Key Insights

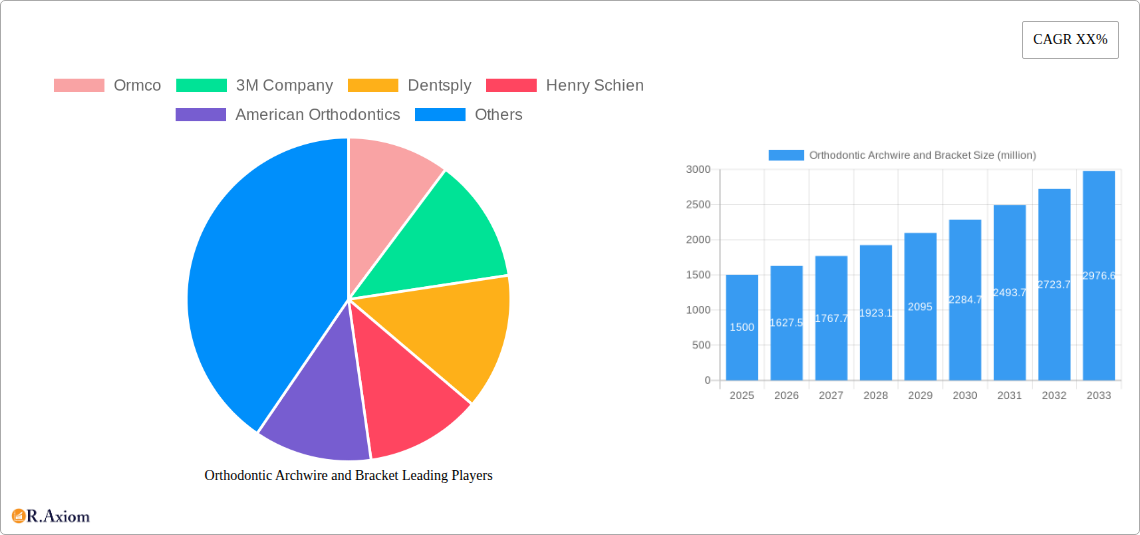

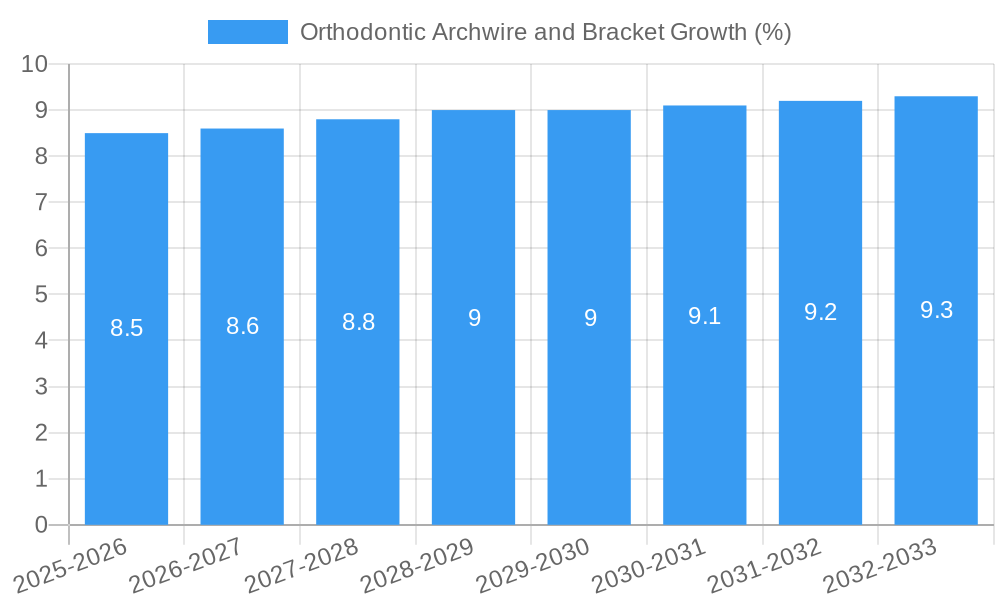

The global Orthodontic Archwire and Bracket market is poised for significant expansion, projected to reach a substantial market size of approximately $1.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust growth is primarily fueled by increasing awareness of oral health and aesthetic concerns, leading to a higher demand for orthodontic treatments globally. Key drivers include the rising prevalence of malocclusion, the growing adoption of advanced orthodontic technologies like lingual braces and clear aligners (which often utilize specialized archwires), and the expanding disposable income in emerging economies, making orthodontic care more accessible. Furthermore, an aging population is also contributing to market growth, as adults increasingly seek orthodontic correction to address dental issues arising from age-related changes. The market is segmented into Hospitals and Dental Clinics, with Dental Clinics representing the larger share due to their specialized focus on orthodontic procedures.

The market landscape for orthodontic archwires and brackets is characterized by a dynamic interplay of innovation and market consolidation. While traditional metal brackets and archwires remain a significant segment, there's a discernible trend towards more esthetic and patient-friendly options, such as ceramic brackets and self-ligating systems, which often incorporate specialized archwire designs for improved patient comfort and treatment efficiency. Restraints include the high cost of some advanced treatments and a potential shortage of trained orthodontic professionals in certain regions. However, ongoing research and development efforts aimed at creating more durable, biocompatible, and cost-effective materials, alongside the increasing availability of affordable treatment options, are expected to mitigate these challenges. Companies like Ormco, 3M Company, and Dentsply are at the forefront, investing in new product development and strategic partnerships to capture market share. The Asia Pacific region, driven by rapid economic development and increasing healthcare expenditure in countries like China and India, is anticipated to be a key growth engine in the coming years.

This comprehensive report delves into the global Orthodontic Archwire and Bracket market, providing in-depth analysis and actionable insights for industry stakeholders. Spanning the historical period from 2019 to 2024 and projecting forward to 2033, with a base and estimated year of 2025, this study offers a detailed examination of market dynamics, innovations, and future prospects. The report is meticulously structured to enhance search engine visibility, incorporating high-traffic keywords relevant to orthodontic devices, dental materials, and healthcare market analysis.

Orthodontic Archwire and Bracket Market Concentration & Innovation

The global Orthodontic Archwire and Bracket market exhibits a moderate level of concentration, with key players such as Ormco, 3M Company, Dentsply, and Henry Schein holding significant market shares, estimated to be over 50% collectively. Innovation serves as a primary growth driver, fueled by advancements in material science, digital dentistry integration, and the development of patient-specific treatment solutions. Regulatory frameworks, including FDA approvals and CE markings, play a crucial role in market access and product validation, influencing market entry strategies for new entrants. Product substitutes, such as clear aligners, represent a growing competitive threat, prompting manufacturers of traditional archwires and brackets to focus on enhanced efficacy, patient comfort, and aesthetic appeal. End-user trends are leaning towards minimally invasive procedures, shorter treatment durations, and improved patient compliance, driving demand for innovative and user-friendly orthodontic systems. Mergers and acquisitions (M&A) activities, with reported deal values in the tens of millions, continue to shape the market landscape, enabling companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of smaller specialized manufacturers by larger entities is a recurring theme, aimed at consolidating market presence and acquiring niche technologies. The overall market size is projected to reach over 1500 million by 2025, with a projected CAGR of approximately 6.5% over the forecast period.

Orthodontic Archwire and Bracket Industry Trends & Insights

The Orthodontic Archwire and Bracket industry is experiencing robust growth, driven by an increasing awareness of oral health, a rising prevalence of malocclusion, and a growing demand for aesthetically pleasing orthodontic treatments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Technological disruptions are at the forefront of this evolution. The integration of digital scanning and 3D printing technologies has revolutionized the customization and precision of orthodontic appliances, leading to improved treatment outcomes and reduced chair time for dental professionals. Advancements in material science, including the development of nickel-titanium (NiTi) alloys with superior superelasticity and shape memory properties, alongside biocompatible ceramic and composite materials for brackets, are enhancing patient comfort and treatment efficiency.

Consumer preferences are increasingly shifting towards discreet and aesthetically superior orthodontic solutions. While traditional metal braces remain a significant segment, there is a discernible rise in the adoption of self-ligating brackets, lingual braces, and the growing popularity of clear aligners, which are influencing the design and material choices for archwires and brackets. This necessitates manufacturers to innovate in areas such as aesthetic bracket designs and low-friction archwire technologies.

Competitive dynamics are intensifying, with established players investing heavily in research and development (R&D) to maintain their market positions and emerging companies focusing on niche segments and innovative product offerings. Strategic partnerships and collaborations between orthodontic device manufacturers and dental technology providers are becoming more prevalent, aiming to create integrated treatment ecosystems. Market penetration is expected to deepen across developed and developing economies, driven by expanding dental insurance coverage, rising disposable incomes, and increasing patient willingness to invest in orthodontic care. The global market size is estimated to exceed 1500 million in 2025, with significant potential for further expansion. The demand for advanced materials that offer improved biomechanical properties and patient comfort continues to be a key area of focus for research and product development. The market penetration of digital orthodontic solutions is expected to cross 30% by 2028.

Dominant Markets & Segments in Orthodontic Archwire and Bracket

The global Orthodontic Archwire and Bracket market is characterized by distinct regional dominance and segment leadership. North America, led by the United States, currently holds the largest market share, estimated at over 35% of the global market. This dominance is attributed to factors such as a high prevalence of malocclusion, a strong emphasis on aesthetic dentistry, advanced healthcare infrastructure, and a high disposable income among the population. The U.S. market alone is projected to reach over 500 million in 2025.

Application: Dental Clinic

The Dental Clinic segment emerges as the most dominant application area for orthodontic archwires and brackets, accounting for an estimated 75% of the total market revenue. This is due to the primary role of dental clinics in delivering orthodontic treatments. Key drivers for this dominance include:

- High Patient Volume: Dental clinics serve a vast patient base seeking orthodontic correction.

- Specialized Services: Orthodontists within these clinics are the primary prescribers and installers of archwires and brackets.

- Technological Adoption: Clinics are at the forefront of adopting new orthodontic technologies and materials to improve patient care and treatment outcomes.

- Economic Policies: Favorable insurance policies and reimbursement rates for orthodontic treatments in countries like the U.S. and Canada further bolster this segment.

- Infrastructure: The widespread availability of well-equipped dental clinics globally supports the consistent demand for these products.

Types: Orthodontic Bracket

Within the types of orthodontic devices, the Orthodontic Bracket segment represents the largest revenue contributor, estimated to be over 60% of the market. This segment's dominance is driven by several factors:

- Fundamental Component: Brackets are the foundational element to which archwires are attached, making them indispensable for most orthodontic treatments.

- Material Innovation: Continuous advancements in bracket materials, including ceramic, sapphire, metal, and self-ligating options, cater to diverse patient needs and preferences for aesthetics and comfort.

- Technological Integration: The development of advanced bracket systems, such as self-ligating and low-friction brackets, enhances treatment efficiency and patient experience, driving demand.

- Market Penetration: The widespread use of various bracket types across different age groups and orthodontic conditions ensures a consistent and substantial market demand. The U.S. orthodontic bracket market is expected to be over 300 million in 2025.

- Product Variety: The extensive range of bracket designs and functionalities available in the market allows orthodontists to tailor treatments effectively, contributing to the segment's significant market share.

Europe, particularly Germany and the UK, follows North America, holding approximately 25% of the market share, driven by a growing awareness of dental aesthetics and an aging population seeking corrective treatments. The Asia Pacific region, with countries like China and India, is emerging as a high-growth market, projected to witness a CAGR exceeding 7.0% due to increasing disposable incomes, expanding healthcare access, and a rising number of dental professionals. The Hospital segment, while smaller in comparison, plays a crucial role in providing orthodontic services for complex cases and as part of comprehensive treatment plans, contributing an estimated 25% to the overall market.

Orthodontic Archwire and Bracket Product Developments

Recent product developments in the Orthodontic Archwire and Bracket market focus on enhancing patient comfort, improving treatment efficiency, and integrating digital technologies. Innovations in superelastic Nickel-Titanium (NiTi) archwires offer controlled and consistent force delivery, leading to shorter treatment durations. Advancements in ceramic and aesthetically pleasing bracket materials are meeting patient demands for discreet orthodontics. Furthermore, the development of smart archwires and integrated sensor technologies promises real-time treatment monitoring and personalized adjustments. These advancements aim to provide a competitive edge by offering superior biomechanical properties, ease of use for clinicians, and improved patient compliance, thereby addressing the evolving needs of the orthodontic sector.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Orthodontic Archwire and Bracket market, segmented by application and type. The primary application segments include Hospitals and Dental Clinics. The Hospital segment, while currently smaller with an estimated market size of over 300 million in 2025, is expected to witness steady growth due to its role in treating complex orthodontic cases and as part of multidisciplinary treatment approaches. The Dental Clinic segment is the largest, projected to reach over 1200 million in 2025, driven by the high volume of routine orthodontic treatments and the direct patient interface.

In terms of product types, the market is divided into Orthodontic Archwires and Orthodontic Brackets. The Orthodontic Archwire segment, estimated at over 600 million in 2025, encompasses various materials and designs aimed at delivering precise forces. The Orthodontic Bracket segment, projected to exceed 900 million in 2025, includes metal, ceramic, self-ligating, and lingual brackets, catering to a wide array of clinical needs and patient preferences. Competitive dynamics within each segment are shaped by material innovation, technological advancements, and pricing strategies.

Key Drivers of Orthodontic Archwire and Bracket Growth

The Orthodontic Archwire and Bracket market is propelled by several key drivers. Firstly, a rising global awareness of oral hygiene and aesthetics is encouraging more individuals to seek orthodontic treatments. Secondly, the increasing prevalence of malocclusion and other dental misalignments across all age groups fuels consistent demand. Technological advancements in materials science, leading to the development of biocompatible, durable, and aesthetically pleasing archwires and brackets (e.g., advanced NiTi alloys, clear ceramic brackets), enhance treatment efficacy and patient comfort. The integration of digital dentistry, including CAD/CAM technologies and 3D printing, is enabling personalized treatment solutions and improving procedural efficiency. Furthermore, expanding healthcare infrastructure and increased healthcare spending in emerging economies are creating new market opportunities. Favorable reimbursement policies and the growing acceptance of orthodontic treatments as an integral part of overall healthcare also contribute significantly to market growth.

Challenges in the Orthodontic Archwire and Bracket Sector

Despite robust growth, the Orthodontic Archwire and Bracket sector faces several challenges. The stringent regulatory approval processes in various regions can be time-consuming and costly, posing a barrier to market entry for new players. Fluctuations in raw material prices, particularly for metals like nickel and titanium, can impact manufacturing costs and profit margins. Intense competition among established and emerging manufacturers leads to price pressures, necessitating continuous innovation and cost-efficiency measures. The increasing popularity of alternative orthodontic treatments, such as clear aligners, presents a significant competitive threat, requiring traditional appliance manufacturers to adapt their product offerings and marketing strategies. Supply chain disruptions, as witnessed during global health crises, can also affect the availability and timely delivery of essential components and finished products.

Emerging Opportunities in Orthodontic Archwire and Bracket

Emerging opportunities in the Orthodontic Archwire and Bracket market are significant. The growing demand for aesthetic and discreet orthodontic solutions is driving innovation in clear and tooth-colored brackets and lingual archwires. Advancements in digital dentistry, including AI-powered treatment planning and personalized appliance design using 3D printing, present a substantial opportunity for integrated solutions. The expanding middle class in developing economies, coupled with increasing awareness of dental aesthetics, is creating a vast untapped market for orthodontic treatments. Furthermore, the development of "smart" orthodontic devices that can monitor treatment progress and provide real-time data to clinicians offers a promising avenue for future innovation and market growth. Opportunities also lie in developing more cost-effective and efficient materials and manufacturing processes to cater to price-sensitive markets.

Leading Players in the Orthodontic Archwire and Bracket Market

The leading players in the Orthodontic Archwire and Bracket market include:

- Ormco

- 3M Company

- Dentsply

- Henry Schein

- American Orthodontics

- G&H Orthodontics

- TP Orthodontics

- GC Orthodontics

- Rocky Mountain Orthodontics

- ACME Monaco

- Patterson

- Ultimate Wireforms

- Forestadent

- Dentaurum

Key Developments in Orthodontic Archwire and Bracket Industry

- 2023 January: Ormco launches a new generation of self-ligating brackets featuring enhanced passive ligation for improved patient comfort and treatment efficiency.

- 2023 February: 3M Company announces strategic collaborations with leading dental universities to accelerate research in advanced orthodontic materials.

- 2023 March: Dentsply unveils an updated portfolio of NiTi archwires with improved superelastic properties and enhanced force delivery systems.

- 2023 April: Henry Schein expands its distribution network in emerging Asian markets, increasing accessibility to orthodontic products.

- 2023 May: American Orthodontics introduces a new line of aesthetically pleasing ceramic brackets with superior bond strength and stain resistance.

- 2024 January: G&H Orthodontics announces significant investment in R&D for digital orthodontic solutions, including 3D-printed custom appliances.

- 2024 February: TP Orthodontics patents a novel archwire design aimed at reducing treatment time for complex malocclusions.

- 2024 March: GC Orthodontics introduces an eco-friendly manufacturing process for its orthodontic brackets, reducing environmental impact.

- 2024 April: Rocky Mountain Orthodontics launches a comprehensive training program for orthodontists on the latest digital workflow integration.

- 2024 May: ACME Monaco develops a new manufacturing technique for orthodontic wires, improving material consistency and performance.

Strategic Outlook for Orthodontic Archwire and Bracket Market

The strategic outlook for the Orthodontic Archwire and Bracket market is characterized by continued innovation and a focus on patient-centric solutions. Manufacturers will likely invest further in R&D to develop advanced materials offering superior biomechanical properties, improved aesthetics, and enhanced patient comfort. The integration of digital dentistry technologies, including AI-driven treatment planning and 3D-printed personalized appliances, will be a key growth catalyst, leading to more efficient and precise treatments. Expansion into emerging markets with growing disposable incomes and increasing awareness of dental health presents a significant opportunity. Strategic partnerships and collaborations will be crucial for companies to leverage technological advancements and expand their market reach. The market's future success hinges on its ability to adapt to evolving consumer preferences, particularly the demand for discreet and faster orthodontic interventions, while navigating regulatory landscapes and competitive pressures.

Orthodontic Archwire and Bracket Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

-

2. Types

- 2.1. Orthodontic Archwire

- 2.2. Orthodontic Bracket

Orthodontic Archwire and Bracket Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Orthodontic Archwire and Bracket REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Orthodontic Archwire

- 5.2.2. Orthodontic Bracket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Orthodontic Archwire

- 6.2.2. Orthodontic Bracket

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Orthodontic Archwire

- 7.2.2. Orthodontic Bracket

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Orthodontic Archwire

- 8.2.2. Orthodontic Bracket

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Orthodontic Archwire

- 9.2.2. Orthodontic Bracket

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Orthodontic Archwire and Bracket Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Orthodontic Archwire

- 10.2.2. Orthodontic Bracket

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ormco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 3M Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dentsply

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henry Schien

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Orthodontics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 G&H Orthodontics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TP Orthodontics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GC Orthodontics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rocky Mountain Orthodontics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACME Monaco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Patterson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ultimate Wireforms

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Forestadent

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dentaurum

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ormco

List of Figures

- Figure 1: Global Orthodontic Archwire and Bracket Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Orthodontic Archwire and Bracket Revenue (million), by Application 2024 & 2032

- Figure 3: North America Orthodontic Archwire and Bracket Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Orthodontic Archwire and Bracket Revenue (million), by Types 2024 & 2032

- Figure 5: North America Orthodontic Archwire and Bracket Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Orthodontic Archwire and Bracket Revenue (million), by Country 2024 & 2032

- Figure 7: North America Orthodontic Archwire and Bracket Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Orthodontic Archwire and Bracket Revenue (million), by Application 2024 & 2032

- Figure 9: South America Orthodontic Archwire and Bracket Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Orthodontic Archwire and Bracket Revenue (million), by Types 2024 & 2032

- Figure 11: South America Orthodontic Archwire and Bracket Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Orthodontic Archwire and Bracket Revenue (million), by Country 2024 & 2032

- Figure 13: South America Orthodontic Archwire and Bracket Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Orthodontic Archwire and Bracket Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Orthodontic Archwire and Bracket Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Orthodontic Archwire and Bracket Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Orthodontic Archwire and Bracket Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Orthodontic Archwire and Bracket Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Orthodontic Archwire and Bracket Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Orthodontic Archwire and Bracket Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Orthodontic Archwire and Bracket Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Orthodontic Archwire and Bracket Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Orthodontic Archwire and Bracket Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Orthodontic Archwire and Bracket Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Orthodontic Archwire and Bracket Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Orthodontic Archwire and Bracket Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Orthodontic Archwire and Bracket Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Orthodontic Archwire and Bracket Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Orthodontic Archwire and Bracket Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Orthodontic Archwire and Bracket Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Orthodontic Archwire and Bracket Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Orthodontic Archwire and Bracket Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Orthodontic Archwire and Bracket Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthodontic Archwire and Bracket?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Orthodontic Archwire and Bracket?

Key companies in the market include Ormco, 3M Company, Dentsply, Henry Schien, American Orthodontics, G&H Orthodontics, TP Orthodontics, GC Orthodontics, Rocky Mountain Orthodontics, ACME Monaco, Patterson, Ultimate Wireforms, Forestadent, Dentaurum.

3. What are the main segments of the Orthodontic Archwire and Bracket?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Orthodontic Archwire and Bracket," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Orthodontic Archwire and Bracket report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Orthodontic Archwire and Bracket?

To stay informed about further developments, trends, and reports in the Orthodontic Archwire and Bracket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence