Key Insights

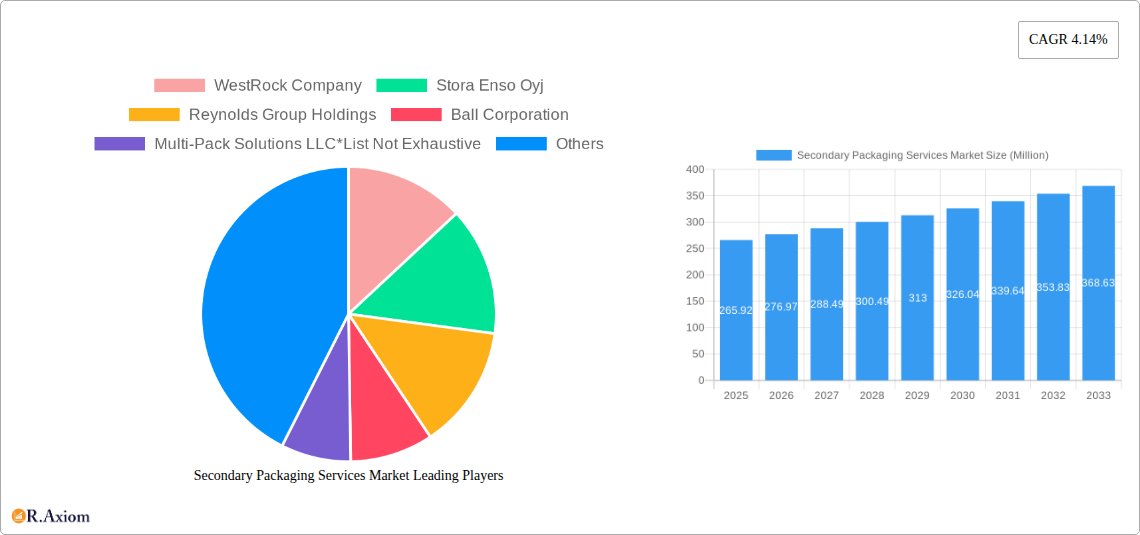

The global secondary packaging services market, valued at $265.92 million in 2025, is projected to experience steady growth, driven by the increasing demand for efficient and protective packaging solutions across various industries. A Compound Annual Growth Rate (CAGR) of 4.14% from 2025 to 2033 indicates a substantial market expansion. Key growth drivers include the rise of e-commerce, necessitating robust and secure packaging for product transit and protection, and the growing focus on sustainable packaging materials to reduce environmental impact. The market is segmented by product type, encompassing folding cartons, corrugated boxes, plastic crates, wraps, and films, each catering to specific needs and industry preferences. End-user industries such as food and beverage, healthcare, consumer electronics, and personal care are major consumers, reflecting the widespread application of secondary packaging across diverse sectors. While specific regional data is unavailable, we can infer that North America and Europe, with their established manufacturing bases and robust supply chains, likely hold significant market share. However, the Asia Pacific region is expected to exhibit robust growth, fuelled by rising consumerism and industrial expansion. Competitive pressures from established players like WestRock, Stora Enso, and Amcor, alongside emerging players offering specialized solutions, are shaping market dynamics. The market's trajectory is influenced by fluctuating raw material prices and evolving consumer preferences towards eco-friendly packaging options.

Secondary Packaging Services Market Market Size (In Million)

The forecast period from 2025 to 2033 anticipates continued market expansion, driven by factors such as increasing product diversification, advancements in packaging technology (e.g., intelligent packaging), and the growing focus on supply chain optimization. Challenges include managing fluctuating raw material costs, adapting to changing regulations regarding sustainable packaging, and ensuring the security and integrity of packaging throughout the supply chain. Companies are actively investing in research and development to create innovative, cost-effective, and sustainable packaging solutions to meet evolving market demands. Successful players are focusing on providing customized packaging solutions, building strong customer relationships, and implementing efficient logistics networks to optimize delivery and reduce costs. The ongoing shift towards e-commerce will continue to be a major driver of growth, emphasizing the need for efficient and protective packaging solutions that enhance consumer experience and ensure product safety.

Secondary Packaging Services Market Company Market Share

Secondary Packaging Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Secondary Packaging Services Market, covering market size, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors.

Secondary Packaging Services Market Concentration & Innovation

The Secondary Packaging Services Market exhibits a moderately concentrated landscape, with several large multinational corporations holding significant market share. Key players like WestRock Company, Stora Enso Oyj, and Amcor PLC contribute substantially to the overall market volume. However, a considerable number of smaller, specialized companies also participate, particularly in niche segments. Market share calculations based on 2024 revenue estimate WestRock at approximately 15%, Stora Enso at 12%, and Amcor at 10%, with the remaining share distributed among other players. Innovation in the sector is driven primarily by the increasing demand for sustainable and eco-friendly packaging solutions, coupled with advancements in materials science and automation technologies. Stringent regulatory frameworks concerning recyclability and waste reduction are also pushing innovation. The industry is witnessing a rise in the use of biodegradable and compostable materials, as well as smart packaging incorporating RFID and other technologies. Product substitutes, such as reusable packaging systems, are gaining traction but still represent a relatively small market share. End-user trends towards personalized and convenient packaging are influencing design and functionality. Mergers and acquisitions (M&A) activities are frequent, with notable deals like the International Paper Company's acquisition of DS Smith in April 2024 for USD 7.2 Billion signifying consolidation within the industry and signifying a significant shift in market power.

- Market Concentration: Moderately concentrated, dominated by a few major players.

- Innovation Drivers: Sustainability, material science advancements, automation, regulatory pressures.

- M&A Activity: Significant, driven by expansion and consolidation strategies, with deal values reaching several Billion USD.

- Product Substitutes: Growing but still a niche market.

- End-User Trends: Demand for convenience, personalization, and sustainability influencing packaging design.

Secondary Packaging Services Market Industry Trends & Insights

The Secondary Packaging Services Market is experiencing robust growth, driven by the increasing demand for packaged goods across various end-user industries. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of automated packaging lines and advanced printing techniques, are enhancing efficiency and reducing costs. Consumer preferences are shifting towards sustainable packaging options, compelling manufacturers to adopt eco-friendly materials and designs. The market is witnessing increased competition, with companies focusing on product differentiation through innovation, superior quality, and cost-effectiveness. Market penetration of sustainable packaging solutions is gradually increasing, with an estimated xx% market share in 2025, projected to grow to xx% by 2033. This growth is fueled by stringent environmental regulations and heightened consumer awareness of environmental issues. The competitive landscape is characterized by both intense price competition and a focus on value-added services such as customized packaging solutions and efficient supply chain management.

Dominant Markets & Segments in Secondary Packaging Services Market

The North American region currently holds the largest market share in the Secondary Packaging Services Market. This dominance is attributed to a combination of factors:

- Economic Strength: Strong economic conditions contribute to high consumer spending on packaged goods.

- Developed Infrastructure: Robust transportation and logistics networks facilitate efficient supply chain management.

- Favorable Regulatory Environment: Relatively less stringent regulations compared to some other regions, coupled with increasing consumer awareness of sustainable packaging.

Within the product type segment, Corrugated Boxes dominate due to their versatility, cost-effectiveness, and recyclability. The Food and Beverage industry accounts for the largest end-user segment due to the significant volume of packaged food and beverages consumed.

- Leading Region: North America

- Leading Product Type: Corrugated Boxes

- Leading End-user Industry: Food and Beverage

Secondary Packaging Services Market Product Developments

Recent product innovations focus heavily on sustainability, with a surge in biodegradable and recyclable packaging materials like plant-based films and compostable cartons. Companies are integrating smart packaging technologies, including RFID tags for improved traceability and inventory management. These innovations offer competitive advantages by enhancing product shelf life, reducing waste, and improving brand perception among environmentally conscious consumers. The market is also seeing a shift toward lighter-weight packaging to reduce transportation costs and environmental impact.

Report Scope & Segmentation Analysis

This report segments the Secondary Packaging Services Market by product type (Folding Cartons, Corrugated Boxes, Plastic Crates, Wraps and Films) and by end-user industry (Food, Beverage, Healthcare, Consumer Electronics, Personal Care and Household Care). Each segment is analyzed based on historical data (2019-2024), estimated market size (2025), and forecast projections (2025-2033). Competitive dynamics within each segment are also examined, identifying key players and their market strategies. Growth projections vary across segments, with the Corrugated Boxes segment anticipated to maintain a higher growth trajectory than some others due to its versatility and cost-effectiveness. The Food and Beverage segment is expected to continue to dominate due to consistently high demand for packaged food and beverages.

Key Drivers of Secondary Packaging Services Market Growth

Several factors contribute to the market's growth. Technological advancements in materials and automation enhance efficiency and reduce costs. The rising demand for packaged goods across various sectors, coupled with changing consumer preferences (such as a preference for convenience and sustainability), are key drivers. Government regulations promoting sustainable packaging further stimulate market expansion. Economic growth in developing countries also fuels this market, as rising disposable incomes lead to increased consumption of packaged products.

Challenges in the Secondary Packaging Services Market Sector

The industry faces challenges including fluctuating raw material prices (impact: increased production costs), stringent environmental regulations (impact: compliance costs), and intense competition (impact: pricing pressure). Supply chain disruptions can cause delays and shortages, while the rising cost of labor can impact profitability. Furthermore, the need to balance sustainability with cost-effectiveness remains a significant challenge for many companies.

Emerging Opportunities in Secondary Packaging Services Market

Significant opportunities exist in developing sustainable packaging solutions using innovative bio-based materials. The growing demand for e-commerce is creating opportunities in protective packaging for online deliveries. The expansion of the healthcare sector, coupled with increasing demand for pharmaceutical packaging, presents a substantial growth prospect. Personalized packaging and smart packaging technologies also offer significant untapped potential.

Leading Players in the Secondary Packaging Services Market Market

Key Developments in Secondary Packaging Services Market Industry

- September 2023: Coca-Cola HBC AG launched innovative plastic-free secondary packaging for its 1.5-liter drinks in Austria, saving an estimated 200 tonnes of plastic annually.

- April 2024: International Paper Company acquired DS Smith for USD 7.2 Billion, significantly strengthening its European operations.

Strategic Outlook for Secondary Packaging Services Market Market

The Secondary Packaging Services Market is poised for continued growth, driven by factors such as increasing demand for packaged goods, technological advancements, and the growing focus on sustainability. Companies that successfully adapt to changing consumer preferences, embrace innovative technologies, and comply with stringent environmental regulations will be best positioned to capitalize on future market opportunities. The market’s future will be shaped by a continuous push towards sustainable and efficient packaging solutions.

Secondary Packaging Services Market Segmentation

-

1. Product Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Plastic Crates

- 1.4. Wraps and Films

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Consumer Electronics

- 2.5. Personal Care and Household Care

Secondary Packaging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Secondary Packaging Services Market Regional Market Share

Geographic Coverage of Secondary Packaging Services Market

Secondary Packaging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Industrial and Consumer Activities across the World; Increased Need for Safe Transportation

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Needs and Awareness Towards a Sustainable Environment

- 3.4. Market Trends

- 3.4.1. The Folding Cartons Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Plastic Crates

- 5.1.4. Wraps and Films

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Consumer Electronics

- 5.2.5. Personal Care and Household Care

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Folding Cartons

- 6.1.2. Corrugated Boxes

- 6.1.3. Plastic Crates

- 6.1.4. Wraps and Films

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Healthcare

- 6.2.4. Consumer Electronics

- 6.2.5. Personal Care and Household Care

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Folding Cartons

- 7.1.2. Corrugated Boxes

- 7.1.3. Plastic Crates

- 7.1.4. Wraps and Films

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Healthcare

- 7.2.4. Consumer Electronics

- 7.2.5. Personal Care and Household Care

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Folding Cartons

- 8.1.2. Corrugated Boxes

- 8.1.3. Plastic Crates

- 8.1.4. Wraps and Films

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Healthcare

- 8.2.4. Consumer Electronics

- 8.2.5. Personal Care and Household Care

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Folding Cartons

- 9.1.2. Corrugated Boxes

- 9.1.3. Plastic Crates

- 9.1.4. Wraps and Films

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Healthcare

- 9.2.4. Consumer Electronics

- 9.2.5. Personal Care and Household Care

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Folding Cartons

- 10.1.2. Corrugated Boxes

- 10.1.3. Plastic Crates

- 10.1.4. Wraps and Films

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Healthcare

- 10.2.4. Consumer Electronics

- 10.2.5. Personal Care and Household Care

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stora Enso Oyj

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reynolds Group Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Multi-Pack Solutions LLC*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Paper Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Packaging Corporation of America

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Berry Global Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sealed Air Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Secondary Packaging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Latin America Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Secondary Packaging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Secondary Packaging Services Market?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Secondary Packaging Services Market?

Key companies in the market include WestRock Company, Stora Enso Oyj, Reynolds Group Holdings, Ball Corporation, Multi-Pack Solutions LLC*List Not Exhaustive, Mondi Group, Amcor PLC, International Paper Company, Packaging Corporation of America, Berry Global Inc, Sealed Air Corporation.

3. What are the main segments of the Secondary Packaging Services Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 265.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Industrial and Consumer Activities across the World; Increased Need for Safe Transportation.

6. What are the notable trends driving market growth?

The Folding Cartons Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Changing Consumer Needs and Awareness Towards a Sustainable Environment.

8. Can you provide examples of recent developments in the market?

April 2024: International Paper Company (IP), a US company, announced the acquisition of DS Smith, a London-based packaging company, for USD 7.2 billion. This strategic acquisition was intended to strengthen IP's operations in Europe through innovation and sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Secondary Packaging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Secondary Packaging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Secondary Packaging Services Market?

To stay informed about further developments, trends, and reports in the Secondary Packaging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence