Key Insights

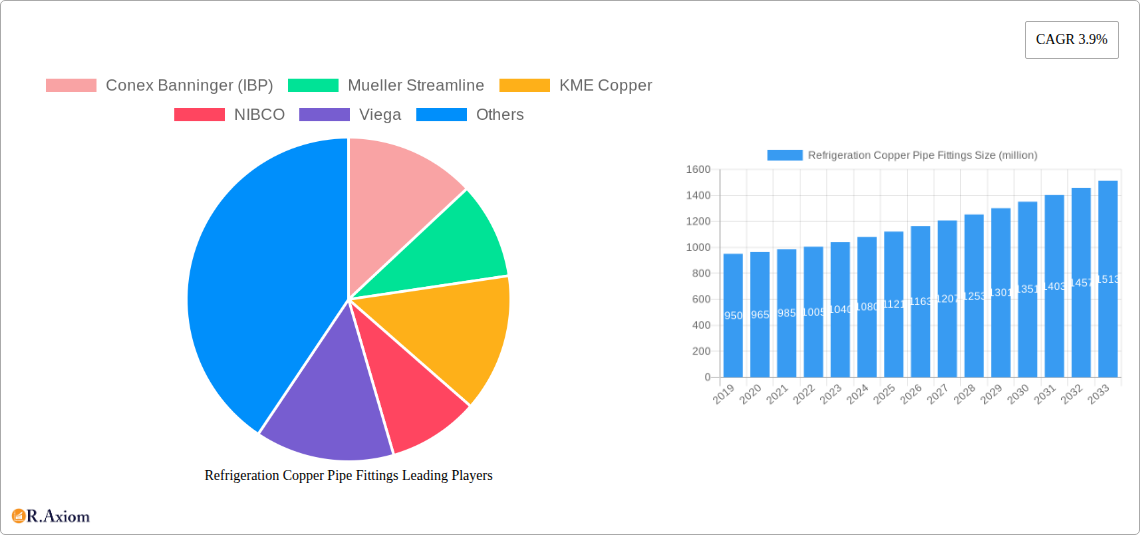

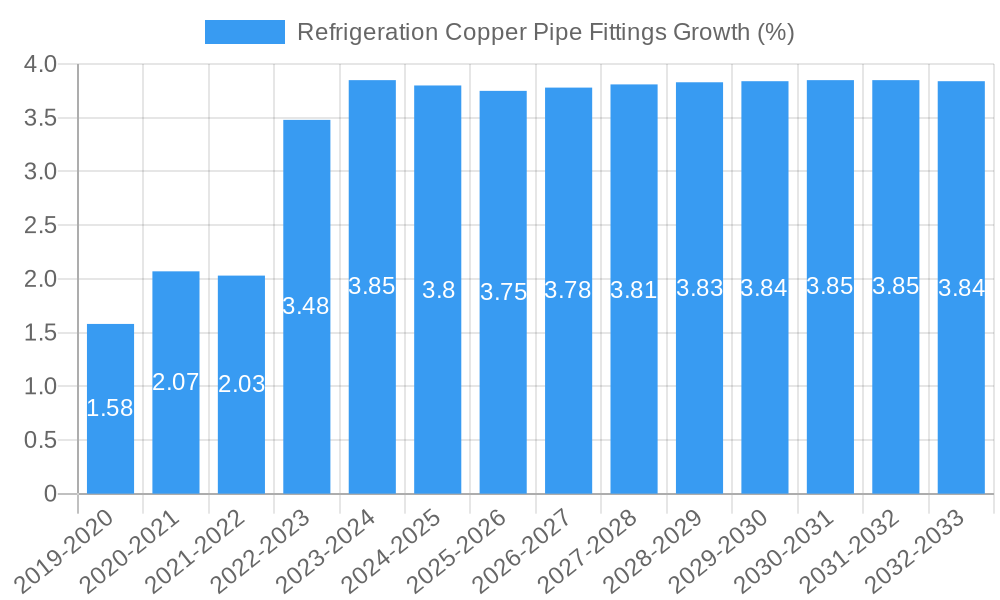

The global Refrigeration Copper Pipe Fittings market is poised for steady growth, projected to reach an estimated \$1,121 million by 2025, with a compound annual growth rate (CAGR) of 3.9% anticipated from 2025 to 2033. This expansion is primarily driven by the escalating demand for efficient and reliable refrigeration systems across various sectors, including residential, commercial, and industrial applications. The increasing adoption of energy-efficient cooling solutions and the growing need for robust HVAC (Heating, Ventilation, and Air Conditioning) infrastructure are significant catalysts for this market's upward trajectory. Furthermore, the inherent properties of copper, such as its excellent thermal conductivity, corrosion resistance, and durability, make it the preferred material for refrigeration components, reinforcing its market dominance. The market is segmented by application, with Refrigeration Copper Pipe and Heat Exchanger being key segments, and by type, featuring 90 Degree Elbow and 45 Degree Elbow fittings, each catering to specific installation requirements.

Geographically, the Asia Pacific region is expected to be a dominant force in the market, fueled by rapid industrialization, urbanization, and a burgeoning middle class that is driving demand for improved living conditions and advanced cooling technologies. China and India, in particular, represent substantial growth opportunities due to their massive populations and ongoing infrastructure development. North America and Europe, while mature markets, continue to exhibit stable demand, driven by replacement cycles, upgrades to more energy-efficient systems, and stringent environmental regulations that favor advanced refrigeration solutions. Key players like Conex Banninger (IBP), Mueller Streamline, KME Copper, NIBCO, and Viega are actively innovating and expanding their product portfolios to cater to evolving market needs and maintain a competitive edge in this dynamic industry. Strategic partnerships, mergers, and acquisitions are also likely to shape the competitive landscape.

Sure, here is the SEO-optimized report description for Refrigeration Copper Pipe Fittings.

Refrigeration Copper Pipe Fittings Market Concentration & Innovation

The global Refrigeration Copper Pipe Fittings market demonstrates a moderate concentration, with leading manufacturers like Conex Banninger (IBP), Mueller Streamline, KME Copper, NIBCO, and Viega holding significant market share estimated at over 60% collectively. Innovation remains a critical differentiator, driven by advancements in material science, manufacturing techniques, and design optimization to meet stringent industry standards and evolving end-user demands. Key innovation drivers include the pursuit of enhanced corrosion resistance, improved thermal conductivity, and streamlined installation processes. Regulatory frameworks, such as those governing refrigerants and safety standards, also profoundly influence product development and market entry strategies, with compliance often necessitating significant investment in R&D.

- Market Share of Leading Players: Estimated at over 60% for the top five companies.

- M&A Activity: Limited but strategic, with deal values typically in the tens of millions for smaller acquisitions, focusing on expanding product portfolios or geographical reach.

- Innovation Focus Areas:

- Advanced alloys for increased durability and performance.

- Manufacturing processes to improve dimensional accuracy and reduce waste.

- Development of fittings compatible with newer, more environmentally friendly refrigerants.

Refrigeration Copper Pipe Fittings Industry Trends & Insights

The Refrigeration Copper Pipe Fittings industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period of 2025–2033. This expansion is primarily fueled by the escalating demand for efficient and reliable refrigeration systems across residential, commercial, and industrial sectors. Technological disruptions, such as the adoption of advanced manufacturing technologies like automated CNC machining and laser welding, are enhancing production efficiency and product quality, leading to better market penetration. Consumer preferences are shifting towards energy-efficient solutions, driving the demand for copper pipe fittings that facilitate optimal heat transfer and minimize refrigerant leakage. Competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, with a strong emphasis on product quality, competitive pricing, and robust distribution networks. The increasing adoption of smart technologies in HVAC systems also influences the design and functionality of pipe fittings, pushing for integrated solutions. Market penetration for specialized high-performance fittings is also on an upward trajectory.

Dominant Markets & Segments in Refrigeration Copper Pipe Fittings

The Refrigeration Copper Pipe Fittings market is dominated by regions with significant industrial and commercial infrastructure development, particularly Asia Pacific, followed by North America and Europe. Within the application segment, Refrigeration Copper Pipe fittings represent the largest share, accounting for an estimated 70% of the total market value, owing to their ubiquitous use in air conditioning units, commercial refrigeration, and industrial cooling systems. The Heat Exchanger application segment, though smaller, is exhibiting a higher growth rate, driven by advancements in heat transfer technology and the increasing demand for efficient cooling solutions in power generation and chemical processing.

- Leading Region: Asia Pacific

- Key Drivers: Rapid urbanization, burgeoning manufacturing sector, increasing disposable incomes leading to higher demand for appliances, and substantial investments in infrastructure projects. Countries like China and India are key contributors.

- Economic Policies: Government initiatives promoting manufacturing and energy efficiency contribute significantly.

- Infrastructure Development: Construction of commercial buildings, data centers, and industrial facilities requires extensive refrigeration systems.

- Dominant Application: Refrigeration Copper Pipe

- Key Drivers: Widespread use in HVAC systems for residential and commercial buildings, growth in the cold chain logistics sector, and demand for reliable appliances.

- End-User Trends: Increasing demand for smaller, more energy-efficient refrigeration units.

- Market Size Projection: Expected to reach a market value of over 500 million USD by 2025.

- Dominant Type: 90 Degree Elbow

- Key Drivers: Versatility in directing refrigerant flow in confined spaces, common requirement in most refrigeration circuit designs, and ease of installation.

- Technological Advancements: Innovations in brazing techniques and material integrity enhance the reliability of 90-degree elbows.

- Market Share: Estimated to hold over 55% of the total fittings market by volume.

Refrigeration Copper Pipe Fittings Product Developments

Recent product developments in Refrigeration Copper Pipe Fittings focus on enhanced durability, superior corrosion resistance, and improved ease of installation. Manufacturers are innovating with advanced copper alloys and specialized coatings to extend the lifespan of fittings in demanding environments. Innovations in leak-proof joint technologies and pre-fabricated bends are streamlining installation processes, reducing labor costs, and minimizing the risk of refrigerant leaks. These advancements cater to the evolving needs of HVACR technicians and system designers, ensuring optimal performance and energy efficiency in refrigeration applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Refrigeration Copper Pipe Fittings market, segmented by Application and Type. The study covers the forecast period of 2025–2033, with a base year of 2025.

- Application Segments:

- Refrigeration Copper Pipe: This segment is projected to witness steady growth driven by the continuous demand for HVAC systems and refrigeration units. Its market size is estimated at over 500 million USD in 2025, with a projected CAGR of 5.2%.

- Heat Exchanger: This segment is expected to grow at a faster pace, with an estimated CAGR of 6.0%, driven by innovations in thermal management and increasing industrial applications. The market size is projected to reach over 150 million USD by 2025.

- Others: This segment includes diverse applications and is projected to grow at a CAGR of 4.8%, with a market size of over 100 million USD in 2025.

- Type Segments:

- 90 Degree Elbow: This is the most dominant type, expected to hold a market share of over 55% by volume in 2025, with a market size exceeding 450 million USD.

- 45 Degree Elbow: This segment is also significant, with a projected market size of over 200 million USD in 2025, growing at a CAGR of 5.0%.

Key Drivers of Refrigeration Copper Pipe Fittings Growth

The growth of the Refrigeration Copper Pipe Fittings market is propelled by several key drivers. The escalating global demand for energy-efficient HVAC systems in residential and commercial buildings is a primary catalyst. Furthermore, the expansion of the cold chain logistics sector, crucial for preserving perishable goods, necessitates reliable refrigeration infrastructure. Technological advancements in manufacturing processes, leading to more durable and cost-effective fittings, also contribute significantly. Government regulations promoting energy efficiency and reducing refrigerant emissions indirectly boost the demand for high-quality copper fittings. The increasing industrialization and infrastructure development in emerging economies further fuel market expansion.

Challenges in the Refrigeration Copper Pipe Fittings Sector

Despite robust growth, the Refrigeration Copper Pipe Fittings sector faces several challenges. Fluctuations in the price of raw materials, particularly copper, can impact manufacturing costs and profit margins. Stringent environmental regulations regarding refrigerant usage and disposal, while driving innovation, also add compliance costs. Intense competition among manufacturers, both established and new entrants, leads to price pressures. Supply chain disruptions, exacerbated by geopolitical events or global health crises, can affect the availability and timely delivery of products. The increasing adoption of alternative materials in certain applications also poses a competitive threat.

Emerging Opportunities in Refrigeration Copper Pipe Fittings

Emerging opportunities in the Refrigeration Copper Pipe Fittings market lie in the growing demand for specialized fittings compatible with next-generation refrigerants, such as HFOs and natural refrigerants, which are more environmentally friendly. The expansion of the data center industry, requiring sophisticated cooling solutions, presents a significant growth avenue. Moreover, smart building technologies and the Internet of Things (IoT) are creating opportunities for integrated pipe fitting solutions with enhanced monitoring capabilities. Developing markets in regions like Southeast Asia and Africa, with their burgeoning construction and industrial sectors, offer untapped potential.

Leading Players in the Refrigeration Copper Pipe Fittings Market

- Conex Banninger (IBP)

- Mueller Streamline

- KME Copper

- NIBCO

- Viega

- TSI Technologies

- Parker

- MM Kembla

- Nippontube

- Zhe JIANG HAI Liang

- Ningbo Yongxiang Copper Pipeline

- Qingdao HONGTAI COPPER

- Ningbo Jintian Copper

- Zhejiang Jiangxin COPPER Pipeline

- Zhejiang Tongbu Pipe Industry

- Linhai Hengye Tubing Equipment

- Fuzhou Zhenxie PIPE

Key Developments in Refrigeration Copper Pipe Fittings Industry

- 2023: Introduction of enhanced antimicrobial coatings on copper fittings to improve hygiene in critical refrigeration applications.

- 2022: Launch of a new range of brazed copper fittings with integrated diagnostic ports for easier system monitoring.

- 2021: Major manufacturers invested in automation to increase production capacity and reduce lead times for high-demand fittings.

- 2020: Increased focus on developing fittings compatible with low-GWP refrigerants to meet evolving environmental regulations.

Strategic Outlook for Refrigeration Copper Pipe Fittings Market

- 2023: Introduction of enhanced antimicrobial coatings on copper fittings to improve hygiene in critical refrigeration applications.

- 2022: Launch of a new range of brazed copper fittings with integrated diagnostic ports for easier system monitoring.

- 2021: Major manufacturers invested in automation to increase production capacity and reduce lead times for high-demand fittings.

- 2020: Increased focus on developing fittings compatible with low-GWP refrigerants to meet evolving environmental regulations.

Strategic Outlook for Refrigeration Copper Pipe Fittings Market

The strategic outlook for the Refrigeration Copper Pipe Fittings market remains highly positive, driven by sustained demand for essential refrigeration and cooling solutions. Future growth will be shaped by continuous innovation in material science and manufacturing, focusing on sustainability, energy efficiency, and advanced functionality. Companies that can adapt to evolving refrigerant technologies, leverage digital manufacturing, and expand their presence in high-growth emerging markets will be best positioned for success. Strategic partnerships and mergers are likely to continue as players seek to broaden their product portfolios and market reach, ensuring a competitive edge in this dynamic industry.

Refrigeration Copper Pipe Fittings Segmentation

-

1. Application

- 1.1. Refrigeration Copper Pipe

- 1.2. Heat Exchanger

- 1.3. Others

-

2. Type

- 2.1. 90 Degree Elbow

- 2.2. 45 Degree Elbow

Refrigeration Copper Pipe Fittings Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Refrigeration Copper Pipe Fittings REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Refrigeration Copper Pipe

- 5.1.2. Heat Exchanger

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 90 Degree Elbow

- 5.2.2. 45 Degree Elbow

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Refrigeration Copper Pipe

- 6.1.2. Heat Exchanger

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 90 Degree Elbow

- 6.2.2. 45 Degree Elbow

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Refrigeration Copper Pipe

- 7.1.2. Heat Exchanger

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 90 Degree Elbow

- 7.2.2. 45 Degree Elbow

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Refrigeration Copper Pipe

- 8.1.2. Heat Exchanger

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 90 Degree Elbow

- 8.2.2. 45 Degree Elbow

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Refrigeration Copper Pipe

- 9.1.2. Heat Exchanger

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 90 Degree Elbow

- 9.2.2. 45 Degree Elbow

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Refrigeration Copper Pipe Fittings Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Refrigeration Copper Pipe

- 10.1.2. Heat Exchanger

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 90 Degree Elbow

- 10.2.2. 45 Degree Elbow

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Conex Banninger (IBP)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mueller Streamline

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KME Copper

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NIBCO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viega

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TSI Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Parker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MM Kembla

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nippontube

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zhe JIANG HAI Liang

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ningbo Yongxiang Copper Pipeline

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qingdao HONGTAI COPPER

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ningbo Jintian Copper

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhejiang Jiangxin COPPER Pipeline

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhejiang Tongbu Pipe Industry

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Linhai Hengye Tubing Equipment

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Fuzhou Zhenxie PIPE

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Conex Banninger (IBP)

List of Figures

- Figure 1: Global Refrigeration Copper Pipe Fittings Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Refrigeration Copper Pipe Fittings Revenue (million), by Application 2024 & 2032

- Figure 3: North America Refrigeration Copper Pipe Fittings Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Refrigeration Copper Pipe Fittings Revenue (million), by Type 2024 & 2032

- Figure 5: North America Refrigeration Copper Pipe Fittings Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Refrigeration Copper Pipe Fittings Revenue (million), by Country 2024 & 2032

- Figure 7: North America Refrigeration Copper Pipe Fittings Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Refrigeration Copper Pipe Fittings Revenue (million), by Application 2024 & 2032

- Figure 9: South America Refrigeration Copper Pipe Fittings Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Refrigeration Copper Pipe Fittings Revenue (million), by Type 2024 & 2032

- Figure 11: South America Refrigeration Copper Pipe Fittings Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Refrigeration Copper Pipe Fittings Revenue (million), by Country 2024 & 2032

- Figure 13: South America Refrigeration Copper Pipe Fittings Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Refrigeration Copper Pipe Fittings Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Refrigeration Copper Pipe Fittings Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Refrigeration Copper Pipe Fittings Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Refrigeration Copper Pipe Fittings Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Refrigeration Copper Pipe Fittings Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Refrigeration Copper Pipe Fittings Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Refrigeration Copper Pipe Fittings Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Refrigeration Copper Pipe Fittings Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Refrigeration Copper Pipe Fittings Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Refrigeration Copper Pipe Fittings Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Refrigeration Copper Pipe Fittings Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Refrigeration Copper Pipe Fittings Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Refrigeration Copper Pipe Fittings Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Refrigeration Copper Pipe Fittings Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Refrigeration Copper Pipe Fittings Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refrigeration Copper Pipe Fittings?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Refrigeration Copper Pipe Fittings?

Key companies in the market include Conex Banninger (IBP), Mueller Streamline, KME Copper, NIBCO, Viega, TSI Technologies, Parker, MM Kembla, Nippontube, Zhe JIANG HAI Liang, Ningbo Yongxiang Copper Pipeline, Qingdao HONGTAI COPPER, Ningbo Jintian Copper, Zhejiang Jiangxin COPPER Pipeline, Zhejiang Tongbu Pipe Industry, Linhai Hengye Tubing Equipment, Fuzhou Zhenxie PIPE.

3. What are the main segments of the Refrigeration Copper Pipe Fittings?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1121 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refrigeration Copper Pipe Fittings," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refrigeration Copper Pipe Fittings report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refrigeration Copper Pipe Fittings?

To stay informed about further developments, trends, and reports in the Refrigeration Copper Pipe Fittings, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence