Key Insights

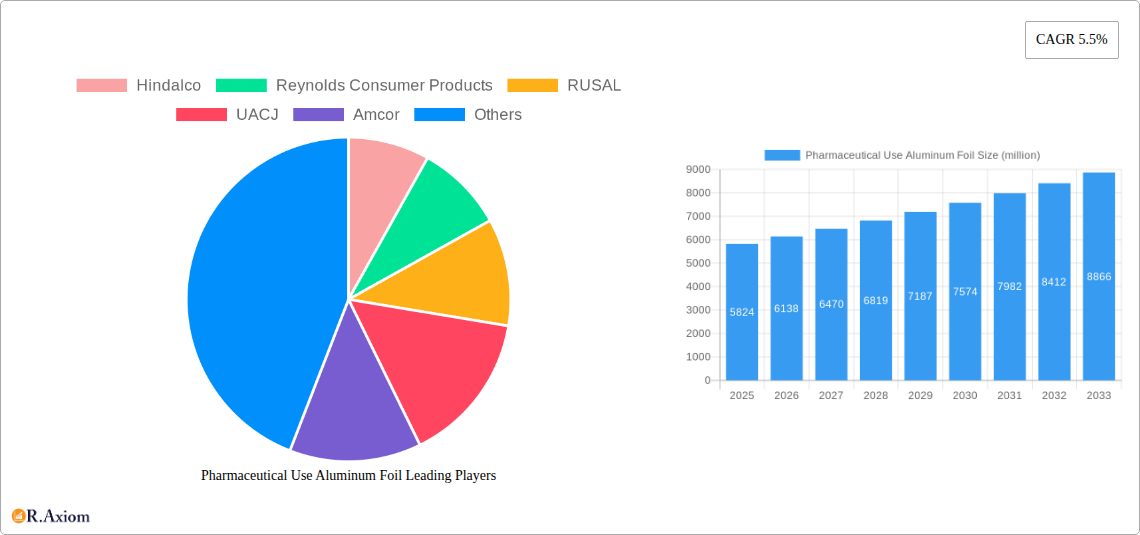

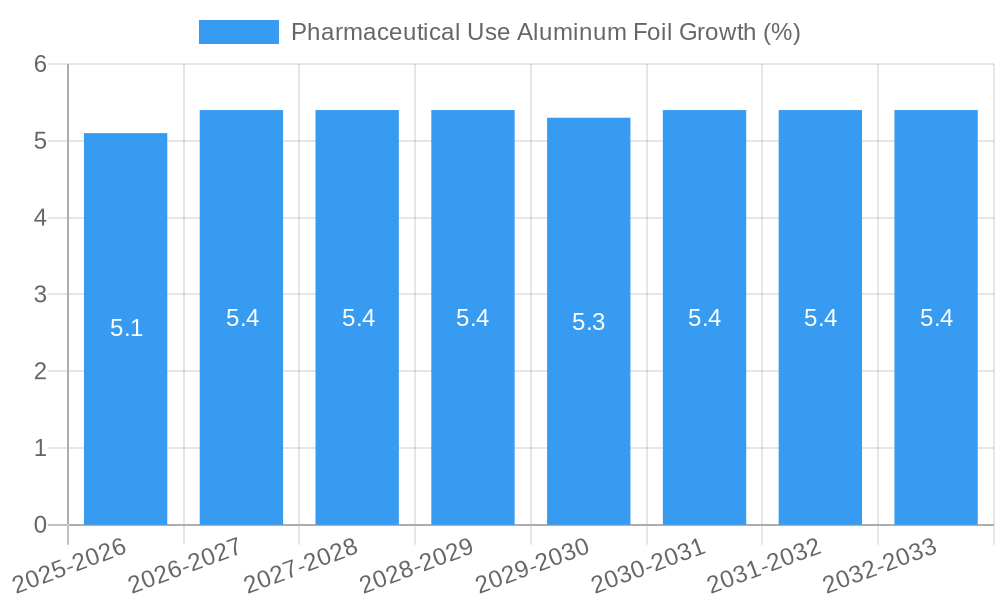

The global Pharmaceutical Use Aluminum Foil market is poised for significant growth, projected to reach an estimated market size of USD 5824 million by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 5.5% throughout the forecast period from 2019 to 2033. The escalating demand for safe, effective, and tamper-evident pharmaceutical packaging is a primary catalyst, with aluminum foil's inherent properties of barrier protection against moisture, light, and oxygen making it an indispensable material. Advancements in pharmaceutical formulations, particularly in sensitive drugs and biologics requiring stringent packaging conditions, further bolster this demand. Emerging economies with expanding healthcare sectors and increasing disposable incomes are also contributing to market expansion, as is the growing awareness and preference for high-quality, reliable drug packaging solutions among both consumers and regulatory bodies. The industry is also witnessing a trend towards more specialized foil types, such as double-zero aluminum foil, offering enhanced formability and sealing capabilities crucial for sophisticated packaging formats like Press Through Packages (PTP).

The market's trajectory is further shaped by key trends such as the increasing adoption of sustainable packaging solutions. While aluminum foil is recyclable, the industry is actively exploring ways to reduce its environmental footprint through lightweighting and improved manufacturing processes. However, the market also faces certain restraints, including the volatility of raw material prices, particularly for aluminum, which can impact overall profitability. Stringent regulatory compliances for pharmaceutical packaging materials also necessitate significant investment in quality control and adherence to international standards, adding to operational costs. Despite these challenges, the inherent advantages of aluminum foil in protecting the integrity and shelf-life of pharmaceutical products, coupled with continuous innovation in its application, ensure its sustained relevance and growth in the global market. Key players are actively investing in research and development to enhance product offerings and expand their global presence, anticipating a dynamic and expanding market landscape.

Here is the SEO-optimized, detailed report description for Pharmaceutical Use Aluminum Foil, ready for immediate use:

Pharmaceutical Use Aluminum Foil Market Concentration & Innovation

The pharmaceutical use aluminum foil market exhibits moderate concentration, with key players like Hindalco, Reynolds Consumer Products, RUSAL, and UACJ holding significant market shares. Innovation is primarily driven by the demand for enhanced barrier properties, child-resistant packaging, and sustainable materials. Regulatory frameworks, such as FDA guidelines for pharmaceutical packaging and GMP requirements, play a crucial role in shaping product development and market entry. Product substitutes, including specialized plastics and other barrier films, pose a competitive challenge, but aluminum foil's unique properties—excellent barrier against moisture, light, and oxygen, combined with its malleability and recyclability—maintain its strong position. End-user trends favor advanced packaging solutions that ensure drug integrity, extend shelf life, and improve patient safety. Mergers and acquisitions (M&A) are expected to continue, with recent M&A deals in the broader packaging sector indicating potential consolidation. For instance, the global packaging M&A market has seen transactions in the range of several hundred million to over a billion dollars in recent years, influencing strategic moves within the pharmaceutical aluminum foil segment. The market share of leading players is estimated to be between 5% and 15% each, with the top five companies collectively holding over 40% of the market. Innovation investment is projected to be in the range of tens of millions of dollars annually.

Pharmaceutical Use Aluminum Foil Industry Trends & Insights

The pharmaceutical use aluminum foil market is poised for robust growth, driven by an escalating global demand for healthcare services and pharmaceutical products. The projected Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is estimated to be between 5.5% and 7.0%, signifying a healthy expansion. This growth is underpinned by several key factors. Firstly, the increasing prevalence of chronic diseases worldwide necessitates a consistent and secure supply of medications, thereby boosting the demand for reliable pharmaceutical packaging solutions like aluminum foil. Secondly, the pharmaceutical industry's relentless pursuit of drug safety and efficacy has led to stricter packaging requirements, favoring materials that offer superior protection against external contaminants, light, and moisture. Aluminum foil excels in these aspects, ensuring the integrity and extending the shelf life of sensitive pharmaceutical compounds. Technological disruptions are also playing a pivotal role. Advancements in foil manufacturing processes are enabling the production of thinner yet stronger foils with improved barrier properties, catering to the ever-evolving needs of drug formulation and delivery systems. Furthermore, the development of specialized coatings and laminates enhances the compatibility of aluminum foil with various active pharmaceutical ingredients (APIs) and reduces the risk of interactions. Consumer preferences are increasingly leaning towards convenient and safe packaging. Press-Through Packages (PTP), often utilizing aluminum foil, offer a sterile and user-friendly way for patients to access their medication, minimizing the risk of contamination and ensuring accurate dosage. The competitive dynamics within the market are characterized by a balance between established global manufacturers and emerging regional players. Companies are investing heavily in research and development to introduce novel packaging solutions that meet stringent regulatory standards and address sustainability concerns. Market penetration for advanced pharmaceutical aluminum foil is anticipated to rise significantly, from approximately 70% in the base year 2025 to over 85% by 2033 in developed markets. The market size is projected to reach over ten billion dollars by 2033, with significant investments in production capacity expected to be in the hundreds of millions of dollars across the industry.

Dominant Markets & Segments in Pharmaceutical Use Aluminum Foil

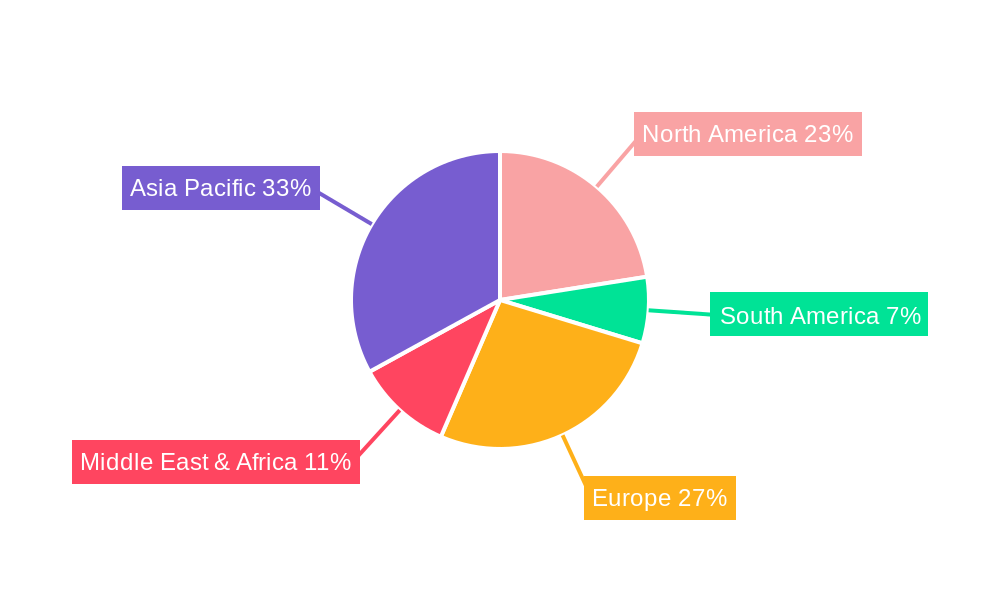

The global pharmaceutical use aluminum foil market's dominance is significantly influenced by a confluence of economic, regulatory, and demographic factors, with Asia Pacific emerging as a key powerhouse. Within this region, China, with its vast manufacturing capabilities and burgeoning pharmaceutical industry, is a leading country. Its economic policies fostering domestic production and export, coupled with substantial investments in healthcare infrastructure, create a fertile ground for aluminum foil demand. The region's dominance is further amplified by its substantial market share in both the manufacturing and consumption of pharmaceutical packaging, estimated to be over 35% of the global market.

Application Segment Dominance:

Press Through Package (PTP) Aluminum Foil: This segment is experiencing remarkable growth and holds a dominant position. Key drivers include:

- Patient Convenience and Safety: PTP aluminum foil offers individual dosage protection, preventing contamination and ensuring easy dispensing, which is highly valued by consumers and healthcare providers.

- Regulatory Compliance: The superior barrier properties of PTP aluminum foil align perfectly with stringent pharmaceutical regulations demanding protection against moisture, light, and oxygen, thus preserving drug efficacy.

- Extended Shelf Life: By minimizing environmental exposure, PTP packaging significantly enhances the shelf life of a wide range of pharmaceutical products, from tablets to capsules.

- Growth Projections: This segment is expected to witness a CAGR of approximately 6.5% during the forecast period, with its market share projected to grow from 50% in 2025 to over 60% by 2033. The market value for PTP aluminum foil is estimated to be over six billion dollars by 2033.

Aluminum Foil Bag: While a significant segment, its growth is more moderate compared to PTP.

- Versatility: Aluminum foil bags are used for a variety of pharmaceutical products, including powders, granules, and semi-solid formulations, offering flexibility in packaging.

- Barrier Protection: They provide excellent protection against environmental factors, crucial for maintaining the stability of sensitive formulations.

- Cost-Effectiveness: For certain applications, aluminum foil bags offer a cost-effective packaging solution.

- Growth Projections: This segment is anticipated to grow at a CAGR of around 5.0%, with its market share expected to remain stable or slightly decrease from 30% in 2025 to 25% by 2033. The market value is estimated to be around three billion dollars by 2033.

Others: This residual category includes specialized applications and niche products.

- Innovation Hub: This segment often houses innovative packaging solutions and specialized foil constructions tailored for unique pharmaceutical needs, such as sterile medical devices or specific drug delivery systems.

- Growth Potential: While smaller, this segment can exhibit higher growth rates due to its innovative nature and niche market appeal.

- Growth Projections: Expected to grow at a CAGR of around 5.8%, with its market share fluctuating between 15% and 20%. The market value is estimated to be around one to two billion dollars by 2033.

Type Segment Dominance:

Double Zero Aluminum Foil: This ultra-thin foil, typically 0.008-0.010 mm thick, is gaining prominence.

- Enhanced Barrier Properties: Its thinness, when combined with appropriate laminations, provides superior barrier performance crucial for highly sensitive pharmaceuticals.

- Lightweighting: Reduces material usage and transportation costs, aligning with sustainability goals.

- Technological Advancements: Manufacturing advancements are making double-zero foil more accessible and cost-effective for pharmaceutical applications.

- Market Share: Expected to capture a growing share, from 40% in 2025 to over 55% by 2033.

Single Zero Aluminum Foil: Standard thickness, typically 0.010-0.020 mm.

- Established Reliability: A long-standing and trusted material in pharmaceutical packaging, offering good all-round protection.

- Cost-Effectiveness: Generally more economical than double-zero foil, making it suitable for a wider range of products.

- Market Share: Currently dominant but expected to see its share gradually decrease from 60% in 2025 to 45% by 2033, as the demand for ultra-thin and high-performance foils increases.

The dominance of these segments is supported by substantial investments in manufacturing facilities, with estimated capital expenditure in the hundreds of millions of dollars annually across the leading players.

Pharmaceutical Use Aluminum Foil Product Developments

Recent product developments in pharmaceutical use aluminum foil focus on enhancing barrier performance, improving drug compatibility, and promoting sustainability. Innovations include the development of thinner gauge foils (double zero) that offer superior protection against moisture, oxygen, and light while reducing material usage. Advanced lamination techniques and specialized coatings are being introduced to ensure excellent adhesion and prevent chemical interactions with sensitive drug formulations. Furthermore, the industry is seeing a surge in the development of child-resistant and senior-friendly foil packaging solutions, addressing both safety and usability needs. These developments are driven by stringent regulatory requirements and a growing demand for high-performance, eco-friendly packaging alternatives, positioning aluminum foil as a leading material for critical pharmaceutical applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the pharmaceutical use aluminum foil market, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented by Application and Type.

Application Segment Analysis:

- Aluminum Foil Bag: This segment, valued at approximately three billion dollars in 2025, offers versatile packaging solutions for powders, granules, and semi-solids. It is projected to grow at a CAGR of around 5.0%, reaching over three billion dollars by 2033. Competitive dynamics include the need for advanced printing capabilities and heat-sealing properties.

- Press Through Package (PTP) Aluminum Foil: The dominant segment, valued at over six billion dollars in 2025, provides high-barrier protection for tablets and capsules. It is expected to expand at a CAGR of approximately 6.5%, surpassing six billion dollars by 2033. Growth is driven by increasing demand for patient convenience and stringent regulatory compliance.

- Others: This niche segment, with a market value of around one to two billion dollars in 2025, encompasses specialized applications like sterile packaging and medical device enclosures. It is anticipated to grow at a CAGR of around 5.8%, reaching one to two billion dollars by 2033, fueled by innovation and bespoke packaging solutions.

Type Segment Analysis:

- Double Zero Aluminum Foil: This segment, valued at over four billion dollars in 2025, represents the high-performance ultra-thin foil category. It is projected to grow at a significant CAGR of approximately 7.0%, capturing over five billion dollars by 2033 due to its superior barrier properties and sustainability benefits.

- Single Zero Aluminum Foil: This established segment, valued at over six billion dollars in 2025, offers reliable and cost-effective protection. It is expected to grow at a CAGR of around 4.5%, reaching around six billion dollars by 2033, though its market share will gradually decline in favor of double-zero foils.

Key Drivers of Pharmaceutical Use Aluminum Foil Growth

The pharmaceutical use aluminum foil market is propelled by a confluence of powerful growth drivers. The escalating global demand for pharmaceuticals, driven by an aging population and the increasing prevalence of chronic diseases, is a primary catalyst. Simultaneously, stringent regulatory mandates worldwide are pushing pharmaceutical manufacturers to adopt packaging solutions that guarantee drug integrity and patient safety, areas where aluminum foil excels due to its exceptional barrier properties against moisture, oxygen, and light. Technological advancements in foil manufacturing are leading to the development of thinner, stronger, and more sustainable foil products, enhancing their appeal. Furthermore, the growing preference for convenient and user-friendly packaging formats, such as Press-Through Packages (PTP), is significantly boosting demand. The market is also benefiting from increased R&D investments by key players, focusing on innovative coatings and laminations that improve drug compatibility and extend shelf life.

Challenges in the Pharmaceutical Use Aluminum Foil Sector

Despite its promising growth trajectory, the pharmaceutical use aluminum foil sector faces several significant challenges. Intense competition from alternative packaging materials, including advanced plastics and specialized barrier films, poses a continuous threat. Fluctuations in raw material prices, particularly aluminum, can impact production costs and profit margins. The complex and evolving regulatory landscape, while a driver of quality, also presents hurdles in terms of compliance costs and time-to-market for new products. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, can affect the availability and timely delivery of raw materials and finished products. Furthermore, the increasing global emphasis on environmental sustainability necessitates continuous innovation in recycling and waste management practices for aluminum foil, which can involve substantial investment. The market is also susceptible to capacity overruns and price wars among manufacturers, particularly in high-volume segments, potentially compressing profitability.

Emerging Opportunities in Pharmaceutical Use Aluminum Foil

The pharmaceutical use aluminum foil market is ripe with emerging opportunities driven by evolving industry needs and technological advancements. The growing demand for personalized medicine and biologics requires highly specialized and protective packaging, creating a niche for advanced aluminum foil solutions. The increasing focus on sustainability presents an opportunity for manufacturers to develop and promote recyclable and eco-friendly aluminum foil packaging, potentially leveraging the high recyclability rate of aluminum. The expansion of healthcare access in emerging economies offers significant market penetration opportunities for cost-effective yet reliable pharmaceutical aluminum foil packaging. Furthermore, the development of smart packaging solutions, integrating features like tamper-evidence and traceability with aluminum foil, holds considerable potential. Innovations in ultra-thin foil manufacturing and specialized coatings are also opening doors for novel applications and enhanced product differentiation.

Leading Players in the Pharmaceutical Use Aluminum Foil Market

- Hindalco

- Reynolds Consumer Products

- RUSAL

- UACJ

- Amcor

- Handi-Foil Corporation

- Lotte Aluminium

- Symetal

- Alibérico Packaging

- Carcano Antonio S.p.A.

- Xiashun Holdings

- Shenhuo Aluminium Foil

- Nanshan Light Alloy

- ChinaLCO

- Henan Zhongfu Industrial

- Wanshun

- Zhejiang Zhongjin Aluminium

- Ding Sheng

- Ming Tai

Key Developments in Pharmaceutical Use Aluminum Foil Industry

- 2023: Introduction of advanced child-resistant pharmaceutical blister packs utilizing specialized aluminum foil composites, enhancing safety and compliance.

- 2022: Significant investment by Hindalco in R&D for developing thinner gauge (double zero) pharmaceutical aluminum foil with improved barrier properties, aiming for a 15% production increase.

- 2021: Reynolds Consumer Products launched a new line of aluminum foil bags with enhanced antimicrobial coatings for pharmaceutical applications, focusing on extended shelf life.

- 2020: RUSAL announced a strategic partnership with a leading pharmaceutical packaging converter to co-develop innovative aluminum foil solutions for sensitive drug formulations.

- 2019: UACJ expanded its production capacity for pharmaceutical-grade aluminum foil by over ten million square meters to meet growing global demand.

Strategic Outlook for Pharmaceutical Use Aluminum Foil Market

The strategic outlook for the pharmaceutical use aluminum foil market is overwhelmingly positive, driven by sustained demand for safe, reliable, and effective drug packaging. Key growth catalysts include the continuous expansion of the global pharmaceutical industry, coupled with increasingly stringent regulatory requirements that favor materials like aluminum foil for their superior protective qualities. Opportunities for innovation lie in the development of more sustainable packaging solutions and the integration of smart technologies. Companies that focus on technological advancements in foil manufacturing, enhanced barrier properties, and customized solutions for specific drug types are best positioned for success. Strategic collaborations and potential mergers and acquisitions will likely shape the competitive landscape, driving market consolidation and fostering greater efficiency. The market's trajectory indicates a strong and consistent growth phase, supported by fundamental healthcare needs and evolving packaging demands.

Pharmaceutical Use Aluminum Foil Segmentation

-

1. Application

- 1.1. Aluminum Foil Bag

- 1.2. Press Through Package (PTP) Aluminum Foil

- 1.3. Others

-

2. Type

- 2.1. Double Zero Aluminum Foil

- 2.2. Single Zero Aluminum Foil

Pharmaceutical Use Aluminum Foil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Use Aluminum Foil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aluminum Foil Bag

- 5.1.2. Press Through Package (PTP) Aluminum Foil

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Double Zero Aluminum Foil

- 5.2.2. Single Zero Aluminum Foil

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aluminum Foil Bag

- 6.1.2. Press Through Package (PTP) Aluminum Foil

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Double Zero Aluminum Foil

- 6.2.2. Single Zero Aluminum Foil

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aluminum Foil Bag

- 7.1.2. Press Through Package (PTP) Aluminum Foil

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Double Zero Aluminum Foil

- 7.2.2. Single Zero Aluminum Foil

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aluminum Foil Bag

- 8.1.2. Press Through Package (PTP) Aluminum Foil

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Double Zero Aluminum Foil

- 8.2.2. Single Zero Aluminum Foil

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aluminum Foil Bag

- 9.1.2. Press Through Package (PTP) Aluminum Foil

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Double Zero Aluminum Foil

- 9.2.2. Single Zero Aluminum Foil

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pharmaceutical Use Aluminum Foil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aluminum Foil Bag

- 10.1.2. Press Through Package (PTP) Aluminum Foil

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Double Zero Aluminum Foil

- 10.2.2. Single Zero Aluminum Foil

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hindalco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reynolds Consumer Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RUSAL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UACJ

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amcor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Handi-Foil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lotte Aluminium

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Symetal

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alibérico Packaging

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Carcano Antonio S.p.A.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Xiashun Holdings

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shenhuo Aluminium Foil

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nanshan Light Alloy

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ChinaLCO

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Henan Zhongfu Industrial

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Wanshun

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zhejiang Zhongjin Aluminium

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ding Sheng

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ming Tai

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Hindalco

List of Figures

- Figure 1: Global Pharmaceutical Use Aluminum Foil Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Use Aluminum Foil Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pharmaceutical Use Aluminum Foil Revenue (million), by Type 2024 & 2032

- Figure 5: North America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Pharmaceutical Use Aluminum Foil Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pharmaceutical Use Aluminum Foil Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pharmaceutical Use Aluminum Foil Revenue (million), by Type 2024 & 2032

- Figure 11: South America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Pharmaceutical Use Aluminum Foil Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pharmaceutical Use Aluminum Foil Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pharmaceutical Use Aluminum Foil Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pharmaceutical Use Aluminum Foil Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pharmaceutical Use Aluminum Foil Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Pharmaceutical Use Aluminum Foil Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Pharmaceutical Use Aluminum Foil Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical Use Aluminum Foil Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Use Aluminum Foil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Pharmaceutical Use Aluminum Foil Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pharmaceutical Use Aluminum Foil Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Use Aluminum Foil?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Pharmaceutical Use Aluminum Foil?

Key companies in the market include Hindalco, Reynolds Consumer Products, RUSAL, UACJ, Amcor, Handi-Foil Corporation, Lotte Aluminium, Symetal, Alibérico Packaging, Carcano Antonio S.p.A., Xiashun Holdings, Shenhuo Aluminium Foil, Nanshan Light Alloy, ChinaLCO, Henan Zhongfu Industrial, Wanshun, Zhejiang Zhongjin Aluminium, Ding Sheng, Ming Tai.

3. What are the main segments of the Pharmaceutical Use Aluminum Foil?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5824 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Use Aluminum Foil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Use Aluminum Foil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Use Aluminum Foil?

To stay informed about further developments, trends, and reports in the Pharmaceutical Use Aluminum Foil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence