Key Insights

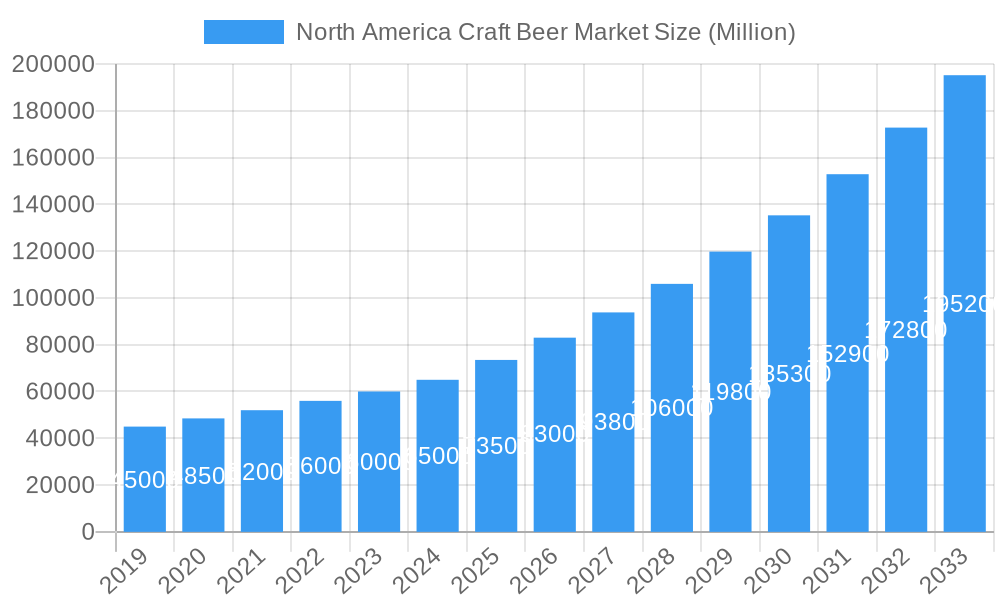

The North American craft beer market is projected for significant expansion, driven by a growing consumer demand for premium and diverse alcoholic beverages. With an estimated market size of $64.02 billion in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 8.61%, the industry is experiencing robust momentum. This growth is propelled by shifting consumer preferences towards artisanal products, unique flavor profiles, and the increasing popularity of specialty brews. Consumers are increasingly seeking craft beer experiences, both in on-trade establishments like bars and restaurants and through off-trade purchases for at-home consumption, facilitated by wider product availability and innovative packaging.

North America Craft Beer Market Market Size (In Billion)

Key growth catalysts for the North American craft beer market include rising disposable incomes across the United States, Canada, and Mexico, enabling greater consumer spending on premium beverages. Continuous product innovation, the proliferation of microbreweries, and the popularity of craft beer events are further expanding market reach and consumer engagement. However, challenges such as intense competition from alternative beverage categories like hard seltzers and ready-to-drink (RTD) cocktails, rising input costs, and evolving regulatory frameworks necessitate strategic adaptation by leading market participants including Anheuser-Busch InBev, Sierra Nevada Brewing Co., and Molson Coors Beverage Company.

North America Craft Beer Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America Craft Beer Market, covering historical data from 2019-2024, a 2025 base year, and forecasts through 2033. It incorporates essential market insights and high-traffic keywords for industry stakeholders, detailing market dynamics, competitive strategies, and future growth opportunities. The study features detailed segmentation by product type and distribution channel, along with an analysis of key industry advancements and prominent players.

North America Craft Beer Market Market Concentration & Innovation

The North America Craft Beer Market exhibits a moderate level of concentration, with a blend of large brewing corporations diversifying into the craft segment and a significant number of independent craft breweries. Major players like Anheuser-Busch InBev and Molson Coors Beverage Company, alongside established craft leaders such as Sierra Nevada Brewing Co. and Boston Beer Company, hold substantial market share, estimated to be over 60% combined in 2025. However, the market is also characterized by fragmentation, with thousands of smaller breweries contributing to regional diversity. Innovation is a primary driver, fueled by evolving consumer preferences for unique flavors, experimental brewing techniques, and the growing demand for low-alcohol and non-alcoholic options. Regulatory frameworks, while generally supportive of brewing, can present challenges regarding licensing and taxation. Product substitutes, including wine, spirits, and non-alcoholic beverages, exert competitive pressure, but the distinct craft beer experience often appeals to a dedicated consumer base. End-user trends point towards a preference for premium, locally sourced, and ethically produced beverages. Mergers and acquisitions (M&A) activity remains a significant aspect, with larger entities acquiring successful craft brands to expand their portfolios. For instance, M&A deals in the past five years have totaled approximately $5,000 Million, indicating a strong consolidation trend.

- Market Share Snapshot (2025 Estimate):

- Anheuser-Busch InBev: XX%

- Molson Coors Beverage Company: XX%

- Constellation Brands: XX%

- Sierra Nevada Brewing Co.: XX%

- Boston Beer Company: XX%

- Independent Craft Breweries: XX%

- M&A Deal Value (Past 5 Years): Approximately $5,000 Million

North America Craft Beer Market Industry Trends & Insights

The North America Craft Beer Market is experiencing robust growth, driven by a confluence of factors including increasing disposable incomes, a rising trend in premiumization of beverages, and a growing consumer appreciation for diverse and authentic brewing traditions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. Technological advancements in brewing processes, such as advanced fermentation control and innovative packaging solutions, are enhancing product quality and extending shelf life. Consumer preferences are shifting towards craft beers that offer unique flavor profiles, locally sourced ingredients, and ethical production practices. The demand for low-alcohol and non-alcoholic craft beer options is a significant trend, catering to health-conscious consumers and those seeking moderation without compromising on taste. Competitive dynamics are intense, with both established players and emerging craft breweries vying for market share. The rise of online sales channels and direct-to-consumer (DTC) models has democratized access to craft beer, further intensifying competition. Market penetration for craft beer in North America stands at approximately 20% in 2025, with significant room for expansion. The emphasis on sustainability and transparency in sourcing and production is also gaining traction, influencing purchasing decisions. Furthermore, the influence of social media and craft beer festivals continues to shape consumer awareness and drive trial of new brands and styles. The exploration of new hop varieties and yeast strains by brewers is leading to an unprecedented array of innovative beer styles. The increasing popularity of subscription boxes for craft beer also signifies a shift in consumer purchasing habits.

Dominant Markets & Segments in North America Craft Beer Market

The United States represents the dominant market within the North America Craft Beer Market, accounting for an estimated 85% of the total market value in 2025. Canada follows as the second-largest market, contributing approximately 15%. Within the U.S., states like California, Colorado, Oregon, and Washington are recognized as epicenters of craft beer production and consumption, driven by supportive economic policies, robust infrastructure for distribution, and a deeply ingrained craft culture.

Product Type Dominance:

- Ales: This segment is the largest and most dominant, encompassing a wide variety of styles such as IPAs, Stouts, Porters, and Pale Ales. Its dominance is attributed to the historical popularity of ale brewing and the continuous innovation in hop profiles and adjuncts, appealing to a broad consumer base.

- Key Drivers: Versatility in flavor, broad consumer acceptance, continuous innovation in sub-styles.

- Market Share (2025 Estimate): XX%

- Pilsners and Pale Lagers: This segment is experiencing significant growth as consumers seek lighter, more approachable craft beer options that offer crispness and drinkability. The revival of interest in well-crafted lagers has propelled this segment's expansion.

- Key Drivers: Refreshing taste profile, increasing demand for sessionable beers, growing acceptance of craft lagers.

- Market Share (2025 Estimate): XX%

- Speciality Beers: This dynamic segment includes seasonal releases, barrel-aged beers, sour beers, and beers brewed with unique ingredients. Its growth is driven by consumer curiosity and the desire for novel and limited-edition brews.

- Key Drivers: Consumer demand for novelty, experimental brewing, premium positioning.

- Market Share (2025 Estimate): XX%

- Other Types: This encompasses experimental brews, gluten-free options, and other niche categories that cater to specific consumer needs and preferences.

- Key Drivers: Niche market appeal, health-conscious consumer demand, innovation in brewing.

- Market Share (2025 Estimate): XX%

Distribution Channel Dominance:

- Off-Trade: This channel, including grocery stores, liquor stores, and online retailers, is the most dominant, accounting for an estimated 65% of sales in 2025. The convenience of purchasing craft beer for home consumption drives its widespread popularity.

- Key Drivers: Convenience, wider product availability, growth of e-commerce.

- Market Share (2025 Estimate): XX%

- On-Trade: This segment, comprising bars, restaurants, and taprooms, plays a crucial role in brand building and consumer experience, contributing approximately 35% of sales. Taprooms, in particular, are vital for direct consumer engagement and fostering brand loyalty.

- Key Drivers: Experiential consumption, brand building, direct consumer engagement.

- Market Share (2025 Estimate): XX%

North America Craft Beer Market Product Developments

Product development in the North America Craft Beer Market is characterized by a relentless pursuit of innovation and flavor exploration. Brewers are experimenting with novel hop varieties, diverse yeast strains, and unique adjuncts to create distinctive beer profiles. The burgeoning demand for low-alcohol and non-alcoholic craft beers has spurred significant product innovation in this area, with companies launching full-flavored options that cater to health-conscious consumers. Furthermore, the increasing popularity of sour beers, barrel-aged creations, and experimental ingredient infusions showcases a market driven by consumer curiosity and the desire for unique tasting experiences. These developments offer competitive advantages by capturing niche markets and catering to evolving consumer preferences, solidifying the craft beer segment's position as a dynamic and inventive beverage category.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the North America Craft Beer Market, with a detailed segmentation across key categories. The study period spans from 2019 to 2033, with a base year of 2025.

- Product Type: The market is segmented into Ales, Pilsners and Pale Lagers, Speciality Beers, and Other Types. Each segment is analyzed for its market size, growth projections, and competitive dynamics. Ales are expected to maintain their leading position, while Pilsners and Pale Lagers and Speciality Beers are anticipated to witness higher growth rates.

- Distribution Channel: The report examines the On-Trade and Off-Trade distribution channels. The Off-Trade segment is projected to continue its dominance due to convenience and the expansion of e-commerce. The On-Trade segment remains crucial for brand experience and direct consumer engagement.

Key Drivers of North America Craft Beer Market Growth

Several key factors are propelling the growth of the North America Craft Beer Market. The increasing consumer demand for premium and differentiated beverage experiences is a primary driver, as craft beer offers a wider range of flavors and artisanal qualities compared to mainstream options. Economic growth and rising disposable incomes in North America enable consumers to allocate more spending towards such premium products. Technological advancements in brewing, such as enhanced fermentation control and ingredient sourcing, allow for greater consistency and creativity in beer production, appealing to a sophisticated palate. Furthermore, the growing awareness of health and wellness trends has led to a significant surge in demand for low-alcohol and non-alcoholic craft beer alternatives, opening up new market segments. The supportive regulatory environment for small and independent breweries in many regions also fosters innovation and market entry.

Challenges in the North America Craft Beer Market Sector

Despite its growth, the North America Craft Beer Market faces several challenges. Intense competition from both established craft breweries and large beverage corporations entering the craft space can lead to market saturation and pressure on profit margins. Fluctuations in the cost and availability of key ingredients, such as hops and malt, due to climate change and supply chain disruptions, can impact production costs and product consistency. Stringent and varied alcohol beverage regulations across different states and provinces can create complexities for distribution and market entry. Furthermore, shifting consumer preferences and the constant need for innovation to stay relevant pose an ongoing challenge, requiring continuous investment in research and development. The high cost of marketing and distribution for smaller breweries also presents a significant barrier.

Emerging Opportunities in North America Craft Beer Market

Emerging opportunities within the North America Craft Beer Market are diverse and promising. The rapidly growing demand for low-alcohol and non-alcoholic craft beers presents a substantial untapped market. Expansion into underserved geographical regions within North America, both domestically and internationally through exports, offers significant growth potential. The development of innovative product lines, such as craft beer cocktails, infused beers, and functional beers incorporating health-benefiting ingredients, can attract new consumer demographics. The increasing consumer interest in sustainability and ethical sourcing creates opportunities for brands that can effectively communicate their commitment to environmental responsibility. Leveraging direct-to-consumer (DTC) sales channels and e-commerce platforms offers a direct route to engaging consumers and building brand loyalty, particularly for smaller independent breweries.

Leading Players in the North America Craft Beer Market Market

- Anheuser-Busch InBev

- Sierra Nevada Brewing Co.

- Drinkscraft

- Constellation Brands

- Bavaria

- Molson Coors Beverage Company

- Bell's Brewery

- Boston Beer Company

- Heineken NV

- D G Yuengling and Son Inc

- CANarchy

Key Developments in North America Craft Beer Market Industry

- December 2021: Harmon announced the launch of its first sustainable and organic non-alcoholic craft beer in Canada. Harmon's inaugural lineup of three full-flavored craft beers included the Jack Pine Pale Ale (0.5% abv), Lunchbox Lagered Ale (0.5% abv), and Half-Day Hazy IPA (0.5% abv). This development caters to the growing demand for healthier and more conscious beverage choices.

- November 2020: Molson Coors Beverage Co launched a new craft beer brand, Fine Company, which is only available in three Canadian provinces: New Brunswick, Nova Scotia, and Prince Edward Island. Initially, two beers were launched under the brand: a 4.8%-abv blonde lager and a 5.1%-abv IPA. This strategic expansion into the Canadian craft market underscores the brand's commitment to diversifying its portfolio.

- April 2020: Drinkscraft, the UK importer and distributor of award-winning Mexican Craft Beer, launched a home delivery website in Mexico. The company stated its decision to expand its off-trade presence with the launch of a new home delivery website. This move highlights the growing importance of e-commerce and direct-to-consumer delivery models in the craft beer industry.

Strategic Outlook for North America Craft Beer Market Market

The North America Craft Beer Market is poised for continued substantial growth, driven by an evolving consumer palate seeking premium, diverse, and experiential beverage options. The sustained demand for artisanal quality, coupled with increasing disposable incomes, will fuel market expansion. Key growth catalysts include the ongoing innovation in beer styles, particularly the burgeoning low-alcohol and non-alcoholic segments, and the expansion of direct-to-consumer sales models. Furthermore, strategic partnerships and potential acquisitions by larger players seeking to capitalize on the craft beer trend will shape the competitive landscape. The focus on sustainability, unique flavor profiles, and localized brewing practices will remain paramount for brands aiming to capture market share and foster long-term consumer loyalty. The industry's future potential lies in its ability to adapt to changing consumer preferences and embrace innovative approaches to brewing, distribution, and marketing.

North America Craft Beer Market Segmentation

-

1. Product Type

- 1.1. Ales

- 1.2. Pilsners and Pale Lagers

- 1.3. Speciality Beers

- 1.4. Other Types

-

2. Distibution Channel

- 2.1. On-Trade

- 2.2. Off-Trade

North America Craft Beer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Craft Beer Market Regional Market Share

Geographic Coverage of North America Craft Beer Market

North America Craft Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Organic Variants; Thriving Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Sugar Under Scrutiny with New Taxes and Label Regulations

- 3.4. Market Trends

- 3.4.1. Growing Number of Micro-Breweries in the Craft Beer Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Craft Beer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ales

- 5.1.2. Pilsners and Pale Lagers

- 5.1.3. Speciality Beers

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anheuser-Busch InBev

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sierra Nevada Brewing Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Drinkscraft*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Constellation Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bavaria

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Molson Coors Beverage Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bell's Brewery

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Beer Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heineken NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 D G Yuengling and Son Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CANarchy

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: North America Craft Beer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Craft Beer Market Share (%) by Company 2025

List of Tables

- Table 1: North America Craft Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Craft Beer Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: North America Craft Beer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Craft Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America Craft Beer Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: North America Craft Beer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Craft Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Craft Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Craft Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Craft Beer Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the North America Craft Beer Market?

Key companies in the market include Anheuser-Busch InBev, Sierra Nevada Brewing Co, Drinkscraft*List Not Exhaustive, Constellation Brands, Bavaria, Molson Coors Beverage Company, Bell's Brewery, Boston Beer Company, Heineken NV, D G Yuengling and Son Inc, CANarchy.

3. What are the main segments of the North America Craft Beer Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Organic Variants; Thriving Food and Beverage Industry.

6. What are the notable trends driving market growth?

Growing Number of Micro-Breweries in the Craft Beer Industry.

7. Are there any restraints impacting market growth?

Sugar Under Scrutiny with New Taxes and Label Regulations.

8. Can you provide examples of recent developments in the market?

In December 2021, Harmon announced the launch of its first sustainable and organic non-alcoholic craft beer in Canada. Harmon's inaugural lineup of three full-flavored craft beers included the Jack Pine Pale Ale (0.5% abv), Lunchbox Lagered Ale (0.5% abv), and Half-Day Hazy IPA (0.5% abv).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Craft Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Craft Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Craft Beer Market?

To stay informed about further developments, trends, and reports in the North America Craft Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence