Key Insights

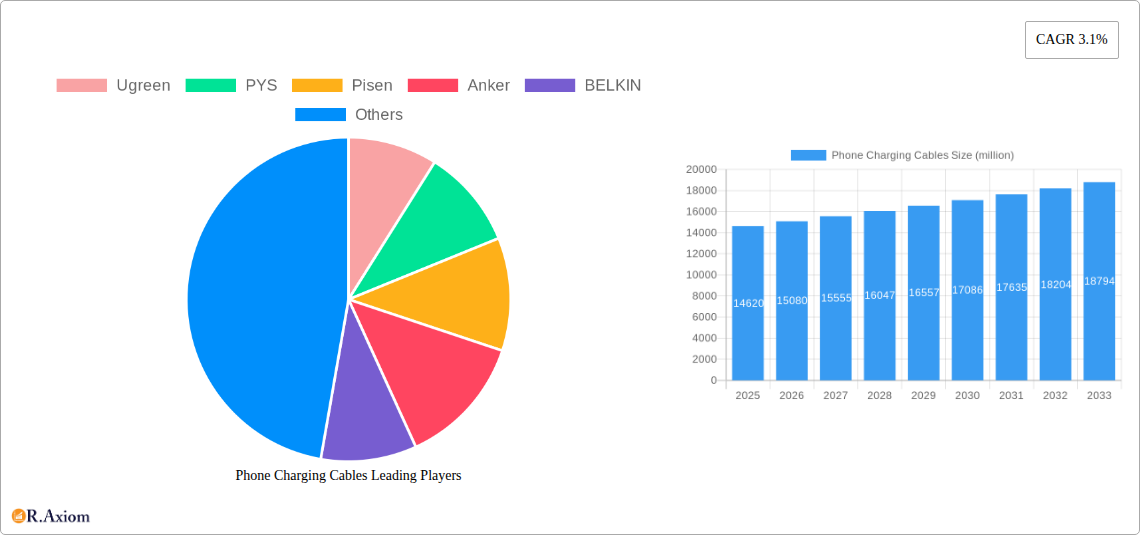

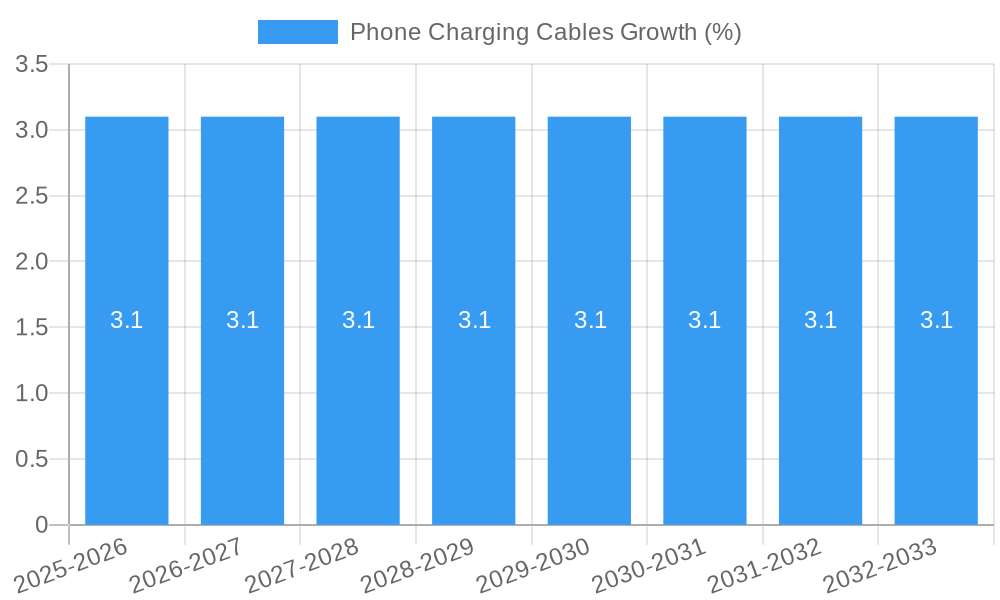

The global market for phone charging cables is projected to reach a substantial \$14,620 million, demonstrating a steady Compound Annual Growth Rate (CAGR) of 3.1% from 2019 to 2033. This consistent expansion is fueled by the ever-increasing smartphone penetration worldwide and the inherent need for reliable charging solutions. The market is primarily driven by the relentless pace of technological advancements in mobile devices, leading to a demand for faster charging capabilities and more durable cable constructions. The widespread adoption of USB-C as a universal standard across most smartphones and accessories has further streamlined the market, simplifying consumer choices while simultaneously driving demand for high-quality USB-C cables. The increasing popularity of portable power banks and the growing reliance on mobile devices for both work and leisure activities continue to bolster the demand for charging cables.

The market is segmented into various applications, with Mobile Phone Accessories Stores and Online Sales emerging as dominant channels, reflecting the consumer preference for convenience and accessibility. 3C Retail Stores also play a significant role in capturing a segment of the market. In terms of cable types, USB-C (Single Cable) is expected to witness the most significant growth, driven by its ubiquity. However, Apple-Lightning (Single Cable) remains a crucial segment due to Apple's continued market presence. The "Multiple Cables in One" category is also gaining traction as consumers seek versatile solutions for charging multiple devices. Key players like Ugreen, PYS, Pisen, Anker, and BELKIN are actively innovating with features like fast charging, enhanced durability, and smart cable management, positioning themselves to capitalize on evolving consumer needs and the robust market growth.

Phone Charging Cables Market Concentration & Innovation

The global phone charging cables market, valued at approximately $X million in the base year of 2025, exhibits a moderate to high concentration. Key players such as Anker, BELKIN, and Huawei hold significant market share, with Ugreen, Pisen, and Baseus also demonstrating strong competitive positioning. Innovation is a critical driver, fueled by the relentless demand for faster charging speeds, enhanced durability, and increased compatibility across devices. The proliferation of USB-C technology has standardized charging protocols, yet niche markets for Apple-Lightning cables persist. Regulatory frameworks, particularly concerning safety standards and materials, play a crucial role in shaping product development and market entry. The threat of product substitutes, while present in the form of wireless charging solutions, has not significantly diminished the demand for wired cables due to their reliability and charging efficiency. End-user trends are leaning towards multi-functional cables and those offering extended lengths and robust build quality to withstand daily wear and tear. Mergers and acquisitions are less prevalent in this segment compared to broader electronics markets, with a greater emphasis on organic growth and product line expansion. Expected M&A deal values in the next decade are projected to reach approximately $xx million, primarily focused on companies with specialized technology or strong regional distribution networks.

Phone Charging Cables Industry Trends & Insights

The phone charging cables industry is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and the ever-expanding smartphone market. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033, reaching an estimated market size of over $XX million by 2033. This expansion is underpinned by the increasing penetration of smartphones worldwide, which necessitates a continuous supply of reliable and efficient charging solutions. Technological disruptions, such as the widespread adoption of USB Power Delivery (USB PD) and Qualcomm Quick Charge technologies, are enabling significantly faster charging times, becoming a key purchasing criterion for consumers. This trend is further amplified by the development of higher wattage chargers and more sophisticated cable materials capable of handling increased power throughput without compromising safety or longevity.

Consumer preferences are rapidly shifting towards cables that offer enhanced durability, tangle-free designs, and multi-device compatibility. The demand for braided nylon and reinforced connectors is soaring as users seek alternatives to traditional plastic cables that often fray or break. The convenience of having a single cable to charge multiple devices, such as smartphones, tablets, and other accessories, is also driving the popularity of multi-cable solutions. Online sales channels have become paramount, facilitating wider market reach and enabling consumers to easily compare features and prices from a plethora of brands, including Anker, BELKIN, Ugreen, and Baseus. The competitive landscape is characterized by intense price competition and a constant drive for product differentiation. Companies are investing heavily in research and development to introduce cables with advanced features like data transfer capabilities, intelligent power management, and even aesthetic customizations. The push for sustainable materials and eco-friendly manufacturing processes is also gaining traction, representing a significant emerging trend. Market penetration of advanced charging cables with higher data transfer speeds and power delivery capabilities is expected to rise significantly as new smartphone models adopt these standards.

Dominant Markets & Segments in Phone Charging Cables

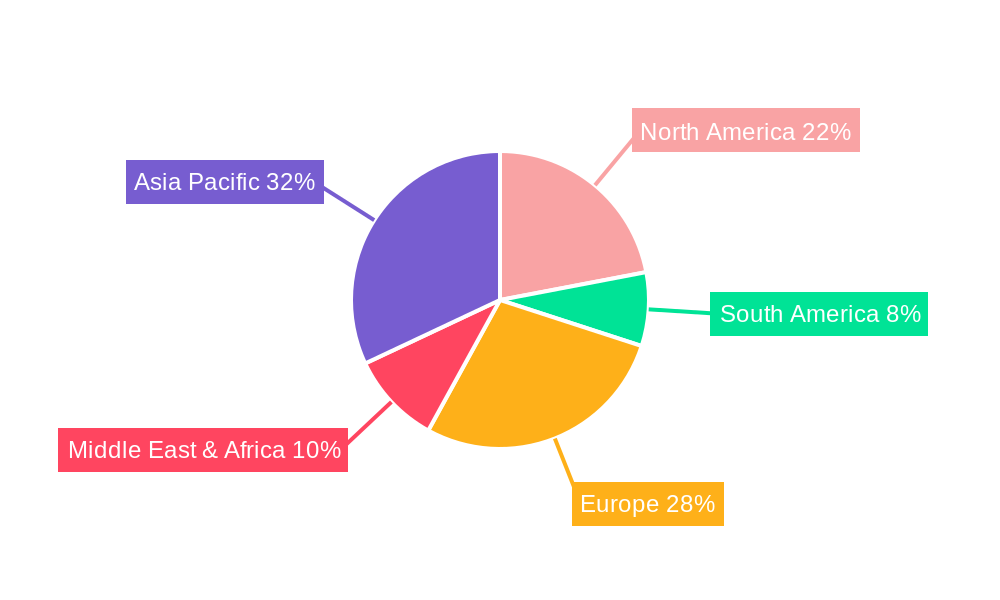

The phone charging cables market exhibits distinct regional dominance and segment preferences. Asia Pacific, particularly China, stands out as the leading region due to its massive smartphone user base, extensive manufacturing capabilities, and the presence of major electronics brands like Huawei, OPPO, and VIVO. Countries within this region benefit from strong economic growth, increasing disposable incomes, and a high rate of technology adoption, contributing significantly to market expansion.

Within the application segments, Online Sales has emerged as the most dominant channel. This is driven by the convenience, competitive pricing, and vast product selection offered by e-commerce platforms. Online retailers such as Amazon, Alibaba, and regional equivalents play a pivotal role in reaching a global customer base. The ease of comparing specifications, reading reviews, and accessing a wide array of brands from Ugreen to Satechi makes online purchasing a preferred choice for many consumers. Mobile Phone Accessories Store and 3C Retail Store (Consumer Electronics, Computer, Communication) remain significant, catering to consumers who prefer to examine products physically and seek immediate purchases. However, their market share is increasingly being challenged by the digital realm.

In terms of product type, USB-C (Single Cable) is rapidly gaining dominance, mirroring the industry-wide shift towards this universal standard. Major smartphone manufacturers, including Apple (for its newer iPhone models), Samsung, Google, and many Android brands, have adopted USB-C as their primary charging and data transfer port. This universal compatibility reduces the need for multiple cable types and simplifies the user experience. While Apple-Lightning (Single Cable) still holds a substantial market share due to the vast installed base of older iPhones, its long-term dominance is being eroded by the widespread adoption of USB-C. Common Single Cable, which often refers to older USB-A to Micro-USB cables, is experiencing a decline in demand as newer devices phase out these connectors. However, they persist in certain legacy devices and accessories. Multiple Cables in One solutions, such as those offering interchangeable tips or combined USB-C and Lightning connectors, are witnessing strong growth. These products appeal to users who own devices with different port types or want a versatile charging solution for their entire ecosystem. Key drivers for dominance in these segments include:

- Technological Standardization: The widespread adoption of USB-C as a universal standard has significantly boosted the demand for USB-C cables and reduced the market fragmentation previously seen with proprietary connectors.

- Smartphone Sales Volume: The sheer volume of smartphones sold globally, with an increasing proportion featuring USB-C ports, directly translates to higher demand for compatible charging cables.

- Consumer Demand for Fast Charging: Technologies like USB PD and Quick Charge are integrated into USB-C cables, making them the preferred choice for users seeking rapid power delivery.

- E-commerce Penetration: The growth of online retail channels provides unparalleled access to a broad range of charging cable options, driving sales for popular and competitively priced products.

- Brand Trust and Quality: Established brands like Anker, BELKIN, and Ugreen have built strong reputations for reliability and performance, leading consumers to choose their offerings within specific segments.

- Economic Factors in Asia Pacific: Favorable manufacturing costs and a massive domestic market contribute to the dominance of Asia Pacific in both production and consumption of phone charging cables.

Phone Charging Cables Product Developments

Product development in the phone charging cables market is characterized by a relentless pursuit of enhanced functionality and user experience. Innovations are focused on faster charging technologies like USB Power Delivery (USB PD) and GaN (Gallium Nitride) integration, enabling higher wattage output and smaller charger sizes. Increased durability through braided nylon, reinforced connectors, and strain relief designs addresses consumer pain points related to cable lifespan. Furthermore, multi-functional cables offering both charging and high-speed data transfer, alongside reversible connectors and integrated LED indicators for charging status, are gaining traction. Competitive advantages are derived from superior build quality, advanced charging protocols, extended warranty periods, and aesthetically pleasing designs that complement modern devices.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global phone charging cables market across several key segments. The Application segmentation includes Mobile Phone Accessories Store, 3C Retail Store, Online Sales, and Others. Each segment's growth trajectory is influenced by consumer purchasing habits and market dynamics. Online Sales is projected to exhibit the highest growth rate, with an estimated market size of approximately $XX million in 2025, expanding to over $XX million by 2033. The Type segmentation covers Apple-Lightning (Single Cable), USB-C (Single Cable), Common Single Cable, and Multiple Cables in One. USB-C (Single Cable) is anticipated to dominate, driven by industry standardization, with a projected market size of over $XX million in 2025. Multiple Cables in One solutions are expected to show significant growth, catering to diverse device ecosystems. Competitive dynamics within each segment are shaped by brand recognition, product features, and pricing strategies.

Key Drivers of Phone Charging Cables Growth

The phone charging cables market is propelled by several interconnected drivers. The rapid and continuous evolution of smartphone technology, with increasingly sophisticated battery capacities and charging requirements, directly fuels demand for advanced charging solutions. The global expansion of mobile device penetration, particularly in emerging economies, creates a vast and growing consumer base. Technological advancements in charging protocols, such as USB Power Delivery and Qualcomm Quick Charge, are creating a market for higher performance and faster charging cables. Economic growth and increasing disposable incomes in various regions allow consumers to invest in premium and durable charging accessories. Furthermore, the growing trend of device convergence, where users rely on multiple gadgets, necessitates versatile and high-quality charging cables.

Challenges in the Phone Charging Cables Sector

Despite robust growth, the phone charging cables sector faces several challenges. Intense market competition leads to price erosion, impacting profit margins for manufacturers and retailers. The rapid pace of technological change necessitates continuous investment in research and development to stay competitive, which can be a significant financial burden. Supply chain disruptions, as witnessed in recent years, can lead to material shortages and increased production costs, affecting product availability and pricing. Regulatory hurdles related to safety standards and environmental compliance can also pose challenges for new market entrants. Furthermore, the proliferation of counterfeit and low-quality products floods the market, damaging brand reputations and creating consumer distrust.

Emerging Opportunities in Phone Charging Cables

Emerging opportunities in the phone charging cables market lie in several key areas. The growing demand for sustainable and eco-friendly products presents an opportunity for manufacturers to develop cables using recycled materials and adopt greener manufacturing processes. The increasing popularity of electric vehicles (EVs) and other high-power electronic devices opens up new avenues for specialized charging cables. Furthermore, the development of smart charging solutions that optimize power delivery and battery health represents a significant innovation area. Customization and personalization options, allowing consumers to choose cable lengths, colors, and even add unique branding, cater to a growing segment of consumers seeking tailored products. The expansion of wireless charging technology also presents an indirect opportunity for companies to offer complementary wired solutions for faster charging or situations where wireless charging is not feasible.

Leading Players in the Phone Charging Cables Market

- Anker

- BELKIN

- Ugreen

- Pisen

- Baseus

- Huawei

- DNS

- ZMI

- CE-Link

- Hank

- NATIVE UNION

- BULL

- Shenzhen JAME

- Nien Yi

- OPPO

- Satechi

- VIVO

- Stiger

- OPSO

- Snowkids

- iWALK

- Capshi/MaxMco

- ESR

- Joyroom

- ORICO

Key Developments in Phone Charging Cables Industry

- 2024: Launch of GaN-based chargers and cables enabling ultra-fast charging for a wider range of devices.

- 2023: Increased adoption of braided materials and reinforced connectors for enhanced cable durability and lifespan.

- 2022: Rise of "multi-cable in one" solutions offering interchangeable tips for USB-C, Lightning, and Micro-USB.

- 2021: Growing emphasis on USB Power Delivery (USB PD) 3.1 standard for higher wattage charging capabilities.

- 2020: Introduction of cables with integrated LED indicators for real-time charging status monitoring.

- 2019: Widespread adoption of USB-C as the standard charging port across most new smartphone models.

Strategic Outlook for Phone Charging Cables Market

The strategic outlook for the phone charging cables market is overwhelmingly positive, driven by sustained demand from the global smartphone ecosystem and ongoing technological advancements. The continued transition towards USB-C, coupled with the evolution of faster charging standards like USB PD, presents significant opportunities for manufacturers to innovate and capture market share. Focus on product durability, user convenience, and aesthetic appeal will remain crucial for differentiation. Companies that can effectively leverage online sales channels, invest in sustainable practices, and adapt to emerging charging technologies will be well-positioned for long-term success. The market is expected to benefit from increasing device dependency and the need for reliable, high-performance charging solutions across a diverse range of consumer electronics.

Phone Charging Cables Segmentation

-

1. Application

- 1.1. Mobile Phone Accessories Store

- 1.2. 3C Retail Store

- 1.3. Online Sales

- 1.4. Others

-

2. Type

- 2.1. Apple-Lightning (Single Cable)

- 2.2. USB-C (Single Cable)

- 2.3. Common Single Cable

- 2.4. Multiple Cables in One

Phone Charging Cables Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Phone Charging Cables REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mobile Phone Accessories Store

- 5.1.2. 3C Retail Store

- 5.1.3. Online Sales

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Apple-Lightning (Single Cable)

- 5.2.2. USB-C (Single Cable)

- 5.2.3. Common Single Cable

- 5.2.4. Multiple Cables in One

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mobile Phone Accessories Store

- 6.1.2. 3C Retail Store

- 6.1.3. Online Sales

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Apple-Lightning (Single Cable)

- 6.2.2. USB-C (Single Cable)

- 6.2.3. Common Single Cable

- 6.2.4. Multiple Cables in One

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mobile Phone Accessories Store

- 7.1.2. 3C Retail Store

- 7.1.3. Online Sales

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Apple-Lightning (Single Cable)

- 7.2.2. USB-C (Single Cable)

- 7.2.3. Common Single Cable

- 7.2.4. Multiple Cables in One

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mobile Phone Accessories Store

- 8.1.2. 3C Retail Store

- 8.1.3. Online Sales

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Apple-Lightning (Single Cable)

- 8.2.2. USB-C (Single Cable)

- 8.2.3. Common Single Cable

- 8.2.4. Multiple Cables in One

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mobile Phone Accessories Store

- 9.1.2. 3C Retail Store

- 9.1.3. Online Sales

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Apple-Lightning (Single Cable)

- 9.2.2. USB-C (Single Cable)

- 9.2.3. Common Single Cable

- 9.2.4. Multiple Cables in One

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Phone Charging Cables Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mobile Phone Accessories Store

- 10.1.2. 3C Retail Store

- 10.1.3. Online Sales

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Apple-Lightning (Single Cable)

- 10.2.2. USB-C (Single Cable)

- 10.2.3. Common Single Cable

- 10.2.4. Multiple Cables in One

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ugreen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PYS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pisen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anker

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BELKIN

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DNS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZMI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Baseus

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CE-Link

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NATIVE UNION

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BULL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shenzhen JAME

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huawei

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nien Yi

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 OPPO

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Satechi

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 VIVO

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Stiger

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 OPSO

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Snowkids

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 iWALK

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Capshi/MaxMco

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 ESR

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Joyroom

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 ORICO

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 Ugreen

List of Figures

- Figure 1: Global Phone Charging Cables Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Phone Charging Cables Revenue (million), by Application 2024 & 2032

- Figure 3: North America Phone Charging Cables Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Phone Charging Cables Revenue (million), by Type 2024 & 2032

- Figure 5: North America Phone Charging Cables Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Phone Charging Cables Revenue (million), by Country 2024 & 2032

- Figure 7: North America Phone Charging Cables Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Phone Charging Cables Revenue (million), by Application 2024 & 2032

- Figure 9: South America Phone Charging Cables Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Phone Charging Cables Revenue (million), by Type 2024 & 2032

- Figure 11: South America Phone Charging Cables Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Phone Charging Cables Revenue (million), by Country 2024 & 2032

- Figure 13: South America Phone Charging Cables Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Phone Charging Cables Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Phone Charging Cables Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Phone Charging Cables Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Phone Charging Cables Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Phone Charging Cables Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Phone Charging Cables Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Phone Charging Cables Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Phone Charging Cables Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Phone Charging Cables Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Phone Charging Cables Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Phone Charging Cables Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Phone Charging Cables Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Phone Charging Cables Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Phone Charging Cables Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Phone Charging Cables Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Phone Charging Cables Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Phone Charging Cables Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Phone Charging Cables Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phone Charging Cables Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Phone Charging Cables Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Phone Charging Cables Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Phone Charging Cables Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Phone Charging Cables Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Phone Charging Cables Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Phone Charging Cables Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Phone Charging Cables Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Phone Charging Cables Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Phone Charging Cables Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phone Charging Cables?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Phone Charging Cables?

Key companies in the market include Ugreen, PYS, Pisen, Anker, BELKIN, DNS, ZMI, Baseus, CE-Link, Hank, NATIVE UNION, BULL, Shenzhen JAME, Huawei, Nien Yi, OPPO, Satechi, VIVO, Stiger, OPSO, Snowkids, iWALK, Capshi/MaxMco, ESR, Joyroom, ORICO.

3. What are the main segments of the Phone Charging Cables?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14620 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phone Charging Cables," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phone Charging Cables report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phone Charging Cables?

To stay informed about further developments, trends, and reports in the Phone Charging Cables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence