Key Insights

The North American automotive camera market is projected for significant growth, driven by the increasing integration of Advanced Driver-Assistance Systems (ADAS) and consumer demand for advanced safety and convenience features. The market is estimated to reach $8.4 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 9% through the 2025-2033 forecast period. This expansion is primarily attributed to stringent government safety regulations, the rise of vehicle electrification, and advancements in sensor technology enabling features such as lane keeping assist, automatic emergency braking, and adaptive cruise control. The adoption of sensing cameras for object detection and drive cameras for recording further accelerates market penetration. Leading companies like Magna International Inc., Denso Corporation, and Robert Bosch GmbH are actively investing in R&D to innovate and secure substantial market share.

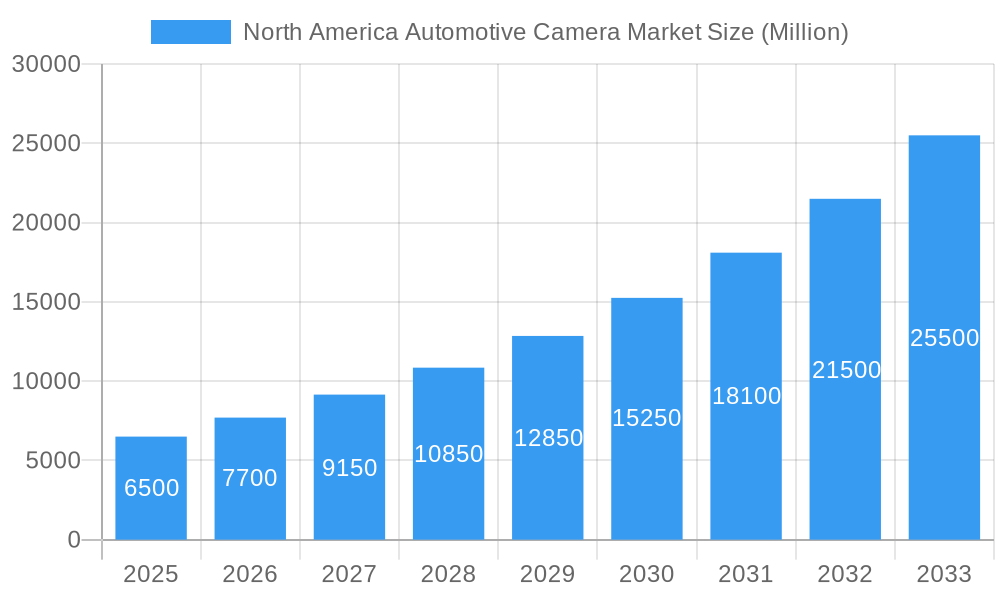

North America Automotive Camera Market Market Size (In Billion)

The market dynamics are shaped by a balance of growth drivers and restraints. While the widespread adoption of ADAS and parking assistance technologies is a key growth factor, challenges like the high cost of sophisticated camera systems and potential cybersecurity vulnerabilities may impede growth in specific segments. Nevertheless, the ongoing progression towards autonomous driving and the increasing complexity of vehicle electronics are expected to supersede these limitations. The North American region, comprising the United States, Canada, and Mexico, serves as a vital center for this market, supported by a robust automotive manufacturing infrastructure and an early adoption rate for technological innovations. Continuous advancements in camera technology, including higher resolution, wider fields of view, and enhanced performance in varied environmental conditions, will be crucial in defining the future trajectory of automotive cameras in the region.

North America Automotive Camera Market Company Market Share

North America Automotive Camera Market Market Concentration & Innovation

The North America automotive camera market exhibits a moderately concentrated landscape, driven by significant investments in research and development and a strong emphasis on technological innovation. Key players like Magna International Inc., Denso Corporation, and Continental AG are at the forefront, continually introducing advanced camera systems for ADAS and parking applications. Regulatory frameworks, particularly those promoting vehicle safety standards, act as a significant innovation driver, pushing manufacturers to integrate sophisticated camera technologies. The increasing demand for enhanced driver assistance systems (ADAS) and autonomous driving features fuels the development of high-resolution, AI-enabled cameras. Product substitutes, such as radar and lidar, exist, but automotive cameras offer a unique combination of visual data capture and cost-effectiveness, making them indispensable. End-user trends clearly favor increased safety and convenience features, directly impacting the demand for advanced camera functionalities. Mergers and acquisitions (M&A) are a notable strategy for market consolidation and technology acquisition. For instance, recent M&A activities have seen larger Tier-1 suppliers acquiring specialized camera technology startups to bolster their portfolios. Estimated M&A deal values in the automotive camera sector are in the hundreds of millions of dollars, reflecting the strategic importance of this segment. The market share of leading players remains substantial, with the top five companies accounting for approximately 60-70% of the total market value, projected to be around $8,500 Million in 2025.

North America Automotive Camera Market Industry Trends & Insights

The North America automotive camera market is experiencing robust growth, propelled by a confluence of technological advancements, evolving consumer preferences, and supportive regulatory mandates. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is an impressive 12.5%, with the market size estimated to reach approximately $18,000 Million by 2033, up from an estimated $8,500 Million in the base year of 2025. This growth is primarily fueled by the escalating adoption of Advanced Driver-Assistance Systems (ADAS) across various vehicle segments, from entry-level sedans to high-end SUVs. Features such as lane keeping assist, automatic emergency braking, adaptive cruise control, and surround-view parking systems are becoming standard, driving the demand for sophisticated drive cameras and sensing cameras.

Technological disruptions are a constant in this market. The miniaturization of camera components, coupled with advancements in image processing algorithms and artificial intelligence (AI), are enabling the development of more powerful and versatile camera solutions. Higher resolution sensors, improved low-light performance, and wider dynamic range are critical for effective perception in diverse driving conditions. The integration of machine learning for object recognition and scene understanding is a key trend, enhancing the capabilities of ADAS and paving the way for higher levels of vehicle automation.

Consumer preferences are increasingly leaning towards vehicles equipped with advanced safety and convenience features. The perceived safety benefits offered by camera-based ADAS, coupled with the convenience of advanced parking assist systems, are significant purchase decision factors for North American consumers. This shift in demand incentivizes automakers to incorporate more camera systems into their vehicle models, thereby expanding the market.

Competitive dynamics within the North America automotive camera market are intense. Major automotive suppliers, including Magna International Inc., Denso Corporation, Continental AG, and Robert Bosch GmbH, are engaged in a fierce race to develop and deploy cutting-edge camera technologies. Partnerships between OEMs and Tier-1 suppliers are crucial for co-development and integration of these systems. The market penetration of ADAS features is rapidly increasing, with projections indicating that over 75% of new vehicles sold in North America will be equipped with at least one ADAS feature by 2028. This pervasive integration underscores the critical role of automotive cameras in the future of mobility.

Dominant Markets & Segments in North America Automotive Camera Market

The North America automotive camera market is characterized by the pronounced dominance of the United States, which consistently accounts for the largest share of sales and adoption. Economic policies in the U.S., such as tax incentives for advanced vehicle technologies and strong consumer spending power, significantly bolster the automotive sector. Furthermore, robust infrastructure development and a high rate of vehicle ownership contribute to the country's leading position.

Dominant Segments by Type:

Drive Camera: Drive cameras, integral to ADAS functionalities like lane departure warning, forward collision warning, and traffic sign recognition, represent a substantial and growing segment. Their dominance is driven by stringent safety regulations and consumer demand for enhanced driving assistance. In 2025, the drive camera segment is estimated to capture over 60% of the total automotive camera market value, projected to be around $5,100 Million.

- Key Drivers:

- Mandatory ADAS feature integration in new vehicle safety standards.

- Increasing consumer awareness and demand for enhanced road safety.

- Technological advancements in AI and image processing for improved perception.

- Growth in long-haul trucking and commercial vehicle applications demanding sophisticated driver monitoring.

- Key Drivers:

Sensing Camera: Sensing cameras, crucial for applications such as surround-view systems, blind-spot detection, and autonomous parking, are another pivotal segment. Their market penetration is propelled by the increasing complexity of vehicle maneuvering and the drive towards semi-autonomous driving capabilities. The sensing camera segment is projected to account for approximately 40% of the market in 2025, estimated at $3,400 Million.

- Key Drivers:

- Consumer demand for convenience in parking and low-speed maneuvers.

- Technological advancements in 360-degree vision and object detection.

- Integration with other sensors for a comprehensive environmental perception.

- Growing popularity of premium vehicle features in the North American market.

- Key Drivers:

Dominant Segments by Application Type:

ADAS (Advanced Driver-Assistance Systems): ADAS applications are the primary growth engine for the North America automotive camera market. The increasing sophistication and widespread adoption of features like adaptive cruise control, automatic emergency braking, and lane-keeping assist are directly dependent on advanced camera systems. This segment is expected to dominate the market throughout the forecast period.

- Key Drivers:

- Government regulations prioritizing vehicle safety and accident reduction.

- Automaker competition to offer superior safety and convenience features.

- Advancements in sensor fusion and AI for enhanced perception capabilities.

- Rising insurance premiums for vehicles without advanced safety features.

- Key Drivers:

Parking: Parking camera systems, including rearview cameras and multi-camera surround-view systems, have witnessed significant growth. The ease of use and enhanced safety provided by these systems make them highly desirable for consumers, particularly in urban environments with limited parking space. This segment continues to see steady growth, driven by affordability and the mandated inclusion of rearview cameras in many regions.

- Key Drivers:

- Mandatory rearview camera regulations in many North American countries.

- Consumer demand for enhanced parking convenience and safety.

- Technological improvements leading to wider fields of view and higher resolution.

- Integration with parking assist and automated parking features.

- Key Drivers:

North America Automotive Camera Market Product Developments

Recent product developments in the North America automotive camera market are focused on enhancing imaging capabilities and intelligent perception. Innovations include higher resolution sensors (e.g., 2MP to 8MP) for greater detail in object detection and scene recognition, improved low-light and HDR (High Dynamic Range) performance to ensure visibility in challenging conditions, and integrated AI processors for on-board data analysis and faster decision-making. Developments also emphasize miniaturization for seamless integration into vehicle design and the creation of specialized cameras, such as thermal cameras for enhanced night vision and driver monitoring systems for increased occupant safety. These advancements aim to provide automotive manufacturers with more robust, efficient, and cost-effective camera solutions that drive the evolution of ADAS and autonomous driving.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America automotive camera market, segmenting it across key parameters to offer granular insights. The market is segmented by Type into Drive Camera and Sensing Camera. The Drive Camera segment is further analyzed for its role in various ADAS functions, with projected growth driven by increasing regulatory mandates for safety features and consumer demand for enhanced driving assistance. The Sensing Camera segment focuses on applications like surround-view systems and blind-spot monitoring, with growth fueled by advancements in object detection and the trend towards enhanced vehicle awareness.

The market is also segmented by Application Type into ADAS (Advanced Driver-Assistance Systems) and Parking. The ADAS segment is the primary growth driver, encompassing a wide array of safety and convenience features, with significant market size and robust growth projections due to rapid technological integration and regulatory push. The Parking segment, while already mature in some aspects, continues to expand with the integration of more sophisticated parking assist and automated parking functionalities, driven by consumer demand for convenience and safety in maneuvering.

Key Drivers of North America Automotive Camera Market Growth

The North America automotive camera market's growth is propelled by several interconnected factors. Foremost is the increasing implementation of ADAS features, driven by regulatory mandates and consumer demand for enhanced safety and convenience. Technological advancements in camera resolution, AI algorithms for object recognition, and sensor fusion are crucial enablers. Furthermore, the increasing sophistication of autonomous driving technologies necessitates advanced camera perception systems. Economic factors, such as rising disposable incomes and a strong automotive sales market in North America, also contribute significantly. Finally, OEMs' strategic focus on differentiating their vehicle offerings through advanced safety and technology features is a major catalyst for widespread camera adoption.

Challenges in the North America Automotive Camera Market Sector

Despite its strong growth trajectory, the North America automotive camera market faces several challenges. High development and integration costs associated with advanced camera systems can be a barrier, especially for smaller automakers or entry-level vehicle segments. Cybersecurity concerns surrounding camera data and system integrity are paramount, requiring robust protective measures. Supply chain disruptions, as evidenced by recent global events, can impact the availability and cost of critical camera components. Additionally, standardization and interoperability issues among different camera systems and automotive platforms can hinder seamless integration. The evolving regulatory landscape, while a driver, can also pose challenges due to varying compliance requirements across different regions and over time.

Emerging Opportunities in North America Automotive Camera Market

Emerging opportunities within the North America automotive camera market are significant and diverse. The continuous advancement in AI and machine learning for real-time data processing opens avenues for more sophisticated perception capabilities, including pedestrian and cyclist detection in complex urban environments. The burgeoning demand for in-cabin monitoring systems to enhance driver safety and personalization presents a new frontier. Furthermore, the development of high-definition and 3D imaging cameras is crucial for enabling higher levels of vehicle autonomy and advanced navigation. The growing trend of vehicle-to-everything (V2X) communication offers opportunities for camera systems to share information with external infrastructure and other vehicles, enhancing overall road safety. Lastly, the increasing adoption of over-the-air (OTA) updates for camera software presents a recurring revenue model and the ability to continuously improve camera functionality post-purchase.

Leading Players in the North America Automotive Camera Market Market

- Magna International Inc.

- Denso Corporation

- Continental AG

- Robert Bosch GmbH

- Valeo SA

- Panasonic Corporation

- ZF Friedrichshafen AG

- Gentex Corporation

- Hella KGaA Hueck & Co.

- Autoliv Inc.

Key Developments in North America Automotive Camera Market Industry

- 2023/Q4: Continental AG announced the development of its next-generation high-resolution automotive camera, offering enhanced object detection capabilities for ADAS.

- 2023/Q3: Magna International Inc. expanded its ADAS solutions portfolio with a new integrated camera and sensor module designed for improved surround-view perception.

- 2023/Q2: Denso Corporation partnered with a leading AI chip manufacturer to accelerate the integration of advanced AI processing into its automotive camera systems.

- 2023/Q1: Valeo SA introduced an innovative in-cabin camera system focused on driver monitoring and occupant safety, meeting evolving automotive safety standards.

- 2022/Q4: ZF Friedrichshafen AG acquired a stake in a specialized camera software company to bolster its AI-driven perception capabilities for autonomous driving.

- 2022/Q3: Robert Bosch GmbH unveiled a new compact camera module optimized for cost-effectiveness and integration into a wider range of vehicle models.

- 2022/Q2: Panasonic Corporation showcased its advanced automotive camera technologies, including high-dynamic-range imaging and predictive object recognition.

- 2022/Q1: Gentex Corporation highlighted its advancements in integrating camera functionalities within automotive mirrors, enhancing driver assistance features.

- 2021/Q4: Hella KGaA Hueck & Co. launched a new series of automotive cameras designed for robust performance in extreme weather conditions.

Strategic Outlook for North America Automotive Camera Market Market

The strategic outlook for the North America automotive camera market remains exceptionally positive, driven by the relentless pursuit of enhanced vehicle safety and the progression towards higher levels of automation. Key growth catalysts include the ongoing integration of sophisticated ADAS features into mainstream vehicles, fueled by both regulatory pressures and consumer demand for advanced driver assistance. The continuous evolution of AI and machine learning algorithms will empower camera systems with superior perception and decision-making capabilities, crucial for autonomous driving applications. Furthermore, the increasing emphasis on in-cabin monitoring and advanced driver safety technologies presents significant new market avenues. Strategic partnerships between OEMs, Tier-1 suppliers, and technology innovators will continue to be vital for co-development and rapid deployment of cutting-edge camera solutions, ensuring the market's robust expansion in the coming years.

North America Automotive Camera Market Segmentation

-

1. Type

- 1.1. Drive Camera

- 1.2. Sensing Camera

-

2. Application Type

- 2.1. ADAS

- 2.2. Parking

North America Automotive Camera Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Camera Market Regional Market Share

Geographic Coverage of North America Automotive Camera Market

North America Automotive Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis On Improving Vehicle Safety; Advancements in Camera Technologies; Others

- 3.3. Market Restrains

- 3.3.1. High Cost Of Camera System; Others

- 3.4. Market Trends

- 3.4.1. ADAS application is projected to lead the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drive Camera

- 5.1.2. Sensing Camera

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. ADAS

- 5.2.2. Parking

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delphi Automotive PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gentex Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hella KGaA Hueck & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch Gmb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friedrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: North America Automotive Camera Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Camera Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Camera Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Automotive Camera Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: North America Automotive Camera Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Camera Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Automotive Camera Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: North America Automotive Camera Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Camera Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Camera Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Camera Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Camera Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the North America Automotive Camera Market?

Key companies in the market include Magna International Inc, Denso Corporation, Delphi Automotive PLC, Gentex Corporation, Continental AG, Valeo SA, Hella KGaA Hueck & Co, Robert Bosch Gmb, Panasonic Corporation, ZF Friedrichshafen AG.

3. What are the main segments of the North America Automotive Camera Market?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis On Improving Vehicle Safety; Advancements in Camera Technologies; Others.

6. What are the notable trends driving market growth?

ADAS application is projected to lead the market.

7. Are there any restraints impacting market growth?

High Cost Of Camera System; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Camera Market?

To stay informed about further developments, trends, and reports in the North America Automotive Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence