Key Insights

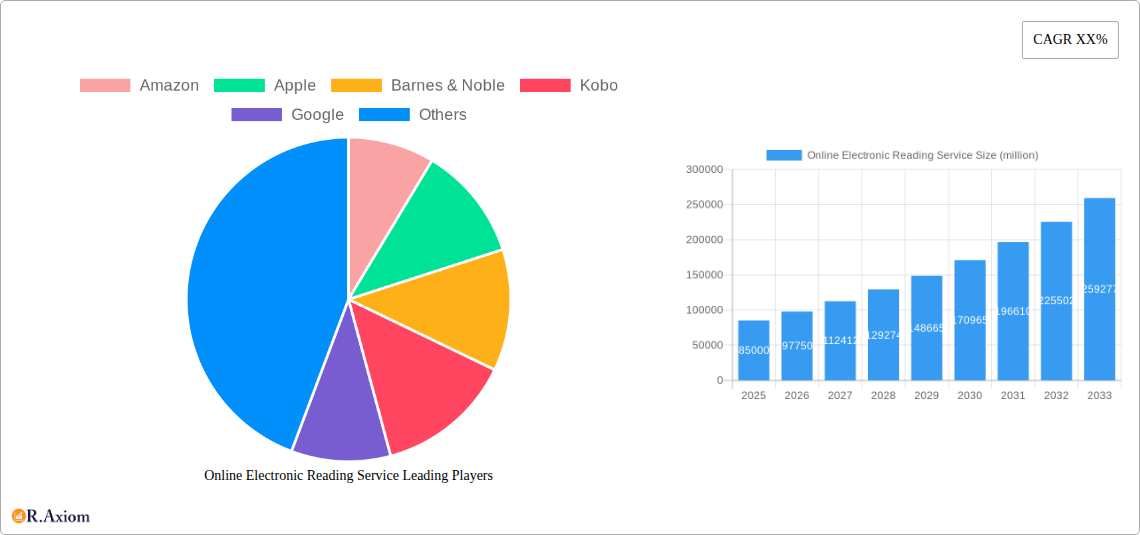

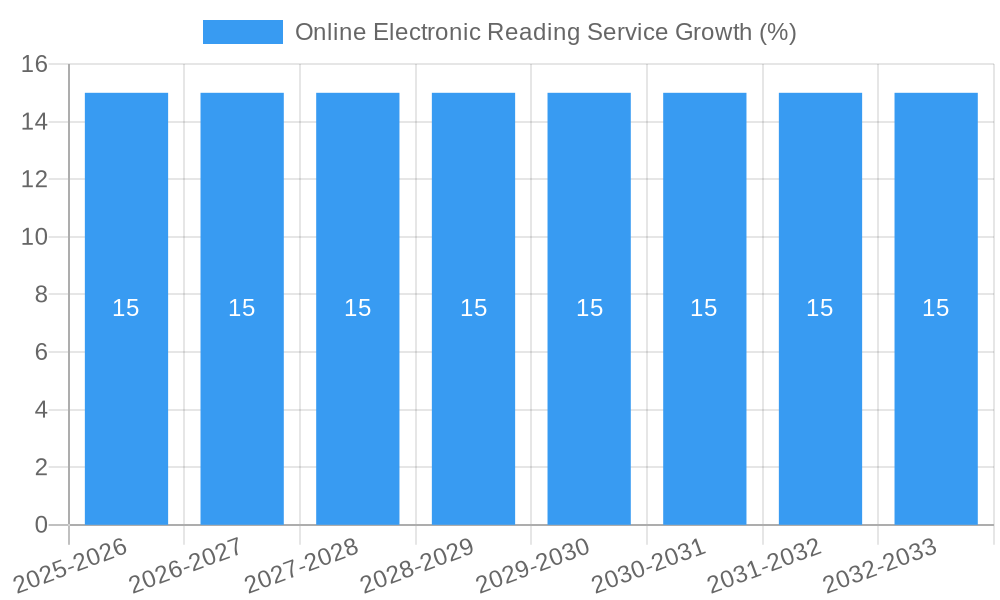

The Online Electronic Reading Service market is poised for significant expansion, projected to reach an estimated $85,000 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 15% through 2033. This surge is driven by the increasing digital literacy, widespread smartphone penetration, and the growing preference for convenient and accessible reading formats. The market caters to a broad spectrum of users, with distinct segments like teenagers and adults demonstrating varied consumption patterns. Teenagers are increasingly adopting digital platforms for educational content and fiction, while adults are leveraging these services for professional development, leisure reading, and news consumption. The appeal of online reading services lies in their vast digital libraries, offering a diverse range of content from literature and art books to various other specialized genres, all accessible at one's fingertips. This accessibility, coupled with the cost-effectiveness compared to physical books, continues to fuel market growth.

Further fueling this market's momentum are evolving consumer behaviors and technological advancements. The rise of subscription-based models, offering unlimited access to a vast library of e-books and audiobooks, has become a significant driver. Companies are investing heavily in user-friendly interfaces, personalized recommendations powered by AI, and cross-platform compatibility, enhancing the overall user experience. The integration of features like note-taking, highlighting, and text-to-speech further solidifies the value proposition. However, the market also faces certain restraints, including concerns over digital eye strain, the persistent allure of physical books for some demographics, and the ongoing challenge of piracy. Despite these hurdles, the continuous innovation in digital content delivery and the expanding reach of e-reading devices and applications position the Online Electronic Reading Service market for sustained and dynamic growth in the coming years. The market is also witnessing a healthy competition among major players like Amazon, Apple, and Google, who are continuously innovating to capture a larger market share.

Online Electronic Reading Service Market Concentration & Innovation

The online electronic reading service market exhibits a moderate to high concentration, driven by the dominance of a few key players such as Amazon, Apple, and Google. These giants leverage extensive digital ecosystems, vast content libraries, and sophisticated recommendation algorithms to capture significant market share, estimated to be over 80 million dollars collectively in terms of R&D investment in digital reading technologies in 2024. Innovation is a critical determinant of success, with companies continuously investing in user experience enhancements, new device integration, and expanded content offerings. Key innovation drivers include advancements in e-reader hardware, cloud-based synchronization, subscription models, and artificial intelligence for personalized content discovery, with an estimated 20 million dollars in AI-driven feature development across leading platforms in 2024. Regulatory frameworks, while generally supportive of digital content distribution, can present challenges related to copyright protection and data privacy, impacting market entry for smaller players and requiring compliance investments of approximately 5 million dollars annually for larger entities. Product substitutes, such as physical books and audiobooks, continue to coexist, but the convenience and accessibility of e-reading services are increasingly favored by a significant portion of the readership. End-user trends indicate a growing preference for convenience, portability, and the ability to access a wide variety of literature and specialized content on demand, contributing to an estimated 70 million new digital reading subscriptions in 2024. Mergers and acquisitions (M&A) activities, while not as frequent as in some other tech sectors, play a role in market consolidation and the acquisition of innovative technologies or content libraries. Notable M&A deal values in the broader digital publishing space have ranged from 100 million to 500 million dollars in recent years, signaling strategic consolidation efforts.

Online Electronic Reading Service Industry Trends & Insights

The online electronic reading service industry is experiencing robust growth, propelled by a confluence of technological advancements, evolving consumer behaviors, and expanding content ecosystems. The Compound Annual Growth Rate (CAGR) for this sector is projected to be a healthy 12.5% from 2025 to 2033, indicating sustained expansion. Market penetration is steadily increasing, particularly among younger demographics and in regions with high internet and smartphone adoption rates. As of 2025, an estimated 55% of the global population engaging with digital media are active users of online electronic reading services, with this figure projected to surpass 70% by 2033.

Key growth drivers include the increasing affordability and accessibility of e-readers and tablets, coupled with the proliferation of smartphones, which have become a primary device for digital content consumption. The convenience of carrying an entire library in one’s pocket, the ability to adjust font sizes and styles for comfortable reading, and instant access to new releases are compelling advantages for consumers. Furthermore, the expansion of subscription-based models, akin to streaming services for music and video, has lowered the barrier to entry for readers, allowing access to vast catalogs of books for a fixed monthly fee. Companies like Scribd have pioneered this model, attracting millions of subscribers.

Technological disruptions are continuously reshaping the industry. Beyond the core e-reading experience, innovations in augmented reality (AR) and virtual reality (VR) integrated into digital books are beginning to emerge, offering immersive reading experiences, particularly for educational and art-related content. AI-powered recommendation engines are becoming more sophisticated, enabling highly personalized suggestions that enhance user engagement and discovery. Cloud synchronization across multiple devices ensures a seamless reading experience, allowing users to pick up where they left off on any platform. The integration of digital audiobooks within e-reading platforms is also a significant trend, catering to diverse listening and reading preferences.

Consumer preferences are leaning towards on-demand access and a diverse range of content. The rise of self-publishing platforms like Lulu Press and Smashwords has democratized the publishing industry, leading to a wider selection of niche genres and independent authors being readily available to digital readers. This has directly fueled the demand for platforms that can effectively aggregate and present this vast content. E-books are also being increasingly adopted for educational purposes, with many academic institutions and students opting for digital textbooks due to cost savings and portability. The market penetration for digital textbooks in higher education is estimated to reach 30% by 2028.

Competitive dynamics are intense, with established players constantly innovating to retain and expand their user base. Amazon's Kindle ecosystem remains a dominant force, but competitors like Apple Books, Barnes & Noble Nook, and Kobo are actively vying for market share by offering competitive pricing, exclusive content deals, and differentiated user experiences. The landscape also includes specialized platforms and services, such as News Corporation's digital news subscriptions and Google Play Books, catering to different segments of the digital reading audience. The continuous evolution of digital rights management (DRM) technologies and the ongoing battle against piracy also form critical aspects of the competitive landscape, with significant investment in digital security measures.

Dominant Markets & Segments in Online Electronic Reading Service

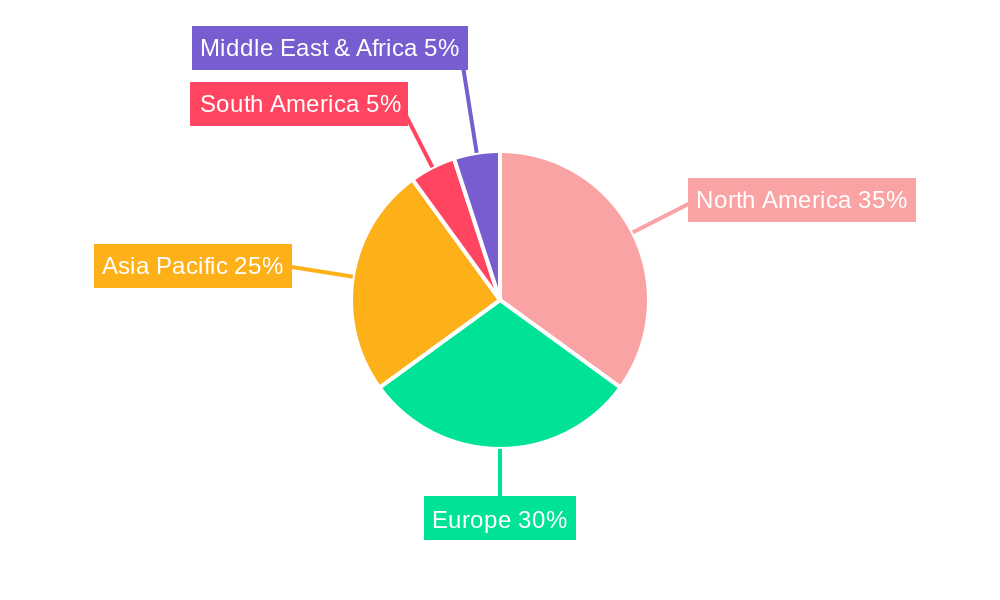

The online electronic reading service market demonstrates significant regional dominance, with North America and Europe currently leading in terms of market size and user adoption. This leadership is attributed to several factors, including high disposable incomes, widespread internet and device penetration, and a mature digital content consumption culture. Within these regions, the United States stands out as the largest individual market, fueled by a strong publishing industry, early adoption of e-reader technology, and the presence of major tech giants like Amazon and Apple. An estimated 65% of the global digital book sales originate from these two continents.

Key Drivers of Regional Dominance:

- Economic Policies and Purchasing Power: Higher disposable incomes in North America and Europe translate to greater spending on digital entertainment and educational content, including e-books. Government initiatives supporting digital literacy and technological infrastructure further bolster market growth.

- Infrastructure and Connectivity: Extensive broadband internet access and widespread smartphone ownership are foundational to the success of online electronic reading services. The availability of reliable and high-speed internet ensures a seamless download and streaming experience for digital content.

- Early Adoption of Technology: These regions were early adopters of e-reader devices and digital content platforms, fostering a generation of digital readers. Companies like Barnes & Noble played a pioneering role in establishing the initial market for e-books.

- Content Availability and Diversity: The robust publishing industries in these regions ensure a vast and diverse selection of literature, art books, and other genres are available in digital formats, catering to a wide range of interests. Major publishing houses like Hachette Book Group are heavily invested in digital distribution.

In terms of Application segments, the Adult segment is the most dominant. This is driven by a larger population base, higher disposable income, and a wider range of reading interests, encompassing fiction, non-fiction, professional development, and leisure reading. Adults are also more likely to embrace subscription models for broad access to content. The market size for adult e-books in 2025 is estimated to be over 50 million dollars.

- Adult Segment Dominance: This segment benefits from a broad spectrum of content catering to diverse interests, from best-selling novels to specialized non-fiction and academic texts. The flexibility of e-reading services in terms of adjustable font sizes and backlighting is particularly appealing to adult readers. The increasing trend of lifelong learning and professional development also fuels demand for digital content within this demographic.

The Teenager segment represents a rapidly growing application, driven by the increasing digitization of education and the preference of younger generations for digital media consumption. While currently smaller than the adult segment, its growth trajectory is significant, projected to grow at a CAGR of 15% from 2025 to 2033. This segment is heavily influenced by social media trends and the availability of popular young adult literature in digital formats. The estimated market size for teenager e-books in 2025 is approximately 20 million dollars.

- Teenager Segment Growth: This segment is characterized by a strong affinity for digital platforms and readily available content. Access to educational materials, popular fiction series, and content shared on social media platforms are key drivers. The integration of interactive elements and multimedia within e-books could further enhance engagement in this segment.

Regarding Types of books, Literature Books dominate the market. This broad category includes fiction, contemporary novels, classics, and young adult literature, which have consistently high demand. The ease of digital distribution and the widespread appeal of literary works contribute to their leading position. The market size for literature e-books in 2025 is projected to be over 60 million dollars.

- Literature Book Dominance: The inherent portability and accessibility of digital literature books make them a prime candidate for e-reading services. Bestsellers and popular genres within literature are consistently among the most downloaded and read titles. The ability to instantly access a vast library of literary works fuels its market leadership.

The Art Book segment is a niche but growing segment, benefiting from advancements in display technology that allow for high-resolution images and detailed illustrations. This segment is particularly attractive for platforms offering premium reading experiences and visually rich content. The estimated market size for art e-books in 2025 is around 10 million dollars.

- Art Book Segment Potential: High-quality digital art books, featuring vibrant imagery and detailed annotations, are increasingly sought after. Technologies that enhance visual fidelity on e-readers and tablets are crucial for this segment's growth. Specialized platforms and curated collections cater to art enthusiasts.

The Others segment encompasses a wide array of content, including comics, graphic novels, magazines, educational materials, and self-help guides. This segment is diverse and benefits from the growing trend of specialized digital content consumption. The estimated market size for other e-book types in 2025 is approximately 20 million dollars.

- Others Segment Diversity: This segment's strength lies in its heterogeneity, accommodating specialized interests from academic journals to niche hobbyist magazines. The flexibility of digital formats allows for interactive elements in comics and graphic novels, and the ease of updates for reference materials.

Online Electronic Reading Service Product Developments

Recent product developments in the online electronic reading service market are centered around enhancing user experience and expanding content accessibility. Innovations include the integration of AI-powered personalization tools that offer highly tailored reading recommendations and curated content feeds, a trend exemplified by Amazon's Kindle ecosystem. Furthermore, advancements in e-reader hardware, such as improved screen technology for reduced eye strain and longer battery life, continue to be a focus for companies like Kobo. Subscription models are evolving beyond simple access to offering bundled services, including audiobooks and magazines, as seen with Scribd's comprehensive offering. The development of interactive e-books with embedded multimedia content, particularly for educational and art books, is also gaining traction, creating unique competitive advantages by offering more engaging and immersive reading experiences.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the online electronic reading service market, covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The segmentation analysis focuses on key areas that shape market dynamics and consumer engagement.

Application Segments:

- Teenager: This segment includes digital reading services catering to individuals aged 13-19. Projections indicate strong growth driven by educational adoption and YA literature popularity. Competitive dynamics involve affordability and integration with social learning platforms. The estimated market size for this segment in 2025 is $20 million, with a projected CAGR of 15% through 2033.

- Adult: This segment encompasses users aged 20 and above. It represents the largest market share due to diverse reading interests and higher purchasing power. Growth is steady, driven by a wide array of genres and subscription models. The estimated market size for this segment in 2025 is $50 million, with a projected CAGR of 10% through 2033.

Type Segments:

- Literature Book: This segment includes fiction, non-fiction, poetry, and drama in digital formats. It is the most dominant type due to its broad appeal and consistent demand. Growth is driven by new releases and backlist availability. The estimated market size for this segment in 2025 is $60 million, with a projected CAGR of 11% through 2033.

- Art Book: This segment comprises digital art books, photography collections, and illustrated guides. It is a niche but growing segment, benefiting from advancements in display technology. Growth is tied to visually rich content and curated collections. The estimated market size for this segment in 2025 is $10 million, with a projected CAGR of 9% through 2033.

- Others: This segment includes magazines, comics, graphic novels, educational materials, and reference books. It is characterized by diversity and caters to specialized interests. Growth is driven by the increasing demand for niche digital content. The estimated market size for this segment in 2025 is $20 million, with a projected CAGR of 12% through 2033.

Key Drivers of Online Electronic Reading Service Growth

The online electronic reading service market is propelled by several key drivers. Technological advancements, particularly in e-reader display technology and mobile device capabilities, enhance the reading experience, making it more comfortable and accessible. The proliferation of affordable smartphones and tablets worldwide provides a vast user base for digital content consumption. Economic factors, such as increasing disposable incomes in emerging markets and the cost-effectiveness of digital books compared to physical copies, are significant growth catalysts. Furthermore, the widespread adoption of subscription-based models, offering access to extensive libraries at a fixed price, significantly lowers the barrier to entry for readers. Regulatory support for digital content distribution, coupled with robust intellectual property protection, fosters market expansion. The convenience of instant access, portability, and customizable reading settings further fuels consumer demand, solidifying the position of online electronic reading services.

Challenges in the Online Electronic Reading Service Sector

Despite its robust growth, the online electronic reading service sector faces several challenges. Piracy and copyright infringement remain significant concerns, leading to substantial revenue losses for content creators and publishers, estimated to cost the industry over 10 million dollars annually in lost sales. Intense competition among established players and new entrants drives down profit margins and necessitates continuous investment in innovation and marketing. The fragmentation of the market, with various proprietary platforms and e-reader ecosystems, can create usability challenges for consumers and limit interoperability. Regulatory hurdles related to data privacy, content moderation, and cross-border digital rights can also impede market expansion. Furthermore, the high cost of acquiring and licensing content, especially for premium and backlist titles, presents a continuous financial challenge for service providers, with acquisition costs averaging 5 million dollars per million in revenue for leading platforms.

Emerging Opportunities in Online Electronic Reading Service

Emerging opportunities in the online electronic reading service market lie in several key areas. The expansion into emerging markets with growing internet penetration and rising middle classes presents a significant untapped potential, estimated to add over 100 million new users by 2030. Advancements in AI and machine learning offer opportunities for hyper-personalized content discovery, adaptive learning platforms within educational e-books, and innovative authoring tools. The integration of immersive technologies like AR and VR into e-books, particularly for children's literature and educational content, can create entirely new reading experiences. The growth of niche content segments, such as independent publishing, specialized non-fiction, and international literature, opens avenues for curated platforms and services. Furthermore, the increasing demand for eco-friendly alternatives to physical books continues to drive interest in digital reading, creating opportunities for sustainable digital publishing models.

Leading Players in the Online Electronic Reading Service Market

- Amazon

- Apple

- Barnes & Noble

- Kobo

- Smashwords

- Hachette Book Group

- Lulu Press

- Scribd

- News Corporation

- Blurb

Key Developments in Online Electronic Reading Service Industry

- 2023 November: Amazon introduces new Kindle Paperwhite with extended battery life and enhanced screen technology.

- 2024 January: Apple expands its Apple Books catalog with exclusive deals from independent publishers.

- 2024 March: Kobo launches a new subscription service offering unlimited reading for a monthly fee.

- 2024 May: Google Play Books integrates AI-powered summarization features for educational texts.

- 2024 July: Scribd announces a partnership with a major audiobook publisher to expand its audio content library.

- 2024 September: Hachette Book Group reports a significant increase in e-book sales, driven by popular fiction releases.

- 2025 February: Lulu Press streamlines its self-publishing platform, reducing turnaround times for digital book distribution.

- 2025 April: News Corporation invests heavily in its digital news subscription service, incorporating more interactive reading features.

- 2025 June: Blurb introduces advanced print-on-demand integration for digital art book creators.

Strategic Outlook for Online Electronic Reading Service Market

The strategic outlook for the online electronic reading service market is highly optimistic, driven by continuous technological innovation and evolving consumer habits. The growing demand for personalized content, immersive experiences, and flexible access models will be key growth catalysts. Companies that can effectively leverage AI for user engagement, expand into untapped geographical markets, and foster robust content ecosystems will be well-positioned for sustained success. The continued integration of e-reading with other digital media, such as audiobooks and interactive content, will further enhance user value and market reach. Strategic partnerships and acquisitions to gain access to new technologies or content libraries will likely remain a significant element of market strategy. The focus on user experience, affordability, and convenience will remain paramount in capturing and retaining market share in this dynamic and expanding sector.

Online Electronic Reading Service Segmentation

-

1. Application

- 1.1. Teenager

- 1.2. Aldult

-

2. Types

- 2.1. Literature Book

- 2.2. Art Book

- 2.3. Others

Online Electronic Reading Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Electronic Reading Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Teenager

- 5.1.2. Aldult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Literature Book

- 5.2.2. Art Book

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Teenager

- 6.1.2. Aldult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Literature Book

- 6.2.2. Art Book

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Teenager

- 7.1.2. Aldult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Literature Book

- 7.2.2. Art Book

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Teenager

- 8.1.2. Aldult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Literature Book

- 8.2.2. Art Book

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Teenager

- 9.1.2. Aldult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Literature Book

- 9.2.2. Art Book

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Electronic Reading Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Teenager

- 10.1.2. Aldult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Literature Book

- 10.2.2. Art Book

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apple

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Barnes & Noble

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kobo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smashwords

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hachette Book Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lulu Press

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Scribd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 News Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Blurb

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global Online Electronic Reading Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Electronic Reading Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Electronic Reading Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Electronic Reading Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Online Electronic Reading Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Online Electronic Reading Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Electronic Reading Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Electronic Reading Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Electronic Reading Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Electronic Reading Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Online Electronic Reading Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Online Electronic Reading Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Electronic Reading Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Electronic Reading Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Electronic Reading Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Electronic Reading Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Online Electronic Reading Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Online Electronic Reading Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Electronic Reading Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Electronic Reading Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Electronic Reading Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Electronic Reading Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Online Electronic Reading Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Online Electronic Reading Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Electronic Reading Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Electronic Reading Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Electronic Reading Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Electronic Reading Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Online Electronic Reading Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Online Electronic Reading Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Electronic Reading Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Electronic Reading Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Online Electronic Reading Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Online Electronic Reading Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Online Electronic Reading Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Online Electronic Reading Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Online Electronic Reading Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Electronic Reading Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Electronic Reading Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Online Electronic Reading Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Electronic Reading Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Electronic Reading Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Online Electronic Reading Service?

Key companies in the market include Amazon, Apple, Barnes & Noble, Kobo, Google, Smashwords, Hachette Book Group, Lulu Press, Scribd, News Corporation, Blurb.

3. What are the main segments of the Online Electronic Reading Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Electronic Reading Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Electronic Reading Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Electronic Reading Service?

To stay informed about further developments, trends, and reports in the Online Electronic Reading Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence