Key Insights

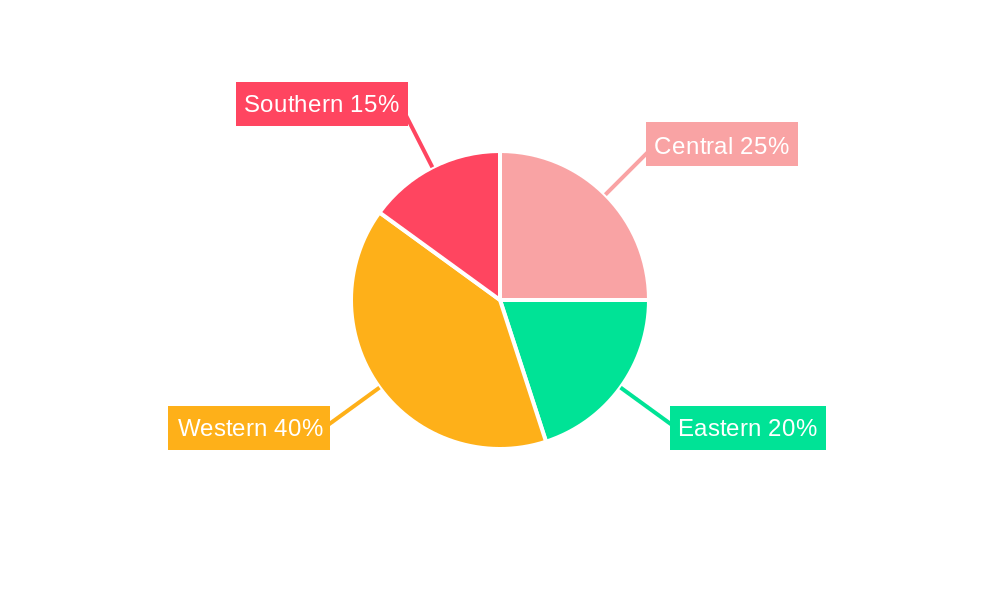

The Saudi Arabia foodservice disposable packaging market is experiencing robust growth, projected to reach a market size of $1.83 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.13% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning HoReCa (Hotels, Restaurants, and Catering) sector, coupled with a rising demand for convenient and hygienic food packaging solutions, is significantly contributing to market growth. Increasing consumer preference for takeaway and delivery services, particularly amongst the younger demographic, further fuels this demand. Furthermore, the ongoing expansion of retail establishments and the rising popularity of quick-service restaurants are also major contributors. The market segmentation reveals strong preference for paper-based packaging, reflecting a growing awareness of environmental sustainability. However, plastic-based packaging still holds a substantial share, presenting an opportunity for sustainable alternatives. Geographic variations exist across the four regions of Saudi Arabia (Central, Eastern, Western, and Southern), with the Western region, containing major cities like Jeddah and Mecca, potentially showing the highest demand due to higher tourism and population density. The market faces some restraints, including fluctuating raw material prices and potential governmental regulations aimed at reducing plastic waste.

Saudi Arabia Foodservice Disposable Packaging Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging companies. Key players such as Packaging Product Company (PPC), Hotpack Packaging Industries LLC, and SAQR Pack, alongside numerous regional players are vying for market share. Successful companies are likely focusing on innovation in sustainable packaging materials, improved supply chain efficiencies, and strategic partnerships to capitalize on growth opportunities. The forecast period (2025-2033) suggests continued expansion, driven by sustained economic growth and evolving consumer preferences. This will present further opportunities for investment and innovation within the Saudi Arabia foodservice disposable packaging market. The market's trajectory hinges on the balance between meeting the increasing demand for convenience and sustainability concerns. Future growth will likely depend on the successful adoption of eco-friendly packaging options that meet both consumer preferences and environmental regulations.

Saudi Arabia Foodservice Disposable Packaging Market Company Market Share

Saudi Arabia Foodservice Disposable Packaging Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Saudi Arabia foodservice disposable packaging market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive market research and data analysis to deliver actionable intelligence. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Saudi Arabia Foodservice Disposable Packaging Market Concentration & Innovation

The Saudi Arabia foodservice disposable packaging market exhibits a moderately concentrated landscape, with several key players holding significant market share. Market leaders such as Packaging Product Company (PPC), Hotpack Packaging Industries LLC, and SAQR Pack are driving innovation through product diversification and technological advancements. However, the market also features a number of smaller, regional players. The level of market concentration is estimated at xx%, with the top 5 players controlling approximately xx% of the total market share.

Innovation Drivers:

- Growing demand for sustainable and eco-friendly packaging solutions.

- Technological advancements in materials science and packaging design.

- Government initiatives promoting circular economy and waste reduction.

- Rising consumer awareness of environmental issues.

Regulatory Frameworks:

The regulatory landscape plays a significant role, shaping material choices and influencing product development. Stringent food safety regulations are driving the adoption of high-quality, certified materials. Furthermore, government policies promoting sustainable packaging are influencing the shift towards eco-friendly alternatives.

Product Substitutes:

Reusable packaging systems and compostable alternatives represent potential substitutes, though their adoption is currently limited by cost and logistical challenges. The impact of these substitutes is expected to grow significantly during the forecast period.

M&A Activities:

M&A activity in the Saudi Arabia foodservice disposable packaging market has been relatively moderate in recent years. However, increased competition and the pursuit of sustainability are likely to drive consolidation in the coming years. While precise deal values are not publicly available for all transactions, the total value of M&A deals in the sector between 2019 and 2024 is estimated to be around xx Million.

Saudi Arabia Foodservice Disposable Packaging Market Industry Trends & Insights

The Saudi Arabia foodservice disposable packaging market is experiencing robust growth fueled by several key factors. The expansion of the foodservice sector, driven by population growth, urbanization, and increasing disposable incomes, is a primary driver. The burgeoning tourism sector also contributes significantly to the market's growth.

Technological disruptions are impacting material choices and packaging designs. The rise of e-commerce and online food delivery services has increased the demand for packaging that provides enhanced product protection during transportation.

Consumer preferences are shifting towards eco-friendly, sustainable options. The growing awareness of environmental concerns is prompting a move away from traditional plastic packaging towards more sustainable alternatives such as biodegradable and compostable materials. This trend is further accelerated by the Saudi Green Initiative and Vision 2030, which actively promote sustainability.

Competitive dynamics are intense, with established players facing competition from emerging companies and international brands. Pricing strategies, product innovation, and supply chain efficiency are key competitive battlegrounds. Market penetration of sustainable packaging is still relatively low but growing rapidly, with a projected xx% increase by 2033.

Dominant Markets & Segments in Saudi Arabia Foodservice Disposable Packaging Market

By Packaging Format:

Paper-based: The paper-based segment dominates the market, driven by its affordability, versatility, and recyclability. Growth is further fueled by increased consumer preference for environmentally conscious options. Key drivers include increasing demand for sustainable alternatives, the growth of the fast-food industry, and government initiatives favoring paper packaging.

Plastic: The plastic segment is substantial, although facing challenges from growing environmental concerns. However, the emergence of recycled and biodegradable plastic options is mitigating this decline.

Other Paper-based Products: This segment includes items like cups, plates, and bowls, showing a significant rise due to the ease of use and environmental awareness.

Aluminum Foil: Aluminum foil maintains its niche in specific applications requiring high-barrier properties.

Tissues: Tissue products like napkins and wet wipes constitute a smaller but stable segment, characterized by steady growth.

By End User:

HoReCa (Hotels, Restaurants, and Catering): This segment is the largest contributor to market revenue, driven by high consumption in restaurants and catering services.

Retail Establishments: Retail businesses are another significant contributor, particularly those involved with prepared foods and takeaway services.

Institutional: This includes hospitals, schools, and other institutions.

Other End User Types: This encompasses smaller-scale businesses and specialized foodservice operations.

The Riyadh and Jeddah regions currently represent the most dominant markets, driven by high population density, robust tourism, and the concentration of foodservice establishments. Key factors include higher disposable income, government infrastructure spending, and a vibrant food and beverage culture.

Saudi Arabia Foodservice Disposable Packaging Market Product Developments

Recent product innovations focus on enhancing sustainability, convenience, and functionality. The emergence of biodegradable and compostable alternatives is a key trend, as is the use of recycled materials. Companies are increasingly emphasizing designs that optimize material usage and minimize waste, driven by increasing environmental concerns and government regulations. These improvements are particularly notable in the paper-based and plastic segments. There is also a push towards customizable packaging solutions catering to the branding needs of foodservice providers.

Report Scope & Segmentation Analysis

This report analyzes the Saudi Arabia foodservice disposable packaging market across several key segments:

By Packaging Format: Paper-based (including boxes, bags, and cartons), Plastic (including films, containers, and cups), Aluminum Foil, Tissues, and Cutlery, Stirrers, and Straws. Each segment's growth projections, market sizes, and competitive dynamics are examined.

By End User: HoReCa (Hotels, Restaurants, and Catering), Retail Establishments, Institutional, and Other End User Types. Each end-user segment's growth is evaluated, considering specific needs and usage patterns.

The report provides detailed insights into the market size, growth projections, and competitive landscape of each segment.

Key Drivers of Saudi Arabia Foodservice Disposable Packaging Market Growth

The growth of the Saudi Arabia foodservice disposable packaging market is fueled by several key factors:

- Growing Foodservice Sector: Expansion of the foodservice industry, driven by rising population and tourism.

- E-commerce Growth: The boom in online food delivery is increasing demand for suitable packaging.

- Government Initiatives: Government support for the food industry and initiatives promoting sustainability.

- Rising Disposable Incomes: Increased spending power allows for greater consumption of packaged food.

Challenges in the Saudi Arabia Foodservice Disposable Packaging Market Sector

The Saudi Arabia foodservice disposable packaging market faces several challenges:

- Environmental Concerns: Growing pressure to reduce plastic waste and adopt sustainable alternatives.

- Fluctuating Raw Material Prices: Price volatility for raw materials, such as paper and plastic, can impact profitability.

- Stringent Regulations: Compliance with food safety and environmental regulations requires considerable investment.

Emerging Opportunities in Saudi Arabia Foodservice Disposable Packaging Market

The market presents several exciting opportunities:

- Sustainable Packaging: Growing demand for eco-friendly, compostable, and recyclable packaging solutions.

- Innovation in Materials: The development and adoption of new, innovative materials with enhanced functionality.

- Customization and Branding: Offering customized packaging solutions to foodservice providers.

Leading Players in the Saudi Arabia Foodservice Disposable Packaging Market Market

- Packaging Product Company (PPC)

- Hotpack Packaging Industries LLC

- SAQR Pack

- Prestige Packing Industry

- Saudi Foam Trays Mfg Co

- Smart Pack

- Falcon Pack

- Napco National

- Saudi Modern Packaging Co Ltd

- Noor Carton & Packaging Industry

Key Developments in Saudi Arabia Foodservice Disposable Packaging Market Industry

April 2024: SABIC launched Saudi Arabia's first circular packaging initiative, promoting a circular plastic economy. FONTE adopted SABIC's certified circular polyethylene for its packaging, produced by Napco National. This significantly impacts the market by promoting sustainable practices.

April 2024: Nova Water launched a 100% recycled water bottle, aligning with Vision 2030's sustainability goals. This highlights the growing focus on eco-friendly packaging and the circular economy.

Strategic Outlook for Saudi Arabia Foodservice Disposable Packaging Market Market

The future of the Saudi Arabia foodservice disposable packaging market appears promising. Continued growth in the foodservice sector, increasing consumer demand for convenience, and a rising focus on sustainability will drive market expansion. Opportunities abound for companies that can offer innovative, sustainable, and cost-effective solutions. The shift towards a circular economy will reshape the competitive landscape, favoring companies committed to responsible manufacturing and eco-friendly materials. The market is poised for significant growth, with substantial opportunities for innovation and expansion in the coming years.

Saudi Arabia Foodservice Disposable Packaging Market Segmentation

-

1. Material

-

1.1. Plastic Resins

- 1.1.1. PP

- 1.1.2. PET

- 1.1.3. PS

- 1.1.4. Other Plastic Resins

- 1.2. Paper and Paperboard

- 1.3. Aluminum Foil

- 1.4. Other Materials

-

1.1. Plastic Resins

-

2. Product

- 2.1. Cups

- 2.2. Tubs and Containers

- 2.3. Bowls

- 2.4. Trays

- 2.5. Clamshell

- 2.6. Other Pr

-

3. Application

- 3.1. Quick Service Restaurants

- 3.2. Full-service Restaurants

- 3.3. Coffee and Snack Outlets

- 3.4. Retail Establishments

- 3.5. Institutional and Hospitality

- 3.6. Other Ap

Saudi Arabia Foodservice Disposable Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Foodservice Disposable Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Foodservice Disposable Packaging Market

Saudi Arabia Foodservice Disposable Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Packaging Food Continues to Grow; Increasing Emphasis on Sustainability is Causing the Vendors to Focus on Recycled Plastics

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns over Recycling and Safe Disposal and Price Volatility of the Raw Materials

- 3.4. Market Trends

- 3.4.1. Cups and Lids to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Foodservice Disposable Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic Resins

- 5.1.1.1. PP

- 5.1.1.2. PET

- 5.1.1.3. PS

- 5.1.1.4. Other Plastic Resins

- 5.1.2. Paper and Paperboard

- 5.1.3. Aluminum Foil

- 5.1.4. Other Materials

- 5.1.1. Plastic Resins

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Cups

- 5.2.2. Tubs and Containers

- 5.2.3. Bowls

- 5.2.4. Trays

- 5.2.5. Clamshell

- 5.2.6. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Quick Service Restaurants

- 5.3.2. Full-service Restaurants

- 5.3.3. Coffee and Snack Outlets

- 5.3.4. Retail Establishments

- 5.3.5. Institutional and Hospitality

- 5.3.6. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Packaging Product Company (PPC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hotpack Packaging Industries LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SAQR Pack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prestige Packing Industry

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saudi Foam Trays Mfg Co *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smart Pack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Falcon Pack

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Napco National

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Modern Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Noor Carton & Packaging Industry

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Packaging Product Company (PPC)

List of Figures

- Figure 1: Saudi Arabia Foodservice Disposable Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Foodservice Disposable Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Saudi Arabia Foodservice Disposable Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Foodservice Disposable Packaging Market?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the Saudi Arabia Foodservice Disposable Packaging Market?

Key companies in the market include Packaging Product Company (PPC), Hotpack Packaging Industries LLC, SAQR Pack, Prestige Packing Industry, Saudi Foam Trays Mfg Co *List Not Exhaustive, Smart Pack, Falcon Pack, Napco National, Saudi Modern Packaging Co Ltd, Noor Carton & Packaging Industry.

3. What are the main segments of the Saudi Arabia Foodservice Disposable Packaging Market?

The market segments include Material, Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Packaging Food Continues to Grow; Increasing Emphasis on Sustainability is Causing the Vendors to Focus on Recycled Plastics.

6. What are the notable trends driving market growth?

Cups and Lids to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Environmental Concerns over Recycling and Safe Disposal and Price Volatility of the Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2024: SABIC, a global chemical industry leader, unveiled Saudi Arabia's first circular packaging initiative under its TRUCIRCLE program to advance a circular plastic economy. FONTE, a prominent player in the Saudi Arabian bakery sector, adopted SABIC's certified circular polyethylene (PE) for its Oat Arabic Bread packaging. These bags, crafted by Napco National, a Saudi manufacturer specializing in flexible film and packaging, utilize two food-contact certified circular polyethylene resin grades (LLDPE) sourced from SABIC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Foodservice Disposable Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Foodservice Disposable Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Foodservice Disposable Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Foodservice Disposable Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence