Key Insights

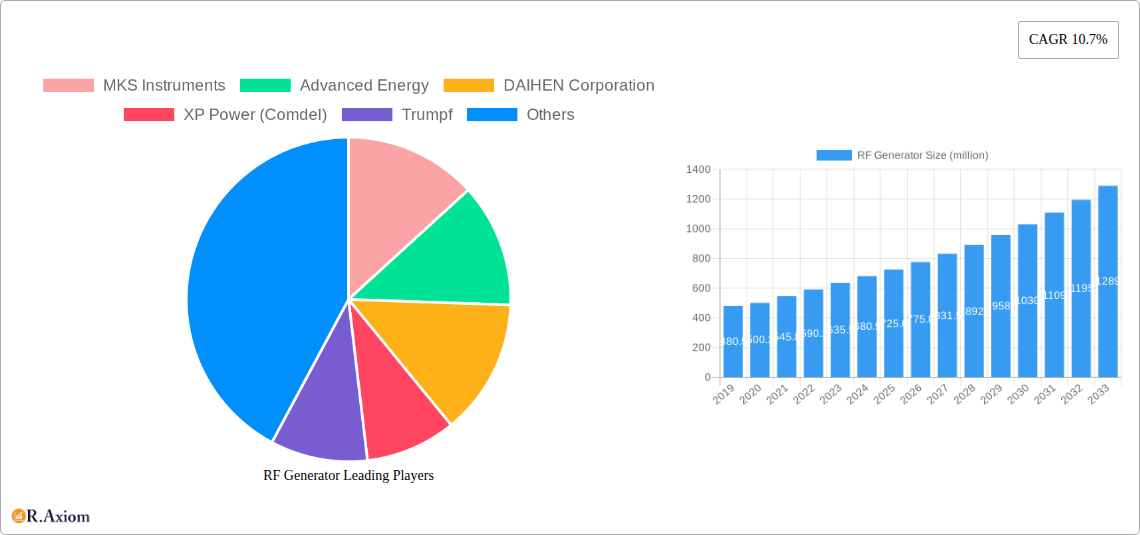

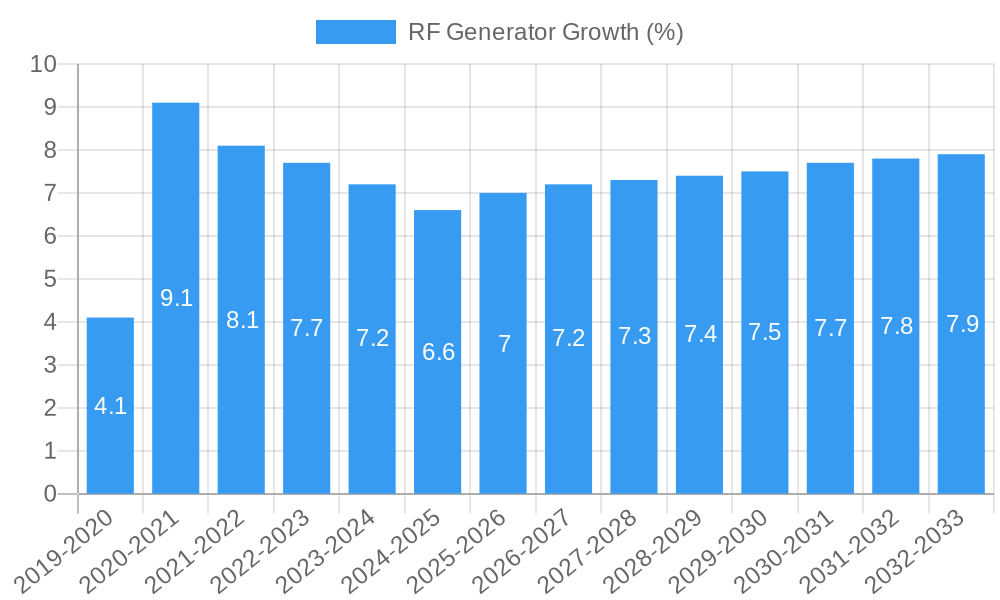

The global RF Generator market is poised for substantial growth, projected to reach an estimated market size of USD 725.6 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.7% anticipated for the forecast period of 2025-2033. This expansion is primarily driven by the burgeoning demand for advanced semiconductor manufacturing processes, particularly those that rely on plasma generation. Technologies such as Plasma-Enhanced Chemical Vapor Deposition (PECVD), Physical Vapor Deposition (PVD), and Atomic Layer Deposition (ALD) are integral to the production of high-performance microelectronics, displays, and advanced materials. The increasing sophistication and miniaturization of electronic devices, coupled with the growing adoption of 5G technology, electric vehicles, and the Internet of Things (IoT), are directly fueling the need for more efficient and precise RF generators. Furthermore, advancements in materials science and the growing research and development activities in areas like solar cell manufacturing and medical device sterilization are also contributing to market expansion.

The market is characterized by a dynamic landscape of technological innovation and evolving industry demands. Key trends include the development of higher power, more stable, and more compact RF generators with improved control capabilities. The increasing adoption of digital control systems and automation within manufacturing processes is also a significant trend, enhancing the performance and reliability of RF generators. While the market presents significant opportunities, certain restraints could influence its trajectory. These include the high initial investment costs associated with sophisticated RF generator systems, stringent regulatory requirements in specific applications, and the ongoing supply chain challenges for critical components. However, the continuous pursuit of technological advancements by leading manufacturers and the growing global investments in semiconductor fabrication facilities are expected to outweigh these restraints, ensuring a positive growth outlook for the RF Generator market.

Here is a detailed, SEO-optimized report description for RF Generators, incorporating high-traffic keywords and structured as requested:

RF Generator Market Concentration & Innovation

The global RF generator market exhibits moderate concentration, with leading players like MKS Instruments, Advanced Energy, and DAIHEN Corporation holding significant market share, estimated in the hundreds of millions of dollars. Innovation is a key differentiator, driven by the relentless demand for higher power, greater efficiency, and finer process control in advanced manufacturing and research applications. Key innovation drivers include the miniaturization of semiconductor components, advancements in plasma-enhanced chemical vapor deposition (PECVD) and physical vapor deposition (PVD) processes, and the increasing adoption of atomic layer deposition (ALD) for next-generation electronics and coatings. Regulatory frameworks, particularly those concerning electromagnetic interference (EMI) and safety standards, influence product design and market entry. The threat of product substitutes is relatively low given the specialized nature of RF generation, though advancements in alternative plasma excitation methods present a long-term consideration. End-user trends strongly favor increased automation, lower cost of ownership, and enhanced process repeatability. Mergers and acquisitions (M&A) activity is a significant factor in market consolidation, with deal values frequently reaching hundreds of millions of dollars as companies seek to expand their product portfolios and geographic reach.

RF Generator Industry Trends & Insights

The RF generator industry is poised for substantial growth, propelled by a confluence of technological advancements and expanding application landscapes. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated to be in the high single digits to low double digits over the forecast period of 2025–2033. This growth is underpinned by escalating demand for high-performance RF generators across critical sectors such as semiconductor manufacturing, aerospace, medical device fabrication, and advanced materials processing. Technological disruptions are continuously reshaping the market, with a strong emphasis on developing more energy-efficient, compact, and digitally controlled RF power supplies. The integration of AI and machine learning for process optimization and predictive maintenance is also gaining traction, enhancing operational efficiency and reducing downtime for end-users. Consumer preferences, or rather end-user demands, are increasingly focused on precision, reliability, and the ability to achieve ultra-high vacuum conditions and delicate film depositions essential for microelectronics and nanotechnology. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a continuous drive for cost optimization, particularly in high-volume manufacturing environments. Market penetration is deepening in emerging economies, driven by government initiatives to boost domestic manufacturing capabilities and technological self-sufficiency. The market size is estimated to reach billions of dollars by the end of the forecast period, with significant contributions from the PECVD and PVD application segments.

Dominant Markets & Segments in RF Generator

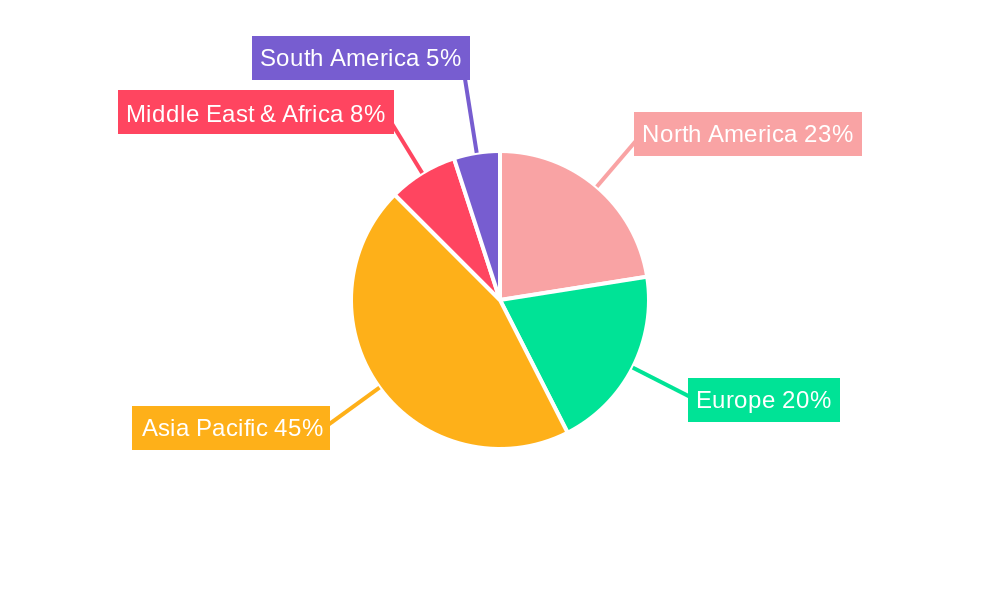

The global RF generator market is characterized by distinct regional dominance and segment-specific growth trajectories. North America and Asia-Pacific are the leading regions, largely driven by the strong presence of semiconductor manufacturing hubs and burgeoning research and development activities. Within these regions, countries like the United States, China, South Korea, and Taiwan are pivotal markets, fueled by substantial investments in advanced electronics manufacturing and government support for high-technology industries.

The application segment of PECVD (Plasma-Enhanced Chemical Vapor Deposition) is a dominant force, accounting for a significant portion of the market revenue, estimated in the hundreds of millions of dollars annually. This dominance is attributed to its widespread use in depositing thin films for semiconductors, solar cells, and protective coatings. Following closely is PVD (Physical Vapor Deposition), another critical application that drives demand for high-power RF generators in metallization, optical coatings, and decorative finishes. ALD (Atomic Layer Deposition), while a smaller segment currently, is experiencing rapid growth due to its precision and suitability for advanced nanotechnology applications, with projected revenue growth in the tens of millions of dollars. HDPCVD (High-Density Plasma Chemical Vapor Deposition) also represents a substantial and growing segment, essential for high-aspect-ratio etching and deposition.

In terms of frequency types, the 13.56MHz and 27.12MHz segments are the most mature and widely adopted, catering to a broad spectrum of industrial plasma processes. These frequencies offer a balance of plasma density and process flexibility, making them go-to choices for numerous applications. The 40.8 MHz frequency is gaining prominence for specific etching and deposition processes requiring finer control and higher plasma uniformity. Emerging frequencies and other specialized types, such as 2Mhz and 4Mhz, are carving out niches in specialized applications where particular plasma characteristics are required, with growth projections in the tens of millions of dollars. Key drivers for dominance in these segments include the established infrastructure for these frequencies, cost-effectiveness, and the availability of a wide range of compatible equipment and consumables. Economic policies supporting advanced manufacturing, infrastructure development for high-tech industrial parks, and increasing global demand for sophisticated electronic devices and materials are all contributing to the sustained dominance of these segments.

RF Generator Product Developments

Recent product developments in the RF generator market focus on enhancing power density, improving efficiency, and enabling more precise process control. Manufacturers are introducing advanced solid-state RF power supplies that offer superior stability and reduced harmonic content compared to older tube-based systems. These innovations are crucial for demanding applications like ALD and HDPCVD, where precise film thickness and uniformity are paramount. The integration of digital control interfaces and advanced diagnostics further empowers users to optimize process parameters and achieve competitive advantages in yield and product quality. Market fit is achieved by tailoring solutions to the specific requirements of emerging semiconductor nodes, advanced display technologies, and specialized industrial coatings, with projected unit sales in the thousands.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global RF generator market, segmenting it by application and type. The application segments analyzed include PECVD, PVD, ALD, HDPCVD, and OtherS. The type segmentation covers key frequencies such as 13.56MHz, 27.12Mhz, 40.8 MHz, 2Mhz, 4Mhz, and Others. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the PECVD segment is projected to maintain its leading position with a significant market share estimated in the hundreds of millions of dollars, driven by the semiconductor industry's ongoing expansion. The ALD segment, while smaller, is expected to exhibit the highest growth rate, fueled by its critical role in next-generation microelectronics. Competitive dynamics within each segment are characterized by innovation in power delivery and process control.

Key Drivers of RF Generator Growth

The growth of the RF generator market is primarily driven by the insatiable demand for advanced semiconductor devices, necessitating sophisticated plasma processing techniques like PECVD and PVD. The expansion of the 5G infrastructure and the proliferation of Internet of Things (IoT) devices are further augmenting this demand. Technological advancements in areas such as solid-state RF power and digital control systems are enabling higher efficiency and greater precision, making RF generators indispensable for next-generation manufacturing. Economic factors, including increased global manufacturing output and government initiatives to promote domestic semiconductor production, also play a crucial role. Furthermore, the expanding applications of RF technology in medical devices, scientific research, and industrial coatings are contributing to market expansion, with projections indicating growth into billions of dollars.

Challenges in the RF Generator Sector

The RF generator sector faces several challenges that can temper its growth trajectory. Stringent regulatory requirements related to electromagnetic compatibility (EMC) and safety standards can increase product development costs and time-to-market. Supply chain disruptions, particularly for specialized components, can lead to production delays and increased costs, impacting market availability. The highly competitive landscape, characterized by intense price pressures, particularly in high-volume applications, can also pose a significant challenge for profitability. Furthermore, the substantial upfront investment required for advanced R&D and manufacturing infrastructure can act as a barrier to entry for new players. The sector's reliance on niche expertise also presents a challenge in finding and retaining skilled personnel.

Emerging Opportunities in RF Generator

Emerging opportunities in the RF generator market are abundant, driven by innovation and evolving industry needs. The rapid advancement of AI and machine learning presents a significant opportunity for integrating intelligent control and optimization into RF power supplies, enhancing process efficiency and predictive maintenance. The burgeoning fields of quantum computing and advanced materials science are creating new demands for highly specialized RF generators capable of precise plasma generation and control. Furthermore, the growing adoption of RF technology in the medical sector for applications like cancer therapy and sterilization, along with its increasing use in fusion energy research, offers substantial new market avenues. The ongoing trend towards miniaturization and energy efficiency in electronic devices also opens doors for innovative, compact, and highly efficient RF generator designs.

Leading Players in the RF Generator Market

- MKS Instruments

- Advanced Energy

- DAIHEN Corporation

- XP Power (Comdel)

- Trumpf

- Comet Plasma Control Technol

- Kyosan Electric Manufacturing

- Beijing Gmppower

- ULVAC

- JEOL

- Adtec Plasma Technology

- New Power Plasma

- DKK

- Plasma Technology

- Pearl Kogyo

- SAIREM

- Reno Subsystems

- T&C Power Conversion

- Seren IPS

- Coaxis Power Systems

- ASE

- EQ Global

- Youngsin RF Co.,Ltd

Key Developments in RF Generator Industry

- 2024: Launch of new solid-state RF generators with enhanced digital control capabilities for improved process stability in semiconductor manufacturing.

- 2023: Strategic acquisition of a specialized RF component manufacturer by a major player to strengthen its supply chain and product integration.

- 2023: Introduction of AI-powered RF power management systems for optimizing energy consumption in industrial plasma processes.

- 2022: Development of high-frequency RF generators (e.g., 915 MHz) for niche applications requiring lower plasma temperatures and higher ion flux.

- 2022: Expansion of product lines to cater to the growing demand for RF generators in advanced display manufacturing (e.g., OLED, MicroLED).

- 2021: Collaboration between RF generator manufacturers and equipment integrators to offer complete plasma processing solutions.

- 2021: Increased focus on developing compact and modular RF generator designs for space-constrained applications.

- 2020: Significant investment in R&D for next-generation RF power amplifiers with higher efficiency and reduced harmonic distortion.

- 2019: Emergence of advanced safety features and interlock systems in RF generators to comply with evolving industrial safety standards.

Strategic Outlook for RF Generator Market

The strategic outlook for the RF generator market is exceptionally positive, driven by sustained innovation and expanding application frontiers. The continuous evolution of the semiconductor industry, coupled with the burgeoning demand for advanced materials, smart devices, and sophisticated medical technologies, will fuel consistent market growth. Companies that focus on developing highly efficient, digitally controlled, and application-specific RF solutions are well-positioned for success. Strategic partnerships, vertical integration, and a commitment to research and development in areas like AI-driven process optimization will be crucial for maintaining a competitive edge and capitalizing on future opportunities, projecting a market size reaching billions of dollars.

RF Generator Segmentation

-

1. Application

- 1.1. PECVD

- 1.2. PVD

- 1.3. ALD

- 1.4. HDPCVD

- 1.5. OtherS

-

2. Types

- 2.1. 13.56MHz

- 2.2. 27.12Mhz

- 2.3. 40.8 MHz

- 2.4. 2Mhz

- 2.5. 4Mhz

- 2.6. Others

RF Generator Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RF Generator REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RF Generator Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. PECVD

- 5.1.2. PVD

- 5.1.3. ALD

- 5.1.4. HDPCVD

- 5.1.5. OtherS

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 13.56MHz

- 5.2.2. 27.12Mhz

- 5.2.3. 40.8 MHz

- 5.2.4. 2Mhz

- 5.2.5. 4Mhz

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America RF Generator Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. PECVD

- 6.1.2. PVD

- 6.1.3. ALD

- 6.1.4. HDPCVD

- 6.1.5. OtherS

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 13.56MHz

- 6.2.2. 27.12Mhz

- 6.2.3. 40.8 MHz

- 6.2.4. 2Mhz

- 6.2.5. 4Mhz

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America RF Generator Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. PECVD

- 7.1.2. PVD

- 7.1.3. ALD

- 7.1.4. HDPCVD

- 7.1.5. OtherS

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 13.56MHz

- 7.2.2. 27.12Mhz

- 7.2.3. 40.8 MHz

- 7.2.4. 2Mhz

- 7.2.5. 4Mhz

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe RF Generator Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. PECVD

- 8.1.2. PVD

- 8.1.3. ALD

- 8.1.4. HDPCVD

- 8.1.5. OtherS

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 13.56MHz

- 8.2.2. 27.12Mhz

- 8.2.3. 40.8 MHz

- 8.2.4. 2Mhz

- 8.2.5. 4Mhz

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa RF Generator Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. PECVD

- 9.1.2. PVD

- 9.1.3. ALD

- 9.1.4. HDPCVD

- 9.1.5. OtherS

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 13.56MHz

- 9.2.2. 27.12Mhz

- 9.2.3. 40.8 MHz

- 9.2.4. 2Mhz

- 9.2.5. 4Mhz

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific RF Generator Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. PECVD

- 10.1.2. PVD

- 10.1.3. ALD

- 10.1.4. HDPCVD

- 10.1.5. OtherS

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 13.56MHz

- 10.2.2. 27.12Mhz

- 10.2.3. 40.8 MHz

- 10.2.4. 2Mhz

- 10.2.5. 4Mhz

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MKS Instruments

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Advanced Energy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DAIHEN Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XP Power (Comdel)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trumpf

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Comet Plasma Control Technol

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kyosan Electric Manufacturing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beijing Gmppower

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ULVAC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JEOL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Adtec Plasma Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 New Power Plasma

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DKK

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Plasma Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pearl Kogyo

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SAIREM

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Reno Subsystems

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 T&C Power Conversion

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Seren IPS

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Coaxis Power Systems

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 ASE

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 EQ Global

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Youngsin RF Co.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 MKS Instruments

List of Figures

- Figure 1: Global RF Generator Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global RF Generator Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America RF Generator Revenue (million), by Application 2024 & 2032

- Figure 4: North America RF Generator Volume (K), by Application 2024 & 2032

- Figure 5: North America RF Generator Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America RF Generator Volume Share (%), by Application 2024 & 2032

- Figure 7: North America RF Generator Revenue (million), by Types 2024 & 2032

- Figure 8: North America RF Generator Volume (K), by Types 2024 & 2032

- Figure 9: North America RF Generator Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America RF Generator Volume Share (%), by Types 2024 & 2032

- Figure 11: North America RF Generator Revenue (million), by Country 2024 & 2032

- Figure 12: North America RF Generator Volume (K), by Country 2024 & 2032

- Figure 13: North America RF Generator Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America RF Generator Volume Share (%), by Country 2024 & 2032

- Figure 15: South America RF Generator Revenue (million), by Application 2024 & 2032

- Figure 16: South America RF Generator Volume (K), by Application 2024 & 2032

- Figure 17: South America RF Generator Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America RF Generator Volume Share (%), by Application 2024 & 2032

- Figure 19: South America RF Generator Revenue (million), by Types 2024 & 2032

- Figure 20: South America RF Generator Volume (K), by Types 2024 & 2032

- Figure 21: South America RF Generator Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America RF Generator Volume Share (%), by Types 2024 & 2032

- Figure 23: South America RF Generator Revenue (million), by Country 2024 & 2032

- Figure 24: South America RF Generator Volume (K), by Country 2024 & 2032

- Figure 25: South America RF Generator Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America RF Generator Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe RF Generator Revenue (million), by Application 2024 & 2032

- Figure 28: Europe RF Generator Volume (K), by Application 2024 & 2032

- Figure 29: Europe RF Generator Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe RF Generator Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe RF Generator Revenue (million), by Types 2024 & 2032

- Figure 32: Europe RF Generator Volume (K), by Types 2024 & 2032

- Figure 33: Europe RF Generator Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe RF Generator Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe RF Generator Revenue (million), by Country 2024 & 2032

- Figure 36: Europe RF Generator Volume (K), by Country 2024 & 2032

- Figure 37: Europe RF Generator Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe RF Generator Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa RF Generator Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa RF Generator Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa RF Generator Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa RF Generator Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa RF Generator Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa RF Generator Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa RF Generator Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa RF Generator Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa RF Generator Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa RF Generator Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa RF Generator Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa RF Generator Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific RF Generator Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific RF Generator Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific RF Generator Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific RF Generator Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific RF Generator Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific RF Generator Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific RF Generator Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific RF Generator Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific RF Generator Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific RF Generator Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific RF Generator Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific RF Generator Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global RF Generator Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global RF Generator Volume K Forecast, by Region 2019 & 2032

- Table 3: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 5: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 7: Global RF Generator Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global RF Generator Volume K Forecast, by Region 2019 & 2032

- Table 9: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 11: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 13: Global RF Generator Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global RF Generator Volume K Forecast, by Country 2019 & 2032

- Table 15: United States RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 23: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 25: Global RF Generator Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global RF Generator Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 35: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 37: Global RF Generator Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global RF Generator Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 59: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 61: Global RF Generator Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global RF Generator Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global RF Generator Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global RF Generator Volume K Forecast, by Application 2019 & 2032

- Table 77: Global RF Generator Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global RF Generator Volume K Forecast, by Types 2019 & 2032

- Table 79: Global RF Generator Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global RF Generator Volume K Forecast, by Country 2019 & 2032

- Table 81: China RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania RF Generator Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific RF Generator Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific RF Generator Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RF Generator?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the RF Generator?

Key companies in the market include MKS Instruments, Advanced Energy, DAIHEN Corporation, XP Power (Comdel), Trumpf, Comet Plasma Control Technol, Kyosan Electric Manufacturing, Beijing Gmppower, ULVAC, JEOL, Adtec Plasma Technology, New Power Plasma, DKK, Plasma Technology, Pearl Kogyo, SAIREM, Reno Subsystems, T&C Power Conversion, Seren IPS, Coaxis Power Systems, ASE, EQ Global, Youngsin RF Co., Ltd.

3. What are the main segments of the RF Generator?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 725.6 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RF Generator," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RF Generator report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RF Generator?

To stay informed about further developments, trends, and reports in the RF Generator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence