Key Insights

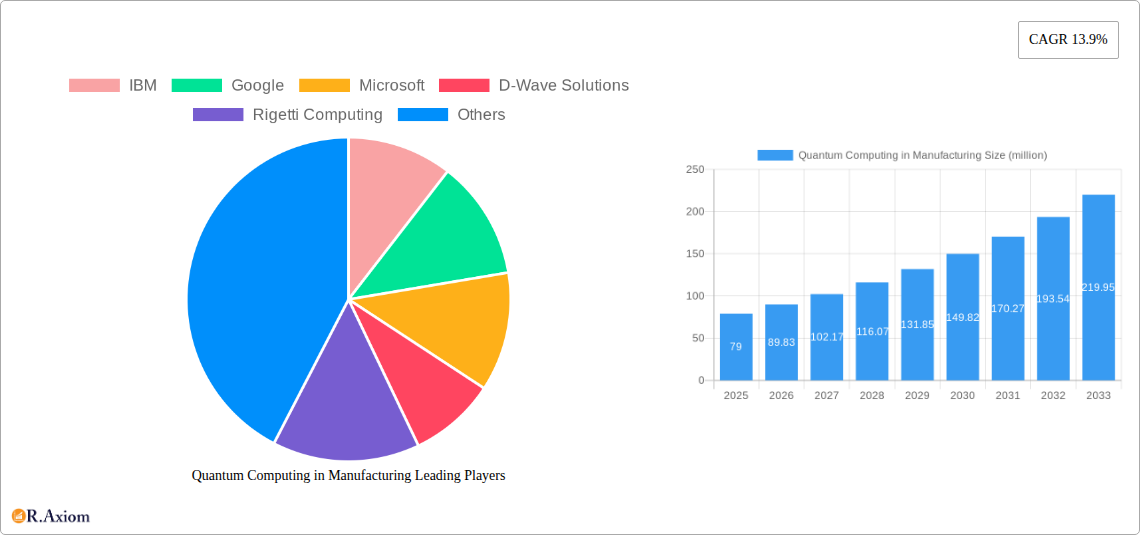

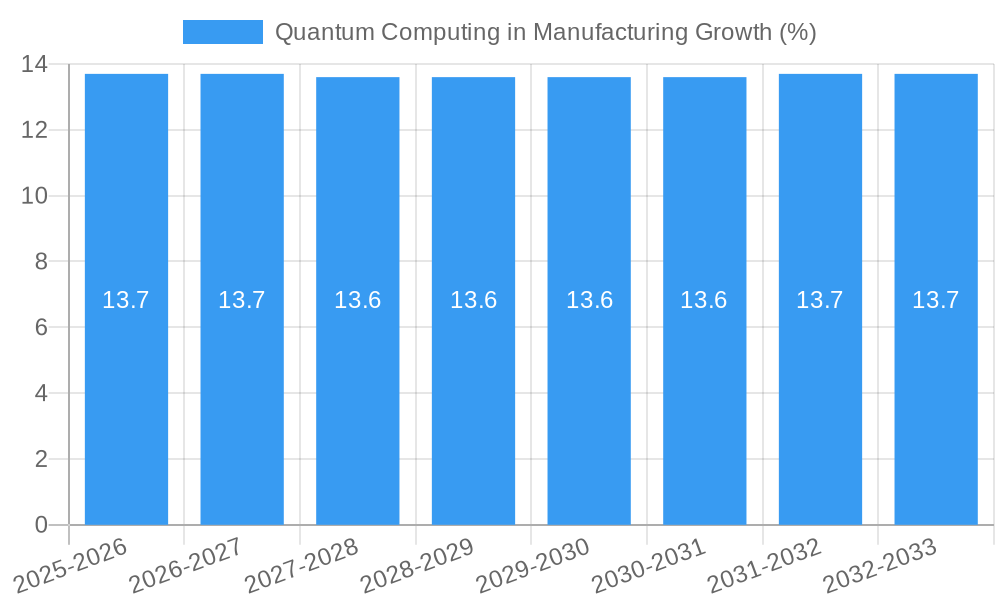

The Quantum Computing in Manufacturing market is poised for substantial growth, projected to reach an estimated $79 million in 2025. This expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 13.9%, indicating a robust and sustained upward trajectory for the sector. Key drivers for this surge include the inherent ability of quantum computing to solve complex optimization problems, accelerate materials science research, and enhance supply chain efficiency – all critical areas for the manufacturing industry. The development of advanced quantum algorithms specifically tailored for manufacturing applications, coupled with increasing investments from both established tech giants and specialized quantum computing firms, are further bolstering market expansion. As businesses across the automotive, electronics, and chemical sectors increasingly recognize the transformative potential of quantum solutions, the adoption rate is expected to accelerate, driving demand for sophisticated quantum hardware and software.

The market's evolution is further shaped by significant trends such as the growing interest in quantum-inspired algorithms as a stepping stone to full quantum advantage, and the collaborative efforts between quantum technology providers and manufacturing enterprises to develop industry-specific use cases. These collaborations are instrumental in bridging the gap between theoretical possibilities and practical implementation, leading to tangible benefits in areas like drug discovery (relevant to chemical manufacturing), battery technology development (automotive and electronics), and logistical network optimization. However, certain restraints, such as the high cost of quantum hardware, the scarcity of skilled quantum programmers and engineers, and the ongoing challenges in achieving fault-tolerant quantum computers, need to be addressed for widespread adoption. Despite these hurdles, the overwhelming strategic importance of quantum computing for future industrial competitiveness ensures continued innovation and investment, making it a pivotal technology for the manufacturing landscape.

This comprehensive report offers an in-depth analysis of the burgeoning Quantum Computing in Manufacturing market. Delve into how disruptive quantum technologies are poised to transform industries, optimize complex processes, accelerate drug discovery, and revolutionize materials science. With a Study Period spanning from 2019 to 2033, a Base Year of 2025, and an Estimated Year also of 2025, this report provides critical insights for stakeholders navigating the evolving landscape. The Forecast Period covers 2025–2033, building upon a robust Historical Period from 2019–2024. Explore market dynamics, key players, and future trends in quantum computing applications for automotive, mechanical, electronic, and chemical industries, alongside broader industry chain services.

Quantum Computing in Manufacturing Market Concentration & Innovation

The Quantum Computing in Manufacturing market is characterized by a dynamic interplay of innovation and strategic development. While still in its nascent stages, the concentration of cutting-edge research and development is primarily driven by major technology giants and specialized quantum computing firms. Innovation is fueled by the pursuit of quantum advantage in solving previously intractable problems within manufacturing, such as complex optimization, advanced materials simulation, and novel process design. Regulatory frameworks are still evolving, with a focus on intellectual property protection and ethical deployment of quantum technologies. Product substitutes currently include advanced classical computing solutions, but the unique capabilities of quantum computing present a distinct value proposition. End-user trends are shifting towards early adopters in sectors seeking a competitive edge through enhanced efficiency and novel product development. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation, with potential deal values reaching into the millions as companies seek to acquire specialized expertise and intellectual property. Key players like IBM, Google, and Microsoft are making substantial investments, alongside specialized firms such as D-Wave Solutions, Rigetti Computing, and Origin Quantum Computing Technology.

- Market Concentration Drivers: Heavy R&D investment by tech giants, emergence of specialized quantum startups, strategic partnerships for application development.

- Innovation Focus: Quantum algorithms for optimization, materials discovery, molecular simulation, machine learning for predictive maintenance, enhanced supply chain logistics.

- Regulatory Considerations: IP protection for quantum algorithms and hardware, data security in quantum computing environments, ethical guidelines for AI integration powered by quantum.

- Product Substitutes: High-performance computing (HPC), specialized classical algorithms for optimization and simulation, but with inherent limitations in scale and complexity.

- End-User Trends: Early adoption in R&D-intensive sectors, focus on quantum-inspired algorithms while waiting for mature quantum hardware, growing interest in cloud-based quantum access.

- M&A Activity: Strategic acquisitions of quantum software companies, quantum hardware component suppliers, and specialized quantum expertise by larger corporations. Estimated M&A deal values are expected to reach tens of millions.

Quantum Computing in Manufacturing Industry Trends & Insights

The Quantum Computing in Manufacturing industry is experiencing exponential growth, driven by an unprecedented surge in demand for enhanced computational power to tackle increasingly complex industrial challenges. Market growth is propelled by the persistent need for greater efficiency, reduced lead times, and the development of next-generation materials and products. Technological disruptions are at the forefront, with advancements in qubit stability, error correction, and quantum algorithm development rapidly maturing. These breakthroughs are enabling the exploration of quantum solutions for process optimization in chemical reactions, predictive maintenance in heavy machinery, and the design of novel materials for the automotive and electronics sectors. Consumer preferences are indirectly influenced by the innovation this technology unlocks, leading to more sophisticated and sustainable products. The Compound Annual Growth Rate (CAGR) is projected to be exceptionally high, potentially exceeding xx% over the forecast period. Market penetration is currently in its early stages, but is expected to accelerate significantly as accessible quantum computing solutions become more prevalent. Competitive dynamics are intensifying, with a race to develop practical quantum applications and secure intellectual property. Companies are actively investing in quantum computing research and development, forging strategic alliances, and exploring cloud-based quantum platforms to democratize access to this transformative technology. The pursuit of quantum advantage is a central theme, pushing the boundaries of what is computationally feasible and opening up new avenues for industrial innovation. The global quantum computing market is poised for substantial expansion, with manufacturing emerging as a key vertical.

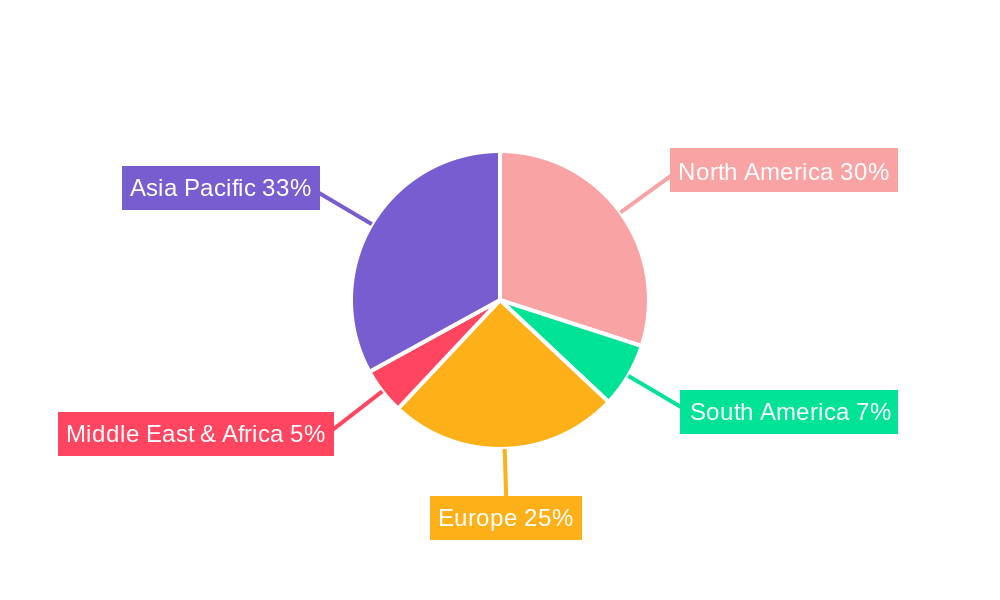

Dominant Markets & Segments in Quantum Computing in Manufacturing

The dominance within the Quantum Computing in Manufacturing market is not yet firmly established, but several regions and segments are showing significant promise. North America, particularly the United States, currently leads in terms of research institutions, venture capital funding, and the presence of major quantum computing players like IBM, Google, and Rigetti Computing. This strong foundation is driven by robust government investment in quantum research and a thriving ecosystem of tech companies and startups. Asia, with China rapidly emerging through companies like Origin Quantum Computing Technology, is also a significant contender, fueled by ambitious national quantum initiatives and substantial industrial demand.

Within the Application segments, the Chemical Industry is poised for early and substantial impact. Quantum computing's ability to accurately simulate molecular interactions can revolutionize catalyst design, drug discovery, and the development of new materials with specific properties, leading to more sustainable and efficient chemical processes. The Automotive sector is another key area, with applications ranging from optimizing complex supply chains and logistics to designing lighter and more durable materials for vehicles, and even simulating battery performance for electric vehicles. The Electronic industry will benefit from improved chip design, advanced materials for next-generation semiconductors, and more efficient manufacturing processes. The Mechanical industry can leverage quantum computing for complex engineering simulations, optimizing designs for strength and efficiency, and enhancing predictive maintenance strategies. Industry Chain Services will also see transformative potential through improved logistics, supply chain optimization, and risk management, impacting every facet of production and distribution.

The Types segment of Manufacturing itself will be fundamentally reshaped by quantum technologies. Beyond specific applications, the core processes of design, production, and quality control will be enhanced. Industry Chain Service providers will integrate quantum capabilities to offer more sophisticated and data-driven solutions, optimizing the entire value stream. Economic policies supporting advanced research and development, alongside the gradual build-out of quantum-ready infrastructure, will be critical drivers of dominance in these leading markets and segments.

- Leading Region: North America (USA) - driven by R&D investment, VC funding, and major tech players.

- Emerging Region: Asia (China) - rapid advancements through national initiatives and industrial demand.

- Dominant Application Segment: Chemical Industry - for molecular simulation, catalyst design, and materials science.

- Key Application Segment: Automotive Industry - supply chain optimization, materials engineering, battery simulation.

- Significant Application Segment: Electronic Industry - chip design, semiconductor materials, manufacturing process enhancement.

- Growing Application Segment: Mechanical Industry - engineering simulations, predictive maintenance, advanced design.

- Transformative Type Segment: Manufacturing - optimization of core production processes.

- Integral Type Segment: Industry Chain Service - enhanced logistics, supply chain optimization, risk management.

Quantum Computing in Manufacturing Product Developments

Product developments in Quantum Computing for Manufacturing are rapidly evolving from theoretical algorithms to tangible hardware and software solutions. Innovations focus on creating more stable and scalable qubit architectures, developing user-friendly quantum programming environments, and building specialized quantum algorithms tailored for industrial problems. Companies are unveiling quantum processors with increasing qubit counts and improved coherence times, alongside cloud-based platforms that provide researchers and businesses access to this cutting-edge technology. The competitive advantage lies in offering efficient, reliable, and application-specific quantum solutions that deliver demonstrable performance improvements over classical computing methods for complex tasks like materials simulation, optimization, and machine learning.

Report Scope & Segmentation Analysis

This report meticulously segments the Quantum Computing in Manufacturing market across critical areas. The Application segments analyzed include: Car, focusing on applications in automotive design, manufacturing, and supply chain; Mechanical, covering its impact on heavy machinery, engineering simulations, and manufacturing processes; Electronic, detailing advancements in semiconductor design and electronic component manufacturing; Chemical Industry, exploring revolution in materials science, drug discovery, and process optimization; and Other, encompassing broader industrial applications. The Types segments examined are: Manufacturing, addressing the core production and operational aspects; and Industry Chain Service, highlighting advancements in logistics, supply chain management, and overall value chain optimization. Each segment's growth projections, estimated market sizes, and competitive dynamics are thoroughly detailed to provide a granular understanding of market opportunities.

Key Drivers of Quantum Computing in Manufacturing Growth

The growth of Quantum Computing in Manufacturing is propelled by several interconnected factors. Technologically, advancements in qubit stability, fault tolerance, and algorithm development are crucial enablers. Economically, the pursuit of enhanced efficiency, reduced operational costs, and the development of novel, high-value products drives investment. Regulatory frameworks that support innovation and intellectual property protection, alongside government funding for quantum research, also play a vital role. For example, the ability to simulate complex molecular structures for new drug development or advanced materials creation offers immense economic potential. Furthermore, the increasing complexity of manufacturing processes and supply chains demands computational power beyond the reach of classical systems.

Challenges in the Quantum Computing in Manufacturing Sector

Despite its immense potential, the Quantum Computing in Manufacturing sector faces significant challenges. Regulatory hurdles are present, particularly concerning the standardization of quantum hardware and software, and the ethical implications of advanced AI integration. Supply chain issues exist in the specialized manufacturing of quantum components, which are often intricate and require specialized materials and expertise. Competitive pressures are intensifying, with a race to achieve quantum advantage before widespread adoption. The high cost of entry for developing and deploying quantum solutions, coupled with a shortage of skilled quantum programmers and researchers, also presents a substantial barrier. The long development cycles for quantum hardware and the need for significant R&D investment represent further constraints.

Emerging Opportunities in Quantum Computing in Manufacturing

Emerging opportunities in Quantum Computing for Manufacturing are vast and transformative. The development of NISQ (Noisy Intermediate-Scale Quantum) era applications offers immediate value in areas like optimization and quantum-inspired algorithms, bridging the gap to fault-tolerant quantum computing. New markets are opening in sectors previously limited by computational constraints, such as personalized medicine through quantum-enhanced drug discovery and the creation of entirely novel materials with unprecedented properties. Consumer preferences for more sustainable and efficient products will be met by quantum-driven innovations in energy efficiency and resource optimization. The continued growth of cloud-based quantum platforms democratizes access, allowing a wider range of manufacturers to explore and leverage quantum capabilities.

Leading Players in the Quantum Computing in Manufacturing Market

- IBM

- Google

- Microsoft

- D-Wave Systems

- Rigetti Computing

- Intel

- Origin Quantum Computing Technology

- Anyon Systems Inc.

- Cambridge Quantum Computing Limited

Key Developments in Quantum Computing in Manufacturing Industry

- 2023/08: IBM unveils its new quantum processor, 'Osprey,' with over 400 qubits, marking a significant step towards more powerful quantum systems.

- 2023/05: Google demonstrates advancements in quantum error correction, a critical step towards building fault-tolerant quantum computers.

- 2023/03: Rigetti Computing announces a roadmap for its next-generation quantum processors, aiming for improved performance and scalability.

- 2022/11: Microsoft expands its Azure Quantum cloud service, offering access to a wider range of quantum hardware and software tools.

- 2022/09: D-Wave Systems releases its 'Advantage2' quantum processor, focusing on increased qubit connectivity and performance for optimization problems.

- 2021/12: Intel showcases its progress in developing silicon-based qubits, a promising approach for scalable quantum computing.

- 2021/10: Origin Quantum Computing Technology announces significant investment and expansion plans in China's burgeoning quantum computing ecosystem.

- 2020/07: Cambridge Quantum Computing Limited and Honeywell Quantum Solutions merge to form Quantinuum, creating a new leader in quantum computing software and hardware.

Strategic Outlook for Quantum Computing in Manufacturing Market

- 2023/08: IBM unveils its new quantum processor, 'Osprey,' with over 400 qubits, marking a significant step towards more powerful quantum systems.

- 2023/05: Google demonstrates advancements in quantum error correction, a critical step towards building fault-tolerant quantum computers.

- 2023/03: Rigetti Computing announces a roadmap for its next-generation quantum processors, aiming for improved performance and scalability.

- 2022/11: Microsoft expands its Azure Quantum cloud service, offering access to a wider range of quantum hardware and software tools.

- 2022/09: D-Wave Systems releases its 'Advantage2' quantum processor, focusing on increased qubit connectivity and performance for optimization problems.

- 2021/12: Intel showcases its progress in developing silicon-based qubits, a promising approach for scalable quantum computing.

- 2021/10: Origin Quantum Computing Technology announces significant investment and expansion plans in China's burgeoning quantum computing ecosystem.

- 2020/07: Cambridge Quantum Computing Limited and Honeywell Quantum Solutions merge to form Quantinuum, creating a new leader in quantum computing software and hardware.

Strategic Outlook for Quantum Computing in Manufacturing Market

The strategic outlook for the Quantum Computing in Manufacturing market is exceptionally promising, driven by the relentless pursuit of computational advantage in solving complex industrial problems. The increasing sophistication of quantum hardware and software, coupled with a growing understanding of practical applications, will unlock new frontiers in efficiency, innovation, and sustainability. Strategic investments in quantum research and development, along with the fostering of collaborative ecosystems, will be paramount. The anticipated breakthroughs in fault-tolerant quantum computing within the next decade will catalyze widespread adoption across key manufacturing sectors, solidifying quantum technology as an indispensable tool for future industrial competitiveness.

Quantum Computing in Manufacturing Segmentation

-

1. Application

- 1.1. Car

- 1.2. Mechanical

- 1.3. Electronic

- 1.4. Chemical Industry

- 1.5. Other

-

2. Types

- 2.1. Manufacturing

- 2.2. Industry Chain Service

Quantum Computing in Manufacturing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Quantum Computing in Manufacturing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Car

- 5.1.2. Mechanical

- 5.1.3. Electronic

- 5.1.4. Chemical Industry

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Manufacturing

- 5.2.2. Industry Chain Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Car

- 6.1.2. Mechanical

- 6.1.3. Electronic

- 6.1.4. Chemical Industry

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Manufacturing

- 6.2.2. Industry Chain Service

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Car

- 7.1.2. Mechanical

- 7.1.3. Electronic

- 7.1.4. Chemical Industry

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Manufacturing

- 7.2.2. Industry Chain Service

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Car

- 8.1.2. Mechanical

- 8.1.3. Electronic

- 8.1.4. Chemical Industry

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Manufacturing

- 8.2.2. Industry Chain Service

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Car

- 9.1.2. Mechanical

- 9.1.3. Electronic

- 9.1.4. Chemical Industry

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Manufacturing

- 9.2.2. Industry Chain Service

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Quantum Computing in Manufacturing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Car

- 10.1.2. Mechanical

- 10.1.3. Electronic

- 10.1.4. Chemical Industry

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Manufacturing

- 10.2.2. Industry Chain Service

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Google

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 D-Wave Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rigetti Computing

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Origin Quantum Computing Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anyon Systems Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cambridge Quantum Computing Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 IBM

List of Figures

- Figure 1: Global Quantum Computing in Manufacturing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Quantum Computing in Manufacturing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Quantum Computing in Manufacturing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Quantum Computing in Manufacturing Revenue (million), by Types 2024 & 2032

- Figure 5: North America Quantum Computing in Manufacturing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Quantum Computing in Manufacturing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Quantum Computing in Manufacturing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Quantum Computing in Manufacturing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Quantum Computing in Manufacturing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Quantum Computing in Manufacturing Revenue (million), by Types 2024 & 2032

- Figure 11: South America Quantum Computing in Manufacturing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Quantum Computing in Manufacturing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Quantum Computing in Manufacturing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Quantum Computing in Manufacturing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Quantum Computing in Manufacturing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Quantum Computing in Manufacturing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Quantum Computing in Manufacturing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Quantum Computing in Manufacturing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Quantum Computing in Manufacturing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Quantum Computing in Manufacturing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Quantum Computing in Manufacturing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Quantum Computing in Manufacturing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Quantum Computing in Manufacturing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Quantum Computing in Manufacturing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Quantum Computing in Manufacturing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Quantum Computing in Manufacturing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Quantum Computing in Manufacturing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Quantum Computing in Manufacturing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Quantum Computing in Manufacturing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Quantum Computing in Manufacturing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Quantum Computing in Manufacturing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Quantum Computing in Manufacturing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Quantum Computing in Manufacturing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Quantum Computing in Manufacturing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Quantum Computing in Manufacturing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Quantum Computing in Manufacturing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Quantum Computing in Manufacturing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Quantum Computing in Manufacturing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Quantum Computing in Manufacturing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Quantum Computing in Manufacturing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Quantum Computing in Manufacturing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Quantum Computing in Manufacturing?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the Quantum Computing in Manufacturing?

Key companies in the market include IBM, Google, Microsoft, D-Wave Solutions, Rigetti Computing, Intel, Origin Quantum Computing Technology, Anyon Systems Inc., Cambridge Quantum Computing Limited.

3. What are the main segments of the Quantum Computing in Manufacturing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 79 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Quantum Computing in Manufacturing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Quantum Computing in Manufacturing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Quantum Computing in Manufacturing?

To stay informed about further developments, trends, and reports in the Quantum Computing in Manufacturing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence