Key Insights

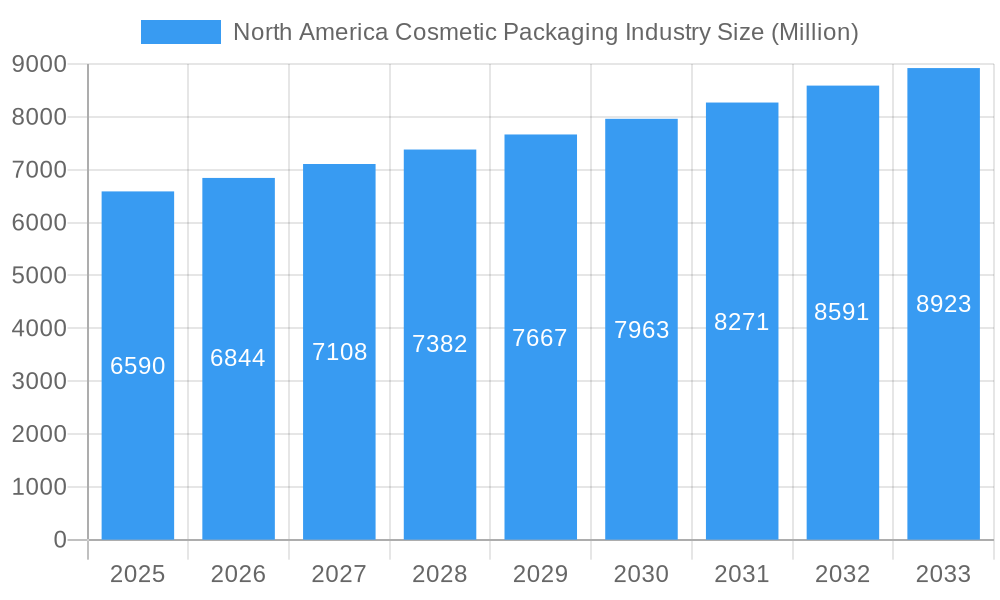

The North American cosmetic packaging market is poised for robust growth, projected to reach approximately USD 6.59 billion by 2025. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 3.90%, indicating sustained demand for innovative and sustainable packaging solutions across the beauty and personal care sectors. The market's dynamism is fueled by evolving consumer preferences, a growing emphasis on premiumization in cosmetic products, and the increasing influence of e-commerce, which necessitates durable and visually appealing packaging. Furthermore, the surge in demand for natural and organic cosmetic formulations is directly translating into a greater need for specialized packaging that preserves product integrity and aligns with eco-conscious branding. Key drivers include advancements in material science offering enhanced barrier properties and aesthetic appeal, as well as the continuous innovation in dispensing technologies that improve user experience and product application.

North America Cosmetic Packaging Industry Market Size (In Billion)

The segmentation of the North American cosmetic packaging market reveals a diverse landscape, with "Plastic Bottles & Containers" and "Flexible Plastic Packaging" likely holding substantial shares due to their versatility, cost-effectiveness, and adaptability to various product types, including hair care, color cosmetics, and skin care. However, a significant trend is the growing demand for sustainable materials like glass and metal, driven by consumer and regulatory pressures. This shift is prompting manufacturers to invest in recyclable and biodegradable options. The "Caps & Closures" segment is also critical, with innovations in pump and dispenser technologies enhancing product functionality and consumer convenience. Major industry players such as Berry Global Group, Amcor PLC, and Berlin Packaging LLC are actively investing in research and development to cater to these evolving demands, focusing on sustainable materials, smart packaging solutions, and customized designs to capture market share in this competitive environment.

North America Cosmetic Packaging Industry Company Market Share

Here is a detailed, SEO-optimized report description for the North America Cosmetic Packaging Industry, designed for immediate use without further modification.

North America Cosmetic Packaging Industry Market Concentration & Innovation

The North America cosmetic packaging market exhibits moderate concentration, with a significant presence of both global giants and specialized regional players. Key companies like Berry Global Group, Amcor PLC, and Silgan Holdings Inc. hold substantial market shares, estimated to be in the range of 10-15% each, contributing to an overall market value projected to reach $50,000 Million by 2025. Innovation is a critical differentiator, driven by the growing demand for sustainable solutions, personalized products, and enhanced consumer experiences. Regulatory frameworks, particularly concerning environmental impact and material safety, are shaping innovation trajectories, pushing manufacturers towards eco-friendly materials and recyclable designs. Product substitutes, such as refillable options and innovative dispensing systems, are emerging to address evolving consumer preferences and environmental concerns. Mergers and acquisitions (M&A) are playing a strategic role in market consolidation and technological advancement, with M&A deal values often ranging from $50 Million to $500 Million, allowing key players to expand their product portfolios and geographical reach. End-user trends favoring premiumization and minimalist aesthetics also influence packaging design and material choices.

North America Cosmetic Packaging Industry Industry Trends & Insights

The North America cosmetic packaging industry is experiencing robust growth, fueled by a confluence of dynamic market trends. The projected market size is estimated to reach $50,000 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025–2033. This growth is predominantly driven by the increasing disposable income and a burgeoning demand for premium and specialized cosmetic products across categories like skin care, color cosmetics, and hair care. Technological disruptions, particularly in material science and manufacturing processes, are reshaping the industry. The emphasis on sustainability is paramount, with a significant market penetration of eco-friendly packaging solutions, including recycled plastics, bio-based materials, and easily recyclable components. Consumer preferences are shifting towards brands that demonstrate environmental responsibility, leading to a rise in demand for minimalist designs, refillable packaging, and transparent labeling regarding material sourcing and recyclability. The competitive landscape is characterized by intense rivalry, with companies vying for market share through product innovation, strategic partnerships, and efficient supply chain management. The rise of direct-to-consumer (DTC) brands has also created new opportunities for flexible and customizable packaging solutions. Furthermore, the growing influence of social media and online beauty influencers is driving demand for visually appealing and Instagrammable packaging, pushing brands to invest in aesthetic differentiation. The increasing adoption of smart packaging technologies, offering enhanced traceability and consumer engagement features, is another emerging trend.

Dominant Markets & Segments in North America Cosmetic Packaging Industry

The North America cosmetic packaging industry is characterized by the dominance of specific regions, countries, and product segments. The United States stands as the leading market, driven by its large consumer base, high disposable income, and a well-established beauty and personal care industry. Canada also contributes significantly to the regional market.

Material Type Dominance:

- Plastic: This segment holds the largest market share due to its versatility, cost-effectiveness, and ability to be molded into various shapes and sizes. The market size for plastic packaging is estimated to be around $25,000 Million by 2025.

- Key Drivers: Lightweight nature, durability, design flexibility, and the ongoing advancements in recycled and bio-based plastics. The demand for plastic bottles and containers is particularly high.

- Glass: Valued for its premium appeal and inertness, glass packaging is prominent in luxury cosmetic segments. The market size for glass packaging is estimated to be around $10,000 Million by 2025.

- Key Drivers: Perceived quality, excellent barrier properties, recyclability, and aesthetic appeal in categories like perfumes and high-end skincare. Glass bottles and containers remain a popular choice.

- Metal: Utilized for specific product types such as aerosols and decorative compacts, metal packaging offers durability and a sleek appearance. The market size for metal packaging is estimated to be around $5,000 Million by 2025.

- Key Drivers: Strength, recyclability, and suitability for products requiring robust protection. Metal containers are essential for certain product formulations.

- Paper: Primarily used for secondary packaging like folding cartons and corrugated boxes, paper packaging is experiencing growth due to its eco-friendly attributes. The market size for paper packaging is estimated to be around $10,000 Million by 2025.

- Key Drivers: Sustainability, biodegradability, and cost-effectiveness for outer packaging solutions. Folding cartons and corrugated boxes are crucial for brand presentation and shipping.

Product Type Dominance:

- Plastic Bottles & Containers: This segment dominates due to its widespread application across all cosmetic categories.

- Key Drivers: Versatility, cost-efficiency, and innovation in dispensing technologies.

- Caps & Closures: Essential components, their innovation in child-resistance and tamper-evidence is crucial.

- Key Drivers: Functionality, safety, and aesthetic integration with primary packaging.

- Pump & Dispenser: These are crucial for hygiene and controlled application, especially in skincare and haircare.

- Key Drivers: Convenience, precise dosage control, and premium feel.

- Flexible Plastic Packaging: Gaining traction for its lightweight and customizable nature, especially in single-use sachets and pouches.

- Key Drivers: Cost-effectiveness, portability, and suitability for sampling and travel-sized products.

Cosmetic Type Dominance:

- Skin Care: This segment is the largest consumer of cosmetic packaging, driven by a diverse product range and continuous innovation.

- Key Drivers: High-value products, emphasis on ingredients, and consumer demand for specialized treatments.

- Color Cosmetics: Requires packaging that is both functional for application and visually appealing to consumers.

- Key Drivers: Trend-driven products, demand for innovative applicators, and aesthetically pleasing compacts and tubes.

- Hair Care: Characterized by a wide range of product formats, from bottles to pouches.

- Key Drivers: Product volume, ease of use, and sustainability concerns regarding large product sizes.

North America Cosmetic Packaging Industry Product Developments

Product innovation in the North America cosmetic packaging industry is primarily focused on sustainability and enhanced user experience. Companies are developing novel materials, such as Dow's SURLYN REN and SURLYN CIR ionomers, derived from biowaste and mixed plastic waste, respectively, for premium perfume and cosmetic packaging. These developments highlight a strong market push towards circular economy principles. Furthermore, advancements in dispensing mechanisms, such as airless pumps and precision applicators, are improving product efficacy and reducing waste. The integration of smart packaging technologies, including QR codes for product authentication and ingredient transparency, is also on the rise, offering consumers greater engagement and traceability. These innovations are crucial for brands to meet evolving consumer demands for eco-conscious and high-performance packaging solutions, providing a competitive edge in a crowded market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America cosmetic packaging market, encompassing detailed segmentation across key categories. The Plastic segment, estimated to reach $25,000 Million by 2025, is further broken down by product types including Plastic Bottles & Containers and Flexible Plastic Packaging, with a projected CAGR of 6.0% driven by demand for sustainability. The Glass segment, valued at $10,000 Million in 2025, includes Glass Bottles & Containers, showing a CAGR of 5.2% due to its premium appeal in skin care and color cosmetics. The Metal segment, estimated at $5,000 Million by 2025, covers Metal Containers, with a CAGR of 4.5%, essential for aerosol products. The Paper segment, expected to reach $10,000 Million by 2025, includes Folding Cartons and Corrugated Boxes, exhibiting a CAGR of 6.5% due to its eco-friendly attributes. Product types like Tubes & Sticks, Caps & Closures, Pump & Dispenser, Droppers, and Ampoules are analyzed across all material types, with significant growth projected for pumps and dispensers due to convenience and hygiene. Cosmetic types like Hair Care, Color Cosmetics, Skin Care, Men's Grooming, and Deodorants are examined, with Skin Care and Color Cosmetics leading in packaging demand and innovation.

Key Drivers of North America Cosmetic Packaging Industry Growth

Several key drivers are propelling the growth of the North America cosmetic packaging industry. The escalating consumer demand for sustainable and eco-friendly packaging solutions is paramount, encouraging the adoption of recycled content, biodegradable materials, and refillable options. Technological advancements in material science and manufacturing processes are enabling the creation of innovative, high-performance, and aesthetically pleasing packaging. The rising disposable income and an increasing focus on personal grooming and well-being, particularly in the skin care and color cosmetics sectors, are fueling market expansion. Furthermore, stringent environmental regulations and increasing consumer awareness regarding waste reduction are compelling manufacturers to invest in greener packaging alternatives. Strategic partnerships and collaborations, aimed at developing and implementing sustainable packaging initiatives, also contribute significantly to market growth.

Challenges in the North America Cosmetic Packaging Industry Sector

The North America cosmetic packaging industry faces several significant challenges that can hinder its growth trajectory. Stringent and evolving regulatory landscapes concerning material safety, recyclability, and waste management can impose increased compliance costs and necessitate substantial investment in research and development for new materials. Supply chain disruptions, exacerbated by global events and logistical complexities, can lead to increased lead times and higher raw material costs. Intense competition among a multitude of players, from established multinational corporations to nimble startups, puts pressure on pricing and necessitates continuous innovation to maintain market share. The fluctuating prices of raw materials, particularly petrochemicals for plastic production, can impact profitability. Moreover, the consumer perception of certain materials and the ongoing effort to balance sustainability with cost-effectiveness and product integrity present ongoing hurdles.

Emerging Opportunities in North America Cosmetic Packaging Industry

Emerging opportunities within the North America cosmetic packaging industry are abundant, driven by evolving consumer demands and technological advancements. The burgeoning demand for sustainable packaging presents a significant opportunity, with a growing market for refillable, compostable, and recycled materials. Innovations in smart packaging, such as QR codes for traceability and interactive consumer experiences, are creating new avenues for brand engagement. The expansion of e-commerce in the beauty sector necessitates lightweight, protective, and visually appealing shipping solutions. The increasing popularity of personalized beauty products opens doors for customizable and modular packaging designs. Furthermore, the growing men's grooming segment and the demand for inclusive beauty products are creating niche markets for specialized packaging. Strategic collaborations focused on circular economy initiatives and the development of novel dispensing technologies also represent promising growth avenues.

Leading Players in the North America Cosmetic Packaging Industry Market

- Berlin Packaging LLC

- Berry Global Group

- Rieke Corp

- AptarGroup Inc

- Quadpack Industries SA

- DS Smith PLC

- Amcor PLC

- Cosmopak Ltd

- Libo Cosmetics Company Ltd

- HCP Packaging Co Ltd

- Albea SA

- Silgan Holdings Inc

- Gerresheimer AG

Key Developments in North America Cosmetic Packaging Industry Industry

- October 2023: Dow, a US-based chemical company, launched two new sustainable ionomer grades, SURLYN REN and SURLYN CIR, for use in perfume and cosmetic packaging. SURLYN CIR is an ionomer grade made from mixed plastic waste, while its SURLYN REN grade is made using biowaste such as cooking oil. This development significantly boosts the availability of eco-friendly raw materials for premium cosmetic packaging.

- May 2023: Sephora and Pact Collective collaborated on the United States and Canadian launch of the Beauty (Re)Purposed collection program. The partnership is designed to simplify the recyclability scenario of many beauty packaging components and divert materials from landfills and oceans. This initiative is pivotal in promoting responsible end-of-life management for cosmetic packaging.

Strategic Outlook for North America Cosmetic Packaging Industry Market

The strategic outlook for the North America cosmetic packaging industry is overwhelmingly positive, driven by a confluence of powerful growth catalysts. The unwavering consumer preference for sustainable and environmentally responsible products will continue to shape innovation, spurring investment in recycled, bio-based, and refillable packaging solutions. Advancements in material science and manufacturing technologies will unlock new possibilities for functional, aesthetically pleasing, and cost-effective packaging. The expanding e-commerce landscape necessitates robust, lightweight, and visually engaging shipping solutions, creating further opportunities. Furthermore, the growing emphasis on personalization and premiumization within the beauty sector will drive demand for innovative and differentiated packaging designs. Companies that strategically align their operations with these trends, focusing on sustainability, technological integration, and consumer-centric solutions, are poised for significant growth and market leadership in the coming years.

North America Cosmetic Packaging Industry Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper

-

2. Product Type

- 2.1. Plastic Bottles & Containers

- 2.2. Glass Bottles & Containers

- 2.3. Metal Containers

- 2.4. Folding Cartons

- 2.5. Corrugated Boxes

- 2.6. Tubes & Sticks

- 2.7. Caps & Closures

- 2.8. Pump & Dispenser

- 2.9. Droppers

- 2.10. Ampoules

- 2.11. Flexible Plastic Packaging

-

3. Cosmetic Type

- 3.1. Hair Care

- 3.2. Color Cosmetics

- 3.3. Skin Care

- 3.4. Men's Grooming

- 3.5. Deodorants

- 3.6. Other Cosmetic Types

North America Cosmetic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cosmetic Packaging Industry Regional Market Share

Geographic Coverage of North America Cosmetic Packaging Industry

North America Cosmetic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Cosmetic Products; Increasing Focus on Innovation and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. Growing Sustainability Concerns

- 3.4. Market Trends

- 3.4.1. Glass Material is Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles & Containers

- 5.2.2. Glass Bottles & Containers

- 5.2.3. Metal Containers

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated Boxes

- 5.2.6. Tubes & Sticks

- 5.2.7. Caps & Closures

- 5.2.8. Pump & Dispenser

- 5.2.9. Droppers

- 5.2.10. Ampoules

- 5.2.11. Flexible Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 5.3.1. Hair Care

- 5.3.2. Color Cosmetics

- 5.3.3. Skin Care

- 5.3.4. Men's Grooming

- 5.3.5. Deodorants

- 5.3.6. Other Cosmetic Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berlin Packaging LLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rieke Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AptarGroup Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quadpack Industries SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DS Smith PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amcor PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cosmopak Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Libo Cosmetics Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HCP Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Albea SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Silgan Holdings Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Gerresheimer AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Berlin Packaging LLC*List Not Exhaustive

List of Figures

- Figure 1: North America Cosmetic Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Cosmetic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Cosmetic Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North America Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2020 & 2033

- Table 4: North America Cosmetic Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Cosmetic Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: North America Cosmetic Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Cosmetic Packaging Industry Revenue Million Forecast, by Cosmetic Type 2020 & 2033

- Table 8: North America Cosmetic Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Cosmetic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cosmetic Packaging Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the North America Cosmetic Packaging Industry?

Key companies in the market include Berlin Packaging LLC*List Not Exhaustive, Berry Global Group, Rieke Corp, AptarGroup Inc, Quadpack Industries SA, DS Smith PLC, Amcor PLC, Cosmopak Ltd, Libo Cosmetics Company Ltd, HCP Packaging Co Ltd, Albea SA, Silgan Holdings Inc, Gerresheimer AG.

3. What are the main segments of the North America Cosmetic Packaging Industry?

The market segments include Material Type, Product Type, Cosmetic Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Cosmetic Products; Increasing Focus on Innovation and Attractive Packaging.

6. What are the notable trends driving market growth?

Glass Material is Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

Growing Sustainability Concerns.

8. Can you provide examples of recent developments in the market?

October 2023: Dow, a US-based chemical company, launched two new sustainable ionomer grades, SURLYN REN and SURLYN CIR, for use in perfume and cosmetic packaging. SURLYN CIR is an ionomer grade made from mixed plastic waste, while its SURLYN REN grade is made using biowaste such as cooking oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cosmetic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cosmetic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cosmetic Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Cosmetic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence