Key Insights

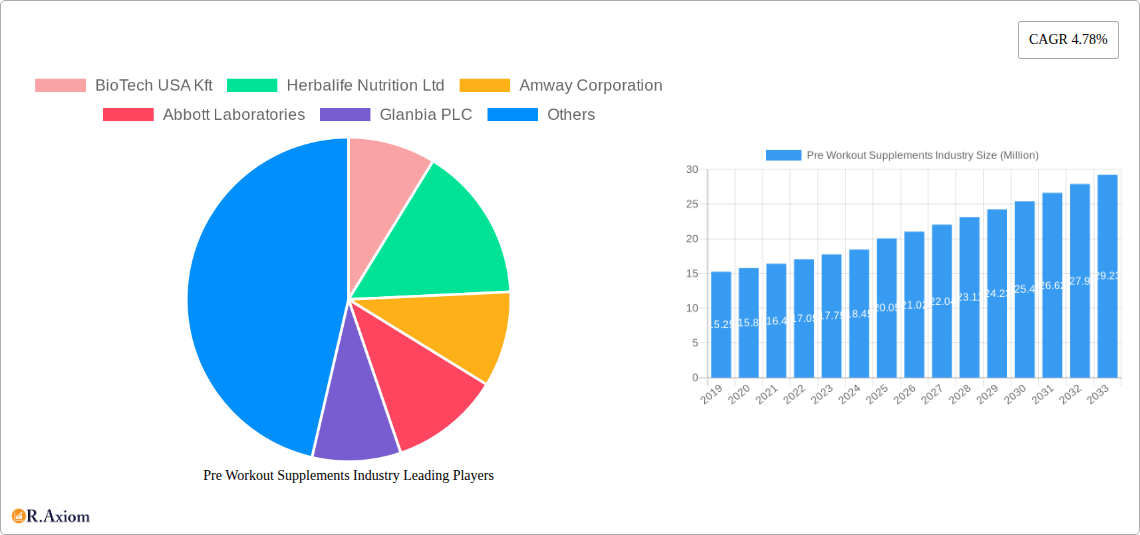

The global Pre Workout Supplements market is poised for robust growth, projected to reach an estimated \$20.05 million in market size by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.78% anticipated throughout the forecast period of 2025-2033. This expansion is fueled by an increasing consumer focus on health and fitness, leading to a greater demand for products that enhance athletic performance and energy levels. The rising popularity of gym culture, competitive sports, and at-home fitness routines further propels the market forward. Key drivers include growing consumer awareness of the benefits of pre-workout supplements, such as improved endurance, focus, and strength, alongside innovations in product formulations offering diverse flavors and effective ingredient combinations. The accessibility of these supplements through various distribution channels, from traditional retail to burgeoning online platforms, also significantly contributes to market penetration.

Pre Workout Supplements Industry Market Size (In Million)

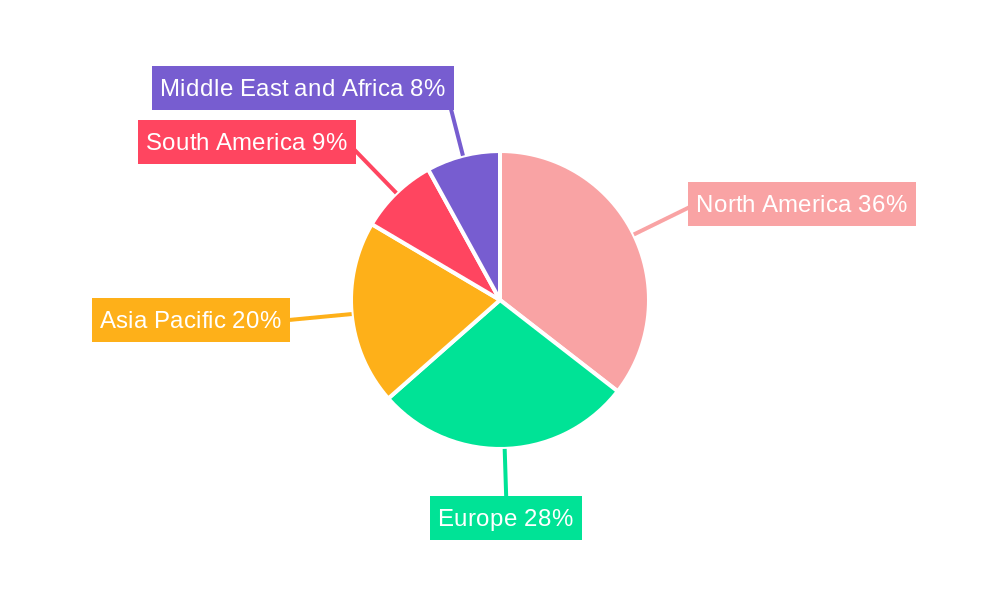

The market is segmented across several key product types, with "Powder" currently holding a dominant position due to its cost-effectiveness and versatility. However, "Capsule/Tablet" and "Drinks" are experiencing notable growth due to their convenience and ease of consumption. Distribution channels are also diverse, with "Hypermarket/Supermarket" and "Specialty Stores" catering to a broad consumer base, while "Online Retail Stores" are rapidly gaining traction, offering unparalleled convenience and a wider selection. Geographically, North America is expected to lead the market, driven by high disposable incomes and a deeply ingrained fitness culture. The Asia Pacific region, however, presents the most promising growth potential due to rapidly developing economies, an increasing middle class, and a growing awareness of health and wellness trends. Emerging challenges include regulatory scrutiny over ingredient claims and potential consumer concerns regarding side effects, necessitating a focus on transparent labeling and scientifically-backed formulations by manufacturers.

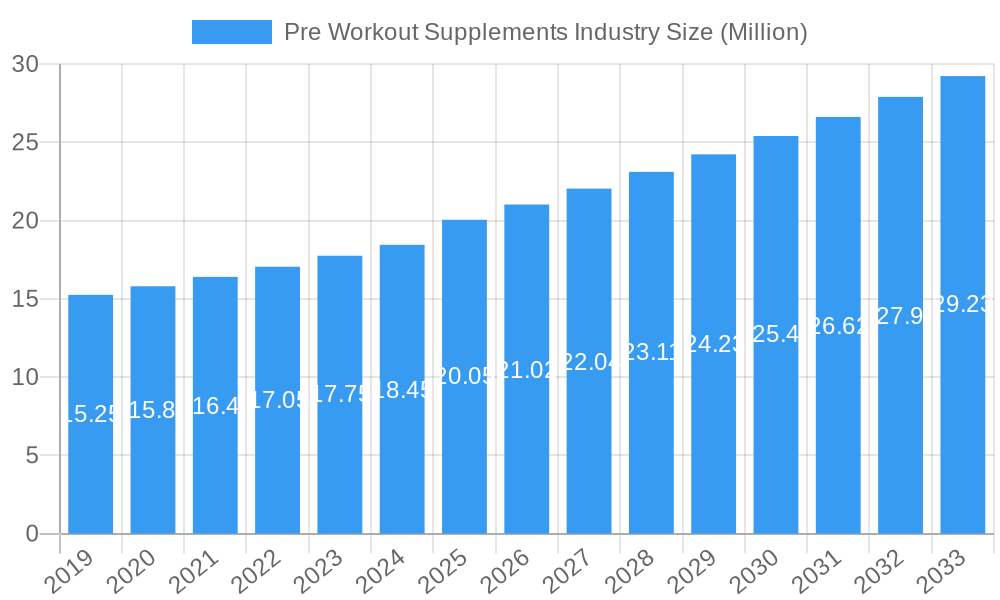

Pre Workout Supplements Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Pre Workout Supplements Industry, encompassing market dynamics, key trends, dominant segments, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving market.

Pre Workout Supplements Industry Market Concentration & Innovation

The Pre Workout Supplements Industry exhibits a moderate to high level of market concentration, with a significant presence of both established giants and agile emerging players. Innovation remains a critical differentiator, driven by consumer demand for enhanced performance, faster recovery, and cleaner ingredient profiles. Regulatory frameworks, while essential for consumer safety, can also act as a barrier to entry for new formulations. Product substitutes, ranging from energy drinks to traditional dietary approaches, constantly challenge market share. End-user trends are increasingly leaning towards natural ingredients, personalized nutrition, and convenient formats. Mergers and Acquisitions (M&A) activities are projected to continue, with an estimated $2,000 Million in deal value over the forecast period, as larger players seek to acquire innovative brands and expand their product portfolios. Key innovation drivers include the development of stimulant-free options, sustained-release formulas, and the integration of nootropics for cognitive enhancement.

- Market Share Dynamics: Leading companies are expected to maintain substantial market shares, with a collective holding of approximately 65% by 2025.

- M&A Activity: Anticipated to increase by 15% year-on-year, driven by consolidation and strategic expansions.

- Innovation Focus: Development of science-backed formulations and transparency in ingredient sourcing.

Pre Workout Supplements Industry Industry Trends & Insights

The Pre Workout Supplements Industry is poised for robust growth, fueled by an escalating awareness of health and fitness, coupled with the increasing popularity of sports and athletic activities globally. The market penetration is estimated to reach 35% by 2025, indicating a significant portion of the target demographic actively engaging with these products. The Compound Annual Growth Rate (CAGR) is projected to be 8.5% during the forecast period, demonstrating a healthy and sustained expansion trajectory. Technological disruptions are playing a pivotal role, with advancements in ingredient science leading to more effective and targeted formulations. The rise of e-commerce and direct-to-consumer (DTC) models has fundamentally altered distribution channels, providing wider accessibility and personalized marketing opportunities. Consumer preferences are evolving towards transparency in ingredients, natural and organic sourcing, and products that cater to specific dietary needs, such as vegan or gluten-free options. Competitive dynamics are intense, characterized by aggressive product launches, strategic marketing campaigns, and a continuous race to offer superior value propositions. The global market size is estimated to reach $18,000 Million by 2025, underscoring the significant economic impact of this sector.

Dominant Markets & Segments in Pre Workout Supplements Industry

The Powder segment is expected to continue its dominance within the Pre Workout Supplements Industry, driven by its versatility, cost-effectiveness, and the ability to incorporate a wide array of ingredients and flavors. The Online Retail Stores distribution channel is experiencing rapid growth, outpacing traditional brick-and-mortar outlets due to convenience, wider product selection, and competitive pricing. Regionally, North America remains the leading market, owing to a deeply ingrained fitness culture and high disposable incomes.

- Dominant Type Segment:

- Powder: Expected to capture approximately 70% of the market share in 2025. Its popularity stems from customizable dosage and cost-efficiency.

- Capsule/Tablet: A significant segment, valued at $3,500 Million in 2025, offering convenience and precise dosing.

- Drinks: Growing steadily, with a market size of $2,000 Million in 2025, appealing to consumers seeking immediate consumption.

- Dominant Distribution Channel:

- Online Retail Stores: Projected to account for over 50% of sales by 2025, driven by global reach and e-commerce penetration.

- Specialty Stores: Maintain a strong presence, catering to informed consumers seeking expert advice, estimated at $4,000 Million in 2025.

- Hypermarket/Supermarket: A substantial channel, particularly for mainstream brands, with an estimated market value of $3,000 Million in 2025.

- Leading Regional Market:

- North America: Continues to lead due to a mature fitness industry and high consumer spending on health and wellness products. The market size here is projected to exceed $8,000 Million by 2025.

Pre Workout Supplements Industry Product Developments

Product innovation in the Pre Workout Supplements Industry is characterized by a focus on synergistic ingredient blends designed to optimize energy, focus, and endurance. Emerging trends include the development of stimulant-free formulas for sensitive individuals and the integration of adaptogens and nootropics to enhance cognitive performance alongside physical benefits. Competitive advantages are being built through enhanced bioavailability of ingredients, natural flavoring, and the elimination of artificial additives. The market fit is increasingly driven by personalized nutrition trends and the demand for transparent, science-backed products that align with specific fitness goals.

Report Scope & Segmentation Analysis

This report segments the Pre Workout Supplements Industry by Type, including Powder, Capsule/Tablet, Drinks, and Other Types. The Powder segment is projected to lead with a substantial market share of $12,000 Million in 2025. The Capsule/Tablet segment is estimated at $3,500 Million, offering convenience. Drinks are projected to reach $2,000 Million, catering to on-the-go consumers. The Distribution Channel segmentation covers Hypermarket/Supermarket, Specialty Stores, Online Retail Stores, and Other Distribution Channels. Online Retail Stores are expected to dominate with a market size of $9,000 Million in 2025, followed by Specialty Stores at $4,000 Million, and Hypermarket/Supermarket at $3,000 Million.

Key Drivers of Pre Workout Supplements Industry Growth

Several key factors are propelling the growth of the Pre Workout Supplements Industry.

- Increasing Health and Fitness Consciousness: A global surge in awareness regarding the importance of physical health and well-being is driving demand for performance-enhancing supplements.

- Growth of the Sports and Fitness Industry: The expansion of gyms, fitness centers, and organized sports events directly correlates with increased supplement usage.

- Technological Advancements in Formulation: Innovations in ingredient science and delivery systems lead to more effective and appealing products.

- Rising Disposable Incomes: In many regions, increased disposable income allows consumers to allocate more resources towards health and wellness products.

Challenges in the Pre Workout Supplements Industry Sector

Despite its growth, the Pre Workout Supplements Industry faces several challenges.

- Stringent Regulatory Scrutiny: Evolving regulations regarding ingredient claims and product safety can lead to compliance costs and market access issues.

- Intense Competition and Price Sensitivity: A crowded market often leads to price wars, impacting profit margins for manufacturers.

- Consumer Skepticism and Misinformation: The prevalence of exaggerated claims and anecdotal evidence can create distrust among some consumers.

- Supply Chain Volatility: Dependence on specific raw materials can make the industry vulnerable to supply disruptions and price fluctuations, estimated to impact production costs by up to 10%.

Emerging Opportunities in Pre Workout Supplements Industry

The Pre Workout Supplements Industry is ripe with emerging opportunities.

- Expansion in Emerging Markets: Developing economies with growing middle classes and increasing health awareness present significant untapped potential.

- Development of Personalized Supplements: Leveraging data analytics and genetic insights to offer tailored pre-workout solutions.

- Focus on Natural and Sustainable Ingredients: Growing consumer demand for eco-friendly and ethically sourced products opens avenues for new product development.

- Integration of Wearable Technology Data: Combining supplement efficacy with data from fitness trackers for optimized user experiences.

Leading Players in the Pre Workout Supplements Industry Market

- BioTech USA Kft

- Herbalife Nutrition Ltd

- Amway Corporation

- Abbott Laboratories

- Glanbia PLC

- Nutrex Research Inc

- MusclePharm Corporation

- QNT SA

- Bulk

- Nutrabolt

Key Developments in Pre Workout Supplements Industry Industry

- 2023/10: Launch of advanced stimulant-free pre-workout formulas targeting a wider consumer base.

- 2024/03: Increased investment in research and development for plant-based pre-workout ingredients.

- 2024/07: Major acquisition of a niche pre-workout brand by a leading supplement company, valued at approximately $500 Million.

- 2024/11: Introduction of personalized pre-workout subscription services by online retailers, forecasting a 20% increase in customer retention.

Strategic Outlook for Pre Workout Supplements Industry Market

The strategic outlook for the Pre Workout Supplements Industry is overwhelmingly positive, driven by continued consumer interest in health, fitness, and performance enhancement. Key growth catalysts include the relentless pursuit of innovative formulations, expansion into underserved demographics, and leveraging digital channels for enhanced customer engagement. The industry is expected to see a further integration of scientific research with product development, leading to highly efficacious and specialized offerings. Opportunities for market leadership lie in establishing strong brand loyalty through transparency, quality, and a commitment to consumer well-being. The projected market size of $25,000 Million by 2033 signifies a robust and enduring growth trajectory for this dynamic sector.

Pre Workout Supplements Industry Segmentation

-

1. Type

- 1.1. Powder

- 1.2. Capsule/ Tablet

- 1.3. Drinks

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Pre Workout Supplements Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Pre Workout Supplements Industry Regional Market Share

Geographic Coverage of Pre Workout Supplements Industry

Pre Workout Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Growing Influence of Healthy Lifestyle Trends and Rising Number of Non-Traditional Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powder

- 5.1.2. Capsule/ Tablet

- 5.1.3. Drinks

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powder

- 6.1.2. Capsule/ Tablet

- 6.1.3. Drinks

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powder

- 7.1.2. Capsule/ Tablet

- 7.1.3. Drinks

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powder

- 8.1.2. Capsule/ Tablet

- 8.1.3. Drinks

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powder

- 9.1.2. Capsule/ Tablet

- 9.1.3. Drinks

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Pre Workout Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Powder

- 10.1.2. Capsule/ Tablet

- 10.1.3. Drinks

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarket/Supermarket

- 10.2.2. Specialty Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BioTech USA Kft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herbalife Nutrition Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amway Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Glanbia PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nutrex Research Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MusclePharm Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QNT SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bulk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nutrabolt

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BioTech USA Kft

List of Figures

- Figure 1: Global Pre Workout Supplements Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pre Workout Supplements Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Pre Workout Supplements Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Pre Workout Supplements Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Pre Workout Supplements Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Pre Workout Supplements Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pre Workout Supplements Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pre Workout Supplements Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Pre Workout Supplements Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Pre Workout Supplements Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Pre Workout Supplements Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Pre Workout Supplements Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pre Workout Supplements Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pre Workout Supplements Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Pre Workout Supplements Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Pre Workout Supplements Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Pre Workout Supplements Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Pre Workout Supplements Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pre Workout Supplements Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Pre Workout Supplements Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Pre Workout Supplements Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Pre Workout Supplements Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Pre Workout Supplements Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Pre Workout Supplements Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Pre Workout Supplements Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pre Workout Supplements Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Pre Workout Supplements Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Pre Workout Supplements Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Pre Workout Supplements Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Pre Workout Supplements Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Pre Workout Supplements Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Pre Workout Supplements Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Pre Workout Supplements Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Pre Workout Supplements Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Pre Workout Supplements Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Pre Workout Supplements Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Pre Workout Supplements Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Pre Workout Supplements Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Pre Workout Supplements Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Pre Workout Supplements Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pre Workout Supplements Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the Pre Workout Supplements Industry?

Key companies in the market include BioTech USA Kft, Herbalife Nutrition Ltd, Amway Corporation, Abbott Laboratories, Glanbia PLC, Nutrex Research Inc *List Not Exhaustive, MusclePharm Corporation, QNT SA, Bulk, Nutrabolt.

3. What are the main segments of the Pre Workout Supplements Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Growing Influence of Healthy Lifestyle Trends and Rising Number of Non-Traditional Users.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pre Workout Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pre Workout Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pre Workout Supplements Industry?

To stay informed about further developments, trends, and reports in the Pre Workout Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence