Key Insights

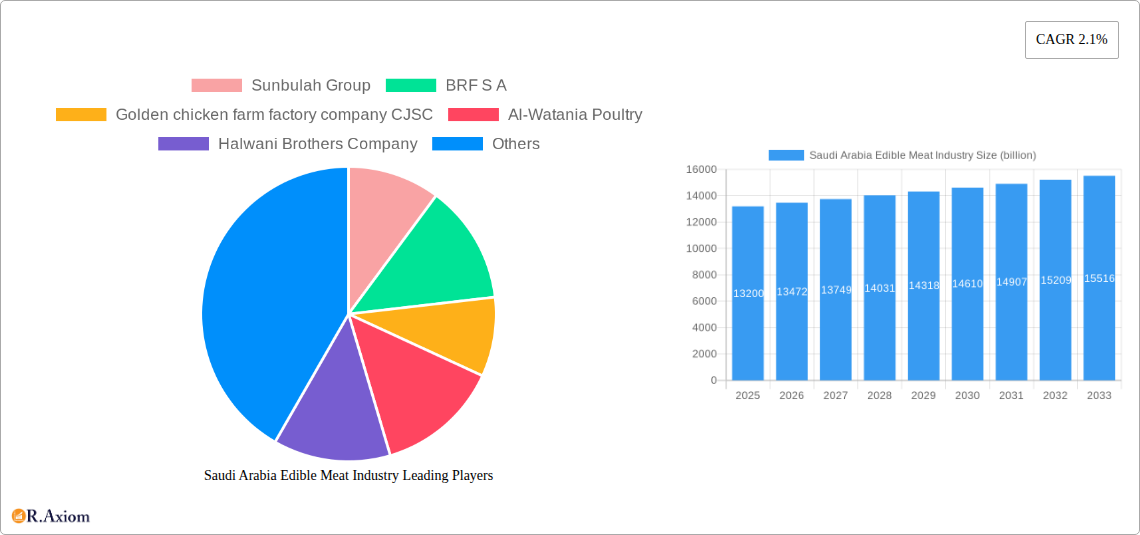

The Saudi Arabia edible meat industry is poised for steady growth, driven by increasing population, rising disposable incomes, and a growing demand for protein-rich diets. The market size in 2025 is valued at approximately $13.2 billion, with a projected Compound Annual Growth Rate (CAGR) of 2.1% through 2033. This expansion is significantly influenced by evolving consumer preferences, with a notable shift towards poultry due to its affordability and perceived health benefits, alongside continued demand for traditional meats like beef and mutton. The increasing availability of various meat forms, including fresh/chilled, frozen, and processed options, caters to diverse consumer needs and consumption patterns, while the expansion of both off-trade (convenience stores, online channels, supermarkets) and on-trade channels further enhances market accessibility. Key players like Sunbulah Group, BRF S.A., and Almarai Food Company are strategically investing in expanding production capacities and diversifying their product portfolios to capture a larger market share.

Saudi Arabia Edible Meat Industry Market Size (In Billion)

The industry faces some headwinds, including fluctuating raw material costs and a growing focus on sustainable sourcing and ethical animal welfare practices. However, government initiatives aimed at boosting local production and ensuring food security are expected to mitigate some of these challenges. The market's segmentation by meat type, form, and distribution channel highlights distinct growth opportunities. While poultry is expected to lead volume growth, the premiumization trend in beef and mutton consumption, particularly in the foodservice sector, presents lucrative avenues. The online channel's rapid expansion, accelerated by changing consumer shopping habits, is becoming a critical distribution strategy for meat providers. Companies that can effectively navigate supply chain complexities, innovate in product development (e.g., plant-based meat alternatives), and align with sustainability goals will be best positioned for long-term success in this dynamic market.

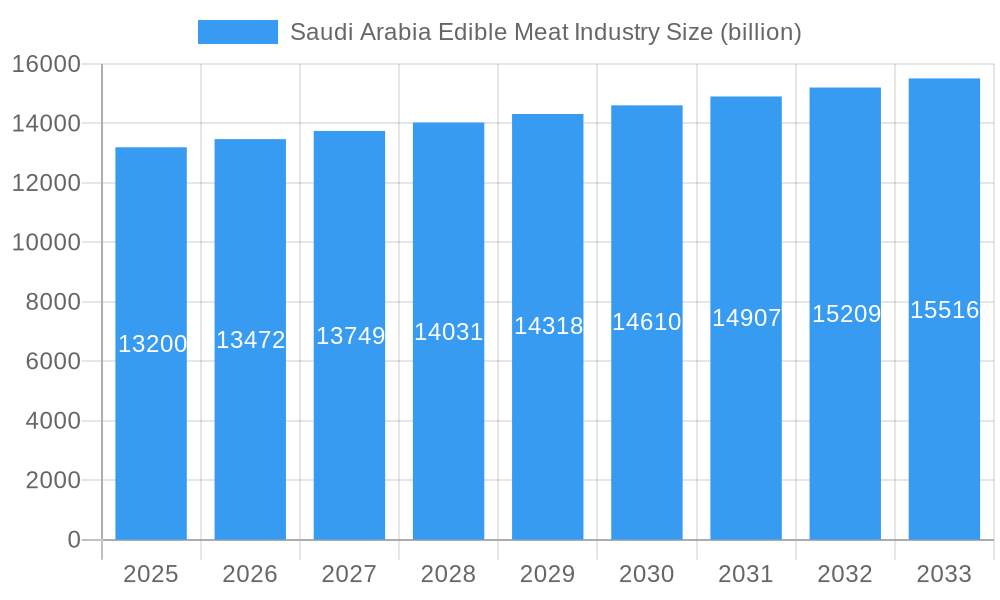

Saudi Arabia Edible Meat Industry Company Market Share

This in-depth report provides an exhaustive analysis of the Saudi Arabia Edible Meat Industry, covering market dynamics, growth drivers, competitive landscape, and future outlook from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this report offers actionable insights for stakeholders navigating this rapidly evolving sector. The Saudi Arabian edible meat market is projected to reach an estimated value of $XX billion by 2025, with significant growth anticipated throughout the forecast period.

Saudi Arabia Edible Meat Industry Market Concentration & Innovation

The Saudi Arabia edible meat industry exhibits a moderate level of market concentration, with a few dominant players holding significant market share. Sunbulah Group, BRF S.A., Golden Chicken Farm Factory Company CJSC, Al-Watania Poultry, Halwani Brothers Company, The Savola Group, Tanmiah Food Company, and Almarai Food Company are key contributors to this landscape. Innovation within the sector is driven by a confluence of factors, including advancements in breeding technologies, sustainable farming practices, and sophisticated processing techniques. The adoption of advanced incubation solutions, as exemplified by Golden Chicken's expansion in February 2023, highlights the industry's commitment to enhancing production efficiency and capacity, adding an estimated 48 million eggs to their yearly production. Regulatory frameworks, primarily influenced by food safety standards and import/export regulations, play a crucial role in shaping market access and operational procedures. Product substitutes, such as plant-based protein alternatives, are gaining traction, posing a competitive challenge. End-user trends lean towards convenience, health consciousness, and Halal certification, influencing product development and marketing strategies. Mergers and acquisitions (M&A) activities, while not extensively detailed in publicly available data, are expected to be a significant avenue for market consolidation and expansion, with potential deal values in the billions of dollars.

Saudi Arabia Edible Meat Industry Industry Trends & Insights

The Saudi Arabia edible meat industry is poised for substantial growth, driven by a burgeoning population, increasing disposable incomes, and a growing demand for protein-rich food products. The projected Compound Annual Growth Rate (CAGR) for the edible meat market in Saudi Arabia is estimated to be XX% during the forecast period. Key market growth drivers include government initiatives aimed at enhancing food security and self-sufficiency, coupled with significant investments in the agricultural and food processing sectors. Technological disruptions are continuously reshaping the industry, from advanced breeding and feed management systems to sophisticated slaughtering and processing technologies that enhance quality and reduce waste. Consumer preferences are increasingly shifting towards healthier, higher-quality meat products, with a growing emphasis on Halal certification and traceability. There is also a rising demand for convenience-based products, such as pre-marinated meats and ready-to-cook options. Competitive dynamics are intensifying, with both local players and international companies vying for market share. The industry is witnessing a surge in investment in automation and digitalization to improve operational efficiency and meet the evolving demands of the market. Market penetration is expected to deepen across all segments, particularly in the poultry and processed meat categories, as consumers seek diverse and convenient protein sources. The overall market penetration for edible meat is projected to reach XX% by the end of the forecast period.

Dominant Markets & Segments in Saudi Arabia Edible Meat Industry

The Saudi Arabia edible meat industry is characterized by the dominance of specific segments and distribution channels. Within the Type segmentation, Poultry holds a significant market share due to its affordability, widespread availability, and cultural acceptance. Beef and Mutton also command substantial demand, particularly during religious festivities and special occasions. The Form segmentation sees Fresh / Chilled and Frozen meats leading the market, catering to both immediate consumption and longer-term storage needs. Processed meats, including sausages, burgers, and deli meats, are gaining popularity due to their convenience and variety.

Key drivers for the dominance of these segments include:

- Economic Policies: Government support for local poultry production and import tariffs on certain meat types favor domestic production and consumption of poultry.

- Infrastructure: The development of advanced cold chain logistics and efficient transportation networks supports the widespread availability of fresh, chilled, and frozen meat products across the Kingdom.

- Consumer Habits: Poultry's versatility in cooking and its perception as a leaner protein source contribute to its high consumption rates.

The Distribution Channel segmentation is heavily influenced by Off-Trade channels. Supermarkets and Hypermarkets are the primary avenues for meat purchases, offering a wide selection and competitive pricing. The Online Channel is experiencing rapid growth, driven by the convenience of home delivery and the expansion of e-commerce platforms. Convenience stores also play a role, particularly for impulse purchases and smaller households. The On-Trade segment, encompassing restaurants, hotels, and catering services, represents a significant market, with demand driven by tourism and the hospitality sector. The increasing adoption of online ordering and delivery services is further bolstering the off-trade segment. The market size for poultry is estimated to be $XX billion in 2025, with fresh/chilled and frozen forms contributing $XX billion and $XX billion respectively.

Saudi Arabia Edible Meat Industry Product Developments

Product developments in the Saudi Arabia edible meat industry are increasingly focused on convenience, health, and premiumization. Innovations include the introduction of value-added products such as marinated meats, ready-to-cook meals, and gourmet cuts. Enhanced processing techniques are also being employed to improve texture, shelf-life, and flavor profiles. Halal certification remains a paramount factor, with companies investing in robust traceability systems and production processes to meet stringent requirements. The competitive advantage for companies lies in their ability to cater to evolving consumer preferences for healthier options, such as lean meat varieties and reduced-sodium processed products, while also leveraging technological advancements to ensure product quality and safety.

Report Scope & Segmentation Analysis

This report meticulously segments the Saudi Arabia edible meat industry across several key dimensions. The Type segmentation encompasses Beef, Mutton, Poultry, and Other Meat, with poultry projected to maintain its leadership in terms of volume and value. The Form segmentation includes Canned, Fresh / Chilled, Frozen, and Processed meats, with fresh/chilled and frozen segments expected to dominate due to consumer preferences for natural products and longer shelf-life solutions, respectively. The Distribution Channel segmentation is divided into Off-Trade, which includes Convenience Stores, Online Channel, Supermarkets and Hypermarkets, and Others, and On-Trade. The online channel is anticipated to witness the highest growth rate within the off-trade segment, driven by increasing digital adoption. The market size for processed meat is projected to reach $XX billion by 2025, exhibiting a significant CAGR of XX%.

Key Drivers of Saudi Arabia Edible Meat Industry Growth

The growth of the Saudi Arabia edible meat industry is propelled by several key factors. A rising population and increasing urbanization are driving up overall demand for food, particularly protein sources. Government support through initiatives like Saudi Vision 2030, aimed at boosting local production and food security, is a significant catalyst. Technological advancements in animal husbandry, feed formulations, and processing techniques are improving efficiency and product quality. Furthermore, a growing middle class with higher disposable incomes is leading to increased consumption of meat products, especially premium and value-added options. The expansion of the retail sector, including modern supermarkets and the burgeoning online channel, is enhancing accessibility and consumer choice.

Challenges in the Saudi Arabia Edible Meat Industry Sector

Despite robust growth prospects, the Saudi Arabia edible meat industry faces several challenges. Stringent import regulations and fluctuating global commodity prices can impact supply chain stability and cost-effectiveness. Climate change and water scarcity pose long-term sustainability challenges for livestock farming. Intense competition from both local and international players necessitates continuous innovation and cost management. Public perception regarding the health impacts of red meat consumption and the growing interest in plant-based alternatives present a competitive pressure. Additionally, ensuring consistent Halal certification across all production and distribution stages requires ongoing vigilance and robust traceability systems.

Emerging Opportunities in Saudi Arabia Edible Meat Industry

Significant emerging opportunities exist within the Saudi Arabia edible meat industry. The growing demand for Halal-certified products extends beyond Saudi Arabia, presenting export potential. The rise of e-commerce and food delivery platforms offers new avenues for market penetration and direct-to-consumer sales. Investments in sustainable and ethical farming practices are gaining traction, appealing to a segment of environmentally conscious consumers. The development of novel protein sources, including cultured meat, and the expansion of processed and convenience meat products cater to evolving lifestyle demands. Furthermore, strategic partnerships and collaborations can unlock access to new technologies, markets, and distribution networks, fostering innovation and scale.

Leading Players in the Saudi Arabia Edible Meat Industry Market

- Sunbulah Group

- BRF S.A.

- Golden Chicken Farm Factory Company CJSC

- Al-Watania Poultry

- Halwani Brothers Company

- The Savola Group

- Tanmiah Food Company

- Almarai Food Company

Key Developments in Saudi Arabia Edible Meat Industry Industry

- February 2023: Golden Chicken has expanded its broiler hatchery in Shaqra with Petersime’s latest X-Streamer™ incubator solution. Being the third hatchery project in partnership with Petersime, the extension has added 48 million eggs to the company’s yearly total production capacity.

- July 2022: BRF Sadia inaugurated its new plant, 'Al Joody,' in Dammam, Saudi Arabia, which helps in increasing its monthly production capacity to 1,200 tons of food. This plant will play an integral role in the growth and development of the poultry industry locally, in the interest of the Saudi consumer.

- July 2022: Tyson Foods and Tanmiah of Saudi Arabia signed a strategic partnership. The strategic partnership is expected to accelerate Tyson Foods’ and Tanmiah’s growth and generate significant value in the short and long term.

Strategic Outlook for Saudi Arabia Edible Meat Industry Market

The strategic outlook for the Saudi Arabia edible meat industry is characterized by sustained growth and evolving market dynamics. Investments in advanced farming technologies, automation, and sustainable practices will be crucial for companies aiming to enhance efficiency, reduce costs, and meet stringent environmental and ethical standards. The continued expansion of the online channel and the development of value-added, convenient meat products will cater to the preferences of a modern consumer base. Strategic alliances and potential mergers and acquisitions will likely reshape the competitive landscape, fostering consolidation and enabling players to achieve greater economies of scale. The industry is well-positioned to capitalize on government support for food security and the growing domestic demand for protein, while also exploring opportunities for export to regional and international Halal markets.

Saudi Arabia Edible Meat Industry Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Poultry

- 1.4. Other Meat

-

2. Form

- 2.1. Canned

- 2.2. Fresh / Chilled

- 2.3. Frozen

- 2.4. Processed

-

3. Distribution Channel

-

3.1. Off-Trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Channel

- 3.1.3. Supermarkets and Hypermarkets

- 3.1.4. Others

- 3.2. On-Trade

-

3.1. Off-Trade

Saudi Arabia Edible Meat Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Edible Meat Industry Regional Market Share

Geographic Coverage of Saudi Arabia Edible Meat Industry

Saudi Arabia Edible Meat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Edible Meat Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Poultry

- 5.1.4. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Canned

- 5.2.2. Fresh / Chilled

- 5.2.3. Frozen

- 5.2.4. Processed

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-Trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Channel

- 5.3.1.3. Supermarkets and Hypermarkets

- 5.3.1.4. Others

- 5.3.2. On-Trade

- 5.3.1. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BRF S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Golden chicken farm factory company CJSC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al-Watania Poultry

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Halwani Brothers Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Savola Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tanmiah Food Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Almarai Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Saudi Arabia Edible Meat Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Edible Meat Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 3: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Saudi Arabia Edible Meat Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Edible Meat Industry?

The projected CAGR is approximately 2.1%.

2. Which companies are prominent players in the Saudi Arabia Edible Meat Industry?

Key companies in the market include Sunbulah Group, BRF S A, Golden chicken farm factory company CJSC, Al-Watania Poultry, Halwani Brothers Company, The Savola Grou, Tanmiah Food Company, Almarai Food Company.

3. What are the main segments of the Saudi Arabia Edible Meat Industry?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

February 2023: Golden Chicken has expanded its broiler hatchery in Shaqra with Petersime’s latest X-Streamer™ incubator solution. Being the third hatchery project in partnership with Petersime, the extension has added 48 million eggs to the company’s yearly total production capacity.July 2022: BRF Sadia inaugurated its new plant, 'Al Joody,' in Dammam, Saudi Arabia, which helps in increasing its monthly production capacity to 1,200 tons of food. which will play an integral role in the growth and development of the poultry industry locally, in the interest of the Saudi consumer.July 2022: Tyson Foods and Tanmiah of Saudi Arabia signed strategic partnership. The strategic partnership is expected to accelerate Tyson Foods’ and Tanmiah’s growth and generate significant value in the short and long term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Edible Meat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Edible Meat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Edible Meat Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Edible Meat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence