Key Insights

The North America Cross Border Road Freight Transport Market is poised for significant expansion, projected to reach $1.16 billion in 2025 and experience a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This growth is primarily fueled by robust trade activities between the United States, Canada, and Mexico. Key drivers include the increasing demand for efficient logistics solutions across diverse industries such as manufacturing, wholesale and retail trade, and construction, all of which rely heavily on timely and cost-effective road freight. The sector benefits from the ongoing integration of supply chains, the expansion of e-commerce, and the strategic importance of North America as a manufacturing and trade hub. Furthermore, ongoing investments in infrastructure, including border crossing enhancements and advanced transportation technologies, are expected to streamline operations and further stimulate market growth.

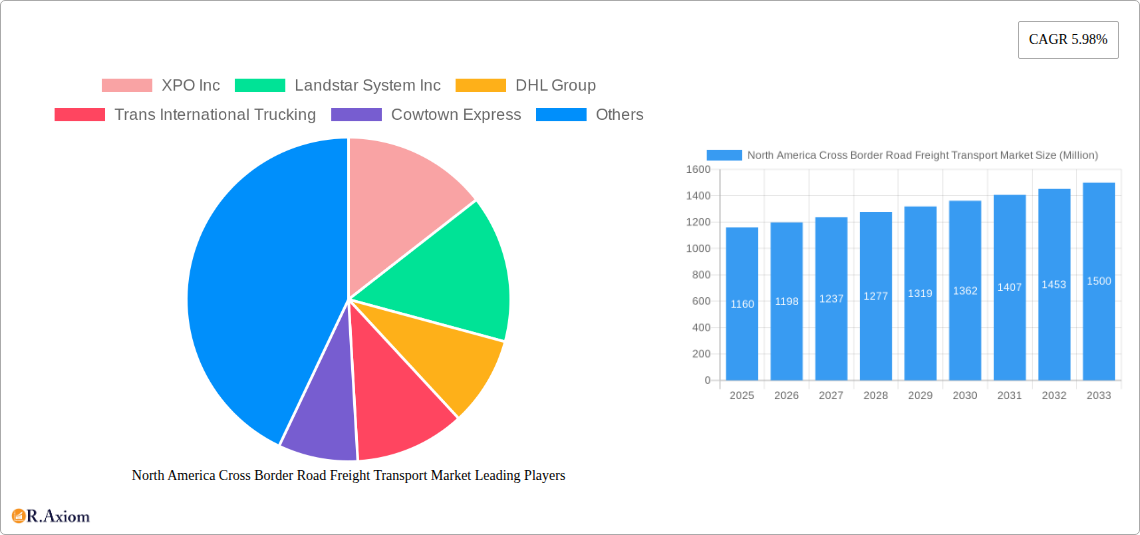

North America Cross Border Road Freight Transport Market Market Size (In Billion)

The market's trajectory is also shaped by emerging trends like the adoption of smart logistics and digitalization, leading to enhanced visibility and efficiency in cross-border operations. The increasing focus on sustainability is driving the adoption of greener logistics practices, influencing carrier choices and operational strategies. However, the market faces certain restraints, including fluctuating fuel prices, the impact of regulatory changes and trade policies, and potential labor shortages within the trucking industry. Despite these challenges, the resilience of North American trade relationships and the continuous need for freight movement will sustain a positive growth outlook. Key industry players such as XPO Inc, Landstar System Inc, DHL Group, and United Parcel Service of America Inc (UPS) are actively competing, investing in fleet modernization and service innovation to capture market share.

North America Cross Border Road Freight Transport Market Company Market Share

This in-depth report provides a detailed analysis of the North America Cross Border Road Freight Transport Market, offering critical insights into market dynamics, growth drivers, competitive landscapes, and future opportunities. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report is an indispensable resource for industry stakeholders, logistics providers, and strategic decision-makers seeking to navigate this complex and evolving market. The market is projected to reach an estimated value of XX billion USD in 2025, with robust growth anticipated throughout the forecast period.

North America Cross Border Road Freight Transport Market Market Concentration & Innovation

The North America Cross Border Road Freight Transport Market exhibits a moderate to high level of market concentration, with a few dominant players holding significant market share. Companies like XPO Inc., Landstar System Inc., DHL Group, Knight-Swift Transportation Holdings Inc., and United Parcel Service of America Inc. (UPS) are key influencers. Innovation is primarily driven by technological advancements in fleet management, real-time tracking, route optimization, and the adoption of sustainable logistics solutions. Regulatory frameworks, including customs regulations, trade agreements (like USMCA), and environmental mandates, significantly shape market operations and compliance costs. Product substitutes, such as rail freight and air cargo, play a role in specific lanes and cargo types, but road freight remains dominant for its flexibility and last-mile delivery capabilities. End-user demand for faster, more reliable, and cost-effective transportation fuels continuous innovation. Mergers and acquisitions (M&A) are a prominent strategy for consolidation and expansion, with notable M&A deal values contributing to market shifts. For instance, UPS's acquisition of MNX Global Logistics signifies a strategic move to bolster its time-critical and healthcare logistics capabilities, with an estimated deal value of hundreds of millions of dollars.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Innovation Drivers: Fleet management technology, real-time tracking, route optimization, sustainability, intermodal integration.

- Regulatory Frameworks: USMCA, customs regulations, emissions standards, driver hour limitations.

- Product Substitutes: Rail freight, air cargo, intermodal transport.

- End-User Trends: Demand for speed, reliability, transparency, and cost-efficiency.

- M&A Activities: Strategic acquisitions and mergers for market consolidation, service expansion, and technological integration.

North America Cross Border Road Freight Transport Market Industry Trends & Insights

The North America Cross Border Road Freight Transport Market is characterized by a strong upward trajectory, driven by burgeoning cross-border trade volumes between the United States, Canada, and Mexico. The estimated market size in 2025 is projected to be XX billion USD. A significant Compound Annual Growth Rate (CAGR) of XX% is anticipated from 2025 to 2033. This growth is underpinned by several key factors. Economic interconnectedness between these nations, facilitated by trade agreements like the United States-Mexico-Canada Agreement (USMCA), continues to boost the movement of goods. The manufacturing sector, in particular, relies heavily on efficient cross-border road freight for just-in-time inventory management and supply chain fluidity. Furthermore, the expanding e-commerce landscape necessitates robust and agile logistics networks capable of handling an increasing volume of parcel and less-than-truckload (LTL) shipments across borders. Technological disruptions are rapidly reshaping the industry. The implementation of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics in route optimization and demand forecasting is enhancing efficiency and reducing operational costs. Advanced telematics and IoT devices provide real-time visibility into shipment status, driver behavior, and vehicle diagnostics, leading to improved safety and asset utilization. The increasing adoption of electric and alternative fuel vehicles by major carriers like Ryder System Inc. addresses growing environmental concerns and meets evolving consumer preferences for sustainable logistics. Consumer preferences are increasingly leaning towards faster delivery times and greater transparency, pushing carriers to invest in technology that enables real-time tracking and provides accurate estimated times of arrival (ETAs). The competitive dynamics within the market are intense, with both large, established players and smaller, niche providers vying for market share. Companies are focusing on enhancing their service offerings, optimizing their networks, and leveraging technology to gain a competitive edge. The market penetration of advanced logistics solutions is steadily increasing as businesses recognize the value of integrated supply chain management. The rise of digital freight matching platforms is also democratizing access to freight for smaller carriers and improving load fill rates for shippers. The overall trend points towards a more digitized, efficient, and environmentally conscious cross-border road freight transport ecosystem.

Dominant Markets & Segments in North America Cross Border Road Freight Transport Market

The North America Cross Border Road Freight Transport Market is dominated by the Wholesale and Retail Trade sector, driven by the immense volume of consumer goods and finished products exchanged between the United States, Canada, and Mexico. This segment consistently accounts for the largest share of freight movement due to robust consumer demand and the integrated nature of North American supply chains. The Manufacturing sector also holds a significant position, relying on efficient cross-border road freight for the transport of raw materials, components, and finished goods to assembly plants and distribution centers across the continent.

Key Drivers of Dominance:

- Wholesale and Retail Trade:

- High consumer spending and demand for a wide array of products.

- Well-established retail distribution networks across North America.

- Growth of e-commerce and the need for rapid delivery of consumer goods.

- Cross-border shopping and trade liberalization initiatives.

- Manufacturing:

- Complex and integrated North American manufacturing supply chains.

- Just-in-time inventory management requiring frequent and reliable transport.

- Movement of specialized components and finished products.

- Trade policies favoring regional production and assembly.

The Construction sector plays a crucial role, particularly in infrastructure development and housing projects, demanding the timely delivery of building materials, heavy machinery, and equipment across borders. The Oil and Gas sector, while subject to commodity price fluctuations, contributes significantly through the transportation of specialized equipment, chemicals, and extracted resources, especially in regions with active extraction activities. The Agriculture, Fishing, and Forestry segment is vital for the cross-border movement of agricultural products, seafood, and timber, often requiring temperature-controlled transport solutions. The Mining and Quarrying sector contributes through the transport of raw materials, heavy equipment, and related supplies, particularly in resource-rich regions. The "Others" segment encompasses a diverse range of industries and specialized freight, all contributing to the overall dynamism of the cross-border road freight market. Economic policies, infrastructure investments, and bilateral trade agreements are pivotal in shaping the dominance of these segments and their respective market shares within the North American cross-border road freight landscape.

North America Cross Border Road Freight Transport Market Product Developments

Product developments in the North America Cross Border Road Freight Transport Market are increasingly focused on enhancing efficiency, sustainability, and customer visibility. The integration of advanced telematics and AI-powered route optimization software allows for dynamic re-routing and fuel efficiency improvements, directly impacting operational costs and delivery times. The introduction and widespread deployment of electric vehicles (EVs), such as the BrightDrop Zevo 600 vans being integrated by Ryder System Inc., signify a major shift towards eco-friendly logistics, reducing emissions and operational noise. Enhanced trailer technologies, including aerodynamic features and advanced braking systems, further contribute to fuel savings and safety. Digital platforms that facilitate seamless booking, real-time tracking, and automated invoicing are becoming standard, offering competitive advantages through improved customer experience and streamlined operations.

Report Scope & Segmentation Analysis

The North America Cross Border Road Freight Transport Market is segmented based on end-user industry, providing a granular view of demand and application.

- Agriculture, Fishing, and Forestry: This segment involves the transportation of agricultural produce, seafood, and timber products across national borders. Growth is influenced by seasonal demand and trade policies affecting food and natural resources.

- Construction: This segment focuses on the movement of building materials, heavy equipment, and related supplies for infrastructure projects and commercial/residential construction. Demand is linked to economic development and investment in infrastructure.

- Manufacturing: This segment covers the transportation of raw materials, intermediate goods, and finished manufactured products, crucial for integrated North American supply chains.

- Oil and Gas: This segment includes the transport of exploration equipment, extracted resources, and chemicals, driven by global energy demand and regional extraction activities.

- Mining and Quarrying: This segment involves the movement of raw ores, minerals, and related heavy machinery and supplies, particularly relevant in resource-rich territories.

- Wholesale and Retail Trade: This segment is the largest, encompassing the distribution of consumer goods and finished products from manufacturers and suppliers to retailers and end consumers, heavily influenced by e-commerce growth.

- Others: This segment captures a broad array of diverse industries and specialized freight, contributing to the overall market size and dynamics.

Key Drivers of North America Cross Border Road Freight Transport Market Growth

The growth of the North America Cross Border Road Freight Transport Market is propelled by several key drivers. The United States-Mexico-Canada Agreement (USMCA) continues to foster robust bilateral and trilateral trade, facilitating the seamless movement of goods and services. Escalating e-commerce penetration across the continent fuels demand for efficient and rapid last-mile delivery solutions for a growing volume of consumer goods. Technological advancements, including AI-powered route optimization, real-time tracking, and fleet management systems, enhance operational efficiency, reduce transit times, and lower costs. The increasing focus on sustainability and emission reduction is driving the adoption of electric and alternative fuel vehicles, supported by government incentives and evolving corporate social responsibility mandates.

Challenges in the North America Cross Border Road Freight Transport Market Sector

Despite robust growth, the North America Cross Border Road Freight Transport Market faces several challenges. Driver shortages remain a persistent issue, impacting capacity and increasing labor costs. Complex and evolving customs regulations and border procedures can lead to delays and increased administrative burdens. Infrastructure bottlenecks, including congested border crossings and inadequate road networks in certain areas, hinder efficient transit. Increasing fuel prices and volatility can significantly impact operational profitability. Moreover, the competitive landscape is highly fragmented, leading to price pressures and the need for continuous innovation to maintain market share. The inherent risks associated with cross-border transportation, such as cargo theft and security concerns, also necessitate robust safety protocols and investments.

Emerging Opportunities in North America Cross Border Road Freight Transport Market

Emerging opportunities in the North America Cross Border Road Freight Transport Market are abundant and transformative. The growing demand for temperature-controlled logistics for pharmaceuticals and perishable goods presents a significant growth avenue. The continued expansion of e-commerce fulfillment and last-mile delivery services, particularly for cross-border online purchases, offers substantial potential. Advancements in autonomous trucking and platooning technology promise to revolutionize efficiency and driver productivity in the long term. Increased investment in green logistics solutions, including electric and hydrogen-powered fleets, aligns with global sustainability goals and opens new markets for eco-friendly transport services. Furthermore, the development of integrated multimodal logistics solutions, leveraging road, rail, and sea transport, offers optimized supply chain strategies for various industries.

Leading Players in the North America Cross Border Road Freight Transport Market Market

- XPO Inc.

- Landstar System Inc.

- DHL Group

- Trans International Trucking

- Cowtown Express

- Fastfrate Group

- Knight-Swift Transportation Holdings Inc.

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- Ryder System Inc.

Key Developments in the North America Cross Border Road Freight Transport Market Industry

- October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.

- September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.

- September 2023: Ryder Systems announced the deployment of its first BrightDrop Zevo 600 electric vans at four strategic Ryder facilities in California, Texas, and New York. Earlier in 2023, Ryder announced plans to introduce 4,000 BrightDrop electric vans to its fleet through 2025, with the first 200 ordered this year. With a cargo capacity of 615 cubic feet, BrightDrop’s electric light commercial van offers the benefits of an electric powertrain with ample cargo space.

Strategic Outlook for North America Cross Border Road Freight Transport Market Market

The strategic outlook for the North America Cross Border Road Freight Transport Market is overwhelmingly positive, driven by sustained economic integration and the rapid evolution of logistics technology. Future growth will be significantly influenced by the adoption of smart fleet management systems, which will enhance efficiency and reduce transit times. The increasing emphasis on sustainability will necessitate continued investment in electric and alternative fuel vehicles, creating a competitive advantage for environmentally conscious carriers. The market's ability to adapt to evolving trade policies and regulatory landscapes will be crucial. Furthermore, the ongoing digital transformation, including the proliferation of AI and IoT in supply chain operations, will unlock new levels of transparency and predictive capabilities. Strategic alliances and partnerships will become increasingly important for expanding service offerings and navigating complex cross-border logistics challenges, ensuring the market remains dynamic and responsive to global trade demands.

North America Cross Border Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

North America Cross Border Road Freight Transport Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cross Border Road Freight Transport Market Regional Market Share

Geographic Coverage of North America Cross Border Road Freight Transport Market

North America Cross Border Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cross Border Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 XPO Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Landstar System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trans International Trucking

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cowtown Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fastfrate Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Knight-Swift Transportation Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America Inc (UPS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Werner Enterprises

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ryder System Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 XPO Inc

List of Figures

- Figure 1: North America Cross Border Road Freight Transport Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Cross Border Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 4: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cross Border Road Freight Transport Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the North America Cross Border Road Freight Transport Market?

Key companies in the market include XPO Inc, Landstar System Inc, DHL Group, Trans International Trucking, Cowtown Express, Fastfrate Group, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, Ryder System Inc.

3. What are the main segments of the North America Cross Border Road Freight Transport Market?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.September 2023: Ryder Systems announced the deployment of its first BrightDrop Zevo 600 electric vans at four strategic Ryder facilities in California, Texas, and New York. Earlier in 2023, Ryder announced plans to introduce 4,000 BrightDrop electric vans to its fleet through 2025, with the first 200 ordered this year. With a cargo capacity of 615 cubic feet, BrightDrop’s electric light commercial van offers the benefits of an electric powertrain with ample cargo space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cross Border Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cross Border Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cross Border Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the North America Cross Border Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence