Key Insights

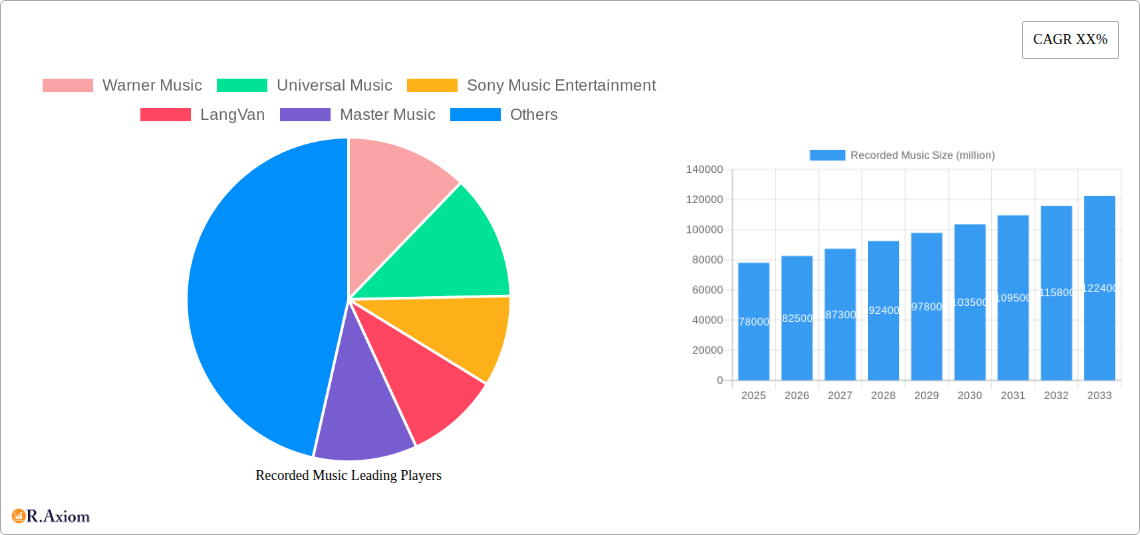

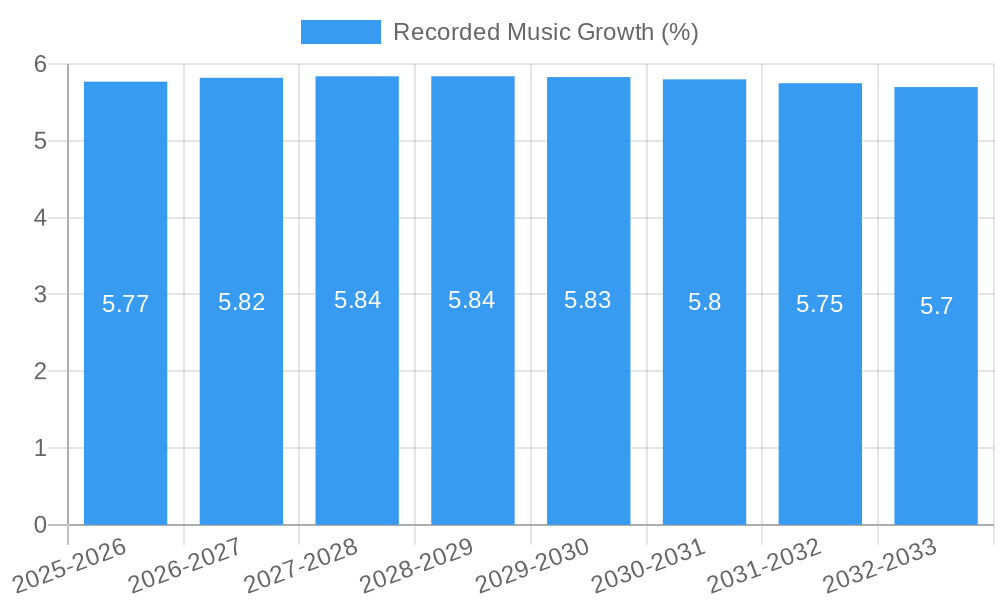

The global recorded music market is poised for robust growth, projected to reach a significant market size of approximately $XX billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of XX%. This expansion is primarily fueled by the increasing adoption of digital streaming services, which have revolutionized music consumption and revenue generation. The shift from physical formats to digital, alongside the continued popularity of vinyl records, indicates a dynamic and evolving consumer preference landscape. The market is segmented by application, with Recreational Activities, Personal, and Commercial uses dominating, reflecting the pervasive integration of recorded music into daily life and various industries. Furthermore, the diverse types of recorded music, including CD Records, Tape Records, and Optical Sound Records, alongside emerging 'Other' categories, showcase the market's adaptability to technological advancements and evolving consumer tastes. Key players like Warner Music, Universal Music, and Sony Music Entertainment are at the forefront of this transformation, strategically investing in digital infrastructure, artist development, and innovative distribution models to capitalize on emerging opportunities.

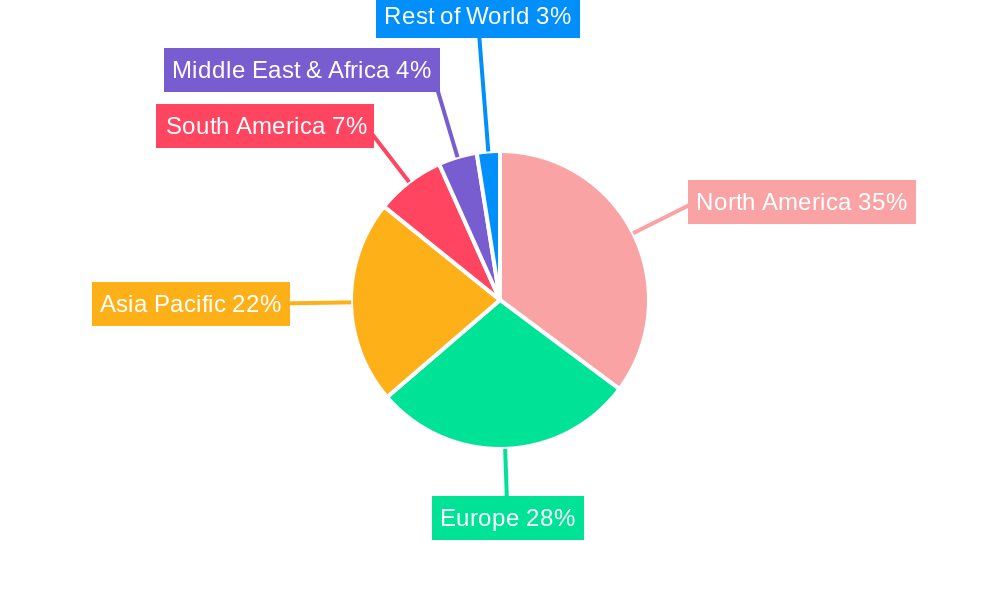

The growth trajectory of the recorded music market is further bolstered by several key trends, including the rise of independent artists and labels leveraging digital platforms for global reach, and the increasing demand for personalized music experiences through AI-driven recommendations and curated playlists. The integration of music into gaming, virtual reality, and metaverse experiences presents novel avenues for market expansion. However, the market also faces certain restraints, such as piracy and the ongoing debate surrounding fair artist compensation in the digital era. Regional dynamics play a crucial role, with Asia Pacific emerging as a significant growth engine due to its burgeoning digital infrastructure and a large, digitally-native population. North America and Europe continue to be dominant markets, driven by mature streaming ecosystems and a strong legacy of music consumption. The ongoing evolution of consumption patterns, coupled with technological innovations, suggests a highly dynamic and promising future for the recorded music industry.

Recorded Music Market Concentration & Innovation

The global recorded music market exhibits a dynamic interplay of concentration and innovation, driven by major labels and emerging players alike. The Big Three – Universal Music, Sony Music Entertainment, and Warner Music – continue to dominate, collectively holding an estimated 70% market share, valued at over 20,000 million in the base year 2025. This concentration is fueled by extensive intellectual property portfolios, established distribution networks, and significant marketing budgets. However, innovation is a crucial counterbalancing force. The rise of independent labels like LangVan, Master Music, Lifesong Records, and China Record Company, alongside niche physical format specialists such as Tokuma Japan Communications and Nippon Crown Co Ltd, fosters diversity.

Key Innovation Drivers:

- Digital Transformation: Streaming platforms and AI-powered music creation tools are democratizing production and distribution, enabling smaller entities to reach global audiences.

- Fan Engagement Platforms: Direct-to-fan models and blockchain-based initiatives are empowering artists and creating new revenue streams, bypassing traditional gatekeepers.

- Emerging Market Growth: Penetration in regions like Asia, with companies like King Record and HNH International gaining traction, presents significant untapped potential.

Regulatory Frameworks: Copyright protection laws and digital rights management (DRM) are critical, though evolving to address the complexities of online distribution. Mergers and acquisitions (M&A) remain a significant strategy for consolidation and expansion, with estimated M&A deal values in the recorded music sector reaching approximately 500 million in 2025. Companies like MPO International and BBS Records Limited are key players in this M&A landscape, particularly in the physical media segment. The ongoing challenge lies in balancing industry consolidation with fostering an environment conducive to artistic and technological innovation.

Recorded Music Industry Trends & Insights

The recorded music industry is undergoing a profound transformation, characterized by robust growth driven by technological advancements, evolving consumer preferences, and shifting competitive dynamics. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7% from 2025 to 2033, with an estimated market size of 30,000 million in the base year 2025. This expansion is largely attributed to the widespread adoption of digital streaming services, which have become the primary mode of music consumption globally. Streaming's market penetration is expected to exceed 80% by 2028, providing a consistent and accessible revenue stream for rights holders.

Technological disruptions are at the forefront of this evolution. Artificial intelligence (AI) is increasingly influencing music creation, with AI-generated music gaining traction and posing both opportunities and challenges for traditional artists and labels. Furthermore, advancements in audio technology, such as immersive audio formats (e.g., Dolby Atmos), are enhancing the listening experience and creating new avenues for monetization. The rise of social media platforms has also become an integral part of music discovery and promotion, with viral trends and influencer marketing playing a significant role in the success of new artists and tracks.

Consumer preferences are also shifting. While global hits continue to dominate, there's a growing appetite for niche genres, independent artists, and personalized music experiences. This has led to the proliferation of curated playlists and algorithmic recommendations on streaming platforms, catering to diverse tastes. The value placed on music experiences is also evolving, with a renewed interest in physical formats like vinyl records, driven by a desire for collectible items and a more tactile engagement with music. This trend, alongside the continued relevance of CD records and the niche appeal of tape records and optical sound records, contributes to a multifaceted market. The competitive landscape is intense, with major record labels, independent distributors, and technology companies vying for market share. Strategic partnerships between streaming services and music labels, as well as direct-to-artist platforms, are becoming increasingly common, reshaping the power dynamics within the industry. The integration of music into other entertainment forms, such as gaming and virtual reality, further expands the reach and revenue potential of recorded music. The ongoing digitalization ensures that adaptability and embracing new technologies are paramount for sustained success in this vibrant industry.

Dominant Markets & Segments in Recorded Music

The recorded music market's dominance is multifaceted, with a clear hierarchy observed across geographical regions and key application segments. North America, encompassing the United States and Canada, continues to be the largest revenue-generating region, accounting for an estimated 35% of the global market share in 2025, valued at over 10,000 million. This dominance is underpinned by robust economic policies, advanced digital infrastructure, and a highly engaged consumer base with a strong appetite for diverse musical content. Economic policies supporting intellectual property rights and a well-established entertainment ecosystem contribute significantly to this regional leadership.

Among the application segments, Recreational Activities emerges as the most dominant, representing approximately 45% of the market value, estimated at 13,500 million in 2025. This segment encompasses music consumption for leisure, entertainment, and personal enjoyment, which is inherently massive and spans across all demographics. The widespread availability of streaming services and the integration of music into daily life through mobile devices and smart home technology further solidify its leading position.

The Personal application segment is also a significant contributor, accounting for around 30% of the market, estimated at 9,000 million. This segment focuses on individual listening habits, including personal playlists, mood-based listening, and the use of music for focus or relaxation. The growth of personalized recommendation algorithms on streaming platforms directly fuels this segment's expansion.

The Commercial segment, representing roughly 20% of the market, valued at 6,000 million, encompasses the use of recorded music in businesses such as retail stores, restaurants, gyms, and public spaces. Licensing and performance rights are crucial here, and the trend towards background music as an ambient enhancer continues to drive demand.

Finally, the Social segment, at approximately 5%, estimated at 1,500 million, involves music used in social gatherings, parties, and community events. While smaller, it represents a vital area for music discovery and shared experiences.

In terms of music types, Optical Sound Records (primarily CD Records) still hold a substantial share, estimated at 30% (around 9,000 million), particularly in emerging markets and among collectors. However, the digital dominance of streaming effectively renders "Other" types, encompassing a vast array of digital audio formats and emerging technologies, the largest and fastest-growing segment, representing over 50% of the market, valued at over 15,000 million. Tape Records, though a niche, still command a small but dedicated following, contributing around 5% ( 1,500 million). The growth trajectory clearly indicates a continued shift towards digital and evolving audio formats, driven by technological innovation and evolving consumer habits.

Recorded Music Product Developments

Product developments in the recorded music sector are increasingly focused on enhancing the listening experience and diversifying consumption methods. Streaming platforms continue to evolve with AI-powered personalization, offering more tailored recommendations and curated content. Immersive audio technologies like Dolby Atmos are gaining traction, providing a richer, spatial sound experience, driving demand for compatible hardware and software. Independent artists are leveraging blockchain technology to create NFTs (Non-Fungible Tokens) for music, offering fans unique ownership stakes and direct support. Physical formats, while declining in overall market share, are seeing innovation through limited edition releases, collector's sets, and sustainable production methods, catering to a dedicated fanbase and appealing to a growing eco-conscious consumer base. The competitive advantage lies in delivering high-fidelity sound, exclusive content, and engaging fan experiences that foster loyalty in a crowded digital landscape.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global recorded music market from 2019 to 2033, with a base year of 2025. The scope encompasses market dynamics, segmentation, key players, and future outlook.

Application Segmentation:

- Recreational Activities: This segment, expected to maintain strong growth, covers music for personal enjoyment, entertainment, and leisure. Projected market size of 13,500 million in 2025, with a CAGR of approximately 7.5% during the forecast period.

- Personal: Focused on individual listening habits, this segment includes music for work, study, and personal mood enhancement. Projected market size of 9,000 million in 2025, with a CAGR of around 6.8%.

- Commercial: Encompasses music usage in public and business spaces, requiring licensing. Projected market size of 6,000 million in 2025, with a CAGR of 5.5%, influenced by evolving retail and hospitality trends.

- Social: Music used in events, parties, and gatherings. Projected market size of 1,500 million in 2025, with a modest CAGR of 4.0%.

Type Segmentation:

- CD Record: While experiencing a decline in overall market share, CD Records continue to hold value, particularly for collectors and in specific markets. Projected market size of 9,000 million in 2025, with a CAGR of -2.0%.

- Tape Record: A niche segment, Tape Records appeal to a dedicated retro market. Projected market size of 1,500 million in 2025, with a stable CAGR of 1.0%.

- Optical Sound Record: This category includes formats beyond CDs. Projected market size of 3,000 million in 2025, with a CAGR of -1.5%.

- Other: This dominant and fastest-growing segment encompasses all digital audio formats, including streaming, downloads, and emerging technologies. Projected market size exceeding 15,000 million in 2025, with a significant CAGR of 9.5%.

Key Drivers of Recorded Music Growth

The growth of the recorded music market is propelled by a confluence of technological, economic, and consumer-driven factors. The ubiquitous adoption of high-speed internet and mobile devices has facilitated the widespread accessibility of digital music streaming, becoming the primary consumption channel globally. Economic prosperity in emerging markets is also a significant driver, increasing disposable income and the ability of a larger population to access paid streaming services and purchase music. Furthermore, favorable regulatory environments that protect intellectual property rights encourage investment and innovation within the industry. The continuous evolution of audio technology, such as spatial audio and AI-powered music creation, opens up new avenues for artist revenue and enhanced consumer experiences. The globalized nature of online platforms allows artists to reach a worldwide audience, breaking down geographical barriers and fostering cross-cultural music appreciation.

Challenges in the Recorded Music Sector

Despite its robust growth, the recorded music sector faces several significant challenges. The persistent issue of piracy and unauthorized distribution of music online continues to erode potential revenue, although digital rights management (DRM) technologies and legal frameworks are working to mitigate this. The complex and often fragmented royalty collection system, particularly across different territories and platforms, can be a source of contention and reduce artist payouts. Intense competition among streaming services leads to price wars and pressure on margins, impacting profitability for labels and artists alike. The increasing cost of marketing and promotion in a saturated digital landscape makes it challenging for new artists to gain visibility. Furthermore, the ethical considerations surrounding AI-generated music and its impact on human creativity and artist livelihoods remain a subject of ongoing debate and require careful navigation.

Emerging Opportunities in Recorded Music

The recorded music sector is ripe with emerging opportunities, driven by evolving consumer behaviors and technological advancements. The metaverse and virtual reality (VR) present new frontiers for music consumption, offering immersive concert experiences and virtual fan engagement. The growth of short-form video platforms like TikTok continues to be a powerful engine for music discovery and virality, creating new pathways for artists to connect with audiences. The increasing demand for personalized and curated music experiences fuels opportunities for niche genres and independent artists to thrive. Furthermore, the rise of Web3 technologies, including NFTs and decentralized platforms, offers innovative ways for artists to monetize their work, build direct relationships with fans, and explore new ownership models. The growing popularity of music in gaming soundtracks and interactive media also opens up significant revenue streams and expands the reach of recorded music to new demographics.

Leading Players in the Recorded Music Market

- Warner Music

- Universal Music

- Sony Music Entertainment

- LangVan

- Master Music

- De Plein Vent Studio

- China Record Company

- Lifesong Records

- King Record

- Nippon Crown Co Ltd

- Tokuma Japan Communications

- HNH International

- BBS Records Limited

- MPO International

Key Developments in Recorded Music Industry

- 2023: Widespread adoption of AI music generation tools, leading to discussions on copyright and artist compensation.

- 2023: Continued growth of immersive audio formats (e.g., Dolby Atmos) in mainstream music releases.

- 2024: Increased investment in blockchain-based music NFTs and decentralized streaming platforms.

- 2024: Major record labels actively exploring partnerships with metaverse platforms for virtual concerts and experiences.

- 2025: Anticipated surge in licensed music usage within gaming environments and VR applications.

- 2025: Focus on sustainable practices in physical music production (e.g., eco-friendly vinyl).

- 2026: Evolution of royalty payment structures to accommodate new digital revenue streams.

- 2027: Potential for increased consolidation through strategic M&A activities among independent labels.

- 2028: Development of advanced AI tools for music analytics and fan engagement prediction.

- 2029: Expansion of music licensing for interactive entertainment beyond gaming.

- 2030: Growing importance of direct-to-fan models for artist income diversification.

- 2031: Continued integration of music with social commerce trends.

- 2032: Advancements in audio fidelity and playback technologies for enhanced listening experiences.

- 2033: Emergence of new global music hubs beyond traditional markets.

Strategic Outlook for Recorded Music Market

The strategic outlook for the recorded music market is one of continued innovation and expansion, driven by the ongoing digital transformation and evolving consumer engagement. The market is poised for sustained growth, with a strong emphasis on leveraging new technologies like AI and Web3 to create novel revenue streams and enhance artist-fan connections. Diversification of product offerings, including immersive audio experiences and innovative physical formats, will be crucial for catering to a broad spectrum of consumer preferences. Strategic partnerships between technology companies, labels, and artists will foster a more dynamic and collaborative ecosystem. The focus will increasingly shift towards personalized music discovery, global market penetration in emerging economies, and the development of robust fan communities. Adaptability and a forward-thinking approach to technological integration will be paramount for stakeholders to capitalize on future opportunities and navigate the evolving landscape of the recorded music industry.

Recorded Music Segmentation

-

1. Application

- 1.1. Recreational Activities

- 1.2. Personal

- 1.3. Commercial

- 1.4. Social

-

2. Types

- 2.1. CD Record

- 2.2. Tape Record

- 2.3. Optical Sound Record

- 2.4. Other

Recorded Music Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Recorded Music REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recorded Music Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Recreational Activities

- 5.1.2. Personal

- 5.1.3. Commercial

- 5.1.4. Social

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. CD Record

- 5.2.2. Tape Record

- 5.2.3. Optical Sound Record

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Recorded Music Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Recreational Activities

- 6.1.2. Personal

- 6.1.3. Commercial

- 6.1.4. Social

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. CD Record

- 6.2.2. Tape Record

- 6.2.3. Optical Sound Record

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Recorded Music Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Recreational Activities

- 7.1.2. Personal

- 7.1.3. Commercial

- 7.1.4. Social

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. CD Record

- 7.2.2. Tape Record

- 7.2.3. Optical Sound Record

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Recorded Music Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Recreational Activities

- 8.1.2. Personal

- 8.1.3. Commercial

- 8.1.4. Social

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. CD Record

- 8.2.2. Tape Record

- 8.2.3. Optical Sound Record

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Recorded Music Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Recreational Activities

- 9.1.2. Personal

- 9.1.3. Commercial

- 9.1.4. Social

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. CD Record

- 9.2.2. Tape Record

- 9.2.3. Optical Sound Record

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Recorded Music Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Recreational Activities

- 10.1.2. Personal

- 10.1.3. Commercial

- 10.1.4. Social

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. CD Record

- 10.2.2. Tape Record

- 10.2.3. Optical Sound Record

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Warner Music

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Universal Music

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sony Music Entertainment

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LangVan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Master Music

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 De Plein Vent Studio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Record Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lifesong Records

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 King Record

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nippon Crown Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tokuma Japan Communications

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HNH International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BBS Records Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MPO International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Warner Music

List of Figures

- Figure 1: Global Recorded Music Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Recorded Music Revenue (million), by Application 2024 & 2032

- Figure 3: North America Recorded Music Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Recorded Music Revenue (million), by Types 2024 & 2032

- Figure 5: North America Recorded Music Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Recorded Music Revenue (million), by Country 2024 & 2032

- Figure 7: North America Recorded Music Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Recorded Music Revenue (million), by Application 2024 & 2032

- Figure 9: South America Recorded Music Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Recorded Music Revenue (million), by Types 2024 & 2032

- Figure 11: South America Recorded Music Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Recorded Music Revenue (million), by Country 2024 & 2032

- Figure 13: South America Recorded Music Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Recorded Music Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Recorded Music Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Recorded Music Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Recorded Music Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Recorded Music Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Recorded Music Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Recorded Music Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Recorded Music Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Recorded Music Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Recorded Music Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Recorded Music Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Recorded Music Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Recorded Music Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Recorded Music Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Recorded Music Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Recorded Music Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Recorded Music Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Recorded Music Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Recorded Music Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Recorded Music Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Recorded Music Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Recorded Music Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Recorded Music Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Recorded Music Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Recorded Music Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Recorded Music Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Recorded Music Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Recorded Music Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recorded Music?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Recorded Music?

Key companies in the market include Warner Music, Universal Music, Sony Music Entertainment, LangVan, Master Music, De Plein Vent Studio, China Record Company, Lifesong Records, King Record, Nippon Crown Co Ltd, Tokuma Japan Communications, HNH International, BBS Records Limited, MPO International.

3. What are the main segments of the Recorded Music?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recorded Music," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recorded Music report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recorded Music?

To stay informed about further developments, trends, and reports in the Recorded Music, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence