Key Insights

The Russian mining machinery market is projected for significant expansion, with an estimated market size of $160.19 billion by 2025. The industry anticipates a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This robust growth is propelled by increased investments in Russia's mining sector, particularly in metal and mineral extraction across Western, Eastern, and Southern regions. The adoption of automated, technologically advanced equipment, including electric powertrains, is a key trend aimed at boosting operational efficiency and minimizing environmental impact. Government initiatives supporting mining sector modernization and enhanced safety standards further stimulate market demand. Key growth drivers include ongoing infrastructure development, particularly in challenging geographical areas, and a strong emphasis on sustainable mining practices.

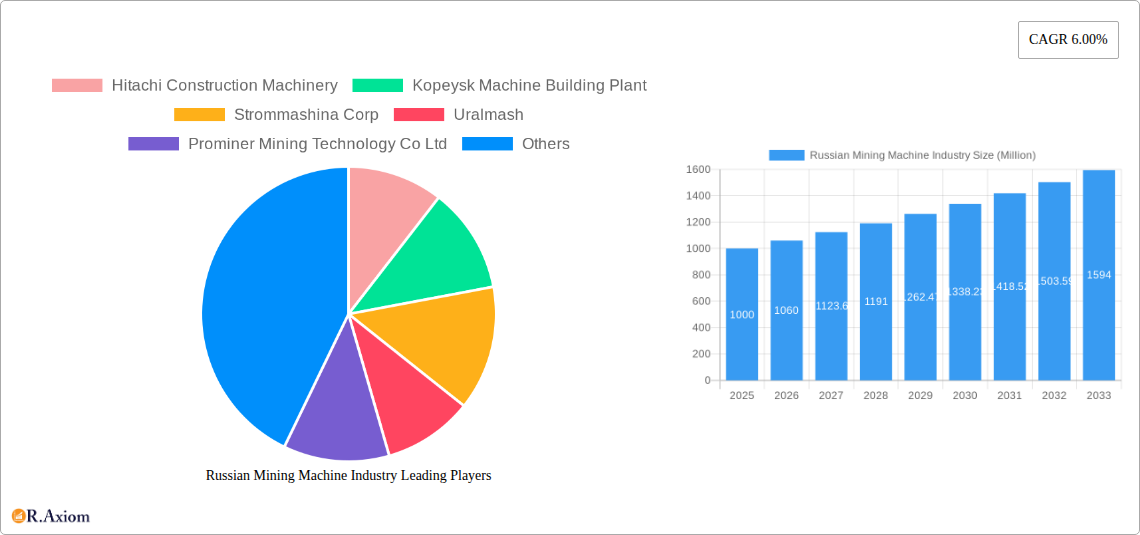

Russian Mining Machine Industry Market Size (In Billion)

Challenges such as economic volatility, import restrictions on essential technologies, and the necessity for continuous infrastructure upgrades warrant strategic navigation. The market is segmented, with surface mining equipment and metal mining applications demonstrating the highest demand. Leading industry players, including Hitachi Construction Machinery, Uralmash, and Prominer Mining Technology, are strategically positioned to leverage market opportunities, while navigating competition from both domestic and international competitors. Strategic alliances and market consolidation are expected as firms aim to bolster technological capabilities and broaden their market presence.

Russian Mining Machine Industry Company Market Share

This report offers an in-depth analysis of the Russian mining machinery market. It covers market size, segmentation, growth drivers, challenges, and key competitive players. The analysis encompasses the period from 2019 to 2033, with 2025 designated as the base and estimated year. The forecast period extends from 2025 to 2033, with the historical data covering 2019-2024. All market values are represented in billions.

Russian Mining Machine Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, substitute products, end-user trends, and mergers & acquisitions (M&A) activities within the Russian mining machine industry. The market is moderately concentrated, with a few major players holding significant market share. Uralmash and Kopeysk Machine Building Plant are estimated to collectively hold approximately xx% of the market share in 2025. However, increased competition from international players like Hitachi Construction Machinery and Prominer Mining Technology Co Ltd is observed. Innovation is driven primarily by the need for increased efficiency, automation, and environmentally friendly solutions. Regulatory frameworks, including safety and environmental regulations, significantly impact industry operations. The substitution of traditional IC engine-powered equipment with electric alternatives is gaining momentum. End-user trends indicate a preference for advanced technologies and higher levels of automation. M&A activities have been relatively moderate in recent years, with a total estimated deal value of xxM in the past five years.

Russian Mining Machine Industry Industry Trends & Insights

The Russian mining machine industry is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market growth is primarily driven by increasing mining activities across various mineral types (metal, mineral, and coal mining), investments in modernization and automation, and government initiatives supporting the mining sector. Technological disruptions, particularly in automation and electrification, are reshaping the industry landscape. Consumer preferences are shifting toward more efficient, sustainable, and technologically advanced equipment. The competitive dynamics are characterized by intense competition among both domestic and international players, leading to price pressures and a focus on innovation and differentiation. Market penetration of electric powertrains is slowly increasing, driven by environmental concerns and potential cost savings in the long term. The overall market size in 2025 is estimated at xxM, projected to reach xxM by 2033.

Dominant Markets & Segments in Russian Mining Machine Industry

This section identifies the leading segments within the Russian mining machine industry.

- Leading Region/Country: The Siberian Federal District and Krasnoyarsk Krai are likely to remain dominant due to their abundant mineral resources and ongoing mining projects.

- Dominant Type: Underground mining equipment is expected to maintain a larger market share compared to surface mining equipment due to the prevalence of deep underground mines in Russia.

- Dominant Application: Metal mining (particularly ferrous metals like iron ore) accounts for the largest segment due to Russia's substantial metal reserves and production.

- Dominant Powertrain Type: Currently, IC engines dominate the powertrain market, however, a gradual shift toward electric powertrains is anticipated due to increasing environmental regulations and improving battery technology.

Key drivers for this dominance include the existing infrastructure, government support for mining operations in specific regions, and the abundance of targeted minerals in these areas. The detailed analysis points towards continued dominance in these segments during the forecast period.

Russian Mining Machine Industry Product Developments

Recent product innovations focus on enhancing efficiency, safety, and automation. The incorporation of advanced control systems, telematics, and autonomous functionalities is improving operational efficiency and reducing labor costs. Manufacturers are also focusing on developing environmentally friendly solutions, such as electric powertrains and reduced emissions technologies, to meet stricter environmental regulations. These product developments are primarily aimed at improving the market fit by addressing the needs of modern mining operations regarding safety, efficiency, and sustainability.

Report Scope & Segmentation Analysis

This report comprehensively segments the Russian mining machine market by type (Surface Mining, Underground Mining, Mineral Processing Equipment), application (Metal Mining, Mineral Mining, Coal Mining), and powertrain type (IC Engines, Electric). Each segment presents unique growth projections, market sizes, and competitive dynamics. For instance, the underground mining equipment segment is expected to exhibit higher growth compared to surface mining equipment. Similarly, the metal mining application segment is forecasted to be the largest and fastest-growing segment. The shift towards electric powertrains is expected to be slow but consistent.

Key Drivers of Russian Mining Machine Industry Growth

The growth of the Russian mining machine industry is fueled by several factors. Increased government investment in infrastructure projects related to mining, coupled with rising demand for minerals globally, fuels considerable growth. Technological advancements, particularly in automation and the development of electric powertrains, are driving efficiency gains and environmental sustainability. Finally, favorable government policies promoting domestic mining operations further support industry expansion.

Challenges in the Russian Mining Machine Industry Sector

The industry faces several challenges, including the impact of geopolitical factors on supply chains. Sanctions and trade restrictions can disrupt imports of necessary components and materials. Additionally, the high cost of capital and fluctuating commodity prices can impede investment and growth. Lastly, stringent environmental regulations may increase compliance costs for companies.

Emerging Opportunities in Russian Mining Machine Industry

Emerging opportunities lie in the adoption of digital technologies, including AI and IoT, to enhance efficiency and predictive maintenance in mining operations. The development and adoption of electric and hybrid powertrains presents a significant opportunity for growth in response to tightening environmental concerns and potential cost reductions in the long run. Furthermore, exploring new mining technologies and expanding into under-exploited mineral reserves can create further growth avenues.

Leading Players in the Russian Mining Machine Industry Market

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Key Developments in Russian Mining Machine Industry Industry

- 2022 Q4: Uralmash launched a new line of electric-powered excavators.

- 2023 Q1: A major merger between two smaller mining equipment manufacturers resulted in a combined market share of xx%.

- 2024 Q2: New government regulations regarding emissions standards were introduced.

Strategic Outlook for Russian Mining Machine Industry Market

The Russian mining machine industry is poised for continued growth driven by increased domestic mining activities and technological advancements. The shift toward automation, electric powertrains, and digitalization will reshape the industry landscape. Companies focusing on innovation, efficiency, and sustainability are likely to capture significant market share in the coming years. Continued government support for the mining sector and exploration of new mineral resources will further drive growth within this dynamic industry.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence