Key Insights

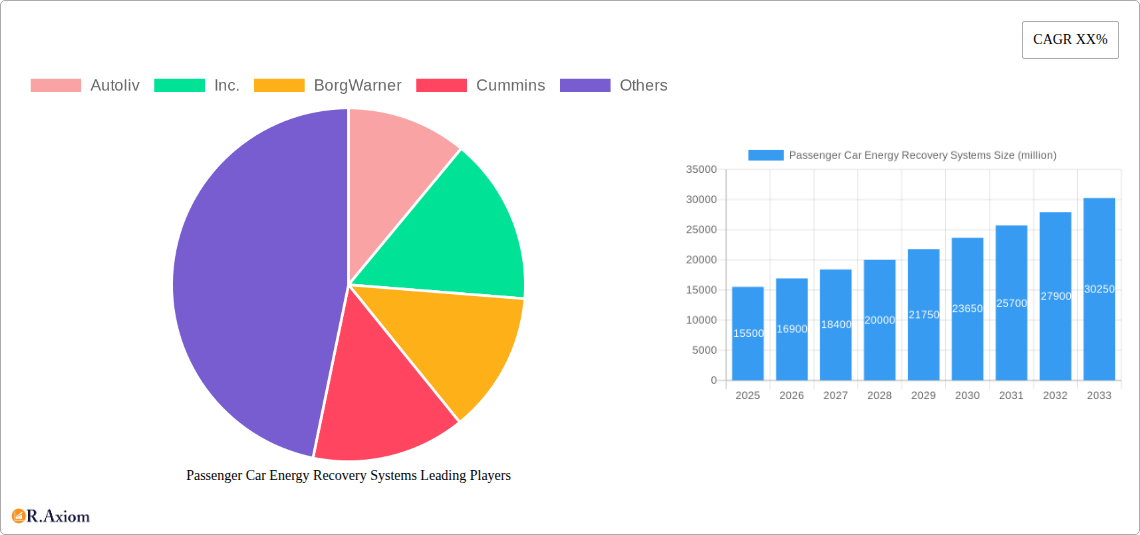

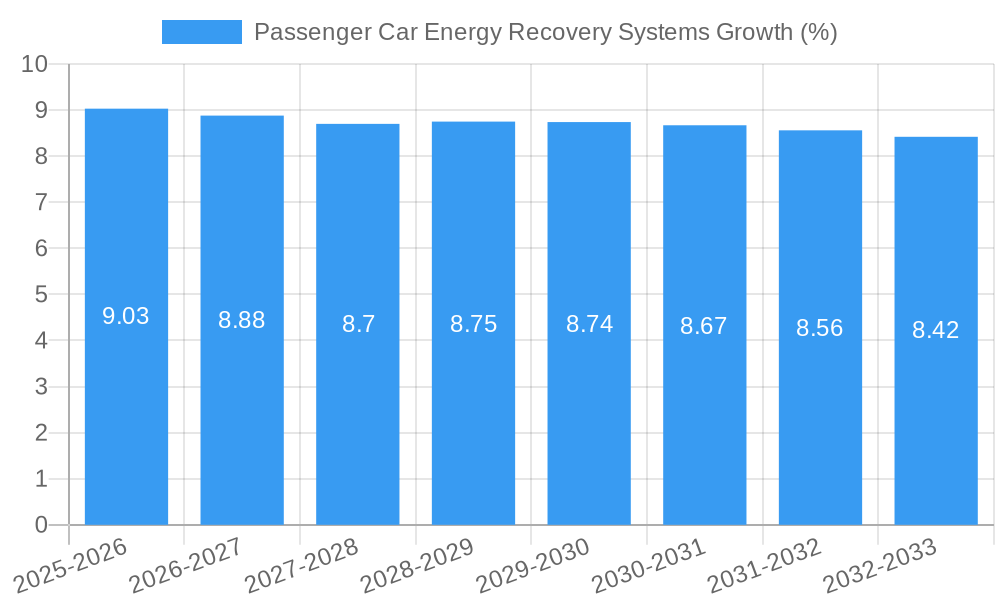

The Passenger Car Energy Recovery Systems market is poised for substantial growth, driven by increasing regulatory pressures for fuel efficiency and reduced emissions worldwide. Valued at an estimated USD 15,500 million in 2025, this dynamic sector is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 9.5% through 2033. This robust expansion is fueled by the dual demand for both Automotive Regenerative Braking Systems and Automotive Waste Heat Recovery Systems. Regenerative braking, crucial for electric and hybrid vehicles, captures kinetic energy during deceleration, converting it into electrical energy, thereby extending range and improving overall efficiency. Simultaneously, waste heat recovery systems are gaining traction in internal combustion engine vehicles to recapture thermal energy, a significant portion of which is otherwise lost, leading to improved fuel economy and lower CO2 emissions. The market is also influenced by evolving consumer preferences towards eco-friendly and cost-effective mobility solutions, further accelerating the adoption of these advanced energy-saving technologies.

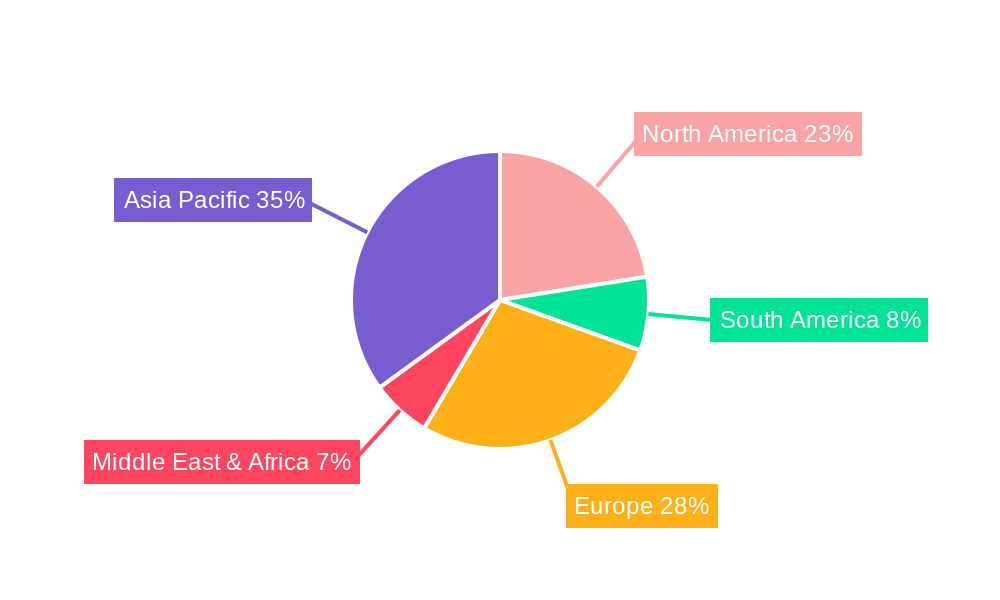

The market is segmented into applications catering to Economy Cars and Premium Cars, with both segments showing strong growth potential. Premium car manufacturers are at the forefront of adopting sophisticated energy recovery technologies to enhance performance and brand image, while the mass-market adoption in economy cars is driven by the pursuit of greater fuel efficiency and lower operating costs. Geographically, Asia Pacific, led by China, is expected to emerge as the largest and fastest-growing regional market due to its massive automotive production and sales volume, coupled with stringent government mandates on vehicle emissions. North America and Europe, with their established automotive industries and strong focus on sustainability, will also represent significant markets. Key players like Robert Bosch, Continental, Denso, and BorgWarner are actively investing in research and development, introducing innovative solutions and expanding their product portfolios to capture market share in this burgeoning sector.

Passenger Car Energy Recovery Systems Market Analysis: 2019-2033

This comprehensive report offers an in-depth analysis of the global Passenger Car Energy Recovery Systems market, providing critical insights for industry stakeholders. Spanning the historical period from 2019 to 2024 and projecting forward to 2033, with a base and estimated year of 2025, this study delves into market dynamics, technological advancements, and future opportunities. The report highlights key players, dominant segments, and emerging trends, offering a roadmap for strategic decision-making in this rapidly evolving sector.

Passenger Car Energy Recovery Systems Market Concentration & Innovation

The Passenger Car Energy Recovery Systems market exhibits a moderate concentration, with a blend of established automotive suppliers and specialized technology providers vying for market share. Innovation is a primary driver, fueled by stringent emission regulations and the increasing demand for fuel efficiency. Companies are heavily investing in R&D to enhance the performance and cost-effectiveness of regenerative braking systems and waste heat recovery technologies. Regulatory frameworks worldwide, such as those promoting electrified vehicles and CO2 emission targets, are accelerating adoption. Product substitutes are limited, with advancements in powertrain electrification representing the most significant alternative. End-user trends indicate a growing preference for vehicles that offer improved fuel economy and reduced environmental impact, driving demand for advanced energy recovery solutions. Merger and acquisition activities are expected to continue as larger players seek to consolidate their market position and acquire innovative technologies. For instance, M&A deals valued in the hundreds of millions are anticipated, further shaping the competitive landscape. Key innovators in this space include:

- Autoliv, Inc.

- BorgWarner, Inc.

- Cummins, Inc.

- Continental AG

- Delphi Automotive

- Denso Corporation

- Faurecia SE

- Gentherm Corporation

- Hitachi Automotive Systems Ltd.

- Honeywell International, Inc.

- Maxwell Technologies, Inc. (now part of Tesla)

- Mitsubishi Heavy Industries Ltd.

- Panasonic Corporation

- Ricardo plc

- Robert Bosch GmbH

- Rheinmetall Automotive AG

- Skeleton Technologies

- Tenneco Inc.

- Torotrak

- ZF TRW

Passenger Car Energy Recovery Systems Industry Trends & Insights

The Passenger Car Energy Recovery Systems market is poised for significant growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive regulatory environments. The global market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025–2033). This growth is primarily attributed to the increasing integration of energy recovery systems in both conventional and electrified vehicles to enhance fuel efficiency and reduce emissions. Technological disruptions are continuously shaping the market, with innovations in materials science and control systems leading to more efficient and compact energy recovery solutions. For example, advancements in supercapacitors and advanced battery technologies are making regenerative braking systems more effective in capturing and redeploying kinetic energy. Waste heat recovery systems are also seeing significant progress, with new thermoelectric generators and Organic Rankine Cycle (ORC) systems demonstrating improved performance and wider applicability in passenger cars.

Consumer preferences are increasingly leaning towards vehicles that offer a lower total cost of ownership, which is directly influenced by improved fuel economy. As a result, energy recovery systems are becoming a key selling point for both economy and premium car segments. The competitive dynamics of the market are characterized by intense innovation and strategic partnerships between established automotive manufacturers and specialized technology providers. Companies are investing heavily in research and development to gain a competitive edge. The market penetration of these systems is expected to rise substantially, particularly as government mandates and incentives for fuel-efficient and low-emission vehicles become more widespread. The projected market size for passenger car energy recovery systems is estimated to reach over $XX billion by 2033. The increasing complexity of vehicle architectures and the drive towards autonomous driving technologies also present opportunities for integrated energy management solutions, further propelling market expansion. The continued focus on sustainability and the circular economy within the automotive sector will undoubtedly fuel further innovation and adoption of these vital technologies.

Dominant Markets & Segments in Passenger Car Energy Recovery Systems

The Passenger Car Energy Recovery Systems market is witnessing robust growth across various regions and segments, with Asia Pacific emerging as the dominant geographical market. This dominance is driven by the region's massive automotive production base, stringent emission standards being implemented in key countries like China and Japan, and a rapidly growing middle class with increasing disposable income for new vehicles. Within Asia Pacific, China is a significant contributor due to its proactive government policies promoting electric vehicles (EVs) and hybrid electric vehicles (HEVs), which heavily rely on regenerative braking systems. The adoption of advanced automotive regenerative braking systems is particularly pronounced in this region, directly contributing to improved fuel efficiency and reduced braking wear.

The Automotive Regenerative Braking System segment is expected to lead the market in terms of revenue and volume. This is largely due to its integral role in hybrid and electric vehicles, which are experiencing exponential growth globally. Key drivers for the dominance of this segment include:

- Government Mandates & Incentives: Policies encouraging the adoption of EVs and HEVs, which are inherently equipped with regenerative braking.

- Technological Advancements: Continuous improvements in energy storage devices like supercapacitors and advanced batteries, enhancing the efficiency and capacity of regenerative braking systems.

- Consumer Demand for Fuel Efficiency: Growing awareness and preference for vehicles that offer lower fuel consumption.

- Reduced Wear and Tear: Extended brake life due to the reduced reliance on friction brakes.

In terms of vehicle application, both Economy Car and Premium Car segments are significant. Economy cars benefit from the improved fuel efficiency that energy recovery systems offer, making them more attractive to budget-conscious buyers. Premium cars, on the other hand, leverage these technologies to enhance performance, offer a smoother driving experience, and meet the sustainability expectations of affluent consumers. The premium segment often pioneers the adoption of more sophisticated energy recovery technologies, setting trends for the broader market. The increasing integration of these systems into mainstream vehicles signifies a shift towards a more energy-conscious automotive industry.

Passenger Car Energy Recovery Systems Product Developments

Recent product developments in Passenger Car Energy Recovery Systems are focused on enhancing efficiency, reducing size and weight, and improving cost-effectiveness. Innovations in automotive regenerative braking systems are leading to more sophisticated control algorithms that optimize energy capture during deceleration, particularly in urban driving cycles. Simultaneously, advancements in automotive waste heat recovery systems are yielding more efficient thermoelectric generators and improved Organic Rankine Cycle (ORC) technologies, capable of converting exhaust heat into usable electrical energy with minimal impact on vehicle performance. These developments are crucial for meeting increasingly stringent fuel economy standards and reducing the overall carbon footprint of passenger vehicles, offering a competitive advantage to manufacturers adopting these cutting-edge solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Passenger Car Energy Recovery Systems market, segmenting it by application and type. The Application segmentation includes Economy Car and Premium Car. Economy cars are increasingly adopting energy recovery technologies to boost fuel efficiency and appeal to cost-conscious consumers, with projected market sizes expected to grow significantly. Premium cars are leveraging these systems for enhanced performance, refined driving dynamics, and to align with sustainability mandates, also showing strong growth.

The Type segmentation encompasses Automotive Regenerative Braking System and Automotive Waste Heat Recovery System. Automotive Regenerative Braking Systems are projected to dominate due to their widespread integration in hybrid and electric vehicles, driven by rapid growth in these vehicle classes and supportive government policies. Automotive Waste Heat Recovery Systems are seeing advancements that improve their efficiency and applicability, offering further potential for fuel savings and emission reductions across various vehicle types, with steady growth anticipated as technology matures.

Key Drivers of Passenger Car Energy Recovery Systems Growth

The growth of the Passenger Car Energy Recovery Systems market is propelled by several key factors. Technological advancements in areas such as advanced battery technology, supercapacitors, and thermoelectric materials are making these systems more efficient and cost-effective. Stringent government regulations mandating improved fuel economy and reduced CO2 emissions globally are a primary catalyst, pushing automakers to integrate these technologies. For instance, the European Union's CO2 emission standards and the U.S. Corporate Average Fuel Economy (CAFE) standards are directly influencing adoption rates. Furthermore, growing consumer awareness regarding environmental sustainability and the desire for reduced running costs are increasing demand for vehicles equipped with energy recovery systems.

Challenges in the Passenger Car Energy Recovery Systems Sector

Despite the positive outlook, the Passenger Car Energy Recovery Systems sector faces several challenges. The high initial cost of some advanced energy recovery technologies can be a barrier to widespread adoption, especially in the economy car segment. Complexity of integration into existing vehicle architectures can also pose engineering hurdles for automakers. Furthermore, supply chain disruptions and the availability of raw materials for critical components like batteries and supercapacitors can impact production volumes and costs. Competitive pressures from alternative solutions like further powertrain electrification without dedicated energy recovery components also present a restraint.

Emerging Opportunities in Passenger Car Energy Recovery Systems

Emerging opportunities in the Passenger Car Energy Recovery Systems market are abundant and diverse. The continued growth of the electric vehicle (EV) and hybrid electric vehicle (HEV) market presents a significant opportunity for regenerative braking systems. Furthermore, advancements in thermoelectric generators and Organic Rankine Cycle (ORC) technology are opening new avenues for automotive waste heat recovery, particularly in internal combustion engine vehicles and plug-in hybrids. The development of integrated energy management systems that combine various energy recovery methods offers potential for optimizing overall vehicle efficiency. Growing demand for sustainable mobility solutions and the potential for vehicle-to-grid (V2G) integration where recovered energy can be fed back to the grid, also present promising future avenues.

Leading Players in the Passenger Car Energy Recovery Systems Market

The Passenger Car Energy Recovery Systems market is characterized by the presence of several key global players who are instrumental in driving innovation and market growth. These companies contribute significantly through their extensive research and development, strategic partnerships, and a broad portfolio of automotive components.

- Autoliv, Inc.

- BorgWarner, Inc.

- Cummins, Inc.

- Continental AG

- Delphi Automotive

- Denso Corporation

- Faurecia SE

- Gentherm Corporation

- Hitachi Automotive Systems Ltd.

- Honeywell International, Inc.

- Maxwell Technologies, Inc.

- Mitsubishi Heavy Industries Ltd.

- Panasonic Corporation

- Ricardo plc

- Robert Bosch GmbH

- Rheinmetall Automotive AG

- Skeleton Technologies

- Tenneco Inc.

- Torotrak

- ZF TRW

Key Developments in Passenger Car Energy Recovery Systems Industry

- 2024/01: Launch of next-generation supercapacitors by Skeleton Technologies, offering higher energy density for improved regenerative braking performance.

- 2023/09: BorgWarner acquires a leading developer of waste heat recovery systems, strengthening its portfolio in this crucial segment.

- 2023/06: Continental AG announces a new integrated braking system that significantly enhances regenerative braking efficiency in EVs.

- 2023/03: Denso Corporation showcases advanced thermoelectric generators with higher conversion efficiency for automotive applications.

- 2022/12: Robert Bosch GmbH expands its offerings in advanced energy management solutions for both hybrid and fully electric vehicles.

- 2022/09: Faurecia invests heavily in R&D for advanced heat recovery systems to meet future emission targets.

Strategic Outlook for Passenger Car Energy Recovery Systems Market

The strategic outlook for the Passenger Car Energy Recovery Systems market remains highly positive, driven by the global imperative for sustainability and efficiency in transportation. The continued transition towards electrified powertrains will solidify the dominance of regenerative braking systems, while advancements in waste heat recovery offer significant potential for further optimization in both new energy vehicles and traditional internal combustion engine vehicles. Strategic collaborations between technology providers and established automakers will be crucial for scaling production and reducing costs. The focus on developing lighter, more compact, and more cost-effective solutions will be a key differentiator. Opportunities lie in exploring new materials, enhancing control software, and integrating these systems into holistic vehicle energy management architectures to maximize fuel savings and minimize environmental impact, ensuring sustained growth and market expansion through 2033.

Passenger Car Energy Recovery Systems Segmentation

-

1. Application

- 1.1. Economy Car

- 1.2. Premium Car

-

2. Types

- 2.1. Automotive Regenerative Braking System

- 2.2. Automotive Waste Heat Recovery System

Passenger Car Energy Recovery Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passenger Car Energy Recovery Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Economy Car

- 5.1.2. Premium Car

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Automotive Regenerative Braking System

- 5.2.2. Automotive Waste Heat Recovery System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Economy Car

- 6.1.2. Premium Car

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Automotive Regenerative Braking System

- 6.2.2. Automotive Waste Heat Recovery System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Economy Car

- 7.1.2. Premium Car

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Automotive Regenerative Braking System

- 7.2.2. Automotive Waste Heat Recovery System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Economy Car

- 8.1.2. Premium Car

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Automotive Regenerative Braking System

- 8.2.2. Automotive Waste Heat Recovery System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Economy Car

- 9.1.2. Premium Car

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Automotive Regenerative Braking System

- 9.2.2. Automotive Waste Heat Recovery System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Passenger Car Energy Recovery Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Economy Car

- 10.1.2. Premium Car

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Automotive Regenerative Braking System

- 10.2.2. Automotive Waste Heat Recovery System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Autoliv

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BorgWarner

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cummins

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Continental

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Delphi Automotive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Denso

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Faurecia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gentherm

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hitachi Automotive Systems Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Honeywell International

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Inc.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Maxwell Technologies

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Inc.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Mitsubishi Heavy Industries Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Panasonic

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ricardo

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Robert Bosch

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Rheinmetall Automotive AG

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Skeleton Technologies

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Tenneco

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Torotrak

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 ZF TRW

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Autoliv

List of Figures

- Figure 1: Global Passenger Car Energy Recovery Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Passenger Car Energy Recovery Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Passenger Car Energy Recovery Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Passenger Car Energy Recovery Systems Revenue (million), by Types 2024 & 2032

- Figure 5: North America Passenger Car Energy Recovery Systems Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Passenger Car Energy Recovery Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Passenger Car Energy Recovery Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Passenger Car Energy Recovery Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Passenger Car Energy Recovery Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Passenger Car Energy Recovery Systems Revenue (million), by Types 2024 & 2032

- Figure 11: South America Passenger Car Energy Recovery Systems Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Passenger Car Energy Recovery Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Passenger Car Energy Recovery Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passenger Car Energy Recovery Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Passenger Car Energy Recovery Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Passenger Car Energy Recovery Systems Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Passenger Car Energy Recovery Systems Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Passenger Car Energy Recovery Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Passenger Car Energy Recovery Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Passenger Car Energy Recovery Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Passenger Car Energy Recovery Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Passenger Car Energy Recovery Systems Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Passenger Car Energy Recovery Systems Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Passenger Car Energy Recovery Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Passenger Car Energy Recovery Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Passenger Car Energy Recovery Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Passenger Car Energy Recovery Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Passenger Car Energy Recovery Systems Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Passenger Car Energy Recovery Systems Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Passenger Car Energy Recovery Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Passenger Car Energy Recovery Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Passenger Car Energy Recovery Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Passenger Car Energy Recovery Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Car Energy Recovery Systems?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Passenger Car Energy Recovery Systems?

Key companies in the market include Autoliv, Inc., BorgWarner, Inc., Cummins, Inc., Continental, Delphi Automotive, Denso, Faurecia, Gentherm, Hitachi Automotive Systems Ltd., Honeywell International, Inc., Maxwell Technologies, Inc., Mitsubishi Heavy Industries Ltd., Panasonic, Ricardo, Robert Bosch, Rheinmetall Automotive AG, Skeleton Technologies, Tenneco, Torotrak, ZF TRW.

3. What are the main segments of the Passenger Car Energy Recovery Systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passenger Car Energy Recovery Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passenger Car Energy Recovery Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passenger Car Energy Recovery Systems?

To stay informed about further developments, trends, and reports in the Passenger Car Energy Recovery Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence