Key Insights

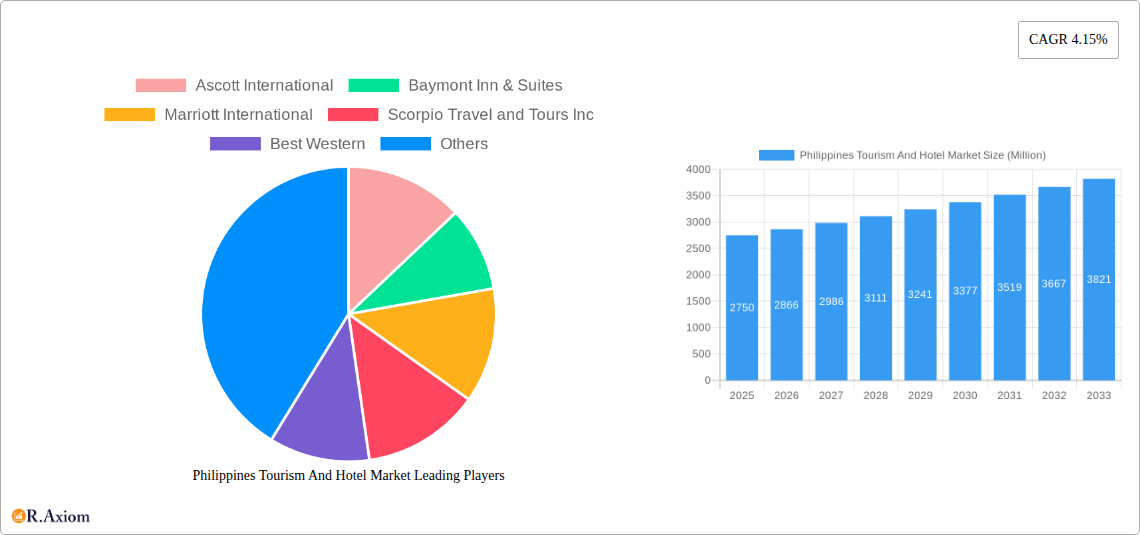

The Philippines tourism and hotel market, valued at $2.75 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.15% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing popularity of the Philippines as a tourist destination, particularly among international travelers seeking diverse experiences ranging from pristine beaches and vibrant cultural heritage to thrilling adventure activities, is a major driver. The government's continued investment in infrastructure improvements, including airport expansions and enhanced transportation networks, further facilitates tourism growth. The rise of online booking platforms has also simplified travel planning and increased accessibility for both domestic and international tourists. Furthermore, a burgeoning middle class in the Philippines, coupled with rising disposable incomes, is boosting domestic tourism, contributing significantly to the market's expansion. Segmentation analysis reveals a diverse market; international tourism likely holds a larger share than domestic tourism due to the Philippines' global appeal, while online booking channels dominate, reflecting contemporary travel habits. The market comprises various tourism types, including business tourism, vacation tourism, eco-tourism, cultural tourism, adventure tourism and event tourism, each presenting unique opportunities for growth.

Philippines Tourism And Hotel Market Market Size (In Billion)

However, the market also faces certain challenges. Seasonality, a common issue in tourism, can lead to fluctuations in demand. The market's dependence on international tourism makes it vulnerable to global economic downturns and geopolitical events. Furthermore, ensuring sustainable tourism practices to preserve the country's natural beauty and cultural heritage is crucial for long-term growth. Competition within the hotel sector, with established international players alongside local chains, necessitates strategic differentiation and service excellence. Successful operators will need to adapt to evolving tourist preferences, prioritize sustainable practices, and leverage technology to enhance customer experience, thus capitalizing on the market’s considerable growth potential. The competitive landscape includes both international hotel chains (e.g., Ascott International, Marriott International, Best Western) and local players, suggesting a dynamic market with opportunities for various business models.

Philippines Tourism And Hotel Market Company Market Share

This comprehensive report provides a detailed analysis of the Philippines tourism and hotel market from 2019 to 2033, offering invaluable insights for industry stakeholders. The study covers market size, segmentation, key players, industry trends, and future growth projections. With a focus on actionable intelligence, this report is essential for strategic decision-making in this dynamic sector.

Philippines Tourism And Hotel Market Market Concentration & Innovation

The Philippines tourism and hotel market exhibits a moderately concentrated landscape, with a few large international chains and a significant number of smaller, locally owned businesses. Market share is largely influenced by brand recognition, location, and service offerings. While Marriott International and Best Western hold significant market share, numerous smaller players compete fiercely, particularly in the budget and boutique hotel segments. The estimated market share for Marriott International in 2025 is xx%, while Best Western holds approximately xx%. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from $xx Million to $xx Million in recent years. Innovation is driven by technological advancements in online booking platforms, personalized guest experiences, and sustainable tourism practices. Regulatory frameworks, including environmental regulations and tourism policies, play a crucial role in shaping market dynamics. The increasing popularity of eco-tourism and cultural tourism presents opportunities for niche players, while the rise of online travel agencies (OTAs) puts pressure on traditional booking channels. Product substitutes, such as homestays and vacation rentals, are gaining traction, forcing established players to adapt and innovate. End-user trends reveal a growing preference for personalized and experiential travel, driving demand for customized packages and unique accommodations.

- Key Metrics:

- Marriott International Market Share (2025): xx%

- Best Western Market Share (2025): xx%

- Average M&A Deal Value (2019-2024): $xx Million

Philippines Tourism And Hotel Market Industry Trends & Insights

The Philippines tourism and hotel market is experiencing robust growth, driven by increasing disposable incomes, rising domestic tourism, and a growing influx of international visitors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, indicating significant expansion potential. Technological disruptions, such as the rise of online booking platforms and mobile travel apps, are transforming the industry, leading to increased transparency and consumer empowerment. Consumer preferences are shifting towards personalized experiences, sustainable practices, and value-for-money accommodations. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, particularly in the budget and niche tourism segments. Market penetration of online booking channels is rapidly increasing, with an estimated xx% of bookings made online in 2025. This trend is further fueled by the increasing smartphone penetration rate and the growing popularity of social media influencing travel decisions. The increasing focus on sustainable and responsible tourism also presents both challenges and opportunities for the industry.

Dominant Markets & Segments in Philippines Tourism And Hotel Market

The Philippines tourism market is dominated by the domestic segment, driven by a large and growing middle class with increased disposable income. International tourism also contributes significantly, with key source markets including South Korea, China, and other Asian countries. Online booking channels are experiencing rapid growth, surpassing traditional methods in market share. Vacation tourism forms the largest segment, followed by business tourism and cultural tourism.

Key Drivers:

- Domestic Tourism: Rising disposable incomes, improved infrastructure, and increased awareness of domestic destinations.

- International Tourism: Strong marketing campaigns, visa facilitation, and the Philippines' unique cultural and natural attractions.

- Online Booking: Convenience, competitive pricing, and wider selection offered by online travel agencies.

- Vacation Tourism: Demand for leisure travel, beach destinations, and cultural experiences.

Dominance Analysis: The domestic tourism segment holds the largest market share, driven primarily by the Philippines’ large population and growing middle class. However, the international tourism segment exhibits higher growth potential due to increasing global travel and the Philippines’ attractiveness as a destination. Online booking channels are experiencing the fastest growth, significantly increasing their market share in the booking channel segment. Vacation tourism maintains the largest share of the tourism type segment, while business tourism and cultural tourism are showing consistent growth.

Philippines Tourism And Hotel Market Product Developments

Product innovation in the Philippines tourism and hotel market is focused on enhancing guest experiences through personalized services, technological integration, and sustainable practices. The increasing popularity of eco-tourism and adventure tourism is driving the development of specialized products and services tailored to these segments. Many hotels are investing in sustainable infrastructure, implementing eco-friendly practices, and promoting local culture and heritage to attract environmentally conscious travelers. This aligns well with global trends and appeals to a growing segment of the market.

Report Scope & Segmentation Analysis

This report segments the Philippines tourism and hotel market by tourists (domestic and international), booking channels (phone, in-person, and online), and tourism types (business, vacation, eco-tourism, cultural tourism, adventure tourism, and event tourism). Each segment presents unique growth projections and market sizes, influenced by specific factors. Competitive dynamics also vary across segments, with varying levels of competition depending on the specific niche.

- By Tourists: The domestic tourism segment is projected to reach $xx Million in 2025, growing at a CAGR of xx% from 2025 to 2033. The international segment is expected to reach $xx Million in 2025, growing at a CAGR of xx%.

- By Booking Channel: Online bookings are projected to dominate, accounting for xx% of total bookings in 2025.

- By Type: Vacation tourism will remain the largest segment, followed by business tourism and a fast-growing eco-tourism and cultural tourism sector.

Key Drivers of Philippines Tourism And Hotel Market Growth

The growth of the Philippines tourism and hotel market is propelled by several key factors. Firstly, the rise in disposable incomes among the middle class fuels domestic travel. Secondly, the government's active promotion of tourism through infrastructure development and marketing campaigns attracts international visitors. Thirdly, the diversification of tourism products, catering to different interests, enhances market appeal. Finally, technological advancements in online booking platforms and mobile applications improve accessibility and convenience.

Challenges in the Philippines Tourism And Hotel Market Sector

The Philippines tourism and hotel market faces various challenges. Infrastructure limitations, particularly in some regions, hinder accessibility. Seasonality impacts revenue streams, leading to fluctuations. Competition from other regional destinations necessitates continuous improvement in services and offerings. Environmental concerns and the need for sustainable practices require careful management. Finally, potential disruptions from natural calamities and political instability are also major factors to consider.

Emerging Opportunities in Philippines Tourism And Hotel Market

The Philippines tourism and hotel market presents significant growth opportunities. The burgeoning niche tourism segments, such as eco-tourism and adventure tourism, offer exciting potential. Investing in sustainable infrastructure and promoting eco-friendly practices can attract environmentally conscious travelers. Utilizing technology to enhance the guest experience, improving online booking processes, and offering personalized services are other avenues for growth. Lastly, focusing on local cultural experiences and heritage can uniquely position the Philippines in the competitive tourism landscape.

Leading Players in the Philippines Tourism And Hotel Market Market

- Ascott International

- Baymont Inn & Suites

- Marriott International

- Scorpio Travel and Tours Inc

- Best Western

- Crown Regency Hotels & Resorts

- Vansol Travel & Tours

- GoldenSky Travel and Tours

- Baron Travel

- Citadines

Key Developments in Philippines Tourism And Hotel Market Industry

June 2023: BWH Hotels expanded its presence in North America, Europe, Africa, and Asia, including Austria, Canada, Dubai (UAE), Ethiopia, France, India, Japan, Netherlands, Saudi Arabia, Sweden, Tanzania, and the United States. This expansion significantly increases BWH’s global reach and competition in various markets.

March 2023: Wyndham Hotels & Resorts partnered with Groups360, enabling immediate online multi-room booking. This development enhances online booking efficiency and convenience for group travel, increasing the appeal for large group bookings.

Strategic Outlook for Philippines Tourism And Hotel Market Market

The Philippines tourism and hotel market holds significant future potential. Continued infrastructure improvements, diversification of tourism offerings, and the promotion of sustainable practices will be crucial for sustained growth. Leveraging technology to enhance the guest experience and cater to evolving consumer preferences will remain a primary focus. Strategic partnerships, both domestically and internationally, will be instrumental in expanding market reach and attracting increased investment. The market's ability to successfully address the challenges and seize the opportunities identified in this report will greatly determine its future growth trajectory.

Philippines Tourism And Hotel Market Segmentation

-

1. Type

- 1.1. Business Tourism

- 1.2. Vacation Tourism

- 1.3. Eco-tourism

- 1.4. Cultural Tourism

- 1.5. Adventure Tourism

- 1.6. Event Tourism

-

2. Tourist

- 2.1. Domestic

- 2.2. International

-

3. Booking Channel

- 3.1. Phone Booking

- 3.2. In-person Booking

- 3.3. Online Booking

Philippines Tourism And Hotel Market Segmentation By Geography

- 1. Philippines

Philippines Tourism And Hotel Market Regional Market Share

Geographic Coverage of Philippines Tourism And Hotel Market

Philippines Tourism And Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry

- 3.3. Market Restrains

- 3.3.1. Language Barriers for International Tourists; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Expanding Airways Network in Philippines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Tourism And Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business Tourism

- 5.1.2. Vacation Tourism

- 5.1.3. Eco-tourism

- 5.1.4. Cultural Tourism

- 5.1.5. Adventure Tourism

- 5.1.6. Event Tourism

- 5.2. Market Analysis, Insights and Forecast - by Tourist

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Phone Booking

- 5.3.2. In-person Booking

- 5.3.3. Online Booking

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ascott International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Baymont Inn & Suites

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marriott International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scorpio Travel and Tours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Best Western

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Regency Hotels & Resorts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vansol Travel & Tours

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GoldenSky Travel and Tours**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baron Travel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Citadines

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ascott International

List of Figures

- Figure 1: Philippines Tourism And Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Tourism And Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 3: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 4: Philippines Tourism And Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Philippines Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Philippines Tourism And Hotel Market Revenue Million Forecast, by Tourist 2020 & 2033

- Table 7: Philippines Tourism And Hotel Market Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 8: Philippines Tourism And Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Tourism And Hotel Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Philippines Tourism And Hotel Market?

Key companies in the market include Ascott International, Baymont Inn & Suites, Marriott International, Scorpio Travel and Tours Inc, Best Western, Crown Regency Hotels & Resorts, Vansol Travel & Tours, GoldenSky Travel and Tours**List Not Exhaustive, Baron Travel, Citadines.

3. What are the main segments of the Philippines Tourism And Hotel Market?

The market segments include Type, Tourist, Booking Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Social Media Influencers is Driving the Growth in the Market; Increasing the Recreational Activities Boost the Tourism Industry.

6. What are the notable trends driving market growth?

Expanding Airways Network in Philippines.

7. Are there any restraints impacting market growth?

Language Barriers for International Tourists; Labor Shortages.

8. Can you provide examples of recent developments in the market?

June 2023: BWH Hotels expanded its presence in North America and Europe, as well as in Africa and Asia. The BWH hotels are now available in Austria, Canada, Dubai, the United Arab Emirates, Ethiopia, France, India, Japan, the Netherlands, Saudi Arabia, Sweden, Tanzania, and the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Tourism And Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Tourism And Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Tourism And Hotel Market?

To stay informed about further developments, trends, and reports in the Philippines Tourism And Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence