Key Insights

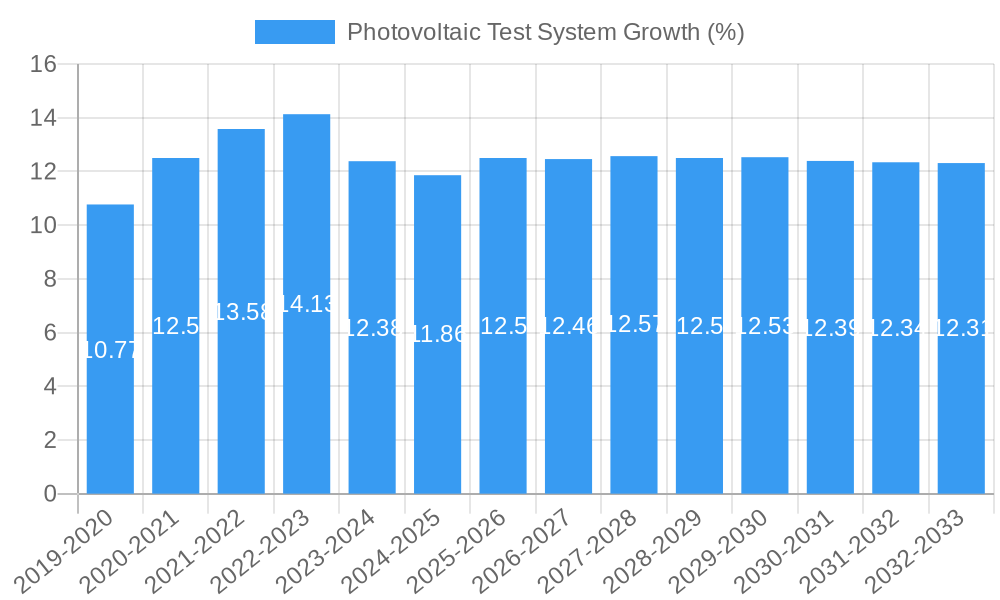

The global Photovoltaic Test System market is poised for significant expansion, projected to reach approximately $2,500 million by 2033, with a robust Compound Annual Growth Rate (CAGR) of 12.5% from its base year valuation of $1,250 million in 2025. This growth is primarily fueled by the escalating global demand for renewable energy, driven by stringent environmental regulations and a growing awareness of climate change. The increasing installation of solar power plants, both utility-scale and distributed, necessitates advanced and reliable testing solutions to ensure optimal performance, safety, and longevity of photovoltaic modules and systems. Furthermore, advancements in solar technology, such as bifacial panels and higher efficiency cells, are creating a need for sophisticated testing equipment capable of validating these new technologies. The market is also being propelled by government initiatives and subsidies promoting solar energy adoption, which directly translate into higher demand for testing and certification services.

The market's trajectory is further shaped by critical trends including the integration of automation and artificial intelligence (AI) in testing processes, leading to faster, more accurate, and cost-effective solutions. The development of portable and on-site testing equipment is also gaining traction, catering to the needs of field technicians and O&M (Operations and Maintenance) providers. However, the market faces certain restraints, such as the high initial cost of sophisticated testing equipment and the availability of skilled personnel to operate them, which could temper rapid adoption in some regions. Despite these challenges, the overarching shift towards a sustainable energy future, coupled with continuous technological innovation by key players like Fluke, Megger, and HIOKI, ensures a dynamic and growth-oriented future for the Photovoltaic Test System market. The market is segmented by application into manufacturing, installation, and research & development, and by type into electrical testers, environmental testers, and performance testers, all contributing to its diverse and expanding landscape.

Here's a detailed, SEO-optimized report description for the Photovoltaic Test System market, incorporating your specifications:

Photovoltaic Test System Market Concentration & Innovation

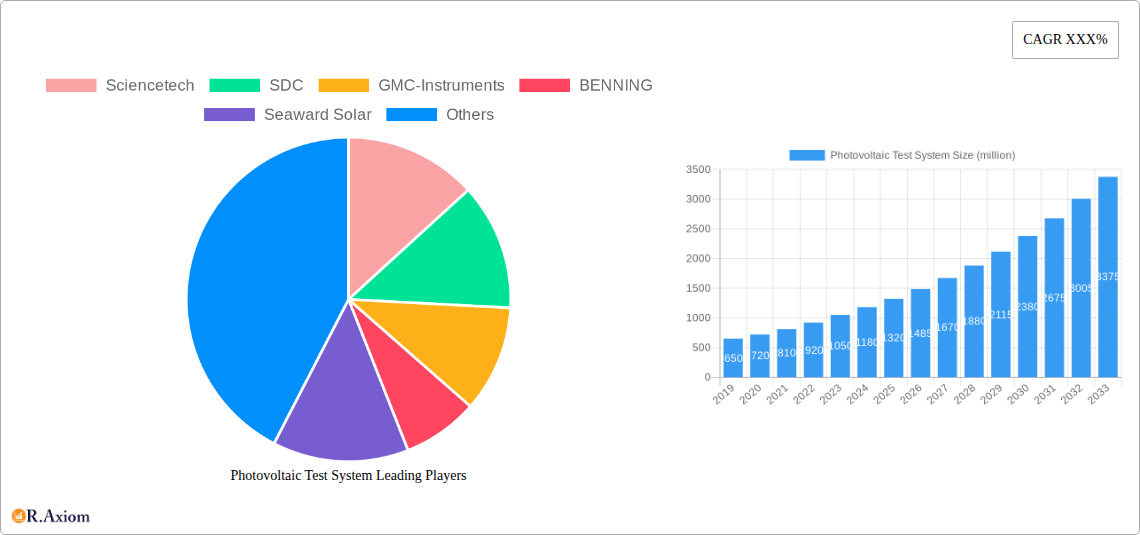

The global Photovoltaic Test System market exhibits a moderate level of concentration, with several key players vying for market share. Leading companies such as Fluke, HIOKI, and Sciencetech are instrumental in driving innovation and setting industry standards. The market is fueled by significant R&D investments aimed at developing more accurate, efficient, and automated testing solutions for solar panels, inverters, and other PV components. Regulatory frameworks, including international IEC standards and national certification requirements, play a crucial role in shaping product development and market access, often mandating stringent performance and safety testing protocols. The increasing adoption of solar energy worldwide, coupled with the growing complexity of PV technologies, presents a continuous need for advanced testing systems. Product substitutes are limited, as specialized photovoltaic test systems offer functionalities that generic electrical testing equipment cannot replicate. End-user trends are leaning towards integrated testing solutions that can perform multiple checks rapidly and provide comprehensive data analysis for quality control and performance optimization. Mergers and acquisitions (M&A) are moderately prevalent, with an estimated M&A deal value of $200 million in the historical period, as larger companies seek to acquire innovative technologies or expand their product portfolios and geographical reach. The market share of the top five players is estimated to be around 60%, indicating a competitive yet consolidated landscape.

Photovoltaic Test System Industry Trends & Insights

The Photovoltaic Test System industry is poised for robust growth, driven by the accelerating global transition towards renewable energy sources. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This expansion is primarily attributed to the escalating demand for solar energy installations, spurred by supportive government policies, declining solar panel costs, and a growing awareness of climate change. Technological advancements are continuously reshaping the industry, with a strong focus on developing intelligent, automated, and portable test systems. These innovations enable faster and more precise testing of photovoltaic modules, inverters, and balance-of-system components, thereby enhancing quality control and ensuring long-term performance. The increasing complexity and efficiency of solar technologies necessitate sophisticated testing equipment capable of verifying intricate electrical parameters and identifying potential defects. Consumer preferences are shifting towards integrated testing solutions that can provide real-time data, cloud connectivity for remote monitoring, and advanced diagnostic capabilities. This trend is further amplified by the need for rapid deployment and efficient maintenance of large-scale solar farms. Competitive dynamics are characterized by fierce innovation and strategic partnerships among established players and emerging technology providers. Market penetration is projected to reach approximately 70% by 2033, indicating a substantial growth opportunity for manufacturers and service providers. The increasing investment in solar research and development is also a significant catalyst, driving the demand for cutting-edge testing equipment. The development of standards for emerging PV technologies, such as perovskite solar cells and flexible PV, will also influence market trends.

Dominant Markets & Segments in Photovoltaic Test System

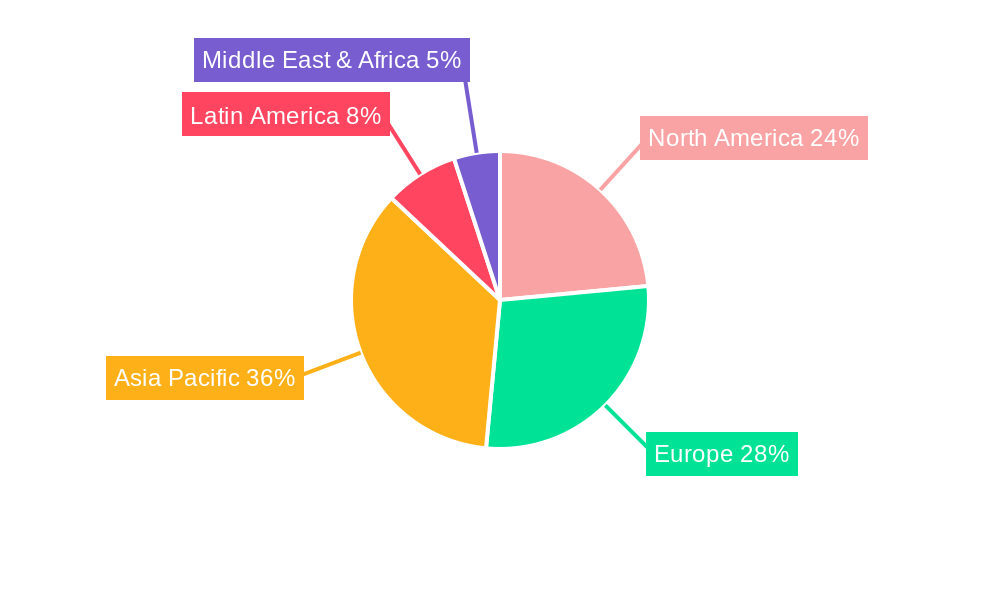

The leading region for the Photovoltaic Test System market is Asia-Pacific, driven by its substantial manufacturing base for solar panels and a rapidly growing installed capacity of solar power. Countries like China, India, and South Korea are at the forefront of this dominance, fueled by favorable government policies, significant investments in renewable energy infrastructure, and a strong demand for both residential and utility-scale solar projects. The economic policies in these nations, including subsidies, tax incentives, and renewable energy targets, are instrumental in driving the uptake of solar technologies and, consequently, the need for advanced photovoltaic test systems.

Key Drivers in Asia-Pacific:

- Government Support and Subsidies: Aggressive renewable energy targets and financial incentives for solar installations.

- Manufacturing Hub: Dominance in global solar panel production, requiring extensive in-line and end-of-line testing.

- Rapidly Expanding Installed Capacity: Massive growth in utility-scale and distributed solar projects demanding robust testing and maintenance.

- Technological Advancement: Investment in R&D for more efficient and cost-effective solar solutions.

In terms of Application: , the Utility-Scale Solar Farms segment holds the largest market share. The sheer volume of solar panels and the critical need for reliability and performance in these large installations necessitate comprehensive testing solutions. This segment benefits from ongoing development of mega solar projects worldwide, particularly in emerging economies.

Dominance Analysis for Utility-Scale Solar Farms:

Utility-scale solar farms represent a cornerstone of global energy infrastructure. The immense number of photovoltaic modules deployed in these installations, often numbering in the millions, underscores the critical importance of thorough and efficient testing. Manufacturers and installers of these projects demand test systems that can rapidly assess individual panel performance, identify potential manufacturing defects, and ensure compliance with stringent grid connection standards. The economic viability of utility-scale solar farms hinges on maximizing energy yield and minimizing downtime, making advanced diagnostic and performance testing systems indispensable. Furthermore, the long operational lifespan of these installations (25+ years) necessitates robust testing during manufacturing, installation, and throughout their service life to detect degradation and potential failures. Government mandates and certifications for grid-connected solar power systems further reinforce the demand for reliable testing equipment.

For Type: , the Automated Test Systems segment is witnessing the fastest growth and commands a significant market share. The increasing scale of solar manufacturing and installation projects necessitates automated solutions to improve throughput, reduce labor costs, and enhance testing consistency.

Dominance Analysis for Automated Test Systems:

Automated test systems are revolutionizing the photovoltaic industry by enabling high-volume, consistent, and rapid testing. In manufacturing environments, automated testers are integrated into production lines to perform essential checks like electroluminescence (EL) imaging, IV curve tracing, and insulation resistance tests on every solar module. This automation significantly boosts production efficiency, reduces the likelihood of human error, and ensures that only high-quality modules reach the market. For large-scale installations, automated systems facilitate quicker site acceptance testing, allowing for faster project commissioning. The trend towards Industry 4.0 and smart manufacturing further propels the adoption of automated test systems, which can often be connected to data analytics platforms for process optimization and predictive maintenance. The investment in these sophisticated systems is justified by the substantial reduction in operational costs and the improved reliability of solar energy generation.

Photovoltaic Test System Product Developments

Recent product developments in photovoltaic test systems focus on enhanced accuracy, speed, and automation. Manufacturers are introducing portable testers with advanced features like AI-driven defect detection, real-time cloud connectivity for data analysis, and extended battery life for field use. Innovations include integrated multi-function testers capable of performing a suite of electrical and thermal diagnostics on PV modules, inverters, and connectors. These advancements aim to streamline the testing process, improve diagnostic capabilities, and reduce overall testing time and costs for solar installations. The competitive advantage lies in offering robust, user-friendly, and highly precise testing solutions that meet evolving industry standards and customer demands for reliable solar energy production.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Photovoltaic Test System market, segmented by Application: (e.g., Utility-Scale Solar Farms, Residential Rooftop Solar, Commercial & Industrial Solar, Off-Grid Systems) and Type: (e.g., Automated Test Systems, Manual Test Systems, Portable Test Systems, Integrated Test Solutions).

Utility-Scale Solar Farms Segment: This segment is projected to reach a market size of $1,500 million by 2033, driven by the continuous global expansion of large-scale solar power plants and the stringent quality control requirements for these projects.

Residential Rooftop Solar Segment: Expected to grow to $800 million by 2033, this segment is characterized by increasing adoption of solar energy in homes, demanding reliable and cost-effective testing solutions for residential installations.

Commercial & Industrial Solar Segment: This segment is forecasted to reach $1,200 million by 2033, influenced by businesses investing in solar to reduce operational costs and meet sustainability goals, requiring scalable and efficient testing.

Off-Grid Systems Segment: With a projected market size of $300 million by 2033, this segment serves remote areas and applications where reliable power generation is critical, necessitating dependable testing for system integrity.

Automated Test Systems Segment: Dominating the market, this segment is estimated to reach $2,500 million by 2033, driven by the need for high throughput, accuracy, and cost-efficiency in manufacturing and large installations.

Manual Test Systems Segment: Projected to reach $700 million by 2033, these systems offer flexibility and are suitable for smaller-scale operations or specific diagnostic tasks.

Portable Test Systems Segment: Expected to grow to $900 million by 2033, these systems are crucial for field inspections, maintenance, and troubleshooting, offering convenience and mobility.

Integrated Test Solutions Segment: This segment, forecasted to reach $1,100 million by 2033, represents the trend towards comprehensive testing platforms that combine multiple functionalities for end-to-end quality assurance.

Key Drivers of Photovoltaic Test System Growth

The growth of the Photovoltaic Test System market is propelled by several critical factors. Firstly, the exponential growth of the global solar energy sector due to climate change concerns and government incentives creates an insatiable demand for PV testing. Secondly, technological advancements in solar panel efficiency and complexity necessitate more sophisticated and accurate testing equipment to ensure performance and reliability. Thirdly, stringent international quality standards and certification requirements mandate rigorous testing protocols, driving adoption of advanced test systems. Lastly, the declining costs of solar power make it increasingly competitive, leading to larger deployment volumes and a corresponding increase in testing needs.

Challenges in the Photovoltaic Test System Sector

Despite robust growth, the Photovoltaic Test System sector faces several challenges. High initial investment costs for advanced automated testing systems can be a barrier for smaller manufacturers and installers. Rapid technological evolution in PV technology requires continuous updates and recalibration of test systems, leading to ongoing R&D and capital expenditure. Supply chain disruptions, as seen in recent global events, can impact the availability of critical components for manufacturing test equipment. Furthermore, global economic uncertainties and fluctuating energy prices can affect investment decisions in new solar projects, indirectly impacting the demand for test systems. The presence of counterfeit or substandard testing equipment also poses a threat to market integrity.

Emerging Opportunities in Photovoltaic Test System

Emerging opportunities in the Photovoltaic Test System market are abundant. The rapid development of next-generation PV technologies like perovskites and tandem cells presents a need for specialized testing solutions. The growing focus on predictive maintenance and performance monitoring of solar farms creates opportunities for smart, data-driven testing systems with AI capabilities. The expansion of distributed energy resources and microgrids in developing economies offers new markets for portable and adaptable testing equipment. Furthermore, the increasing emphasis on battery storage integration with solar systems opens avenues for test systems that can evaluate the combined performance of PV and storage solutions.

Leading Players in the Photovoltaic Test System Market

- Sciencetech

- SDC

- GMC-Instruments

- BENNING

- Seaward Solar

- Megger

- Metrel

- MECO

- Chauvin Arnoux

- HT Instruments

- HellermannTyton

- Fluke

- Emazys

- HIOKI

Key Developments in Photovoltaic Test System Industry

- 2023 November: Fluke launches a new generation of portable PV test meters with enhanced data logging and cloud connectivity for utility-scale applications.

- 2023 July: HIOKI introduces an advanced electroluminescence (EL) inspection system designed for high-throughput solar module manufacturing lines.

- 2023 February: Sciencetech announces a strategic partnership with a leading solar research institute to develop specialized test equipment for emerging PV technologies.

- 2022 September: Seaward Solar expands its product portfolio with integrated solar installation test kits, catering to the growing residential solar market.

- 2022 April: Megger acquires a specialized company in automated PV string testing, strengthening its position in utility-scale testing solutions.

Strategic Outlook for Photovoltaic Test System Market

The strategic outlook for the Photovoltaic Test System market is highly optimistic, driven by the sustained global push towards renewable energy. Future growth will be catalyzed by continuous innovation in automated and AI-powered testing solutions that enhance efficiency and predictive capabilities. The increasing demand for testing across the entire solar value chain, from module manufacturing to installation and ongoing maintenance, will fuel market expansion. Companies that can offer integrated, data-driven testing platforms and adapt to the evolving landscape of PV technologies will be best positioned for success. Strategic collaborations and acquisitions will likely continue as players seek to expand their technological prowess and market reach.

Photovoltaic Test System Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Photovoltaic Test System Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Photovoltaic Test System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Photovoltaic Test System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sciencetech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SDC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GMC-Instruments

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BENNING

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seaward Solar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Megger

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Metrel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MECO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chauvin Arnoux

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HT Instruments

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HellermannTyton

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fluke

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Emazys

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HIOKI

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Sciencetech

List of Figures

- Figure 1: Global Photovoltaic Test System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Photovoltaic Test System Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Photovoltaic Test System Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Photovoltaic Test System Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Photovoltaic Test System Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Photovoltaic Test System Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Photovoltaic Test System Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Photovoltaic Test System Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Photovoltaic Test System Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Photovoltaic Test System Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Photovoltaic Test System Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Photovoltaic Test System Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Photovoltaic Test System Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Photovoltaic Test System Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Photovoltaic Test System Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Photovoltaic Test System Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Photovoltaic Test System Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Photovoltaic Test System Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Photovoltaic Test System Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Photovoltaic Test System Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Photovoltaic Test System Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Photovoltaic Test System Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Photovoltaic Test System Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Photovoltaic Test System Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Photovoltaic Test System Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Photovoltaic Test System Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Photovoltaic Test System Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Photovoltaic Test System Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Photovoltaic Test System Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Photovoltaic Test System Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Photovoltaic Test System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Photovoltaic Test System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Photovoltaic Test System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Photovoltaic Test System Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Photovoltaic Test System Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Photovoltaic Test System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Photovoltaic Test System Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Photovoltaic Test System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Photovoltaic Test System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Photovoltaic Test System Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Photovoltaic Test System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Photovoltaic Test System?

Key companies in the market include Sciencetech, SDC, GMC-Instruments, BENNING, Seaward Solar, Megger, Metrel, MECO, Chauvin Arnoux, HT Instruments, HellermannTyton, Fluke, Emazys, HIOKI.

3. What are the main segments of the Photovoltaic Test System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Photovoltaic Test System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Photovoltaic Test System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Photovoltaic Test System?

To stay informed about further developments, trends, and reports in the Photovoltaic Test System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence