Key Insights

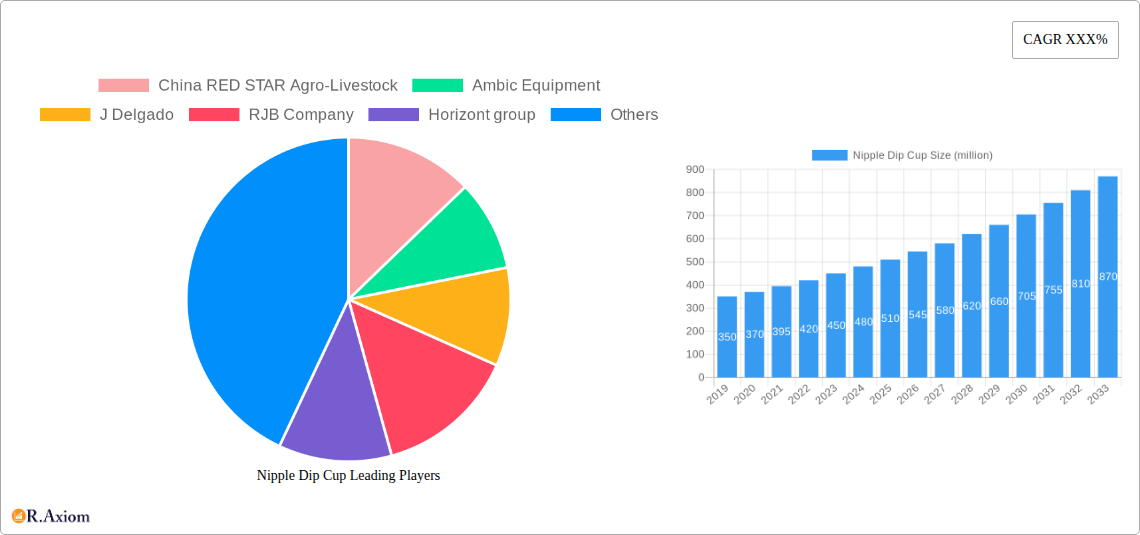

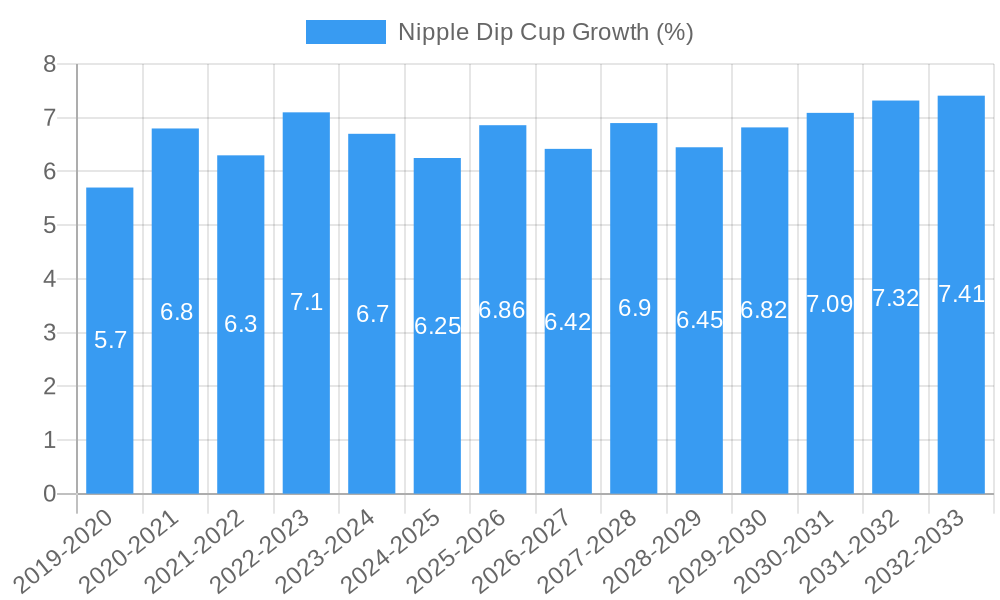

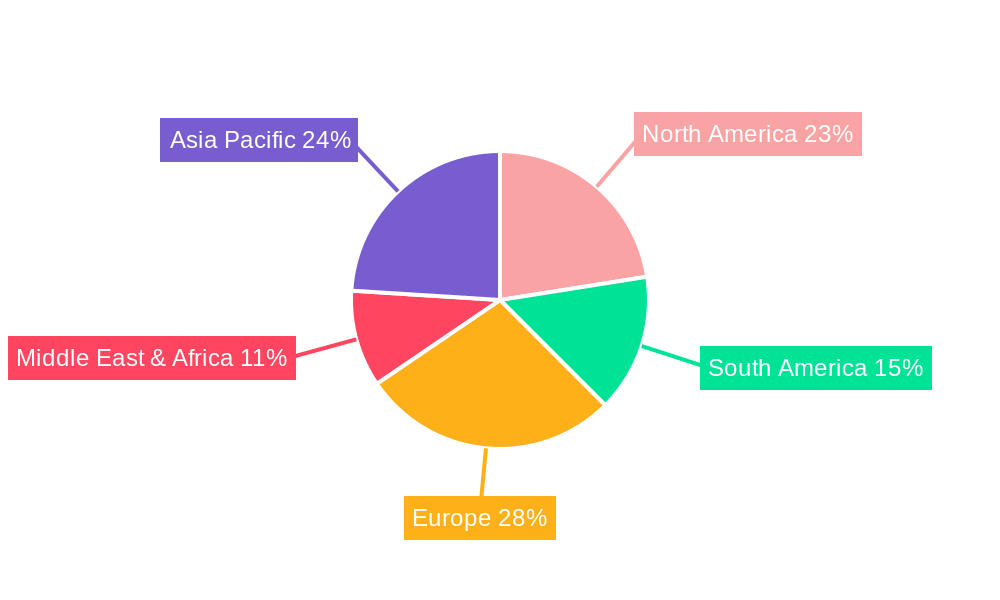

The global Nipple Dip Cup market is poised for significant expansion, projected to reach an estimated market size of $550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% expected through 2033. This upward trajectory is primarily fueled by the increasing global demand for livestock products, driven by a growing population and rising disposable incomes. Modern agricultural practices are increasingly emphasizing animal health and productivity, leading to greater adoption of advanced animal husbandry tools like nipple dip cups, which are crucial for hygiene and disease prevention in dairy and beef cattle, as well as sheep. The market's growth is further bolstered by technological advancements in materials science, leading to the development of more durable, efficient, and cost-effective dip cup solutions. Innovations in design, such as improved dispensing mechanisms and enhanced antiseptic efficacy, are also contributing to market penetration. The Asia Pacific region, particularly China and India, is emerging as a key growth engine due to its rapidly expanding livestock sector and increasing investment in modern farming infrastructure.

The market is segmented into various applications, with Cattle holding the dominant share, followed by Sheep and then 'Others' which encompasses poultry and other farm animals. This segmentation reflects the extensive use of nipple dip cups in large-scale cattle operations for post-milking teat dipping, a critical practice for mastitis prevention. In terms of type, Grass and Aluminum dominate the current market, with Plastic gaining traction due to its lightweight nature and cost-effectiveness. Restraints to market growth include the initial investment costs for some advanced systems and the availability of alternative teat dipping methods, although the efficacy and widespread acceptance of nipple dip cups are expected to mitigate these challenges. Emerging trends point towards the development of smart, automated dip cup systems that offer greater precision in application and real-time data on herd health, further enhancing their appeal to technologically-driven agricultural enterprises. The market is characterized by the presence of several key players, including China RED STAR Agro-Livestock, Ambic Equipment, and Horizont group, who are actively engaged in product innovation and geographical expansion to capture market share.

Nipple Dip Cup Market Concentration & Innovation

The global nipple dip cup market exhibits a moderate concentration, with a few key players like China RED STAR Agro-Livestock, Ambic Equipment, J Delgado, RJB Company, Horizont group, and Interpuls holding significant market share, estimated in the hundreds of millions. Innovation in this sector is primarily driven by the increasing demand for efficient and hygienic udder care solutions in livestock farming, particularly for cattle and sheep. Regulatory frameworks, such as those concerning animal welfare and food safety, play a crucial role in shaping product development and adoption. The market is also influenced by the availability of product substitutes, including manual application methods and alternative udder health treatments, though nipple dip cups offer distinct advantages in ease of use and uniform application. End-user trends indicate a growing preference for automated and user-friendly systems, pushing manufacturers towards more ergonomic designs and advanced material choices like durable plastics and specialized aluminum alloys. Merger and acquisition activities, while not extensively reported, are expected to contribute to market consolidation, with estimated deal values potentially reaching tens of millions. The overall market innovation is projected to continue its upward trajectory, reflecting a strong commitment to improving animal health and farm productivity.

Nipple Dip Cup Industry Trends & Insights

The nipple dip cup industry is experiencing robust growth, fueled by an escalating global demand for dairy and meat products, which directly translates into an increased focus on animal health and farm productivity. The Compound Annual Growth Rate (CAGR) for the nipple dip cup market is projected to be between 5% and 7% over the forecast period of 2025–2033. Technological disruptions are at the forefront of industry evolution, with advancements in material science leading to the development of more durable, lightweight, and chemically resistant plastic and aluminum nipple dip cups. Automated application systems are gaining traction, offering unparalleled precision and speed compared to manual methods, thereby reducing labor costs and improving the consistency of disinfectant application. Consumer preferences are shifting towards solutions that enhance animal welfare and reduce the risk of mastitis and other udder infections. This has led to a surge in demand for high-quality, reliable udder dipping solutions. Market penetration of advanced nipple dip cups is expected to rise significantly, especially in developed agricultural economies. Competitive dynamics are characterized by intense product differentiation and a focus on providing comprehensive udder care solutions. Companies are investing heavily in research and development to introduce innovative designs that minimize product waste and maximize efficacy. The integration of smart technologies for monitoring dipping cycles and disinfectant levels is an emerging trend that promises to revolutionize farm management practices. The emphasis on biosecurity in livestock farming further underpins the market’s upward trajectory.

Dominant Markets & Segments in Nipple Dip Cup

The Cattle segment undeniably dominates the nipple dip cup market, accounting for an estimated 70% of the total market value. This dominance is driven by the sheer scale of the global cattle population and the critical importance of mastitis prevention in dairy herds, which significantly impacts milk production and quality. Key drivers of this segment's leadership include:

- Economic Policies: Government subsidies and incentives aimed at improving dairy farm profitability and sustainability directly influence the adoption of advanced udder care technologies.

- Infrastructure: The widespread availability of modern dairy farming infrastructure, including automated milking parlors, supports the seamless integration of nipple dip cup systems.

- Technological Advancements: Continuous innovation in cup design and disinfectant formulations tailored for cattle udders enhances efficacy and user convenience, further solidifying its market position.

The Sheep segment represents a growing, albeit smaller, portion of the market, with an estimated 20% market share. The increasing global demand for lamb and wool, coupled with a rising awareness of ovine udder health, are key growth factors.

- Growing Awareness: Farmers are increasingly recognizing the economic impact of udder infections in sheep, prompting investment in preventative measures.

- Specialized Designs: The development of sheep-specific nipple dip cups, designed for smaller teats and different milking practices, is expanding market reach.

The Others segment, encompassing goats and other livestock, holds approximately 10% of the market share but offers significant growth potential due to the diversification of livestock farming.

In terms of Type, Plastic nipple dip cups currently hold the largest market share, estimated at over 60%, due to their cost-effectiveness, durability, and ease of cleaning.

- Cost-Effectiveness: Plastic materials offer a lower manufacturing cost, making them accessible to a wider range of farmers.

- Durability and Hygiene: Advanced plastics are resistant to corrosion and can be easily sterilized, ensuring hygienic application.

- Lightweight Design: Plastic cups are lightweight, enhancing user comfort during repeated use.

Aluminum nipple dip cups, while representing a smaller segment (approximately 25% of the market), are valued for their superior durability and chemical resistance, making them a preferred choice in demanding environments.

- Enhanced Durability: Aluminum’s robust nature ensures a longer product lifespan, even under heavy use.

- Chemical Resistance: It offers excellent resistance to a wide range of udder disinfectants.

Grass type, referring to specialized formulations or application methods for grassland-based farming, is a nascent segment with less than 5% of the current market share, but shows promise for future expansion.

Nipple Dip Cup Product Developments

Recent product developments in the nipple dip cup market focus on enhancing user experience, improving disinfectant delivery, and ensuring animal welfare. Innovations include ergonomically designed cups that fit comfortably in the hand, reducing operator fatigue. Advancements in materials have led to the creation of more durable and chemically resistant plastic and aluminum cups. Furthermore, the development of integrated dipping systems that ensure precise and consistent disinfectant application is a key trend, minimizing waste and maximizing efficacy. These developments aim to streamline udder care practices, reduce the incidence of mastitis, and ultimately contribute to improved livestock health and farm productivity.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global nipple dip cup market, encompassing various segmentation parameters to provide a comprehensive overview. The Application segmentation includes Cattle, Sheep, and Others, offering insights into the specific needs and market dynamics of each livestock category. The Type segmentation further breaks down the market into Grass, Aluminum, and Plastic materials, highlighting the technological and material preferences influencing product adoption. Each segment is analyzed for its current market size, projected growth rates, and competitive landscape, offering detailed market intelligence for strategic decision-making.

Key Drivers of Nipple Dip Cup Growth

The growth of the nipple dip cup market is primarily propelled by the escalating global demand for animal protein, necessitating increased efficiency and productivity in livestock farming. This drives the adoption of advanced udder care solutions to prevent diseases like mastitis, which can significantly impact milk yields and animal health. Stringent regulatory frameworks focused on animal welfare and food safety also encourage the use of hygienic and reliable dipping systems. Technological advancements in material science and product design, leading to more durable, user-friendly, and cost-effective nipple dip cups, further fuel market expansion. The increasing awareness among farmers about the economic benefits of preventative udder care also plays a crucial role.

Challenges in the Nipple Dip Cup Sector

Despite the positive growth trajectory, the nipple dip cup sector faces several challenges. Fluctuations in raw material prices, particularly for plastics and aluminum, can impact manufacturing costs and profitability. Intense competition among a fragmented market base can lead to price wars, affecting profit margins. Furthermore, the adoption of advanced nipple dip cup systems can be hindered by the initial capital investment required, especially for small-scale farmers. Regulatory compliance in different regions can also pose a challenge, requiring manufacturers to adapt their products and processes accordingly. Supply chain disruptions, as experienced globally, can also impact the timely availability of raw materials and finished goods.

Emerging Opportunities in Nipple Dip Cup

Emerging opportunities in the nipple dip cup market lie in the development of smart, connected dipping systems that integrate with farm management software for real-time data monitoring and analysis. The growing demand for organic and sustainable farming practices presents an opportunity for eco-friendly material innovations and disinfectant formulations. Expansion into emerging economies with rapidly growing livestock sectors also offers significant untapped potential. Furthermore, the development of specialized nipple dip cups for niche livestock, such as goats and exotic animals, can open new avenues for market growth. The increasing focus on animal welfare and disease prevention globally will continue to drive demand for effective udder care solutions.

Leading Players in the Nipple Dip Cup Market

- China RED STAR Agro-Livestock

- Ambic Equipment

- J Delgado

- RJB Company

- Horizont group

- Interpuls

Key Developments in Nipple Dip Cup Industry

- 2023: Introduction of advanced antimicrobial plastics in nipple dip cup manufacturing, enhancing hygiene and longevity.

- 2023: Launch of new ergonomic nipple dip cup designs aimed at reducing farmer fatigue and improving application accuracy.

- 2022: Increased R&D investment in automated udder dipping systems for large-scale dairy operations.

- 2022: Expansion of product lines by key players to include sheep-specific nipple dip cups to cater to a growing niche market.

- 2021: Focus on developing biodegradable or recyclable materials for nipple dip cups to align with sustainability trends.

Strategic Outlook for Nipple Dip Cup Market

The strategic outlook for the nipple dip cup market remains highly optimistic, driven by the sustained global demand for dairy and meat products and an unwavering commitment to animal health and biosecurity. Future growth catalysts will include the continued integration of digital technologies for smarter farm management, the development of novel disinfectant delivery systems, and a greater emphasis on sustainable and eco-friendly product designs. Market players are expected to focus on expanding their geographical reach, particularly in developing agricultural economies, and on offering comprehensive udder care solutions that encompass both equipment and specialized consumables. The ongoing pursuit of improved farm productivity and animal welfare will ensure a robust and expanding market for innovative nipple dip cup solutions.

Nipple Dip Cup Segmentation

-

1. Application

- 1.1. Cattle

- 1.2. Sheep

- 1.3. Others

-

2. Type

- 2.1. Grass

- 2.2. Aluminum

- 2.3. Plastic

Nipple Dip Cup Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nipple Dip Cup REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cattle

- 5.1.2. Sheep

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Grass

- 5.2.2. Aluminum

- 5.2.3. Plastic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cattle

- 6.1.2. Sheep

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Grass

- 6.2.2. Aluminum

- 6.2.3. Plastic

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cattle

- 7.1.2. Sheep

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Grass

- 7.2.2. Aluminum

- 7.2.3. Plastic

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cattle

- 8.1.2. Sheep

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Grass

- 8.2.2. Aluminum

- 8.2.3. Plastic

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cattle

- 9.1.2. Sheep

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Grass

- 9.2.2. Aluminum

- 9.2.3. Plastic

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nipple Dip Cup Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cattle

- 10.1.2. Sheep

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Grass

- 10.2.2. Aluminum

- 10.2.3. Plastic

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China RED STAR Agro-Livestock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ambic Equipment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 J Delgado

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RJB Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Horizont group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Interpuls

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 China RED STAR Agro-Livestock

List of Figures

- Figure 1: Global Nipple Dip Cup Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Nipple Dip Cup Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Nipple Dip Cup Revenue (million), by Application 2024 & 2032

- Figure 4: North America Nipple Dip Cup Volume (K), by Application 2024 & 2032

- Figure 5: North America Nipple Dip Cup Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Nipple Dip Cup Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Nipple Dip Cup Revenue (million), by Type 2024 & 2032

- Figure 8: North America Nipple Dip Cup Volume (K), by Type 2024 & 2032

- Figure 9: North America Nipple Dip Cup Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Nipple Dip Cup Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Nipple Dip Cup Revenue (million), by Country 2024 & 2032

- Figure 12: North America Nipple Dip Cup Volume (K), by Country 2024 & 2032

- Figure 13: North America Nipple Dip Cup Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Nipple Dip Cup Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Nipple Dip Cup Revenue (million), by Application 2024 & 2032

- Figure 16: South America Nipple Dip Cup Volume (K), by Application 2024 & 2032

- Figure 17: South America Nipple Dip Cup Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Nipple Dip Cup Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Nipple Dip Cup Revenue (million), by Type 2024 & 2032

- Figure 20: South America Nipple Dip Cup Volume (K), by Type 2024 & 2032

- Figure 21: South America Nipple Dip Cup Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Nipple Dip Cup Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Nipple Dip Cup Revenue (million), by Country 2024 & 2032

- Figure 24: South America Nipple Dip Cup Volume (K), by Country 2024 & 2032

- Figure 25: South America Nipple Dip Cup Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Nipple Dip Cup Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Nipple Dip Cup Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Nipple Dip Cup Volume (K), by Application 2024 & 2032

- Figure 29: Europe Nipple Dip Cup Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Nipple Dip Cup Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Nipple Dip Cup Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Nipple Dip Cup Volume (K), by Type 2024 & 2032

- Figure 33: Europe Nipple Dip Cup Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Nipple Dip Cup Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Nipple Dip Cup Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Nipple Dip Cup Volume (K), by Country 2024 & 2032

- Figure 37: Europe Nipple Dip Cup Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Nipple Dip Cup Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Nipple Dip Cup Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Nipple Dip Cup Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Nipple Dip Cup Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Nipple Dip Cup Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Nipple Dip Cup Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Nipple Dip Cup Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Nipple Dip Cup Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Nipple Dip Cup Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Nipple Dip Cup Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Nipple Dip Cup Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Nipple Dip Cup Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Nipple Dip Cup Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Nipple Dip Cup Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Nipple Dip Cup Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Nipple Dip Cup Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Nipple Dip Cup Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Nipple Dip Cup Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Nipple Dip Cup Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Nipple Dip Cup Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Nipple Dip Cup Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Nipple Dip Cup Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Nipple Dip Cup Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Nipple Dip Cup Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Nipple Dip Cup Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nipple Dip Cup Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nipple Dip Cup Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Nipple Dip Cup Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Nipple Dip Cup Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Nipple Dip Cup Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Nipple Dip Cup Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Nipple Dip Cup Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Nipple Dip Cup Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Nipple Dip Cup Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Nipple Dip Cup Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Nipple Dip Cup Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Nipple Dip Cup Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Nipple Dip Cup Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Nipple Dip Cup Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Nipple Dip Cup Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Nipple Dip Cup Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Nipple Dip Cup Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Nipple Dip Cup Volume K Forecast, by Country 2019 & 2032

- Table 81: China Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Nipple Dip Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Nipple Dip Cup Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nipple Dip Cup?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Nipple Dip Cup?

Key companies in the market include China RED STAR Agro-Livestock, Ambic Equipment, J Delgado, RJB Company, Horizont group, Interpuls.

3. What are the main segments of the Nipple Dip Cup?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nipple Dip Cup," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nipple Dip Cup report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nipple Dip Cup?

To stay informed about further developments, trends, and reports in the Nipple Dip Cup, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence