Key Insights

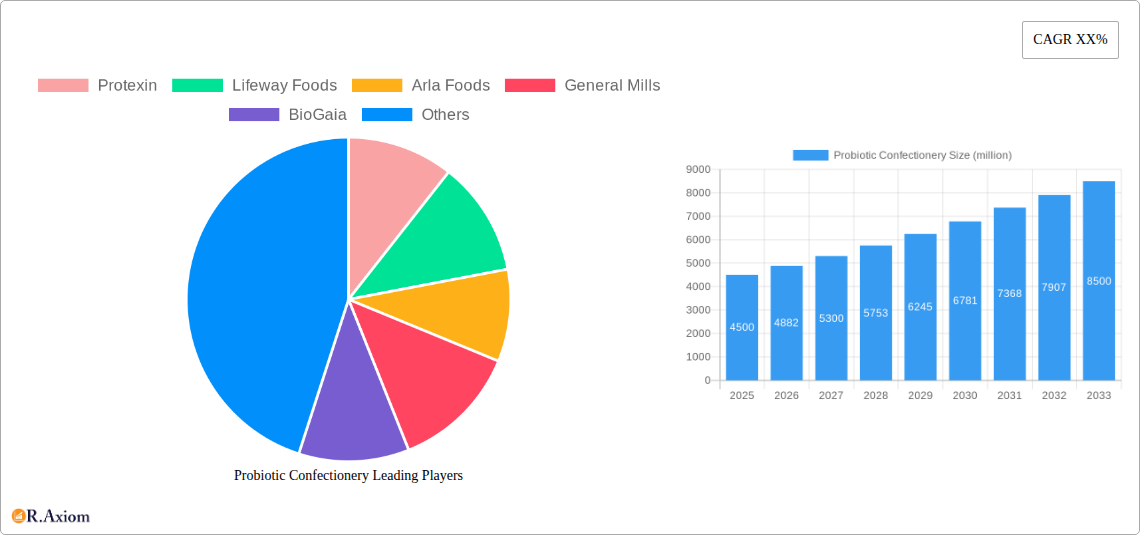

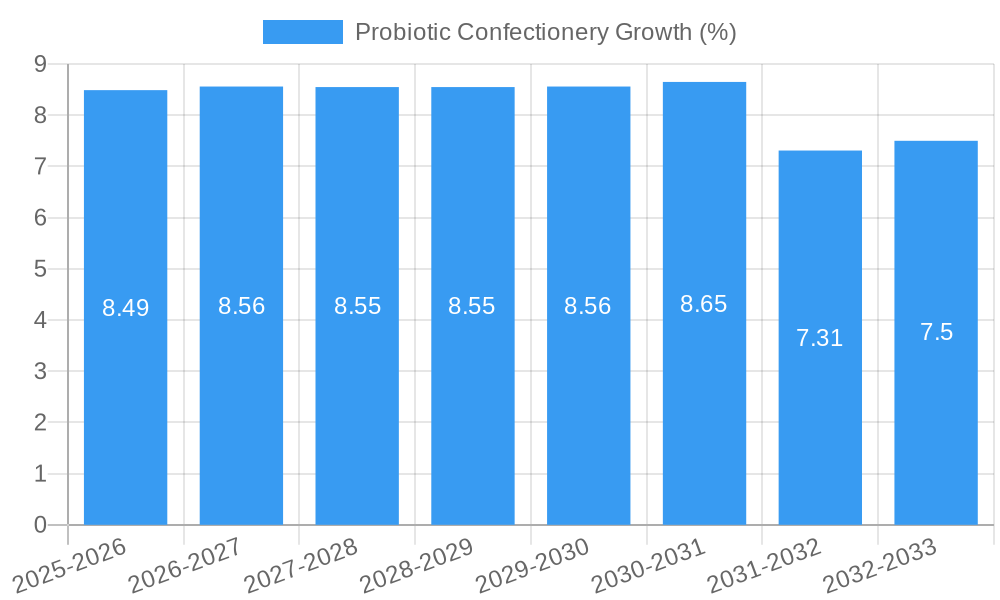

The global Probiotic Confectionery market is poised for significant expansion, estimated at approximately $4,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust growth is primarily fueled by a surging consumer demand for healthier snack options that offer functional benefits. The "better-for-you" trend is revolutionizing the confectionery landscape, with consumers actively seeking products that contribute to their well-being, particularly digestive health. Probiotic-infused candies, gummies, and chocolates are emerging as a popular choice, blending indulgence with health advantages. This demand is further amplified by increasing awareness regarding the gut microbiome's role in overall health, prompting manufacturers to innovate and incorporate beneficial bacteria into everyday treats. The market is witnessing a dynamic interplay of established confectionery giants and specialized probiotic companies, all vying to capture a share of this burgeoning segment.

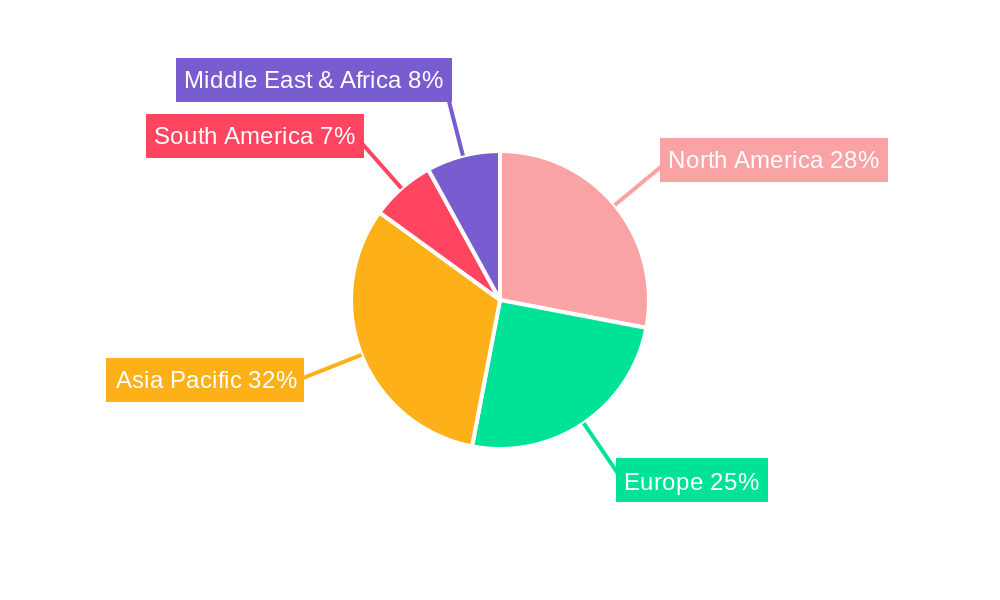

The market's expansion is underpinned by several key drivers, including advancements in probiotic strain stability and delivery mechanisms, which ensure the efficacy of probiotics even within the processing and shelf-life of confectionery products. The growing prevalence of digestive health issues globally also serves as a significant catalyst. Furthermore, the versatility of confectionery formats allows for broad consumer appeal across various age groups, from children to adults. However, challenges such as maintaining probiotic viability throughout the product's lifespan and educating consumers about the specific benefits of probiotic confectionery remain critical considerations. Despite these, the forecast indicates a strong upward trajectory, with significant opportunities in regions like Asia Pacific, driven by its large population and increasing disposable incomes, alongside continued strong performance in established markets like North America and Europe. The application segment of dietary supplements and food & beverages is expected to dominate, with yeast and bacteria being the primary types of probiotics incorporated.

Probiotic Confectionery Market Concentration & Innovation

The probiotic confectionery market is characterized by a moderate concentration, with key players like Nestlé, Danone, and General Mills holding significant shares. The market is driven by a strong innovation pipeline, focusing on novel delivery systems for probiotics within popular confectionery formats. Regulatory frameworks are evolving, with an increasing focus on clear labeling and substantiated health claims for probiotic ingredients, influencing product development and market entry strategies. Product substitutes include traditional probiotic supplements and fortified foods. End-user trends reveal a growing demand for convenient and enjoyable ways to consume probiotics, particularly among health-conscious millennials and Gen Z consumers seeking gut health benefits. Merger and acquisition (M&A) activities are strategically important for consolidating market share and acquiring proprietary technologies. For instance, recent M&A deals in the broader functional food sector have seen valuations in the hundreds of millions, signaling investor confidence. Expected market share for leading confectionery giants in probiotic segments are estimated to be between 10-15% in the forecast period.

Probiotic Confectionery Industry Trends & Insights

The probiotic confectionery industry is poised for substantial growth, driven by an escalating global awareness of gut health and its impact on overall well-being. This burgeoning consumer interest translates into a robust demand for innovative products that seamlessly integrate probiotics into everyday treats, thereby overcoming the often-perceived medicinal nature of traditional supplements. Technological disruptions are playing a pivotal role, with advancements in microencapsulation techniques ensuring probiotic viability and efficacy throughout the product's shelf life and during consumption. This innovation addresses a critical challenge of maintaining live microorganisms in confectionery matrices. Consumer preferences are rapidly shifting towards products that offer dual benefits: indulgence and health. This "healthification" trend in confectionery is a primary growth driver, with consumers actively seeking out snacks that contribute to their dietary goals, especially improved digestive health. The competitive dynamics within the market are intensifying, with both established food giants and specialized probiotic ingredient suppliers vying for market dominance. Strategic partnerships and product differentiation are becoming crucial for sustained success. The projected Compound Annual Growth Rate (CAGR) for the probiotic confectionery market is estimated to be in the range of 8-10% over the forecast period of 2025–2033, indicating a healthy expansion trajectory. Market penetration, currently estimated at 15% in developed regions, is expected to climb significantly as awareness and product availability increase globally.

Dominant Markets & Segments in Probiotic Confectionery

North America and Europe currently represent the dominant markets for probiotic confectionery, driven by high disposable incomes, advanced healthcare awareness, and a strong consumer inclination towards functional foods. Within these regions, the United States and Germany are leading countries, with significant market penetration and a high concentration of key players.

Application Dominance:

- Food & Beverages: This segment is the most dominant, accounting for an estimated 60% of the probiotic confectionery market share in 2025. The widespread acceptance of confectionery as a daily indulgence makes it a prime vehicle for probiotic integration. Economic policies promoting healthy eating and robust retail infrastructure further bolster this segment's growth.

- Dietary Supplements: While a significant segment, its dominance is slightly less than Food & Beverages, holding approximately 30% of the market. This segment benefits from a more targeted consumer base actively seeking health solutions.

- Animal Feed: This segment, though growing, is currently a smaller contributor, estimated at 8% of the market. However, increasing pet humanization trends are driving innovation and investment in this area.

- Others: This residual category, encompassing niche applications, holds an estimated 2% market share.

Type Dominance:

- Bacteria: This is the predominant type, commanding an estimated 75% of the probiotic confectionery market. Bifidobacterium and Lactobacillus strains are particularly popular due to their well-researched health benefits, including digestive health and immune support.

- Yeast: While less common than bacteria, probiotic yeast strains, such as Saccharomyces boulardii, are gaining traction and are estimated to hold around 25% of the market, especially for specific digestive conditions.

The dominance in these segments is fueled by extensive research and development, targeted marketing campaigns highlighting specific health benefits, and strategic partnerships between confectionery manufacturers and probiotic ingredient suppliers like Chr. Hansen Holding and Danisco.

Probiotic Confectionery Product Developments

Product innovation in probiotic confectionery is centered on enhancing consumer experience and probiotic efficacy. Key developments include the introduction of chewable gummies, probiotic-infused chocolates, and flavored candies designed to mask any unpleasant taste associated with probiotic strains. Companies like Protexin and Lifeway Foods are actively exploring novel delivery systems, such as microencapsulation, to ensure the survival of beneficial bacteria through digestion. These advancements cater to a growing demand for convenient and palatable gut health solutions, offering distinct competitive advantages in a crowded marketplace.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global probiotic confectionery market. The market is segmented by Application into Dietary Supplements, Food & Beverages, Animal Feed, and Others.

- Dietary Supplements: This segment is projected to witness a CAGR of 9% from 2025 to 2033, with an estimated market size of $1.2 billion in 2025. It attracts a health-conscious demographic seeking targeted gut health benefits.

- Food & Beverages: Expected to grow at a CAGR of 10% during the forecast period, this segment is estimated to reach $1.5 billion in 2025. Its broad appeal and integration into everyday treats drive its dominance.

- Animal Feed: This segment, estimated at $200 million in 2025, is predicted to grow at a CAGR of 7%. Increasing pet ownership and a focus on animal wellness are key growth drivers.

- Others: Holding an estimated market size of $50 million in 2025, this niche segment is expected to grow at a CAGR of 6%.

The market is also segmented by Type into Yeast and Bacteria.

- Bacteria: This segment, valued at $2.8 billion in 2025, is projected to expand at a CAGR of 9.5%. The extensive research supporting the efficacy of bacterial strains fuels its market leadership.

- Yeast: Estimated at $900 million in 2025, this segment is expected to grow at a CAGR of 8.5%, driven by its specific therapeutic applications.

Key Drivers of Probiotic Confectionery Growth

The probiotic confectionery market is experiencing robust growth propelled by several key factors. Firstly, a significant surge in consumer awareness regarding the multifaceted health benefits of probiotics, particularly for digestive well-being and immune system support, is a primary driver. Secondly, technological advancements in probiotic encapsulation and stabilization techniques are enabling the incorporation of live microorganisms into confectionery products without compromising their viability or taste. This innovation addresses a critical barrier to widespread adoption. Thirdly, favorable economic conditions and increasing disposable incomes in emerging economies are expanding the market for premium functional food products, including probiotic confectionery. Furthermore, evolving regulatory landscapes in some regions are providing clearer guidelines for health claims, fostering consumer confidence and encouraging product development.

Challenges in the Probiotic Confectionery Sector

Despite its promising growth, the probiotic confectionery sector faces several challenges. A significant restraint is the inherent difficulty in ensuring the viability of live probiotic cultures throughout the product's shelf life and through the harsh acidic environment of the stomach. This requires sophisticated and often costly stabilization technologies. Regulatory hurdles also pose a challenge, as varying and sometimes stringent regulations regarding health claims and ingredient sourcing across different geographies can hinder market expansion and product differentiation. Supply chain complexities, particularly concerning the temperature-sensitive nature of some probiotic strains, can lead to increased logistical costs and potential product degradation. Moreover, consumer skepticism or a lack of understanding regarding the specific benefits and strain efficacy can limit market penetration. The estimated cost of research and development for novel probiotic strains and delivery systems can also be substantial, representing a barrier to entry for smaller players.

Emerging Opportunities in Probiotic Confectionery

Emerging opportunities in the probiotic confectionery market are abundant and diverse. The growing demand for plant-based and vegan probiotic confectionery presents a significant untapped market segment, catering to ethical consumer preferences. Innovations in personalized nutrition, where probiotic confectionery could be tailored to individual gut microbiomes, represent a futuristic yet increasingly attainable opportunity. The expansion into emerging markets in Asia and Latin America, where awareness of functional foods is rapidly growing, offers substantial growth potential. Furthermore, the development of probiotic confectionery specifically formulated for children, addressing issues like picky eating and digestive comfort, could unlock a new demographic. Collaborations between confectionery brands and reputable probiotic research institutions can enhance credibility and drive consumer trust.

Leading Players in the Probiotic Confectionery Market

- Protexin

- Lifeway Foods

- Arla Foods

- General Mills

- BioGaia

- DuPont

- Danisco

- Yakult Honsha

- Chr. Hansen Holding

- Nestle

- Danone

- Sun Biotics

- Nature’s Bounty

- Probi

- Winclove Probiotics

Key Developments in Probiotic Confectionery Industry

- 2023: Nestlé launches a new line of probiotic-infused gummies targeting digestive health, with estimated sales in the tens of millions.

- 2023: Danone partners with a leading ingredient supplier to develop novel probiotic chocolate bars, focusing on enhanced gut microbiome support.

- 2022: Protexin introduces a new range of probiotic mints with extended shelf-life formulations, supported by over $5 million in R&D investment.

- 2022: Lifeway Foods expands its probiotic beverage offerings with confectionery-inspired flavors, aiming to capture a younger demographic.

- 2021: Chr. Hansen Holding announces advancements in microencapsulation technology, promising higher probiotic viability in confectionery applications, with potential market impact in the hundreds of millions.

- 2020: General Mills invests in a startup specializing in gut-friendly confectionery, signaling strategic interest in this growing segment.

Strategic Outlook for Probiotic Confectionery Market

The strategic outlook for the probiotic confectionery market remains highly optimistic, driven by the confluence of increasing consumer health consciousness and continuous innovation in product development. The "healthification" trend in the food industry, coupled with the proven benefits of probiotics for gut health, positions this market for sustained expansion. Key growth catalysts include the development of novel delivery systems that enhance probiotic efficacy and palatability, the expansion into underserved demographic segments (e.g., children, elderly), and the penetration of emerging markets. Strategic collaborations between ingredient manufacturers and confectionery brands will be crucial for co-creating innovative products that meet evolving consumer demands. Furthermore, clear and substantiated health claims, supported by robust scientific evidence, will be instrumental in building consumer trust and driving long-term market success. The market is expected to witness continued investment in R&D and M&A activities as companies seek to secure market share and technological leadership.

Probiotic Confectionery Segmentation

-

1. Application

- 1.1. Dietary Supplements

- 1.2. Food & Beverages

- 1.3. Animal Feed

- 1.4. Others

-

2. Types

- 2.1. Yeast

- 2.2. Bacteria

Probiotic Confectionery Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Probiotic Confectionery REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dietary Supplements

- 5.1.2. Food & Beverages

- 5.1.3. Animal Feed

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Yeast

- 5.2.2. Bacteria

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dietary Supplements

- 6.1.2. Food & Beverages

- 6.1.3. Animal Feed

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Yeast

- 6.2.2. Bacteria

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dietary Supplements

- 7.1.2. Food & Beverages

- 7.1.3. Animal Feed

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Yeast

- 7.2.2. Bacteria

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dietary Supplements

- 8.1.2. Food & Beverages

- 8.1.3. Animal Feed

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Yeast

- 8.2.2. Bacteria

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dietary Supplements

- 9.1.2. Food & Beverages

- 9.1.3. Animal Feed

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Yeast

- 9.2.2. Bacteria

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Probiotic Confectionery Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dietary Supplements

- 10.1.2. Food & Beverages

- 10.1.3. Animal Feed

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Yeast

- 10.2.2. Bacteria

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Protexin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lifeway Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arla Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Mills

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BioGaia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DuPont

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danisco

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yakult Honsha

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chr. Hansen Holding

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nestle

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Danone

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sun Biotics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nature’s Bounty

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Probi

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Winclove Probiotics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Protexin

List of Figures

- Figure 1: Global Probiotic Confectionery Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Probiotic Confectionery Revenue (million), by Application 2024 & 2032

- Figure 3: North America Probiotic Confectionery Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Probiotic Confectionery Revenue (million), by Types 2024 & 2032

- Figure 5: North America Probiotic Confectionery Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Probiotic Confectionery Revenue (million), by Country 2024 & 2032

- Figure 7: North America Probiotic Confectionery Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Probiotic Confectionery Revenue (million), by Application 2024 & 2032

- Figure 9: South America Probiotic Confectionery Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Probiotic Confectionery Revenue (million), by Types 2024 & 2032

- Figure 11: South America Probiotic Confectionery Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Probiotic Confectionery Revenue (million), by Country 2024 & 2032

- Figure 13: South America Probiotic Confectionery Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Probiotic Confectionery Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Probiotic Confectionery Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Probiotic Confectionery Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Probiotic Confectionery Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Probiotic Confectionery Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Probiotic Confectionery Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Probiotic Confectionery Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Probiotic Confectionery Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Probiotic Confectionery Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Probiotic Confectionery Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Probiotic Confectionery Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Probiotic Confectionery Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Probiotic Confectionery Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Probiotic Confectionery Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Probiotic Confectionery Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Probiotic Confectionery Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Probiotic Confectionery Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Probiotic Confectionery Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Probiotic Confectionery Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Probiotic Confectionery Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Probiotic Confectionery Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Probiotic Confectionery Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Probiotic Confectionery Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Probiotic Confectionery Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Probiotic Confectionery Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Probiotic Confectionery Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Probiotic Confectionery Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Probiotic Confectionery Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Probiotic Confectionery?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Probiotic Confectionery?

Key companies in the market include Protexin, Lifeway Foods, Arla Foods, General Mills, BioGaia, DuPont, Danisco, Yakult Honsha, Chr. Hansen Holding, Nestle, Danone, Sun Biotics, Nature’s Bounty, Probi, Winclove Probiotics.

3. What are the main segments of the Probiotic Confectionery?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Probiotic Confectionery," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Probiotic Confectionery report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Probiotic Confectionery?

To stay informed about further developments, trends, and reports in the Probiotic Confectionery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence