Key Insights

The semiconductor logistics market is poised for significant expansion, driven by escalating global demand for advanced semiconductors. With a projected compound annual growth rate (CAGR) of 8%, the market is estimated to reach $150 billion by 2025. Key growth catalysts include the pervasive integration of electronics in automotive, healthcare, and consumer electronics, demanding sophisticated and secure supply chain solutions for semiconductor handling and storage. The inherent complexity and high value of semiconductor components necessitate specialized logistics, encompassing temperature-controlled transit, protective packaging, and efficient customs clearance.

Semiconductor Logistics Market Market Size (In Billion)

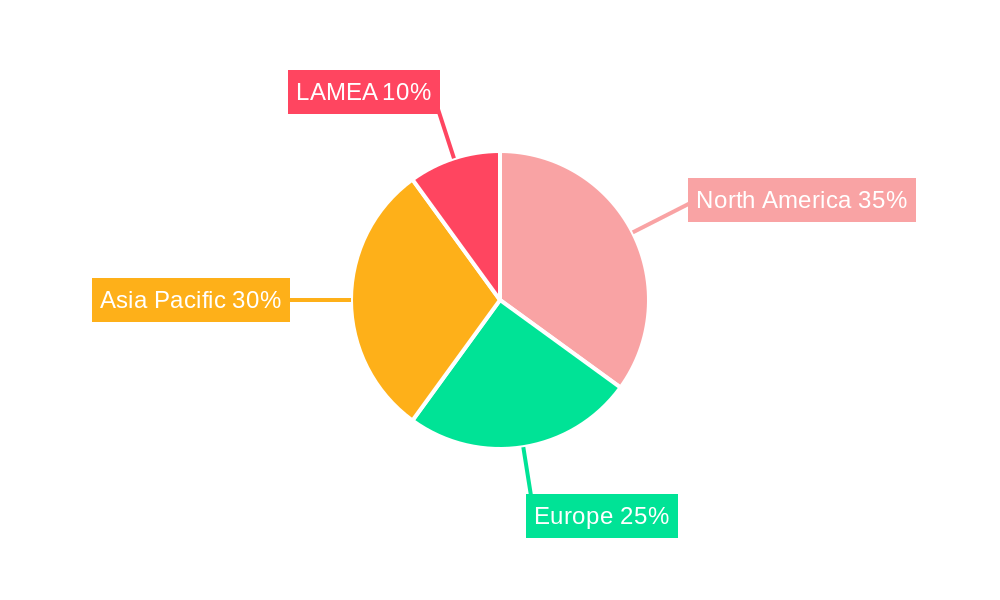

The market is segmented by service type, including transportation, warehousing, distribution, and value-added services such as packaging and customs brokerage, alongside domestic and international destinations. Leading global logistics providers like DHL, Kuehne+Nagel, and DB Schenker are at the forefront, leveraging their extensive networks to meet the precise requirements of semiconductor manufacturers and consumers. Prominent market shares are concentrated in North America and Asia-Pacific, owing to robust manufacturing bases and strong consumer markets. Potential growth inhibitors include geopolitical risks, market demand volatility, and the imperative for continuous investment in advanced logistics infrastructure to manage the increasing sensitivity and value of semiconductor shipments.

Semiconductor Logistics Market Company Market Share

The forecast period from 2025 to 2033 presents a landscape rich with opportunities. Continuous innovation in semiconductor technology, leading to miniaturization and enhanced performance, will amplify the need for specialized logistics. Strategic collaborations between logistics providers and semiconductor firms will be instrumental in optimizing supply chains, shortening lead times, and ensuring secure global delivery. Expect substantial investments in advanced technologies, including real-time tracking and monitoring, AI-driven route optimization, and blockchain for enhanced transparency and security. Emerging markets will also contribute to market expansion. Crucially, adherence to regulatory compliance and addressing environmental considerations will be vital for sustainable industry growth.

Semiconductor Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Semiconductor Logistics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The global market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Semiconductor Logistics Market Concentration & Innovation

This section analyzes the competitive landscape of the Semiconductor Logistics Market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with key players holding significant market share. However, the presence of numerous smaller players ensures a dynamic and competitive environment.

- Market Share: Top 5 players account for approximately xx% of the market share in 2024, with DB Schenker, Kuehne+Nagel, and DHL among the leading players. Precise figures are detailed within the full report.

- Innovation Drivers: Technological advancements in tracking, automation, and data analytics are key drivers of innovation, leading to improved efficiency and transparency in semiconductor logistics. The increasing demand for specialized handling and secure transportation further fuels innovation.

- Regulatory Frameworks: Stringent regulations concerning the transportation of sensitive electronic components influence logistics strategies and necessitate compliance. Variations in regulations across different regions impact operational costs and complexity.

- Product Substitutes: While direct substitutes are limited, alternative transportation modes and logistics solutions (e.g., optimized routing, improved packaging) constantly challenge existing practices.

- End-User Trends: The growing demand for high-performance semiconductors across various end-use industries, particularly electronics, automotive, and healthcare, fuels market growth.

- M&A Activities: The report analyzes significant M&A activities in the Semiconductor Logistics Market, detailing deal values and their impact on market consolidation. The total value of M&A deals during the historical period (2019-2024) is estimated at xx Million.

Semiconductor Logistics Market Industry Trends & Insights

This section delves into the key industry trends shaping the Semiconductor Logistics Market. The market is experiencing robust growth driven by a surge in global semiconductor demand, particularly from the automotive, consumer electronics, and 5G infrastructure sectors. Technological advancements like the Internet of Things (IoT) and artificial intelligence (AI) are significantly impacting logistics operations, leading to increased efficiency and reduced costs. Consumer preference for faster delivery times and increased transparency in supply chains is also influencing market dynamics. The increasing adoption of advanced technologies such as blockchain for enhanced security and traceability is creating new opportunities. The competitive landscape is characterized by ongoing consolidation, with larger players expanding their service offerings and geographical reach. The market penetration of advanced logistics solutions is steadily increasing.

Dominant Markets & Segments in Semiconductor Logistics Market

The Semiconductor Logistics Market is a dynamic and rapidly growing sector, significantly influenced by geographical location and specialized service needs. Asia-Pacific remains the dominant region, fueled by a high concentration of semiconductor manufacturing facilities and a massive consumer base driving robust demand. North America and Europe also maintain substantial market shares, reflecting their strong technological innovation and established semiconductor industries. This market segmentation offers a granular view of the diverse landscape.

By Function:

- Transportation: Air freight continues to be the preferred mode, prioritizing the swift and secure delivery of these high-value, time-sensitive components. However, sea and road freight play increasingly important supporting roles, particularly for less time-critical shipments or those with larger volumes. The selection of transportation mode often depends on factors such as distance, cost, and required delivery speed.

- Warehousing and Distribution: The demand for specialized warehousing is paramount. Facilities must maintain stringent environmental controls, including precise temperature and humidity regulation, to protect the sensitive nature of semiconductor components and prevent damage or degradation. This specialized requirement fuels significant segment growth.

- Value-added Services: Beyond basic transportation and storage, value-added services are becoming increasingly critical. These include sophisticated packaging solutions designed to withstand the rigors of transit, seamless customs clearance procedures, efficient freight brokerage, and other specialized handling to ensure the integrity of the semiconductor components throughout the entire supply chain.

By Destination:

- International: The globalized nature of the semiconductor industry underscores the dominance of international logistics. Complex cross-border shipments require specialized expertise in navigating international regulations, customs procedures, and logistical coordination across multiple jurisdictions.

- Domestic: Efficient domestic transportation and distribution networks within key manufacturing and consumption hubs are essential for timely delivery and responsiveness to market fluctuations. Optimization within these domestic networks is key to minimizing lead times and maximizing efficiency.

Key Regional Drivers:

- Asia-Pacific: Rapid economic expansion, substantial investments in semiconductor fabrication plants (fabs), and proactive government support for infrastructure development are key growth catalysts.

- North America: The presence of major semiconductor manufacturers and a robust technology ecosystem contribute to significant market demand and influence.

- Europe: Robust research and development in semiconductor technologies and expanding adoption across various industries drive ongoing market growth.

Semiconductor Logistics Market Product Developments

Recent innovations focus on advanced tracking technologies, automated warehousing systems, and specialized packaging solutions designed to protect sensitive semiconductor components during transportation. These developments aim to improve efficiency, enhance security, and reduce costs. The market is also seeing the adoption of technologies like AI and machine learning to optimize logistics operations and predict potential disruptions. Such innovations improve the speed, safety, and efficiency of semiconductor delivery, directly impacting market competition.

Report Scope & Segmentation Analysis

This report segments the Semiconductor Logistics Market by function (Transportation, Warehousing and Distribution, Value-added Services) and destination (Domestic, International). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The transportation segment is further categorized into air, sea, and road freight, while value-added services include packaging, customs clearance, freight brokerage, and other specialized logistics solutions. Growth projections for each segment are presented in the full report, with expected market sizes for the forecast period 2025-2033. Competitive dynamics within each segment are also evaluated.

Key Drivers of Semiconductor Logistics Market Growth

The Semiconductor Logistics Market is experiencing strong growth due to several factors:

- The escalating demand for semiconductors across various end-use industries, fueled by technological advancements like IoT and 5G.

- Growing investments in semiconductor manufacturing capacity, especially in Asia-Pacific.

- The increasing need for secure and reliable transportation and storage solutions for high-value semiconductor components.

- Technological advancements in logistics technologies, including automation, AI, and data analytics, improving efficiency and reducing costs.

Challenges in the Semiconductor Logistics Market Sector

The Semiconductor Logistics Market faces several challenges:

- Geopolitical uncertainties: Trade wars and supply chain disruptions can significantly impact logistics operations and costs.

- Supply chain complexities: The intricate global supply chains for semiconductors necessitate precise coordination and planning, increasing vulnerability to disruptions.

- Regulatory hurdles: Varying regulations across countries and regions pose complexities for logistics providers.

- Competition: The market is characterized by intense competition, particularly among large, established logistics companies.

Emerging Opportunities in Semiconductor Logistics Market

Several emerging opportunities exist in the Semiconductor Logistics Market:

- The rise of specialized logistics solutions tailored to the unique requirements of semiconductor transportation.

- Growing adoption of advanced technologies, such as blockchain, for improved traceability and security.

- Expansion into new markets, particularly in developing economies with growing semiconductor demand.

- Development of sustainable and environmentally friendly logistics solutions.

Leading Players in the Semiconductor Logistics Market Market

- DB Schenker

- Kuehne+Nagel

- DHL

- Dintec Shipping Express

- Nippon Express

- Yusen Logistics

- CEVA Logistics

- Omni Logistics

- MAERSK

- Dimerco

- HOYER Group

Key Developments in Semiconductor Logistics Market Industry

- December 2022: Kuehne+Nagel launched its "SemiconChain" air freight offering, enhancing security and reliability for semiconductor supply chains. This development signals a push towards specialized, high-quality solutions within the industry.

- November 2022: Jaguar Land Rover's partnerships to secure semiconductor supplies highlight the critical role of robust logistics in ensuring automotive production. This demonstrates the increasing reliance on strong supply chain partnerships to mitigate risk.

Strategic Outlook for Semiconductor Logistics Market Market

The Semiconductor Logistics Market is poised for continued growth, driven by technological advancements, increasing semiconductor demand, and ongoing efforts to optimize supply chain efficiency. Opportunities exist for logistics providers to invest in advanced technologies, develop specialized services, and expand into new markets to capitalize on this growth. The focus on enhanced security, traceability, and sustainability will further shape the industry's strategic direction.

Semiconductor Logistics Market Segmentation

-

1. Function

-

1.1. Transportation

- 1.1.1. Roadways

- 1.1.2. Railways

- 1.1.3. Water and Seaways

- 1.1.4. Airways

- 1.2. Warehousing and Distribution

- 1.3. Value-ad

-

1.1. Transportation

-

2. Destination

- 2.1. Domestic

- 2.2. International

Semiconductor Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Semiconductor Logistics Market Regional Market Share

Geographic Coverage of Semiconductor Logistics Market

Semiconductor Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs

- 3.4. Market Trends

- 3.4.1. Increasing demand for semiconductor driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Transportation

- 5.1.1.1. Roadways

- 5.1.1.2. Railways

- 5.1.1.3. Water and Seaways

- 5.1.1.4. Airways

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value-ad

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Transportation

- 6.1.1.1. Roadways

- 6.1.1.2. Railways

- 6.1.1.3. Water and Seaways

- 6.1.1.4. Airways

- 6.1.2. Warehousing and Distribution

- 6.1.3. Value-ad

- 6.1.1. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Transportation

- 7.1.1.1. Roadways

- 7.1.1.2. Railways

- 7.1.1.3. Water and Seaways

- 7.1.1.4. Airways

- 7.1.2. Warehousing and Distribution

- 7.1.3. Value-ad

- 7.1.1. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Transportation

- 8.1.1.1. Roadways

- 8.1.1.2. Railways

- 8.1.1.3. Water and Seaways

- 8.1.1.4. Airways

- 8.1.2. Warehousing and Distribution

- 8.1.3. Value-ad

- 8.1.1. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Transportation

- 9.1.1.1. Roadways

- 9.1.1.2. Railways

- 9.1.1.3. Water and Seaways

- 9.1.1.4. Airways

- 9.1.2. Warehousing and Distribution

- 9.1.3. Value-ad

- 9.1.1. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Semiconductor Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Transportation

- 10.1.1.1. Roadways

- 10.1.1.2. Railways

- 10.1.1.3. Water and Seaways

- 10.1.1.4. Airways

- 10.1.2. Warehousing and Distribution

- 10.1.3. Value-ad

- 10.1.1. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kuehne+Nagel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dintec Shipping Express**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Express

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yusen Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CEVA Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omni Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MAERSK

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dimerco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HOYER Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global Semiconductor Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Logistics Market Revenue (billion), by Function 2025 & 2033

- Figure 3: North America Semiconductor Logistics Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America Semiconductor Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 5: North America Semiconductor Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America Semiconductor Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Semiconductor Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Semiconductor Logistics Market Revenue (billion), by Function 2025 & 2033

- Figure 9: South America Semiconductor Logistics Market Revenue Share (%), by Function 2025 & 2033

- Figure 10: South America Semiconductor Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 11: South America Semiconductor Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 12: South America Semiconductor Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Semiconductor Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Semiconductor Logistics Market Revenue (billion), by Function 2025 & 2033

- Figure 15: Europe Semiconductor Logistics Market Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Semiconductor Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 17: Europe Semiconductor Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: Europe Semiconductor Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Semiconductor Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Semiconductor Logistics Market Revenue (billion), by Function 2025 & 2033

- Figure 21: Middle East & Africa Semiconductor Logistics Market Revenue Share (%), by Function 2025 & 2033

- Figure 22: Middle East & Africa Semiconductor Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 23: Middle East & Africa Semiconductor Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 24: Middle East & Africa Semiconductor Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Semiconductor Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Semiconductor Logistics Market Revenue (billion), by Function 2025 & 2033

- Figure 27: Asia Pacific Semiconductor Logistics Market Revenue Share (%), by Function 2025 & 2033

- Figure 28: Asia Pacific Semiconductor Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 29: Asia Pacific Semiconductor Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: Asia Pacific Semiconductor Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Semiconductor Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 2: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Global Semiconductor Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 5: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 6: Global Semiconductor Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 11: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 12: Global Semiconductor Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 17: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 18: Global Semiconductor Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 29: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 30: Global Semiconductor Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Semiconductor Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 38: Global Semiconductor Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 39: Global Semiconductor Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Semiconductor Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Logistics Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Semiconductor Logistics Market?

Key companies in the market include DB Schenker, Kuehne+Nagel, DHL, Dintec Shipping Express**List Not Exhaustive, Nippon Express, Yusen Logistics, CEVA Logistics, Omni Logistics, MAERSK, Dimerco, HOYER Group.

3. What are the main segments of the Semiconductor Logistics Market?

The market segments include Function, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities.

6. What are the notable trends driving market growth?

Increasing demand for semiconductor driving the market.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs.

8. Can you provide examples of recent developments in the market?

December 2022: Kuehne+Nagel has launched a new air freight shipment offering to address the unique needs of global semiconductor supply chains. All industry stakeholders can establish reliable and agile supply chains with a robust air freight capacity, security solutions, and the new quality standard, "SemiconChain" as the core elements of the offering. The growing demand for semiconductors, as well as the increasing pressure on manufacturing, necessitate a faultless supply chain to support continuous operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Logistics Market?

To stay informed about further developments, trends, and reports in the Semiconductor Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence