Key Insights

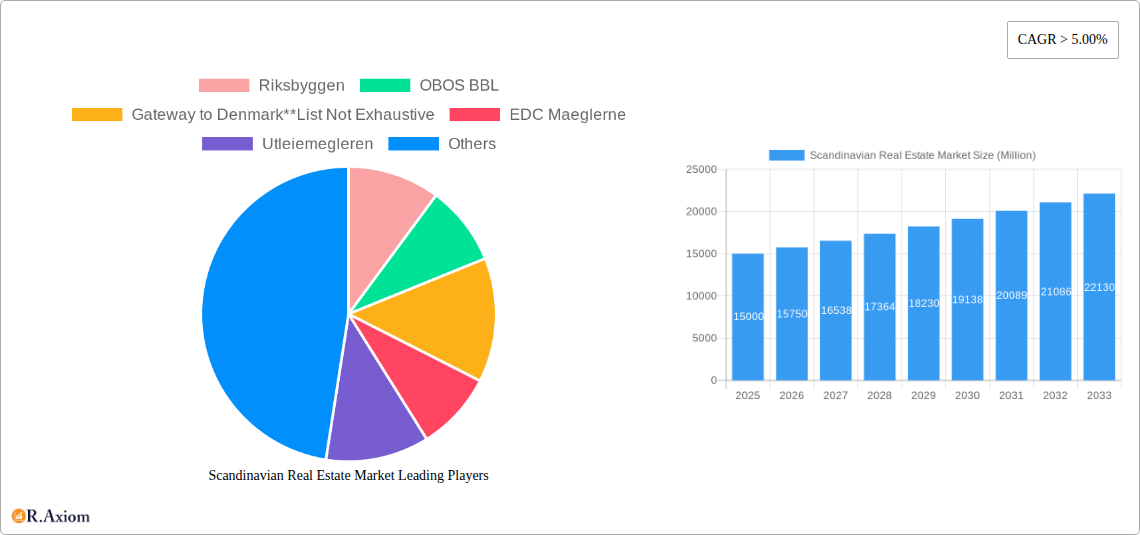

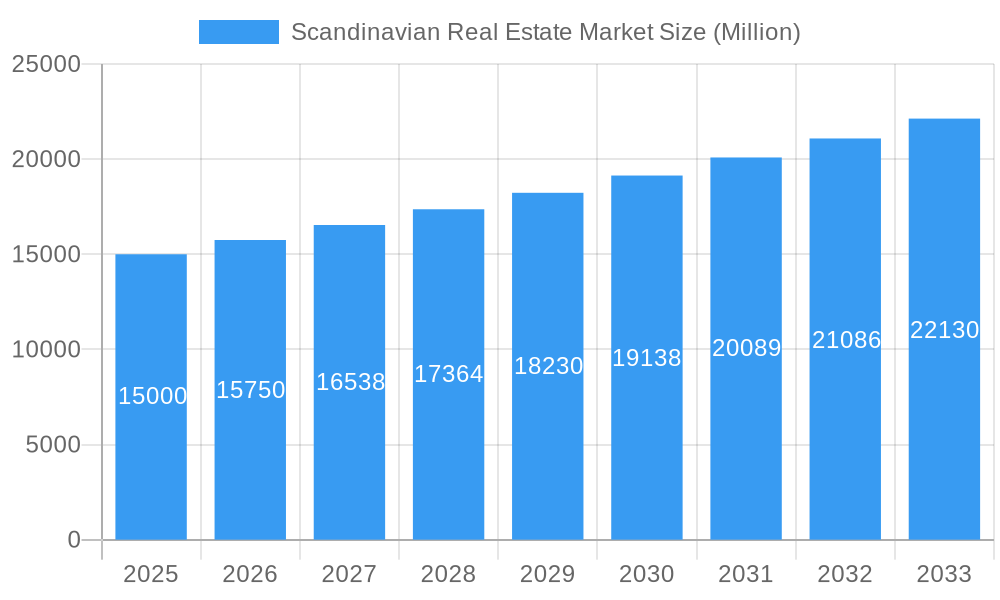

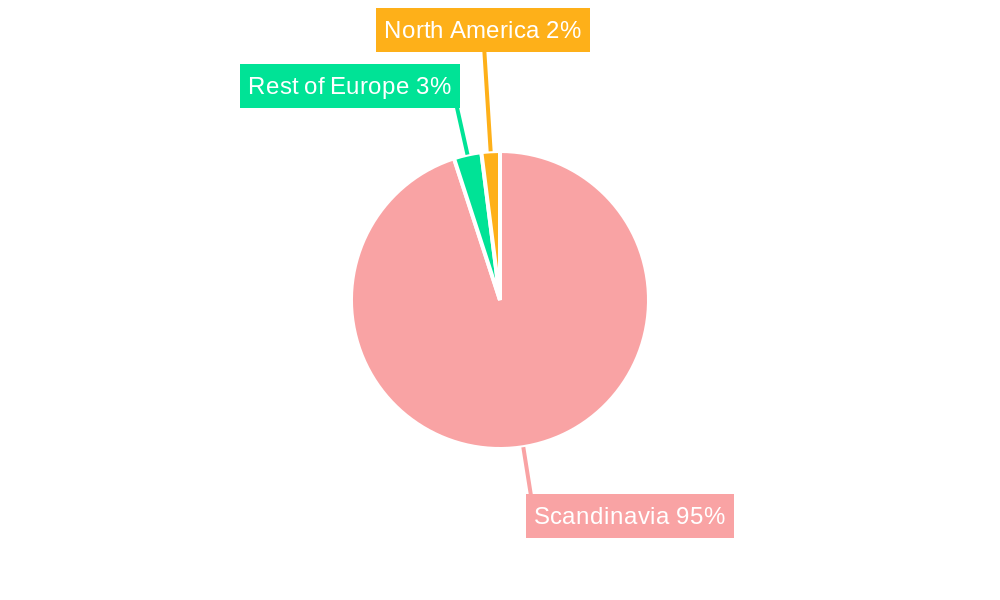

The Scandinavian real estate market, encompassing Norway, Sweden, and Denmark, exhibits robust growth potential, fueled by several key factors. A compound annual growth rate (CAGR) exceeding 5% indicates a consistently expanding market, driven primarily by strong economic performance in the region, increasing urbanization, and a rising demand for both residential and commercial properties. The segment breakdown reveals a diverse market, with Villas and Landed Houses, as well as Apartments and Condominiums, contributing significantly to overall growth. Government policies supporting sustainable development and infrastructure projects also contribute to market expansion. While limited data on North America is provided, we can infer that the Scandinavian market is primarily regional in focus.

Scandinavian Real Estate Market Market Size (In Billion)

However, challenges remain. Potential restraints include fluctuating interest rates, which can impact affordability, and variations in government regulations across the three nations. Competition among established players like Riksbyggen, OBOS BBL, and others, necessitates innovative strategies for market penetration. The projected market size for 2025 and beyond necessitates careful consideration of these dynamics to accurately reflect market potential and challenges. Analyzing the historical period (2019-2024) and forecasting from a 2025 base year to 2033 allows for a comprehensive understanding of market trajectory, identifying opportunities and potential risks for investors and stakeholders. The consistent growth trend observed suggests a continued positive outlook for the Scandinavian real estate sector, albeit one requiring astute navigation of market fluctuations and regulatory considerations.

Scandinavian Real Estate Market Company Market Share

Scandinavian Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the Scandinavian real estate market, covering the period from 2019 to 2033. It offers in-depth insights into market trends, key players, growth drivers, and challenges, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market dynamics until 2033. This report is crucial for investors, developers, policymakers, and industry professionals seeking to navigate the complexities and capitalize on opportunities within this dynamic market.

Scandinavian Real Estate Market Market Concentration & Innovation

The Scandinavian real estate market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Riksbyggen, OBOS BBL, and Fastighets AB Balder are examples of prominent companies influencing market dynamics. However, a considerable number of smaller and mid-sized firms also contribute to the overall market activity. Market concentration metrics, such as the Herfindahl-Hirschman Index (HHI), will be calculated and presented in the full report. Innovation is driven by increasing adoption of PropTech solutions, sustainable building practices, and evolving consumer preferences towards smart homes and energy-efficient properties. Regulatory frameworks, such as building codes and zoning regulations, significantly impact development patterns and innovation cycles. Product substitutes, like co-living spaces and rental platforms, present competitive pressures. The analysis will include a detailed account of M&A activities within the period, including deal values (xx Million) and the impact on market consolidation.

- Key Metrics: Market share of top 5 players (xx%), Average M&A deal value (xx Million), Number of M&A transactions (xx).

- Innovation Drivers: PropTech adoption, sustainable building, smart home technologies.

- Regulatory Landscape: Building codes, zoning regulations, environmental policies.

Scandinavian Real Estate Market Industry Trends & Insights

The Scandinavian real estate market is characterized by robust growth driven by several factors. Population growth, urbanization, and increasing disposable incomes are key contributors to sustained demand. The report will delve into the Compound Annual Growth Rate (CAGR) of the market for the forecast period (2025-2033) projected to be xx%. Technological disruptions, such as the integration of IoT devices and big data analytics in property management, are transforming industry operations. Consumer preferences are shifting towards sustainable, energy-efficient, and technologically advanced homes. Competitive dynamics are shaped by factors like land scarcity, construction costs, and evolving regulatory landscapes. Market penetration of green building certifications will also be analyzed (xx%).

Dominant Markets & Segments in Scandinavian Real Estate Market

The Scandinavian real estate market is segmented by property type (villas and landed houses, apartments and condominiums) and by country (Norway, Sweden, Denmark, other Scandinavian countries). While the full report will contain a detailed breakdown, initial analysis suggests that apartments and condominiums represent the largest segment by type, driven by urbanization and high demand in major cities. Among countries, Sweden displays relatively strong growth, attributed to its robust economy and supportive government policies.

- Key Drivers (Sweden): Strong economy, supportive government policies, robust infrastructure.

- Key Drivers (Apartments & Condominiums): Urbanization, high demand in major cities, affordability considerations.

Norway and Denmark also represent substantial markets, each with its own unique economic and regulatory context influencing market dynamics. A deeper analysis of the "Other Scandinavian Countries" segment will be conducted to identify emerging opportunities.

Scandinavian Real Estate Market Product Developments

Product innovation in the Scandinavian real estate market is heavily influenced by sustainable development, technological integration, and consumer preferences for energy efficiency. Developers are incorporating smart home technologies, renewable energy solutions, and environmentally friendly building materials. This trend directly impacts the market fit of new developments, leading to premium pricing for sustainable and technologically advanced properties.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Scandinavian real estate market, segmented by property type and country.

By Type:

- Villas and Landed Houses: This segment exhibits relatively slower growth compared to apartments and condominiums, with a projected market size of xx Million by 2033. Competition is moderate, with a mix of large and small developers.

- Apartments and Condominiums: This segment dominates the market, driven by high demand in urban areas. The market size is projected to reach xx Million by 2033, with intense competition among developers.

By Country:

- Norway: The Norwegian market displays steady growth, characterized by a focus on sustainable construction and high-quality developments.

- Sweden: Sweden shows robust growth due to its strong economy and pro-development policies.

- Denmark: The Danish market displays moderate growth with its own unique regulatory and economic landscape.

- Other Scandinavian Countries: This segment offers potential for future growth, although market size is relatively smaller compared to the major markets.

Key Drivers of Scandinavian Real Estate Market Growth

Several factors contribute to the growth of the Scandinavian real estate market. Strong economic performance across the region, particularly in Sweden and Norway, fuels increased demand for residential and commercial properties. Government initiatives supporting sustainable development and infrastructure projects further stimulate growth. Technological advancements in construction and property management optimize efficiency and reduce costs.

Challenges in the Scandinavian Real Estate Market Sector

The Scandinavian real estate sector faces several challenges. Strict environmental regulations and high construction costs can limit profitability. Land scarcity, particularly in urban areas, poses a significant constraint on development. Fluctuations in interest rates and economic downturns can impact market sentiment and investment decisions. These factors contribute to an estimated xx% reduction in project starts in periods of economic downturn.

Emerging Opportunities in Scandinavian Real Estate Market

Emerging trends point to significant opportunities. The growing adoption of PropTech solutions, such as smart home technologies and digital platforms, presents lucrative avenues for innovation. The increasing focus on sustainable and energy-efficient construction offers substantial market potential. Furthermore, expanding into the co-living and co-working spaces segment presents an exciting opportunity to cater to evolving lifestyle preferences.

Leading Players in the Scandinavian Real Estate Market Market

- Riksbyggen

- OBOS BBL

- Gateway to Denmark

- EDC Maeglerne

- Utleiemegleren

- Fastighets AB Balder

- Eiendomsmegler Krogsveen AS

- Oscar Properties Holding AB

- Veidekke ASA

- Akelius Residential Property AB

- A Enggaard A/S

- Dades AS

- L E Lundbergforetagen AB

- Betonmast AS

- ELF Development

- Danish Homes

Key Developments in Scandinavian Real Estate Market Industry

- 2022 Q4: Introduction of new green building standards in Sweden.

- 2023 Q1: Merger between two mid-sized developers in Norway.

- 2023 Q3: Launch of a major PropTech platform in Denmark.

(Further developments will be detailed in the full report)

Strategic Outlook for Scandinavian Real Estate Market Market

The Scandinavian real estate market is poised for continued growth, driven by strong fundamentals and emerging trends. Strategic focus on sustainability, technological integration, and evolving consumer preferences will be key for success. The market offers significant opportunities for both established players and new entrants willing to adapt to the evolving landscape. The potential for growth in the coming years is substantial, offering attractive investment prospects and promising returns for those who capitalize on emerging trends.

Scandinavian Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

Scandinavian Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Scandinavian Real Estate Market Regional Market Share

Geographic Coverage of Scandinavian Real Estate Market

Scandinavian Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Growing Housing Market in Norway to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas and Landed Houses

- 6.1.2. Apartments and Condominiums

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas and Landed Houses

- 7.1.2. Apartments and Condominiums

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas and Landed Houses

- 8.1.2. Apartments and Condominiums

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas and Landed Houses

- 9.1.2. Apartments and Condominiums

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Scandinavian Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas and Landed Houses

- 10.1.2. Apartments and Condominiums

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riksbyggen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OBOS BBL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gateway to Denmark**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EDC Maeglerne

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Utleiemegleren

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fastighets AB Balder

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eiendomsmegler Krogsveen AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oscar Properties Holding AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Veidekke ASA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Akelius Residential Property AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 A Enggaard A/S

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dades AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 L E Lundbergforetagen AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Betonmast AS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ELF Development

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Danish Homes

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Riksbyggen

List of Figures

- Figure 1: Global Scandinavian Real Estate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Scandinavian Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Scandinavian Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Scandinavian Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Scandinavian Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Scandinavian Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America Scandinavian Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Scandinavian Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Scandinavian Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Scandinavian Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Scandinavian Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Scandinavian Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Scandinavian Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Scandinavian Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa Scandinavian Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Scandinavian Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Scandinavian Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Scandinavian Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Scandinavian Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Scandinavian Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Scandinavian Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Scandinavian Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Scandinavian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Scandinavian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Scandinavian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Scandinavian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Scandinavian Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Scandinavian Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Scandinavian Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Scandinavian Real Estate Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Scandinavian Real Estate Market?

Key companies in the market include Riksbyggen, OBOS BBL, Gateway to Denmark**List Not Exhaustive, EDC Maeglerne, Utleiemegleren, Fastighets AB Balder, Eiendomsmegler Krogsveen AS, Oscar Properties Holding AB, Veidekke ASA, Akelius Residential Property AB, A Enggaard A/S, Dades AS, L E Lundbergforetagen AB, Betonmast AS, ELF Development, Danish Homes.

3. What are the main segments of the Scandinavian Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Growing Housing Market in Norway to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Scandinavian Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Scandinavian Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Scandinavian Real Estate Market?

To stay informed about further developments, trends, and reports in the Scandinavian Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence