Key Insights

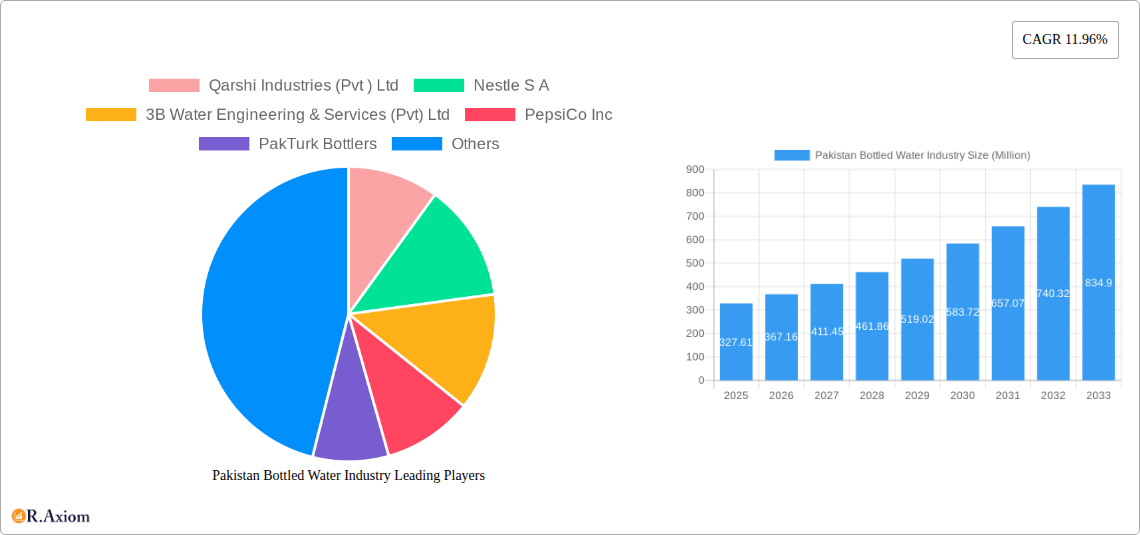

The Pakistan bottled water market, valued at $327.61 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.96% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and increasing health consciousness among the Pakistani population are driving demand for safe and convenient hydration options. The burgeoning urban population and expanding tourism sector also contribute significantly to market expansion. Furthermore, a growing preference for bottled water over tap water, due to concerns about water quality and safety, particularly in less developed areas, fuels market growth. The market is segmented by product type (still and sparkling water) and distribution channel (on-trade and off-trade). Major players like Nestle S.A., PepsiCo Inc., and The Coca-Cola Company compete alongside local brands such as Qarshi Industries (Pvt) Ltd and Sufi Group of Industries, indicating a dynamic competitive landscape.

Pakistan Bottled Water Industry Market Size (In Million)

The Asia-Pacific region, and specifically Pakistan within it, experiences particularly strong growth due to its large and rapidly developing economy. While challenges remain, such as fluctuating raw material prices and intense competition, the long-term outlook for the Pakistan bottled water market remains positive. Strategic partnerships, product diversification, and targeted marketing campaigns will play crucial roles in shaping the market's trajectory. Focus on sustainable packaging and environmentally conscious production practices will also become increasingly important to meet evolving consumer preferences and regulatory requirements. The market's future growth will likely be influenced by government regulations on water quality and plastic waste management, impacting packaging choices and production processes.

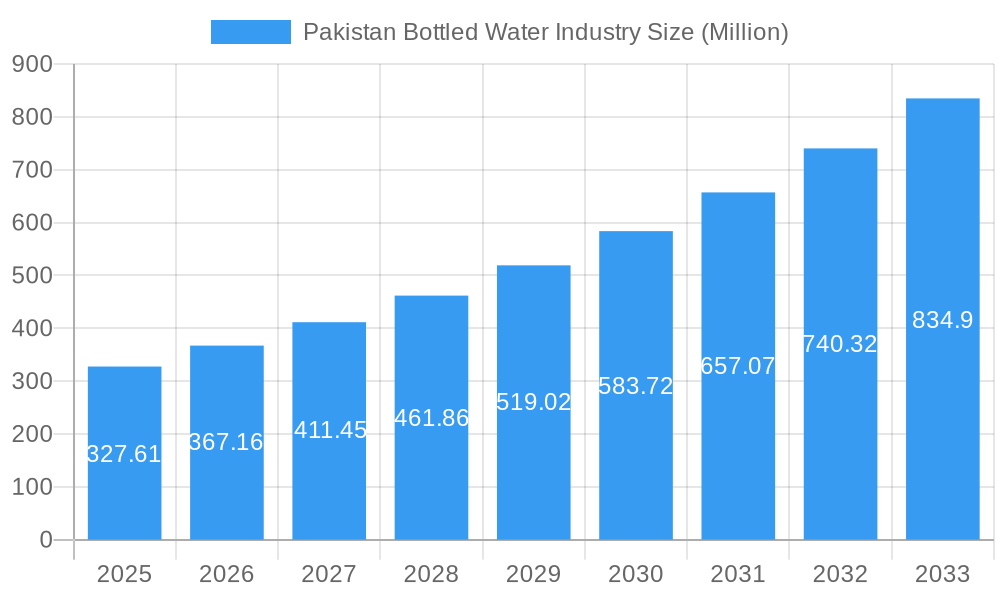

Pakistan Bottled Water Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Pakistan bottled water industry, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on the dynamic Pakistani bottled water market.

Pakistan Bottled Water Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Pakistan bottled water industry, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The market is characterized by a mix of multinational giants and local players, leading to a moderately concentrated market structure. While precise market share data for each player is unavailable at this time, Nestlé S.A., PepsiCo Inc., and The Coca-Cola Company are significant players, holding a combined estimated xx% of the market in 2025. Other key players include Qarshi Industries (Pvt) Ltd, 3B Water Engineering & Services (Pvt) Ltd, PakTurk Bottlers, Reignwood Investments UK Ltd (VOSS Water), Aqua Fujitenma Inc, Danone S.A., Sufi Group of Industries, and Masafi LLC.

- Market Concentration: Moderate, with significant presence of multinational corporations.

- Innovation Drivers: Growing consumer demand for premium and functional waters (e.g., mineral water, flavored water), increasing health consciousness, and sustainability concerns drive innovation.

- Regulatory Framework: The regulatory environment impacts product standards and labeling requirements. Further analysis is required to fully detail the specific impact.

- Product Substitutes: Tap water, other beverages (juices, sodas).

- End-User Trends: Health-conscious consumers drive demand for natural and purified water.

- M&A Activities: The M&A landscape in the Pakistan bottled water sector is characterized by xx Million in deal value (estimated) during the historical period. Further details are unavailable due to data limitations.

Pakistan Bottled Water Industry Industry Trends & Insights

The Pakistan bottled water market exhibits robust growth, driven by several key factors. The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be xx%, and is projected to continue to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx% in 2025, with significant potential for future growth, particularly in underserved regions.

Key growth drivers include rising disposable incomes, increasing urbanization, changing lifestyles, and growing health awareness. Technological disruptions in packaging and distribution are also shaping the market. However, competitive pressures and fluctuating raw material costs pose challenges. Consumer preferences are shifting towards healthier, more sustainable options, impacting the demand for different product types and packaging formats.

Dominant Markets & Segments in Pakistan Bottled Water Industry

The Pakistan bottled water market is dominated by the Still Water segment due to its broad appeal and affordability. The Off-Trade distribution channel (e.g., supermarkets, convenience stores) holds a larger market share than the On-Trade (e.g., restaurants, hotels) segment, reflecting consumer purchasing habits.

Key Drivers of Segment Dominance:

- Still Water: Affordability, widespread availability, preference for plain water.

- Off-Trade: Convenience, wider reach, lower prices compared to On-Trade.

Dominance Analysis: Further detailed geographic dominance analysis requires additional data.

Pakistan Bottled Water Industry Product Developments

Product innovation focuses on enhancing convenience, taste, and health benefits. This includes the introduction of functional waters with added vitamins, minerals, or electrolytes. Sustainable packaging solutions and eco-friendly production practices are also gaining traction, meeting consumer demands. Market fit is largely determined by affordability and consumer preference for taste and perceived health benefits.

Report Scope & Segmentation Analysis

This report segments the Pakistan bottled water market based on product type (Still Water, Sparkling Water) and distribution channel (On-Trade, Off-Trade).

Still Water: This segment is projected to maintain a significant share of the overall market, driven by consistently high demand. The CAGR for this segment during the forecast period is estimated at xx%.

Sparkling Water: This segment exhibits a lower market share compared to still water but demonstrates consistent growth due to evolving consumer preferences. The forecast CAGR for this segment is xx%.

On-Trade: This segment's growth is closely linked to the hospitality and food service sectors. The CAGR is projected at xx%.

Off-Trade: The Off-Trade segment dominates the market, reflecting the convenience of retail purchases. The CAGR for this segment is projected at xx%.

Key Drivers of Pakistan Bottled Water Industry Growth

Key growth drivers include:

- Rising Disposable Incomes: Increased purchasing power fuels demand for bottled water.

- Urbanization: Higher population density in urban areas boosts consumption.

- Health and Wellness Trends: Growing awareness of health and hydration drives demand.

- Government Initiatives: Regulations promoting clean water access and hygiene indirectly boost demand.

Challenges in the Pakistan Bottled Water Industry Sector

Challenges include:

- Water Scarcity: This is a major constraint in certain regions, impacting production costs and supply chain stability.

- Infrastructure Limitations: Inadequate infrastructure in some areas hinders distribution and reach.

- Intense Competition: The presence of numerous players creates competitive pressure.

- Fluctuating Raw Material Prices: Increases in plastic and energy costs affect profitability.

Emerging Opportunities in Pakistan Bottled Water Industry

Opportunities include:

- Premiumization: Growing demand for premium and functional waters.

- Sustainable Packaging: Focus on eco-friendly and recyclable packaging to appeal to environmentally conscious consumers.

- Expansion into Underserved Regions: Potential for growth in less developed areas with limited access to clean water.

- Innovative Distribution Channels: Exploring new distribution methods for wider reach and enhanced efficiency.

Leading Players in the Pakistan Bottled Water Industry Market

- Qarshi Industries (Pvt ) Ltd

- Nestle S A

- 3B Water Engineering & Services (Pvt) Ltd

- PepsiCo Inc

- PakTurk Bottlers

- Reignwood Investments UK Ltd (VOSS Water)

- Aqua Fujitenma Inc

- Danone S A

- Sufi Group of Industries

- The Coca-Cola Company

- Masafi LLC

Key Developments in Pakistan Bottled Water Industry Industry

- December 2021: Coca-Cola Beverages Pakistan Limited established a water filtration plant in Haripur as part of its PAANI CSR project. This demonstrates corporate social responsibility and enhances the company's image.

- March 2022: PepsiCo's collaboration with WaterAid to provide clean water in Pakistan showcases a commitment to social impact and potentially improves brand perception.

Strategic Outlook for Pakistan Bottled Water Industry Market

The Pakistan bottled water market presents a significant growth opportunity. Expanding consumer base, increasing health consciousness, and ongoing investment in infrastructure will drive market expansion. Companies focusing on innovation, sustainability, and efficient distribution will be best positioned to capture significant market share in the coming years. The market is projected to experience considerable expansion, particularly in the premium and functional water segments.

Pakistan Bottled Water Industry Segmentation

-

1. Type

- 1.1. Still Water

- 1.2. Sparkling Water

-

2. Distribution Channel

- 2.1. On Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Home and Office Delivery (HOD)

- 2.2.5. Other Distribution Channels

Pakistan Bottled Water Industry Segmentation By Geography

- 1. Pakistan

Pakistan Bottled Water Industry Regional Market Share

Geographic Coverage of Pakistan Bottled Water Industry

Pakistan Bottled Water Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players

- 3.3. Market Restrains

- 3.3.1. Need for Stringent Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Escalating Concern for Quality Drinking Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Bottled Water Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Water

- 5.1.2. Sparkling Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Home and Office Delivery (HOD)

- 5.2.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qarshi Industries (Pvt ) Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3B Water Engineering & Services (Pvt) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PakTurk Bottlers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reignwood Investments UK Ltd (VOSS Water)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aqua Fujitenma Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Danone S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sufi Group of Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Coca-Cola Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Masafi LLC*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Qarshi Industries (Pvt ) Ltd

List of Figures

- Figure 1: Pakistan Bottled Water Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Pakistan Bottled Water Industry Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Bottled Water Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Pakistan Bottled Water Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Pakistan Bottled Water Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Pakistan Bottled Water Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Pakistan Bottled Water Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Pakistan Bottled Water Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Bottled Water Industry?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Pakistan Bottled Water Industry?

Key companies in the market include Qarshi Industries (Pvt ) Ltd, Nestle S A, 3B Water Engineering & Services (Pvt) Ltd, PepsiCo Inc, PakTurk Bottlers, Reignwood Investments UK Ltd (VOSS Water), Aqua Fujitenma Inc, Danone S A, Sufi Group of Industries, The Coca-Cola Company, Masafi LLC*List Not Exhaustive.

3. What are the main segments of the Pakistan Bottled Water Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 327.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players.

6. What are the notable trends driving market growth?

Escalating Concern for Quality Drinking Water.

7. Are there any restraints impacting market growth?

Need for Stringent Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

March 2022: The global beverage and snack conglomerate PepsiCo collaborated with WaterAid in a bid to provide clean water to the masses of Pakistan. The company claimed that it is working to improve access to clean water for underserved urban communities in Pakistan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Bottled Water Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Bottled Water Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Bottled Water Industry?

To stay informed about further developments, trends, and reports in the Pakistan Bottled Water Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence