Key Insights

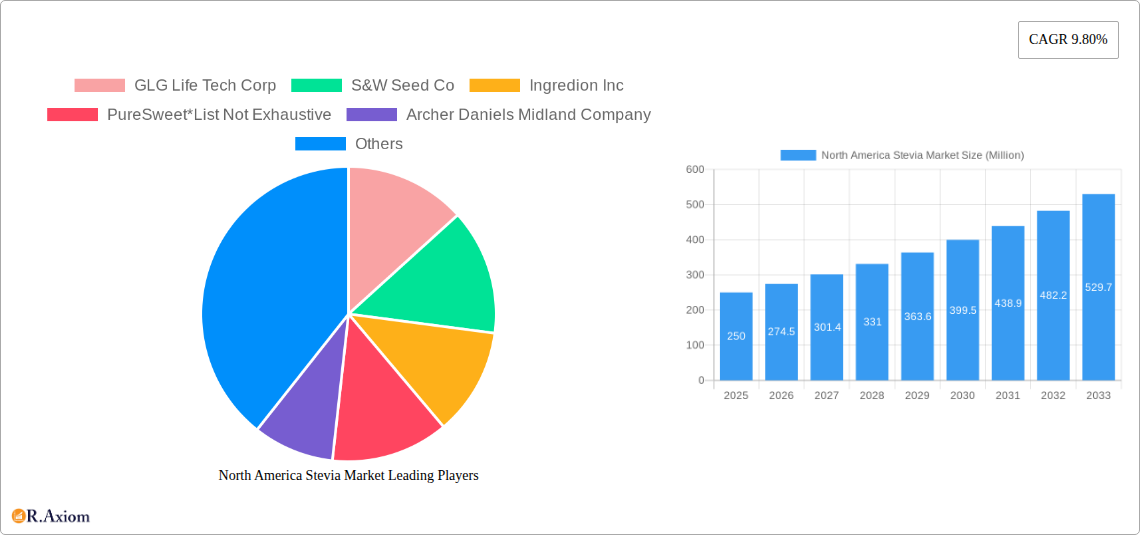

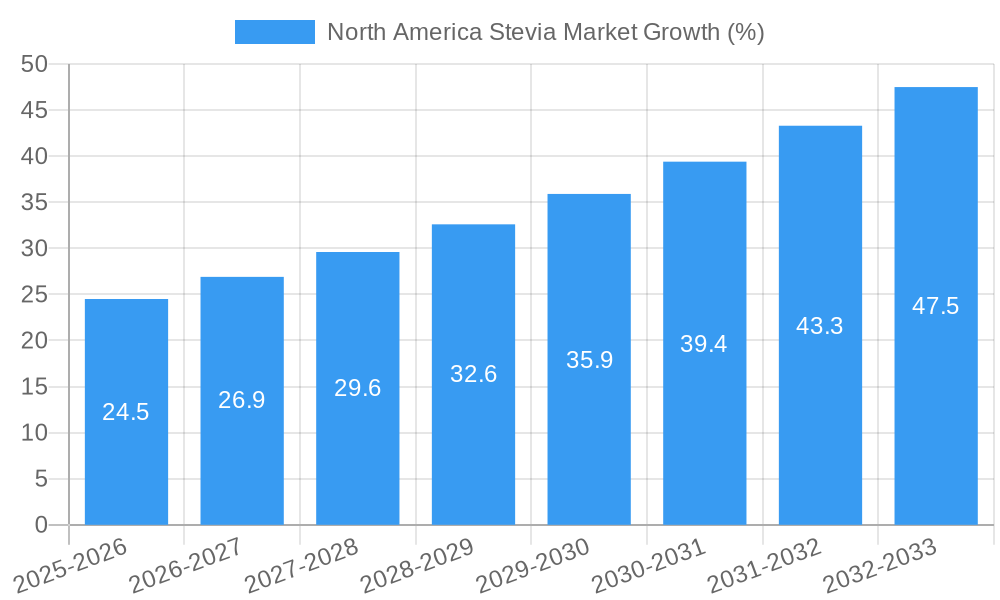

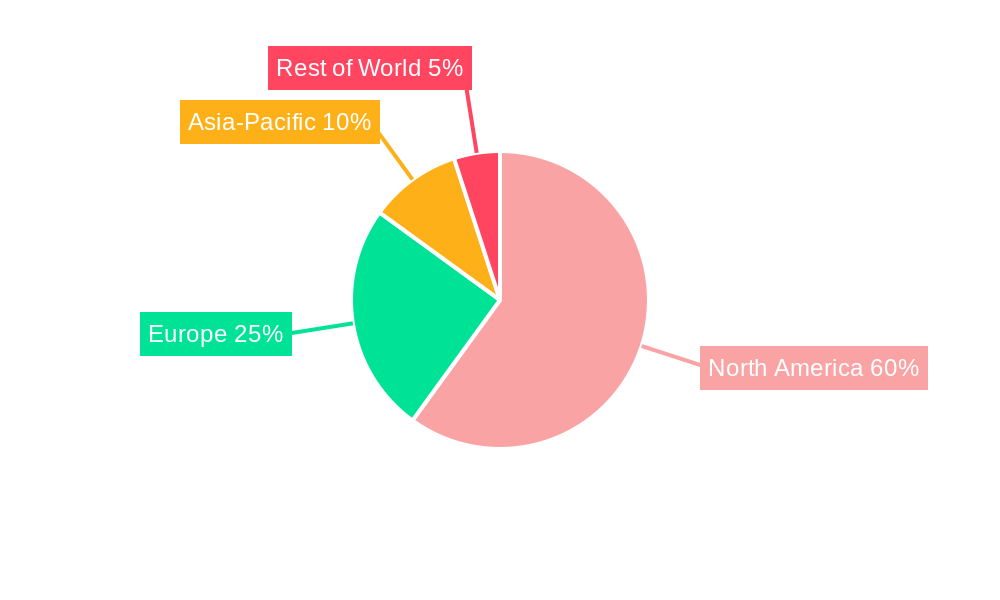

The North American stevia market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing consumer demand for natural and low-calorie sweeteners. The market's Compound Annual Growth Rate (CAGR) of 9.80% from 2019-2033 indicates a significant expansion, with substantial potential across various application segments. The rising prevalence of diabetes and obesity, coupled with growing health consciousness, are major catalysts. Consumers are actively seeking alternatives to traditional high-calorie sweeteners, making stevia an attractive option due to its intense sweetness and negligible caloric content. Within the North American market, the United States represents the largest segment, fueled by high consumption of processed foods and beverages incorporating stevia. Canada and Mexico also contribute significantly, although their market shares may be smaller. The liquid form of stevia is currently the most popular, driven by its versatility in various food and beverage applications. However, the powder form is projected to experience faster growth due to its convenience in home use and cost-effectiveness. The bakery and beverage segments are currently the largest consumers, but expanding applications in dairy, confectionery, and pharmaceuticals promise further growth. Key players like Ingredion Inc, Cargill, and Tate & Lyle are actively investing in research and development, further fueling innovation within the stevia market. Competition is fierce, with companies focusing on product differentiation through improved taste and purity.

The forecast period of 2025-2033 anticipates continued expansion, driven by advancements in stevia extraction and processing technologies that improve taste profiles and reduce production costs. Regulatory approvals and guidelines also play a crucial role, ensuring consumer safety and trust. While challenges such as the relatively higher price compared to traditional sweeteners exist, ongoing innovation and increasing consumer preference for natural alternatives are expected to overcome these barriers, ensuring sustained growth in the North American stevia market throughout the forecast period. The presence of established players like Archer Daniels Midland Company and PureCircle adds to the market's stability and ensures consistent supply and distribution.

North America Stevia Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America stevia market, offering actionable insights for stakeholders across the value chain. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report meticulously examines market size, growth drivers, challenges, opportunities, and competitive landscape, offering a 360-degree view of this dynamic market. Key players analyzed include GLG Life Tech Corp, S&W Seed Co, Ingredion Inc, PureSweet, Archer Daniels Midland Company, Cargill, PureCircle, and Tate & Lyle.

North America Stevia Market Market Concentration & Innovation

The North America stevia market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, specialized companies indicates a dynamic competitive environment. Market share data for 2025 estimates that the top five players collectively hold approximately xx% of the market. Innovation is driven by the increasing demand for natural sweeteners, coupled with ongoing research to enhance stevia's taste profile and functional properties. Regulatory frameworks, particularly those related to food labeling and ingredient approvals, play a significant role in shaping market dynamics. Consumer preference shifts towards healthier and natural food and beverage options are major drivers for growth. The market also witnesses several mergers and acquisitions (M&A) activities, with deal values ranging from xx Million to xx Million in recent years, reflecting strategic consolidation and expansion efforts by key players. Key factors affecting market concentration include:

- Technological advancements: Improved extraction and processing techniques are leading to higher-quality stevia products.

- Product differentiation: Companies are focusing on developing unique stevia-based products to gain a competitive edge.

- Strategic partnerships: Collaborations between stevia producers and food and beverage companies are expanding market reach.

- Regulatory landscape: Changes in food labeling regulations impact market dynamics.

North America Stevia Market Industry Trends & Insights

The North America stevia market is experiencing robust growth, projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by the rising consumer awareness of health and wellness, leading to increased demand for natural and low-calorie sweeteners. Technological advancements in stevia extraction and processing have resulted in improved taste and functionality, addressing previous limitations and enhancing market appeal. The market penetration of stevia in various food and beverage categories is increasing steadily, with significant growth observed in beverages and confectionery. Consumer preference for natural and clean-label products has created substantial opportunities for stevia, and companies are strategically positioning their products to cater to this evolving demand. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of new entrants, leading to innovations in product offerings and pricing strategies.

Dominant Markets & Segments in North America Stevia Market

The United States dominates the North America stevia market, accounting for the largest market share owing to high consumer demand for natural sweeteners and established distribution networks. Within the market segmentation:

By Type:

- Powder: This segment holds the largest market share due to its versatility and ease of use across various applications. Drivers include its wide usage in various formulations.

- Liquid: Growing demand for ready-to-use stevia solutions is fuelling the liquid segment's growth. Drivers include convenience.

- Leaf: This segment is comparatively smaller but is expected to experience steady growth due to the increasing popularity of natural and organic products. Drivers include the demand for organic and natural products.

By Application:

- Beverages: This segment holds the dominant position owing to the widespread use of stevia in carbonated soft drinks, juices, and other beverages. Drivers include growth of health-conscious consumers.

- Confectionery: The confectionery segment is also a significant user of stevia, driven by the increasing demand for low-calorie and natural sweeteners in candies, chocolates, and other confectionery products. Drivers include low-calorie product demand.

- Dairy Food Products: The growing demand for low-calorie and healthier dairy alternatives fuels the adoption of stevia in yogurts, ice creams, and other dairy products. Drivers include healthy food trends.

- Bakery: Stevia is gaining traction in baked goods, though the segment’s growth is relatively slower compared to beverages and confectionery, due to taste and functional challenges. Drivers include low-calorie product demand.

North America Stevia Market Product Developments

Recent product developments in the North America stevia market focus on enhancing taste and functionality to overcome previous limitations. Companies are investing in advanced extraction and processing technologies to create stevia products with improved sweetness profiles, reduced bitterness, and enhanced stability. New stevia blends and formulations are being developed to cater to specific applications and consumer preferences. The emphasis on clean-label ingredients and the growing demand for natural food and beverage options are further shaping product innovation strategies.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America stevia market, segmented by type (powder, liquid, leaf) and application (bakery, dairy food products, beverages, pharmaceuticals, confectionery, other applications). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The report provides detailed forecasts, including market size estimations and growth rates for each segment during the forecast period (2025-2033).

Key Drivers of North America Stevia Market Growth

The North America stevia market is driven by several factors, including:

- Increasing demand for natural sweeteners: Consumers are increasingly seeking healthier alternatives to artificial sweeteners.

- Growing health consciousness: The rising awareness of the health risks associated with excessive sugar consumption is fuelling demand for low-calorie and natural sweeteners.

- Technological advancements: Improved extraction and processing techniques have addressed previous taste and functionality issues.

- Favorable regulatory environment: Regulatory approvals for stevia as a food additive in several countries support market growth.

Challenges in the North America Stevia Market Sector

The North America stevia market faces certain challenges:

- Price volatility: Fluctuations in raw material costs and supply chain disruptions can impact profitability.

- Taste and functionality limitations: While improvements have been made, some consumers still find the taste of stevia less desirable compared to sugar.

- Competition from other sweeteners: Stevia competes with other natural and artificial sweeteners, leading to competitive pressures.

- Regulatory hurdles: Variations in regulatory frameworks across different regions may pose challenges for companies expanding their operations.

Emerging Opportunities in North America Stevia Market

Emerging opportunities include:

- Expansion into new applications: Stevia's potential use in new food and beverage categories is a significant growth area.

- Development of novel stevia blends: Blending stevia with other natural sweeteners can improve its taste and functionality.

- Growth of the organic and sustainable stevia segment: Meeting the rising demand for sustainable and organic ingredients.

- Increased penetration in emerging markets: Expanding into new geographic markets in North America.

Leading Players in the North America Stevia Market Market

- GLG Life Tech Corp

- S&W Seed Co

- Ingredion Inc

- PureSweet

- Archer Daniels Midland Company

- Cargill

- PureCircle

- Tate & Lyle

Key Developments in North America Stevia Market Industry

- 2022 Q4: Ingredion Inc. launched a new stevia-based sweetener with improved taste.

- 2023 Q1: PureCircle announced a strategic partnership to expand its stevia production capacity.

- 2023 Q3: A major merger between two stevia producers reshaped market dynamics. (Further details available in the full report).

Strategic Outlook for North America Stevia Market Market

The North America stevia market presents a promising outlook for the future, driven by sustained demand for natural sweeteners and ongoing innovation. Companies that invest in research and development, focusing on improving taste and functionality, while establishing sustainable and efficient production processes will be well-positioned to capitalize on the growing market opportunities. The market is expected to witness further consolidation through M&A activities and increased competition, particularly among players focusing on differentiated product offerings and specialized applications. Continued focus on consumer preferences for natural, clean-label ingredients will continue to shape market dynamics, while regulatory changes in labeling and health regulations will continue to influence market growth.

North America Stevia Market Segmentation

-

1. Type

- 1.1. Powder

- 1.2. Liquid

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Food Products

- 2.3. Beverages

- 2.4. Pharmaceuticals

- 2.5. Confectionery

- 2.6. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

North America Stevia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rapid Growth in the North America Stevia Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stevia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powder

- 5.1.2. Liquid

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Food Products

- 5.2.3. Beverages

- 5.2.4. Pharmaceuticals

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Stevia Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Stevia Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Stevia Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Stevia Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 GLG Life Tech Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 S&W Seed Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ingredion Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PureSweet*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Archer Daniels Midland Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cargill

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PureCircle

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tate & Lyle

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 GLG Life Tech Corp

List of Figures

- Figure 1: North America Stevia Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Stevia Market Share (%) by Company 2024

List of Tables

- Table 1: North America Stevia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Stevia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Stevia Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Stevia Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Stevia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Stevia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Stevia Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Stevia Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Stevia Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Stevia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Stevia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stevia Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Stevia Market?

Key companies in the market include GLG Life Tech Corp, S&W Seed Co, Ingredion Inc, PureSweet*List Not Exhaustive, Archer Daniels Midland Company, Cargill, PureCircle, Tate & Lyle.

3. What are the main segments of the North America Stevia Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rapid Growth in the North America Stevia Market.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stevia Market?

To stay informed about further developments, trends, and reports in the North America Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence