Key Insights

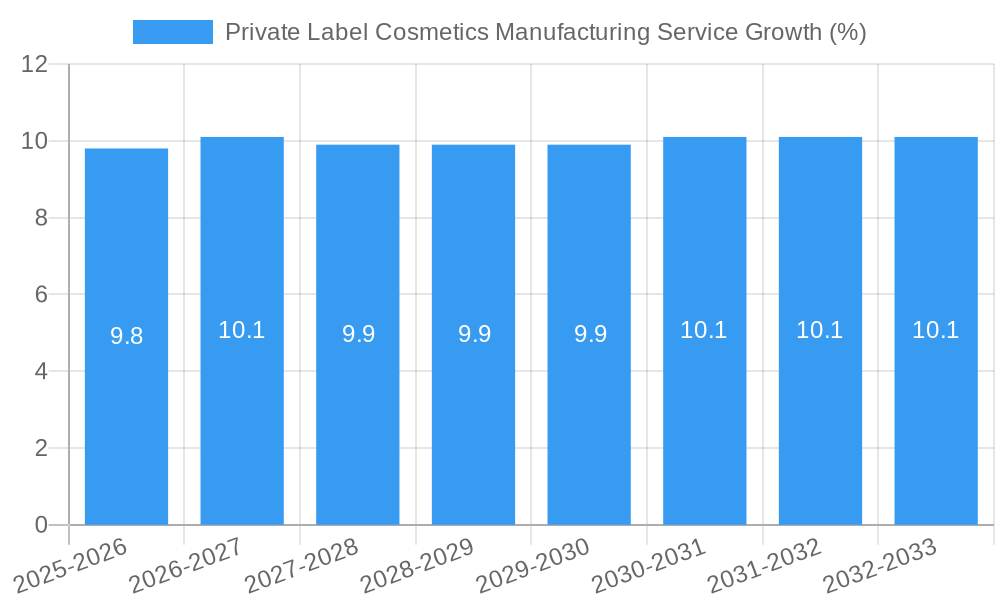

The global Private Label Cosmetics Manufacturing Service market is poised for significant expansion, estimated at a robust $XX billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% through 2033. This growth is primarily fueled by the increasing demand for personalized beauty products and the rising entrepreneurial spirit within the cosmetics industry. Small and medium-sized businesses, as well as established brands seeking to diversify their offerings or test new product lines without substantial upfront investment in manufacturing infrastructure, are increasingly turning to private label manufacturers. These services offer a comprehensive solution, encompassing product development, formulation, sourcing of raw materials, manufacturing, and packaging. Key drivers include the growing consumer interest in niche and indie beauty brands, the desire for unique formulations tailored to specific needs (e.g., clean beauty, vegan, cruelty-free), and the cost-effectiveness of outsourcing production. The market benefits from a diverse range of applications, with skincare dominating, followed closely by makeup and haircare. The "all process" segment, which covers the entire manufacturing chain, holds a dominant share, reflecting the comprehensive nature of private label services.

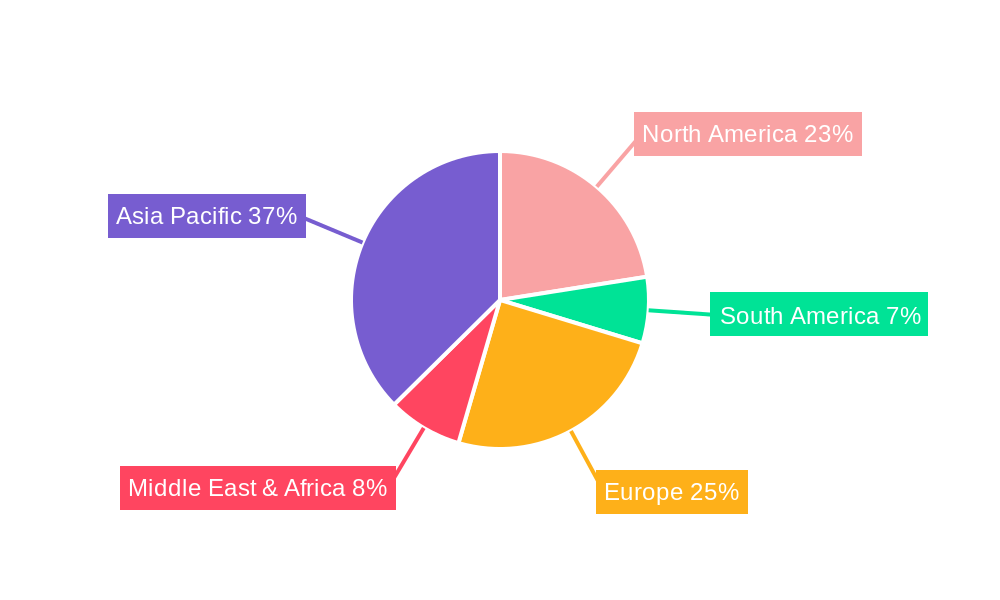

The market's trajectory is further supported by emerging trends such as the integration of sustainable and ethical practices, the demand for innovative ingredient technologies, and the rise of direct-to-consumer (DTC) brands that rely heavily on agile and efficient private label partners. While the market exhibits strong growth potential, certain restraints may influence its pace. These include the stringent regulatory landscape governing cosmetic product safety and labeling across different regions, potential supply chain disruptions for key ingredients, and the intense competition among private label manufacturers, which can exert pressure on pricing. Nonetheless, strategic collaborations between brands and manufacturers, coupled with continuous innovation in formulations and manufacturing processes, are expected to drive market penetration. Geographically, Asia Pacific is anticipated to lead market share, driven by its vast manufacturing capabilities and burgeoning consumer base, with significant contributions from China, South Korea, and India. North America and Europe also represent substantial markets, characterized by high consumer spending power and a strong demand for premium and customized beauty solutions.

Private Label Cosmetics Manufacturing Service Market Concentration & Innovation

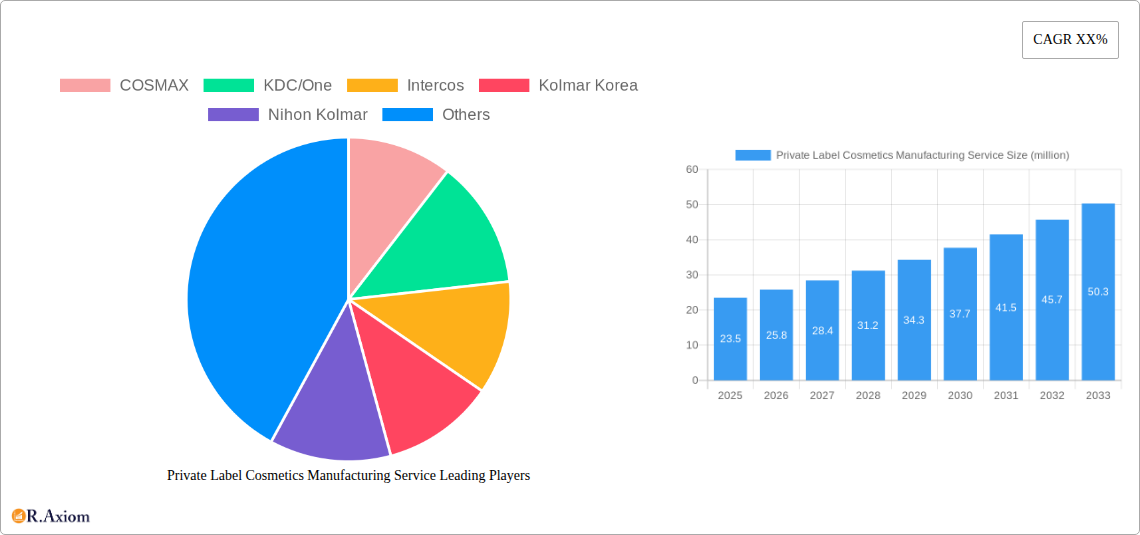

The private label cosmetics manufacturing service market exhibits a moderate to high concentration, with key players like COSMAX, KDC/One, Intercos, and Kolmar Korea dominating a significant portion of the global market share, estimated to be over 60 million dollars. These established manufacturers leverage advanced R&D capabilities and large-scale production facilities to cater to a diverse range of clients, from emerging indie brands to established retailers. Innovation serves as a crucial differentiator, driven by rapid advancements in ingredient technology, sustainable formulations, and personalized beauty solutions. The regulatory landscape, particularly concerning ingredient safety and labeling in major markets like the EU and USA, plays a pivotal role in shaping innovation trajectories and manufacturing processes, influencing an estimated 50 million dollars in R&D investment annually. Product substitutes, while present in the form of DIY beauty trends, are largely outpaced by the convenience, quality, and scalability offered by professional private label services. End-user trends are increasingly leaning towards clean beauty, efficacy-driven products, and environmentally conscious packaging, pushing manufacturers to invest in novel sustainable materials and production methods, accounting for an estimated 45 million dollars in sustainable material sourcing. Mergers and acquisitions (M&A) are a recurring theme, as larger players seek to expand their geographical reach, technological expertise, or product portfolio. Recent M&A deals have collectively surpassed a valuation of 300 million dollars, indicating a consolidation phase driven by the pursuit of economies of scale and enhanced market competitiveness.

Private Label Cosmetics Manufacturing Service Industry Trends & Insights

The private label cosmetics manufacturing service industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% between the base year 2025 and the end of the forecast period in 2033. This expansion is propelled by several interconnected trends. A primary growth driver is the escalating demand from beauty brands and retailers seeking to develop unique product lines without the substantial investment in in-house manufacturing infrastructure. This has led to an increasing market penetration of private label services, now estimated to serve over 55% of emerging beauty brands and 30% of established retailers seeking to diversify their offerings. Technological disruptions are revolutionizing the sector, with advancements in AI-powered formulation, robotic automation in production lines, and 3D printing for packaging innovations leading to increased efficiency and reduced lead times, impacting an estimated 40 million dollars in technology adoption annually. Consumer preferences are a powerful force, with a heightened demand for clean, sustainable, and ethically sourced beauty products. This translates into manufacturers investing heavily in natural and organic ingredient sourcing, biodegradable packaging solutions, and cruelty-free certifications, representing an estimated 50 million dollars in R&D for sustainable ingredients. Furthermore, the growing emphasis on personalization, driven by advancements in genetic profiling and consumer data analysis, is creating opportunities for tailored formulations and bespoke product development, an area attracting an estimated 35 million dollars in specialized formulation research. The competitive dynamics are characterized by a blend of large, established contract manufacturers and nimble, specialized players, each vying for market share by offering distinct advantages in terms of scalability, niche expertise, or speed to market. The global market size for private label cosmetics manufacturing services is projected to reach an impressive 120 billion dollars by 2033.

Dominant Markets & Segments in Private Label Cosmetics Manufacturing Service

The private label cosmetics manufacturing service market is heavily influenced by regional economic policies, robust retail infrastructure, and evolving consumer demographics. The North American region, particularly the United States, currently holds a dominant position, accounting for an estimated 30% of the global market share in 2025. This dominance is fueled by a highly developed retail landscape, a strong consumer appetite for new beauty products, and a supportive regulatory environment for cosmetic innovation. Within North America, the Skincare segment is the largest and most dynamic application, representing approximately 40% of the total market value. This is driven by an aging population, increased awareness of skincare benefits, and the burgeoning demand for anti-aging, sun protection, and specialized treatment products, with an estimated market size of 40 billion dollars for skincare private label manufacturing.

- Key Drivers for Skincare Dominance:

- Consumer Demand for Efficacy: Consumers are increasingly seeking scientifically backed formulations and results-driven skincare products.

- Aging Population: A growing demographic of older consumers actively seeks anti-aging and revitalizing skincare solutions.

- Wellness Trend: The integration of wellness into beauty routines drives demand for products addressing stress, sleep, and overall skin health.

- Retailer Private Label Expansion: Major retailers are expanding their own-brand skincare lines to capture a larger share of this lucrative market.

In terms of Types, the All Process segment, where manufacturers handle everything from formulation and ingredient sourcing to packaging and quality control, is the most sought-after, comprising an estimated 70% of private label manufacturing contracts. This offers comprehensive end-to-end solutions, appealing to brands that lack in-house expertise or resources. The Makeup application follows closely behind Skincare, with an estimated market share of 35%, driven by trends in color cosmetics, the influence of social media influencers, and the demand for innovative makeup formulations. Haircare accounts for an estimated 20% of the market, with a growing focus on specialized treatments, sustainable formulations, and personalized hair solutions. The Others segment, encompassing categories like personal care, fragrances, and ingestible beauty, is a niche but growing area, contributing an estimated 5%.

Private Label Cosmetics Manufacturing Service Product Developments

Recent product developments in private label cosmetics manufacturing are characterized by a strong emphasis on sustainable and eco-friendly formulations. Manufacturers are innovating with biodegradable packaging, upcycled ingredients, and waterless formulations to meet rising consumer demand for environmentally conscious products. Technological advancements are also driving the development of highly effective, science-backed skincare with unique active ingredient combinations, and personalized makeup formulations tailored to individual skin tones and preferences. Competitive advantages are being built through the ability to offer rapid prototyping, flexible minimum order quantities (MOQs), and robust quality assurance protocols.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the private label cosmetics manufacturing service market, segmented by Application and Type. The Application segmentation includes Skincare, which is projected to maintain its leading position with an estimated market size of 40 billion dollars by 2025, driven by strong consumer demand for efficacy and anti-aging solutions. Makeup is the second-largest segment, estimated at 35 billion dollars, fueled by the influence of social media and evolving fashion trends. Haircare, valued at an estimated 20 billion dollars, is experiencing growth due to the demand for specialized treatments and sustainable options. The Others segment, covering personal care and fragrances, is projected to reach 5 billion dollars, representing niche but expanding opportunities.

In terms of Types, the All Process segment, offering complete manufacturing solutions, is expected to dominate with an estimated 70% market share, reflecting the demand for end-to-end services. The Half Process segment, where clients provide specific formulations or components, is projected to capture the remaining 30% of the market, catering to brands with existing R&D capabilities.

Key Drivers of Private Label Cosmetics Manufacturing Service Growth

The growth of the private label cosmetics manufacturing service sector is primarily driven by the increasing desire of brands and retailers to launch unique product lines without incurring the high costs of in-house manufacturing. This economic driver, estimated to save brands an average of 20 million dollars in initial setup costs, allows for greater agility and faster market entry. Technological advancements, such as AI-driven formulation and automation, are also crucial, enabling faster product development cycles and improved efficiency, contributing an estimated 15 million dollars in operational cost reductions. Furthermore, evolving consumer preferences for customized, clean, and sustainable beauty products are compelling brands to seek specialized manufacturers capable of meeting these demands, fostering innovation and investment in new ingredient technologies and eco-friendly packaging solutions, estimated at 25 million dollars annually.

Challenges in the Private Label Cosmetics Manufacturing Service Sector

The private label cosmetics manufacturing service sector faces several challenges that can impact growth and profitability. Stringent and evolving regulatory frameworks across different regions, particularly concerning ingredient safety and claims substantiation, necessitate significant compliance efforts and can lead to increased R&D and testing costs, estimated at 10 million dollars per major market. Supply chain disruptions and volatility in raw material prices, exacerbated by global events, can affect production schedules and increase manufacturing costs, leading to an estimated 5 million dollars in unforeseen expenses. Intense competition among contract manufacturers, coupled with price pressures from clients, can squeeze profit margins. Additionally, maintaining consistent quality and adhering to the specific brand identity of diverse clients requires robust quality control systems and effective communication, a challenge that can indirectly impact brand reputation.

Emerging Opportunities in Private Label Cosmetics Manufacturing Service

Emerging opportunities in the private label cosmetics manufacturing service market are abundant and diverse. The growing demand for clean beauty, organic, and vegan formulations presents a significant avenue for growth, with an estimated 15% annual increase in demand for certified ingredients. The expansion of the men's grooming and skincare market offers new product development potential. Furthermore, the increasing adoption of e-commerce and direct-to-consumer (DTC) models by beauty brands creates opportunities for manufacturers offering flexible order quantities and faster turnaround times. Technological advancements in personalized beauty, including AI-driven diagnostics and bespoke formulations, are poised to become a major growth area, attracting an estimated 10 million dollars in new technology investments.

Leading Players in the Private Label Cosmetics Manufacturing Service Market

- COSMAX

- KDC/One

- Intercos

- Kolmar Korea

- Nihon Kolmar

- Nox Bellow Cosmetics

- Mana Products

- Cosmecca

- Chromavis

- Ancorotti Cosmetics

- BioTruly

- A&H International Cosmetics

- Bawei Biotechnology

- Easycare Group

- Ridgepole

- Life-Beauty

- Homar

- Lady Burd Cosmetics

- Nutrix International

- Chemco Corp

- RainShadow Labs

- Dynamic Blending

- Audrey Morris Cosmetics

Key Developments in Private Label Cosmetics Manufacturing Service Industry

- 2023/09: Intercos announces strategic expansion of its R&D facilities in Asia to focus on sustainable ingredient innovation, impacting an estimated 5 million dollars in R&D investment.

- 2023/06: KDC/One acquires a specialized packaging manufacturer, enhancing its end-to-end service offering and streamlining production, a deal valued at approximately 50 million dollars.

- 2022/12: COSMAX invests heavily in AI-powered formulation development, aiming to accelerate product launch timelines and offer hyper-personalized solutions, representing a 10 million dollar investment.

- 2022/07: Kolmar Korea expands its green manufacturing initiatives, focusing on reducing water and energy consumption in its production processes.

- 2021/10: Nihon Kolmar partners with a biotechnology firm to develop novel, ethically sourced botanical extracts for skincare applications.

Strategic Outlook for Private Label Cosmetics Manufacturing Service Market

- 2023/09: Intercos announces strategic expansion of its R&D facilities in Asia to focus on sustainable ingredient innovation, impacting an estimated 5 million dollars in R&D investment.

- 2023/06: KDC/One acquires a specialized packaging manufacturer, enhancing its end-to-end service offering and streamlining production, a deal valued at approximately 50 million dollars.

- 2022/12: COSMAX invests heavily in AI-powered formulation development, aiming to accelerate product launch timelines and offer hyper-personalized solutions, representing a 10 million dollar investment.

- 2022/07: Kolmar Korea expands its green manufacturing initiatives, focusing on reducing water and energy consumption in its production processes.

- 2021/10: Nihon Kolmar partners with a biotechnology firm to develop novel, ethically sourced botanical extracts for skincare applications.

Strategic Outlook for Private Label Cosmetics Manufacturing Service Market

The strategic outlook for the private label cosmetics manufacturing service market is overwhelmingly positive, driven by persistent demand from brands seeking cost-effective, agile, and innovative solutions. The continued consumer focus on clean beauty, sustainability, and personalized products will fuel innovation and specialization among manufacturers. Strategic investments in advanced technologies, such as AI and automation, will be crucial for maintaining competitiveness and improving operational efficiencies, with an estimated 20 million dollars projected for technology upgrades. Furthermore, expansion into emerging geographical markets and niche product categories will offer significant growth catalysts. Manufacturers that can adeptly navigate regulatory landscapes, offer flexible and scalable production, and demonstrate a commitment to sustainability will be best positioned for sustained success in this dynamic market.

Private Label Cosmetics Manufacturing Service Segmentation

-

1. Application

- 1.1. Skincare

- 1.2. Makeup

- 1.3. Haircare

- 1.4. Others

-

2. Types

- 2.1. All process

- 2.2. Half process

Private Label Cosmetics Manufacturing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Private Label Cosmetics Manufacturing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Skincare

- 5.1.2. Makeup

- 5.1.3. Haircare

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. All process

- 5.2.2. Half process

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Skincare

- 6.1.2. Makeup

- 6.1.3. Haircare

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. All process

- 6.2.2. Half process

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Skincare

- 7.1.2. Makeup

- 7.1.3. Haircare

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. All process

- 7.2.2. Half process

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Skincare

- 8.1.2. Makeup

- 8.1.3. Haircare

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. All process

- 8.2.2. Half process

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Skincare

- 9.1.2. Makeup

- 9.1.3. Haircare

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. All process

- 9.2.2. Half process

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Private Label Cosmetics Manufacturing Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Skincare

- 10.1.2. Makeup

- 10.1.3. Haircare

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. All process

- 10.2.2. Half process

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 COSMAX

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KDC/One

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intercos

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kolmar Korea

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nihon Kolmar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nox Bellow Cosmetics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mana Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cosmecca

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chromavis

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ancorotti Cosmetics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BioTruly

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 A&H International Cosmetics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bawei Biotechnology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Easycare Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ridgepole

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Life-Beauty

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Homar

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Lady Burd Cosmetics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Nutrix International

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Chemco Corp

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 RainShadow Labs

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Dynamic Blending

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Audrey Morris Cosmetics

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 COSMAX

List of Figures

- Figure 1: Global Private Label Cosmetics Manufacturing Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Private Label Cosmetics Manufacturing Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Private Label Cosmetics Manufacturing Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Private Label Cosmetics Manufacturing Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Private Label Cosmetics Manufacturing Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Private Label Cosmetics Manufacturing Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Private Label Cosmetics Manufacturing Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Private Label Cosmetics Manufacturing Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Private Label Cosmetics Manufacturing Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Private Label Cosmetics Manufacturing Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Private Label Cosmetics Manufacturing Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Private Label Cosmetics Manufacturing Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Private Label Cosmetics Manufacturing Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Private Label Cosmetics Manufacturing Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Private Label Cosmetics Manufacturing Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Private Label Cosmetics Manufacturing Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Private Label Cosmetics Manufacturing Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private Label Cosmetics Manufacturing Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Private Label Cosmetics Manufacturing Service?

Key companies in the market include COSMAX, KDC/One, Intercos, Kolmar Korea, Nihon Kolmar, Nox Bellow Cosmetics, Mana Products, Cosmecca, Chromavis, Ancorotti Cosmetics, BioTruly, A&H International Cosmetics, Bawei Biotechnology, Easycare Group, Ridgepole, Life-Beauty, Homar, Lady Burd Cosmetics, Nutrix International, Chemco Corp, RainShadow Labs, Dynamic Blending, Audrey Morris Cosmetics.

3. What are the main segments of the Private Label Cosmetics Manufacturing Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private Label Cosmetics Manufacturing Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private Label Cosmetics Manufacturing Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private Label Cosmetics Manufacturing Service?

To stay informed about further developments, trends, and reports in the Private Label Cosmetics Manufacturing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence