Key Insights

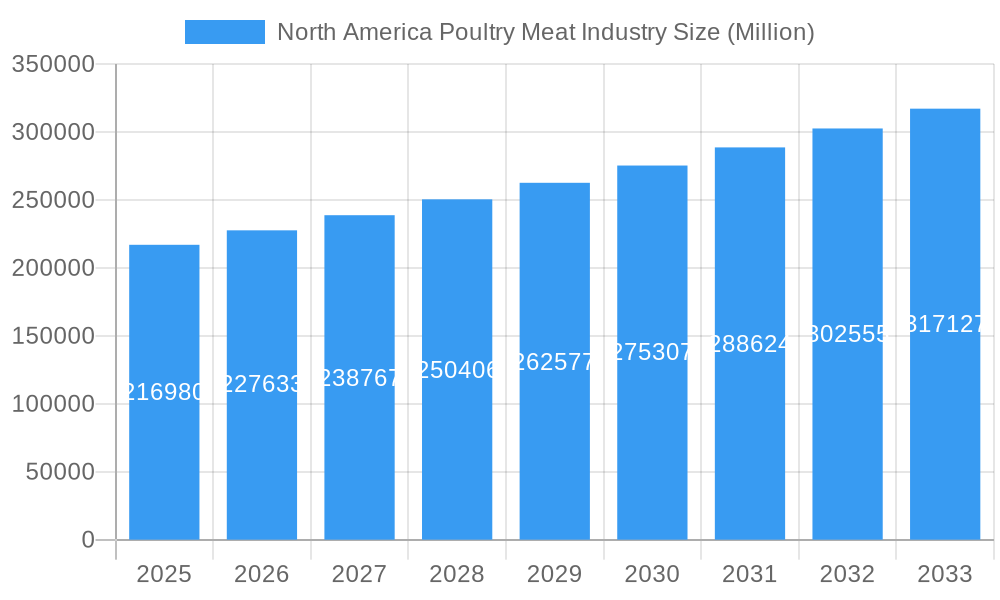

The North American poultry meat industry is poised for substantial growth, projected to reach an estimated market size of $216.98 billion in 2025. This expansion is fueled by a robust compound annual growth rate (CAGR) of 4.96% through 2033. Several key drivers are propelling this upward trajectory, including increasing consumer demand for protein-rich diets, the perceived health benefits of poultry over red meat, and the growing popularity of convenience-oriented poultry products like pre-marinated items and ready-to-cook meals. Innovations in processing technologies, leading to a wider variety of value-added products such as chicken nuggets, meatballs, and sausages, are further stimulating market penetration. The expanding foodservice sector, particularly quick-service restaurants and casual dining establishments heavily reliant on poultry, also plays a significant role in its market dominance. Furthermore, evolving consumer preferences towards healthier, sustainably sourced, and ethically raised poultry options are shaping product development and sourcing strategies across the region.

North America Poultry Meat Industry Market Size (In Billion)

Despite the optimistic outlook, the industry faces certain restraints. Fluctuations in raw material costs, particularly feed grains, can impact profitability and pricing strategies. Stringent regulations concerning animal welfare, food safety, and environmental impact also necessitate continuous investment in compliance and operational adjustments. However, the industry's adaptability is evident in its segmentation. The "Processed" segment, encompassing deli meats, marinated tenders, meatballs, nuggets, and sausages, is expected to be a significant growth engine, catering to the demand for convenience and diverse culinary applications. Distribution channels are also evolving, with the "Off-Trade" segment, particularly online channels and supermarkets, experiencing accelerated growth, alongside the continued importance of traditional retail and the "On-Trade" foodservice sector. North America, with the United States as its dominant market, alongside Canada and Mexico, represents a mature yet dynamic landscape for poultry consumption and production.

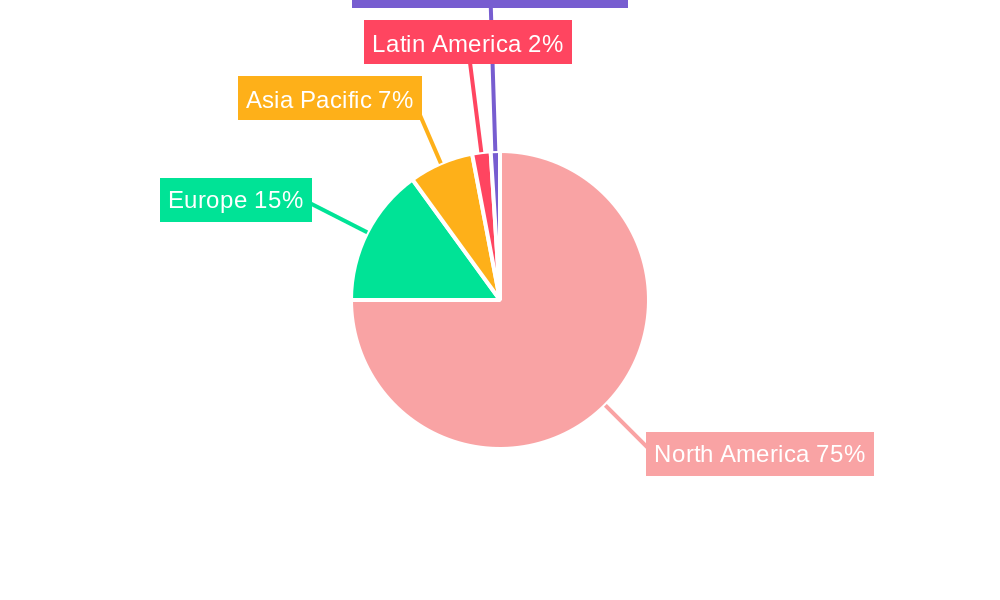

North America Poultry Meat Industry Company Market Share

Unlock critical insights into the North America poultry meat market, a dynamic sector projected to reach over $150 billion by 2025. This in-depth report provides a granular analysis of market concentration, innovation, trends, dominant segments, product developments, and key growth drivers and challenges. Leveraging high-traffic keywords such as "poultry meat market," "chicken market," "turkey market," "processed poultry," "food industry trends," and "meat consumption" in North America, this report is essential for industry stakeholders, including manufacturers, distributors, retailers, investors, and policymakers. Understand the competitive landscape featuring giants like WH Group Limited, Tyson Foods Inc., JBS SA, and Cargill Inc., and navigate the evolving consumer preferences and technological advancements shaping the future of this multi-billion dollar industry.

North America Poultry Meat Industry Market Concentration & Innovation

The North America poultry meat industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share. Leading companies like Tyson Foods Inc., JBS SA, WH Group Limited, and Cargill Inc. exert considerable influence over production, pricing, and distribution. Innovation is a key differentiator, driven by consumer demand for healthier, convenient, and ethically sourced poultry products. Investment in research and development focuses on advanced processing technologies, novel product formulations (e.g., plant-based alternatives derived from poultry processing by-products), and improved farm-to-fork traceability. Regulatory frameworks, including food safety standards set by agencies like the FDA and USDA, play a crucial role in shaping market practices and ensuring consumer confidence. Product substitutes, such as red meat and plant-based proteins, pose a continuous competitive challenge, necessitating ongoing product development and marketing strategies. End-user trends highlight a growing preference for lean protein, ready-to-cook meals, and value-added products. Mergers and acquisitions (M&A) activities are prevalent, with recent deals valued in the hundreds of millions to billions of dollars, aimed at expanding market reach, acquiring new technologies, and consolidating market share. For instance, strategic alliances and acquisitions are crucial for companies to maintain their competitive edge and adapt to evolving market demands.

North America Poultry Meat Industry Industry Trends & Insights

The North America poultry meat industry is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This expansion is underpinned by several robust market growth drivers. Firstly, the increasing global population coupled with rising disposable incomes in North America fuels a consistent demand for protein-rich foods, with poultry meat being a preferred choice due to its perceived health benefits and affordability compared to other meats. Secondly, technological disruptions are revolutionizing the sector. Advancements in automated farming, precision agriculture, and advanced processing techniques are enhancing efficiency, reducing costs, and improving product quality and safety. The adoption of AI and IoT in supply chain management is optimizing logistics and reducing waste. Consumer preferences are rapidly shifting towards healthier and more sustainable options. There is a discernible trend towards organic, free-range, and antibiotic-free poultry products, driving demand for specialized production methods. Furthermore, the convenience factor remains paramount, with consumers seeking a wide array of processed and ready-to-cook poultry items that fit busy lifestyles. Competitive dynamics are intense, with established players investing heavily in branding, product innovation, and market penetration strategies. The rise of online grocery platforms and direct-to-consumer models is also reshaping distribution channels and consumer access. Market penetration for value-added and convenience poultry products is steadily increasing, indicating a strong consumer appetite for innovation. The industry is also experiencing a surge in demand for plant-based poultry alternatives, often developed by traditional poultry companies, reflecting a dual strategy to cater to diverse consumer needs and sustainability concerns. This trend highlights the industry's adaptability and forward-thinking approach to market evolution.

Dominant Markets & Segments in North America Poultry Meat Industry

The North America poultry meat industry exhibits distinct dominance across various segments and geographical regions. The United States consistently emerges as the leading market, driven by its substantial population, high per capita consumption of poultry, and a well-developed agricultural and food processing infrastructure. Canada and Mexico also represent significant markets with their own unique consumer preferences and regulatory environments. Within the Form segmentation, the Fresh / Chilled segment holds a commanding market share, reflecting consumer preference for unprocessed meats for everyday cooking. However, the Processed segment is experiencing robust growth, driven by convenience and a wide array of product offerings. This includes:

- Deli Meats: A staple for sandwiches and snacks, with consistent demand.

- Marinated/Tenders: Popular for quick meal preparation and appealing to family consumers.

- Meatballs & Sausages: Versatile products with established market appeal.

- Nuggets: A perennial favorite, especially among younger demographics, with ongoing innovation in flavor and texture.

- Other Processed Poultry: Encompassing a broad range of value-added products like breaded cutlets, seasoned portions, and ready-to-eat meals.

The Distribution Channel segmentation showcases the dominance of Off-Trade channels, which account for the majority of poultry meat sales.

- Supermarkets and Hypermarkets: These remain the primary retail outlets, offering a vast selection and competitive pricing. Their extensive reach and customer loyalty contribute significantly to their dominance.

- Online Channel: This segment is witnessing rapid expansion, fueled by the convenience of home delivery and the increasing adoption of e-commerce for groceries. Key players are investing heavily in their online presence and partnerships with delivery platforms.

- Convenience Stores: Offer impulse purchases and on-the-go options, particularly for smaller packaged processed poultry items.

- Others (Off-Trade): Includes specialty stores and discount retailers.

The On-Trade channel, encompassing restaurants, hotels, and catering services, also represents a substantial, albeit more fragmented, market for poultry meat, driven by food service demand. Economic policies that support agricultural exports, infrastructure development for efficient cold chain logistics, and consumer-centric marketing campaigns are key drivers of dominance in these segments.

North America Poultry Meat Industry Product Developments

Product innovation in the North America poultry meat industry is centered on enhancing consumer convenience, nutritional value, and taste. Companies are actively developing new flavors, marinades, and cooking methods for both fresh and processed poultry products. The rise of plant-based alternatives, often using poultry processing by-products or entirely novel ingredients, represents a significant area of development, catering to vegetarian and flexitarian consumers. Innovations in packaging are also crucial, focusing on extended shelf life, resealability, and eco-friendly materials. The emphasis is on creating products that offer a superior sensory experience and align with evolving dietary trends, such as high-protein, low-fat, and minimally processed options.

Report Scope & Segmentation Analysis

This report meticulously segments the North America poultry meat market across Form, Distribution Channel, and specific Processed Types. The Form segmentation includes Canned, Fresh / Chilled, Frozen, and Processed poultry. The Processed category is further detailed into Deli Meats, Marinated/Tenders, Meatballs, Nuggets, Sausages, and Other Processed Poultry. The Distribution Channel segmentation covers Off-Trade (comprising Convenience Stores, Online Channel, Supermarkets and Hypermarkets, and Others) and On-Trade. Growth projections for each segment are analyzed within the historical period (2019-2024) and forecast period (2025-2033), with estimated market sizes for the base year of 2025. Competitive dynamics within each micro-segment are evaluated, highlighting key players and their market penetration strategies.

Key Drivers of North America Poultry Meat Industry Growth

Several pivotal factors are driving the growth of the North America poultry meat industry. Economically, rising consumer disposable incomes and the relatively stable pricing of poultry compared to other protein sources make it an attractive choice for a broad consumer base. Technologically, advancements in breeding, feed efficiency, processing automation, and cold chain logistics are enhancing productivity, reducing operational costs, and improving product quality and safety. Regulatory frameworks that support sustainable farming practices and ensure food safety build consumer trust and encourage industry expansion. Furthermore, evolving consumer preferences for healthier, convenient, and versatile protein options are creating significant demand for various poultry meat products, from fresh cuts to innovative processed items. The ongoing trend of flexitarianism also contributes positively, as consumers increasingly incorporate poultry into their diets.

Challenges in the North America Poultry Meat Industry Sector

Despite its growth trajectory, the North America poultry meat industry faces several significant challenges. Regulatory hurdles, including stringent food safety standards and evolving animal welfare regulations, can increase operational costs and necessitate substantial capital investment for compliance. Supply chain vulnerabilities, such as disease outbreaks (e.g., avian influenza), fluctuations in feed prices, and labor shortages, can disrupt production and impact profitability. Intense competitive pressures from both domestic and international players, as well as the growing popularity of plant-based protein alternatives, demand continuous innovation and cost management. Environmental concerns related to poultry farming, including water usage and waste management, also present a challenge that requires sustainable solutions and responsible practices to maintain public acceptance and regulatory compliance. The industry must also navigate the complexities of global trade policies and tariffs.

Emerging Opportunities in North America Poultry Meat Industry

The North America poultry meat industry is ripe with emerging opportunities. The increasing demand for value-added and convenience poultry products, such as ready-to-cook meals, marinated chicken cuts, and pre-seasoned options, presents a significant avenue for growth. The expanding online retail channel offers new direct-to-consumer opportunities and the ability to reach a wider customer base with specialized offerings. Technological advancements in food processing and packaging can lead to the development of innovative, healthier, and longer-shelf-life products. Furthermore, the growing consumer interest in sustainable and ethically sourced poultry creates a market for niche products and brands that emphasize transparency in their production methods. The development of protein-rich snacks and functional foods incorporating poultry ingredients also represents an emerging trend.

Leading Players in the North America Poultry Meat Industry Market

- WH Group Limited

- George's Inc

- House Of Raeford

- Tyson Foods Inc

- Perdue Farms Inc

- Sysco Corporation

- The Kraft Heinz Company

- Foster Farms Inc

- Continental Grain Company

- Hormel Foods Corporation

- Cargill Inc

- Koch Foods Inc

- JBS SA

Key Developments in North America Poultry Meat Industry Industry

- March 2023: Kraft Heinz Company and BEES announced an expanded partnership to propel the B2B marketplace, with the ambition to unlock 1 million potential new points of sale across LATAM for the Company, specifically to enhance its footprint in Mexico, Colombia and Peru.

- March 2023: Tyson® brand introduces chicken sandwiches and sliders, bringing restaurant-quality taste to home. The new Tyson Chicken Breast Sandwiches and Sliders are available in Original and Spicy. The new product is available in the frozen snacks section at retailers nationwide.

- February 2023: Morning Star and Pringles combine iconic flavors in first-of-its-kind plant-based CHIK'N Fries. All-new MorningStar Farms® Chik'n Fries are available in two delicious Pringles® flavors: Original and Scorchin' Cheddar Cheeze.

Strategic Outlook for North America Poultry Meat Industry Market

The strategic outlook for the North America poultry meat industry is one of continued innovation and adaptation to evolving consumer demands. Key growth catalysts include further investment in the online sales channel, development of advanced plant-based poultry alternatives, and a greater emphasis on sustainability and ethical sourcing. Companies that can effectively leverage technological advancements in processing and supply chain management to offer cost-effective, high-quality, and convenient products will be best positioned for success. Strategic partnerships and targeted acquisitions will remain crucial for expanding market share and entering new product categories. The industry's ability to respond to health and wellness trends, coupled with robust marketing efforts highlighting its nutritional benefits, will be paramount in sustaining its growth trajectory and navigating the competitive landscape.

North America Poultry Meat Industry Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

North America Poultry Meat Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Poultry Meat Industry Regional Market Share

Geographic Coverage of North America Poultry Meat Industry

North America Poultry Meat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Poultry consumption in the region grew amid the rising prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Poultry Meat Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WH Group Limite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 George's Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 House Of Raeford

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tyson Foods Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Perdue Farms Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sysco Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Kraft Heinz Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Foster Farms Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Continental Grain Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hormel Foods Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cargill Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Koch Foods Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JBS SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 WH Group Limite

List of Figures

- Figure 1: North America Poultry Meat Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Poultry Meat Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Poultry Meat Industry Revenue undefined Forecast, by Form 2020 & 2033

- Table 2: North America Poultry Meat Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Poultry Meat Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Poultry Meat Industry Revenue undefined Forecast, by Form 2020 & 2033

- Table 5: North America Poultry Meat Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Poultry Meat Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Poultry Meat Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Poultry Meat Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Poultry Meat Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Poultry Meat Industry?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the North America Poultry Meat Industry?

Key companies in the market include WH Group Limite, George's Inc, House Of Raeford, Tyson Foods Inc, Perdue Farms Inc, Sysco Corporation, The Kraft Heinz Company, Foster Farms Inc, Continental Grain Company, Hormel Foods Corporation, Cargill Inc, Koch Foods Inc, JBS SA.

3. What are the main segments of the North America Poultry Meat Industry?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Poultry consumption in the region grew amid the rising prices.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

March 2023: Kraft Heinz Company and BEES announced an expanded partnership to propel the B2B marketplace, with the ambition to unlock 1 million potential new points of sale across LATAM for the Company, specifically to enhance its footprint in Mexico, Colombia and Peru.March 2023: Tyson® brand introduces chicken sandwiches and sliders, bringing restaurant-quality taste to home. The new Tyson Chicken Breast Sandwiches and Sliders are available in Original and Spicy. The new product is available in the frozen snacks section at retailers nationwide.February 2023: Morning Star and Pringles combine iconic flavors in first-of-its-kind plant-based CHIK'N Fries. All-new MorningStar Farms® Chik'n Fries are available in two delicious Pringles® flavors: Original and Scorchin' Cheddar Cheeze.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Poultry Meat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Poultry Meat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Poultry Meat Industry?

To stay informed about further developments, trends, and reports in the North America Poultry Meat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence