Key Insights

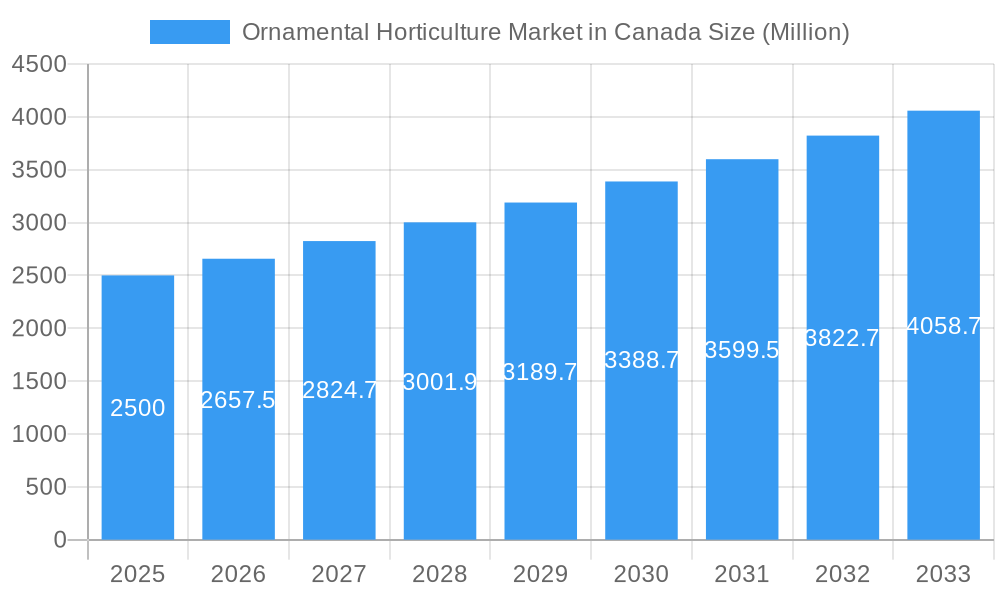

The ornamental horticulture market in Canada is poised for significant growth, driven by increasing consumer demand for aesthetic enhancements in homes and public spaces, alongside a rising interest in gardening and outdoor living. With a projected Compound Annual Growth Rate (CAGR) of 6.20%, the market, estimated to be valued at approximately USD 2,500 million in 2025, will expand robustly throughout the forecast period ending in 2033. This expansion is fueled by several key drivers, including the growing popularity of urban gardening and indoor plants, the demand for sustainable and eco-friendly horticultural products, and the continuous innovation in plant varieties and cultivation techniques. The trend towards beautifying residential landscapes, coupled with the increasing adoption of ornamental plants for commercial landscaping and public park development, is a primary growth catalyst. Furthermore, the rising disposable incomes and a greater emphasis on mental well-being, often associated with connecting with nature, are contributing to sustained consumer spending on floral and plant products.

Ornamental Horticulture Market in Canada Market Size (In Billion)

The market segmentation reveals diverse opportunities within floriculture, encompassing greenhouse flowers, cut flowers, and a wide array of potted plants. Popular cut flower varieties like roses, lilies, and tulips, alongside bedding plants and various ornamental potted plants, are expected to see consistent demand. The distribution channels are equally varied, with flower chain stores, domestic wholesalers, retail florists, and garden centers playing crucial roles in reaching end consumers. However, challenges such as fluctuating weather patterns impacting outdoor cultivation, increasing operational costs due to labor and resource scarcity, and stringent import/export regulations for plant materials could pose restraints. Despite these, the underlying consumer desire for green spaces and floral beauty, combined with advancements in greenhouse technology and efficient distribution networks, positions the Canadian ornamental horticulture market for sustained positive development and increasing market size, reaching an estimated USD 4,000 million by 2033.

Ornamental Horticulture Market in Canada Company Market Share

This in-depth report provides a detailed analysis of the Canadian ornamental horticulture market, offering critical insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, segmentation, key players, and future projections. The Canadian ornamental horticulture industry, encompassing floriculture and nursery operations, is experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and supportive government initiatives.

Ornamental Horticulture Market in Canada Market Concentration & Innovation

The Canadian ornamental horticulture market exhibits a moderate level of concentration, with a blend of large-scale commercial growers and numerous smaller independent nurseries. Innovation is a key driver, fueled by demand for sustainable practices, disease-resistant varieties, and unique ornamental offerings. Regulatory frameworks, primarily at the provincial level, govern aspects such as plant health, pesticide use, and land use, impacting operational efficiencies. Product substitutes, while present in the form of artificial plants or alternative decorative items, hold a limited market share due to the inherent appeal of live flora. End-user trends are shifting towards home gardening, urban greening initiatives, and a growing appreciation for locally sourced and aesthetically pleasing plants. Merger and acquisition (M&A) activities are anticipated to increase as established players seek to expand their market reach and product portfolios. For instance, potential M&A deals could range from several million to tens of millions of dollars for significant acquisitions, reflecting the industry's growth trajectory.

- Market Share: While specific data is proprietary, large players like Mastronardi Produce and SunSelect Produce Ltd. likely hold significant shares in specific segments.

- Innovation Drivers:

- Development of drought-tolerant and pest-resistant plant varieties.

- Adoption of precision agriculture technologies in greenhouse operations.

- Introduction of novel plant species and cultivars.

- Sustainable packaging and distribution solutions.

- M&A Activities: Expected to focus on consolidating market presence and acquiring innovative technologies or specialized product lines.

Ornamental Horticulture Market in Canada Industry Trends & Insights

The Canadian ornamental horticulture market is poised for robust growth, driven by an increasing demand for plants that enhance living spaces and promote well-being. This trend is amplified by urbanization, where indoor plants and balcony gardens are becoming increasingly popular. The market penetration of ornamental plants is steadily rising, particularly within the urban demographic. Technological disruptions are playing a crucial role, with advancements in hydroponics, vertical farming, and LED lighting systems revolutionizing greenhouse cultivation, enabling year-round production and improved energy efficiency. Consumer preferences are evolving towards plants that are easy to care for, offer specific aesthetic benefits, and are sourced sustainably and locally. This has led to a surge in demand for native plants and varieties that support local biodiversity. Competitive dynamics are characterized by a mix of established national players and numerous regional nurseries, all vying for market share through product differentiation, pricing strategies, and enhanced customer service. The industry's projected Compound Annual Growth Rate (CAGR) is estimated to be between 4% and 6% over the forecast period, indicating a healthy expansion.

- Growth Drivers:

- Rising disposable incomes and increased spending on home décor and lifestyle products.

- Growing popularity of indoor plants for air purification and aesthetic appeal.

- Government initiatives promoting urban greening and horticultural education.

- Expansion of e-commerce platforms for plant sales, increasing accessibility.

- Technological Disruptions:

- Smart greenhouse technologies for climate control and resource management.

- AI-driven plant diagnostics and pest management solutions.

- Development of bio-stimulants and organic fertilizers.

- Consumer Preferences:

- Demand for low-maintenance and pet-friendly plants.

- Interest in rare and exotic plant species.

- Emphasis on environmentally friendly growing practices.

- Competitive Dynamics:

- Intensified competition among online plant retailers and traditional garden centers.

- Strategic partnerships between growers and landscape contractors.

Dominant Markets & Segments in Ornamental Horticulture Market in Canada

Within the Canadian ornamental horticulture market, Floriculture, particularly Greenhouse Flowers, stands out as a dominant segment. This dominance is driven by the year-round demand for cut flowers and potted plants, facilitated by advanced greenhouse technologies. Within Greenhouse Flowers, Bedding plants represent a significant sub-segment, catering to seasonal gardening needs across the country. Cuttings, including popular varieties like Chrysanthemums and Geraniums, are crucial for propagating a wide array of ornamental plants, underpinning the entire floriculture value chain. Cut Flowers, featuring staples such as Roses and Tulips, cater to the celebratory and gifting occasions. Potted Plants, encompassing Tropical foliage and green plants, continue to gain traction due to their aesthetic and air-purifying qualities, especially in urban settings.

The Nursery segment also holds substantial importance, supplying a broad range of plants for landscaping and retail. Distribution Channels are diverse, with Garden Centres and Retail Florists being primary points of sale for consumers. Landscape Contractors represent a significant B2B channel, driving demand for larger volumes and specialized plant materials. Domestic Wholesalers play a vital role in the supply chain, connecting growers with various retail outlets.

- Dominant Segments:

- Floriculture (Greenhouse Flowers): Driven by consistent demand for cut flowers and ornamental potted plants, supported by advanced cultivation techniques.

- Bedding Plants: High seasonal demand for landscaping and home gardens.

- Cuttings: Essential for propagation, supporting the wider floriculture industry.

- Cut Flowers: Steady demand for events, gifts, and décor.

- Potted Plants: Growing popularity for indoor use and decorative purposes.

- Nursery: Crucial for providing a wide array of plants for both retail and commercial landscaping.

- Floriculture (Greenhouse Flowers): Driven by consistent demand for cut flowers and ornamental potted plants, supported by advanced cultivation techniques.

- Key Distribution Channels:

- Garden Centres: Direct access to a broad consumer base, offering a wide variety of plants.

- Retail Florists: Specialized channel for cut flowers and arrangements, catering to gifting occasions.

- Landscape Contractors: Significant B2B channel, driving demand for bulk plant materials for commercial and residential projects.

- Domestic Wholesalers: Essential intermediaries facilitating efficient distribution across the supply chain.

- Geographic Dominance: While not explicitly detailed, provinces with milder climates and significant agricultural infrastructure, such as British Columbia and Ontario, are likely to be dominant in production.

Ornamental Horticulture Market in Canada Product Developments

Product development in the Canadian ornamental horticulture market is characterized by a focus on sustainability, enhanced consumer appeal, and resilience. Innovations include the development of drought-tolerant plant varieties to meet growing demand for low-maintenance landscaping and the introduction of disease-resistant cultivars to reduce pesticide reliance. Advanced breeding techniques are yielding unique flower colors, improved bloom longevity, and novel plant forms. Applications are expanding beyond traditional decorative uses to include plants for urban farming initiatives, medicinal herb gardens, and indoor air quality improvement. Competitive advantages are being gained through proprietary plant genetics, efficient propagation methods, and the ability to offer a diverse and high-quality product range year-round, supported by technologies like LED lighting for extended growing seasons.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Canadian ornamental horticulture market, segmented by Type, Distribution Channel, and specific product categories.

By Type:

- Floriculture: This segment is further divided into Greenhouse Flowers and Nursery.

- Greenhouse Flowers: Encompasses Bedding plants, Cuttings (Chrysanthemums, Geraniums, Impatiens, Poinsettias, Other cuttings), Cut Flowers (Tulips, Gerberas, Snapdragons, Lilies, Alstroemerias, Freesias, Lisianthus, Roses, Daffodils, Irises, Other cut flowers), and Potted Plants (Tropical foliage and green plants, Fine herb plants, Outdoor hanging pots, Vegetable plants, Miniature roses, Kalanchoes, Herbaceous flowering perennials, Begonias, Petunias, African violets, Hawker's balsams, Orchids, Calibrachoas, Cyclamens, Other Potted Plants). This segment is projected to experience strong growth due to continuous demand and technological advancements in controlled environment agriculture.

- Nursery: This segment includes a broad range of trees, shrubs, and perennial plants for landscaping and garden use, expected to grow in tandem with the construction and landscaping industries.

- Distribution Channel: Key channels analyzed include Flower Chain Stores, Domestic Wholesalers, Retail Outlet, Retail Florists, Garden Centres, and Landscape Contractors. Each channel presents unique market penetration and growth dynamics. For instance, Garden Centres and Retail Florists cater directly to end consumers, while Landscape Contractors drive bulk sales for larger projects.

The analysis includes projected market sizes and competitive dynamics within each segment, providing a granular understanding of the market landscape.

Key Drivers of Ornamental Horticulture Market in Canada Growth

The growth of the Canadian ornamental horticulture market is propelled by several interconnected factors. A significant driver is the increasing consumer focus on well-being and home beautification, leading to higher spending on plants for both indoor and outdoor spaces. Technological advancements in greenhouse cultivation, such as improved lighting, climate control, and automation, enable more efficient and sustainable production, thereby expanding product availability and variety. Government support, including agricultural grants and initiatives promoting local production and exports, plays a crucial role in fostering industry expansion. Furthermore, the growing trend towards urban gardening and the desire for aesthetically pleasing and eco-friendly living environments are creating sustained demand for ornamental plants.

- Consumer Lifestyle Trends: Increased emphasis on home décor, wellness, and biophilic design.

- Technological Advancements: Innovations in controlled environment agriculture, breeding, and propagation techniques.

- Government Support: Funding programs and policies encouraging horticultural development and trade.

- Urbanization: Growing demand for plants in urban settings for green spaces and indoor environments.

Challenges in the Ornamental Horticulture Market in Canada Sector

Despite the positive growth trajectory, the Canadian ornamental horticulture sector faces several challenges. Labor shortages, particularly skilled labor for cultivation and greenhouse management, pose a significant operational hurdle. The increasing costs of energy, water, and inputs like fertilizers and pest control agents can impact profitability. Stringent regulations related to plant health, biosecurity, and environmental standards, while necessary, can increase compliance costs. Furthermore, intense competition from international markets, particularly with lower production costs, presents a challenge for domestic growers. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials and finished products.

- Labor Shortages: Difficulty in attracting and retaining skilled horticultural workers.

- Rising Operational Costs: Increased expenses for energy, water, and agricultural inputs.

- Regulatory Compliance: Adherence to evolving environmental and biosecurity standards.

- Global Competition: Pressure from imports due to varying production costs.

Emerging Opportunities in Ornamental Horticulture Market in Canada

The Canadian ornamental horticulture market is ripe with emerging opportunities. The growing demand for sustainable and organic plant production presents a significant avenue for differentiation and premium pricing. The expansion of e-commerce platforms offers new direct-to-consumer sales channels, reaching a wider customer base across Canada. Developing niche markets, such as specialized edible flowers, rare houseplants, or native plant species for conservation efforts, can create unique market positions. Furthermore, advancements in plant breeding for climate resilience and urban adaptability are opening doors for new product lines that cater to evolving environmental conditions and consumer needs. The focus on local sourcing and shorter supply chains also presents an opportunity for Canadian growers to build brand loyalty.

- Sustainable & Organic Production: Catering to eco-conscious consumers.

- E-commerce Expansion: Leveraging online platforms for direct sales and wider reach.

- Niche Market Development: Focusing on specialized or high-demand plant categories.

- Climate-Resilient Plant Varieties: Addressing changing environmental conditions.

Leading Players in the Ornamental Horticulture Market in Canada Market

- Hort Americas

- SunSelect Produce Ltd.

- Stonehouse Group

- Mastronardi Produce

- PlantHaven International

Key Developments in Ornamental Horticulture Market in Canada Industry

- March 2022: The Ministry of Agriculture and Agri-Food invested USD 1.5 million for two projects with the Canadian Nursery Landscape Association (CNLA) to help capture new opportunities for market growth and boost exports.

- February 2022: The Ministry of Agriculture and Agri-Food invested USD 535,000 to support Flowers Canada Growers Inc. (FCG) in its efforts to further improve and strengthen Canada's floriculture industry. With an investment of nearly USD 460,000 through the AgriMarketing Program, FCG is supporting marketing activities to promote the benefits of Canada's floriculture products, which will help increase sales throughout Canada and the United States.

- February 2022: Eurosa Farms launched greenhouse cultivation of cut flowers, producing about 70,000 roses ahead of Valentine's Day. Eurosa Farms upgraded its greenhouse lights with a new LED system last fall, to increase efficiency and boost winter production.

Strategic Outlook for Ornamental Horticulture Market in Canada Market

The strategic outlook for the Canadian ornamental horticulture market is highly positive, driven by a confluence of sustained consumer demand and ongoing innovation. Future growth catalysts will include a deeper integration of smart technologies for optimized greenhouse operations, leading to increased yields and reduced environmental impact. The continued rise of e-commerce will further democratize access to ornamental plants, expanding market reach beyond traditional retail channels. Strategic partnerships between growers, distributors, and landscape professionals will be crucial for capitalizing on evolving market needs. Furthermore, a strong emphasis on developing climate-resilient and aesthetically diverse plant varieties will ensure long-term market relevance and consumer appeal, positioning Canada as a leader in sustainable and innovative ornamental horticulture.

Ornamental Horticulture Market in Canada Segmentation

-

1. Type

-

1.1. Floriculture

-

1.1.1. Greenhouse Flowers

- 1.1.1.1. Bedding plants

-

1.1.1.2. Cuttings

- 1.1.1.2.1. Chrysanthemums

- 1.1.1.2.2. Geraniums

- 1.1.1.2.3. Impatiens

- 1.1.1.2.4. Poinsettias

- 1.1.1.2.5. Other cuttings

-

1.1.1.3. Cut Flowers

- 1.1.1.3.1. Tulips

- 1.1.1.3.2. Gerberas

- 1.1.1.3.3. Snapdragons

- 1.1.1.3.4. Lilies

- 1.1.1.3.5. Alstroemerias

- 1.1.1.3.6. Freesias

- 1.1.1.3.7. Lisianthus

- 1.1.1.3.8. Roses

- 1.1.1.3.9. Daffodils

- 1.1.1.3.10. Irises

- 1.1.1.3.11. Other cut flowers

-

1.1.2. Potted Plants

- 1.1.2.1. Tropical foliage and green plants

- 1.1.2.2. Fine herb plants

- 1.1.2.3. Outdoor hanging pots

- 1.1.2.4. Vegetable plants

- 1.1.2.5. Miniature roses

- 1.1.2.6. Kalanchoes

- 1.1.2.7. Herbaceous flowering perennials

- 1.1.2.8. Begonias

- 1.1.2.9. Petunias

- 1.1.2.10. African violets

- 1.1.2.11. Hawker's balsams

- 1.1.2.12. Orchids

- 1.1.2.13. Calibrachoas

- 1.1.2.14. Cyclamens

- 1.1.2.15. Other Potted Plants

-

1.1.1. Greenhouse Flowers

- 1.2. Nursery

-

1.1. Floriculture

-

2. Distribution Channel

- 2.1. Flower Chain Stores

- 2.2. Domestic Wholesalers

- 2.3. Retail Outlet

- 2.4. Retail Florists

- 2.5. Garden Centres

- 2.6. Landscape Contractors

- 2.7. Other Distribution Channels

-

3. Type

-

3.1. Floriculture

-

3.1.1. Greenhouse Flowers

- 3.1.1.1. Bedding plants

-

3.1.1.2. Cuttings

- 3.1.1.2.1. Chrysanthemums

- 3.1.1.2.2. Geraniums

- 3.1.1.2.3. Impatiens

- 3.1.1.2.4. Poinsettias

- 3.1.1.2.5. Other cuttings

-

3.1.1.3. Cut Flowers

- 3.1.1.3.1. Tulips

- 3.1.1.3.2. Gerberas

- 3.1.1.3.3. Snapdragons

- 3.1.1.3.4. Lilies

- 3.1.1.3.5. Alstroemerias

- 3.1.1.3.6. Freesias

- 3.1.1.3.7. Lisianthus

- 3.1.1.3.8. Roses

- 3.1.1.3.9. Daffodils

- 3.1.1.3.10. Irises

- 3.1.1.3.11. Other cut flowers

-

3.1.2. Potted Plants

- 3.1.2.1. Tropical foliage and green plants

- 3.1.2.2. Fine herb plants

- 3.1.2.3. Outdoor hanging pots

- 3.1.2.4. Vegetable plants

- 3.1.2.5. Miniature roses

- 3.1.2.6. Kalanchoes

- 3.1.2.7. Herbaceous flowering perennials

- 3.1.2.8. Begonias

- 3.1.2.9. Petunias

- 3.1.2.10. African violets

- 3.1.2.11. Hawker's balsams

- 3.1.2.12. Orchids

- 3.1.2.13. Calibrachoas

- 3.1.2.14. Cyclamens

- 3.1.2.15. Other Potted Plants

-

3.1.1. Greenhouse Flowers

- 3.2. Nursery

-

3.1. Floriculture

-

4. Distribution Channel

- 4.1. Flower Chain Stores

- 4.2. Domestic Wholesalers

- 4.3. Retail Outlet

- 4.4. Retail Florists

- 4.5. Garden Centres

- 4.6. Landscape Contractors

- 4.7. Other Distribution Channels

Ornamental Horticulture Market in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ornamental Horticulture Market in Canada Regional Market Share

Geographic Coverage of Ornamental Horticulture Market in Canada

Ornamental Horticulture Market in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Export Drives the Ornamental Horticulture Category in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Floriculture

- 5.1.1.1. Greenhouse Flowers

- 5.1.1.1.1. Bedding plants

- 5.1.1.1.2. Cuttings

- 5.1.1.1.2.1. Chrysanthemums

- 5.1.1.1.2.2. Geraniums

- 5.1.1.1.2.3. Impatiens

- 5.1.1.1.2.4. Poinsettias

- 5.1.1.1.2.5. Other cuttings

- 5.1.1.1.3. Cut Flowers

- 5.1.1.1.3.1. Tulips

- 5.1.1.1.3.2. Gerberas

- 5.1.1.1.3.3. Snapdragons

- 5.1.1.1.3.4. Lilies

- 5.1.1.1.3.5. Alstroemerias

- 5.1.1.1.3.6. Freesias

- 5.1.1.1.3.7. Lisianthus

- 5.1.1.1.3.8. Roses

- 5.1.1.1.3.9. Daffodils

- 5.1.1.1.3.10. Irises

- 5.1.1.1.3.11. Other cut flowers

- 5.1.1.2. Potted Plants

- 5.1.1.2.1. Tropical foliage and green plants

- 5.1.1.2.2. Fine herb plants

- 5.1.1.2.3. Outdoor hanging pots

- 5.1.1.2.4. Vegetable plants

- 5.1.1.2.5. Miniature roses

- 5.1.1.2.6. Kalanchoes

- 5.1.1.2.7. Herbaceous flowering perennials

- 5.1.1.2.8. Begonias

- 5.1.1.2.9. Petunias

- 5.1.1.2.10. African violets

- 5.1.1.2.11. Hawker's balsams

- 5.1.1.2.12. Orchids

- 5.1.1.2.13. Calibrachoas

- 5.1.1.2.14. Cyclamens

- 5.1.1.2.15. Other Potted Plants

- 5.1.1.1. Greenhouse Flowers

- 5.1.2. Nursery

- 5.1.1. Floriculture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flower Chain Stores

- 5.2.2. Domestic Wholesalers

- 5.2.3. Retail Outlet

- 5.2.4. Retail Florists

- 5.2.5. Garden Centres

- 5.2.6. Landscape Contractors

- 5.2.7. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Floriculture

- 5.3.1.1. Greenhouse Flowers

- 5.3.1.1.1. Bedding plants

- 5.3.1.1.2. Cuttings

- 5.3.1.1.2.1. Chrysanthemums

- 5.3.1.1.2.2. Geraniums

- 5.3.1.1.2.3. Impatiens

- 5.3.1.1.2.4. Poinsettias

- 5.3.1.1.2.5. Other cuttings

- 5.3.1.1.3. Cut Flowers

- 5.3.1.1.3.1. Tulips

- 5.3.1.1.3.2. Gerberas

- 5.3.1.1.3.3. Snapdragons

- 5.3.1.1.3.4. Lilies

- 5.3.1.1.3.5. Alstroemerias

- 5.3.1.1.3.6. Freesias

- 5.3.1.1.3.7. Lisianthus

- 5.3.1.1.3.8. Roses

- 5.3.1.1.3.9. Daffodils

- 5.3.1.1.3.10. Irises

- 5.3.1.1.3.11. Other cut flowers

- 5.3.1.2. Potted Plants

- 5.3.1.2.1. Tropical foliage and green plants

- 5.3.1.2.2. Fine herb plants

- 5.3.1.2.3. Outdoor hanging pots

- 5.3.1.2.4. Vegetable plants

- 5.3.1.2.5. Miniature roses

- 5.3.1.2.6. Kalanchoes

- 5.3.1.2.7. Herbaceous flowering perennials

- 5.3.1.2.8. Begonias

- 5.3.1.2.9. Petunias

- 5.3.1.2.10. African violets

- 5.3.1.2.11. Hawker's balsams

- 5.3.1.2.12. Orchids

- 5.3.1.2.13. Calibrachoas

- 5.3.1.2.14. Cyclamens

- 5.3.1.2.15. Other Potted Plants

- 5.3.1.1. Greenhouse Flowers

- 5.3.2. Nursery

- 5.3.1. Floriculture

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Flower Chain Stores

- 5.4.2. Domestic Wholesalers

- 5.4.3. Retail Outlet

- 5.4.4. Retail Florists

- 5.4.5. Garden Centres

- 5.4.6. Landscape Contractors

- 5.4.7. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Floriculture

- 6.1.1.1. Greenhouse Flowers

- 6.1.1.1.1. Bedding plants

- 6.1.1.1.2. Cuttings

- 6.1.1.1.2.1. Chrysanthemums

- 6.1.1.1.2.2. Geraniums

- 6.1.1.1.2.3. Impatiens

- 6.1.1.1.2.4. Poinsettias

- 6.1.1.1.2.5. Other cuttings

- 6.1.1.1.3. Cut Flowers

- 6.1.1.1.3.1. Tulips

- 6.1.1.1.3.2. Gerberas

- 6.1.1.1.3.3. Snapdragons

- 6.1.1.1.3.4. Lilies

- 6.1.1.1.3.5. Alstroemerias

- 6.1.1.1.3.6. Freesias

- 6.1.1.1.3.7. Lisianthus

- 6.1.1.1.3.8. Roses

- 6.1.1.1.3.9. Daffodils

- 6.1.1.1.3.10. Irises

- 6.1.1.1.3.11. Other cut flowers

- 6.1.1.2. Potted Plants

- 6.1.1.2.1. Tropical foliage and green plants

- 6.1.1.2.2. Fine herb plants

- 6.1.1.2.3. Outdoor hanging pots

- 6.1.1.2.4. Vegetable plants

- 6.1.1.2.5. Miniature roses

- 6.1.1.2.6. Kalanchoes

- 6.1.1.2.7. Herbaceous flowering perennials

- 6.1.1.2.8. Begonias

- 6.1.1.2.9. Petunias

- 6.1.1.2.10. African violets

- 6.1.1.2.11. Hawker's balsams

- 6.1.1.2.12. Orchids

- 6.1.1.2.13. Calibrachoas

- 6.1.1.2.14. Cyclamens

- 6.1.1.2.15. Other Potted Plants

- 6.1.1.1. Greenhouse Flowers

- 6.1.2. Nursery

- 6.1.1. Floriculture

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Flower Chain Stores

- 6.2.2. Domestic Wholesalers

- 6.2.3. Retail Outlet

- 6.2.4. Retail Florists

- 6.2.5. Garden Centres

- 6.2.6. Landscape Contractors

- 6.2.7. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Floriculture

- 6.3.1.1. Greenhouse Flowers

- 6.3.1.1.1. Bedding plants

- 6.3.1.1.2. Cuttings

- 6.3.1.1.2.1. Chrysanthemums

- 6.3.1.1.2.2. Geraniums

- 6.3.1.1.2.3. Impatiens

- 6.3.1.1.2.4. Poinsettias

- 6.3.1.1.2.5. Other cuttings

- 6.3.1.1.3. Cut Flowers

- 6.3.1.1.3.1. Tulips

- 6.3.1.1.3.2. Gerberas

- 6.3.1.1.3.3. Snapdragons

- 6.3.1.1.3.4. Lilies

- 6.3.1.1.3.5. Alstroemerias

- 6.3.1.1.3.6. Freesias

- 6.3.1.1.3.7. Lisianthus

- 6.3.1.1.3.8. Roses

- 6.3.1.1.3.9. Daffodils

- 6.3.1.1.3.10. Irises

- 6.3.1.1.3.11. Other cut flowers

- 6.3.1.2. Potted Plants

- 6.3.1.2.1. Tropical foliage and green plants

- 6.3.1.2.2. Fine herb plants

- 6.3.1.2.3. Outdoor hanging pots

- 6.3.1.2.4. Vegetable plants

- 6.3.1.2.5. Miniature roses

- 6.3.1.2.6. Kalanchoes

- 6.3.1.2.7. Herbaceous flowering perennials

- 6.3.1.2.8. Begonias

- 6.3.1.2.9. Petunias

- 6.3.1.2.10. African violets

- 6.3.1.2.11. Hawker's balsams

- 6.3.1.2.12. Orchids

- 6.3.1.2.13. Calibrachoas

- 6.3.1.2.14. Cyclamens

- 6.3.1.2.15. Other Potted Plants

- 6.3.1.1. Greenhouse Flowers

- 6.3.2. Nursery

- 6.3.1. Floriculture

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Flower Chain Stores

- 6.4.2. Domestic Wholesalers

- 6.4.3. Retail Outlet

- 6.4.4. Retail Florists

- 6.4.5. Garden Centres

- 6.4.6. Landscape Contractors

- 6.4.7. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Floriculture

- 7.1.1.1. Greenhouse Flowers

- 7.1.1.1.1. Bedding plants

- 7.1.1.1.2. Cuttings

- 7.1.1.1.2.1. Chrysanthemums

- 7.1.1.1.2.2. Geraniums

- 7.1.1.1.2.3. Impatiens

- 7.1.1.1.2.4. Poinsettias

- 7.1.1.1.2.5. Other cuttings

- 7.1.1.1.3. Cut Flowers

- 7.1.1.1.3.1. Tulips

- 7.1.1.1.3.2. Gerberas

- 7.1.1.1.3.3. Snapdragons

- 7.1.1.1.3.4. Lilies

- 7.1.1.1.3.5. Alstroemerias

- 7.1.1.1.3.6. Freesias

- 7.1.1.1.3.7. Lisianthus

- 7.1.1.1.3.8. Roses

- 7.1.1.1.3.9. Daffodils

- 7.1.1.1.3.10. Irises

- 7.1.1.1.3.11. Other cut flowers

- 7.1.1.2. Potted Plants

- 7.1.1.2.1. Tropical foliage and green plants

- 7.1.1.2.2. Fine herb plants

- 7.1.1.2.3. Outdoor hanging pots

- 7.1.1.2.4. Vegetable plants

- 7.1.1.2.5. Miniature roses

- 7.1.1.2.6. Kalanchoes

- 7.1.1.2.7. Herbaceous flowering perennials

- 7.1.1.2.8. Begonias

- 7.1.1.2.9. Petunias

- 7.1.1.2.10. African violets

- 7.1.1.2.11. Hawker's balsams

- 7.1.1.2.12. Orchids

- 7.1.1.2.13. Calibrachoas

- 7.1.1.2.14. Cyclamens

- 7.1.1.2.15. Other Potted Plants

- 7.1.1.1. Greenhouse Flowers

- 7.1.2. Nursery

- 7.1.1. Floriculture

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Flower Chain Stores

- 7.2.2. Domestic Wholesalers

- 7.2.3. Retail Outlet

- 7.2.4. Retail Florists

- 7.2.5. Garden Centres

- 7.2.6. Landscape Contractors

- 7.2.7. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Floriculture

- 7.3.1.1. Greenhouse Flowers

- 7.3.1.1.1. Bedding plants

- 7.3.1.1.2. Cuttings

- 7.3.1.1.2.1. Chrysanthemums

- 7.3.1.1.2.2. Geraniums

- 7.3.1.1.2.3. Impatiens

- 7.3.1.1.2.4. Poinsettias

- 7.3.1.1.2.5. Other cuttings

- 7.3.1.1.3. Cut Flowers

- 7.3.1.1.3.1. Tulips

- 7.3.1.1.3.2. Gerberas

- 7.3.1.1.3.3. Snapdragons

- 7.3.1.1.3.4. Lilies

- 7.3.1.1.3.5. Alstroemerias

- 7.3.1.1.3.6. Freesias

- 7.3.1.1.3.7. Lisianthus

- 7.3.1.1.3.8. Roses

- 7.3.1.1.3.9. Daffodils

- 7.3.1.1.3.10. Irises

- 7.3.1.1.3.11. Other cut flowers

- 7.3.1.2. Potted Plants

- 7.3.1.2.1. Tropical foliage and green plants

- 7.3.1.2.2. Fine herb plants

- 7.3.1.2.3. Outdoor hanging pots

- 7.3.1.2.4. Vegetable plants

- 7.3.1.2.5. Miniature roses

- 7.3.1.2.6. Kalanchoes

- 7.3.1.2.7. Herbaceous flowering perennials

- 7.3.1.2.8. Begonias

- 7.3.1.2.9. Petunias

- 7.3.1.2.10. African violets

- 7.3.1.2.11. Hawker's balsams

- 7.3.1.2.12. Orchids

- 7.3.1.2.13. Calibrachoas

- 7.3.1.2.14. Cyclamens

- 7.3.1.2.15. Other Potted Plants

- 7.3.1.1. Greenhouse Flowers

- 7.3.2. Nursery

- 7.3.1. Floriculture

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Flower Chain Stores

- 7.4.2. Domestic Wholesalers

- 7.4.3. Retail Outlet

- 7.4.4. Retail Florists

- 7.4.5. Garden Centres

- 7.4.6. Landscape Contractors

- 7.4.7. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Floriculture

- 8.1.1.1. Greenhouse Flowers

- 8.1.1.1.1. Bedding plants

- 8.1.1.1.2. Cuttings

- 8.1.1.1.2.1. Chrysanthemums

- 8.1.1.1.2.2. Geraniums

- 8.1.1.1.2.3. Impatiens

- 8.1.1.1.2.4. Poinsettias

- 8.1.1.1.2.5. Other cuttings

- 8.1.1.1.3. Cut Flowers

- 8.1.1.1.3.1. Tulips

- 8.1.1.1.3.2. Gerberas

- 8.1.1.1.3.3. Snapdragons

- 8.1.1.1.3.4. Lilies

- 8.1.1.1.3.5. Alstroemerias

- 8.1.1.1.3.6. Freesias

- 8.1.1.1.3.7. Lisianthus

- 8.1.1.1.3.8. Roses

- 8.1.1.1.3.9. Daffodils

- 8.1.1.1.3.10. Irises

- 8.1.1.1.3.11. Other cut flowers

- 8.1.1.2. Potted Plants

- 8.1.1.2.1. Tropical foliage and green plants

- 8.1.1.2.2. Fine herb plants

- 8.1.1.2.3. Outdoor hanging pots

- 8.1.1.2.4. Vegetable plants

- 8.1.1.2.5. Miniature roses

- 8.1.1.2.6. Kalanchoes

- 8.1.1.2.7. Herbaceous flowering perennials

- 8.1.1.2.8. Begonias

- 8.1.1.2.9. Petunias

- 8.1.1.2.10. African violets

- 8.1.1.2.11. Hawker's balsams

- 8.1.1.2.12. Orchids

- 8.1.1.2.13. Calibrachoas

- 8.1.1.2.14. Cyclamens

- 8.1.1.2.15. Other Potted Plants

- 8.1.1.1. Greenhouse Flowers

- 8.1.2. Nursery

- 8.1.1. Floriculture

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Flower Chain Stores

- 8.2.2. Domestic Wholesalers

- 8.2.3. Retail Outlet

- 8.2.4. Retail Florists

- 8.2.5. Garden Centres

- 8.2.6. Landscape Contractors

- 8.2.7. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Floriculture

- 8.3.1.1. Greenhouse Flowers

- 8.3.1.1.1. Bedding plants

- 8.3.1.1.2. Cuttings

- 8.3.1.1.2.1. Chrysanthemums

- 8.3.1.1.2.2. Geraniums

- 8.3.1.1.2.3. Impatiens

- 8.3.1.1.2.4. Poinsettias

- 8.3.1.1.2.5. Other cuttings

- 8.3.1.1.3. Cut Flowers

- 8.3.1.1.3.1. Tulips

- 8.3.1.1.3.2. Gerberas

- 8.3.1.1.3.3. Snapdragons

- 8.3.1.1.3.4. Lilies

- 8.3.1.1.3.5. Alstroemerias

- 8.3.1.1.3.6. Freesias

- 8.3.1.1.3.7. Lisianthus

- 8.3.1.1.3.8. Roses

- 8.3.1.1.3.9. Daffodils

- 8.3.1.1.3.10. Irises

- 8.3.1.1.3.11. Other cut flowers

- 8.3.1.2. Potted Plants

- 8.3.1.2.1. Tropical foliage and green plants

- 8.3.1.2.2. Fine herb plants

- 8.3.1.2.3. Outdoor hanging pots

- 8.3.1.2.4. Vegetable plants

- 8.3.1.2.5. Miniature roses

- 8.3.1.2.6. Kalanchoes

- 8.3.1.2.7. Herbaceous flowering perennials

- 8.3.1.2.8. Begonias

- 8.3.1.2.9. Petunias

- 8.3.1.2.10. African violets

- 8.3.1.2.11. Hawker's balsams

- 8.3.1.2.12. Orchids

- 8.3.1.2.13. Calibrachoas

- 8.3.1.2.14. Cyclamens

- 8.3.1.2.15. Other Potted Plants

- 8.3.1.1. Greenhouse Flowers

- 8.3.2. Nursery

- 8.3.1. Floriculture

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Flower Chain Stores

- 8.4.2. Domestic Wholesalers

- 8.4.3. Retail Outlet

- 8.4.4. Retail Florists

- 8.4.5. Garden Centres

- 8.4.6. Landscape Contractors

- 8.4.7. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Floriculture

- 9.1.1.1. Greenhouse Flowers

- 9.1.1.1.1. Bedding plants

- 9.1.1.1.2. Cuttings

- 9.1.1.1.2.1. Chrysanthemums

- 9.1.1.1.2.2. Geraniums

- 9.1.1.1.2.3. Impatiens

- 9.1.1.1.2.4. Poinsettias

- 9.1.1.1.2.5. Other cuttings

- 9.1.1.1.3. Cut Flowers

- 9.1.1.1.3.1. Tulips

- 9.1.1.1.3.2. Gerberas

- 9.1.1.1.3.3. Snapdragons

- 9.1.1.1.3.4. Lilies

- 9.1.1.1.3.5. Alstroemerias

- 9.1.1.1.3.6. Freesias

- 9.1.1.1.3.7. Lisianthus

- 9.1.1.1.3.8. Roses

- 9.1.1.1.3.9. Daffodils

- 9.1.1.1.3.10. Irises

- 9.1.1.1.3.11. Other cut flowers

- 9.1.1.2. Potted Plants

- 9.1.1.2.1. Tropical foliage and green plants

- 9.1.1.2.2. Fine herb plants

- 9.1.1.2.3. Outdoor hanging pots

- 9.1.1.2.4. Vegetable plants

- 9.1.1.2.5. Miniature roses

- 9.1.1.2.6. Kalanchoes

- 9.1.1.2.7. Herbaceous flowering perennials

- 9.1.1.2.8. Begonias

- 9.1.1.2.9. Petunias

- 9.1.1.2.10. African violets

- 9.1.1.2.11. Hawker's balsams

- 9.1.1.2.12. Orchids

- 9.1.1.2.13. Calibrachoas

- 9.1.1.2.14. Cyclamens

- 9.1.1.2.15. Other Potted Plants

- 9.1.1.1. Greenhouse Flowers

- 9.1.2. Nursery

- 9.1.1. Floriculture

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Flower Chain Stores

- 9.2.2. Domestic Wholesalers

- 9.2.3. Retail Outlet

- 9.2.4. Retail Florists

- 9.2.5. Garden Centres

- 9.2.6. Landscape Contractors

- 9.2.7. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Floriculture

- 9.3.1.1. Greenhouse Flowers

- 9.3.1.1.1. Bedding plants

- 9.3.1.1.2. Cuttings

- 9.3.1.1.2.1. Chrysanthemums

- 9.3.1.1.2.2. Geraniums

- 9.3.1.1.2.3. Impatiens

- 9.3.1.1.2.4. Poinsettias

- 9.3.1.1.2.5. Other cuttings

- 9.3.1.1.3. Cut Flowers

- 9.3.1.1.3.1. Tulips

- 9.3.1.1.3.2. Gerberas

- 9.3.1.1.3.3. Snapdragons

- 9.3.1.1.3.4. Lilies

- 9.3.1.1.3.5. Alstroemerias

- 9.3.1.1.3.6. Freesias

- 9.3.1.1.3.7. Lisianthus

- 9.3.1.1.3.8. Roses

- 9.3.1.1.3.9. Daffodils

- 9.3.1.1.3.10. Irises

- 9.3.1.1.3.11. Other cut flowers

- 9.3.1.2. Potted Plants

- 9.3.1.2.1. Tropical foliage and green plants

- 9.3.1.2.2. Fine herb plants

- 9.3.1.2.3. Outdoor hanging pots

- 9.3.1.2.4. Vegetable plants

- 9.3.1.2.5. Miniature roses

- 9.3.1.2.6. Kalanchoes

- 9.3.1.2.7. Herbaceous flowering perennials

- 9.3.1.2.8. Begonias

- 9.3.1.2.9. Petunias

- 9.3.1.2.10. African violets

- 9.3.1.2.11. Hawker's balsams

- 9.3.1.2.12. Orchids

- 9.3.1.2.13. Calibrachoas

- 9.3.1.2.14. Cyclamens

- 9.3.1.2.15. Other Potted Plants

- 9.3.1.1. Greenhouse Flowers

- 9.3.2. Nursery

- 9.3.1. Floriculture

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Flower Chain Stores

- 9.4.2. Domestic Wholesalers

- 9.4.3. Retail Outlet

- 9.4.4. Retail Florists

- 9.4.5. Garden Centres

- 9.4.6. Landscape Contractors

- 9.4.7. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Floriculture

- 10.1.1.1. Greenhouse Flowers

- 10.1.1.1.1. Bedding plants

- 10.1.1.1.2. Cuttings

- 10.1.1.1.2.1. Chrysanthemums

- 10.1.1.1.2.2. Geraniums

- 10.1.1.1.2.3. Impatiens

- 10.1.1.1.2.4. Poinsettias

- 10.1.1.1.2.5. Other cuttings

- 10.1.1.1.3. Cut Flowers

- 10.1.1.1.3.1. Tulips

- 10.1.1.1.3.2. Gerberas

- 10.1.1.1.3.3. Snapdragons

- 10.1.1.1.3.4. Lilies

- 10.1.1.1.3.5. Alstroemerias

- 10.1.1.1.3.6. Freesias

- 10.1.1.1.3.7. Lisianthus

- 10.1.1.1.3.8. Roses

- 10.1.1.1.3.9. Daffodils

- 10.1.1.1.3.10. Irises

- 10.1.1.1.3.11. Other cut flowers

- 10.1.1.2. Potted Plants

- 10.1.1.2.1. Tropical foliage and green plants

- 10.1.1.2.2. Fine herb plants

- 10.1.1.2.3. Outdoor hanging pots

- 10.1.1.2.4. Vegetable plants

- 10.1.1.2.5. Miniature roses

- 10.1.1.2.6. Kalanchoes

- 10.1.1.2.7. Herbaceous flowering perennials

- 10.1.1.2.8. Begonias

- 10.1.1.2.9. Petunias

- 10.1.1.2.10. African violets

- 10.1.1.2.11. Hawker's balsams

- 10.1.1.2.12. Orchids

- 10.1.1.2.13. Calibrachoas

- 10.1.1.2.14. Cyclamens

- 10.1.1.2.15. Other Potted Plants

- 10.1.1.1. Greenhouse Flowers

- 10.1.2. Nursery

- 10.1.1. Floriculture

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Flower Chain Stores

- 10.2.2. Domestic Wholesalers

- 10.2.3. Retail Outlet

- 10.2.4. Retail Florists

- 10.2.5. Garden Centres

- 10.2.6. Landscape Contractors

- 10.2.7. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Floriculture

- 10.3.1.1. Greenhouse Flowers

- 10.3.1.1.1. Bedding plants

- 10.3.1.1.2. Cuttings

- 10.3.1.1.2.1. Chrysanthemums

- 10.3.1.1.2.2. Geraniums

- 10.3.1.1.2.3. Impatiens

- 10.3.1.1.2.4. Poinsettias

- 10.3.1.1.2.5. Other cuttings

- 10.3.1.1.3. Cut Flowers

- 10.3.1.1.3.1. Tulips

- 10.3.1.1.3.2. Gerberas

- 10.3.1.1.3.3. Snapdragons

- 10.3.1.1.3.4. Lilies

- 10.3.1.1.3.5. Alstroemerias

- 10.3.1.1.3.6. Freesias

- 10.3.1.1.3.7. Lisianthus

- 10.3.1.1.3.8. Roses

- 10.3.1.1.3.9. Daffodils

- 10.3.1.1.3.10. Irises

- 10.3.1.1.3.11. Other cut flowers

- 10.3.1.2. Potted Plants

- 10.3.1.2.1. Tropical foliage and green plants

- 10.3.1.2.2. Fine herb plants

- 10.3.1.2.3. Outdoor hanging pots

- 10.3.1.2.4. Vegetable plants

- 10.3.1.2.5. Miniature roses

- 10.3.1.2.6. Kalanchoes

- 10.3.1.2.7. Herbaceous flowering perennials

- 10.3.1.2.8. Begonias

- 10.3.1.2.9. Petunias

- 10.3.1.2.10. African violets

- 10.3.1.2.11. Hawker's balsams

- 10.3.1.2.12. Orchids

- 10.3.1.2.13. Calibrachoas

- 10.3.1.2.14. Cyclamens

- 10.3.1.2.15. Other Potted Plants

- 10.3.1.1. Greenhouse Flowers

- 10.3.2. Nursery

- 10.3.1. Floriculture

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Flower Chain Stores

- 10.4.2. Domestic Wholesalers

- 10.4.3. Retail Outlet

- 10.4.4. Retail Florists

- 10.4.5. Garden Centres

- 10.4.6. Landscape Contractors

- 10.4.7. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hort Americas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SunSelect Produce Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stonehouse Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mastronardi Produce

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PlantHaven International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Hort Americas

List of Figures

- Figure 1: Global Ornamental Horticulture Market in Canada Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 7: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 9: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 13: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 17: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 19: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 23: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 25: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 27: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 33: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 37: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 43: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 47: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 48: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 49: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 37: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 48: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ornamental Horticulture Market in Canada?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Ornamental Horticulture Market in Canada?

Key companies in the market include Hort Americas, SunSelect Produce Ltd. , Stonehouse Group , Mastronardi Produce , PlantHaven International .

3. What are the main segments of the Ornamental Horticulture Market in Canada?

The market segments include Type, Distribution Channel, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Export Drives the Ornamental Horticulture Category in the Country.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

March 2022: The Ministry of Agriculture and Agri-Food has invested USD 1.5 million for two projects with the Canadian Nursery Landscape Association (CNLA) to help capture new opportunities for market growth and boost exports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ornamental Horticulture Market in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ornamental Horticulture Market in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ornamental Horticulture Market in Canada?

To stay informed about further developments, trends, and reports in the Ornamental Horticulture Market in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence