Key Insights

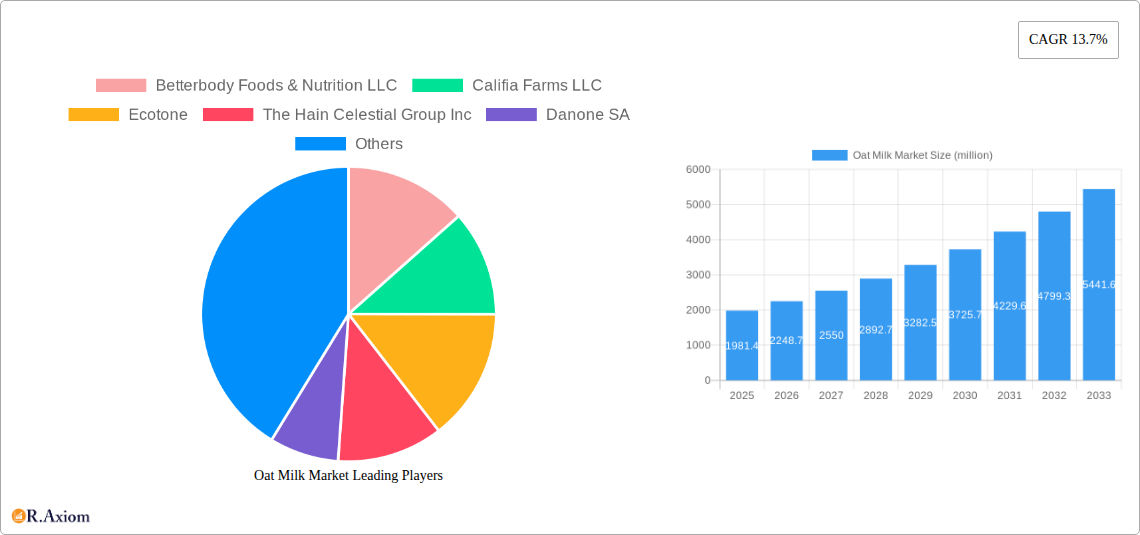

The global Oat Milk Market is poised for significant expansion, projected to reach approximately $1,981.4 million by 2025, driven by a compelling compound annual growth rate (CAGR) of 13.7% through 2033. This robust growth trajectory is fueled by a confluence of evolving consumer preferences and increasing awareness of the health and environmental benefits associated with oat-based beverages. Growing demand for plant-based alternatives, a surge in lactose intolerance and dairy allergies, and a rising interest in sustainable food systems are primary market catalysts. Furthermore, the versatility of oat milk, extending beyond a direct dairy substitute to applications in coffee, smoothies, and culinary preparations, is broadening its consumer base. The market is witnessing innovation in product formulations, including enhanced nutritional profiles and diverse flavor offerings, catering to a wider spectrum of tastes and dietary needs.

Oat Milk Market Market Size (In Billion)

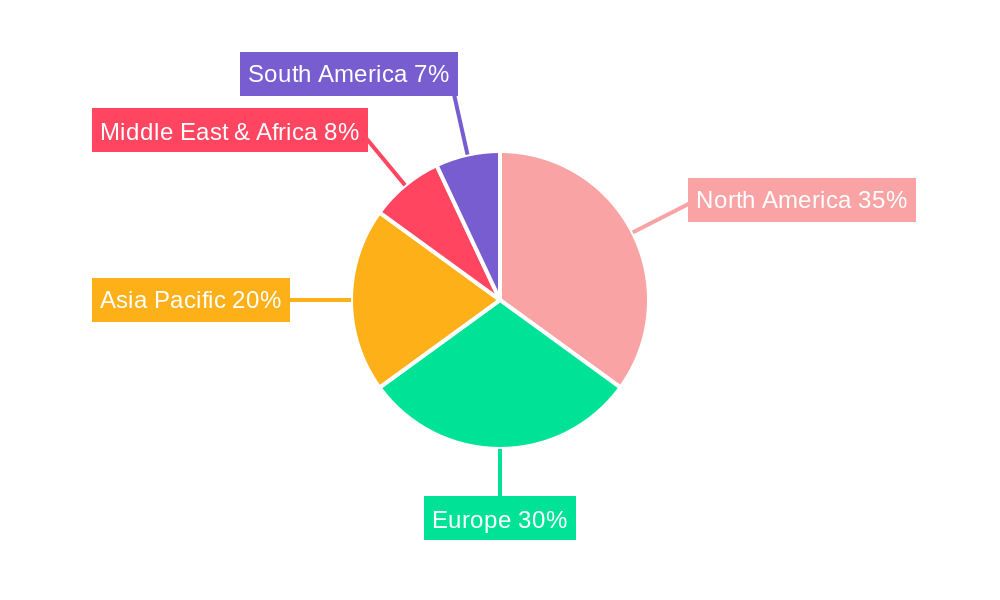

Key trends shaping the oat milk landscape include the escalating adoption of oat milk within the Off-Trade distribution channel, with online retail and convenience stores emerging as significant growth drivers alongside traditional supermarkets and hypermarkets. The On-Trade sector is also seeing increased penetration as cafes and restaurants integrate oat milk into their menus. Geographically, North America and Europe are leading the charge in oat milk consumption, owing to established plant-based food cultures and supportive regulatory environments. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate as consumer awareness and product availability increase. While the market is experiencing strong momentum, potential restraints could include fluctuating raw material prices for oats and intensifying competition from other plant-based milk alternatives. Nevertheless, the overarching demand for healthier and more sustainable food options positions the oat milk market for sustained and vigorous growth.

Oat Milk Market Company Market Share

This in-depth report delivers a comprehensive analysis of the global oat milk market, projecting a significant valuation of over $10,000 million by 2033. The study meticulously examines market dynamics, key players, and emerging trends from 2019 to 2033, with a base year of 2025. With a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning plant-based milk sector. The analysis covers market concentration, product innovation, distribution channel segmentation, and strategic insights for navigating this dynamic dairy alternative landscape.

Oat Milk Market Market Concentration & Innovation

The oat milk market exhibits a moderate level of concentration, with a few key players holding substantial market share, estimated to be around 70% of the total market value in 2025. Innovation is a significant driver, with companies continuously investing in research and development to enhance nutritional profiles, flavor varieties, and sustainability practices. Regulatory frameworks, particularly concerning labeling and fortification, are evolving and will influence market entry and product development. Product substitutes, including almond milk, soy milk, and other plant-based beverages, present a constant competitive pressure, driving innovation in oat milk's unique selling propositions, such as its creaminess and environmental benefits. End-user trends are increasingly leaning towards health-conscious and environmentally aware consumers, fueling demand for oat milk. Mergers and acquisitions (M&A) activities are expected to shape market consolidation, with anticipated deal values reaching over $500 million in the coming years, as larger food and beverage corporations seek to expand their vegan food portfolios.

- Market Concentration: Dominated by a few leading brands, but with increasing fragmentation due to new entrants.

- Innovation Drivers: Focus on taste, texture, nutritional fortification (e.g., added vitamins and minerals), and sustainable sourcing and packaging.

- Regulatory Frameworks: Evolving standards for plant-based claims, nutritional labeling, and environmental impact assessments.

- Product Substitutes: Intense competition from almond, soy, coconut, and other non-dairy milk alternatives.

- End-User Trends: Growing demand driven by health benefits, lactose intolerance, ethical concerns, and environmental consciousness.

- M&A Activities: Strategic acquisitions to gain market share, access new technologies, and expand product lines.

Oat Milk Market Industry Trends & Insights

The oat milk industry is experiencing remarkable growth driven by a confluence of factors. Increasing consumer awareness regarding the health benefits of dairy-free diets and the environmental impact of dairy farming is a primary growth driver. The rising prevalence of lactose intolerance and veganism globally further bolsters demand for oat-based beverages. Technological advancements in processing and extraction methods have led to improved taste, texture, and shelf-life of oat milk products, making them more appealing to a wider consumer base. This has also enabled manufacturers to create a diverse range of oat milk products, including unsweetened, flavored, and fortified varieties, catering to specific dietary needs and preferences. The competitive landscape is dynamic, with both established dairy giants and agile startups vying for market share. Companies are investing heavily in marketing and branding to highlight the superior qualities of oat milk, such as its creamy texture and versatility in culinary applications. Furthermore, the growing trend of e-commerce and online grocery shopping has made oat milk more accessible to consumers worldwide, contributing to increased market penetration. The overall market penetration of oat milk is projected to exceed XX% by 2025. The CAGR of the oat milk market is expected to remain robust, estimated at XX% from 2025 to 2033.

Dominant Markets & Segments in Oat Milk Market

The oat milk market is witnessing a dominant presence in the Off-Trade distribution channel, which is projected to account for over 80% of the market share by 2025. Within the Off-Trade segment, Supermarkets and Hypermarkets represent the largest sub-segment, driven by their wide product availability, competitive pricing, and convenience for consumers stocking their pantries. The Online Retail segment is rapidly gaining traction, exhibiting the highest growth rate due to its convenience, wider selection, and direct-to-consumer accessibility. Specialist retailers are also playing a crucial role in catering to niche markets and health-conscious consumers. The On-Trade segment, encompassing cafes, restaurants, and foodservice providers, is also experiencing significant growth as oat milk becomes a preferred alternative for coffee-based beverages and other culinary uses.

Off-Trade Dominance: The primary driver of oat milk sales, encompassing all retail purchases outside of foodservice.

- Supermarkets and Hypermarkets: Leading sub-segment due to large store footprints and broad consumer reach. Key drivers include extensive product variety and promotional activities.

- Online Retail: Experiencing the fastest growth, fueled by convenience, personalized shopping experiences, and expanding delivery networks. Economic policies supporting digital commerce and infrastructure development for logistics are key enablers.

- Specialist Retailers: Catering to health-conscious and vegan consumers, offering curated selections and expert advice.

- Others (Convenience Stores, Warehouse Clubs, Gas Stations): Growing in importance for impulse purchases and broader accessibility.

On-Trade Growth: Increasing integration into cafe menus and restaurant offerings, driven by consumer demand for plant-based options.

Oat Milk Market Product Developments

Product innovation in the oat milk market is characterized by a focus on enhanced nutritional profiles and diverse flavor offerings. Manufacturers are developing oat milk variants fortified with essential vitamins and minerals like calcium, vitamin D, and B vitamins, appealing to health-conscious consumers. The introduction of unsweetened versions addresses growing concerns about sugar intake, while novel flavors such as chocolate, vanilla, and even barista blends are expanding consumer choice and culinary applications. These developments are driven by technological advancements in ingredient processing and formulation, aiming to replicate the sensory experience of dairy milk while offering distinct plant-based advantages. Competitive advantages are being built through superior taste, creamy texture, and sustainable sourcing practices, differentiating brands in a crowded market.

Report Scope & Segmentation Analysis

This report provides an exhaustive analysis of the oat milk market, segmented by distribution channels. The Off-Trade segment, projected to reach over $8,000 million by 2033, is further divided into Convenience Stores, Online Retail, Specialist Retailers, Supermarkets and Hypermarkets, and Others (Warehouse clubs, gas stations, etc.). Each sub-segment is analyzed for its market size, growth projections, and competitive dynamics. The On-Trade segment, expected to grow at a CAGR of XX% from 2025 to 2033, is also examined for its evolving role in foodservice.

Off-Trade: Encompasses all retail sales, expected to dominate the market.

- Convenience Stores: Steady growth, driven by impulse buys and on-the-go consumption.

- Online Retail: Significant growth potential due to e-commerce expansion and shifting consumer purchasing habits.

- Specialist Retailers: Niche market, catering to specific dietary needs and preferences.

- Supermarkets and Hypermarkets: Continued dominance due to broad reach and product availability.

- Others (Warehouse clubs, gas stations, etc.): Expanding reach through varied retail touchpoints.

On-Trade: Growing segment as foodservice providers increasingly offer plant-based options.

Key Drivers of Oat Milk Market Growth

The oat milk market is propelled by several significant growth drivers. A primary factor is the escalating consumer preference for plant-based alternatives due to health concerns, including lactose intolerance and a desire for dairy-free options. The growing awareness of the environmental sustainability of oat cultivation compared to traditional dairy farming also contributes significantly. Technological advancements in production processes have enhanced the taste and texture of oat milk, making it a more appealing substitute. Furthermore, supportive government initiatives promoting healthy eating and sustainable agriculture, coupled with the expanding availability of oat milk across various retail channels, including online platforms, are crucial growth catalysts.

- Rising Health Consciousness: Increased demand for dairy-free, lactose-free, and plant-based diets.

- Environmental Sustainability: Growing consumer preference for eco-friendly food choices.

- Product Innovation: Continuous development of improved taste, texture, and nutritional profiles.

- Expanding Distribution Networks: Greater accessibility through supermarkets, online retail, and foodservice.

- Favorable Regulatory Landscape: Government support for plant-based food industries.

Challenges in the Oat Milk Market Sector

Despite its robust growth, the oat milk market faces certain challenges. Price sensitivity among consumers remains a barrier, with oat milk often being priced higher than conventional dairy milk, impacting market penetration in price-sensitive regions. Supply chain volatility, including potential fluctuations in oat crop yields and ingredient sourcing complexities, can affect production costs and availability. Intense competition from established dairy milk and other plant-based milk alternatives necessitates continuous innovation and effective marketing strategies. Moreover, certain regulatory hurdles related to labeling claims and ingredient standards can pose challenges for new market entrants and product development.

- Price Competition: Higher production costs leading to premium pricing compared to dairy milk.

- Supply Chain Disruptions: Vulnerability to agricultural factors and raw material availability.

- Intense Competition: Pressure from established dairy and other plant-based alternatives.

- Regulatory Complexities: Navigating varied labeling and ingredient standards globally.

Emerging Opportunities in Oat Milk Market

The oat milk market presents a wealth of emerging opportunities. The expansion into developing economies, where awareness and adoption of plant-based diets are on the rise, offers significant untapped potential. Innovations in oat milk applications beyond beverages, such as in baking, cooking, and the development of dairy-free ice creams and yogurts, can open new revenue streams. Collaborations with food service providers and the development of specialized barista-grade oat milk for the coffee industry are also promising avenues. Furthermore, the increasing consumer demand for transparent and sustainable sourcing presents an opportunity for brands to differentiate themselves through ethical and eco-friendly practices.

- Emerging Markets: Penetration into untapped geographic regions with growing demand for plant-based products.

- New Product Applications: Diversification into culinary uses, dairy alternatives in food products, and specialized beverages.

- Foodservice Partnerships: Increased integration into cafe and restaurant menus.

- Sustainable Sourcing: Leveraging consumer preference for ethical and environmentally friendly products.

Leading Players in the Oat Milk Market Market

- Betterbody Foods & Nutrition LLC

- Califia Farms LLC

- Ecotone

- The Hain Celestial Group Inc

- Danone SA

- Ripple Foods PBC

- Oatly Group AB

- Elmhurst Milked LLC

- Campbell Soup Company

- Agrifoods International Cooperative Ltd

- SunOpta Inc

- The Rise Brewing Co

- Green Grass Foods Inc (Nutpods)

Key Developments in Oat Milk Market Industry

- September 2022: Elmhurst launched its reformulated unsweetened Oat Milk with enhanced nutritional benefits. The new formula includes more calcium, healthy fat, and potassium than the prior Elmhurst Oat Milk.

- June 2022: Elmhurst 1925 announced the launch of three products, including Chocolate Milked Oats and Unsweetened Milked Oats, across all Whole Foods Market chain locations.

- May 2022: Oatly Group launched its one-hour delivery for its bestselling oat-based products, including oat milk, and frozen non-dairy dessert pints and novelties in Los Angeles and New York City through popular food delivery apps.

Strategic Outlook for Oat Milk Market Market

The strategic outlook for the oat milk market is exceptionally positive, driven by sustained consumer demand for healthier and more sustainable food choices. Companies are expected to focus on expanding their product portfolios with innovative formulations, including those catering to specific dietary needs and enhanced nutritional profiles. Investment in sustainable sourcing and production practices will be crucial for brand differentiation and consumer loyalty. Strategic partnerships with foodservice providers and the expansion of online retail channels will be key to increasing market reach and accessibility. Furthermore, continued investment in marketing and consumer education to highlight the benefits of oat milk will be essential for maintaining growth momentum in this dynamic plant-based dairy alternative sector.

Oat Milk Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Retail

- 1.1.3. Specialist Retailers

- 1.1.4. Supermarkets and Hypermarkets

- 1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 1.2. On-Trade

-

1.1. Off-Trade

Oat Milk Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oat Milk Market Regional Market Share

Geographic Coverage of Oat Milk Market

Oat Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry

- 3.3. Market Restrains

- 3.3.1. Competition from Other Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Retail

- 5.1.1.3. Specialist Retailers

- 5.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Off-Trade

- 6.1.1.1. Convenience Stores

- 6.1.1.2. Online Retail

- 6.1.1.3. Specialist Retailers

- 6.1.1.4. Supermarkets and Hypermarkets

- 6.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 6.1.2. On-Trade

- 6.1.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Off-Trade

- 7.1.1.1. Convenience Stores

- 7.1.1.2. Online Retail

- 7.1.1.3. Specialist Retailers

- 7.1.1.4. Supermarkets and Hypermarkets

- 7.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 7.1.2. On-Trade

- 7.1.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Off-Trade

- 8.1.1.1. Convenience Stores

- 8.1.1.2. Online Retail

- 8.1.1.3. Specialist Retailers

- 8.1.1.4. Supermarkets and Hypermarkets

- 8.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 8.1.2. On-Trade

- 8.1.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Off-Trade

- 9.1.1.1. Convenience Stores

- 9.1.1.2. Online Retail

- 9.1.1.3. Specialist Retailers

- 9.1.1.4. Supermarkets and Hypermarkets

- 9.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 9.1.2. On-Trade

- 9.1.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Off-Trade

- 10.1.1.1. Convenience Stores

- 10.1.1.2. Online Retail

- 10.1.1.3. Specialist Retailers

- 10.1.1.4. Supermarkets and Hypermarkets

- 10.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 10.1.2. On-Trade

- 10.1.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Betterbody Foods & Nutrition LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Califia Farms LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ecotone

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Hain Celestial Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danone SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ripple Foods PBC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oatly Group AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elmhurst Milked LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Campbell Soup Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Agrifoods International Cooperative Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SunOpta Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Rise Brewing Co

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Green Grass Foods Inc (Nutpods)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Betterbody Foods & Nutrition LLC

List of Figures

- Figure 1: Global Oat Milk Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Oat Milk Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 3: North America Oat Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Oat Milk Market Revenue (million), by Country 2025 & 2033

- Figure 5: North America Oat Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Oat Milk Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: South America Oat Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America Oat Milk Market Revenue (million), by Country 2025 & 2033

- Figure 9: South America Oat Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Oat Milk Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Oat Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Oat Milk Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Oat Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Oat Milk Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: Middle East & Africa Oat Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Middle East & Africa Oat Milk Market Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Oat Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Oat Milk Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 19: Asia Pacific Oat Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Oat Milk Market Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific Oat Milk Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Oat Milk Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Oat Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Oat Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Oat Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Oat Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Oat Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Oat Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: China Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Oat Milk Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oat Milk Market?

The projected CAGR is approximately 13.7%.

2. Which companies are prominent players in the Oat Milk Market?

Key companies in the market include Betterbody Foods & Nutrition LLC, Califia Farms LLC, Ecotone, The Hain Celestial Group Inc, Danone SA, Ripple Foods PBC, Oatly Group AB, Elmhurst Milked LLC, Campbell Soup Company, Agrifoods International Cooperative Ltd, SunOpta Inc, The Rise Brewing Co, Green Grass Foods Inc (Nutpods).

3. What are the main segments of the Oat Milk Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1981.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Other Substitute Products.

8. Can you provide examples of recent developments in the market?

September 2022: Elmhurst launched its reformulated unsweetened Oat Milk with enhanced nutritional benefits. The new formula includes more calcium, healthy fat, and potassium than the prior Elmhurst Oat Milk.June 2022: Elmhurst 1925 announced the launch of three products, including Chocolate Milked Oats and Unsweetened Milked Oats, across all Whole Foods Market chain locations.May 2022: Oatly Group launched its one-hour delivery for its bestselling oat-based products, including oat milk, and frozen non-dairy dessert pints and novelties in Los Angeles and New York City through popular food delivery apps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oat Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oat Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oat Milk Market?

To stay informed about further developments, trends, and reports in the Oat Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence