Key Insights

The North American organic baby food market is projected for robust expansion, anticipating a market size of $8.62 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 16.3% through 2033. This growth is driven by heightened parental focus on infant health and nutrition, increasing demand for convenient, wholesome options, and a strong consumer shift towards organic and natural products. Key growth factors include rising disposable incomes among young families, amplified awareness of organic diet benefits, and the influence of digital platforms promoting healthier lifestyles. Emerging trends such as plant-based organic options, allergen-free formulations, and eco-friendly packaging further shape market evolution.

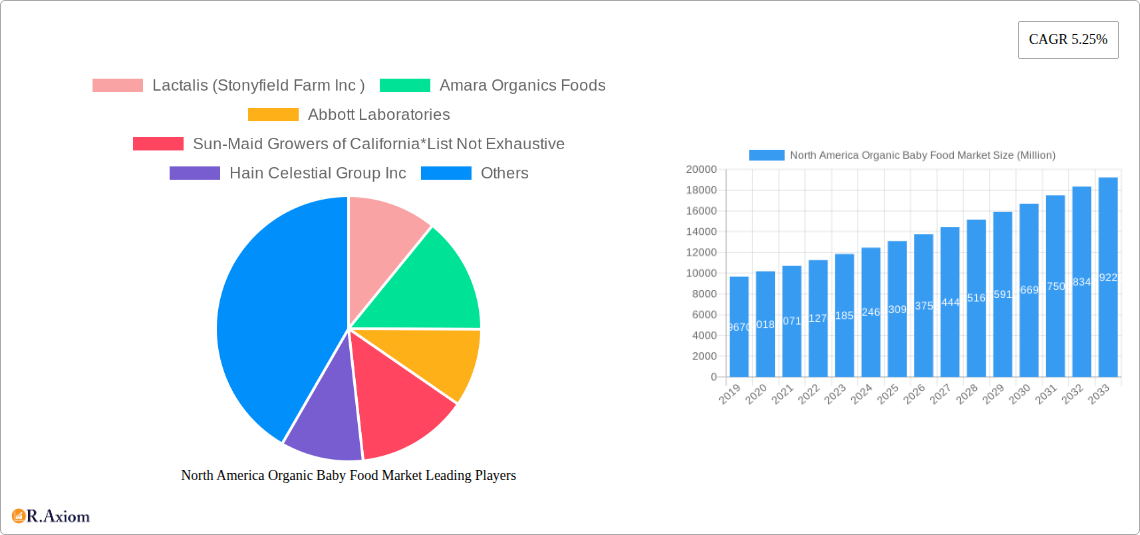

North America Organic Baby Food Market Market Size (In Billion)

Potential restraints include the premium pricing of organic baby food, which may deter price-sensitive consumers, and consumer confusion surrounding organic certifications and ingredient labels. Stringent food safety and organic claim regulations also necessitate manufacturer compliance. Despite these challenges, the market remains resilient, with Milk Formula dominating due to its essential role in infant nutrition, followed by Dried and Prepared Baby Food. Online retail is a growing distribution channel, complementing established hypermarkets and supermarkets. The United States is expected to lead market growth, supported by strong contributions from Canada and Mexico.

North America Organic Baby Food Market Company Market Share

The North American organic baby food market exhibits moderate concentration, with established players and emerging niche brands. Innovation, driven by parental demand for convenient, nutritious, and ethically sourced products, is a key differentiator. Regulatory bodies like the FDA and Health Canada ensure product safety and labeling standards. Competition arises from homemade and conventional baby food alternatives. End-user preferences strongly favor organic, non-GMO, and plant-based ingredients, emphasizing transparency in sourcing. Mergers and acquisitions (M&A) are prevalent, with larger companies acquiring smaller, innovative brands to expand their organic portfolios and market reach, exemplified by strategic integrations within the industry.

North America Organic Baby Food Market Industry Trends & Insights

The North America organic baby food market is poised for substantial growth, driven by a confluence of evolving consumer preferences, heightened awareness regarding infant nutrition, and increasing disposable incomes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust expansion is primarily propelled by a heightened parental focus on providing babies with the purest and most nutritious food options available, leading to a significant surge in the demand for organic and natural ingredients. The growing acceptance of organic certifications and the perceived health benefits associated with organic produce are creating a favorable environment for market players. Technological advancements are also playing a crucial role, with innovative packaging solutions enhancing product shelf-life and convenience, and sophisticated processing techniques ensuring optimal nutrient retention. Furthermore, the digital revolution has democratized access to information, empowering parents to make informed decisions about their children's diets, thereby escalating the demand for transparently sourced and clearly labeled organic baby food products. The competitive landscape is dynamic, with both established multinational corporations and agile startups vying for market share. This intense competition fosters continuous innovation in product formulation, flavor profiles, and dietary options, catering to a wider spectrum of infant needs, including specialized dietary requirements and allergen-free formulations. The increasing penetration of online retail channels has further intensified competition by providing consumers with a wider selection and greater price transparency, forcing brick-and-mortar retailers to adapt their strategies. The market penetration of organic baby food is expected to reach over 65% by the end of the forecast period, indicating a strong shift in consumer habits. This growth trajectory is supported by an increasing number of product launches featuring unique ingredients and functional benefits, such as gut health support and immune system enhancement. The overall industry outlook suggests a sustained period of growth, driven by these multifaceted factors.

Dominant Markets & Segments in North America Organic Baby Food Market

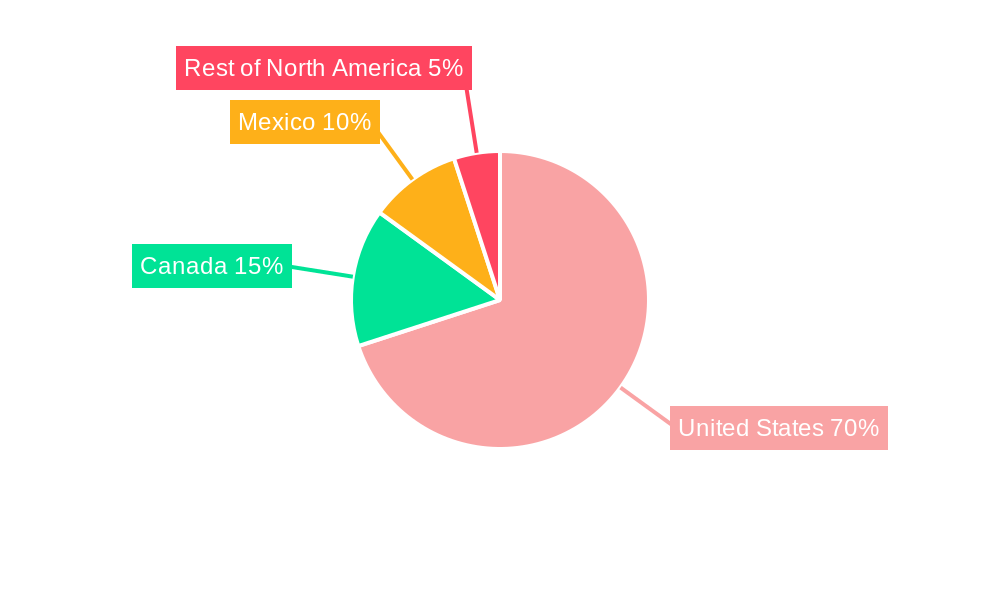

The United States stands as the dominant market within the North America organic baby food sector, accounting for an estimated 70% of the total market revenue in 2025. This leadership is attributed to several key drivers including a large and health-conscious consumer base, robust economic policies supporting organic agriculture, and extensive retail infrastructure. The high disposable income levels in the U.S. allow parents to prioritize premium organic options for their infants.

Dominance by Product Type:

- Milk Formula: Holds a significant market share, estimated at 35% of the total market in 2025.

- Key Drivers: Critical for infant nutrition, strong brand loyalty, and increasing demand for specialized organic formulas addressing specific dietary needs (e.g., lactose-free, hypoallergenic).

- Dominance Analysis: The U.S. market, in particular, sees a high demand for organic milk formulas due to widespread parental concern about formula ingredients and the availability of a broad range of organic options.

- Prepared Baby Food: Follows closely, accounting for approximately 30% of the market in 2025.

- Key Drivers: Convenience for busy parents, growing variety of flavors and textures, and appeal of ready-to-eat meals.

- Dominance Analysis: The convenience factor is highly valued in the U.S. and Canadian markets, driving sales of pouches and jars.

- Dried Baby Food: Represents around 20% of the market in 2025.

- Key Drivers: Longer shelf life, affordability, and versatility in preparation.

- Dominance Analysis: While perhaps less of a primary choice for initial feeding, dried options remain popular for toddlers and older infants, particularly in convenience-focused households.

- Other Product Types: Includes purees, snacks, and cereals, contributing approximately 15% in 2025.

- Key Drivers: Growing demand for organic snacks and teething biscuits, catering to specific developmental stages.

- Dominance Analysis: This segment is characterized by high innovation and a proliferation of new product offerings.

Dominance by Distribution Channel:

- Hypermarket/Supermarket: The leading distribution channel, capturing an estimated 45% of the market in 2025.

- Key Drivers: Wide product availability, competitive pricing, one-stop shopping convenience, and established brand presence.

- Dominance Analysis: Large grocery chains in the U.S. and Canada offer extensive organic baby food sections, making them the preferred choice for a majority of consumers.

- Online Retail Stores: Experiencing rapid growth, projected to hold 30% of the market in 2025.

- Key Drivers: Convenience, wider selection beyond physical stores, subscription services, and competitive pricing.

- Dominance Analysis: The ease of online shopping, especially for bulky items or regular purchases, is significantly impacting traditional retail, with platforms like Amazon and direct-to-consumer websites gaining traction.

- Drugstores/Pharmacies: Account for approximately 15% in 2025.

- Key Drivers: Accessibility, impulse purchases, and availability of essential baby care products alongside food.

- Dominance Analysis: Pharmacies often cater to urgent needs and offer a curated selection, particularly in urban areas.

- Convenience Stores: Hold a smaller but growing share, around 10% in 2025.

- Key Drivers: Quick access for immediate needs.

- Dominance Analysis: Their role is more supplementary, catering to on-the-go consumption rather than primary shopping trips.

Geographical Dominance:

- United States: As mentioned, the clear leader, driven by economic strength and consumer consciousness.

- Canada: Represents the second-largest market, with a strong emphasis on health and wellness, accounting for approximately 20% of the market.

- Key Drivers: Government initiatives promoting healthy eating, high consumer awareness of organic benefits, and a well-developed retail network.

- Mexico: An emerging market, showing significant growth potential due to increasing urbanization and rising disposable incomes, projected to contribute around 8% by 2025.

- Key Drivers: Growing middle class, increasing awareness of health benefits, and a burgeoning organic product market.

- Rest of North America: Includes smaller economies and regions, collectively holding approximately 2% of the market.

North America Organic Baby Food Market Product Developments

Innovation in the North America organic baby food market is characterized by a strong focus on plant-based ingredients, allergen-free formulations, and functional benefits. Companies are developing a wider array of organic pouches, snacks, and meals incorporating nutrient-dense ingredients like chickpeas, black beans, and lentils, as exemplified by Gerber's "plant-tastic" line. Product developments also emphasize sustainability, with a growing trend towards carbon-neutral options. Competitive advantages are being forged through unique flavor combinations, the introduction of superfoods, and clear labeling that highlights organic certifications, non-GMO status, and absence of artificial additives.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America organic baby food market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented across Product Types including Milk Formula, Dried Baby Food, Prepared Baby Food, and Other Product Types. Growth projections and market sizes are detailed for each, with Prepared Baby Food expected to see significant CAGR due to convenience. The Distribution Channel segmentation covers Hypermarket/Supermarket, Drugstores/Pharmacies, Convenience Stores, and Online Retail Stores, with Online Retail Stores exhibiting the highest growth potential. Geographically, the analysis encompasses the United States, Canada, Mexico, and the Rest of North America, with the United States dominating the market. Competitive dynamics are assessed within each segment.

Key Drivers of North America Organic Baby Food Market Growth

Several key drivers are fueling the growth of the North America organic baby food market. The escalating parental awareness regarding the long-term health benefits of organic nutrition for infants is a primary catalyst. Technological advancements in food processing and preservation are enabling the creation of more nutrient-dense and convenient organic baby food options. Furthermore, supportive government regulations and certifications for organic products enhance consumer trust and market accessibility. The increasing disposable income among target demographics also plays a crucial role, allowing parents to invest in premium organic choices.

Challenges in the North America Organic Baby Food Market Sector

Despite robust growth, the North America organic baby food market faces several challenges. Stringent regulatory hurdles and compliance costs can be significant, particularly for smaller manufacturers entering the market. Fluctuations in the availability and cost of organic raw materials due to climate change and agricultural practices can impact supply chains and pricing. Intense competition from both established brands and private labels, coupled with the growing popularity of homemade baby food, necessitates continuous innovation and competitive pricing strategies. Ensuring consistent quality and safety across diverse product lines also remains a paramount concern.

Emerging Opportunities in North America Organic Baby Food Market

Emerging opportunities in the North America organic baby food market lie in the expanding demand for plant-based and allergen-free formulations, catering to evolving dietary preferences and growing concerns about allergies. The increasing penetration of e-commerce presents significant opportunities for direct-to-consumer sales and broader market reach, especially for niche brands. Furthermore, the development of functional organic baby food products, offering benefits such as gut health support and immune system enhancement, is a promising avenue. Expansion into emerging markets within North America, like Mexico, also presents substantial growth potential.

Leading Players in the North America Organic Baby Food Market Market

- Lactalis (Stonyfield Farm Inc)

- Amara Organics Foods

- Abbott Laboratories

- Sun-Maid Growers of California

- Hain Celestial Group Inc

- Danone S A

- Hero Group (Beech-Nut Nutrition Corporation)

- Reckitt Benckiser Group plc (Mead Johnson & Company LLC)

- Kraft Heinz Company

- Nestlé S A

Key Developments in North America Organic Baby Food Market Industry

- April 2022: Gerber, a Nestlé brand, announced the debut of plant-tastic, a new line of carbon-neutral, plant-protein baby food. Plant-tastic offers a variety of organic pouches, snacks, and meals made with nutrient-dense plant-based ingredients. Chickpeas, black beans, navy beans, and lentils are used in every plant-tastic recipe.

- April 2021: Sun-Maid Growers of California acquired Plum Organics, a premium, organic baby food and kids snack brand, from Campbell Soup Company. Plum Organics offers a wide range of organic foods and snack products to meet the nutritional needs of babies, toddlers, and kids. Plum Organics' products are certified organic and non-GMO.

- January 2021: Baby Gourmet, a Canadian organic meal and snack brand for babies and toddlers, was acquired by The Hero Group. Slammers Snacks, a Baby Gourmet-owned organic United States children's snack brand, is included in the acquisition.

Strategic Outlook for North America Organic Baby Food Market Market

The strategic outlook for the North America organic baby food market is overwhelmingly positive, driven by sustained demand for healthier infant nutrition and increasing parental education on the benefits of organic consumption. Future growth will be propelled by continued innovation in product formulations, particularly in plant-based and specialized dietary options, alongside a strong emphasis on sustainable sourcing and eco-friendly packaging. Expansion through e-commerce channels and strategic partnerships will be crucial for market penetration. Companies that prioritize transparency, adapt to evolving consumer preferences, and invest in product development that addresses emerging health trends are best positioned for long-term success and market leadership in this dynamic sector.

North America Organic Baby Food Market Segmentation

-

1. Product Type

- 1.1. Milk Formula

- 1.2. Dried Baby Food

- 1.3. Prepared Baby Food

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Drugstores/Pharmacies

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Organic Baby Food Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Organic Baby Food Market Regional Market Share

Geographic Coverage of North America Organic Baby Food Market

North America Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Busy Lifestyle of Parents Fostering RTE Product Adaptation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Milk Formula

- 5.1.2. Dried Baby Food

- 5.1.3. Prepared Baby Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Drugstores/Pharmacies

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Milk Formula

- 6.1.2. Dried Baby Food

- 6.1.3. Prepared Baby Food

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Drugstores/Pharmacies

- 6.2.3. Convenience Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Milk Formula

- 7.1.2. Dried Baby Food

- 7.1.3. Prepared Baby Food

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Drugstores/Pharmacies

- 7.2.3. Convenience Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Milk Formula

- 8.1.2. Dried Baby Food

- 8.1.3. Prepared Baby Food

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Drugstores/Pharmacies

- 8.2.3. Convenience Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Milk Formula

- 9.1.2. Dried Baby Food

- 9.1.3. Prepared Baby Food

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Drugstores/Pharmacies

- 9.2.3. Convenience Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lactalis (Stonyfield Farm Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amara Organics Foods

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Abbott Laboratories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sun-Maid Growers of California*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hain Celestial Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Danone S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hero Group (Beech-Nut Nutrition Corporation)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Reckitt Benckiser Group plc (Mead Johnson & Company LLC)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kraft Heinz Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nestlé S A

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lactalis (Stonyfield Farm Inc )

List of Figures

- Figure 1: North America Organic Baby Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Organic Baby Food Market Share (%) by Company 2025

List of Tables

- Table 1: North America Organic Baby Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Organic Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Organic Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Organic Baby Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Organic Baby Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Organic Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Organic Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Organic Baby Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Organic Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Organic Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Organic Baby Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Organic Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Organic Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Organic Baby Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Organic Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Organic Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Organic Baby Food Market?

The projected CAGR is approximately 16.3%.

2. Which companies are prominent players in the North America Organic Baby Food Market?

Key companies in the market include Lactalis (Stonyfield Farm Inc ), Amara Organics Foods, Abbott Laboratories, Sun-Maid Growers of California*List Not Exhaustive, Hain Celestial Group Inc, Danone S A, Hero Group (Beech-Nut Nutrition Corporation), Reckitt Benckiser Group plc (Mead Johnson & Company LLC), Kraft Heinz Company, Nestlé S A.

3. What are the main segments of the North America Organic Baby Food Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Busy Lifestyle of Parents Fostering RTE Product Adaptation.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

April 2022: Gerber, a Nestlé brand, announced the debut of plant-tastic, a new line of carbon-neutral, plant-protein baby food. Plant-tastic offers a variety of organic pouches, snacks, and meals made with nutrient-dense plant-based ingredients. Chickpeas, black beans, navy beans, and lentils are used in every plant-tastic recipe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the North America Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence