Key Insights

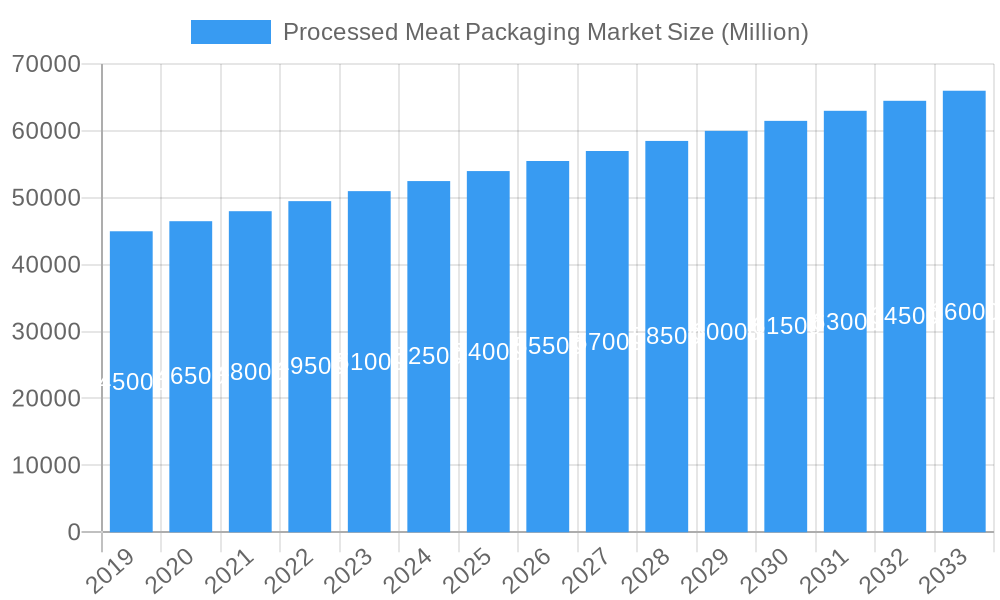

The global processed meat packaging market is projected to experience significant expansion, reaching an estimated $15.62 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% through 2033. This growth is driven by increasing demand for convenient food options, a rising preference for ready-to-eat meat products, and advancements in packaging technologies that enhance shelf life and product safety. The expanding organized retail sector and the growth of e-commerce platforms for food products are also contributing to increased accessibility and distribution, further fueling market growth. Manufacturers are investing in innovative packaging solutions that offer superior barrier properties, extended freshness, and enhanced product appeal.

Processed Meat Packaging Market Market Size (In Billion)

Material innovation and evolving consumer preferences are key factors shaping the processed meat packaging market. Plastics dominate the market due to their versatility, cost-effectiveness, and the wide range of available formats including pouches, bags, films, wraps, trays, and containers. Metal packaging, particularly aluminum, is also important for retorted and shelf-stable products. Demand for both fresh and frozen, as well as processed and ready-to-eat meat options, caters to diverse consumer needs. Leading companies such as Amcor PLC, Berry Global Inc., and Sealed Air Corporation are focusing on research and development for sustainable and functional packaging solutions in response to environmental concerns and regulatory requirements. The Asia Pacific region, notably China and India, is identified as a high-growth market due to rapid urbanization, rising disposable incomes, and a significant shift towards processed food consumption.

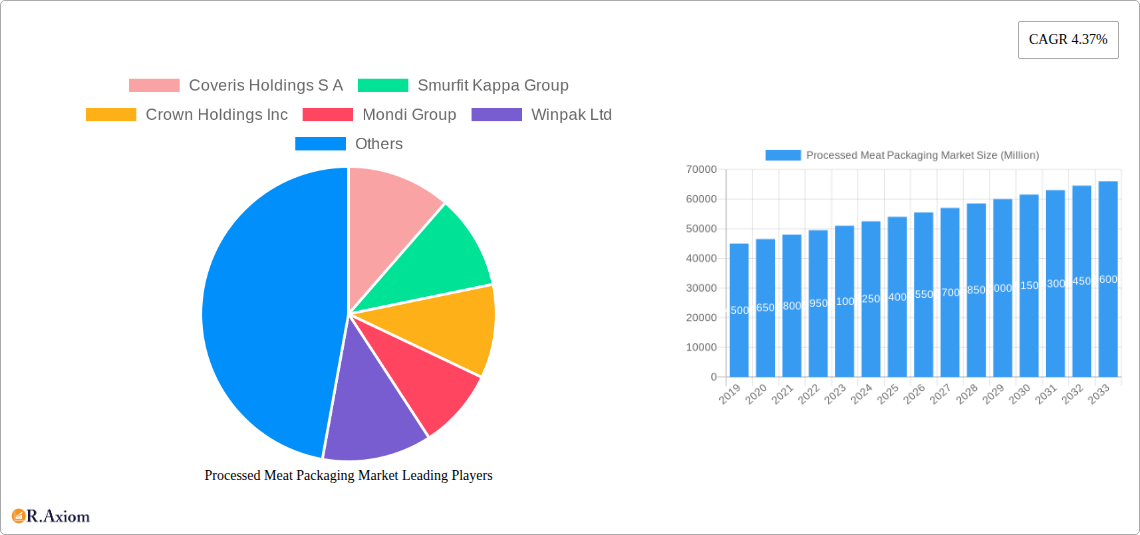

Processed Meat Packaging Market Company Market Share

This comprehensive report offers strategic insights and actionable intelligence for stakeholders in the global processed meat packaging market. Covering the period from 2019 to 2033, with a base year of 2025, the analysis delves into market size, segmentation, key drivers, challenges, opportunities, and competitive landscapes to guide businesses in this dynamic sector.

Processed Meat Packaging Market Market Concentration & Innovation

The Processed Meat Packaging Market exhibits a moderate to high level of concentration, with key players like Amcor PLC, Berry Global Inc, and Sealed Air Corporation holding significant market shares. Innovation is a critical driver, fueled by the demand for enhanced food safety, extended shelf life, and sustainable packaging solutions. Regulatory frameworks, particularly concerning food contact materials and waste reduction, are continuously shaping product development and market strategies. Product substitutes, such as alternative protein sources and evolving consumer dietary habits, present a dynamic challenge. End-user trends are shifting towards convenience, premiumization, and increased demand for ready-to-eat and minimally processed meat products. Mergers and acquisitions (M&A) are prevalent, with significant deal values observed as companies aim to expand their product portfolios, geographical reach, and technological capabilities. For instance, several strategic acquisitions in the flexible packaging segment have been recorded in recent years, aimed at consolidating market presence and acquiring specialized technologies, with an estimated aggregate M&A deal value of over $5,000 million in the historical period.

Processed Meat Packaging Market Industry Trends & Insights

The global Processed Meat Packaging Market is poised for robust growth, driven by a confluence of factors that are fundamentally reshaping the food industry. A projected Compound Annual Growth Rate (CAGR) of approximately 5.2% underscores the sector's strong upward trajectory. This expansion is primarily fueled by increasing global meat consumption, particularly in emerging economies, where rising disposable incomes and urbanization lead to greater demand for processed and convenient food options. The processed meat sector itself is witnessing innovation in product variety, from sausages and hams to ready-to-eat meals, all of which require specialized packaging to maintain quality, extend shelf life, and ensure consumer safety. Technological disruptions are playing a pivotal role, with advancements in barrier films, modified atmosphere packaging (MAP), and active packaging technologies significantly enhancing product freshness and reducing spoilage. The push towards sustainability is another major trend; consumers are increasingly aware of the environmental impact of packaging, driving demand for recyclable, compostable, and bio-based materials. This has spurred significant investment in research and development for eco-friendly packaging solutions. Furthermore, the rise of e-commerce and food delivery services has created new avenues for processed meat products, necessitating packaging that can withstand the rigors of transit and maintain product integrity. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on cost-efficiency. Companies are investing in high-barrier plastics, advanced printing technologies for enhanced branding, and tamper-evident features to build consumer trust. The market penetration of innovative packaging solutions, such as retort pouches and high-performance films, is steadily increasing, catering to the diverse needs of processors and consumers alike, with an estimated market penetration of flexible plastic packaging reaching 65% in the processed meat sector by 2025.

Dominant Markets & Segments in Processed Meat Packaging Market

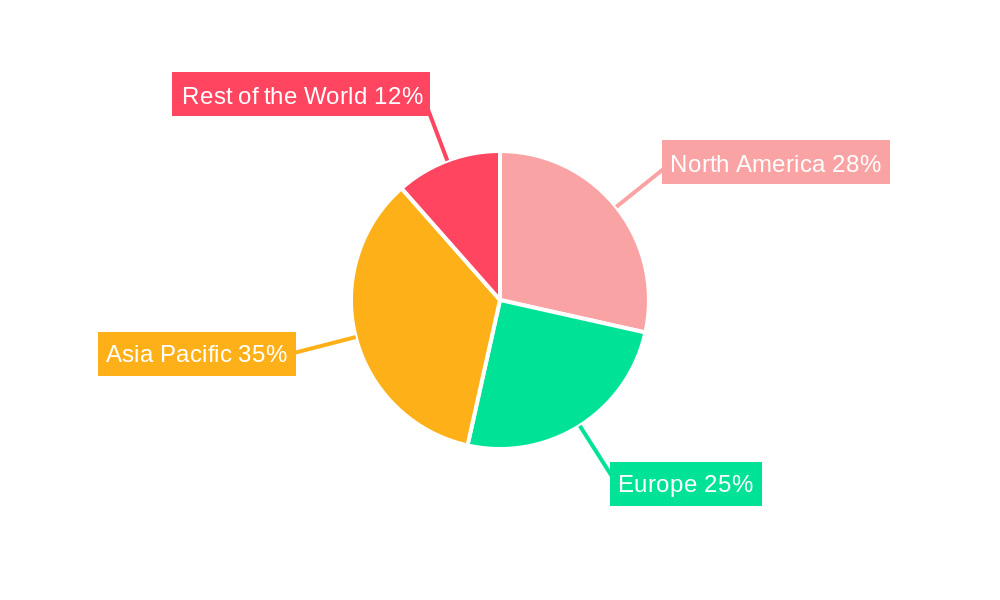

The Processed Meat Packaging Market is characterized by distinct regional dominance and segment-specific growth patterns. Asia Pacific currently holds a significant share, driven by its large population, increasing disposable incomes, and a growing middle class with a preference for convenient and processed food options. Countries like China and India are at the forefront of this expansion, supported by favorable economic policies that encourage food processing and infrastructure development for better distribution networks. Within the material type segmentation, Plastic packaging, particularly Flexible options, dominates the market. This dominance is attributable to its versatility, cost-effectiveness, and excellent barrier properties. Among flexible products, Pouches and Bags are extensively used due to their convenience and suitability for various processed meat products. Films and Wraps also command a substantial share, essential for extending the shelf life of products like sliced meats and cured products. Rigid plastic packaging, including Trays and Containers, is also gaining traction, especially for ready-to-eat meals and premium processed meat products, offering enhanced product presentation and protection. The Type of Meat segmentation reveals that Processed meat packaging accounts for the largest share, reflecting the sheer volume and diversity of products within this category. However, the Ready to Eat segment is witnessing the fastest growth, propelled by evolving consumer lifestyles and the demand for quick meal solutions. Economic policies promoting food safety and hygiene standards further bolster the demand for reliable packaging solutions. Infrastructure development, including cold chain logistics, plays a crucial role in facilitating the distribution of processed meat products, thereby influencing packaging choices. For instance, the growth of supermarkets and hypermarkets in emerging economies, a direct result of supportive economic policies, is a key driver for packaged processed meats. The market penetration of sustainable packaging solutions within the plastic segment, such as recyclable films and mono-material structures, is a significant trend in developed regions like North America and Europe, driven by stringent environmental regulations and heightened consumer awareness. The increasing adoption of advanced barrier technologies in plastic films, such as EVOH and PVDC, is crucial for extending the shelf life of processed meats, a key factor in reducing food waste and increasing market reach.

Processed Meat Packaging Market Product Developments

Product innovations in the Processed Meat Packaging Market are centered on enhancing food safety, extending shelf life, and improving sustainability. Key developments include the introduction of high-barrier multi-layer films with superior oxygen and moisture resistance, crucial for preserving the quality of vacuum-sealed and modified atmosphere packaged processed meats. Advanced printing technologies enable enhanced branding and consumer information on packaging. The development of active packaging, incorporating agents that absorb ethylene or scavenge oxygen, is another significant trend, directly contributing to extended shelf life and reduced spoilage. Furthermore, the industry is witnessing a surge in the development of compostable and biodegradable packaging alternatives, addressing growing environmental concerns and meeting regulatory demands for sustainable solutions. These innovations provide a competitive advantage by catering to evolving consumer preferences and stringent regulatory requirements.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Processed Meat Packaging Market, segmented by Material Type and Type of Meat. The Material Type segment includes Plastic, further categorized into Flexible (Pouches, Bags, Films and Wraps, Other Flexible Products) and Rigid (Trays and Containers, Other Rigid Products), and Metal (Aluminum, Steel, Other Material Types). The Type of Meat segment encompasses Fresh and Frozen, Processed, and Ready to Eat. The Plastic segment, particularly flexible films and pouches, is projected to maintain its leading market share due to its cost-effectiveness and versatility. Growth projections for Rigid Plastic, driven by demand for convenient meal solutions, are robust. The Metal segment, while mature, continues to be relevant for certain processed meat applications due to its excellent barrier properties. The Processed meat segment is expected to witness steady growth, while the Ready to Eat segment is anticipated to experience the highest CAGR, reflecting evolving consumer lifestyles.

Key Drivers of Processed Meat Packaging Market Growth

The growth of the Processed Meat Packaging Market is propelled by several key factors. Increasing global meat consumption, driven by population growth and rising disposable incomes, is a primary driver. The demand for convenience food and ready-to-eat meals, fueled by busy lifestyles, significantly boosts the need for appropriate packaging. Technological advancements in packaging materials, such as high-barrier films and active packaging, enhance food safety and extend shelf life, reducing spoilage and waste. Evolving consumer preferences for visually appealing and informative packaging, coupled with a growing awareness of sustainability, are also key influencers. Regulatory support for food safety standards further solidifies the market for reliable packaging solutions. For example, the adoption of advanced barrier films has been critical in enabling the expansion of shelf-stable processed meat products into new geographical markets.

Challenges in the Processed Meat Packaging Market Sector

Despite robust growth, the Processed Meat Packaging Market faces several challenges. Volatility in raw material prices, particularly for plastics and metals, can impact profit margins. Stringent and evolving regulatory landscapes concerning food contact materials and waste management can necessitate costly compliance measures and product redesign. Intense competition from both established players and emerging regional manufacturers exerts downward pressure on pricing. Supply chain disruptions, exacerbated by geopolitical events and logistics challenges, can affect the availability and timely delivery of packaging materials. Consumer perception and demand for genuinely sustainable packaging solutions, beyond simple recyclability, present an ongoing challenge for material innovation and adoption. For instance, the increasing global focus on plastic waste reduction is pushing for a faster transition to circular economy models, which can be complex and costly to implement.

Emerging Opportunities in Processed Meat Packaging Market

Emerging opportunities in the Processed Meat Packaging Market are abundant. The growing demand for plant-based and alternative protein products presents a significant new avenue for specialized packaging solutions that cater to their unique shelf-life and barrier requirements. The expansion of e-commerce and direct-to-consumer sales models creates opportunities for innovative, durable, and temperature-controlled packaging. The increasing adoption of smart packaging technologies, incorporating features like track-and-trace capabilities and shelf-life indicators, offers enhanced consumer engagement and supply chain traceability. Furthermore, the development and widespread adoption of biodegradable and compostable packaging materials, driven by consumer demand and regulatory mandates, represent a substantial growth area. Investments in advanced recycling technologies and the development of mono-material packaging structures also unlock new market potential.

Leading Players in the Processed Meat Packaging Market Market

- Coveris Holdings S A

- Smurfit Kappa Group

- Crown Holdings Inc

- Mondi Group

- Winpak Ltd

- Amcor PLC

- Berry Global Inc

- Sonoco Products Company

- Viscofan Group

- Sealed Air Corporation

Key Developments in Processed Meat Packaging Market Industry

- 2023: Amcor PLC launched a new range of recyclable mono-material flexible packaging solutions, addressing growing sustainability demands in the processed meat sector.

- 2022: Berry Global Inc expanded its portfolio of rigid trays with enhanced barrier properties, catering to the increasing demand for ready-to-eat processed meat products.

- 2021: Sealed Air Corporation introduced advanced modified atmosphere packaging films that significantly extend the shelf life of fresh and processed meats.

- 2020: Mondi Group invested in new production lines for sustainable packaging films, focusing on bio-based and compostable materials.

- 2019: Crown Holdings Inc acquired a company specializing in innovative aluminum packaging for processed foods, strengthening its market position.

Strategic Outlook for Processed Meat Packaging Market Market

The strategic outlook for the Processed Meat Packaging Market is exceptionally positive, driven by an ongoing surge in consumer demand for convenient, safe, and sustainable food options. Key growth catalysts include the continued expansion of processed and ready-to-eat meat consumption globally, particularly in developing regions. Technological advancements in material science, such as high-barrier films and smart packaging, will continue to drive innovation and create value. The increasing emphasis on a circular economy and the push for sustainable packaging solutions present significant opportunities for companies investing in recyclable, compostable, and bio-based alternatives. Strategic collaborations and mergers will likely continue to shape the competitive landscape, enabling companies to enhance their product offerings and market reach. Businesses that can effectively balance cost-efficiency with innovative and sustainable packaging solutions will be well-positioned for sustained success in this dynamic market.

Processed Meat Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastic

-

1.1.1. Flexible (By Product Type)

- 1.1.1.1. Pouches

- 1.1.1.2. Bags

- 1.1.1.3. Films and Wraps

- 1.1.1.4. Other Flexible Products

-

1.1.1. Flexible (By Product Type)

-

1.2. Rigid (By Product Type)

- 1.2.1. Trays and Containers

- 1.2.2. Other Rigid Products

-

1.3. Metal

- 1.3.1. Aluminum

- 1.3.2. Steel

- 1.3.3. Other Material Types

-

1.1. Plastic

-

2. Type of Meat

- 2.1. Fresh and Frozen

- 2.2. Processed

- 2.3. Ready to Eat

Processed Meat Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Processed Meat Packaging Market Regional Market Share

Geographic Coverage of Processed Meat Packaging Market

Processed Meat Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in pack sizes coupled with move towards convenience; Recent advancements in food packaging technology has led to extension of shelf life

- 3.3. Market Restrains

- 3.3.1 Dynamic nature of regulatory changes

- 3.3.2 specifically in the case of plastic packaging; Price competition has been a major concern impacting the packaging manufacturers

- 3.4. Market Trends

- 3.4.1. Flexible Plastic is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processed Meat Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Flexible (By Product Type)

- 5.1.1.1.1. Pouches

- 5.1.1.1.2. Bags

- 5.1.1.1.3. Films and Wraps

- 5.1.1.1.4. Other Flexible Products

- 5.1.1.1. Flexible (By Product Type)

- 5.1.2. Rigid (By Product Type)

- 5.1.2.1. Trays and Containers

- 5.1.2.2. Other Rigid Products

- 5.1.3. Metal

- 5.1.3.1. Aluminum

- 5.1.3.2. Steel

- 5.1.3.3. Other Material Types

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Type of Meat

- 5.2.1. Fresh and Frozen

- 5.2.2. Processed

- 5.2.3. Ready to Eat

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Processed Meat Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.1.1. Flexible (By Product Type)

- 6.1.1.1.1. Pouches

- 6.1.1.1.2. Bags

- 6.1.1.1.3. Films and Wraps

- 6.1.1.1.4. Other Flexible Products

- 6.1.1.1. Flexible (By Product Type)

- 6.1.2. Rigid (By Product Type)

- 6.1.2.1. Trays and Containers

- 6.1.2.2. Other Rigid Products

- 6.1.3. Metal

- 6.1.3.1. Aluminum

- 6.1.3.2. Steel

- 6.1.3.3. Other Material Types

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Type of Meat

- 6.2.1. Fresh and Frozen

- 6.2.2. Processed

- 6.2.3. Ready to Eat

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Processed Meat Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.1.1. Flexible (By Product Type)

- 7.1.1.1.1. Pouches

- 7.1.1.1.2. Bags

- 7.1.1.1.3. Films and Wraps

- 7.1.1.1.4. Other Flexible Products

- 7.1.1.1. Flexible (By Product Type)

- 7.1.2. Rigid (By Product Type)

- 7.1.2.1. Trays and Containers

- 7.1.2.2. Other Rigid Products

- 7.1.3. Metal

- 7.1.3.1. Aluminum

- 7.1.3.2. Steel

- 7.1.3.3. Other Material Types

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Type of Meat

- 7.2.1. Fresh and Frozen

- 7.2.2. Processed

- 7.2.3. Ready to Eat

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Processed Meat Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.1.1. Flexible (By Product Type)

- 8.1.1.1.1. Pouches

- 8.1.1.1.2. Bags

- 8.1.1.1.3. Films and Wraps

- 8.1.1.1.4. Other Flexible Products

- 8.1.1.1. Flexible (By Product Type)

- 8.1.2. Rigid (By Product Type)

- 8.1.2.1. Trays and Containers

- 8.1.2.2. Other Rigid Products

- 8.1.3. Metal

- 8.1.3.1. Aluminum

- 8.1.3.2. Steel

- 8.1.3.3. Other Material Types

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Type of Meat

- 8.2.1. Fresh and Frozen

- 8.2.2. Processed

- 8.2.3. Ready to Eat

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Rest of the World Processed Meat Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.1.1. Flexible (By Product Type)

- 9.1.1.1.1. Pouches

- 9.1.1.1.2. Bags

- 9.1.1.1.3. Films and Wraps

- 9.1.1.1.4. Other Flexible Products

- 9.1.1.1. Flexible (By Product Type)

- 9.1.2. Rigid (By Product Type)

- 9.1.2.1. Trays and Containers

- 9.1.2.2. Other Rigid Products

- 9.1.3. Metal

- 9.1.3.1. Aluminum

- 9.1.3.2. Steel

- 9.1.3.3. Other Material Types

- 9.1.1. Plastic

- 9.2. Market Analysis, Insights and Forecast - by Type of Meat

- 9.2.1. Fresh and Frozen

- 9.2.2. Processed

- 9.2.3. Ready to Eat

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Coveris Holdings S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Smurfit Kappa Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Crown Holdings Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mondi Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Winpak Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Amcor PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Berry Global Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sonoco Products Company*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Viscofan Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sealed Air Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Coveris Holdings S A

List of Figures

- Figure 1: Global Processed Meat Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Processed Meat Packaging Market Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Processed Meat Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Processed Meat Packaging Market Revenue (billion), by Type of Meat 2025 & 2033

- Figure 5: North America Processed Meat Packaging Market Revenue Share (%), by Type of Meat 2025 & 2033

- Figure 6: North America Processed Meat Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Processed Meat Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Processed Meat Packaging Market Revenue (billion), by Material Type 2025 & 2033

- Figure 9: Europe Processed Meat Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Europe Processed Meat Packaging Market Revenue (billion), by Type of Meat 2025 & 2033

- Figure 11: Europe Processed Meat Packaging Market Revenue Share (%), by Type of Meat 2025 & 2033

- Figure 12: Europe Processed Meat Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Processed Meat Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Processed Meat Packaging Market Revenue (billion), by Material Type 2025 & 2033

- Figure 15: Asia Pacific Processed Meat Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Asia Pacific Processed Meat Packaging Market Revenue (billion), by Type of Meat 2025 & 2033

- Figure 17: Asia Pacific Processed Meat Packaging Market Revenue Share (%), by Type of Meat 2025 & 2033

- Figure 18: Asia Pacific Processed Meat Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Processed Meat Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Processed Meat Packaging Market Revenue (billion), by Material Type 2025 & 2033

- Figure 21: Rest of the World Processed Meat Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Rest of the World Processed Meat Packaging Market Revenue (billion), by Type of Meat 2025 & 2033

- Figure 23: Rest of the World Processed Meat Packaging Market Revenue Share (%), by Type of Meat 2025 & 2033

- Figure 24: Rest of the World Processed Meat Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Processed Meat Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Processed Meat Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Processed Meat Packaging Market Revenue billion Forecast, by Type of Meat 2020 & 2033

- Table 3: Global Processed Meat Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Processed Meat Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Global Processed Meat Packaging Market Revenue billion Forecast, by Type of Meat 2020 & 2033

- Table 6: Global Processed Meat Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Processed Meat Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Global Processed Meat Packaging Market Revenue billion Forecast, by Type of Meat 2020 & 2033

- Table 11: Global Processed Meat Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Processed Meat Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Processed Meat Packaging Market Revenue billion Forecast, by Type of Meat 2020 & 2033

- Table 19: Global Processed Meat Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Processed Meat Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 26: Global Processed Meat Packaging Market Revenue billion Forecast, by Type of Meat 2020 & 2033

- Table 27: Global Processed Meat Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Latin America Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Processed Meat Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processed Meat Packaging Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Processed Meat Packaging Market?

Key companies in the market include Coveris Holdings S A, Smurfit Kappa Group, Crown Holdings Inc, Mondi Group, Winpak Ltd, Amcor PLC, Berry Global Inc, Sonoco Products Company*List Not Exhaustive, Viscofan Group, Sealed Air Corporation.

3. What are the main segments of the Processed Meat Packaging Market?

The market segments include Material Type, Type of Meat.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Reduction in pack sizes coupled with move towards convenience; Recent advancements in food packaging technology has led to extension of shelf life.

6. What are the notable trends driving market growth?

Flexible Plastic is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Dynamic nature of regulatory changes. specifically in the case of plastic packaging; Price competition has been a major concern impacting the packaging manufacturers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processed Meat Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processed Meat Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processed Meat Packaging Market?

To stay informed about further developments, trends, and reports in the Processed Meat Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence