Key Insights

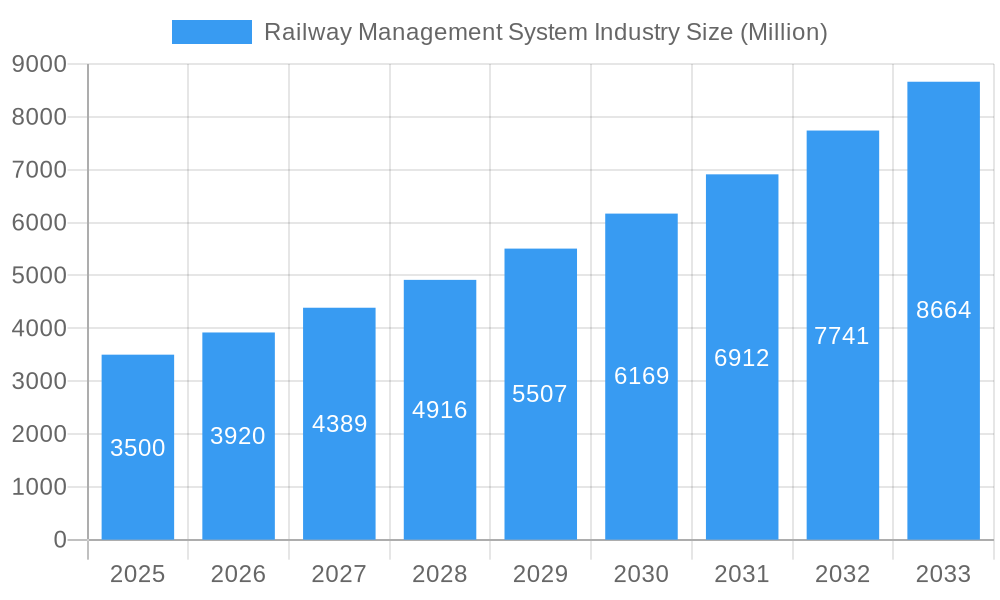

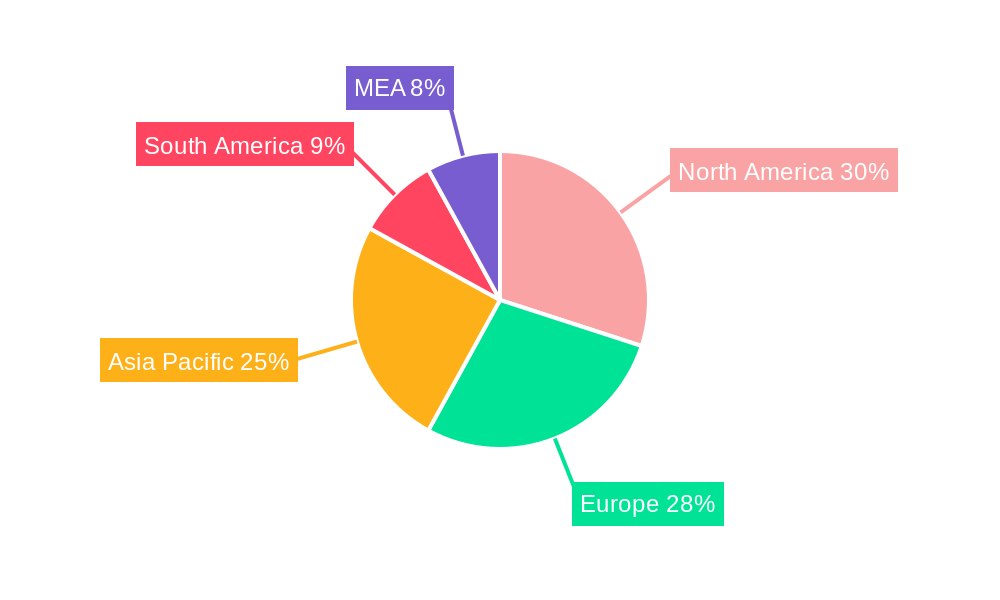

The Railway Management System (RMS) market is poised for substantial growth, driven by increasing passenger volumes, the demand for enhanced operational efficiency, and the critical need for improved safety and security across global rail networks. The market is projected to reach $59.79 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 9.73% from the base year 2025. This expansion is propelled by significant investments in infrastructure modernization, the integration of advanced technologies such as AI and IoT for predictive maintenance and real-time monitoring, and an increasing reliance on data-driven decision-making in railway operations. The solutions segment, covering software and hardware for system integration and management, is anticipated to lead market share, followed closely by the services segment, which includes consulting, implementation, and maintenance. Cloud-based deployment models are gaining prominence due to their scalability, flexibility, and cost-effectiveness. Key industry players, including Indra Sistemas SA, IBM, Alcatel-Lucent Enterprise, Thales Group, and Cisco Systems, are actively influencing the market through innovation and strategic collaborations. Geographic expansion, particularly in the rapidly developing economies of Asia-Pacific and South America, is a significant contributor to the market's upward trajectory.

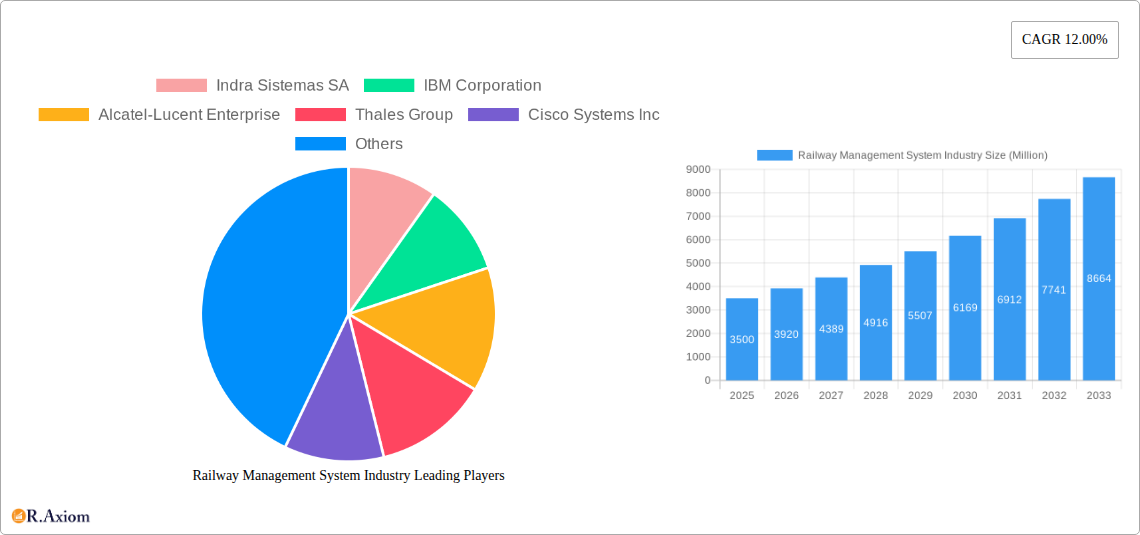

Railway Management System Industry Market Size (In Billion)

The competitive environment features a mix of established industry leaders and emerging technology providers competing for market dominance. The success of RMS vendors will depend on their capacity to deliver integrated, secure, and scalable solutions customized for the unique requirements of individual railway operators. Potential growth restraints include challenges related to legacy system integration, cybersecurity vulnerabilities, and the necessity for skilled workforce development. Nevertheless, continuous technological advancements, evolving government regulations emphasizing safety and efficiency, and the escalating demand for superior passenger experiences are expected to propel sustained market growth.

Railway Management System Industry Company Market Share

Railway Management System Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Railway Management System (RMS) industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report utilizes rigorous data analysis to project a market value exceeding $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Railway Management System Industry Market Concentration & Innovation

The Railway Management System market exhibits a moderately concentrated structure, with several major players holding significant market share. Indra Sistemas SA, IBM Corporation, and Thales Group are among the leading companies, collectively accounting for an estimated XX% of the market in 2025. Market concentration is influenced by factors such as technological expertise, established customer relationships, and extensive geographical reach. Innovation within the RMS sector is driven by the need for enhanced efficiency, safety, and passenger experience. Key innovation drivers include the adoption of AI, IoT, Big Data analytics, and cloud computing. Stringent regulatory frameworks concerning safety and data security heavily influence market dynamics, shaping product development and deployment strategies. The emergence of substitute technologies, such as advanced signaling systems, also impacts the competitive landscape. End-user preferences are shifting towards integrated, scalable RMS solutions that offer improved operational efficiency and cost savings. M&A activity in recent years has been moderate, with deal values averaging approximately $XX Million. Notable acquisitions include [mention any significant acquisitions if available, otherwise state "no major acquisitions reported during the study period"].

Railway Management System Industry Industry Trends & Insights

The Railway Management System market is experiencing robust growth, driven by increasing investments in railway infrastructure modernization across the globe. Government initiatives aimed at improving transportation efficiency and enhancing passenger experience are significantly contributing to market expansion. Technological disruptions, particularly the adoption of cloud-based solutions and AI-powered predictive maintenance, are transforming industry operations. The growing demand for seamless connectivity and real-time data monitoring fuels the adoption of advanced communication and data analytics tools. Consumer preferences increasingly favor secure and reliable transportation systems, driving the demand for sophisticated RMS solutions that enhance safety and security. Competitive dynamics are shaped by ongoing product innovation, strategic partnerships, and acquisitions. Market penetration of cloud-based RMS solutions is projected to reach XX% by 2033, indicating a strong adoption trend among railway operators. The overall market growth trajectory is expected to remain positive throughout the forecast period, driven by several factors.

Dominant Markets & Segments in Railway Management System Industry

The North American region currently holds the largest market share in the Railway Management System industry, driven by substantial investments in infrastructure development and modernization. Europe is another key market, experiencing steady growth due to ongoing initiatives to improve railway efficiency and safety.

- By Component: The "Solutions" segment dominates the market, driven by the increasing demand for comprehensive RMS solutions that integrate various functionalities.

- Rail Security: The "Services" segment, specifically those related to rail security, is experiencing rapid growth due to increasing concerns about safety and security in railway operations.

- By Deployment Mode: The "On-Premise" segment currently holds the largest market share, although the "Cloud" segment is expected to experience significant growth in the coming years due to its scalability and cost-effectiveness. Key drivers of growth in these segments include:

- Economic Policies: Government funding for infrastructure projects and initiatives to support technological advancement are driving market growth.

- Infrastructure Development: Investments in modernization and expansion of railway networks are creating significant demand for sophisticated RMS solutions.

This dominance is largely attributed to robust government support, advanced technological infrastructure, and the presence of key market players.

Railway Management System Industry Product Developments

Recent product innovations in the Railway Management System industry focus on enhanced integration, improved data analytics capabilities, and increased security features. Cloud-based solutions are gaining traction, offering scalability and flexibility to railway operators. The integration of AI and machine learning is enabling predictive maintenance and optimized resource allocation. These advancements lead to significant competitive advantages, enabling companies to offer more efficient, reliable, and cost-effective solutions. Technological trends point towards further integration with other transportation systems and the adoption of more advanced communication protocols. This market fit is clearly in line with the increasing demand for real-time monitoring and control functionalities.

Report Scope & Segmentation Analysis

This report segments the Railway Management System market by component (Solutions, Services), deployment mode (On-Premise, Cloud), and geography. The "Solutions" segment is projected to experience a CAGR of XX% during the forecast period, driven by increasing demand for comprehensive RMS capabilities. The "Services" segment, specifically those related to rail security, is expected to exhibit strong growth due to rising safety concerns. The "On-Premise" deployment model currently dominates the market but the "Cloud" segment is expected to witness significant growth due to its advantages in scalability and cost-effectiveness.

Key Drivers of Railway Management System Industry Growth

Several factors contribute to the growth of the Railway Management System market. Technological advancements, such as the increasing adoption of AI, IoT, and Big Data analytics, are improving the efficiency and safety of railway operations. Government initiatives aimed at upgrading railway infrastructure and promoting sustainable transportation are driving significant investments in RMS solutions. Furthermore, the rising demand for improved passenger experience and enhanced security is fueling market growth. The increasing focus on automation to improve operational efficiency also plays a crucial role.

Challenges in the Railway Management System Industry Sector

The Railway Management System industry faces several challenges. High initial investment costs and the complexity of integrating new technologies across existing legacy systems can hinder adoption. Stringent regulatory compliance requirements and data security concerns represent significant obstacles. Supply chain disruptions and skilled labor shortages can further impact market growth. The overall impact of these challenges is estimated to decrease projected market growth by approximately XX% by 2033.

Emerging Opportunities in Railway Management System Industry

The Railway Management System industry presents promising opportunities. Emerging markets in Asia and Africa offer considerable growth potential, driven by rapid infrastructure development. The adoption of advanced technologies such as blockchain for improved data security and autonomous train operations presents lucrative opportunities for innovation. Growing concerns about sustainability are creating opportunities for energy-efficient RMS solutions. The integration with other transportation modes, forming intelligent multimodal transport systems, represents another significant opportunity.

Leading Players in the Railway Management System Industry Market

Key Developments in Railway Management System Industry Industry

- January 2023: Alstom launches a new generation of onboard train control systems.

- March 2022: IBM partners with a major railway operator to implement an AI-powered predictive maintenance system.

- June 2021: Thales Group acquires a smaller RMS technology provider, expanding its product portfolio.

- [Add further developments with specific dates and impact as available]

Strategic Outlook for Railway Management System Market

The Railway Management System market is poised for continued growth, driven by technological advancements, rising investments in railway infrastructure, and increasing demand for enhanced safety and efficiency. The adoption of cloud-based solutions, AI, and IoT will further shape market dynamics. The focus on sustainable transportation will drive innovations in energy-efficient RMS technologies. The future potential of the market is significant, with substantial opportunities for companies that can successfully innovate and adapt to evolving market needs.

Railway Management System Industry Segmentation

-

1. Component

-

1.1. Solutions

- 1.1.1. Rail Asset Management System

- 1.1.2. Rail Traffic Management System

- 1.1.3. Rail Operation Management System

- 1.1.4. Rail Control System

- 1.1.5. Rail Maintenance Management System

- 1.1.6. Passenger Information System

- 1.1.7. Rail Security

-

1.2. Services

- 1.2.1. Training and Consulting

- 1.2.2. System Integration and Deployment

- 1.2.3. Support and Maintenance

- 1.2.4. Managed Service

- 1.2.5. Professional Service

-

1.1. Solutions

-

2. Deployment Mode

- 2.1. On-Premise

- 2.2. Cloud

Railway Management System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Railway Management System Industry Regional Market Share

Geographic Coverage of Railway Management System Industry

Railway Management System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Demand for Regional as well as International Travel; Rapid Urbanization in Developing and Underdeveloped Countries

- 3.3. Market Restrains

- 3.3.1. ; Operational Inefficiency and Increasing Congestion with Respect to the Existing Railway Infrastructure Capacity

- 3.4. Market Trends

- 3.4.1. Passenger Information System to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Railway Management System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.1.1. Rail Asset Management System

- 5.1.1.2. Rail Traffic Management System

- 5.1.1.3. Rail Operation Management System

- 5.1.1.4. Rail Control System

- 5.1.1.5. Rail Maintenance Management System

- 5.1.1.6. Passenger Information System

- 5.1.1.7. Rail Security

- 5.1.2. Services

- 5.1.2.1. Training and Consulting

- 5.1.2.2. System Integration and Deployment

- 5.1.2.3. Support and Maintenance

- 5.1.2.4. Managed Service

- 5.1.2.5. Professional Service

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Railway Management System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.1.1. Rail Asset Management System

- 6.1.1.2. Rail Traffic Management System

- 6.1.1.3. Rail Operation Management System

- 6.1.1.4. Rail Control System

- 6.1.1.5. Rail Maintenance Management System

- 6.1.1.6. Passenger Information System

- 6.1.1.7. Rail Security

- 6.1.2. Services

- 6.1.2.1. Training and Consulting

- 6.1.2.2. System Integration and Deployment

- 6.1.2.3. Support and Maintenance

- 6.1.2.4. Managed Service

- 6.1.2.5. Professional Service

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Railway Management System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.1.1. Rail Asset Management System

- 7.1.1.2. Rail Traffic Management System

- 7.1.1.3. Rail Operation Management System

- 7.1.1.4. Rail Control System

- 7.1.1.5. Rail Maintenance Management System

- 7.1.1.6. Passenger Information System

- 7.1.1.7. Rail Security

- 7.1.2. Services

- 7.1.2.1. Training and Consulting

- 7.1.2.2. System Integration and Deployment

- 7.1.2.3. Support and Maintenance

- 7.1.2.4. Managed Service

- 7.1.2.5. Professional Service

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Railway Management System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.1.1. Rail Asset Management System

- 8.1.1.2. Rail Traffic Management System

- 8.1.1.3. Rail Operation Management System

- 8.1.1.4. Rail Control System

- 8.1.1.5. Rail Maintenance Management System

- 8.1.1.6. Passenger Information System

- 8.1.1.7. Rail Security

- 8.1.2. Services

- 8.1.2.1. Training and Consulting

- 8.1.2.2. System Integration and Deployment

- 8.1.2.3. Support and Maintenance

- 8.1.2.4. Managed Service

- 8.1.2.5. Professional Service

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Railway Management System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.1.1. Rail Asset Management System

- 9.1.1.2. Rail Traffic Management System

- 9.1.1.3. Rail Operation Management System

- 9.1.1.4. Rail Control System

- 9.1.1.5. Rail Maintenance Management System

- 9.1.1.6. Passenger Information System

- 9.1.1.7. Rail Security

- 9.1.2. Services

- 9.1.2.1. Training and Consulting

- 9.1.2.2. System Integration and Deployment

- 9.1.2.3. Support and Maintenance

- 9.1.2.4. Managed Service

- 9.1.2.5. Professional Service

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Indra Sistemas SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alcatel-Lucent Enterprise

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thales Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cisco Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Alstom SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Huawei Technologies Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hitachi Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ABB Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 General Electric Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Indra Sistemas SA

List of Figures

- Figure 1: Global Railway Management System Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Railway Management System Industry Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Railway Management System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Railway Management System Industry Revenue (billion), by Deployment Mode 2025 & 2033

- Figure 5: North America Railway Management System Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 6: North America Railway Management System Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Railway Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Railway Management System Industry Revenue (billion), by Component 2025 & 2033

- Figure 9: Europe Railway Management System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Railway Management System Industry Revenue (billion), by Deployment Mode 2025 & 2033

- Figure 11: Europe Railway Management System Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 12: Europe Railway Management System Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Railway Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Railway Management System Industry Revenue (billion), by Component 2025 & 2033

- Figure 15: Asia Pacific Railway Management System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Railway Management System Industry Revenue (billion), by Deployment Mode 2025 & 2033

- Figure 17: Asia Pacific Railway Management System Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Asia Pacific Railway Management System Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Railway Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Railway Management System Industry Revenue (billion), by Component 2025 & 2033

- Figure 21: Rest of the World Railway Management System Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Railway Management System Industry Revenue (billion), by Deployment Mode 2025 & 2033

- Figure 23: Rest of the World Railway Management System Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 24: Rest of the World Railway Management System Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Railway Management System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Railway Management System Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Railway Management System Industry Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 3: Global Railway Management System Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Railway Management System Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 5: Global Railway Management System Industry Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 6: Global Railway Management System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Railway Management System Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 8: Global Railway Management System Industry Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Railway Management System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Railway Management System Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 11: Global Railway Management System Industry Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 12: Global Railway Management System Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Railway Management System Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 14: Global Railway Management System Industry Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 15: Global Railway Management System Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Railway Management System Industry?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Railway Management System Industry?

Key companies in the market include Indra Sistemas SA, IBM Corporation, Alcatel-Lucent Enterprise, Thales Group, Cisco Systems Inc, Siemens AG, Alstom SA, Huawei Technologies Co Ltd, Hitachi Limited, ABB Limited, General Electric Company.

3. What are the main segments of the Railway Management System Industry?

The market segments include Component, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.79 billion as of 2022.

5. What are some drivers contributing to market growth?

; High Demand for Regional as well as International Travel; Rapid Urbanization in Developing and Underdeveloped Countries.

6. What are the notable trends driving market growth?

Passenger Information System to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Operational Inefficiency and Increasing Congestion with Respect to the Existing Railway Infrastructure Capacity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Railway Management System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Railway Management System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Railway Management System Industry?

To stay informed about further developments, trends, and reports in the Railway Management System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence