innovation is a key differentiator, driven by advancements in sensor technology, image processing, and miniaturization. The market is shaped by stringent regulatory frameworks, particularly for military and law enforcement applications, influencing product design and performance standards. Product substitutes, such as thermal imaging cameras, offer alternative solutions for low-light surveillance, though night vision cameras maintain distinct advantages in specific use cases. End-user trends highlight a growing demand for enhanced surveillance capabilities across civilian sectors, complementing traditional military applications. Mergers and acquisitions (M&A) activities are observed as key players seek to expand their product portfolios and geographical reach, with recent M&A deal values estimated in the tens of millions of dollars.

- Market Share Dynamics: Dominated by a few large players in the military segment, with increasing fragmentation in the consumer and industrial markets.

- Innovation Drivers: Advancements in CMOS sensors, AI-powered image enhancement, and integration with IoT devices.

- Regulatory Impact: Strict export controls and performance requirements for defense-grade equipment.

- M&A Activities: Strategic acquisitions to gain access to new technologies and customer bases.

Night Vision Cameras Market Industry Trends & Insights

The global night vision cameras market is poised for significant growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This upward trajectory is fueled by escalating security concerns worldwide, coupled with rapid technological advancements in imaging and sensor technology. The increasing adoption of night vision capabilities in non-traditional sectors like automotive, public safety, and even residential security is a pivotal trend. Manufacturers are continuously innovating, moving towards more compact, power-efficient, and feature-rich devices. The integration of artificial intelligence (AI) for enhanced image processing, object detection, and reduced noise in low-light conditions is becoming a standard. Furthermore, the development of color night vision technology, which offers more detailed and recognizable imagery compared to traditional monochrome outputs, is gaining traction, especially in surveillance and wildlife monitoring applications. The market penetration of night vision cameras is steadily increasing across various end-user segments as the cost of sophisticated technology becomes more accessible. Consumer preferences are shifting towards user-friendly interfaces, wireless connectivity, and seamless integration with smart home ecosystems. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on delivering high-resolution, reliable, and affordable night vision solutions. The demand for specialized night vision systems for applications such as border surveillance, search and rescue operations, and autonomous vehicle navigation further bolsters market expansion. The evolving geopolitical landscape and the persistent threat of criminal activities are also significant contributors to the sustained demand for advanced surveillance and observation tools, including sophisticated night vision cameras.

Dominant Markets & Segments in Night Vision Cameras Market

The night vision cameras market is experiencing dominant growth in the Military and Defense end-user segment, driven by ongoing geopolitical tensions and the need for enhanced battlefield awareness and surveillance capabilities. This segment accounts for a substantial portion of the market share, estimated at over 45% in 2025.

- Military and Defense:

- Key Drivers: Increased defense spending globally, demand for advanced tactical surveillance equipment, border security initiatives, and counter-terrorism operations.

- Dominance Factors: Necessity for superior low-light performance in hostile environments, integration with other defense systems, and stringent performance requirements necessitating advanced technology.

- Market Size Projection: Expected to reach approximately USD 8,500 million by 2033.

The Public and Residential Infrastructure segment is emerging as a rapidly growing area, fueled by increasing concerns about urban security, crime prevention, and the desire for enhanced home surveillance. The penetration of smart home devices and the availability of more affordable, user-friendly night vision cameras are key accelerators.

- Public and Residential Infrastructure:

- Key Drivers: Rising urban crime rates, demand for smart home security solutions, increased adoption of surveillance systems in public spaces, and government initiatives for safer cities.

- Dominance Factors: Growing consumer awareness of security needs, integration with alarm systems, and remote monitoring capabilities.

- Market Size Projection: Projected to exhibit a CAGR of over 8.0% during the forecast period.

In terms of Type, Wireless Night Vision Cameras are gaining significant traction due to their ease of installation, flexibility, and integration with modern wireless networks, capturing an estimated market share of around 60% in 2025.

- Wireless Night Vision Cameras:

- Key Drivers: Ease of deployment without extensive wiring, compatibility with Wi-Fi and mobile networks, and suitability for diverse installation locations.

- Dominance Factors: Consumer preference for convenient and adaptable security solutions.

- Market Size Projection: Expected to be the leading segment by revenue.

The Industrial segment also presents substantial opportunities, driven by the need for continuous monitoring in hazardous environments, oil and gas exploration, mining operations, and critical infrastructure protection where low-light conditions are prevalent.

- Industrial:

- Key Drivers: Demand for remote monitoring in hazardous and low-light industrial settings, asset protection, and operational efficiency.

- Dominance Factors: Requirement for ruggedized and specialized night vision solutions for specific industrial applications.

- Market Size Projection: Growing steadily with investments in industrial automation and safety.

Night Vision Cameras Market Product Developments

Product development in the night vision cameras market is characterized by a strong focus on enhancing image quality and expanding functionalities. Innovations include the adoption of advanced CMOS and CCD sensors for improved low-light sensitivity and resolution, alongside sophisticated image processing algorithms that reduce noise and enhance detail. The emergence of color night vision technology is a significant trend, offering users more recognizable and informative visuals in dark conditions. Miniaturization and power efficiency are also key development areas, enabling the integration of night vision capabilities into smaller devices and extending battery life. Competitive advantages are being derived from increased integration with AI for intelligent analysis, wider fields of view, and enhanced connectivity options, catering to both professional and consumer markets.

Report Scope & Segmentation Analysis

The Night Vision Cameras Market report offers a comprehensive segmentation analysis covering critical aspects of the industry. The segmentation includes:

- Type: The market is divided into Wired Night Vision Cameras and Wireless Night Vision Cameras. Wired cameras offer stable connectivity and power, often favored for fixed installations, while wireless cameras provide flexibility and ease of deployment. Growth projections indicate a strong upward trend for wireless variants.

- End User: Key end-user segments include Military and Defense, Industrial, Public and Residential Infrastructure, Transportation, Research, and Other End Users. Each segment presents unique demand drivers and growth potential, with Military and Defense currently holding the largest market share, while Public and Residential Infrastructure shows rapid expansion. Market sizes and competitive dynamics vary significantly across these categories.

Key Drivers of Night Vision Cameras Market Growth

Several key drivers are propelling the night vision cameras market forward. The escalating global security concerns and the persistent need for effective surveillance in low-light conditions remain primary motivators. Advancements in imaging technologies, such as the development of high-sensitivity sensors and AI-powered image enhancement, are making night vision more accessible and effective. Furthermore, the increasing adoption of night vision in non-traditional sectors, including automotive for enhanced driving safety, residential security for improved home monitoring, and industrial applications for operational efficiency in challenging environments, is significantly boosting demand. Government investments in defense and border security also play a crucial role.

Challenges in the Night Vision Cameras Market Sector

Despite robust growth, the night vision cameras market faces several challenges. High initial costs associated with advanced technologies can be a barrier to entry for some consumer and smaller industrial applications. Regulatory hurdles and strict export controls, particularly for military-grade equipment, can impact global market accessibility. Supply chain disruptions and the reliance on specialized components can also pose risks to production and pricing. Moreover, competition from alternative low-light imaging technologies, such as thermal cameras, necessitates continuous innovation to maintain market differentiation. The need for specialized training for optimal use of certain professional-grade night vision systems can also limit widespread adoption.

Emerging Opportunities in Night Vision Cameras Market

Emerging opportunities within the night vision cameras market are diverse and promising. The continued miniaturization and cost reduction of technology are opening doors for wider consumer adoption in areas like hunting, wildlife observation, and recreational activities. The automotive sector presents a significant opportunity with the integration of night vision systems into vehicles to enhance driver safety. Furthermore, advancements in AI and machine learning are enabling more sophisticated object recognition and tracking capabilities, creating demand for intelligent surveillance solutions in smart cities and critical infrastructure protection. The growing trend of remote sensing and monitoring in industries like agriculture and environmental research also offers new avenues for specialized night vision camera applications.

Leading Players in the Night Vision Cameras Market Market

- Sharp Corporation

- General Dynamics Global Imaging Technologies Inc

- TAK Technologies Private Limited

- Elbit Systems Ltd

- Nivisys LLC

- Rockwell Collins Inc

- Harris Corporation

- BAE Systems PLC

- Intevac Inc

- Tactical Night Vision Company Inc

- Panasonic Corporation

- FLIR Systems Inc

- Photonis

- Sony Corporation

Key Developments in Night Vision Cameras Market Industry

- October 2023: Google is in the process of implementing a solution to address the issue of blurry night vision on select Nest Cam models. According to a statement provided to 9to5Google, the fix is currently being deployed to the battery-powered Nest Cam model, the battery-powered Nest Doorbell, and the second-generation wired Nest Doorbell.

- August 2023: ROVAOM has announced the launch of its 4K color night vision camera, available for just USD 249. The camera boasts an impressive 4K UHD video recording feature, enabling users to capture clear and vibrant images, even in low-light conditions. Whether you are engaging in outdoor activities, observing wildlife, or monitoring security, the ROVAOM camera guarantees to provide you with authentic, vivid, and lifelike visuals.

Strategic Outlook for Night Vision Cameras Market Market

The strategic outlook for the night vision cameras market is characterized by sustained growth, driven by technological innovation and expanding application horizons. Key growth catalysts include the relentless pursuit of enhanced imaging capabilities, such as higher resolution, improved low-light sensitivity, and the integration of AI for intelligent analysis. The increasing demand for reliable surveillance solutions across military, public safety, industrial, and even consumer sectors will continue to fuel market expansion. Strategic focus areas for companies will include developing cost-effective solutions, expanding into emerging geographical markets, and forming partnerships to integrate night vision technology into broader smart ecosystem solutions. The market is ripe for advancements that enhance user experience, portability, and overall functionality.

Night Vision Cameras Market Segmentation

-

1. Type

- 1.1. Wired Night Vision Cameras

- 1.2. Wireless Night Vision Cameras

-

2. End User

- 2.1. Military and Defense

- 2.2. Industrial

- 2.3. Public and Residential Infrastructure

- 2.4. Transportation

- 2.5. Research

- 2.6. Other End Users

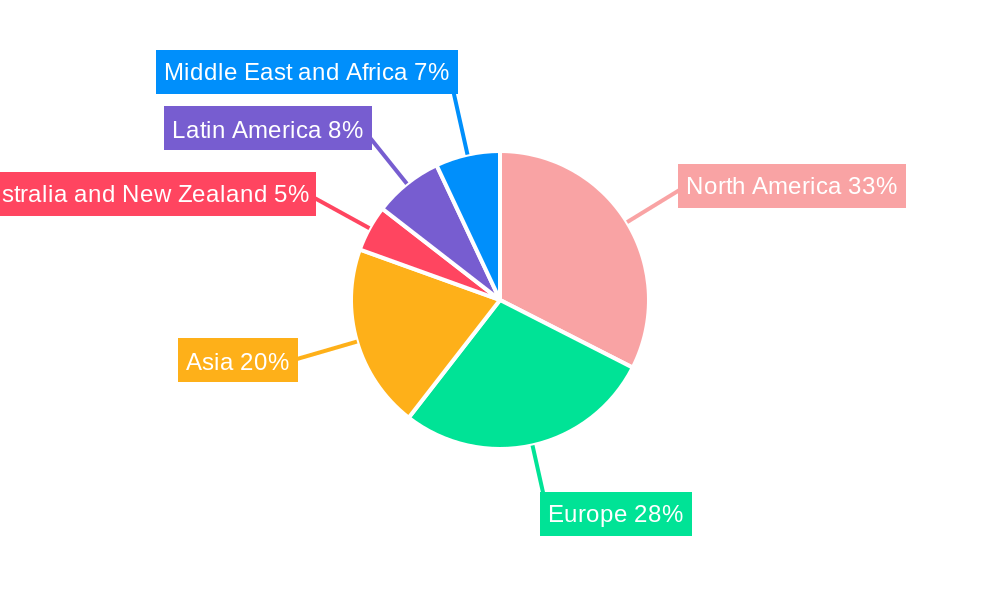

Night Vision Cameras Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Night Vision Cameras Market Regional Market Share

Geographic Coverage of Night Vision Cameras Market

Night Vision Cameras Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Advanced Surveillance Technology; Automotive Night Vision Applications

- 3.3. Market Restrains

- 3.3.1. Targetting through Transparent Obstacles

- 3.4. Market Trends

- 3.4.1. Military and Defense Segment is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired Night Vision Cameras

- 5.1.2. Wireless Night Vision Cameras

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Military and Defense

- 5.2.2. Industrial

- 5.2.3. Public and Residential Infrastructure

- 5.2.4. Transportation

- 5.2.5. Research

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired Night Vision Cameras

- 6.1.2. Wireless Night Vision Cameras

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Military and Defense

- 6.2.2. Industrial

- 6.2.3. Public and Residential Infrastructure

- 6.2.4. Transportation

- 6.2.5. Research

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired Night Vision Cameras

- 7.1.2. Wireless Night Vision Cameras

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Military and Defense

- 7.2.2. Industrial

- 7.2.3. Public and Residential Infrastructure

- 7.2.4. Transportation

- 7.2.5. Research

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired Night Vision Cameras

- 8.1.2. Wireless Night Vision Cameras

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Military and Defense

- 8.2.2. Industrial

- 8.2.3. Public and Residential Infrastructure

- 8.2.4. Transportation

- 8.2.5. Research

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired Night Vision Cameras

- 9.1.2. Wireless Night Vision Cameras

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Military and Defense

- 9.2.2. Industrial

- 9.2.3. Public and Residential Infrastructure

- 9.2.4. Transportation

- 9.2.5. Research

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired Night Vision Cameras

- 10.1.2. Wireless Night Vision Cameras

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Military and Defense

- 10.2.2. Industrial

- 10.2.3. Public and Residential Infrastructure

- 10.2.4. Transportation

- 10.2.5. Research

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Night Vision Cameras Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wired Night Vision Cameras

- 11.1.2. Wireless Night Vision Cameras

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Military and Defense

- 11.2.2. Industrial

- 11.2.3. Public and Residential Infrastructure

- 11.2.4. Transportation

- 11.2.5. Research

- 11.2.6. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Sharp Corporation*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 General Dynamics Global Imaging Technologies Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 TAK Technologies Private Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Elbit Systems Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nivisys LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rockwell Collins Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Harris Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BAE Systems PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intevac Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tactical Night Vision Company Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Panasonic Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 FLIR Systems Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Photonis

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sony Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Sharp Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Night Vision Cameras Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Australia and New Zealand Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Australia and New Zealand Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Night Vision Cameras Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Night Vision Cameras Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Night Vision Cameras Market Revenue (Million), by End User 2025 & 2033

- Figure 35: Middle East and Africa Night Vision Cameras Market Revenue Share (%), by End User 2025 & 2033

- Figure 36: Middle East and Africa Night Vision Cameras Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Night Vision Cameras Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Night Vision Cameras Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Night Vision Cameras Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Night Vision Cameras Market Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Night Vision Cameras Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Night Vision Cameras Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the Night Vision Cameras Market?

Key companies in the market include Sharp Corporation*List Not Exhaustive, General Dynamics Global Imaging Technologies Inc, TAK Technologies Private Limited, Elbit Systems Ltd, Nivisys LLC, Rockwell Collins Inc, Harris Corporation, BAE Systems PLC, Intevac Inc, Tactical Night Vision Company Inc, Panasonic Corporation, FLIR Systems Inc, Photonis, Sony Corporation.

3. What are the main segments of the Night Vision Cameras Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Advanced Surveillance Technology; Automotive Night Vision Applications.

6. What are the notable trends driving market growth?

Military and Defense Segment is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Targetting through Transparent Obstacles.

8. Can you provide examples of recent developments in the market?

October 2023: Google is in the process of implementing a solution to address the issue of blurry night vision on select Nest Cam models. According to a statement provided to 9to5Google, the fix is currently being deployed to the battery-powered Nest Cam model, the battery-powered Nest Doorbell, and the second-generation wired Nest Doorbell.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Night Vision Cameras Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Night Vision Cameras Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Night Vision Cameras Market?

To stay informed about further developments, trends, and reports in the Night Vision Cameras Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence