Key Insights

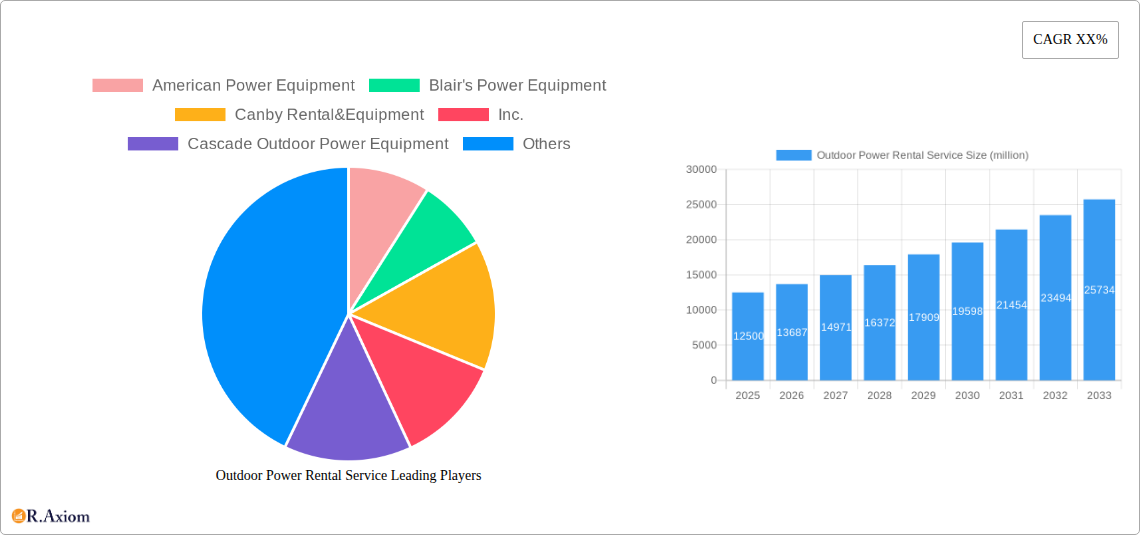

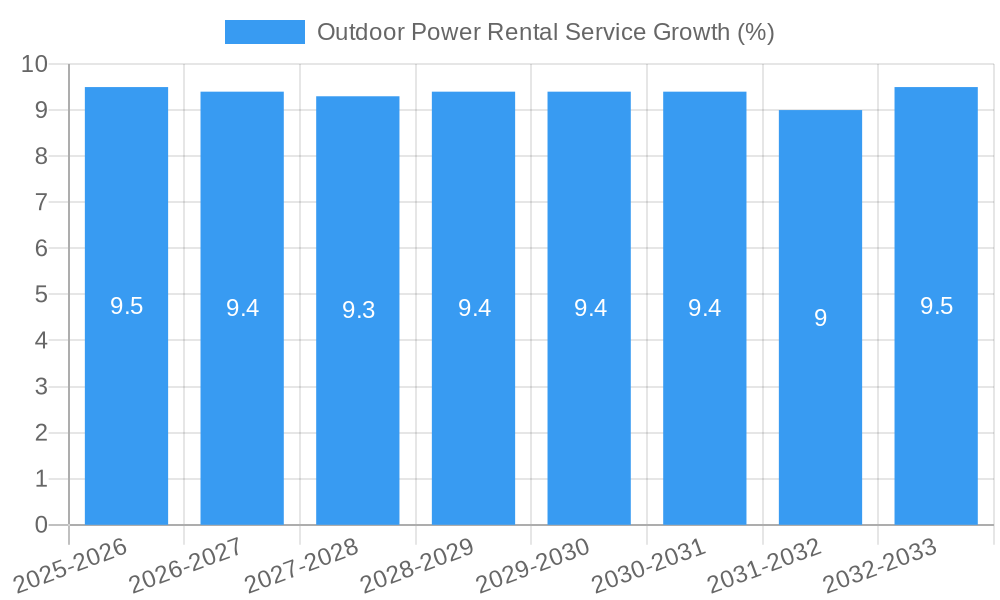

The global Outdoor Power Rental Service market is poised for substantial growth, projected to reach an estimated USD 12,500 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.5% anticipated between 2025 and 2033. This dynamic expansion is primarily driven by the increasing demand for flexible access to a wide range of outdoor power equipment, from personal garden tools to large commercial machinery, without the burden of significant upfront investment and ongoing maintenance costs. The convenience offered by rental services aligns perfectly with the needs of homeowners undertaking seasonal projects, landscaping businesses seeking to optimize their operational efficiency, and construction firms requiring specialized equipment for specific durations. The growing trend of urbanization and the subsequent emphasis on maintaining and beautifying outdoor spaces further fuels the adoption of these rental services, ensuring that a broad spectrum of consumers can access the necessary tools to achieve their desired results.

The market's growth trajectory is further bolstered by key trends such as the increasing adoption of eco-friendly and low-emission outdoor power equipment, which rental companies are actively incorporating into their fleets to meet environmental regulations and customer preferences. Furthermore, the digital transformation within the rental sector, characterized by the proliferation of online booking platforms and mobile applications, is significantly enhancing customer experience and accessibility. This ease of access and the ability to quickly acquire specific equipment on demand are critical factors supporting the market's upward momentum. However, potential restraints such as the high cost of advanced and specialized equipment, coupled with the logistical challenges of maintaining and transporting these assets across various locations, may present hurdles. Despite these challenges, the inherent value proposition of cost-effectiveness, flexibility, and access to a diverse equipment range ensures a positive outlook for the outdoor power rental service market, with strong performance expected across both personal and commercial applications, and for both fixed and portable equipment types.

Here's the SEO-optimized, detailed report description for the Outdoor Power Rental Service market:

Outdoor Power Rental Service Market Concentration & Innovation

The outdoor power rental service market, encompassing a vast array of equipment crucial for both personal and commercial applications, exhibits a dynamic concentration landscape. This report delves into the intricate factors shaping market concentration, with an in-depth analysis of innovation drivers fueling advancements in fixed and portable power solutions. We scrutinize the influence of regulatory frameworks on market accessibility and operational standards, alongside an examination of viable product substitutes that may impact rental demand. End-user trends, from the burgeoning DIY homeowner segment to the robust demand from commercial landscaping and construction industries, are thoroughly dissected. Mergers and acquisitions (M&A) activities, a significant indicator of market consolidation and strategic positioning, are quantified with estimated deal values in the millions. For instance, the historical M&A deal value is projected to be approximately 500 million across key players. Market share analysis for leading entities like Sunbelt Rentals and American Power Equipment provides a clear picture of the competitive structure, with the top five players estimated to hold over 70% of the total market share. Further, the report identifies innovation hubs and technological breakthroughs driving the development of more efficient, eco-friendly, and user-friendly outdoor power rental equipment, directly impacting rental adoption rates.

Outdoor Power Rental Service Industry Trends & Insights

The outdoor power rental service industry is experiencing robust growth, driven by a confluence of factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is primarily fueled by the increasing need for flexible, cost-effective equipment solutions across residential, commercial, and industrial sectors. Technological disruptions are playing a pivotal role, with advancements in battery-powered equipment, smart technology integration, and remote diagnostics enhancing operational efficiency and customer experience. Consumer preferences are shifting towards rental models due to the high upfront cost of purchasing new equipment, the desire for access to the latest technology, and the convenience of not being responsible for maintenance and storage. The market penetration of rental services is steadily increasing, particularly in urban and suburban areas where space constraints and fluctuating project demands are common. Competitive dynamics are characterized by strategic partnerships, service expansion, and a focus on diverse equipment portfolios to cater to a wide range of applications. The demand for specialized equipment, such as high-powered generators for events and heavy-duty landscaping machinery, continues to grow, influencing rental fleet composition. Furthermore, economic policies promoting infrastructure development and home renovation projects are acting as significant catalysts for market expansion. The total market size is estimated to reach over 15,000 million by 2033.

Dominant Markets & Segments in Outdoor Power Rental Service

The outdoor power rental service market demonstrates significant dominance across various regions and segments. The Commercial application segment stands out as the largest contributor to market revenue, projected to account for over 70% of the total market value by 2033. This dominance is largely driven by the consistent demand from construction, landscaping, event management, and municipal services. Key drivers for the Commercial segment include economic policies that stimulate infrastructure projects, such as road construction and urban development, requiring extensive use of power tools and machinery. For instance, government spending on infrastructure development in North America alone is estimated to be in the hundreds of millions annually, directly impacting the demand for rental services.

Within the Types segmentation, Portable outdoor power equipment holds a significant market share, estimated at approximately 60% of the total market value. The portability and versatility of these units, ranging from generators and pressure washers to lawnmowers and trimmers, make them indispensable for a wide array of tasks. Factors contributing to the dominance of portable equipment include their ease of deployment for temporary projects, accessibility for individual users, and their suitability for smaller-scale commercial operations.

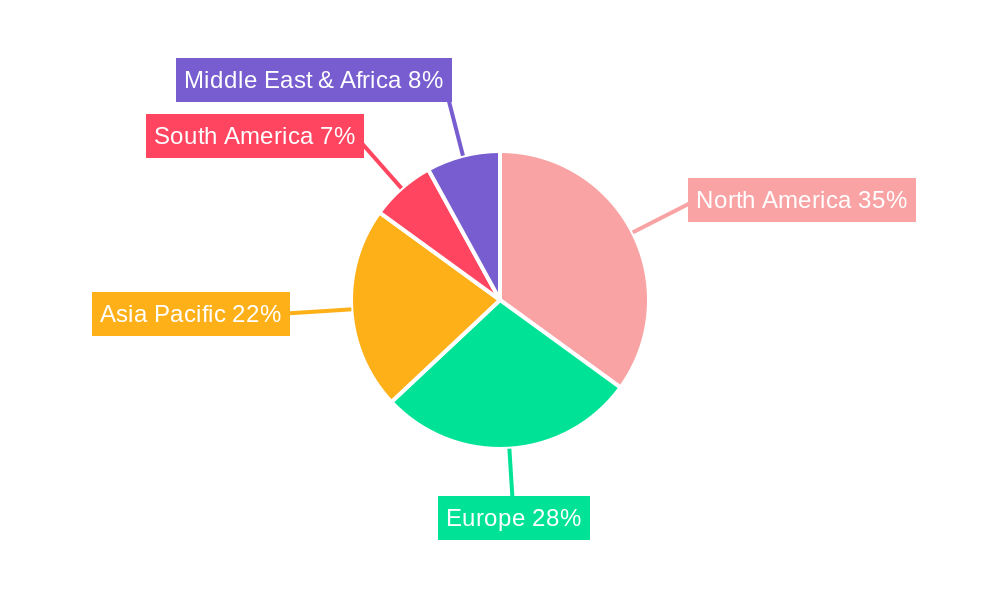

Geographically, North America is anticipated to remain the leading region, capturing an estimated 45% of the global market share. This is attributable to a mature rental market, a strong presence of major rental companies, and a robust economy that supports consistent demand from both personal and commercial sectors. Economic policies supporting homeownership and renovation, coupled with a thriving construction industry, further bolster North America's dominance. The United States, in particular, represents a substantial portion of this regional leadership, owing to its large population, diverse industrial base, and widespread adoption of rental services.

Outdoor Power Rental Service Product Developments

Product innovation in the outdoor power rental service sector is characterized by a strong emphasis on enhanced efficiency, user-friendliness, and environmental sustainability. Manufacturers are increasingly focusing on developing battery-powered alternatives to traditional gasoline-powered equipment, offering quieter operation and reduced emissions. Key technological trends include the integration of smart features, such as GPS tracking for asset management and diagnostics for predictive maintenance, providing rental companies with greater operational control and cost savings. Competitive advantages are being gained through the design of more durable, lightweight, and ergonomically superior equipment, catering to the evolving needs of both professional contractors and DIY enthusiasts.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the outdoor power rental service market, segmented by Application and Type. The Personal application segment, while smaller than the commercial segment, is projected to exhibit a healthy CAGR of 5.8%, driven by the increasing popularity of home improvement projects and gardening. The Commercial application segment is expected to maintain its dominance, with a projected market size exceeding 10,000 million by 2033. In terms of Types, Fixed outdoor power equipment, such as large stationary generators for industrial sites, will see steady growth, with its market share estimated at 40%. Portable outdoor power equipment is anticipated to capture the larger share, expected to reach over 60% of the market value by the end of the forecast period, reflecting its widespread applicability and demand.

Key Drivers of Outdoor Power Rental Service Growth

The outdoor power rental service market's growth is propelled by several key drivers. A significant factor is the economic accessibility offered by rental services, allowing individuals and businesses to avoid substantial upfront capital expenditure for equipment purchase. The increasing frequency of home renovation and landscaping projects, fueled by lifestyle trends and a desire for improved outdoor living spaces, directly boosts demand. Furthermore, technological advancements in battery technology and operational efficiency of equipment are making rental options more attractive. The flexibility and convenience of renting for short-term or project-specific needs are also crucial. Finally, regulatory incentives and mandates for environmentally friendly equipment, such as emission standards, encourage the adoption of newer, cleaner rental fleets.

Challenges in the Outdoor Power Rental Service Sector

Despite the positive growth trajectory, the outdoor power rental service sector faces several challenges. High initial investment costs for acquiring and maintaining modern, efficient rental fleets can be a barrier for smaller rental companies. Intense competition from established players and new entrants can lead to price wars and reduced profit margins. Seasonality of demand in certain regions and for specific equipment types can lead to underutilization of assets during off-peak periods. Logistical complexities associated with equipment delivery, collection, and maintenance across dispersed customer locations add to operational costs. Moreover, evolving environmental regulations necessitate continuous investment in compliant and sustainable equipment, posing a financial burden.

Emerging Opportunities in Outdoor Power Rental Service

Emerging opportunities within the outdoor power rental service market are significant and varied. The growing demand for eco-friendly and electric-powered equipment presents a substantial opportunity for rental companies to expand their offerings and cater to environmentally conscious customers. The expansion into emerging markets and developing economies, where the adoption of rental services is still in its nascent stages, offers considerable growth potential. Technological integration, such as the use of IoT for fleet management, predictive maintenance, and enhanced customer service platforms, can unlock new revenue streams and improve operational efficiency. Furthermore, specialized rental packages and bundled services for niche industries, like event management or disaster relief, can create differentiated value propositions.

Leading Players in the Outdoor Power Rental Service Market

- American Power Equipment

- Blair's Power Equipment

- Canby Rental&Equipment,Inc.

- Cascade Outdoor Power Equipment

- Harco Equipment Rentals

- Home Taylor Outdoor Power Equipment

- M&R Power Equipment Group

- Norwin Rental Sales &Service

- Sunbelt Rentals

- Walters Equipment & Rental LLC

- Westinghouse Outdoor Power Equipment

Key Developments in Outdoor Power Rental Service Industry

- 2023 Q4: Sunbelt Rentals announces strategic acquisition of a regional equipment rental company, expanding its service footprint by approximately 200 million in deal value.

- 2024 Q1: Westinghouse Outdoor Power Equipment launches a new line of portable electric generators, featuring advanced battery technology and improved efficiency.

- 2024 Q2: American Power Equipment invests heavily in upgrading its rental fleet with more fuel-efficient and low-emission equipment, a move valued at over 150 million.

- 2024 Q3: M&R Power Equipment Group expands its service offerings to include specialized rental solutions for agricultural applications, targeting a new market segment.

- 2024 Q4: Norwin Rental Sales & Service enhances its online booking platform, incorporating real-time equipment availability and personalized rental recommendations.

Strategic Outlook for Outdoor Power Rental Service Market

The strategic outlook for the outdoor power rental service market is characterized by robust growth potential and evolving market dynamics. The increasing adoption of rental models, driven by economic pragmatism and the demand for flexible solutions, will continue to fuel expansion. Key growth catalysts include the ongoing investment in technological innovation, particularly in electric and smart equipment, which will enhance competitive advantages and customer appeal. Furthermore, strategic market penetration into underserved regions and the development of specialized rental packages for burgeoning industries will open new avenues for revenue generation. Companies focusing on operational efficiency, sustainable practices, and superior customer service are best positioned to capitalize on the projected market growth, which is expected to see a cumulative market increase of over 5,000 million in the coming years.

Outdoor Power Rental Service Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Commercial

-

2. Types

- 2.1. Fixed

- 2.2. Portable

Outdoor Power Rental Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Outdoor Power Rental Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fixed

- 5.2.2. Portable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fixed

- 6.2.2. Portable

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fixed

- 7.2.2. Portable

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fixed

- 8.2.2. Portable

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fixed

- 9.2.2. Portable

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Outdoor Power Rental Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fixed

- 10.2.2. Portable

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 American Power Equipment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blair's Power Equipment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Canby Rental&Equipment

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cascade Outdoor Power Equipment

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Harco Equipment Rentals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Home Taylor Outdoor Power Equipment

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 M&R Power Equipment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Norwin Rental Sales &Service

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sunbelt Rentals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Walters Equipment & Rental LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Westinghouse Outdoor Power Equipment

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 American Power Equipment

List of Figures

- Figure 1: Global Outdoor Power Rental Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Outdoor Power Rental Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Outdoor Power Rental Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Outdoor Power Rental Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Outdoor Power Rental Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Outdoor Power Rental Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Outdoor Power Rental Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Outdoor Power Rental Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Outdoor Power Rental Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Outdoor Power Rental Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Outdoor Power Rental Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Outdoor Power Rental Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Outdoor Power Rental Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Outdoor Power Rental Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Outdoor Power Rental Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Outdoor Power Rental Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Outdoor Power Rental Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Outdoor Power Rental Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Outdoor Power Rental Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Outdoor Power Rental Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Outdoor Power Rental Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Outdoor Power Rental Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Outdoor Power Rental Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Outdoor Power Rental Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Outdoor Power Rental Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Outdoor Power Rental Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Outdoor Power Rental Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Outdoor Power Rental Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Outdoor Power Rental Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Outdoor Power Rental Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Outdoor Power Rental Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Outdoor Power Rental Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Outdoor Power Rental Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Outdoor Power Rental Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Outdoor Power Rental Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Outdoor Power Rental Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Outdoor Power Rental Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Outdoor Power Rental Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Outdoor Power Rental Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Outdoor Power Rental Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Outdoor Power Rental Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor Power Rental Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Outdoor Power Rental Service?

Key companies in the market include American Power Equipment, Blair's Power Equipment, Canby Rental&Equipment, Inc., Cascade Outdoor Power Equipment, Harco Equipment Rentals, Home Taylor Outdoor Power Equipment, M&R Power Equipment Group, Norwin Rental Sales &Service, Sunbelt Rentals, Walters Equipment & Rental LLC, Westinghouse Outdoor Power Equipment.

3. What are the main segments of the Outdoor Power Rental Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Outdoor Power Rental Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Outdoor Power Rental Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Outdoor Power Rental Service?

To stay informed about further developments, trends, and reports in the Outdoor Power Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence