Key Insights

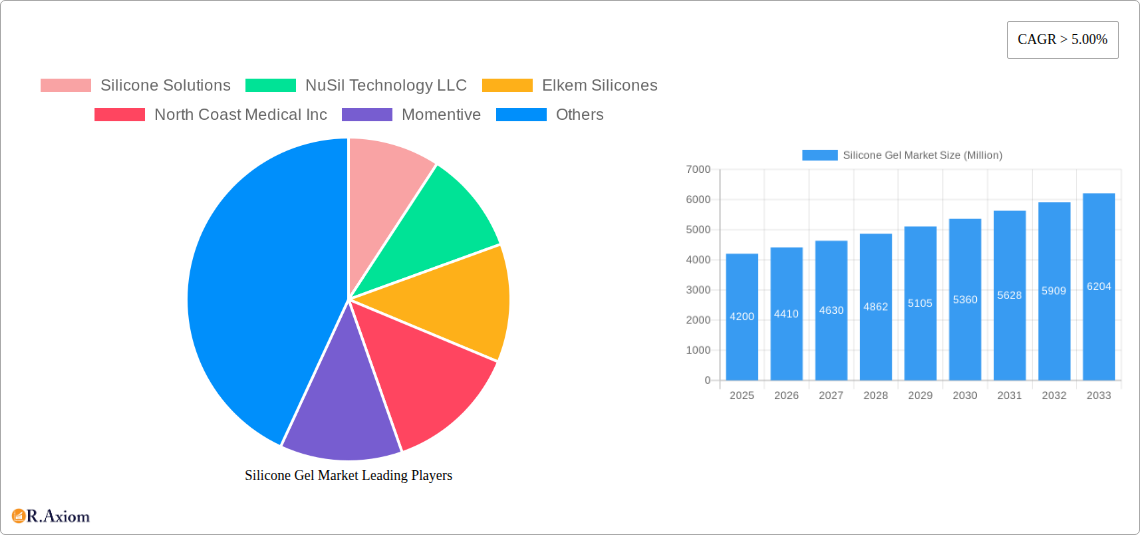

The global Silicone Gel Market is projected for robust expansion, with a current market size estimated at USD 4,200 Million in 2025, poised for significant growth. Driven by a Compound Annual Growth Rate (CAGR) exceeding 5.00%, the market is expected to reach a substantial valuation by 2033. This upward trajectory is primarily fueled by the increasing demand across diverse end-user industries. The Cosmetics and Personal Care sector is a major consumer, leveraging silicone gels for their unique textural properties, skin feel, and formulation benefits in products like moisturizers, foundations, and hair care. The Healthcare industry is another significant growth engine, utilizing silicone gels for their biocompatibility and therapeutic applications in wound dressings, medical device coatings, and drug delivery systems. Furthermore, the Electrical and Electronics sector is increasingly incorporating silicone gels for their insulating, shock-absorbing, and thermal management properties in advanced components and devices. Emerging applications in other diversified industries are also contributing to the market's sustained expansion.

Silicone Gel Market Market Size (In Billion)

The market's growth is strategically supported by continuous innovation and advancements in silicone gel formulations, offering enhanced performance characteristics tailored to specific application needs. Key trends include the development of specialized silicone gels with improved flexibility, temperature resistance, and biocompatibility, catering to niche and high-value applications. The Asia Pacific region, led by robust economies like China and India, is anticipated to be a dominant force in market expansion due to its burgeoning manufacturing capabilities and rapidly growing end-user industries. North America and Europe also represent mature yet consistently growing markets, driven by technological advancements and high consumer spending on premium products. While the market exhibits strong growth potential, certain restraints such as the fluctuating raw material prices and the development of alternative materials in specific segments could pose challenges. However, the inherent versatility and performance advantages of silicone gels are expected to outweigh these potential hurdles, ensuring a dynamic and expanding market landscape.

Silicone Gel Market Company Market Share

Sure, here is the SEO-optimized report description for the Silicone Gel Market:

Silicone Gel Market Market Concentration & Innovation

The global silicone gel market exhibits a moderate to high concentration, with a few key players like Dow, Momentive, Shin-Etsu Chemical Co Ltd, and Wacker Chemie AG holding significant market shares. Innovation is a crucial differentiator, driven by the demand for enhanced properties such as improved thermal conductivity, biocompatibility, and flexibility across diverse applications. Research and development investments are focused on creating specialized silicone gels for advanced medical devices, high-performance electronics, and next-generation personal care products. Regulatory frameworks, particularly concerning biocompatibility and safety standards in the healthcare and cosmetics sectors, play a vital role in shaping product development and market entry. The presence of product substitutes, such as other elastomeric materials and gels, necessitates continuous innovation to maintain competitive advantage. End-user trends are increasingly leaning towards sustainable and bio-based silicone alternatives. Mergers and acquisition (M&A) activities are expected to continue, with deal values potentially reaching several hundred million dollars as companies seek to expand their product portfolios, geographical reach, and technological capabilities. This strategic consolidation aims to optimize supply chains and leverage synergistic benefits to meet the evolving demands of the silicone gel market.

Silicone Gel Market Industry Trends & Insights

The global silicone gel market is poised for robust growth, driven by an increasing demand across a spectrum of high-growth industries. The estimated market size for 2025 stands at approximately $5,000 million, with a projected Compound Annual Growth Rate (CAGR) of over 7.5% from 2025 to 2033. This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and significant investments in key application sectors.

Market growth drivers are multifaceted. In the healthcare sector, the biocompatibility and cushioning properties of silicone gels are paramount for applications in medical implants, wound care, prosthetics, and wearable medical devices. The rising global healthcare expenditure and the increasing adoption of advanced medical technologies are significant contributors to this demand. The electrical and electronics industry is another major growth engine, with silicone gels being indispensable as encapsulants, thermal interface materials (TIMs), and sealants in consumer electronics, automotive components, and power management systems. The growing trend of miniaturization and the need for enhanced thermal dissipation in these devices further boost the demand for high-performance silicone gels.

Technological disruptions are continuously reshaping the market. Advancements in synthesis techniques are leading to the development of silicone gels with tailored properties, such as enhanced flexibility, optical clarity, and specific adhesion characteristics. The integration of smart functionalities into silicone gels, such as self-healing capabilities and embedded sensors, presents exciting future prospects. Furthermore, the development of more sustainable and eco-friendly silicone gel formulations is gaining traction, driven by growing environmental consciousness and regulatory pressures.

Consumer preferences are also playing a pivotal role, particularly in the cosmetics and personal care industry. Silicone gels are highly sought after for their unique sensory properties, providing a smooth, silky feel and improving the spreadability and performance of skincare, haircare, and cosmetic products. The demand for anti-aging formulations, sunscreens, and long-lasting makeup products, which often incorporate silicone gels, is on the rise.

Competitive dynamics within the silicone gel market are characterized by intense rivalry among both established global players and emerging regional manufacturers. Strategic partnerships, product innovation, and a focus on niche applications are key strategies employed by companies to gain a competitive edge. The market penetration of silicone gels is steadily increasing as their versatility and performance benefits become more widely recognized across various end-user industries. The historical period of 2019–2024 witnessed consistent growth, laying a strong foundation for the accelerated expansion anticipated in the forecast period.

Dominant Markets & Segments in Silicone Gel Market

The global Silicone Gel Market is experiencing significant traction across multiple end-user industries, with Healthcare emerging as a particularly dominant and high-growth segment. This dominance is driven by a confluence of factors including the inherent biocompatibility, inertness, and versatile physical properties of silicone gels, which make them ideal for a wide array of medical applications.

In the Healthcare segment, silicone gels are integral to the manufacturing of:

- Medical implants: Providing soft tissue augmentation, cushioning for orthopedic implants, and flexible components for pacemakers and other internal medical devices. The increasing prevalence of chronic diseases and the aging global population are directly contributing to the demand for advanced medical implants, thereby boosting the silicone gel market.

- Wound care products: Acting as a gentle, non-adherent interface for dressings, promoting healing and reducing scarring. The rising incidence of burns, diabetic foot ulcers, and surgical wounds fuels the need for effective wound management solutions, where silicone gels play a critical role.

- Prosthetics and orthotics: Offering comfort, flexibility, and a natural feel for prosthetic limbs and orthotic devices, enhancing the quality of life for individuals with mobility challenges.

- Wearable medical devices and sensors: Providing flexible, skin-friendly encapsulation and thermal management solutions for continuous glucose monitors, ECG patches, and other diagnostic and monitoring devices. The burgeoning wearable technology market and the increasing focus on remote patient monitoring are significant growth catalysts.

The estimated market size for the Healthcare segment in 2025 is projected to be approximately $2,500 million, representing a substantial portion of the overall silicone gel market. Key drivers for this segment include robust government initiatives supporting healthcare infrastructure development, increasing disposable incomes in emerging economies, and a growing awareness of advanced medical treatments. Furthermore, stringent regulatory approvals, while posing a barrier to entry, also signify the high level of trust and performance associated with medical-grade silicone gels.

The Electrical and Electronics segment also represents a significant and rapidly growing market for silicone gels. These materials are essential for:

- Thermal Interface Materials (TIMs): Facilitating efficient heat transfer between electronic components and heat sinks in high-power devices, CPUs, GPUs, and LED lighting, preventing overheating and improving device longevity.

- Encapsulation and potting: Protecting sensitive electronic components from moisture, dust, vibration, and thermal shock in automotive electronics, industrial control systems, and consumer electronics.

- Adhesives and sealants: Providing flexible bonding and sealing solutions in the assembly of electronic devices.

The global trend towards miniaturization, increased power density, and the proliferation of smart devices, including smartphones, tablets, and IoT devices, are propelling the demand for advanced thermal management solutions offered by silicone gels. The Automotive industry, with its increasing integration of electronics, also contributes significantly to this segment's growth.

The Cosmetics and Personal Care segment, while smaller in terms of volume compared to Healthcare and Electrical/Electronics, is characterized by high-value applications and consistent demand. Silicone gels are prized for their aesthetic and functional benefits in:

- Skincare: Providing a smooth, non-greasy feel, improving spreadability, and offering occlusive properties for moisturizers and anti-aging creams.

- Haircare: Enhancing shine, manageability, and providing heat protection for conditioners and styling products.

- Color cosmetics: Improving the texture and longevity of foundations, primers, and lipsticks.

Consumer demand for products that offer a luxurious feel and superior performance is a key driver in this segment. The Others segment encompasses a variety of niche applications, including industrial lubrication, coatings, and specialized sealants, which collectively contribute to the overall market growth. The continued expansion and diversification of applications underscore the indispensable role of silicone gels across a broad industrial landscape.

Silicone Gel Market Product Developments

Product developments in the silicone gel market are centered on enhancing performance and expanding application versatility. Innovations include the creation of ultra-high thermal conductivity silicone gels for advanced electronics cooling, highly biocompatible formulations for next-generation medical implants and drug delivery systems, and optically clear gels for advanced display technologies and LED encapsulation. Furthermore, the development of self-healing and shape-memory silicone gels is opening up new frontiers in robotics and smart materials. These advancements aim to provide superior thermal management, improved patient outcomes, extended device lifespans, and novel functionalities, thereby offering a significant competitive advantage in their respective markets.

Report Scope & Segmentation Analysis

The Silicone Gel Market report offers comprehensive segmentation analysis across critical dimensions, providing detailed insights into market dynamics and growth trajectories.

End-user Industry Segmentation:

- Cosmetics and Personal Care: This segment encompasses the use of silicone gels in skincare, haircare, and color cosmetics, driven by their sensory properties and performance-enhancing capabilities. Growth projections indicate a steady expansion due to evolving consumer demand for premium beauty products. Market sizes are moderate but exhibit high value. Competitive dynamics are characterized by brand differentiation and ingredient innovation.

- Electrical and Electronics: This segment includes applications such as thermal interface materials, encapsulants, and sealants for consumer electronics, automotive, and industrial applications. Significant growth is projected, fueled by the proliferation of electronic devices and the need for efficient thermal management. Market sizes are substantial and growing rapidly. Competition is intense, focusing on thermal performance and reliability.

- Healthcare: This segment covers medical implants, wound care, prosthetics, and wearable medical devices. It is a dominant segment with substantial and consistent growth, driven by aging populations and advancements in medical technology. Market sizes are significant, and growth is robust. Regulatory compliance and biocompatibility are key competitive factors.

- Others: This segment includes a diverse range of industrial applications, such as lubricants, sealants, and coatings, where silicone gels provide specialized performance characteristics. Growth in this segment is steady, driven by niche industrial demands. Market sizes are smaller but diverse. Competition focuses on specialized performance and cost-effectiveness.

Key Drivers of Silicone Gel Market Growth

The silicone gel market is propelled by several interconnected growth drivers. Technologically, the demand for advanced materials with enhanced thermal conductivity, improved biocompatibility, and greater flexibility is paramount. This is evident in the healthcare sector’s need for biocompatible gels in medical implants and wearable devices, and the electronics sector's requirement for efficient thermal management materials. Economically, increasing global healthcare expenditure, the burgeoning consumer electronics market, and the growth of the automotive industry are directly fueling demand. For instance, the rising adoption of electric vehicles, with their complex electronic systems, necessitates high-performance silicone gels for thermal management and encapsulation. Regulatory factors, such as increasing emphasis on product safety and biocompatibility standards, particularly in healthcare and personal care, indirectly drive the development and adoption of specialized, high-quality silicone gels.

Challenges in the Silicone Gel Market Sector

Despite its growth, the silicone gel market faces several challenges. Regulatory hurdles, particularly concerning the stringent approval processes for medical-grade silicone gels, can significantly slow down market entry and product adoption. Supply chain disruptions and volatility in the prices of raw materials, such as silicon and methanol, can impact production costs and profit margins. Intense competitive pressures from established players and the emergence of new market entrants necessitate continuous innovation and cost optimization. The development and adoption of sustainable alternatives also present a challenge as industries strive for more environmentally friendly materials. Furthermore, the high initial investment required for specialized R&D and manufacturing facilities can be a barrier for smaller companies.

Emerging Opportunities in Silicone Gel Market

Emerging opportunities in the silicone gel market are ripe with potential. The growing demand for advanced wearable health monitoring devices presents a significant avenue, requiring flexible, skin-friendly, and biocompatible silicone gels. The expansion of 5G technology and the Internet of Things (IoT) will drive the need for high-performance thermal management solutions in smaller, more powerful electronic devices. Sustainable and bio-based silicone gels are gaining traction, offering eco-friendly alternatives that cater to growing environmental consciousness. The automotive sector, especially the transition to electric vehicles, offers substantial opportunities for silicone gels in battery thermal management, sensor encapsulation, and advanced driver-assistance systems (ADAS). Furthermore, 3D printing of medical devices and custom prosthetics is creating a niche for specialized silicone gels with specific rheological properties.

Leading Players in the Silicone Gel Market Market

- Dow

- Momentive

- Wacker Chemie AG

- Shin-Etsu Chemical Co Ltd

- Elkem Silicones

- NuSil Technology LLC

- Gelest Inc

- Siltech Corporation

- ACC Silicones LTD

- Silicone Solutions

- North Coast Medical Inc

Key Developments in Silicone Gel Market Industry

- 2024 (Q1): Dow launches a new line of high-performance thermal interface materials for advanced computing applications.

- 2023 (Q4): Momentive announces a strategic partnership to develop advanced silicone gels for next-generation wearable medical devices.

- 2023 (Q3): Wacker Chemie AG expands its silicone gel production capacity to meet rising demand from the automotive sector.

- 2023 (Q2): Shin-Etsu Chemical Co Ltd introduces a new series of optically clear silicone gels for LED encapsulation.

- 2023 (Q1): Elkem Silicones acquires a specialized silicone gel manufacturer to broaden its product portfolio in the healthcare segment.

- 2022 (Q4): NuSil Technology LLC receives FDA approval for a novel biocompatible silicone gel for soft tissue augmentation.

- 2022 (Q3): Gelest Inc develops a range of functionalized silicone gels for advanced research applications.

- 2022 (Q2): Siltech Corporation introduces innovative silicone gel formulations with enhanced self-healing properties.

Strategic Outlook for Silicone Gel Market Market

The strategic outlook for the silicone gel market is exceptionally positive, driven by continuous innovation and expanding application horizons. The increasing demand for high-performance materials in the healthcare and electronics sectors will remain a primary growth catalyst. Companies that invest in research and development, focusing on specialty silicone gels with tailored properties such as superior thermal management, enhanced biocompatibility, and advanced functionalities like self-healing, will be well-positioned for success. Furthermore, strategic collaborations, targeted acquisitions, and a commitment to sustainability will be crucial for navigating the competitive landscape and capitalizing on emerging opportunities in rapidly evolving markets. The market is expected to witness sustained growth and technological advancements, solidifying silicone gels as indispensable materials across a multitude of industries.

Silicone Gel Market Segmentation

-

1. End-user Industry

- 1.1. Cosmetics and Personal Care

- 1.2. Electrical and Electronics

- 1.3. Healthcare

- 1.4. Others

Silicone Gel Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silicone Gel Market Regional Market Share

Geographic Coverage of Silicone Gel Market

Silicone Gel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Cosmetics and Personal Care; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; High Manufacturing Cost; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Increasing demand from Electrical & Electronics Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Cosmetics and Personal Care

- 5.1.2. Electrical and Electronics

- 5.1.3. Healthcare

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Cosmetics and Personal Care

- 6.1.2. Electrical and Electronics

- 6.1.3. Healthcare

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Cosmetics and Personal Care

- 7.1.2. Electrical and Electronics

- 7.1.3. Healthcare

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Cosmetics and Personal Care

- 8.1.2. Electrical and Electronics

- 8.1.3. Healthcare

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Cosmetics and Personal Care

- 9.1.2. Electrical and Electronics

- 9.1.3. Healthcare

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Silicone Gel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Cosmetics and Personal Care

- 10.1.2. Electrical and Electronics

- 10.1.3. Healthcare

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silicone Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NuSil Technology LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elkem Silicones

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 North Coast Medical Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Momentive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dow

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siltech Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ACC Silicones LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shin-Etsu Chemical Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gelest Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wacker Chemie AG*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Silicone Solutions

List of Figures

- Figure 1: Global Silicone Gel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Silicone Gel Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Silicone Gel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Silicone Gel Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific Silicone Gel Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Silicone Gel Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Silicone Gel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Silicone Gel Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Silicone Gel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Silicone Gel Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Silicone Gel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Silicone Gel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Silicone Gel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Silicone Gel Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Silicone Gel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Silicone Gel Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Silicone Gel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Silicone Gel Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Silicone Gel Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Silicone Gel Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Silicone Gel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Silicone Gel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Silicone Gel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: India Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Silicone Gel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Canada Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Silicone Gel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Silicone Gel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Silicone Gel Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Silicone Gel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Silicone Gel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicone Gel Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Silicone Gel Market?

Key companies in the market include Silicone Solutions, NuSil Technology LLC, Elkem Silicones, North Coast Medical Inc, Momentive, Dow, Siltech Corporation, ACC Silicones LTD, Shin-Etsu Chemical Co Ltd, Gelest Inc, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Silicone Gel Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Cosmetics and Personal Care; Other Drivers.

6. What are the notable trends driving market growth?

Increasing demand from Electrical & Electronics Industry.

7. Are there any restraints impacting market growth?

; High Manufacturing Cost; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicone Gel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicone Gel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicone Gel Market?

To stay informed about further developments, trends, and reports in the Silicone Gel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence