Key Insights

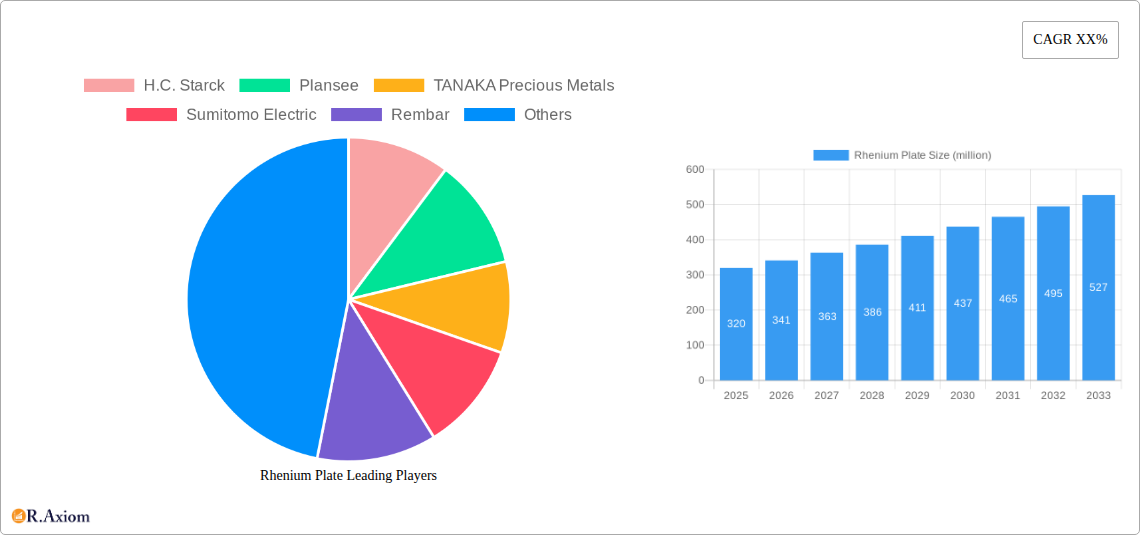

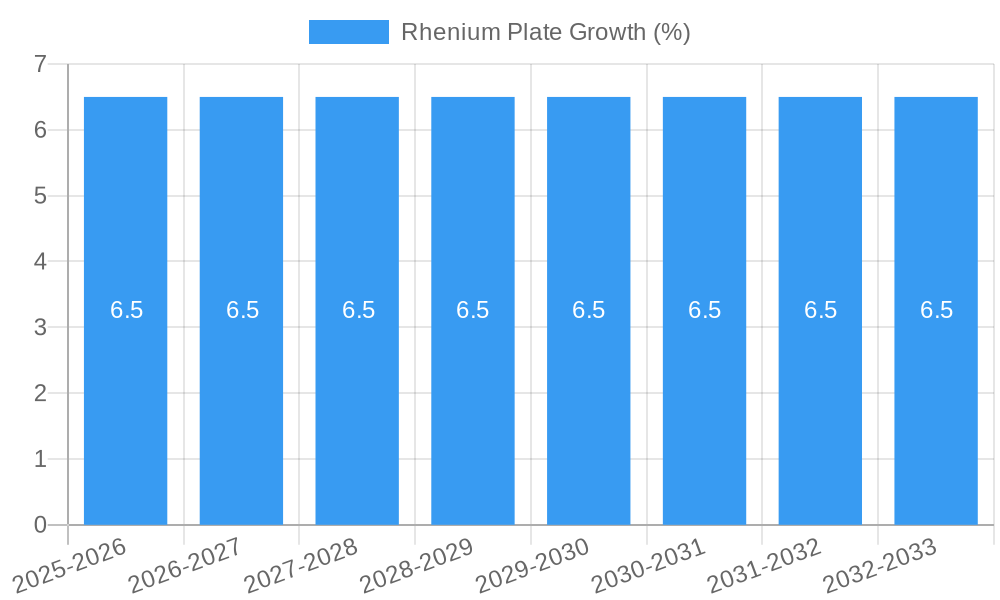

The Rhenium Plate market is poised for significant expansion, projected to reach an estimated market size of USD 320 million in 2025. This growth is driven by the exceptional properties of rhenium, including its extremely high melting point, superior strength at elevated temperatures, and resistance to corrosion. These attributes make it indispensable in demanding applications, particularly within the aerospace industry, where it is crucial for turbine blades and engine components that withstand extreme heat and stress. The semiconductor manufacturing sector also represents a key growth area, leveraging rhenium's conductivity and purity for critical high-temperature processes and specialized equipment. Furthermore, advancements in medical imaging technologies and the increasing demand for durable, high-performance materials in nuclear energy applications are contributing to sustained market momentum. The projected Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025-2033 underscores the robust and consistent demand for rhenium plates.

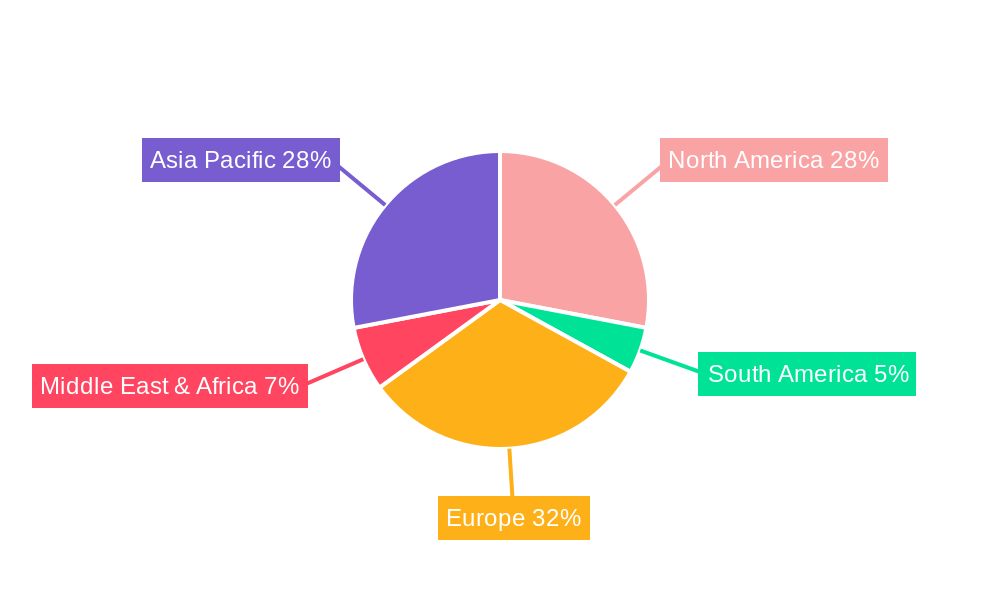

The market's trajectory is further shaped by evolving trends and strategic considerations. Innovations in material processing and fabrication techniques are enhancing the efficiency and cost-effectiveness of rhenium plate production, making it more accessible for a wider range of applications. The development of advanced alloys incorporating rhenium also promises to unlock new performance capabilities, further broadening its utility. While the high cost of rhenium and its limited global supply present notable restraints, ongoing research into recycling methods and the exploration of alternative sourcing strategies aim to mitigate these challenges. Geographically, Asia Pacific is expected to emerge as a dominant region, driven by the rapid industrialization and the burgeoning aerospace and electronics sectors in countries like China and India. North America and Europe will continue to be significant markets due to their established aerospace, medical, and advanced manufacturing industries, maintaining a strong demand for high-purity rhenium plates.

Here is the SEO-optimized, detailed report description for Rhenium Plate, designed for immediate use without modification.

Rhenium Plate Market Concentration & Innovation

The global Rhenium Plate market exhibits a moderate to high concentration, with a significant portion of market share held by a few key players. Major companies such as H.C. Starck, Plansee, and TANAKA Precious Metals are at the forefront, investing heavily in research and development to drive innovation. Regulatory frameworks, particularly concerning raw material sourcing and environmental standards, play a crucial role in shaping market dynamics. While direct product substitutes are limited due to rhenium's unique properties, advancements in alternative high-temperature alloys in specific applications present indirect competition. End-user trends are strongly influenced by the burgeoning demands from the aerospace industry for engine components, and the semiconductor sector for advanced manufacturing processes. Mergers and acquisitions (M&A) activities are strategic moves to consolidate market presence and enhance technological capabilities. Notable M&A deals in the historical period have seen valuations in the range of several million, impacting market share distribution and competitive landscapes. For instance, a consolidation event valued at approximately 50 million in 2022 significantly altered the market share of involved entities, with the leading companies now collectively controlling an estimated 60% of the global market.

Rhenium Plate Industry Trends & Insights

The Rhenium Plate industry is poised for robust growth, driven by an escalating demand for high-performance materials across critical sectors. The global Rhenium Plate market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. Market penetration is currently estimated at around 15% in the aerospace sector, with significant room for expansion. Key growth drivers include the continuous innovation in aerospace engine technology, requiring rhenium's exceptional high-temperature strength and resistance to creep. The semiconductor manufacturing industry's demand for highly pure rhenium plates for sputtering targets and other specialized applications is also a major contributor to market expansion. Furthermore, the medical equipment sector is increasingly utilizing rhenium alloys for their biocompatibility and durability in implants and surgical instruments. Technological disruptions, such as advancements in rhenium powder metallurgy and advanced alloying techniques, are improving the quality and applicability of rhenium plates. Consumer preferences are shifting towards lighter, more durable, and high-performance materials, directly benefiting the rhenium plate market. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on supply chain security, given the scarcity of rhenium resources. The market is also witnessing a growing interest in sustainable sourcing and recycling of rhenium, influencing manufacturing processes and product development. The estimated market size for rhenium plates in the base year 2025 is approximately 800 million.

Dominant Markets & Segments in Rhenium Plate

The Aerospace Industry stands as the dominant market for Rhenium Plate applications, accounting for an estimated 45% of the global market share in 2025. This dominance is fueled by the unparalleled requirement for rhenium's superior high-temperature strength and creep resistance in critical jet engine components like turbine blades and combustors. Economic policies favoring defense spending and civil aviation expansion significantly bolster this segment. Infrastructure development in advanced aerospace manufacturing facilities further supports its leading position.

Within the Types segmentation, Foil represents the most significant segment, holding approximately 40% of the market. This is directly linked to its widespread use in the aerospace industry for cladding and high-temperature shielding applications. The growing demand for thinner and more flexible components in advanced electronics also contributes to the foil segment's prominence.

The Semiconductor Manufacturing segment is a rapidly growing application, projected to capture 25% of the market by 2025. The increasing complexity of semiconductor devices and the need for sputtering targets with exceptional purity and performance are key drivers. Technological advancements in chip manufacturing, supported by government initiatives promoting domestic semiconductor production, are further accelerating this segment's growth.

The Medical Equipment segment, while currently smaller at an estimated 15% market share, is experiencing substantial growth. Rhenium's biocompatibility and radiopacity make it ideal for applications such as cardiovascular stents and radiation therapy applicators. Advancements in medical technology and an aging global population are key drivers.

The Chemical Industry utilizes rhenium plates for catalysts and specialized equipment, representing around 10% of the market. Its catalytic properties in petroleum refining and chemical synthesis drive demand.

The Nuclear Energy Field, though representing a smaller portion of the market at approximately 5%, is an area with significant future potential. Rhenium's high melting point and neutron absorption cross-section make it valuable for certain nuclear reactor components and fuel applications.

Rhenium Plate Product Developments

Recent product developments in the Rhenium Plate market focus on enhancing purity, improving manufacturing efficiency, and expanding application ranges. Innovations in advanced powder metallurgy and alloying techniques are yielding rhenium plates with superior mechanical properties and higher resistance to extreme temperatures, crucial for next-generation aerospace engines. Developments in ultra-thin rhenium foil production are catering to the burgeoning demands of the semiconductor industry for advanced sputtering targets and specialized electronic components. These advancements are driven by a need for materials that can withstand increasingly harsh operating environments and enable miniaturization in electronic devices, offering significant competitive advantages through improved performance and reliability.

Report Scope & Segmentation Analysis

The report comprehensively segments the Rhenium Plate market by Application and Type. In the Application segment, the Aerospace Industry is a dominant force, projected to reach a market size of approximately 360 million by 2033, driven by new aircraft manufacturing and engine upgrades. The Semiconductor Manufacturing segment, valued at around 200 million in 2025, is expected to witness a CAGR of 8.2% due to the increasing demand for high-performance chips. Medical Equipment is projected to grow from 120 million in 2025 to 240 million by 2033, fueled by advancements in medical devices. The Chemical Industry, with a current market size of 80 million, will see steady growth. The Nuclear Energy Field is expected to expand from 40 million to 90 million by 2033. In the Type segment, Foil is the largest, anticipated to reach 320 million by 2033. Silk and Membrane types, while smaller, are crucial for specialized applications and are experiencing focused development.

Key Drivers of Rhenium Plate Growth

The Rhenium Plate market's growth is primarily propelled by the relentless innovation within the Aerospace Industry, demanding materials capable of withstanding extreme temperatures and pressures for advanced jet engines. The Semiconductor Manufacturing sector's insatiable need for highly pure rhenium plates for sputtering targets to produce next-generation microchips is another significant catalyst. Furthermore, government initiatives and substantial R&D investments aimed at advancing defense capabilities and promoting technological self-sufficiency in critical industries are fostering market expansion. The unique properties of rhenium, such as its exceptional melting point and resistance to corrosion, make it indispensable in specialized applications where alternatives are insufficient.

Challenges in the Rhenium Plate Sector

A primary challenge facing the Rhenium Plate sector is the inherent scarcity and high cost of rhenium ore, leading to price volatility and supply chain vulnerabilities. The stringent environmental regulations associated with mining and processing rhenium also pose significant compliance hurdles and operational costs. Furthermore, the development of alternative materials or technologies that can partially substitute rhenium in certain less demanding applications, although limited, presents a competitive pressure. Geopolitical factors and the concentration of rhenium reserves in a few countries can also disrupt supply chains, impacting market stability.

Emerging Opportunities in Rhenium Plate

Emerging opportunities in the Rhenium Plate market are significantly influenced by the growing demand for advanced materials in renewable energy technologies, such as high-temperature components in next-generation solar thermal systems. The increasing application of rhenium in advanced medical imaging equipment and targeted drug delivery systems presents a burgeoning market. Furthermore, advancements in rhenium recycling technologies offer a sustainable pathway to mitigate supply constraints and reduce environmental impact, creating new business models. The ongoing exploration of space and the development of hypersonic technologies also represent potential growth avenues for high-performance rhenium alloys.

Leading Players in the Rhenium Plate Market

- H.C. Starck

- Plansee

- TANAKA Precious Metals

- Sumitomo Electric

- Rembar

- Elmetsa Group

- Stanford Advanced Materials

- Admat Inc.

- Espimetals

- Evaporation Material

- Ningbo Tianhua Institute of Chemical Machinery and Metallurgy

- Exotech

- GfE Gesellschaft für Elektrometallurgie

- Rhenium Alloys

- Tungsten Heavy Powder

- Metal Cutting

- China Rhenium New Materials Co.,Ltd.

Key Developments in Rhenium Plate Industry

- 2023: H.C. Starck announces a breakthrough in ultra-high purity rhenium powder production, improving efficiency by 15%.

- 2023: Plansee invests several million in expanding its rhenium processing capacity to meet surging aerospace demand.

- 2022: TANAKA Precious Metals develops a new rhenium alloy with enhanced creep resistance for critical engine components.

- 2022: Sumitomo Electric announces a strategic partnership to secure long-term rhenium supply for its semiconductor division.

- 2021: Rembar introduces a new range of rhenium foils with increased tensile strength.

- 2021: A significant M&A deal valued at approximately 50 million consolidates market share for key players.

Strategic Outlook for Rhenium Plate Market

The strategic outlook for the Rhenium Plate market remains highly positive, driven by its critical role in advanced technological applications. Future growth will be catalyzed by sustained demand from the aerospace and semiconductor industries, coupled with emerging opportunities in healthcare and potentially nuclear energy. Companies that can secure stable rhenium supply chains, invest in innovative processing techniques, and develop specialized rhenium alloys for niche applications will be best positioned for success. The focus on sustainability through efficient recycling processes will also be a key strategic differentiator, contributing to long-term market viability and stakeholder value.

Rhenium Plate Segmentation

-

1. Application

- 1.1. Aerospace Industry

- 1.2. Semiconductor Manufacturing

- 1.3. Medical Equipment

- 1.4. Chemical Industry

- 1.5. Nuclear Energy Field

-

2. Types

- 2.1. Foil

- 2.2. Silk

- 2.3. Membrane

Rhenium Plate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rhenium Plate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace Industry

- 5.1.2. Semiconductor Manufacturing

- 5.1.3. Medical Equipment

- 5.1.4. Chemical Industry

- 5.1.5. Nuclear Energy Field

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Foil

- 5.2.2. Silk

- 5.2.3. Membrane

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace Industry

- 6.1.2. Semiconductor Manufacturing

- 6.1.3. Medical Equipment

- 6.1.4. Chemical Industry

- 6.1.5. Nuclear Energy Field

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Foil

- 6.2.2. Silk

- 6.2.3. Membrane

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace Industry

- 7.1.2. Semiconductor Manufacturing

- 7.1.3. Medical Equipment

- 7.1.4. Chemical Industry

- 7.1.5. Nuclear Energy Field

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Foil

- 7.2.2. Silk

- 7.2.3. Membrane

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace Industry

- 8.1.2. Semiconductor Manufacturing

- 8.1.3. Medical Equipment

- 8.1.4. Chemical Industry

- 8.1.5. Nuclear Energy Field

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Foil

- 8.2.2. Silk

- 8.2.3. Membrane

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace Industry

- 9.1.2. Semiconductor Manufacturing

- 9.1.3. Medical Equipment

- 9.1.4. Chemical Industry

- 9.1.5. Nuclear Energy Field

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Foil

- 9.2.2. Silk

- 9.2.3. Membrane

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rhenium Plate Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace Industry

- 10.1.2. Semiconductor Manufacturing

- 10.1.3. Medical Equipment

- 10.1.4. Chemical Industry

- 10.1.5. Nuclear Energy Field

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Foil

- 10.2.2. Silk

- 10.2.3. Membrane

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 H.C. Starck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plansee

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TANAKA Precious Metals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumitomo Electric

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rembar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elmetsa Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stanford Advanced Materials

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Admat Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Espimetals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Evaporation Material

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ningbo Tianhua Institute of Chemical Machinery and Metallurgy

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Exotech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GfE Gesellschaft für Elektrometallurgie

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Rhenium Alloys

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tungsten Heavy Powder

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Metal Cutting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 China Rhenium New Materials Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 H.C. Starck

List of Figures

- Figure 1: Global Rhenium Plate Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rhenium Plate Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rhenium Plate Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rhenium Plate Revenue (million), by Types 2024 & 2032

- Figure 5: North America Rhenium Plate Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Rhenium Plate Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rhenium Plate Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rhenium Plate Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rhenium Plate Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rhenium Plate Revenue (million), by Types 2024 & 2032

- Figure 11: South America Rhenium Plate Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Rhenium Plate Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rhenium Plate Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rhenium Plate Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rhenium Plate Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rhenium Plate Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Rhenium Plate Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Rhenium Plate Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rhenium Plate Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rhenium Plate Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rhenium Plate Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rhenium Plate Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Rhenium Plate Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Rhenium Plate Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rhenium Plate Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rhenium Plate Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rhenium Plate Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rhenium Plate Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Rhenium Plate Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Rhenium Plate Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rhenium Plate Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rhenium Plate Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Rhenium Plate Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Rhenium Plate Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Rhenium Plate Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Rhenium Plate Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Rhenium Plate Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rhenium Plate Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rhenium Plate Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Rhenium Plate Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rhenium Plate Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rhenium Plate?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Rhenium Plate?

Key companies in the market include H.C. Starck, Plansee, TANAKA Precious Metals, Sumitomo Electric, Rembar, Elmetsa Group, Stanford Advanced Materials, Admat Inc., Espimetals, Evaporation Material, Ningbo Tianhua Institute of Chemical Machinery and Metallurgy, Exotech, GfE Gesellschaft für Elektrometallurgie, Rhenium Alloys, Tungsten Heavy Powder, Metal Cutting, China Rhenium New Materials Co., Ltd..

3. What are the main segments of the Rhenium Plate?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rhenium Plate," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rhenium Plate report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rhenium Plate?

To stay informed about further developments, trends, and reports in the Rhenium Plate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence