Key Insights

The Retail Ready Packaging (RRP) market, valued at approximately 78.31 billion in its 2025 base year, is projected for significant expansion with a Compound Annual Growth Rate (CAGR) of 5.7%. This growth is propelled by escalating consumer demand for sustainable and eco-friendly packaging, driving adoption of recyclable materials and waste-minimizing designs. The e-commerce boom further fuels RRP adoption, enhancing unboxing experiences and product protection during transit. Increased emphasis on brand visibility and shelf appeal also contributes, fostering the use of sophisticated display containers and customized solutions. The market is segmented by material (paper & paperboard, plastics, others), package type (die-cut displays, corrugated boxes, shrink-wrapped trays), and end-user application (food, beverage, household products). Leading companies such as WestRock, Smurfit Kappa, and DS Smith are instrumental in shaping the market through innovation and strategic initiatives. North America and Asia Pacific are poised for strong growth due to robust retail sectors and expanding e-commerce penetration.

Retail Ready Packaging Industry Market Size (In Billion)

Key challenges include fluctuating raw material costs and the capital investment required for compliance with stringent environmental regulations. While minimalist packaging trends may limit design complexity, the persistent drive for personalization and premium brand experiences is expected to mitigate these restraints. Future market dynamics will be shaped by advancements in packaging materials and printing technologies, alongside a growing emphasis on sustainability and supply chain traceability. Innovation and differentiation are critical for smaller enterprises to capture market share amidst established players.

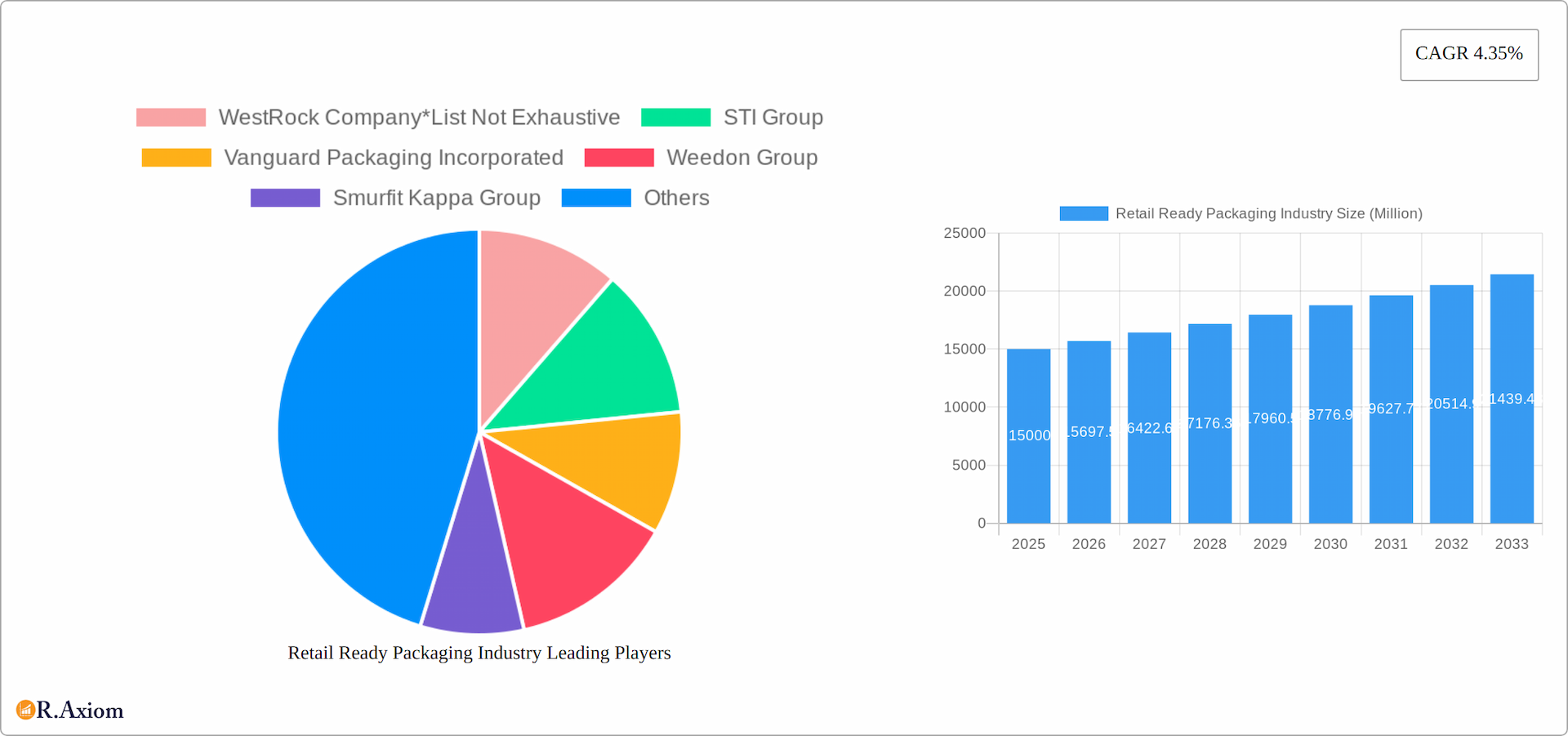

Retail Ready Packaging Industry Company Market Share

Retail Ready Packaging Industry: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides a detailed analysis of the Retail Ready Packaging industry, encompassing market size, segmentation, growth drivers, challenges, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period analyzed is 2019-2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic sector. The total market size in 2025 is estimated at $XX Million.

Retail Ready Packaging Industry Market Concentration & Innovation

The retail-ready packaging (RRP) industry presents a dynamic competitive landscape, characterized by a strategic interplay of market concentration, innovation, regulatory evolution, and dynamic merger and acquisition (M&A) activity. While a select group of large, multinational corporations commands a substantial portion of the market share – with key players like WestRock Company, Smurfit Kappa Group, DS Smith PLC, and International Paper Company collectively holding an estimated 60% share in 2025 – the industry's vitality is also significantly fueled by the ingenuity of smaller, specialized enterprises. These niche players are instrumental in driving advancements in specialized segments, pushing the boundaries of what RRP can achieve.

- Market Concentration: The retail-ready packaging market exhibits moderate concentration. The Herfindahl-Hirschman Index (HHI) is estimated to be around [Insert HHI Value Here], signifying a market where a few dominant firms exist alongside a multitude of smaller competitors.

- Innovation Drivers: The relentless pursuit of sustainability is paramount, driven by heightened environmental consciousness, consumer demand for eco-friendly products, and increasingly stringent global regulations. The explosive growth of e-commerce necessitates packaging that ensures product integrity during transit while also facilitating immediate shelf-readiness. Key innovations focus on developing lightweight, easily recyclable materials, and sophisticated designs that optimize handling, assembly, and on-shelf presentation, thereby enhancing the shopper experience.

- Regulatory Frameworks: Evolving regulatory landscapes worldwide are playing a pivotal role in shaping the industry. Stringent mandates concerning material composition, recyclability standards, and clear labeling requirements are accelerating the adoption of sustainable and circular economy-compatible packaging solutions.

- Product Substitutes: While traditional paperboard and corrugated solutions remain the backbone of RRP, the market is witnessing a growing diversification of material options. Advanced plastics and innovative biodegradable alternatives are steadily gaining traction, posing a competitive challenge and encouraging RRP manufacturers to continually refine their offerings. The competitive pressure from these emerging substitutes is projected to intensify throughout the forecast period.

- End-User Trends: Retailers are increasingly demanding highly customized packaging solutions that not only protect products but also serve as powerful branding and marketing tools. The emphasis is on enhancing the in-store visual appeal, optimizing the unboxing experience for consumers, and ultimately driving sales through superior display and brand storytelling.

- M&A Activity: The RRP sector has been a hotbed of strategic consolidation. Significant M&A activity, with aggregate deal values estimated to be around [Insert M&A Deal Value Here] over the past five years, has enabled companies to broaden their geographic reach, acquire cutting-edge technologies, and integrate specialized expertise, thereby solidifying their competitive positions.

Retail Ready Packaging Industry Industry Trends & Insights

The retail ready packaging market exhibits strong growth potential, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be approximately xx% during the forecast period (2025-2033). This growth is fueled by the expansion of e-commerce, increasing consumer demand for convenient and sustainable packaging, and advancements in packaging technology.

Market penetration of retail-ready packaging solutions is steadily rising across various sectors, particularly in the food and beverage industries. Technological advancements, such as automated packaging lines and the integration of smart packaging features, are further accelerating market growth. Consumer preferences are shifting towards eco-friendly and convenient packaging solutions, pushing manufacturers to adopt sustainable materials and designs. Competitive dynamics are intensified by increasing consolidation through mergers and acquisitions, technological advancements, and the emergence of new players. These factors are shaping the industry landscape, driving innovation, and reshaping the competitive environment.

Dominant Markets & Segments in Retail Ready Packaging Industry

The global retail ready packaging market is segmented by material type, package type, and end-user application.

By Material Type: Paper and paperboard continues to dominate the market, holding an estimated xx% market share in 2025 due to its cost-effectiveness and recyclability. Plastics are also a significant segment, particularly for applications requiring barrier properties or high impact resistance. Other materials hold a smaller share but are growing as demand for sustainable alternatives increases.

By Type of Package: Corrugated cardboard boxes represent the largest segment, driven by its versatility and suitability for various products. Die-cut display containers are gaining popularity for their ability to enhance product visibility and in-store appeal. Shrink-wrapped trays and modified cases offer efficient and protective solutions. Plastic containers cater to specific product needs, while other packaging types fill specialized niches.

By End-User Application: The food and beverage industries are the largest consumers of retail ready packaging, followed by household products. Other end-user applications include pharmaceuticals, cosmetics, and industrial goods. The growth of these segments is directly influenced by factors such as economic development, consumer spending patterns, and the prevalence of supermarkets and organized retail.

Key Drivers:

- Economic Growth: Rising disposable incomes and consumer spending in developing economies are driving demand.

- E-commerce Boom: The rapid expansion of e-commerce necessitates efficient and protective packaging solutions.

- Infrastructure Development: Improved transportation and logistics networks facilitate the widespread adoption of retail-ready packaging.

Retail Ready Packaging Industry Product Developments

Recent product innovations include the integration of sustainable materials, improved designs for automated handling, and smart packaging features that enhance the consumer experience. The industry is witnessing a shift towards lightweighting and minimizing material usage to reduce environmental impact while maintaining product protection. Companies are leveraging technology to improve packaging efficiency, supply chain optimization, and brand visibility.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the retail ready packaging market, segmented by material type (paper and paperboard, plastics, other material types), package type (die-cut display containers, corrugated cardboard boxes, shrink-wrapped trays, modified cases, plastic containers, other package types), and end-user application (food, beverage, household products, other end-user applications). Each segment is analyzed based on historical data, current market size, and future growth projections, considering competitive dynamics and growth drivers specific to each segment.

Key Drivers of Retail Ready Packaging Industry Growth

The growth trajectory of the retail-ready packaging market is propelled by a confluence of powerful forces. The global imperative towards sustainability, bolstered by growing environmental awareness and robust regulatory frameworks, is a primary catalyst. Concurrently, the exponential expansion of e-commerce continues to fuel demand for sophisticated packaging that offers both protection during transit and immediate in-store display readiness. Furthermore, technological advancements in areas such as automated packaging processes and the integration of smart packaging features are significantly enhancing operational efficiency, optimizing supply chain logistics, and improving the overall product journey from manufacturer to consumer.

Challenges in the Retail Ready Packaging Industry Sector

Despite its robust growth, the retail-ready packaging sector navigates several inherent challenges. Fluctuations in the cost of key raw materials, particularly paper and board, can exert considerable pressure on profit margins, necessitating agile sourcing and pricing strategies. Adhering to increasingly rigorous environmental regulations, including ensuring the recyclability and compostability of packaging materials, presents ongoing operational and developmental hurdles. Moreover, the highly competitive nature of the market, characterized by established global players and agile new entrants, demands continuous investment in innovation, cost optimization, and the development of differentiated solutions to maintain and expand market share.

Emerging Opportunities in Retail Ready Packaging Industry

Growing demand for sustainable and eco-friendly packaging solutions presents a major opportunity for companies that can offer innovative, recyclable, and biodegradable alternatives. The integration of digital technologies, such as smart packaging and RFID tracking, can enhance supply chain visibility and provide valuable data insights. Expansion into emerging markets, particularly in developing economies experiencing rapid economic growth, holds significant potential.

Leading Players in the Retail Ready Packaging Industry Market

- WestRock Company

- STI Group

- Vanguard Packaging Incorporated

- Weedon Group

- Smurfit Kappa Group

- Caps Cases Limited

- Cardboard Box Company

- DS Smith PLC

- Mondi Group

- International Paper Company

Key Developments in Retail Ready Packaging Industry Industry

- October 2022: ORBIS Corporation showcased its XpressBulk retail-ready merchandising trays at PACK EXPO 2022, highlighting the importance of reusable packaging solutions for supply chain efficiency and sustainability.

- February 2022: Linpac Packaging launched a new line of rigid-plastic, retail-ready packaging, emphasizing flexibility, structural integrity, and impact absorption.

Strategic Outlook for Retail Ready Packaging Industry Market

The retail-ready packaging market is strategically positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by ongoing innovation in materials and design, a significant and increasing demand for environmentally responsible packaging solutions, and the continued expansion of the e-commerce landscape. Companies that excel in integrating sustainable practices throughout their operations, adeptly adopt advanced packaging technologies, and provide highly customized, value-added solutions will be exceptionally well-placed to capture future market opportunities. The market is projected to achieve a valuation of [Insert Market Value by 2033] by 2033, reflecting its dynamic and expanding influence within the retail sector.

Retail Ready Packaging Industry Segmentation

-

1. Material Type

- 1.1. Paper and Paperboard

- 1.2. Plastics

- 1.3. Other Material Types

-

2. Type of Package

- 2.1. Die-cut Display Containers

- 2.2. Corrugated Cardboard Boxes

- 2.3. Shrink Wrapped Trays

- 2.4. Modified Cases

- 2.5. Plastic Containers

- 2.6. Other Type of Packages

-

3. End-User Application

- 3.1. Food

- 3.2. Beverage

- 3.3. Household Products

- 3.4. Other End-User Applications

Retail Ready Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdoms

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of the Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Ready Packaging Industry Regional Market Share

Geographic Coverage of Retail Ready Packaging Industry

Retail Ready Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest Towards Convenient and Eco-friendly Shopping Solutions; Growing Need for Streamlining the Supply Chain Process

- 3.3. Market Restrains

- 3.3.1. Investment in R&D Activities and Additional Capital Expenditure

- 3.4. Market Trends

- 3.4.1. Die-cut Display Container to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastics

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Package

- 5.2.1. Die-cut Display Containers

- 5.2.2. Corrugated Cardboard Boxes

- 5.2.3. Shrink Wrapped Trays

- 5.2.4. Modified Cases

- 5.2.5. Plastic Containers

- 5.2.6. Other Type of Packages

- 5.3. Market Analysis, Insights and Forecast - by End-User Application

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Household Products

- 5.3.4. Other End-User Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Paper and Paperboard

- 6.1.2. Plastics

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Type of Package

- 6.2.1. Die-cut Display Containers

- 6.2.2. Corrugated Cardboard Boxes

- 6.2.3. Shrink Wrapped Trays

- 6.2.4. Modified Cases

- 6.2.5. Plastic Containers

- 6.2.6. Other Type of Packages

- 6.3. Market Analysis, Insights and Forecast - by End-User Application

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Household Products

- 6.3.4. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Paper and Paperboard

- 7.1.2. Plastics

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Type of Package

- 7.2.1. Die-cut Display Containers

- 7.2.2. Corrugated Cardboard Boxes

- 7.2.3. Shrink Wrapped Trays

- 7.2.4. Modified Cases

- 7.2.5. Plastic Containers

- 7.2.6. Other Type of Packages

- 7.3. Market Analysis, Insights and Forecast - by End-User Application

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Household Products

- 7.3.4. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Paper and Paperboard

- 8.1.2. Plastics

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Type of Package

- 8.2.1. Die-cut Display Containers

- 8.2.2. Corrugated Cardboard Boxes

- 8.2.3. Shrink Wrapped Trays

- 8.2.4. Modified Cases

- 8.2.5. Plastic Containers

- 8.2.6. Other Type of Packages

- 8.3. Market Analysis, Insights and Forecast - by End-User Application

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Household Products

- 8.3.4. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Paper and Paperboard

- 9.1.2. Plastics

- 9.1.3. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Type of Package

- 9.2.1. Die-cut Display Containers

- 9.2.2. Corrugated Cardboard Boxes

- 9.2.3. Shrink Wrapped Trays

- 9.2.4. Modified Cases

- 9.2.5. Plastic Containers

- 9.2.6. Other Type of Packages

- 9.3. Market Analysis, Insights and Forecast - by End-User Application

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Household Products

- 9.3.4. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Retail Ready Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Paper and Paperboard

- 10.1.2. Plastics

- 10.1.3. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Type of Package

- 10.2.1. Die-cut Display Containers

- 10.2.2. Corrugated Cardboard Boxes

- 10.2.3. Shrink Wrapped Trays

- 10.2.4. Modified Cases

- 10.2.5. Plastic Containers

- 10.2.6. Other Type of Packages

- 10.3. Market Analysis, Insights and Forecast - by End-User Application

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Household Products

- 10.3.4. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 STI Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vanguard Packaging Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weedon Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smurfit Kappa Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caps Cases Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cardboard Box Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DS Smith PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mondi Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Paper Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WestRock Company*List Not Exhaustive

List of Figures

- Figure 1: Global Retail Ready Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 5: North America Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 6: North America Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 7: North America Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 8: North America Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 13: Europe Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 14: Europe Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 15: Europe Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 16: Europe Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 21: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 22: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 23: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 24: Asia Pacific Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Latin America Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 29: Latin America Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 30: Latin America Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 31: Latin America Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 32: Latin America Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Type of Package 2025 & 2033

- Figure 37: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Type of Package 2025 & 2033

- Figure 38: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by End-User Application 2025 & 2033

- Figure 39: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 40: Middle East and Africa Retail Ready Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Retail Ready Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 3: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 4: Global Retail Ready Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 7: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 8: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 13: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 14: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdoms Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of the Europe Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 20: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 21: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 22: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of the Asia Pacific Retail Ready Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 28: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 29: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 30: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Retail Ready Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 32: Global Retail Ready Packaging Industry Revenue billion Forecast, by Type of Package 2020 & 2033

- Table 33: Global Retail Ready Packaging Industry Revenue billion Forecast, by End-User Application 2020 & 2033

- Table 34: Global Retail Ready Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Ready Packaging Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Retail Ready Packaging Industry?

Key companies in the market include WestRock Company*List Not Exhaustive, STI Group, Vanguard Packaging Incorporated, Weedon Group, Smurfit Kappa Group, Caps Cases Limited, Cardboard Box Company, DS Smith PLC, Mondi Group, International Paper Company.

3. What are the main segments of the Retail Ready Packaging Industry?

The market segments include Material Type, Type of Package, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest Towards Convenient and Eco-friendly Shopping Solutions; Growing Need for Streamlining the Supply Chain Process.

6. What are the notable trends driving market growth?

Die-cut Display Container to Hold Significant Share.

7. Are there any restraints impacting market growth?

Investment in R&D Activities and Additional Capital Expenditure.

8. Can you provide examples of recent developments in the market?

October 2022: At the 2022 PACK EXPO, ORBIS Corporation, a global pioneer in reusable packaging, highlighted the importance integrated reusable packaging solutions play in enhancing supply chain effectiveness and sustainability. By enabling a quick and simple transfer of product from the truck directly to the store floor, the XpressBulk retail-ready merchandising trays offer a sustainable, effective solution for the manual shelf replenishment process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Ready Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Ready Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Ready Packaging Industry?

To stay informed about further developments, trends, and reports in the Retail Ready Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence