Key Insights

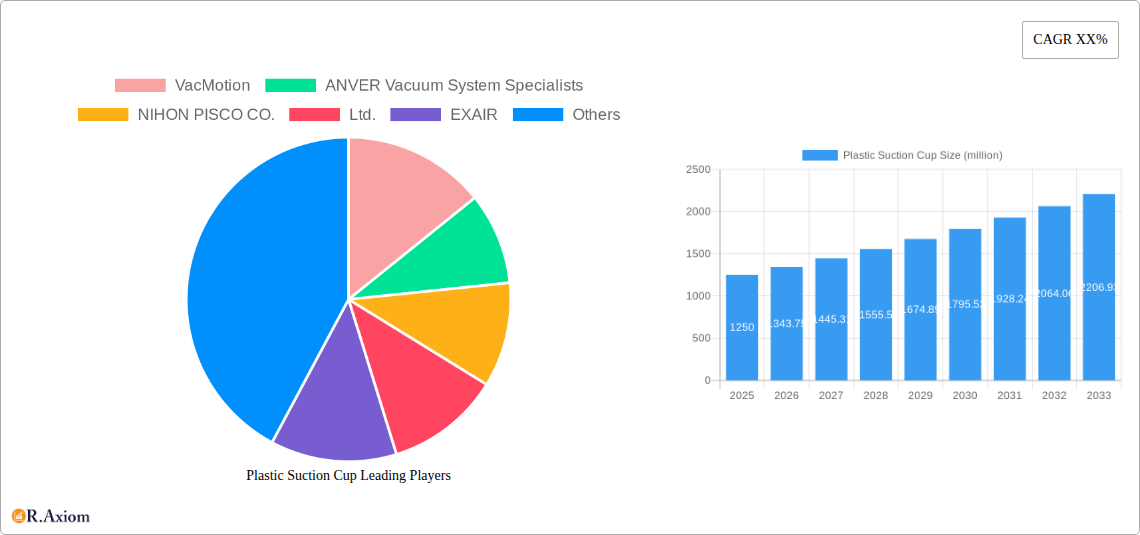

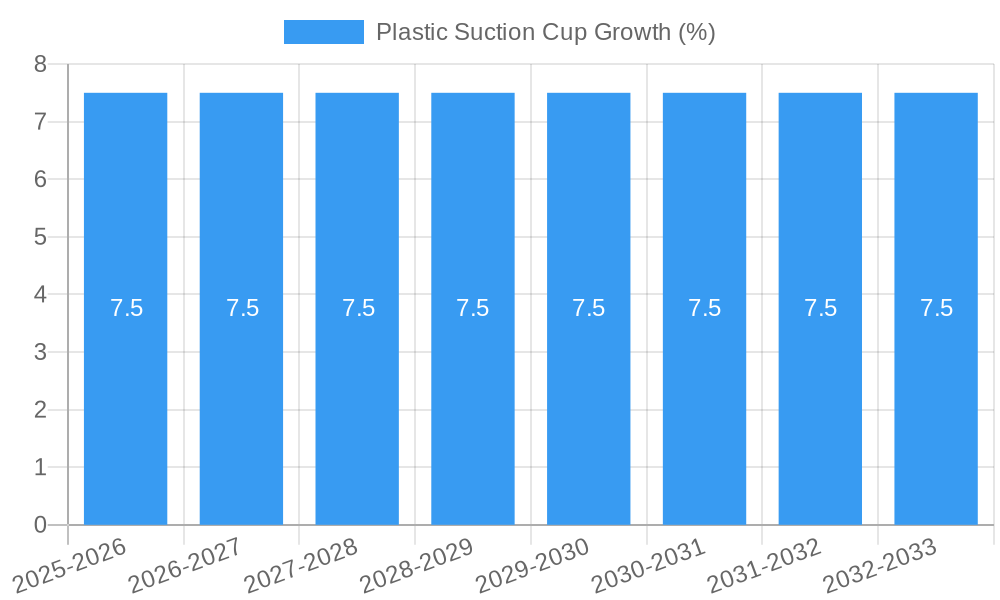

The global plastic suction cup market is poised for significant expansion, projected to reach an estimated market size of $1,250 million by 2025. This robust growth trajectory is fueled by a Compound Annual Growth Rate (CAGR) of 7.5% anticipated during the forecast period of 2025-2033. The market's vitality stems from the increasing demand across a diverse range of industries, notably aerospace and national defense, where reliable and precise handling solutions are paramount. The semiconductor industry's relentless pursuit of miniaturization and automation further bolsters this demand, as plastic suction cups offer a non-marring and cost-effective alternative for delicate component manipulation. The medical sector also presents a burgeoning opportunity, driven by advancements in robotic surgery, diagnostics, and automated laboratory processes requiring gentle yet secure gripping mechanisms. These dynamic applications, coupled with the inherent advantages of plastic suction cups – their lightweight nature, chemical resistance, and adaptability to various surfaces – are collectively propelling market expansion.

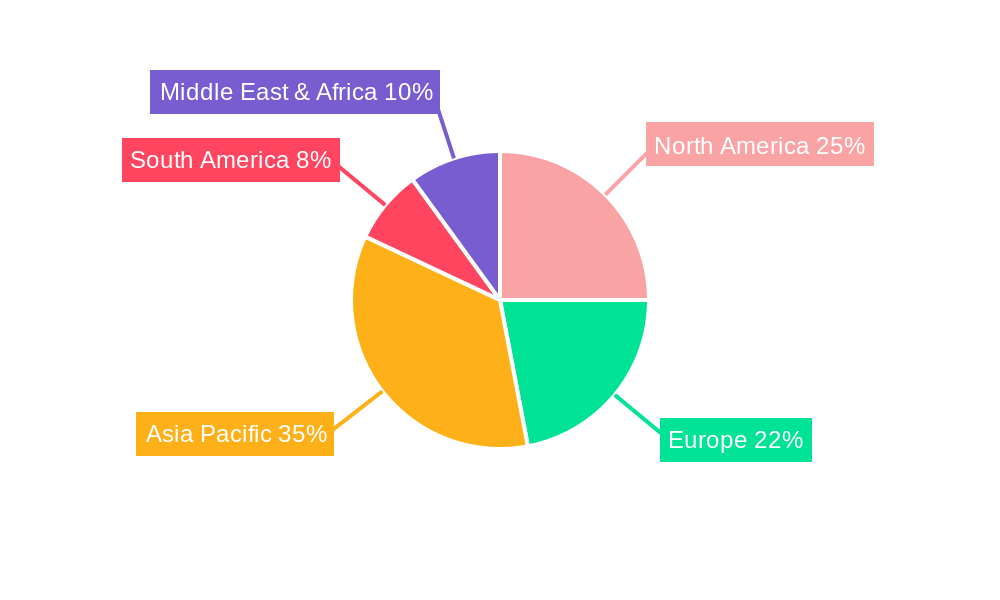

Despite the overwhelmingly positive outlook, certain factors warrant consideration. The evolving regulatory landscape concerning material sourcing and sustainability could introduce complexities for manufacturers. Furthermore, intense price competition within a fragmented market, with numerous established and emerging players like VacMotion, ANVER Vacuum System Specialists, and Schmalz, necessitates continuous innovation in product design and manufacturing efficiency. However, the ongoing technological advancements in material science, leading to enhanced durability and specialized functionalities for plastic suction cups, are expected to mitigate these restraints. The market's segmentation by type, including circular, rectangular, flat, and corrugated pipe suction cups, reflects a broad spectrum of specific industrial needs, all contributing to the overall market's upward momentum. The Asia Pacific region, led by China and India, is anticipated to be a significant growth engine due to its burgeoning manufacturing sector and substantial investments in automation.

Plastic Suction Cup Market Concentration & Innovation

The global plastic suction cup market exhibits a moderate concentration, with leading players such as Schmalz, Piab, and ANVER Vacuum System Specialists holding significant market share, estimated to be over 30% combined. Innovation is a key driver, with companies investing heavily in the development of advanced materials offering enhanced durability, chemical resistance, and specialized gripping capabilities. Regulatory frameworks, particularly concerning safety standards in industries like Medical and Aerospace, are shaping product design and material selection. Product substitutes, including magnetic grippers and pneumatic manipulators, present a competitive challenge, forcing plastic suction cup manufacturers to continually refine their offerings. End-user trends lean towards automation and robotics, demanding higher performance and reliability from suction cups. Mergers and acquisitions (M&A) activity, with estimated deal values in the tens of millions, have been observed as larger entities seek to consolidate their market position and expand their product portfolios. For instance, a recent acquisition of a niche plastic suction cup manufacturer by a global automation solutions provider further underscores this trend, aiming to integrate specialized gripping technology into broader robotic systems.

Plastic Suction Cup Industry Trends & Insights

The plastic suction cup industry is poised for substantial growth, driven by the relentless march of automation across a multitude of sectors. This dynamic market is witnessing a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2019 to 2033, a testament to the increasing adoption of robotics and automated handling systems. The market penetration of plastic suction cups, particularly in emerging economies, is on an upward trajectory, fueled by industrial expansion and a growing need for efficient material handling solutions. Technological advancements are at the forefront, with a significant focus on developing suction cups with improved resilience to extreme temperatures, harsh chemicals, and demanding surface conditions. Smart suction cups, integrated with sensors for real-time monitoring of grip force and leakage, are emerging as a key innovation, offering enhanced process control and predictive maintenance capabilities. Consumer preferences are evolving, with a growing demand for lightweight, high-performance suction cups that can handle delicate or irregularly shaped objects without causing damage. This has spurred research into novel polymer formulations and innovative cup designs, such as bellows-style cups for uneven surfaces and specialized cups for the semiconductor industry designed to prevent particulate contamination. The competitive landscape is characterized by intense rivalry among established players and agile new entrants, all vying to capture market share through product differentiation, cost leadership, and strategic partnerships. The integration of advanced manufacturing techniques, like 3D printing, is also beginning to influence production, enabling the creation of customized suction cup solutions for highly specific applications, further pushing the boundaries of what is possible in automated gripping. The increasing adoption of e-commerce and the resulting pressure on logistics and warehousing operations also represent a significant tailwind for the plastic suction cup market, as efficient automated sorting and picking systems become indispensable. The continuous need for cost-effective and reliable gripping solutions across diverse manufacturing and assembly processes solidifies the long-term growth prospects for this essential industrial component.

Dominant Markets & Segments in Plastic Suction Cup

The plastic suction cup market is characterized by dominant regions and segments, each driven by distinct factors.

Leading Region: Asia Pacific

- Economic Policies: Favorable government initiatives promoting manufacturing and industrial automation within countries like China, Japan, and South Korea are significant drivers. These policies often include tax incentives and subsidies for adopting advanced technologies.

- Infrastructure Development: Robust investment in industrial infrastructure, including smart factories and automated logistics hubs, creates a substantial demand for reliable gripping solutions.

- Manufacturing Hub: The Asia Pacific region's status as a global manufacturing powerhouse, particularly in electronics, automotive, and consumer goods, directly translates to a high volume of plastic suction cup applications.

Dominant Segment: Semiconductor Application

- Precision Handling: The semiconductor industry demands exceptionally precise and contamination-free handling of delicate wafers and components. Plastic suction cups made from specialized, non-outgassing materials are crucial for these applications.

- Cleanroom Environments: The stringent requirements of cleanroom environments necessitate materials that minimize particle generation and are easily cleanable. Advanced plastic formulations are meeting these demands.

- Technological Advancement: The continuous innovation within the semiconductor sector, leading to smaller and more complex components, requires increasingly sophisticated and specialized gripping solutions.

Dominant Segment: Circular Type

- Versatility: Circular plastic suction cups are the most widely used due to their inherent versatility in gripping a broad range of smooth, flat, and slightly curved surfaces.

- Ease of Integration: Their simple design makes them easy to integrate into various robotic end-effectors and vacuum gripping systems.

- Cost-Effectiveness: The standardized manufacturing processes for circular cups often lead to greater cost-effectiveness, making them an attractive choice for high-volume applications.

Plastic Suction Cup Product Developments

- Precision Handling: The semiconductor industry demands exceptionally precise and contamination-free handling of delicate wafers and components. Plastic suction cups made from specialized, non-outgassing materials are crucial for these applications.

- Cleanroom Environments: The stringent requirements of cleanroom environments necessitate materials that minimize particle generation and are easily cleanable. Advanced plastic formulations are meeting these demands.

- Technological Advancement: The continuous innovation within the semiconductor sector, leading to smaller and more complex components, requires increasingly sophisticated and specialized gripping solutions.

Dominant Segment: Circular Type

- Versatility: Circular plastic suction cups are the most widely used due to their inherent versatility in gripping a broad range of smooth, flat, and slightly curved surfaces.

- Ease of Integration: Their simple design makes them easy to integrate into various robotic end-effectors and vacuum gripping systems.

- Cost-Effectiveness: The standardized manufacturing processes for circular cups often lead to greater cost-effectiveness, making them an attractive choice for high-volume applications.

Plastic Suction Cup Product Developments

Recent product developments in the plastic suction cup market focus on enhanced material science and intelligent design. Innovations include specialized nitrile rubber and silicone compounds offering superior oil resistance and high-temperature tolerance for demanding industrial environments. The introduction of cups with integrated sensors for grip verification and leakage detection is a significant trend, improving automation reliability. Furthermore, the development of custom-molded suction cups for intricate or delicate object handling in the aerospace and medical sectors is gaining traction, providing optimized gripping forces and minimizing surface damage, thereby enhancing competitive advantages for users.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global plastic suction cup market, segmented by Application and Type.

- Aerospace: This segment, projected to grow at a CAGR of 5.8%, encompasses suction cups used for handling composite materials, aircraft components, and in assembly lines. Key players focus on high-strength, lightweight materials and designs that prevent surface marring.

- National Defense: Applications in this segment include handling sensitive equipment and in the manufacturing of military hardware. Reliability and durability in extreme conditions are paramount.

- Semiconductor: This segment is characterized by extreme precision requirements, with a focus on ultra-clean materials and designs that prevent particulate contamination. Projected market size in 2025 is estimated at USD 150 million.

- Medical: This high-growth segment, with a projected CAGR of 7.2%, involves suction cups for handling vials, syringes, and in laboratory automation. Biocompatibility and sterilization capabilities are critical.

- Other: This broad category includes applications in packaging, food processing, automotive manufacturing, and general industrial handling.

- Circular: The most prevalent type, offering broad applicability for smooth surfaces, with market share estimated at 45%.

- Rectangle: Suited for handling elongated objects and in pick-and-place operations, with a market share of approximately 20%.

- Flat: Ideal for large, flat surfaces in applications like sheet metal handling, accounting for around 15% of the market.

- Corrugated Pipe: Specialized cups designed for gripping pipes and cylindrical objects, with a niche but growing market share of 10%.

- Other: Encompasses specialized and custom-designed suction cups for unique applications.

Key Drivers of Plastic Suction Cup Growth

The plastic suction cup market is propelled by several key drivers. The overarching trend of industrial automation and the increasing adoption of robotics across diverse sectors, from manufacturing to logistics, is a primary catalyst. Technological advancements in material science, leading to more durable, resilient, and specialized suction cups, further fuel demand. The growing need for efficient and cost-effective material handling solutions in industries like aerospace and semiconductor manufacturing, where precision and reliability are paramount, also contributes significantly. Furthermore, government initiatives promoting advanced manufacturing and Industry 4.0 adoption in various regions are creating a conducive environment for market expansion.

Challenges in the Plastic Suction Cup Sector

Despite robust growth, the plastic suction cup sector faces several challenges. The susceptibility of some plastic materials to degradation from certain chemicals and high temperatures can limit their application in specific environments. Intense price competition, particularly from low-cost manufacturers, can pressure profit margins for established players. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of raw materials. Additionally, the emergence of advanced alternative gripping technologies, such as magnetic grippers and adaptive soft robotics, presents a competitive threat that necessitates continuous innovation.

Emerging Opportunities in Plastic Suction Cup

Emerging opportunities in the plastic suction cup market are abundant. The expansion of e-commerce and the subsequent growth in automated warehousing and fulfillment centers present a significant demand for efficient pick-and-place solutions. The increasing use of collaborative robots (cobots) in manufacturing environments opens avenues for smaller, more adaptable, and safer suction cup designs. Furthermore, the development of "smart" suction cups with integrated sensors for real-time monitoring and predictive maintenance offers a pathway to higher-value applications and service-based revenue streams. The growing focus on sustainable manufacturing also presents an opportunity for bio-based or recyclable plastic suction cup materials.

Leading Players in the Plastic Suction Cup Market

- VacMotion

- ANVER Vacuum System Specialists

- NIHON PISCO CO.,Ltd.

- EXAIR

- Sommer-Technik

- COVAL ITALIA

- GIMATIC

- Shanghai Herolift Automation Equipment Co.,Ltd

- SIDAMO

- AIRBEST

- Suction Cups

- Effegomma

- Sam Engineers

- Piab

- Schmalz

Key Developments in Plastic Suction Cup Industry

- 2023/09: Schmalz launches new series of high-performance, oil-resistant suction cups for demanding automotive applications.

- 2023/07: Piab introduces innovative bellows suction cups designed for optimal handling of delicate and irregularly shaped objects.

- 2023/05: ANVER Vacuum System Specialists expands its product line with specialized suction cups for aerospace component handling.

- 2022/12: NIHON PISCO CO.,Ltd. announces development of advanced polymer suction cups with enhanced chemical resistance.

- 2022/10: EXAIR releases new ESD-safe suction cups for semiconductor and electronics handling.

- 2022/08: GIMATIC introduces integrated sensor technology in its suction cups for real-time grip monitoring.

- 2022/06: COVAL ITALIA unveils a range of lightweight and flexible suction cups for robotic applications.

- 2022/04: Effegomma showcases sustainable, bio-based plastic suction cup prototypes.

Strategic Outlook for Plastic Suction Cup Market

The strategic outlook for the plastic suction cup market is overwhelmingly positive, driven by sustained demand from the burgeoning automation and robotics sectors. Manufacturers will increasingly focus on developing high-performance, specialized suction cups that address the nuanced requirements of precision industries like semiconductors and aerospace. The integration of smart technologies, offering enhanced control and data analytics, will be a key differentiator. Strategic partnerships and potential M&A activities will continue to shape the market landscape, as companies aim to expand their technological capabilities and global reach. The emphasis on sustainable materials and manufacturing processes will also grow, presenting an opportunity for environmentally conscious players.

Plastic Suction Cup Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. National Defense

- 1.3. Semiconductor

- 1.4. Medical

- 1.5. Other

-

2. Types

- 2.1. Circular

- 2.2. Rectangle

- 2.3. Flat

- 2.4. Corrugated Pipe

- 2.5. Other

Plastic Suction Cup Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Suction Cup REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. National Defense

- 5.1.3. Semiconductor

- 5.1.4. Medical

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Circular

- 5.2.2. Rectangle

- 5.2.3. Flat

- 5.2.4. Corrugated Pipe

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. National Defense

- 6.1.3. Semiconductor

- 6.1.4. Medical

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Circular

- 6.2.2. Rectangle

- 6.2.3. Flat

- 6.2.4. Corrugated Pipe

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. National Defense

- 7.1.3. Semiconductor

- 7.1.4. Medical

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Circular

- 7.2.2. Rectangle

- 7.2.3. Flat

- 7.2.4. Corrugated Pipe

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. National Defense

- 8.1.3. Semiconductor

- 8.1.4. Medical

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Circular

- 8.2.2. Rectangle

- 8.2.3. Flat

- 8.2.4. Corrugated Pipe

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. National Defense

- 9.1.3. Semiconductor

- 9.1.4. Medical

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Circular

- 9.2.2. Rectangle

- 9.2.3. Flat

- 9.2.4. Corrugated Pipe

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plastic Suction Cup Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. National Defense

- 10.1.3. Semiconductor

- 10.1.4. Medical

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Circular

- 10.2.2. Rectangle

- 10.2.3. Flat

- 10.2.4. Corrugated Pipe

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VacMotion

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ANVER Vacuum System Specialists

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NIHON PISCO CO.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EXAIR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sommer-Technik

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 COVAL ITALIA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GIMATIC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai Herolift Automation Equipment Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SIDAMO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AIRBEST

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suction Cups

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Effegomma

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sam Engineers

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Piab

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Schmalz

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 VacMotion

List of Figures

- Figure 1: Global Plastic Suction Cup Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plastic Suction Cup Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plastic Suction Cup Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plastic Suction Cup Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plastic Suction Cup Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plastic Suction Cup Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plastic Suction Cup Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plastic Suction Cup Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plastic Suction Cup Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plastic Suction Cup Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plastic Suction Cup Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plastic Suction Cup Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plastic Suction Cup Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plastic Suction Cup Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plastic Suction Cup Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plastic Suction Cup Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plastic Suction Cup Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plastic Suction Cup Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plastic Suction Cup Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plastic Suction Cup Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plastic Suction Cup Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plastic Suction Cup Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plastic Suction Cup Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plastic Suction Cup Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plastic Suction Cup Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plastic Suction Cup Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plastic Suction Cup Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plastic Suction Cup Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plastic Suction Cup Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plastic Suction Cup Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plastic Suction Cup Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plastic Suction Cup Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plastic Suction Cup Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plastic Suction Cup Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plastic Suction Cup Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plastic Suction Cup Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plastic Suction Cup Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plastic Suction Cup Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plastic Suction Cup Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plastic Suction Cup Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plastic Suction Cup Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Suction Cup?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plastic Suction Cup?

Key companies in the market include VacMotion, ANVER Vacuum System Specialists, NIHON PISCO CO., Ltd., EXAIR, Sommer-Technik, COVAL ITALIA, GIMATIC, Shanghai Herolift Automation Equipment Co., Ltd, SIDAMO, AIRBEST, Suction Cups, Effegomma, Sam Engineers, Piab, Schmalz.

3. What are the main segments of the Plastic Suction Cup?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Suction Cup," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Suction Cup report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Suction Cup?

To stay informed about further developments, trends, and reports in the Plastic Suction Cup, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence