Key Insights

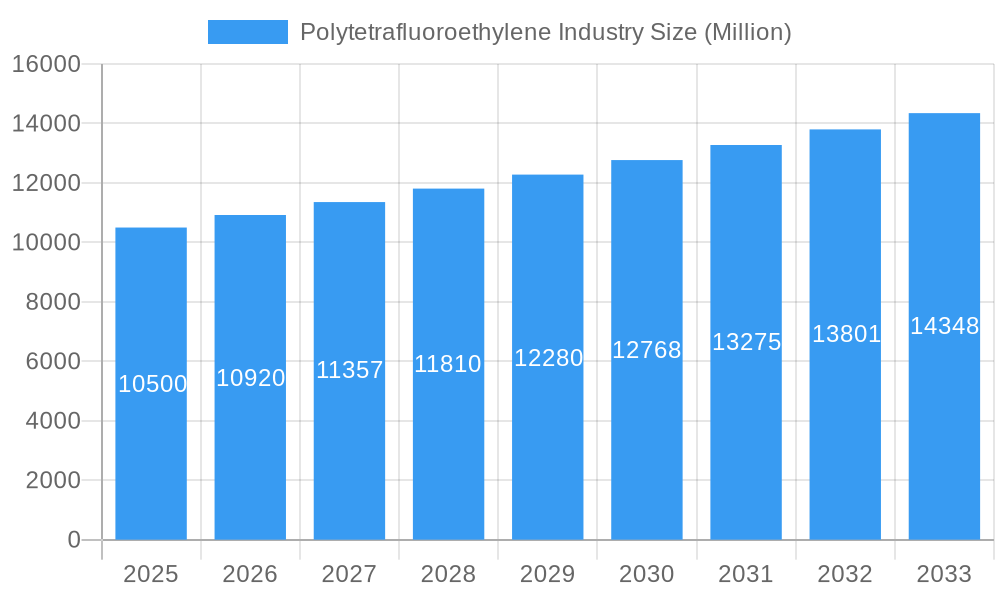

The global Polytetrafluoroethylene (PTFE) market is projected for robust expansion, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.00%. With a current market size estimated at USD 10,500 million in 2025, the industry is poised for sustained value creation, reaching approximately USD 14,500 million by 2033. This growth is propelled by an increasing demand across critical sectors, including aerospace for its non-stick and high-temperature resistance properties, the automotive industry for components requiring chemical inertness and low friction, and the building and construction sector for its use in architectural membranes and coatings. The electrical and electronics segment also significantly contributes, leveraging PTFE's excellent insulating capabilities. Furthermore, the packaging industry benefits from its barrier properties and chemical resistance, ensuring product integrity.

Polytetrafluoroethylene Industry Market Size (In Billion)

Key drivers underpinning this market growth include technological advancements in PTFE processing, leading to enhanced product performance and novel applications. The increasing emphasis on sustainable materials and processes is also creating opportunities for specialized PTFE grades. However, the market faces restraints such as volatile raw material prices and the availability of alternative high-performance fluoropolymers. Geographically, the Asia Pacific region, particularly China and India, is emerging as a dominant force, driven by rapid industrialization and a burgeoning manufacturing base. North America and Europe remain significant markets due to established industries and a focus on high-value applications. Companies like Zhejiang Juhua Co Ltd, Daikin Industries Ltd, and 3M are at the forefront of innovation and market expansion, continually introducing advanced PTFE solutions to meet evolving industry needs.

Polytetrafluoroethylene Industry Company Market Share

Polytetrafluoroethylene (PTFE) Industry Market Research Report: Forecast 2025-2033

This comprehensive report offers an in-depth analysis of the global Polytetrafluoroethylene (PTFE) market, a critical fluoropolymer with unparalleled non-stick, chemical-resistant, and low-friction properties. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, the report provides detailed projections for the forecast period of 2025–2033. It delves into market dynamics, key players, segmentation, growth drivers, challenges, and emerging opportunities, making it an indispensable resource for industry stakeholders seeking to navigate the evolving PTFE landscape. This report is meticulously crafted for immediate use, requiring no further modifications.

Polytetrafluoroethylene Industry Market Concentration & Innovation

The Polytetrafluoroethylene (PTFE) industry exhibits a moderate level of market concentration, with a few dominant global players holding significant market share, estimated to be around XX% for the top 5 companies collectively. Innovation remains a crucial driver, fueled by relentless R&D efforts focused on enhancing PTFE properties for specialized applications and developing more sustainable manufacturing processes. Regulatory frameworks, particularly concerning environmental impact and chemical safety, are increasingly shaping industry practices and product development. While direct product substitutes are limited due to PTFE's unique attribute profile, alternative materials with overlapping functionalities are constantly emerging, demanding continuous innovation. End-user trends, such as the growing demand for high-performance materials in aerospace and automotive sectors, are significantly influencing product development and market growth. Mergers and acquisitions (M&A) activities, though not at an unprecedented pace, are strategically employed by leading companies to expand product portfolios, gain technological expertise, and secure market access. Estimated M&A deal values in the PTFE sector are in the range of XX Million to XX Million, reflecting strategic investments in growth and consolidation.

- Key Innovation Drivers:

- Development of specialized PTFE grades for extreme temperature and chemical resistance.

- Advancements in PTFE composite materials for enhanced mechanical strength and thermal conductivity.

- Focus on environmentally friendly production methods and PFAS-free alternatives.

- Regulatory Landscape:

- Stringent regulations regarding per- and polyfluoroalkyl substances (PFAS) are influencing R&D and production.

- Emphasis on lifecycle assessment and sustainable material management.

- Competitive Landscape:

- Strategic partnerships and collaborations to drive technological advancements.

- Focus on vertical integration to control supply chains and ensure quality.

Polytetrafluoroethylene Industry Industry Trends & Insights

The Polytetrafluoroethylene (PTFE) industry is poised for robust growth, driven by an escalating demand for high-performance materials across a multitude of sectors. The estimated Compound Annual Growth Rate (CAGR) for the PTFE market is projected to be approximately XX% during the forecast period (2025–2033). This growth is underpinned by several key factors, including the intrinsic properties of PTFE, such as its exceptional chemical inertness, thermal stability, and low coefficient of friction, which make it indispensable in demanding applications. Technological disruptions are also playing a pivotal role, with ongoing advancements in manufacturing processes leading to more efficient production and the development of novel PTFE-based composites with tailored properties. Consumer preferences are increasingly leaning towards durable, reliable, and high-performing materials, especially in sectors like automotive and electrical & electronics, where PTFE’s dielectric strength and wear resistance are highly valued. The competitive dynamics within the industry are characterized by a blend of established global players and emerging regional manufacturers, all vying for market share through product differentiation, strategic pricing, and customer-centric solutions. Market penetration of PTFE is expected to deepen, particularly in developing economies that are witnessing significant industrial expansion and infrastructure development. The increasing adoption of advanced manufacturing techniques and the growing need for materials that can withstand harsh operating conditions are further bolstering market expansion. The exploration of new applications in renewable energy sectors, such as in battery components and fuel cells, also represents a significant growth avenue. The trend towards miniaturization in electronics further boosts demand for PTFE's insulating properties.

Dominant Markets & Segments in Polytetrafluoroethylene Industry

The Electrical and Electronics segment is a dominant force within the Polytetrafluoroethylene (PTFE) industry, driven by the polymer's exceptional electrical insulation properties, thermal stability, and resistance to chemicals and moisture. This segment's dominance is further amplified by the continuous evolution of the electronics sector, characterized by miniaturization, increased power density, and the demand for high-reliability components. The Automotive industry represents another significant and rapidly growing segment. PTFE is extensively used in seals, gaskets, bearings, and fuel system components due to its low friction, chemical resistance to fuels and lubricants, and ability to withstand extreme temperatures. The push towards electric vehicles (EVs) is creating new opportunities for PTFE in battery components and high-voltage insulation. The Aerospace sector also heavily relies on PTFE for its lightweight yet robust properties, essential for critical components in aircraft and spacecraft, including seals, hoses, and wire insulation, where performance under extreme conditions is paramount.

- Electrical and Electronics Segment:

- Key Drivers: High demand for insulators in wires, cables, connectors, and circuit boards; miniaturization of electronic devices; increasing use in 5G infrastructure and semiconductor manufacturing.

- Dominance Factors: Superior dielectric strength, thermal resistance, and chemical inertness make it ideal for high-performance electronic components.

- Automotive Segment:

- Key Drivers: Growing automotive production globally; increasing adoption of EVs; demand for durable and high-performance components like seals, O-rings, and fuel hoses; lightweighting initiatives.

- Dominance Factors: Excellent chemical resistance to automotive fluids, low friction for reduced wear, and thermal stability in engine compartments.

- Aerospace Segment:

- Key Drivers: Stringent performance requirements for aircraft and spacecraft components; demand for lightweight yet durable materials; use in seals, gaskets, and electrical insulation in critical systems.

- Dominance Factors: Resistance to extreme temperatures, corrosive chemicals, and radiation, coupled with its low friction properties.

- Building and Construction Segment:

- Key Drivers: Growing infrastructure development and urbanization; use in architectural membranes, coatings, and sealants for weatherproofing and corrosion resistance.

- Dominance Factors: Durability, UV resistance, and low maintenance requirements.

- Industrial and Machinery Segment:

- Key Drivers: Need for robust components in chemical processing, manufacturing, and heavy machinery; use in pump seals, valve components, and conveyor belts for chemical resistance and low friction.

- Dominance Factors: Chemical inertness, high-temperature performance, and non-stick properties for continuous operation.

- Packaging Segment:

- Key Drivers: Demand for non-stick coatings in food processing equipment and packaging machinery; use in release films and tapes.

- Dominance Factors: Non-stick properties and FDA compliance for food contact applications.

Polytetrafluoroethylene Industry Product Developments

Product development in the Polytetrafluoroethylene (PTFE) industry is heavily focused on enhancing performance characteristics and expanding application areas. Innovations include the development of specialized PTFE grades with improved mechanical strength, enhanced thermal conductivity, and greater chemical resistance for demanding environments. Functionalized fluoropolymers, like those introduced by AGC Inc. with Fluon+ Composites, are enabling the creation of high-performance carbon fiber-reinforced thermoplastic composites for automotive and aerospace applications. Furthermore, research is ongoing to develop more environmentally sustainable PTFE manufacturing processes and explore novel applications in areas such as advanced battery technologies, as evidenced by Daikin Industries Ltd.'s investment in TeraWatt Technology, aiming to boost lithium-ion battery performance.

Report Scope & Segmentation Analysis

This report segments the Polytetrafluoroethylene (PTFE) market by End User Industry. The primary segments analyzed include:

- Aerospace: This segment is expected to witness steady growth driven by the demand for lightweight, high-performance materials in aircraft and spacecraft. Projected market size for this segment is estimated to be in the range of XX Million to XX Million by 2033.

- Automotive: This segment is anticipated to be a significant growth driver, particularly with the rise of electric vehicles and the increasing use of advanced materials for improved efficiency and durability. Market size is projected to range from XX Million to XX Million by 2033.

- Building and Construction: Growth in this segment is linked to infrastructure development and the demand for durable, weather-resistant materials in architectural applications. Estimated market size is between XX Million and XX Million by 2033.

- Electrical and Electronics: This segment is expected to continue its strong growth trajectory, fueled by the expansion of the electronics industry and the need for high-performance insulation and dielectric materials. Market size is forecast to be XX Million to XX Million by 2033.

- Industrial and Machinery: Demand in this segment is driven by the need for chemical-resistant and low-friction components in various industrial processes. Projected market size is XX Million to XX Million by 2033.

- Packaging: This segment's growth is tied to the food processing and packaging machinery industries, leveraging PTFE's non-stick properties. Estimated market size is XX Million to XX Million by 2033.

- Other End-user Industries: This encompasses diverse applications in medical devices, textiles, and renewable energy, expected to contribute to the overall market expansion.

Key Drivers of Polytetrafluoroethylene Industry Growth

The Polytetrafluoroethylene (PTFE) industry's growth is propelled by several synergistic factors. Technologically, the inherent properties of PTFE—such as exceptional chemical inertness, thermal stability, non-stick surface, and low friction—make it indispensable in high-performance applications where other materials fail. Economically, the expansion of key end-user industries like automotive, aerospace, and electronics, especially in emerging economies, directly translates to increased demand for PTFE. Regulatory tailwinds, while also presenting challenges, are pushing for the development of more durable and environmentally compliant PTFE solutions, fostering innovation and new market opportunities. For instance, the growing demand for high-efficiency components in renewable energy sectors and advanced medical devices further fuels market expansion. The increasing adoption of advanced manufacturing technologies also contributes to the growth by enabling more precise and cost-effective PTFE component production.

Challenges in the Polytetrafluoroethylene Industry Sector

Despite its widespread utility, the Polytetrafluoroethylene (PTFE) industry faces significant challenges. Regulatory hurdles, particularly concerning the environmental impact and potential health concerns associated with certain PFAS compounds, are leading to increased scrutiny and stricter regulations globally. This necessitates substantial investment in research and development for safer alternatives and cleaner production methods. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production costs and availability. Competitive pressures from alternative materials that offer comparable functionalities at lower price points, albeit with compromises in performance, also pose a threat. The high energy consumption associated with PTFE manufacturing further adds to production costs and environmental concerns, prompting the industry to explore more energy-efficient processes.

Emerging Opportunities in Polytetrafluoroethylene Industry

Emerging opportunities in the Polytetrafluoroethylene (PTFE) industry lie in the development of advanced PTFE composites with tailored properties for niche applications. The burgeoning renewable energy sector, particularly in energy storage solutions like advanced batteries and fuel cells, presents a significant avenue for growth. Growing demand for high-performance materials in medical devices, including biocompatible implants and surgical instruments, also offers considerable potential. Furthermore, the increasing focus on sustainable manufacturing and the development of bio-based or recycled PTFE materials are creating new market frontiers. The expansion of 5G infrastructure and the continued miniaturization of electronic devices will also drive demand for high-quality PTFE insulation and components.

Leading Players in the Polytetrafluoroethylene Industry Market

- Zhejiang Juhua Co Ltd

- Daikin Industries Ltd

- Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- 3M

- HaloPolymer

- Shanghai Huayi 3F New Materials Co Ltd

- The Chemours Company

- Sinochem

- AGC Inc

Key Developments in Polytetrafluoroethylene Industry Industry

- October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.

- July 2022: Daikin Industries Ltd. invested in a US-based start-up company, TeraWatt Technology, to develop applications and further enhance battery technologies for lithium-ion batteries.

- February 2022: Gujarat Fluorochemicals Limited invested in the expansion of its PTFE capacity in its integrated manufacturing facility at Dahej in India. The PTFE capacity is expected to be operational in 2023.

Strategic Outlook for Polytetrafluoroethylene Industry Market

The strategic outlook for the Polytetrafluoroethylene (PTFE) market is characterized by continued innovation and expansion into high-growth sectors. Companies are focusing on developing advanced PTFE formulations that meet the stringent requirements of emerging technologies such as electric vehicles, renewable energy systems, and next-generation electronics. Investment in sustainable manufacturing practices and the exploration of circular economy principles will be crucial for long-term market viability and regulatory compliance. Strategic partnerships and mergers, driven by the need to acquire specialized expertise and broaden market reach, are expected to shape the competitive landscape. The report forecasts significant growth driven by the inherent superiority of PTFE's properties coupled with a proactive approach to addressing environmental concerns and evolving market demands, ensuring its continued relevance and importance across diverse industrial applications.

Polytetrafluoroethylene Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

Polytetrafluoroethylene Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polytetrafluoroethylene Industry Regional Market Share

Geographic Coverage of Polytetrafluoroethylene Industry

Polytetrafluoroethylene Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application of PFA Resin in the Semiconductor Industry; Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications

- 3.3. Market Restrains

- 3.3.1. Environmental and Health Hazards Associated With PFA; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Building and Construction

- 6.1.4. Electrical and Electronics

- 6.1.5. Industrial and Machinery

- 6.1.6. Packaging

- 6.1.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Building and Construction

- 7.1.4. Electrical and Electronics

- 7.1.5. Industrial and Machinery

- 7.1.6. Packaging

- 7.1.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Building and Construction

- 8.1.4. Electrical and Electronics

- 8.1.5. Industrial and Machinery

- 8.1.6. Packaging

- 8.1.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Building and Construction

- 9.1.4. Electrical and Electronics

- 9.1.5. Industrial and Machinery

- 9.1.6. Packaging

- 9.1.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Polytetrafluoroethylene Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Building and Construction

- 10.1.4. Electrical and Electronics

- 10.1.5. Industrial and Machinery

- 10.1.6. Packaging

- 10.1.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhejiang Juhua Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daikin Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dongyue Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gujarat Fluorochemicals Limited (GFL)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HaloPolymer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanghai Huayi 3F New Materials Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Chemours Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinochem

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AGC Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Juhua Co Ltd

List of Figures

- Figure 1: Global Polytetrafluoroethylene Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Polytetrafluoroethylene Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 3: North America Polytetrafluoroethylene Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Polytetrafluoroethylene Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Polytetrafluoroethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Polytetrafluoroethylene Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 7: South America Polytetrafluoroethylene Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America Polytetrafluoroethylene Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Polytetrafluoroethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polytetrafluoroethylene Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 11: Europe Polytetrafluoroethylene Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Polytetrafluoroethylene Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Polytetrafluoroethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Polytetrafluoroethylene Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa Polytetrafluoroethylene Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa Polytetrafluoroethylene Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Polytetrafluoroethylene Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polytetrafluoroethylene Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific Polytetrafluoroethylene Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific Polytetrafluoroethylene Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Polytetrafluoroethylene Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 2: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 9: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 25: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 33: Global Polytetrafluoroethylene Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Polytetrafluoroethylene Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polytetrafluoroethylene Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Polytetrafluoroethylene Industry?

Key companies in the market include Zhejiang Juhua Co Ltd, Daikin Industries Ltd, Dongyue Group, Gujarat Fluorochemicals Limited (GFL), 3M, HaloPolymer, Shanghai Huayi 3F New Materials Co Ltd, The Chemours Company, Sinochem, AGC Inc.

3. What are the main segments of the Polytetrafluoroethylene Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application of PFA Resin in the Semiconductor Industry; Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Environmental and Health Hazards Associated With PFA; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.July 2022: Daikin Industries Ltd. invested in a US-based start-up company, TeraWatt Technology, to develop applications and further enhance battery technologies for lithium-ion batteries.February 2022: Gujarat Fluorochemicals Limited invested in the expansion of its PTFE capacity in its integrated manufacturing facility at Dahej in India. The PTFE capacity is expected to be operational in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polytetrafluoroethylene Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polytetrafluoroethylene Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polytetrafluoroethylene Industry?

To stay informed about further developments, trends, and reports in the Polytetrafluoroethylene Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence