Key Insights

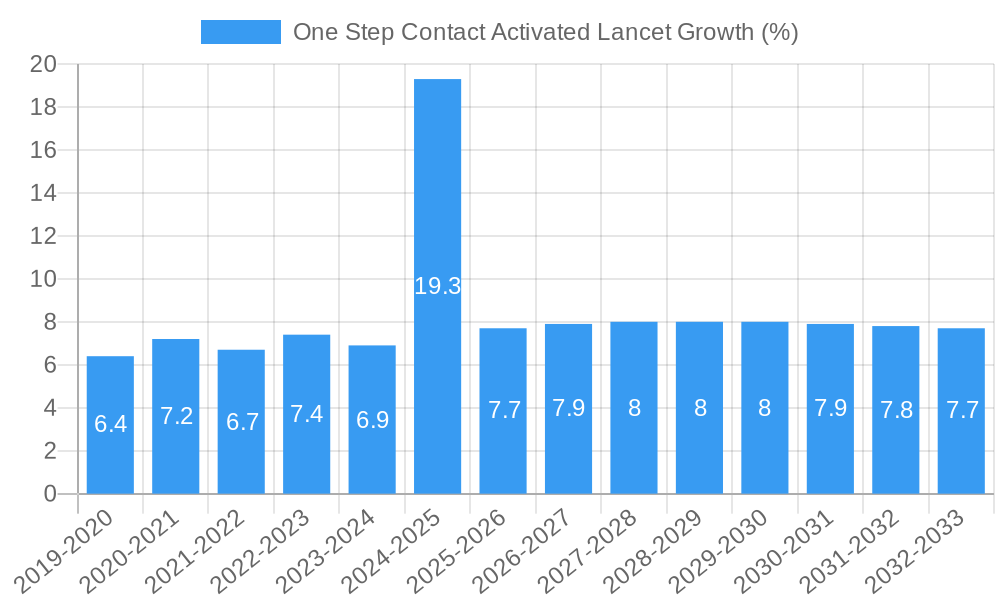

The global One Step Contact Activated Lancet market is poised for substantial expansion, projected to reach an estimated $650 million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust growth is underpinned by several significant drivers, most notably the increasing prevalence of diabetes globally. As more individuals are diagnosed with diabetes, the demand for convenient and user-friendly blood glucose monitoring devices, which rely heavily on lancets, escalates. Furthermore, advancements in lancet technology, leading to less painful and more accurate blood sampling, are also fueling market adoption. The market is segmented by application, with hospitals and clinics accounting for the largest share due to higher patient volumes and established procurement channels. However, the "Others" segment, encompassing home-use devices and retail sales, is experiencing rapid growth driven by patient empowerment and the increasing accessibility of self-monitoring solutions.

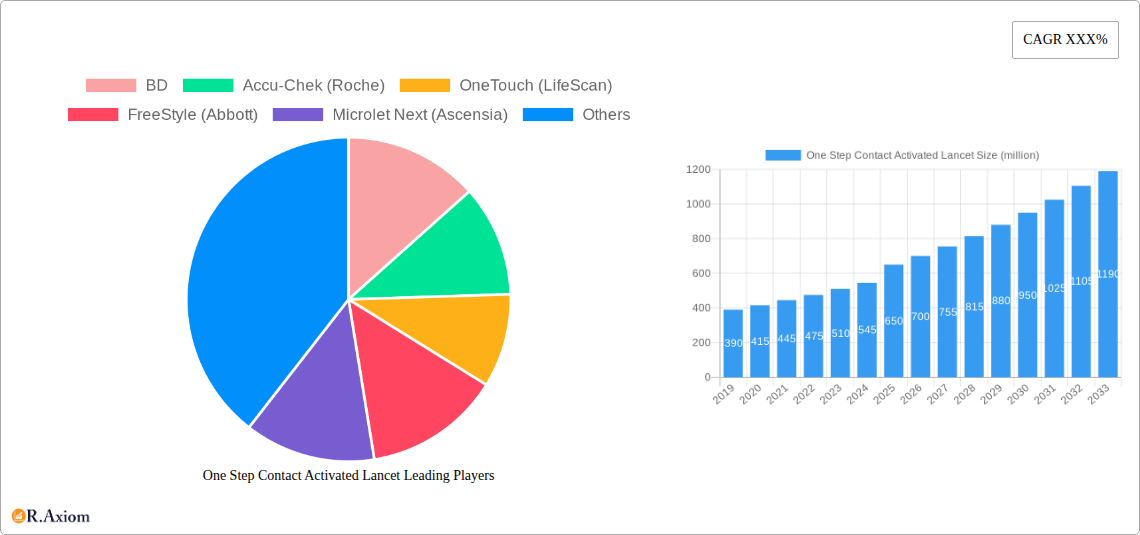

The market is further delineated by lancet type, with both "Below 30G" and "Above 30G" segments demonstrating significant market presence. Below 30G lancets, typically finer and associated with less pain, are gaining traction as comfort becomes a primary concern for users. Conversely, Above 30G lancets continue to hold a strong position, offering a balance of efficacy and cost-effectiveness. Key players such as BD, Accu-Chek (Roche), and FreeStyle (Abbott) are actively innovating and expanding their product portfolios to capture market share. Geographically, the Asia Pacific region is emerging as a high-growth market, driven by rising healthcare expenditure, increasing diabetes rates, and a growing awareness of the importance of blood glucose management. While the market presents immense opportunities, restraints such as the cost of advanced lancet technologies and the availability of alternative diagnostic methods could pose challenges. Nevertheless, the overarching trend towards proactive diabetes management and improved patient comfort solidifies a positive outlook for the One Step Contact Activated Lancet market.

One Step Contact Activated Lancet Market Concentration & Innovation

The global One Step Contact Activated Lancet market is characterized by a moderate to high concentration, driven by the presence of several large, established players alongside a growing number of specialized manufacturers. Innovation within this sector is primarily focused on enhancing patient comfort, safety, and ease of use. Key innovation drivers include the development of ultra-thin needles, advanced lancing technologies that minimize pain sensation, and integrated safety mechanisms to prevent needlestick injuries. Regulatory frameworks, particularly those governing medical device safety and efficacy, play a crucial role in shaping product development and market entry. While direct product substitutes are limited given the specific application of blood glucose monitoring, advancements in alternative blood sampling techniques or continuous glucose monitoring (CGM) systems could pose indirect competitive threats. End-user trends are leaning towards greater demand for user-friendly, disposable devices, particularly among the aging population and individuals managing chronic conditions like diabetes. Merger and acquisition (M&A) activities, while not at an extremely high volume, are observed as key players seek to expand their product portfolios and geographical reach. Recent M&A deal values have been in the range of tens to hundreds of million, consolidating market share and intellectual property. The market share distribution reveals leading players holding substantial portions, with significant opportunities for niche players focusing on specific technological advancements or underserved market segments.

One Step Contact Activated Lancet Industry Trends & Insights

The global One Step Contact Activated Lancet market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2019 to 2033. This sustained expansion is fueled by a confluence of escalating healthcare needs, technological advancements, and a growing emphasis on proactive health management. The increasing prevalence of diabetes worldwide, now affecting over 500 million individuals, directly translates into a consistently high demand for blood glucose monitoring devices, and consequently, for the lancets used in them. Market penetration for one-step contact activated lancets is already substantial in developed regions, estimated to be above 80% for diabetes management, with significant room for growth in emerging economies as healthcare infrastructure and disposable incomes improve. Technological disruptions are continuously reshaping the industry. The integration of advanced materials for needle sharpness, ergonomic designs for better grip and control, and improved safety features like automatic needle retraction are key differentiators. Furthermore, the miniaturization of diagnostic devices and the growing adoption of smart connected health solutions are indirectly influencing the demand for seamless and user-friendly lancet options that integrate with digital health platforms. Consumer preferences are increasingly aligned with convenience, minimal pain, and affordability. Patients are seeking a blood sampling experience that is as painless and straightforward as possible, leading to higher adoption rates of one-step activated lancets that require no pre-loading or manual adjustment. The competitive landscape is dynamic, with established companies like BD, Accu-Chek (Roche), and OneTouch (LifeScan) maintaining significant market share through extensive distribution networks and brand recognition. However, emerging players are carving out niches by offering innovative features or targeting specific market segments with cost-effective solutions. The overall market penetration of one-step activated lancets is expected to climb to over 90% by 2033, underscoring their position as a standard in blood glucose monitoring. The market size is projected to reach approximately 1.2 billion units by 2025, growing to over 1.8 billion units by 2033. The average selling price is estimated to be around $0.25 per unit, contributing to a global market value that is expected to exceed $350 million in 2025 and surpass $550 million by 2033.

Dominant Markets & Segments in One Step Contact Activated Lancet

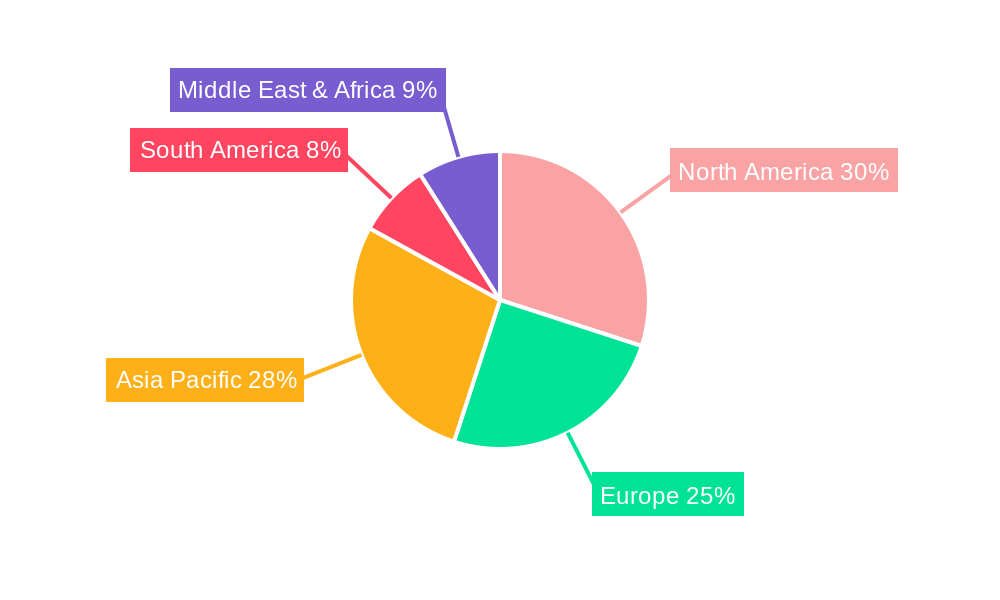

The global One Step Contact Activated Lancet market exhibits distinct regional dominance and segment preferences, driven by varying healthcare infrastructures, economic conditions, and patient demographics.

Leading Region and Country Dominance:

North America, particularly the United States, currently holds the largest market share, estimated at approximately 35% of the global market. This dominance is attributed to:

- High Diabetes Prevalence: The US has one of the highest rates of diabetes globally, driving substantial demand for blood glucose monitoring supplies.

- Advanced Healthcare Infrastructure: A well-developed healthcare system and widespread access to diagnostic tools facilitate high adoption rates of advanced lancets.

- Reimbursement Policies: Favorable reimbursement policies for diabetes management supplies further support market growth.

- Consumer Awareness: High levels of consumer awareness regarding diabetes management and preventative healthcare contribute to consistent product demand.

Europe, with a market share of around 30%, also represents a significant territory. Key drivers include:

- Aging Population: The increasing elderly population across European countries leads to a higher incidence of age-related diseases, including diabetes.

- Strong Healthcare Systems: Robust national healthcare systems and a focus on public health initiatives ensure consistent demand.

- Technological Adoption: A receptive market for new medical technologies and devices.

The Asia-Pacific region is emerging as the fastest-growing market, projected to witness a CAGR of over 6.8% during the forecast period. Factors contributing to this growth include:

- Rising Diabetes Incidence: A significant and growing diabetes population in countries like China and India.

- Improving Healthcare Access: Government initiatives and private investments are expanding healthcare infrastructure and accessibility in developing economies.

- Increasing Disposable Incomes: A growing middle class with greater purchasing power for healthcare products.

Segment Dominance:

Application: Hospital and Clinic Segments

- Hospital Segment: This segment is a major contributor, accounting for an estimated 45% of the market. Hospitals utilize these lancets for in-patient blood glucose monitoring, pre-operative assessments, and for diabetic patients admitted for various conditions. The sheer volume of patients and the need for sterile, single-use devices make hospitals a consistent demand driver. The adoption of advanced, safety-engineered lancets is particularly high in hospital settings to mitigate needlestick injuries. The market size for the hospital segment is projected to be around $160 million in 2025, growing to $250 million by 2033.

- Clinic Segment: Clinics, including primary care facilities and specialized diabetes clinics, represent another significant application, holding approximately 35% of the market. These settings are crucial for routine blood glucose testing and patient education. The convenience and safety of one-step activated lancets are highly valued by clinic staff for efficient patient throughput. The market size for the clinic segment is estimated at $130 million in 2025 and is expected to reach $200 million by 2033.

- Others (Homecare, Pharmacy): The "Others" segment, encompassing homecare use by individuals and purchase through pharmacies, is also substantial and growing rapidly, representing about 20% of the market. This segment is fueled by the increasing number of individuals managing diabetes at home and the broader trend towards self-care. The market size for this segment is projected at $75 million in 2025, expanding to $120 million by 2033.

Type: Below 30G and Above 30G Needle Gauges

- Below 30G: Lancets with needle gauges below 30G (e.g., 30G, 32G) are increasingly preferred due to their thinner profile, which translates to less pain and discomfort for the user. This category holds a dominant market share, estimated at around 70%. The advancements in precision manufacturing allow for the creation of these ultra-thin needles without compromising blood sample volume. This segment is expected to grow robustly as patient comfort becomes a paramount consideration. The market size for the Below 30G segment is projected at $260 million in 2025, growing to $410 million by 2033.

- Above 30G: While less prevalent than thinner gauges, lancets above 30G (e.g., 28G) still cater to a segment of users who may require a slightly larger blood sample or have specific preferences. This category holds about 30% of the market. The market size for the Above 30G segment is estimated at $100 million in 2025 and is projected to reach $155 million by 2033.

One Step Contact Activated Lancet Product Developments

Product innovation in the one-step contact activated lancet market centers on enhancing user experience and safety. Developments include ultra-thin needles (e.g., 33G) for reduced pain, ergonomic designs for improved grip and control, and advanced safety features such as automatic needle retraction to prevent accidental sticks and re-use. Companies are also focusing on integrated lancing devices that offer adjustable depth settings and reduced vibration for a more comfortable puncture. The competitive advantage lies in offering a virtually painless, efficient, and safe blood sampling solution that seamlessly integrates into the daily routine of individuals managing diabetes or other conditions requiring frequent blood glucose testing.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global One Step Contact Activated Lancet market. The market is segmented by Application into Hospital, Clinic, and Others (including homecare and pharmacies). The Type segmentation focuses on needle gauge, categorizing the market into Below 30G and Above 30G.

Hospital Segment: This segment is expected to witness steady growth, driven by ongoing patient admissions and the need for sterile, single-use lancets in clinical settings. Growth projections are approximately 5.2% CAGR. The market size for this segment is anticipated to be around $160 million in 2025, expanding to $250 million by 2033. Competitive dynamics here are influenced by bulk purchasing agreements and device integration capabilities.

Clinic Segment: Clinics will continue to be a significant driver, with a projected CAGR of 5.5%. The market size is estimated at $130 million in 2025, growing to $200 million by 2033. Ease of use and cost-effectiveness are key competitive factors.

Others Segment: This segment, encompassing homecare and pharmacies, is expected to show the highest growth rate, around 6.0% CAGR, due to the rise of home-based healthcare. The market size is projected at $75 million in 2025, reaching $120 million by 2033. Brand recognition and accessibility through retail channels are crucial.

Below 30G Type: This category is forecast to grow at a strong CAGR of 5.8%, driven by patient preference for less painful blood sampling. The market size is estimated at $260 million in 2025, reaching $410 million by 2033. Technological innovation in needle manufacturing is a key competitive differentiator.

Above 30G Type: This segment is expected to grow at a moderate CAGR of 4.5%. The market size is projected at $100 million in 2025, expanding to $155 million by 2033. While demand is steadier, innovation is less pronounced compared to thinner gauges.

Key Drivers of One Step Contact Activated Lancet Growth

The growth of the One Step Contact Activated Lancet market is propelled by several key factors. Firstly, the persistent and increasing global burden of diabetes, a chronic condition requiring regular blood glucose monitoring, forms the fundamental demand driver. Secondly, technological advancements in lancet design, such as the development of ultra-thin needles (e.g., 33G) and improved ergonomic features, significantly enhance user comfort and reduce pain perception, thereby driving adoption. Thirdly, the growing emphasis on patient convenience and the trend towards self-management of chronic diseases encourage the use of single-use, easy-to-operate lancets for home use. Furthermore, supportive regulatory environments that prioritize patient safety, leading to the development and approval of advanced safety-engineered lancets, also contribute positively. Economic factors, such as increasing disposable incomes in emerging markets, are expanding access to essential medical devices.

Challenges in the One Step Contact Activated Lancet Sector

Despite the promising growth, the One Step Contact Activated Lancet sector faces several challenges. Regulatory hurdles, while ensuring safety, can also prolong the product development and approval process, potentially delaying market entry for new innovations. Supply chain disruptions, as observed in recent global events, can impact the availability and cost of raw materials and finished products, leading to price volatility. Intense competition from both established players and new entrants can lead to price erosion, impacting profit margins. Moreover, the ongoing development of alternative blood glucose monitoring technologies, such as continuous glucose monitoring (CGM) systems, which eliminate the need for traditional finger pricks, poses a long-term threat by potentially reducing the overall demand for lancets. The cost of advanced, ultra-thin lancets can also be a barrier for price-sensitive consumers in certain markets, limiting market penetration.

Emerging Opportunities in One Step Contact Activated Lancet

Emerging opportunities in the One Step Contact Activated Lancet market lie in several key areas. The vast and growing markets in developing economies, such as Asia-Pacific and Latin America, present significant untapped potential due to increasing diabetes prevalence and improving healthcare infrastructure. Technological innovation continues to offer opportunities, particularly in developing even more comfortable and less invasive lancing solutions, perhaps integrating smart features or biodegradable materials. The increasing trend towards personalized medicine and home-based healthcare also opens avenues for lancets that can be integrated with digital health platforms and remote patient monitoring systems, enhancing data collection and patient management. Furthermore, exploring niche applications beyond diabetes management, such as for veterinary use or specific diagnostic tests requiring small blood samples, could unlock new revenue streams.

Leading Players in the One Step Contact Activated Lancet Market

- BD

- Accu-Chek (Roche)

- OneTouch (LifeScan)

- FreeStyle (Abbott)

- Microlet Next (Ascensia)

- Terumo

- Genteel

- CareTouch

- Pip Diabetes Care

- Owen Mumford

- Trividia Health

- AUVON

Key Developments in One Step Contact Activated Lancet Industry

- 2023: Abbott launches an enhanced FreeStyle lancet with a focus on improved comfort and ease of use.

- 2022: BD introduces a new safety-engineered lancet with enhanced features for healthcare professionals.

- 2021: Roche's Accu-Chek brand expands its range of lancets to cater to a wider patient demographic.

- 2020: LifeScan's OneTouch lancets see increased demand due to rising diabetes management needs during the pandemic.

- 2019: Ascensia's Microlet Next lancets gain traction for their user-friendly design and affordability.

Strategic Outlook for One Step Contact Activated Lancet Market

The strategic outlook for the One Step Contact Activated Lancet market remains positive, with growth primarily driven by the persistent global increase in diabetes prevalence and continuous innovation aimed at enhancing user comfort and safety. Companies are advised to focus on expanding their presence in emerging markets by adapting product offerings to local needs and price sensitivities. Further investment in R&D for next-generation lancets, potentially incorporating smart technologies or novel pain-reduction mechanisms, will be crucial for maintaining a competitive edge. Strategic partnerships with healthcare providers and distributors will be vital for market penetration. While the threat of CGM exists, the immediate future still holds significant potential for traditional lancets, especially for cost-conscious populations and in regions with less developed healthcare infrastructure.

One Step Contact Activated Lancet Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Type

- 2.1. Below 30G

- 2.2. Above 30G

One Step Contact Activated Lancet Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

One Step Contact Activated Lancet REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Below 30G

- 5.2.2. Above 30G

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Below 30G

- 6.2.2. Above 30G

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Below 30G

- 7.2.2. Above 30G

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Below 30G

- 8.2.2. Above 30G

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Below 30G

- 9.2.2. Above 30G

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific One Step Contact Activated Lancet Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Below 30G

- 10.2.2. Above 30G

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accu-Chek (Roche)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OneTouch (LifeScan)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FreeStyle (Abbott)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microlet Next (Ascensia)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Terumo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Genteel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CareTouch

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pip Diabetes Care

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Owen Mumford

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Trividia Health

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AUVON

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BD

List of Figures

- Figure 1: Global One Step Contact Activated Lancet Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global One Step Contact Activated Lancet Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America One Step Contact Activated Lancet Revenue (million), by Application 2024 & 2032

- Figure 4: North America One Step Contact Activated Lancet Volume (K), by Application 2024 & 2032

- Figure 5: North America One Step Contact Activated Lancet Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America One Step Contact Activated Lancet Volume Share (%), by Application 2024 & 2032

- Figure 7: North America One Step Contact Activated Lancet Revenue (million), by Type 2024 & 2032

- Figure 8: North America One Step Contact Activated Lancet Volume (K), by Type 2024 & 2032

- Figure 9: North America One Step Contact Activated Lancet Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America One Step Contact Activated Lancet Volume Share (%), by Type 2024 & 2032

- Figure 11: North America One Step Contact Activated Lancet Revenue (million), by Country 2024 & 2032

- Figure 12: North America One Step Contact Activated Lancet Volume (K), by Country 2024 & 2032

- Figure 13: North America One Step Contact Activated Lancet Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America One Step Contact Activated Lancet Volume Share (%), by Country 2024 & 2032

- Figure 15: South America One Step Contact Activated Lancet Revenue (million), by Application 2024 & 2032

- Figure 16: South America One Step Contact Activated Lancet Volume (K), by Application 2024 & 2032

- Figure 17: South America One Step Contact Activated Lancet Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America One Step Contact Activated Lancet Volume Share (%), by Application 2024 & 2032

- Figure 19: South America One Step Contact Activated Lancet Revenue (million), by Type 2024 & 2032

- Figure 20: South America One Step Contact Activated Lancet Volume (K), by Type 2024 & 2032

- Figure 21: South America One Step Contact Activated Lancet Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America One Step Contact Activated Lancet Volume Share (%), by Type 2024 & 2032

- Figure 23: South America One Step Contact Activated Lancet Revenue (million), by Country 2024 & 2032

- Figure 24: South America One Step Contact Activated Lancet Volume (K), by Country 2024 & 2032

- Figure 25: South America One Step Contact Activated Lancet Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America One Step Contact Activated Lancet Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe One Step Contact Activated Lancet Revenue (million), by Application 2024 & 2032

- Figure 28: Europe One Step Contact Activated Lancet Volume (K), by Application 2024 & 2032

- Figure 29: Europe One Step Contact Activated Lancet Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe One Step Contact Activated Lancet Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe One Step Contact Activated Lancet Revenue (million), by Type 2024 & 2032

- Figure 32: Europe One Step Contact Activated Lancet Volume (K), by Type 2024 & 2032

- Figure 33: Europe One Step Contact Activated Lancet Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe One Step Contact Activated Lancet Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe One Step Contact Activated Lancet Revenue (million), by Country 2024 & 2032

- Figure 36: Europe One Step Contact Activated Lancet Volume (K), by Country 2024 & 2032

- Figure 37: Europe One Step Contact Activated Lancet Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe One Step Contact Activated Lancet Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa One Step Contact Activated Lancet Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa One Step Contact Activated Lancet Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa One Step Contact Activated Lancet Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa One Step Contact Activated Lancet Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa One Step Contact Activated Lancet Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa One Step Contact Activated Lancet Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa One Step Contact Activated Lancet Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa One Step Contact Activated Lancet Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa One Step Contact Activated Lancet Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa One Step Contact Activated Lancet Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa One Step Contact Activated Lancet Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa One Step Contact Activated Lancet Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific One Step Contact Activated Lancet Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific One Step Contact Activated Lancet Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific One Step Contact Activated Lancet Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific One Step Contact Activated Lancet Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific One Step Contact Activated Lancet Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific One Step Contact Activated Lancet Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific One Step Contact Activated Lancet Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific One Step Contact Activated Lancet Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific One Step Contact Activated Lancet Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific One Step Contact Activated Lancet Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific One Step Contact Activated Lancet Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific One Step Contact Activated Lancet Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global One Step Contact Activated Lancet Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global One Step Contact Activated Lancet Volume K Forecast, by Region 2019 & 2032

- Table 3: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 5: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 7: Global One Step Contact Activated Lancet Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global One Step Contact Activated Lancet Volume K Forecast, by Region 2019 & 2032

- Table 9: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 11: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 13: Global One Step Contact Activated Lancet Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global One Step Contact Activated Lancet Volume K Forecast, by Country 2019 & 2032

- Table 15: United States One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 23: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 25: Global One Step Contact Activated Lancet Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global One Step Contact Activated Lancet Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 35: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 37: Global One Step Contact Activated Lancet Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global One Step Contact Activated Lancet Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 59: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 61: Global One Step Contact Activated Lancet Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global One Step Contact Activated Lancet Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global One Step Contact Activated Lancet Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global One Step Contact Activated Lancet Volume K Forecast, by Application 2019 & 2032

- Table 77: Global One Step Contact Activated Lancet Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global One Step Contact Activated Lancet Volume K Forecast, by Type 2019 & 2032

- Table 79: Global One Step Contact Activated Lancet Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global One Step Contact Activated Lancet Volume K Forecast, by Country 2019 & 2032

- Table 81: China One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific One Step Contact Activated Lancet Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific One Step Contact Activated Lancet Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the One Step Contact Activated Lancet?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the One Step Contact Activated Lancet?

Key companies in the market include BD, Accu-Chek (Roche), OneTouch (LifeScan), FreeStyle (Abbott), Microlet Next (Ascensia), Terumo, Genteel, CareTouch, Pip Diabetes Care, Owen Mumford, Trividia Health, AUVON.

3. What are the main segments of the One Step Contact Activated Lancet?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "One Step Contact Activated Lancet," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the One Step Contact Activated Lancet report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the One Step Contact Activated Lancet?

To stay informed about further developments, trends, and reports in the One Step Contact Activated Lancet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence