Key Insights

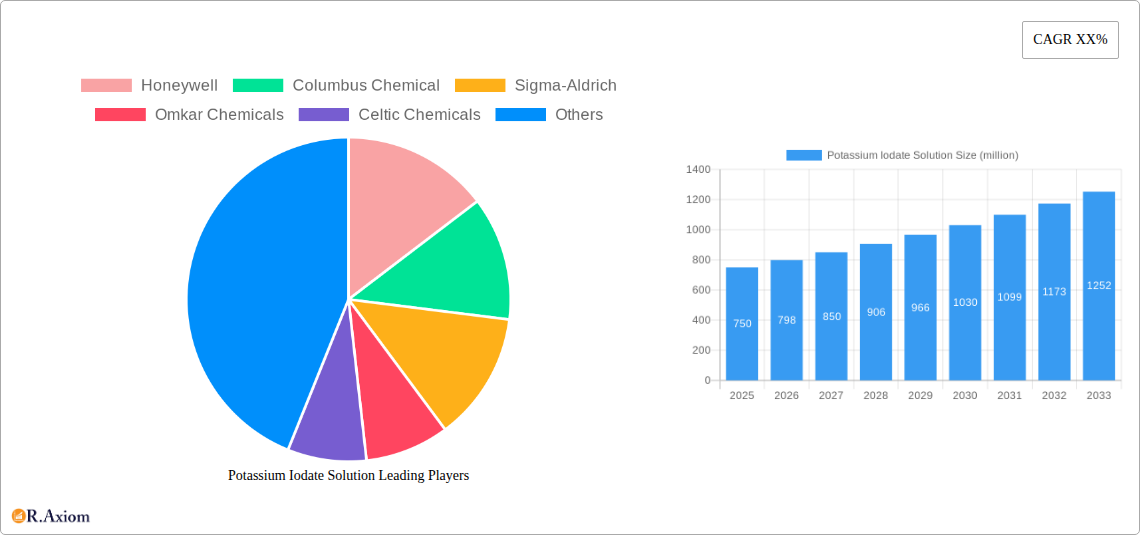

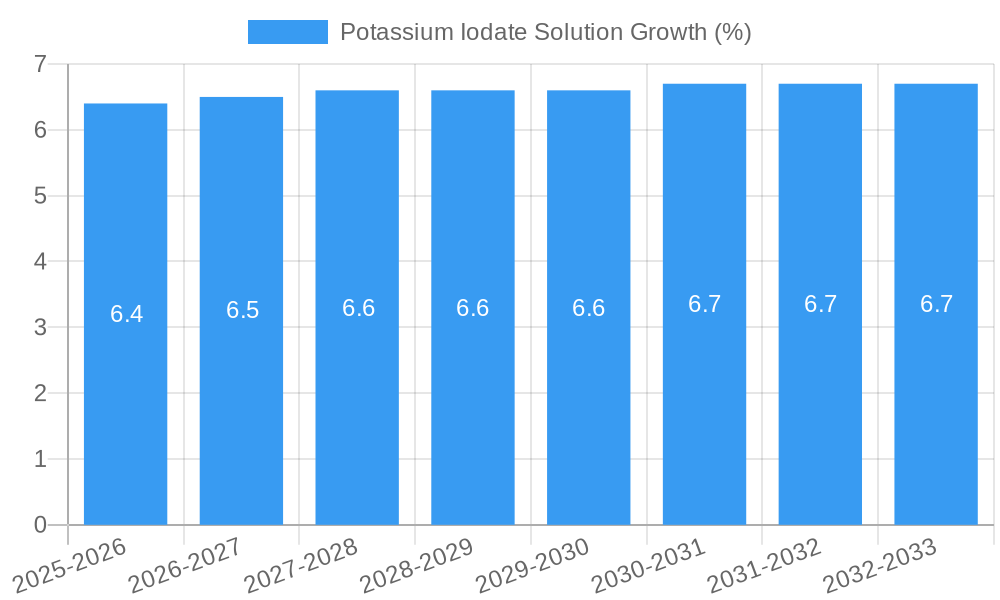

The global Potassium Iodate Solution market is poised for substantial growth, estimated at a market size of approximately $750 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This upward trajectory is primarily fueled by the escalating demand from the medical and biological sectors, where potassium iodate solutions are indispensable for diagnostic assays, analytical procedures, and specialized reagent preparations. The increasing prevalence of chronic diseases and the continuous advancements in pharmaceutical research and development are significant drivers for this growth. Furthermore, its application in water treatment as a disinfectant and in the food industry as a dough conditioner, though smaller segments, contribute to market expansion. The market's value is denominated in millions of US dollars, reflecting the significant financial investment and economic activity within this sector.

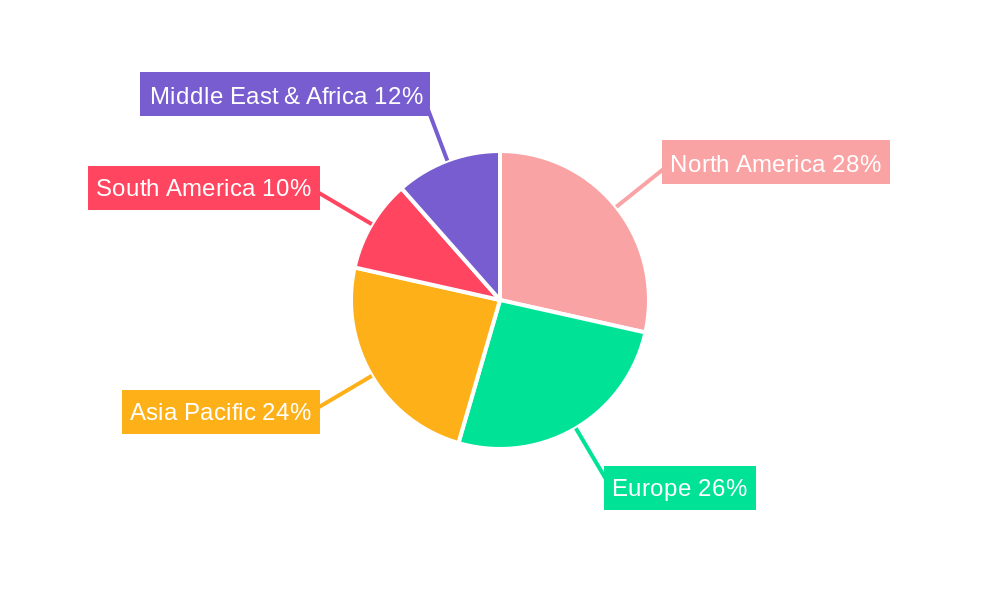

The market is characterized by a robust competitive landscape with key players like Honeywell, Columbus Chemical, Sigma-Aldrich, and Fisher Scientific actively engaged in innovation and market expansion. These companies are focusing on enhancing product purity and developing customized solutions to meet the stringent requirements of various applications. The report segments the market based on purity levels—Analytical Purity, Chemically Purity, and Premium Purity—each catering to specific industrial demands. Geographically, North America and Europe currently hold significant market shares due to advanced healthcare infrastructure and strong R&D investments. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by a burgeoning pharmaceutical industry, increasing healthcare spending, and a growing demand for high-purity chemicals. Emerging restraints include stringent regulatory compliances for chemical manufacturing and the volatility in raw material prices, which could impact profit margins. Despite these challenges, the overarching positive trends in healthcare and biotechnology assure a dynamic and expanding market for potassium iodate solutions.

Potassium Iodate Solution Market Concentration & Innovation

The Potassium Iodate Solution market demonstrates a moderate to high concentration, characterized by the presence of established global players and a growing number of regional suppliers. Key companies like Honeywell, Columbus Chemical, Sigma-Aldrich, and Fisher Scientific hold significant market shares, leveraging their extensive distribution networks and strong brand recognition. Innovation is primarily driven by the increasing demand for high-purity analytical-grade potassium iodate solutions for advanced laboratory research, quality control in the pharmaceutical industry, and specialized biological applications. Regulatory frameworks, particularly those governing pharmaceutical manufacturing and environmental standards, play a crucial role in shaping product development and market access. The development of novel analytical techniques and stricter quality assurance protocols are pushing the demand for Potassium Iodate Solutions with extremely low impurity levels. Product substitutes, while existing, are often less effective or cost-prohibitive for specific high-precision applications, thus maintaining the demand for potassium iodate. End-user trends indicate a growing preference for ready-to-use, certified solutions that minimize preparation errors and ensure batch-to-batch consistency. Mergers and acquisitions (M&A) activities are anticipated to rise as larger players seek to consolidate their market position, acquire innovative technologies, or expand their geographical reach. Deal values in M&A are expected to range from tens to hundreds of million dollars, reflecting strategic consolidation and portfolio expansion.

- Market Share Distribution: Dominated by a few key players, with significant contributions from mid-sized and emerging companies.

- Innovation Drivers: Demand for analytical purity, advancements in scientific instrumentation, stricter quality control mandates in pharmaceuticals, and research in novel biological applications.

- Regulatory Landscape: Influenced by FDA, EMA, and other national regulatory bodies governing chemical purity and safety.

- Product Substitutes: Limited for high-precision analytical applications, but some alternatives exist for less demanding uses.

- End-User Preferences: Increasing demand for pre-made, certified, and traceable solutions.

- M&A Activity: Expected to increase, targeting companies with specialized product offerings or strong regional presence. M&A deal values are projected to range from xx million to xx million.

Potassium Iodate Solution Industry Trends & Insights

The global Potassium Iodate Solution market is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of approximately 5.2% from 2019 to 2033. This upward trajectory is fueled by several key market growth drivers, primarily stemming from the expanding life sciences sector, including pharmaceutical research and development, diagnostics, and biotechnology. The increasing prevalence of chronic diseases and the associated demand for advanced drug discovery and manufacturing processes directly translate into a higher requirement for high-purity analytical reagents like potassium iodate solutions. Furthermore, advancements in analytical chemistry and the growing adoption of sophisticated laboratory techniques, such as titration and spectroscopy, are significant contributors to market expansion. The trend towards precision medicine and personalized healthcare necessitates highly accurate and reliable reagents for accurate diagnosis and treatment efficacy testing, thereby boosting demand for chemically pure and premium purity potassium iodate solutions.

Technological disruptions, while not revolutionary in the production of potassium iodate itself, are impacting its application. The development of automated laboratory systems and microfluidic devices is creating a need for standardized, precisely formulated solutions that can be seamlessly integrated into these workflows. This is leading to a demand for custom formulations and higher levels of quality control. Consumer preferences are evolving towards suppliers offering comprehensive technical support, efficient supply chains, and adherence to stringent international quality standards like ISO certifications. Traceability and certification of purity are becoming paramount for end-users in highly regulated industries.

Competitive dynamics in the market are characterized by a blend of global market leaders, regional specialists, and niche manufacturers. The market penetration of potassium iodate solutions is already high in developed regions due to their established research infrastructure and stringent quality requirements. However, emerging economies are witnessing increasing penetration driven by growing investments in healthcare and research. The competitive landscape is also influenced by factors such as pricing strategies, product quality, reliability of supply, and the breadth of the product portfolio offered by manufacturers. Companies are increasingly focusing on developing solutions with enhanced stability and shelf-life, catering to the needs of laboratories that may not have frequent or large-scale usage. The market is also seeing a trend towards sustainable manufacturing practices and eco-friendly packaging, aligning with broader industry sustainability goals. The estimated market size in 2025 is projected to reach xx billion, with significant contributions from all purity grades.

Dominant Markets & Segments in Potassium Iodate Solution

The Medical application segment is poised to dominate the Potassium Iodate Solution market, driven by its critical role in pharmaceutical quality control, drug formulation, and in vitro diagnostic (IVD) kit manufacturing. Within the Medical segment, the Analytical Purity type will likely witness the highest demand, as stringent regulatory requirements for pharmaceuticals necessitate extremely high purity reagents for accurate testing and validation of drug products. The forecast period of 2025–2033 is expected to see sustained growth in this sub-segment.

Leading Region Analysis: North America, particularly the United States, is expected to remain a dominant market for Potassium Iodate Solution.

- Key Drivers in North America:

- Economic Policies: Robust government funding for scientific research and development, including significant investments in the biotechnology and pharmaceutical sectors.

- Infrastructure: Well-established laboratory infrastructure, presence of leading research institutions, and a high concentration of pharmaceutical and chemical companies.

- Regulatory Framework: Strict adherence to FDA regulations, which mandates high purity standards for reagents used in drug manufacturing and testing.

- Technological Advancements: Early adoption of advanced analytical techniques and a strong focus on innovation within the life sciences.

Dominance Analysis in Specific Segments:

Application: Medical: The medical application segment's dominance is underscored by the continuous growth of the pharmaceutical industry, driven by an aging global population, increasing healthcare expenditure, and the constant need for new drug development. Pharmaceutical companies rely heavily on potassium iodate solutions for various quality control procedures, including titrimetric assays to determine the purity and concentration of active pharmaceutical ingredients (APIs) and excipients. Its use in the production of certain diagnostic reagents also contributes to its prominence. The estimated market size for the Medical segment in 2025 is xx million.

Types: Analytical Purity: The demand for analytical purity is paramount in the medical and research sectors. This grade of potassium iodate is characterized by extremely low levels of impurities, ensuring the accuracy and reliability of analytical results. For instance, in pharmaceutical quality control, even trace impurities can lead to erroneous assay results, potentially impacting drug safety and efficacy. The increasing stringency of regulatory bodies worldwide, such as the FDA and EMA, further solidifies the need for analytical purity. Manufacturers are investing in advanced purification techniques and rigorous testing protocols to meet these exacting standards. The market share for Analytical Purity is projected to be xx% of the total market in 2025.

Application: Biology: The biology segment, encompassing molecular biology, cell culture, and biochemical research, also presents significant growth potential. Potassium iodate finds applications in specific biochemical assays and as a reagent in certain staining or fixation processes. As research in areas like genomics, proteomics, and synthetic biology expands, the demand for specialized reagents, including high-purity potassium iodate solutions, is expected to rise. The growth in the biotechnology sector, coupled with increased funding for academic research, will be a key driver.

Types: Chemically Purity: While analytical purity caters to the most stringent requirements, chemically pure grades offer a balance of purity and cost-effectiveness, making them suitable for a wider range of general laboratory applications and less demanding industrial processes. This segment is expected to witness steady growth, supported by its use in educational institutions and various industrial quality control labs that do not require the ultra-high purity of analytical grades.

Application: Others: The "Others" category encompasses a diverse range of applications, including industrial quality control, environmental testing, and some niche manufacturing processes. While individually these may represent smaller markets, collectively they contribute to the overall demand. For example, in environmental monitoring, potassium iodate can be used in certain analytical methods for detecting specific pollutants. The growth in these diverse industrial sectors will indirectly drive demand for potassium iodate solutions.

Types: Premium Purity: Premium purity grades are designed for advanced applications that demand superior performance and reliability beyond standard analytical grades. This could include specialized research in advanced materials science, high-end analytical instrumentation, or critical components in complex scientific experiments. As scientific research pushes boundaries, the need for such specialized reagents will increase.

Potassium Iodate Solution Product Developments

Product developments in the Potassium Iodate Solution market are primarily focused on enhancing purity, stability, and ease of use. Manufacturers are investing in advanced purification techniques to achieve even lower impurity profiles, meeting the ever-increasing demands from the pharmaceutical and analytical sectors. The development of ready-to-use, certified standard solutions with guaranteed shelf-life and precise concentrations is a key trend, simplifying laboratory workflows and reducing potential errors. These developments offer significant competitive advantages by catering to the evolving needs of researchers and quality control professionals, ensuring greater accuracy and reproducibility in their experiments and analyses. The focus on specialized formulations for specific applications, such as those in biological research or advanced materials testing, is also a growing area of innovation.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Potassium Iodate Solution market, segmented by Application, Type, and Region.

Application: Medical: This segment focuses on the use of Potassium Iodate Solution in pharmaceutical manufacturing, drug discovery, diagnostics, and clinical research. Growth projections for this segment are robust, driven by the expanding healthcare sector and stringent quality control requirements in drug development. The market size is estimated to be substantial, with high competitive intensity due to the presence of major pharmaceutical and chemical suppliers.

Application: Biology: This segment covers the application of Potassium Iodate Solution in academic research, biotechnology, molecular biology, and life sciences laboratories. Growth is anticipated to be steady, supported by ongoing advancements in biological sciences and increasing research funding. Market size is moderate, with a growing number of specialized suppliers catering to research needs.

Application: Others: This segment includes diverse industrial applications such as environmental monitoring, industrial quality control, and various niche manufacturing processes. Growth in this segment will be influenced by the expansion of these respective industries. Market size is varied, with opportunities arising from emerging industrial applications.

Types: Analytical Purity: This segment focuses on Potassium Iodate Solution with the highest level of purity, essential for precise analytical testing and pharmaceutical applications. Growth projections are strong, driven by stringent regulatory demands and the pursuit of accuracy in research. Market size is significant, with high competition among suppliers focusing on quality and certification.

Types: Chemically Purity: This segment encompasses Potassium Iodate Solution suitable for general laboratory use and industrial applications where high, but not ultra-high, purity is required. Growth is expected to be steady, supported by its widespread use in various sectors. Market size is substantial, offering opportunities for cost-effective solutions.

Types: Premium Purity: This segment targets specialized research and advanced analytical applications requiring superior performance and reliability. Growth is projected to be niche but significant, driven by cutting-edge scientific research. Market size is smaller but commands premium pricing.

Types: Others: This category includes various other grades of Potassium Iodate Solution, tailored for specific industrial or research needs not covered by the primary categories. Market size and growth will depend on the specific applications emerging within this segment.

Key Drivers of Potassium Iodate Solution Growth

The growth of the Potassium Iodate Solution market is propelled by a confluence of powerful drivers. The relentless expansion of the pharmaceutical and biotechnology sectors stands as a primary catalyst, with increased R&D spending and the development of novel therapeutics demanding high-purity reagents for drug synthesis, quality control, and analytical testing. Advances in analytical chemistry and instrumentation, such as sophisticated titration systems and spectroscopic techniques, necessitate reliable and precisely formulated potassium iodate solutions for accurate measurements. Furthermore, a growing global emphasis on environmental monitoring and testing is creating demand for reagents used in various analytical procedures to detect and quantify pollutants. Stringent regulatory frameworks across industries, particularly in pharmaceuticals and food safety, mandate the use of high-quality, traceable reagents, thereby fostering the demand for certified analytical and chemically pure grades of potassium iodate solutions.

Challenges in the Potassium Iodate Solution Sector

Despite the promising growth outlook, the Potassium Iodate Solution sector faces several significant challenges. Fluctuations in raw material prices, particularly iodine, can impact production costs and overall market pricing, creating volatility for manufacturers. Stringent regulatory hurdles and evolving compliance standards across different regions can be complex and costly to navigate, potentially delaying product launches or market entry. Supply chain disruptions, whether due to geopolitical events, natural disasters, or logistical issues, can lead to shortages and impact the availability of critical raw materials or finished products. Intense competitive pressure, especially from established global players and emerging low-cost manufacturers, can lead to price erosion and pressure on profit margins. Finally, technical challenges in achieving ultra-high purity consistently at a commercial scale can limit the availability of the highest grades and pose barriers to entry for new players.

Emerging Opportunities in Potassium Iodate Solution

The Potassium Iodate Solution market is ripe with emerging opportunities. The growing demand for personalized medicine and advanced diagnostics is creating a need for highly specialized and ultra-pure reagents, opening doors for premium purity grades. The expansion of biotechnology research, particularly in areas like genomics and synthetic biology, is fueling the demand for diverse and precisely formulated solutions. As emerging economies continue to invest heavily in healthcare and scientific infrastructure, they represent significant untapped markets for potassium iodate solutions. Furthermore, the development of novel applications in materials science and advanced chemical synthesis offers new avenues for growth. Companies that can offer sustainable manufacturing practices and eco-friendly packaging solutions are likely to gain a competitive edge as environmental consciousness grows among end-users.

Leading Players in the Potassium Iodate Solution Market

- Honeywell

- Columbus Chemical

- Sigma-Aldrich

- Omkar Chemicals

- Celtic Chemicals

- Nile Chemicals

- Cfm Oskar Tropitzsch

- Infinium Pharmachem

- Materion

- Fisher Scientific

- Iofina

- Tocean Iodine Products

- Triveni Chemicals

- Adani Pharma

- ProChem

- Samrat Remedies Limited

- Santa Cruz Biotechnology

- U-Win Chemical Technology

- Aladdin

Key Developments in Potassium Iodate Solution Industry

- 2023 (Q4): Honeywell launches a new line of ultra-high purity Potassium Iodate solutions, catering to advanced pharmaceutical analysis and research.

- 2023 (Q3): Columbus Chemical expands its manufacturing capacity for Chemically Pure Potassium Iodate to meet growing industrial demand.

- 2023 (Q2): Sigma-Aldrich introduces enhanced packaging for its Potassium Iodate solutions, focusing on improved stability and user safety.

- 2023 (Q1): Omkar Chemicals announces strategic partnerships to increase its distribution network in Southeast Asia for its diverse range of Potassium Iodate products.

- 2022 (Q4): Iofina completes the acquisition of a smaller iodine processing facility, bolstering its raw material supply chain for Potassium Iodate production.

- 2022 (Q3): Materion showcases its specialized Potassium Iodate formulations for materials science applications at a major industry exhibition.

- 2022 (Q2): Fisher Scientific expands its online catalog with a comprehensive range of Potassium Iodate solutions from various trusted manufacturers.

Strategic Outlook for Potassium Iodate Solution Market

The strategic outlook for the Potassium Iodate Solution market is overwhelmingly positive, driven by sustained demand from critical sectors and ongoing technological advancements. Key growth catalysts include the expanding global pharmaceutical industry, the continuous innovation in life sciences research, and the increasing adoption of stringent quality control measures across various industries. Strategic focus for market players should be on strengthening their research and development capabilities to offer ultra-high purity grades and specialized formulations that meet evolving analytical and biological needs. Expanding geographical reach, particularly into emerging economies with growing healthcare and industrial sectors, presents a significant opportunity. Furthermore, forging strategic partnerships and collaborations to enhance supply chain resilience and customer service will be crucial for sustained success in this dynamic market. Companies that can adapt to evolving regulatory landscapes and embrace sustainable practices will be well-positioned for long-term growth.

Potassium Iodate Solution Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Biology

- 1.3. Others

-

2. Types

- 2.1. Analytical Purity

- 2.2. Chemically Purity

- 2.3. Premium Purity

- 2.4. Others

Potassium Iodate Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Potassium Iodate Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Biology

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Analytical Purity

- 5.2.2. Chemically Purity

- 5.2.3. Premium Purity

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Biology

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Analytical Purity

- 6.2.2. Chemically Purity

- 6.2.3. Premium Purity

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Biology

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Analytical Purity

- 7.2.2. Chemically Purity

- 7.2.3. Premium Purity

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Biology

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Analytical Purity

- 8.2.2. Chemically Purity

- 8.2.3. Premium Purity

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Biology

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Analytical Purity

- 9.2.2. Chemically Purity

- 9.2.3. Premium Purity

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Potassium Iodate Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Biology

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Analytical Purity

- 10.2.2. Chemically Purity

- 10.2.3. Premium Purity

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Columbus Chemical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sigma-Aldrich

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Omkar Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Celtic Chemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nile Chemicals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cfm Oskar Tropitzsch

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Infinium Pharmachem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Materion

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fisher Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Iofina

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tocean Iodine Products

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Triveni Chemicals

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Adani Pharma

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ProChem

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Samrat Remedies Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Santa Cruz Biotechnology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 U-Win Chemical Technology

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Aladdin

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Honeywell

List of Figures

- Figure 1: Global Potassium Iodate Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Potassium Iodate Solution Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Potassium Iodate Solution Revenue (million), by Application 2024 & 2032

- Figure 4: North America Potassium Iodate Solution Volume (K), by Application 2024 & 2032

- Figure 5: North America Potassium Iodate Solution Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Potassium Iodate Solution Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Potassium Iodate Solution Revenue (million), by Types 2024 & 2032

- Figure 8: North America Potassium Iodate Solution Volume (K), by Types 2024 & 2032

- Figure 9: North America Potassium Iodate Solution Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Potassium Iodate Solution Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Potassium Iodate Solution Revenue (million), by Country 2024 & 2032

- Figure 12: North America Potassium Iodate Solution Volume (K), by Country 2024 & 2032

- Figure 13: North America Potassium Iodate Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Potassium Iodate Solution Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Potassium Iodate Solution Revenue (million), by Application 2024 & 2032

- Figure 16: South America Potassium Iodate Solution Volume (K), by Application 2024 & 2032

- Figure 17: South America Potassium Iodate Solution Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Potassium Iodate Solution Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Potassium Iodate Solution Revenue (million), by Types 2024 & 2032

- Figure 20: South America Potassium Iodate Solution Volume (K), by Types 2024 & 2032

- Figure 21: South America Potassium Iodate Solution Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Potassium Iodate Solution Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Potassium Iodate Solution Revenue (million), by Country 2024 & 2032

- Figure 24: South America Potassium Iodate Solution Volume (K), by Country 2024 & 2032

- Figure 25: South America Potassium Iodate Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Potassium Iodate Solution Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Potassium Iodate Solution Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Potassium Iodate Solution Volume (K), by Application 2024 & 2032

- Figure 29: Europe Potassium Iodate Solution Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Potassium Iodate Solution Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Potassium Iodate Solution Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Potassium Iodate Solution Volume (K), by Types 2024 & 2032

- Figure 33: Europe Potassium Iodate Solution Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Potassium Iodate Solution Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Potassium Iodate Solution Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Potassium Iodate Solution Volume (K), by Country 2024 & 2032

- Figure 37: Europe Potassium Iodate Solution Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Potassium Iodate Solution Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Potassium Iodate Solution Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Potassium Iodate Solution Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Potassium Iodate Solution Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Potassium Iodate Solution Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Potassium Iodate Solution Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Potassium Iodate Solution Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Potassium Iodate Solution Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Potassium Iodate Solution Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Potassium Iodate Solution Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Potassium Iodate Solution Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Potassium Iodate Solution Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Potassium Iodate Solution Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Potassium Iodate Solution Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Potassium Iodate Solution Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Potassium Iodate Solution Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Potassium Iodate Solution Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Potassium Iodate Solution Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Potassium Iodate Solution Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Potassium Iodate Solution Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Potassium Iodate Solution Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Potassium Iodate Solution Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Potassium Iodate Solution Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Potassium Iodate Solution Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Potassium Iodate Solution Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Potassium Iodate Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Potassium Iodate Solution Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Potassium Iodate Solution Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Potassium Iodate Solution Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Potassium Iodate Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Potassium Iodate Solution Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Potassium Iodate Solution Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Potassium Iodate Solution Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Potassium Iodate Solution Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Potassium Iodate Solution Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Potassium Iodate Solution Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Potassium Iodate Solution Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Potassium Iodate Solution Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Potassium Iodate Solution Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Potassium Iodate Solution Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Potassium Iodate Solution Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Potassium Iodate Solution Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Potassium Iodate Solution Volume K Forecast, by Country 2019 & 2032

- Table 81: China Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Potassium Iodate Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Potassium Iodate Solution Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Potassium Iodate Solution?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Potassium Iodate Solution?

Key companies in the market include Honeywell, Columbus Chemical, Sigma-Aldrich, Omkar Chemicals, Celtic Chemicals, Nile Chemicals, Cfm Oskar Tropitzsch, Infinium Pharmachem, Materion, Fisher Scientific, Iofina, Tocean Iodine Products, Triveni Chemicals, Adani Pharma, ProChem, Samrat Remedies Limited, Santa Cruz Biotechnology, U-Win Chemical Technology, Aladdin.

3. What are the main segments of the Potassium Iodate Solution?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Potassium Iodate Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Potassium Iodate Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Potassium Iodate Solution?

To stay informed about further developments, trends, and reports in the Potassium Iodate Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence