Key Insights

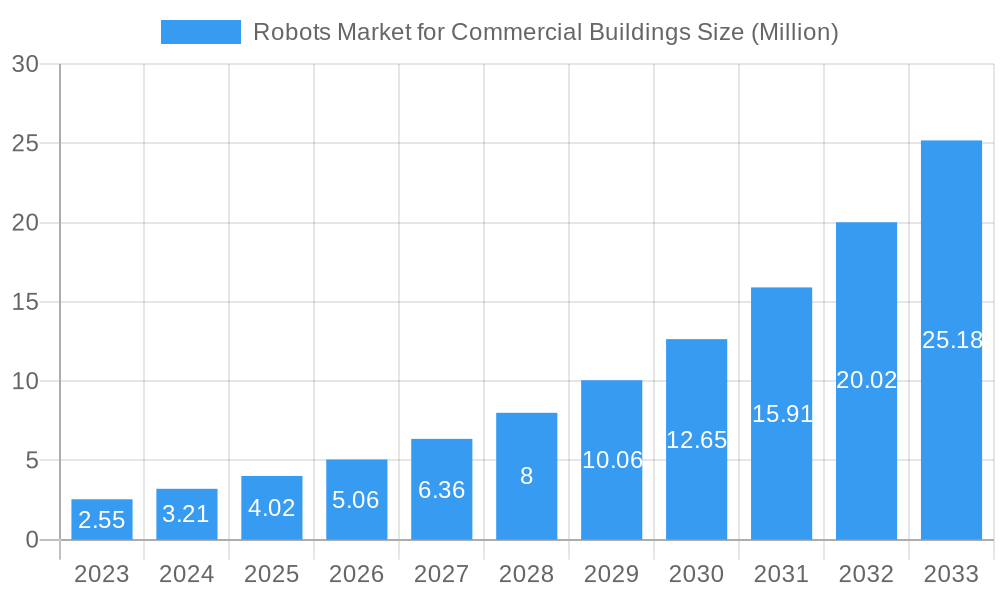

The global market for robots in commercial buildings is experiencing explosive growth, currently valued at approximately $4.02 billion. This rapid expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 25.70%, projecting substantial market development throughout the forecast period of 2025-2033. A significant driver for this surge is the increasing demand for automation to enhance operational efficiency, reduce labor costs, and improve hygiene standards across various commercial sectors. Specifically, floor cleaning robots and disinfection robots are leading the charge, becoming indispensable tools for maintaining pristine and safe environments in retail spaces, healthcare facilities, and airports. The rise of smart buildings and the integration of Internet of Things (IoT) technologies further bolster this growth, enabling seamless operation and data-driven insights from robotic systems.

Robots Market for Commercial Buildings Market Size (In Million)

The market segmentation highlights the diverse applications of robotics in commercial settings. Beyond cleaning and disinfection, robots are increasingly being deployed for tasks such as retail shelf management, streamlining inventory and restocking processes, and serving robots, revolutionizing customer service in restaurants and hospitality. Building service robots are also gaining traction, assisting with tasks ranging from security patrols to maintenance. Geographically, North America and Europe are expected to maintain significant market shares due to early adoption of advanced technologies and a strong emphasis on operational efficiency. However, the Asia Pacific region is poised for the most rapid growth, driven by increasing investments in smart infrastructure, a burgeoning retail sector, and government initiatives promoting technological adoption. While the market's trajectory is overwhelmingly positive, potential challenges such as high initial investment costs and the need for skilled personnel for maintenance and operation, alongside evolving regulatory landscapes, will require strategic attention from market players.

Robots Market for Commercial Buildings Company Market Share

This in-depth market research report provides a detailed analysis of the global Robots Market for Commercial Buildings, encompassing a study period from 2019 to 2033, with a base year of 2025. The report offers critical insights into market size, growth drivers, emerging trends, competitive landscape, and future projections. It delves into specific robot types such as Floor Cleaning Robots, Disinfection Robots, Retail Shelf Management Robots, Serving Robots, and Building Service Robots, and analyzes their adoption across key end-user verticals including Retail, Restaurants, Healthcare Facilities, Airports, and Other End-user Verticals. With an estimated market value of $50 Million in 2025 and a projected CAGR of 15.0% during the forecast period (2025-2033), this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector.

Robots Market for Commercial Buildings Market Concentration & Innovation

The Robots Market for Commercial Buildings exhibits a moderately concentrated landscape, with a few key players holding significant market share. Innovation remains a paramount driver, fueled by advancements in artificial intelligence (AI), machine learning, sensor technology, and autonomous navigation. These technological leaps are enabling robots to perform increasingly complex tasks with greater efficiency and safety. Regulatory frameworks, while still evolving, are gradually adapting to facilitate the integration of robots in public and commercial spaces, particularly concerning safety standards and data privacy. Product substitutes, such as manual labor and less sophisticated automation, are steadily being outpaced by the cost-effectiveness and performance benefits offered by advanced robotics. End-user trends are strongly favoring automation to address labor shortages, enhance operational efficiency, and improve customer experience. Mergers and acquisitions (M&A) activities are expected to continue as larger companies seek to acquire innovative startups and expand their product portfolios. For instance, recent M&A deals in the broader robotics sector have seen valuations reaching $500 Million for well-positioned companies. The market share distribution in 2025 is estimated to be: Leading Players (60%), Mid-Tier Players (30%), and Emerging Players (10%). M&A deal values are anticipated to grow by 10% annually.

Robots Market for Commercial Buildings Industry Trends & Insights

The Robots Market for Commercial Buildings is poised for substantial growth, driven by a confluence of factors that are reshaping commercial operations. The escalating demand for enhanced operational efficiency and cost reduction in service industries is a primary growth catalyst. Businesses across Retail, Restaurants, and Healthcare are increasingly turning to robots to automate repetitive tasks, minimize human error, and optimize resource allocation. The ongoing labor shortage in many developed economies further amplifies this trend, making robotic solutions a necessity rather than a luxury. Technological disruptions, particularly in AI and sensor technology, are continuously pushing the boundaries of what commercial robots can achieve. Enhanced navigation systems, sophisticated object recognition, and improved human-robot interaction capabilities are making robots more versatile and adaptable to diverse commercial environments. Consumer preferences are also evolving, with a growing acceptance and even anticipation of robotic assistance, especially in customer-facing roles such as delivery and service. The competitive dynamics of the market are characterized by intense innovation, strategic partnerships, and a race to secure market share. Companies are investing heavily in research and development to offer more intelligent, user-friendly, and cost-effective robotic solutions. The market penetration of robots in commercial buildings is projected to increase from 15% in 2023 to 40% by 2030. The compound annual growth rate (CAGR) of the market is estimated at 15.0% between 2025 and 2033. The increasing adoption of robots for hygiene and sanitation purposes, particularly in the wake of global health concerns, represents a significant market expansion opportunity. Furthermore, the rise of smart buildings and the Internet of Things (IoT) ecosystem provides a fertile ground for integrated robotic solutions that can communicate and collaborate, further boosting efficiency and functionality. The demand for robots capable of performing multiple tasks is also on the rise, offering a more compelling return on investment for businesses.

Dominant Markets & Segments in Robots Market for Commercial Buildings

The Retail vertical is emerging as a dominant end-user segment within the Robots Market for Commercial Buildings. This dominance is driven by several key factors:

- Economic Policies: Favorable retail policies and incentives aimed at boosting consumer spending and streamlining business operations directly impact the adoption of automation. Governments are increasingly recognizing the role of technology in modernizing retail infrastructure.

- Infrastructure: The widespread presence of large retail spaces, including hypermarkets, supermarkets, and shopping malls, provides the ideal physical infrastructure for the deployment of various robotic solutions.

- Consumer Demand: The ever-increasing consumer expectation for seamless shopping experiences, from efficient stock management to personalized services, is pushing retailers to adopt innovative solutions.

Within the Type of Robots, Floor Cleaning Robots are currently leading the market. Their widespread applicability across diverse commercial settings, from offices and hotels to retail outlets and healthcare facilities, contributes to their significant market share. The continuous need for maintaining hygiene and a pristine environment in public spaces fuels the demand for these robots.

- Key Drivers for Floor Cleaning Robots:

- Labor Cost Savings: Significant reduction in labor expenditure compared to manual cleaning.

- Improved Hygiene Standards: Consistent and thorough cleaning ensures higher sanitation levels.

- Increased Efficiency: Autonomous operation allows for continuous cleaning with minimal supervision.

- 24/7 Operation Capability: Robots can operate during off-peak hours, ensuring minimal disruption.

The Retail vertical’s dominance is further propelled by the demand for Retail Shelf Management Robots, which are revolutionizing inventory management and product display. These robots ensure optimal stock levels, accurate pricing, and attractive merchandising, directly impacting sales and customer satisfaction.

- Key Drivers for Retail Shelf Management Robots:

- Real-time Inventory Tracking: Minimizing stockouts and overstocking.

- Planogram Compliance: Ensuring products are displayed according to marketing strategies.

- Reduced Shrinkage: Identifying misplaced or missing items.

- Enhanced Customer Experience: Products are readily available and presented attractively.

Geographically, North America is projected to be the dominant market, driven by early adoption of advanced technologies, a strong emphasis on operational efficiency, and significant investment in R&D. The presence of major retail chains and a high density of commercial buildings further solidify its leading position. Countries like the United States are at the forefront of this trend, with substantial investments in automation across various commercial sectors.

Robots Market for Commercial Buildings Product Developments

Product developments in the Robots Market for Commercial Buildings are focused on enhancing autonomy, intelligence, and functionality. Innovations in AI-powered navigation systems are enabling robots to operate more efficiently in complex and dynamic environments. The integration of advanced sensors allows for better object recognition, obstacle avoidance, and human-robot interaction. Furthermore, there's a growing trend towards developing modular robots that can be customized with different end-effectors to perform a variety of tasks, increasing their versatility and value proposition. For instance, advancements in UV-C disinfection technology are leading to more effective and safer disinfection robots, crucial for maintaining public health.

Robots Market for Commercial Buildings Report Scope & Segmentation Analysis

The Robots Market for Commercial Buildings is segmented by Type of Robots into Floor Cleaning Robots, Disinfection Robots, Retail Shelf Management Robots, Serving Robots, and Building Service Robots. Additionally, the market is segmented by End-user Verticals into Retail, Restaurants, Healthcare Facilities, Airports, and Other End-user Verticals. The Floor Cleaning Robots segment is anticipated to hold a significant market share of 30% by 2028, owing to their broad applicability and the persistent need for cleanliness. The Retail vertical is expected to dominate, capturing approximately 35% of the market share by 2028, driven by the demand for efficient operations and enhanced customer experiences. The Healthcare Facilities segment is also a critical area of growth, particularly for disinfection robots, with projected growth of 20% CAGR.

Key Drivers of Robots Market for Commercial Buildings Growth

The growth of the Robots Market for Commercial Buildings is primarily propelled by several interconnected factors. Firstly, the persistent global labor shortage across various industries necessitates automation to maintain operational continuity and productivity. Secondly, the increasing emphasis on enhancing operational efficiency and reducing costs drives businesses to adopt robotic solutions for repetitive and labor-intensive tasks. Technological advancements, including sophisticated AI, machine learning, and improved sensor technologies, are making robots more capable and cost-effective. Furthermore, the growing awareness and demand for improved hygiene and sanitation standards, especially post-pandemic, are boosting the adoption of disinfection robots. Finally, favorable government initiatives and investments in automation technologies further stimulate market expansion.

Challenges in the Robots Market for Commercial Buildings Sector

Despite the promising growth, the Robots Market for Commercial Buildings faces several challenges. High initial investment costs for advanced robotic systems can be a barrier for small and medium-sized enterprises (SMEs). The integration of robots with existing infrastructure and legacy systems can also be complex and time-consuming. Cybersecurity concerns related to connected robots and data privacy are also significant considerations. Furthermore, the need for skilled personnel to operate, maintain, and repair these sophisticated machines presents a workforce challenge. Regulatory hurdles and the lack of standardized protocols for robot deployment in public spaces can also slow down adoption rates. The market is estimated to face a 5% slowdown in adoption due to these integration challenges.

Emerging Opportunities in Robots Market for Commercial Buildings

Emerging opportunities in the Robots Market for Commercial Buildings are abundant, driven by evolving consumer needs and technological advancements. The growing demand for personalized services in the retail and hospitality sectors presents opportunities for robots that can offer tailored experiences. The integration of robots with IoT platforms is creating smart building ecosystems where robots can collaborate and optimize building management. The expansion of e-commerce and the need for efficient last-mile delivery services are creating a surge in demand for autonomous delivery robots. Furthermore, the increasing focus on sustainability and energy efficiency in commercial buildings opens avenues for robots that can monitor and manage energy consumption. The potential for robots in elder care facilities and assisted living environments is another significant emerging opportunity.

Leading Players in the Robots Market for Commercial Buildings Market

- SoftBank Robotics Corp

- ABB Ltd

- Denso Corporation

- Pudu Robotics

- Mitsubishi Electric Corporation

- Nachi Fujikoshi Corporation

- Fanuc Corporation

- Kawasaki Robotics GmbH

- Samsung Electronics Co Ltd

- Ecovacs Robotics

- Diversey

- iRobot Corporation

- Vorwerk & Co KG

- Kuka AG

- Yaskawa Electric Corporation

Key Developments in Robots Market for Commercial Buildings Industry

- January 2023: Pudu Robotics, a service robot manufacturer, deployed its robotic solutions in more than 600 cities worldwide as of the end of 2022. The company aims to expand its services and use cases in 2023. To bring its robots to more industries, PUDU has partnered with several major hotel brands, including Marriott and Hilton. PUDU's robots have also been used at restaurants, shopping malls, convenience stores, and office buildings.

- September 2022: Magna and Cartken, a San Francisco-based autonomous robotics company, announced an agreement to manufacture Cartken's autonomous delivery robot fleet to meet the growing demand for last-mile delivery. The company is expected to manufacture robots at a Magna facility in Michigan.

Strategic Outlook for Robots Market for Commercial Buildings Market

The strategic outlook for the Robots Market for Commercial Buildings is exceptionally bright, driven by continued innovation and increasing adoption across diverse sectors. The future will likely see more collaborative robots (cobots) working alongside humans, enhancing productivity without replacing the workforce entirely. The development of AI-powered analytics will enable robots to provide deeper insights into operational performance and customer behavior. Strategic partnerships between technology providers and end-users will be crucial for tailor-made solutions and seamless integration. The market is expected to witness a significant increase in robots designed for specialized tasks, catering to the unique needs of industries like healthcare, logistics, and facility management. Continued investment in R&D, coupled with supportive regulatory frameworks, will pave the way for widespread deployment and unlock the full potential of robotics in commercial environments.

Robots Market for Commercial Buildings Segmentation

-

1. Type of Robots

- 1.1. Floor Cleaning Robots

- 1.2. Disinfection Robots

- 1.3. Retail Shelf Management Robots

- 1.4. Serving Robots

- 1.5. Building Service Robots

-

2. End-user Verticals

- 2.1. Retail

- 2.2. Restaurants

- 2.3. Healthcare Facilities

- 2.4. Airports

- 2.5. Other End-user Verticals

Robots Market for Commercial Buildings Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Robots Market for Commercial Buildings Regional Market Share

Geographic Coverage of Robots Market for Commercial Buildings

Robots Market for Commercial Buildings REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Government Initiatives for Robot Research; Various Business Models

- 3.2.2 Such As Leasing and Robot-as-a-Service

- 3.3. Market Restrains

- 3.3.1. High Product Cost; Lack of Customer Awareness

- 3.4. Market Trends

- 3.4.1. Floor Cleaning Robots Expected to Have a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Robots

- 5.1.1. Floor Cleaning Robots

- 5.1.2. Disinfection Robots

- 5.1.3. Retail Shelf Management Robots

- 5.1.4. Serving Robots

- 5.1.5. Building Service Robots

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Retail

- 5.2.2. Restaurants

- 5.2.3. Healthcare Facilities

- 5.2.4. Airports

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Robots

- 6. North America Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Robots

- 6.1.1. Floor Cleaning Robots

- 6.1.2. Disinfection Robots

- 6.1.3. Retail Shelf Management Robots

- 6.1.4. Serving Robots

- 6.1.5. Building Service Robots

- 6.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.2.1. Retail

- 6.2.2. Restaurants

- 6.2.3. Healthcare Facilities

- 6.2.4. Airports

- 6.2.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type of Robots

- 7. Europe Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Robots

- 7.1.1. Floor Cleaning Robots

- 7.1.2. Disinfection Robots

- 7.1.3. Retail Shelf Management Robots

- 7.1.4. Serving Robots

- 7.1.5. Building Service Robots

- 7.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.2.1. Retail

- 7.2.2. Restaurants

- 7.2.3. Healthcare Facilities

- 7.2.4. Airports

- 7.2.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type of Robots

- 8. Asia Pacific Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Robots

- 8.1.1. Floor Cleaning Robots

- 8.1.2. Disinfection Robots

- 8.1.3. Retail Shelf Management Robots

- 8.1.4. Serving Robots

- 8.1.5. Building Service Robots

- 8.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.2.1. Retail

- 8.2.2. Restaurants

- 8.2.3. Healthcare Facilities

- 8.2.4. Airports

- 8.2.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type of Robots

- 9. Latin America Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Robots

- 9.1.1. Floor Cleaning Robots

- 9.1.2. Disinfection Robots

- 9.1.3. Retail Shelf Management Robots

- 9.1.4. Serving Robots

- 9.1.5. Building Service Robots

- 9.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.2.1. Retail

- 9.2.2. Restaurants

- 9.2.3. Healthcare Facilities

- 9.2.4. Airports

- 9.2.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type of Robots

- 10. Middle East and Africa Robots Market for Commercial Buildings Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Robots

- 10.1.1. Floor Cleaning Robots

- 10.1.2. Disinfection Robots

- 10.1.3. Retail Shelf Management Robots

- 10.1.4. Serving Robots

- 10.1.5. Building Service Robots

- 10.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.2.1. Retail

- 10.2.2. Restaurants

- 10.2.3. Healthcare Facilities

- 10.2.4. Airports

- 10.2.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type of Robots

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SoftBank Robotics Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pudu Robotics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Electric Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nachi Fujikoshi Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fanuc Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kawasaki Robotics GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung Electronics Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ecovacs Robotics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Diversey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 iRobot Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Vorwerk & Co KG*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kuka AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yaskawa Electric Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 SoftBank Robotics Corp

List of Figures

- Figure 1: Global Robots Market for Commercial Buildings Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Robots Market for Commercial Buildings Revenue (Million), by Type of Robots 2025 & 2033

- Figure 3: North America Robots Market for Commercial Buildings Revenue Share (%), by Type of Robots 2025 & 2033

- Figure 4: North America Robots Market for Commercial Buildings Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 5: North America Robots Market for Commercial Buildings Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 6: North America Robots Market for Commercial Buildings Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Robots Market for Commercial Buildings Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Robots Market for Commercial Buildings Revenue (Million), by Type of Robots 2025 & 2033

- Figure 9: Europe Robots Market for Commercial Buildings Revenue Share (%), by Type of Robots 2025 & 2033

- Figure 10: Europe Robots Market for Commercial Buildings Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 11: Europe Robots Market for Commercial Buildings Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 12: Europe Robots Market for Commercial Buildings Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Robots Market for Commercial Buildings Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Robots Market for Commercial Buildings Revenue (Million), by Type of Robots 2025 & 2033

- Figure 15: Asia Pacific Robots Market for Commercial Buildings Revenue Share (%), by Type of Robots 2025 & 2033

- Figure 16: Asia Pacific Robots Market for Commercial Buildings Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 17: Asia Pacific Robots Market for Commercial Buildings Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 18: Asia Pacific Robots Market for Commercial Buildings Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Robots Market for Commercial Buildings Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Robots Market for Commercial Buildings Revenue (Million), by Type of Robots 2025 & 2033

- Figure 21: Latin America Robots Market for Commercial Buildings Revenue Share (%), by Type of Robots 2025 & 2033

- Figure 22: Latin America Robots Market for Commercial Buildings Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 23: Latin America Robots Market for Commercial Buildings Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 24: Latin America Robots Market for Commercial Buildings Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Robots Market for Commercial Buildings Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Robots Market for Commercial Buildings Revenue (Million), by Type of Robots 2025 & 2033

- Figure 27: Middle East and Africa Robots Market for Commercial Buildings Revenue Share (%), by Type of Robots 2025 & 2033

- Figure 28: Middle East and Africa Robots Market for Commercial Buildings Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 29: Middle East and Africa Robots Market for Commercial Buildings Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 30: Middle East and Africa Robots Market for Commercial Buildings Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Robots Market for Commercial Buildings Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 2: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 5: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 8: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 9: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 11: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 12: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 14: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 15: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Type of Robots 2020 & 2033

- Table 17: Global Robots Market for Commercial Buildings Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 18: Global Robots Market for Commercial Buildings Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robots Market for Commercial Buildings?

The projected CAGR is approximately 25.70%.

2. Which companies are prominent players in the Robots Market for Commercial Buildings?

Key companies in the market include SoftBank Robotics Corp, ABB Ltd, Denso Corporation, Pudu Robotics, Mitsubishi Electric Corporation, Nachi Fujikoshi Corporation, Fanuc Corporation, Kawasaki Robotics GmbH, Samsung Electronics Co Ltd, Ecovacs Robotics, Diversey, iRobot Corporation, Vorwerk & Co KG*List Not Exhaustive, Kuka AG, Yaskawa Electric Corporation.

3. What are the main segments of the Robots Market for Commercial Buildings?

The market segments include Type of Robots, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Initiatives for Robot Research; Various Business Models. Such As Leasing and Robot-as-a-Service.

6. What are the notable trends driving market growth?

Floor Cleaning Robots Expected to Have a Major Share.

7. Are there any restraints impacting market growth?

High Product Cost; Lack of Customer Awareness.

8. Can you provide examples of recent developments in the market?

January 2023: Pudu Robotics, a service robot manufacturer, deployed its robotic solutions in more than 600 cities worldwide as of the end of 2022. The company aims to expand its services and use cases in 2023. To bring its robots to more industries, PUDU has partnered with several major hotel brands, including Marriott and Hilton. PUDU's robots have also been used at restaurants, shopping malls, convenience stores, and office buildings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robots Market for Commercial Buildings," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robots Market for Commercial Buildings report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robots Market for Commercial Buildings?

To stay informed about further developments, trends, and reports in the Robots Market for Commercial Buildings, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence