Key Insights

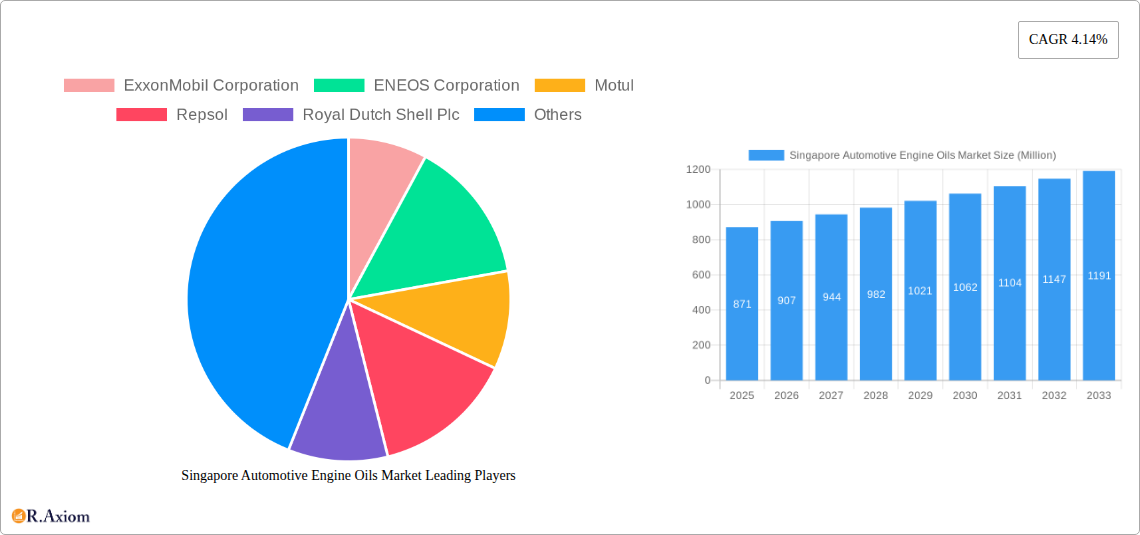

The Singapore Automotive Engine Oils Market is poised for steady growth, with an estimated market size of approximately $871 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.14% through 2033. This expansion is primarily fueled by the robust and evolving automotive sector in Singapore, characterized by a significant fleet of passenger vehicles, a growing commercial vehicle segment, and a thriving motorcycle market. Increasing consumer awareness regarding engine longevity and performance, coupled with stringent emission standards, drives the demand for high-quality, advanced engine oils. The market sees a strong emphasis on synthetic and semi-synthetic formulations due to their superior lubrication properties, fuel efficiency benefits, and extended drain intervals, aligning with Singapore's focus on sustainability and reduced environmental impact. Key players such as ExxonMobil Corporation, ENEOS Corporation, Motul, Repsol, Royal Dutch Shell Plc, Chevron Corporation, Idemitsu Kosan Co Ltd, TotalEnergies, AP Oil, and BP Plc (Castrol) are actively engaged in product innovation and strategic partnerships to capture market share and cater to the sophisticated demands of the Singaporean automotive landscape.

Singapore Automotive Engine Oils Market Market Size (In Million)

Further analysis reveals that the market's trajectory is influenced by several converging factors. The sustained demand for passenger vehicles, despite potential shifts towards electric mobility in the long term, ensures a consistent need for engine oils. Concurrently, the burgeoning logistics and transportation industry in Singapore necessitates high-performance engine oils for commercial vehicles, supporting the nation's role as a regional hub. While the initial investment in synthetic engine oils might be a restraining factor for some price-sensitive consumers, the long-term benefits of enhanced engine protection and reduced maintenance costs are increasingly recognized. Technological advancements in engine design, demanding more specialized lubricant formulations, also contribute to market dynamism. The government's initiatives promoting efficient and environmentally friendly transportation further bolster the adoption of premium engine oils that contribute to reduced emissions and improved fuel economy. Overall, the Singapore automotive engine oils market presents a landscape of sustained demand driven by technological evolution, environmental consciousness, and the enduring importance of internal combustion engine vehicles.

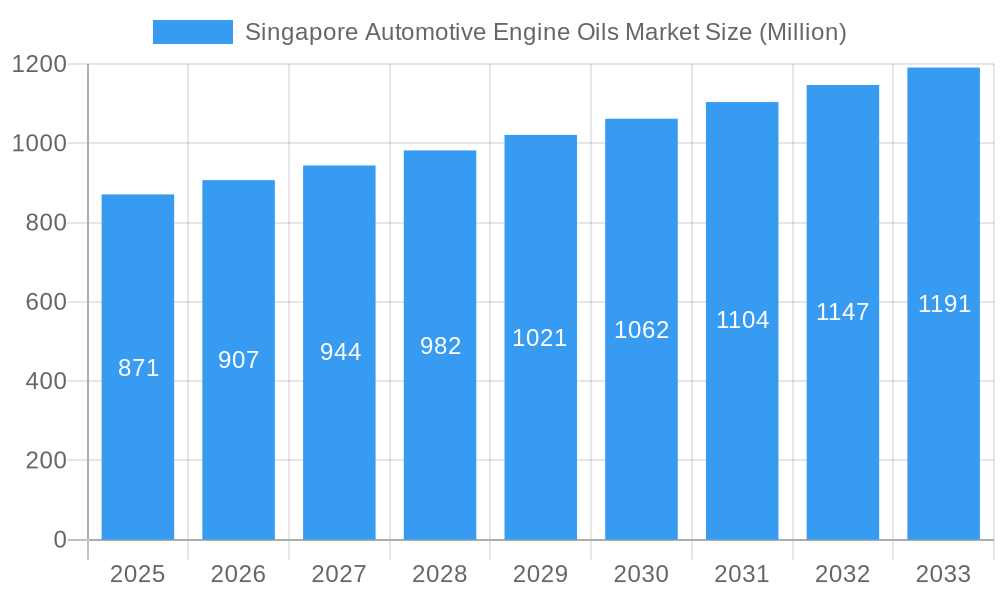

Singapore Automotive Engine Oils Market Company Market Share

Here is a detailed, SEO-optimized report description for the Singapore Automotive Engine Oils Market, designed for maximum search visibility and engagement.

The Singapore automotive engine oils market exhibits a moderate to high level of market concentration, driven by the significant presence of global giants and established regional players. Key companies such as ExxonMobil Corporation, ENEOS Corporation, Motul, Repsol, Royal Dutch Shell Plc, Chevron Corporation, Idemitsu Kosan Co Ltd, TotalEnergie, AP Oil, and BP Plc (Castrol) collectively command a substantial market share. Innovation is a critical differentiator, with companies investing in advanced formulations to meet evolving engine technologies, stringent emission standards, and consumer demand for enhanced fuel efficiency and extended drain intervals. Regulatory frameworks, primarily governed by the Land Transport Authority (LTA) and environmental agencies, influence product development and market entry, pushing for the adoption of eco-friendly and high-performance lubricants. Product substitutes, including lower-grade oils and alternative lubrication technologies, pose a limited but present challenge. End-user trends are shifting towards synthetic and semi-synthetic engine oils, driven by a desire for superior engine protection and performance. Merger and acquisition (M&A) activities are less frequent but can significantly impact market dynamics by consolidating market share and expanding product portfolios. While specific M&A deal values are proprietary, the strategic importance of Singapore as a regional hub fuels ongoing competitive strategies among leading lubricant manufacturers.

Singapore Automotive Engine Oils Market Industry Trends & Insights

The Singapore automotive engine oils market is on a trajectory of sustained growth, propelled by several dynamic trends and industry insights. The market is estimated to reach a valuation of approximately $650 Million by 2033, with a compound annual growth rate (CAGR) of around 3.5% during the forecast period of 2025–2033. This growth is fundamentally driven by an ever-expanding vehicle parc, despite a maturing automotive sales landscape. The increasing adoption of sophisticated engine technologies, such as turbocharging and direct injection, necessitates the use of advanced engine oils that can withstand higher operating temperatures and pressures. Furthermore, Singapore's commitment to environmental sustainability fuels the demand for low-viscosity, fuel-efficient engine oils that contribute to reduced emissions and improved mileage.

Technological disruptions are playing a pivotal role. The shift from conventional mineral oils to semi-synthetic and fully synthetic formulations is a dominant trend, offering superior lubrication, enhanced wear protection, and extended drain intervals. This aligns with consumer preferences for convenience and reduced maintenance costs. The integration of additive technologies, including advanced detergents, dispersants, and friction modifiers, is crucial for meeting the performance demands of modern internal combustion engines and the emerging hybrid powertrains.

Consumer preferences are increasingly informed by a desire for premium products that offer demonstrable benefits. Factors such as perceived engine longevity, fuel economy gains, and environmental impact are influencing purchasing decisions. Lubricant manufacturers are responding by developing specialized product lines tailored to specific vehicle types and driving conditions.

The competitive dynamics within the Singapore automotive engine oils market are characterized by intense rivalry among global lubricant majors, local distributors, and independent brands. Companies are differentiating themselves through product innovation, strategic partnerships, and robust distribution networks. The presence of major players like ExxonMobil Corporation, ENEOS Corporation, Motul, Repsol, Royal Dutch Shell Plc, Chevron Corporation, Idemitsu Kosan Co Ltd, TotalEnergie, AP Oil, and BP Plc (Castrol) signifies a mature market where customer loyalty and brand reputation are paramount. The market penetration of premium synthetic oils is steadily increasing as consumers become more aware of their long-term economic and performance advantages, even at a higher upfront cost. The base year of 2025 is projected to see a market value of approximately $510 Million, setting the stage for robust expansion through 2033.

Dominant Markets & Segments in Singapore Automotive Engine Oils Market

The Singapore automotive engine oils market is primarily segmented by Vehicle Type, encompassing Commercial Vehicles, Motorcycles, and Passenger Vehicles, and by Product Grade, which typically includes mineral, semi-synthetic, and synthetic oils. Within these segments, Passenger Vehicles represent the dominant market share, accounting for approximately 55% of the total market value in 2025, estimated at $280 Million. This dominance is driven by the high per capita ownership of passenger cars and a strong demand for premium, high-performance lubricants.

Passenger Vehicles: The strong economic standing of Singapore, coupled with a sophisticated automotive aftermarket, supports a robust demand for advanced engine oils. Factors such as the prevalence of fuel-efficient engine technologies, a well-maintained road infrastructure, and a consumer base that prioritizes vehicle longevity and performance contribute to the significant market penetration of synthetic and semi-synthetic engine oils in this segment. The average price point for passenger vehicle engine oils is higher due to the technological advancements embedded in these formulations.

Motorcycles: This segment holds a substantial market share of approximately 30%, valued at $155 Million in 2025. Singapore's dense urban environment and the practicalities of commuting contribute to a large motorcycle parc. The demand here is for specialized motorcycle engine oils that offer superior clutch performance, gear protection, and heat dissipation, often with distinct formulation requirements compared to automotive oils. The increasing popularity of performance motorcycles also drives the adoption of premium synthetic oils in this category.

Commercial Vehicles: This segment accounts for the remaining 15% of the market, estimated at $75 Million in 2025. Despite its smaller share, this segment is crucial for industrial and logistical operations. The demand is characterized by a need for durable, long-drain interval engine oils that can withstand the rigorous operating conditions of heavy-duty use. While cost-effectiveness is a significant driver, fleet operators are increasingly recognizing the long-term economic benefits of higher-quality lubricants in reducing maintenance downtime and improving fuel efficiency. The stringent emission regulations for commercial fleets also influence the product grades and specifications required.

Product Grade: Within each vehicle type, the demand for Synthetic engine oils is experiencing the fastest growth, projected to reach over 60% market share by 2033. This is driven by their superior performance characteristics. Semi-synthetic oils continue to hold a significant share due to their balance of performance and cost. Mineral oils, while the most economical, are gradually declining in market share, particularly in passenger vehicles and performance motorcycles.

Singapore Automotive Engine Oils Market Product Developments

Product innovation in the Singapore automotive engine oils market is centered on meeting the evolving demands of modern engines and environmental regulations. Companies are actively developing and promoting advanced synthetic formulations that offer exceptional wear protection, thermal stability, and fuel economy benefits. Key product developments include low-viscosity engine oils designed for smaller, high-performance engines, as well as specialized lubricants for hybrid and electric vehicle powertrains (where applicable for hybrid components). The integration of advanced additive packages that enhance engine cleanliness, reduce friction, and extend drain intervals remains a crucial area of focus. These innovations provide competitive advantages by offering superior performance, greater efficiency, and extended engine life, aligning with both consumer expectations and industry trends.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Singapore automotive engine oils market, segmented by Vehicle Type and Product Grade. The Vehicle Type segmentation includes:

- Passenger Vehicles: This segment analyzes the market for engine oils used in cars, SUVs, and MPVs. Projections indicate a steady growth driven by technological advancements and consumer preference for premium lubricants, with a market size estimated at $280 Million in 2025.

- Motorcycles: This segment focuses on engine oils for motorcycles and scooters. Its growth is influenced by urban mobility trends and the demand for specialized two-wheeler lubricants, with an estimated market size of $155 Million in 2025.

- Commercial Vehicles: This segment covers engine oils for trucks, buses, and other heavy-duty vehicles. Growth is driven by logistics and transportation demands, with an estimated market size of $75 Million in 2025.

The Product Grade segmentation includes:

- Mineral Oils: Traditional engine oils derived from petroleum.

- Semi-Synthetic Oils: A blend of mineral and synthetic base oils.

- Synthetic Oils: Fully synthetic engine oils offering the highest performance.

Each segment is analyzed for its market size, growth projections, and competitive dynamics within the study period of 2019–2033.

Key Drivers of Singapore Automotive Engine Oils Market Growth

The Singapore automotive engine oils market is propelled by several key drivers:

- Increasing Vehicle Parc: A growing number of vehicles on Singaporean roads, especially passenger cars and motorcycles, directly translates to higher demand for engine oils.

- Technological Advancements in Engines: Modern engines, with features like turbocharging and direct injection, require advanced, high-performance lubricants to ensure optimal operation and longevity.

- Growing Demand for Fuel Efficiency and Emission Reduction: Stringent environmental regulations and a growing consumer awareness drive the adoption of low-viscosity and synthetic engine oils that enhance fuel economy and minimize emissions.

- Premiumization Trend: Consumers are increasingly willing to invest in higher-quality, premium engine oils for better engine protection and extended service intervals, leading to a higher average selling price.

- Robust Aftermarket Infrastructure: Singapore's well-developed automotive aftermarket and a high density of service centers ensure consistent demand and accessibility for a wide range of engine oil products.

Challenges in the Singapore Automotive Engine Oils Market Sector

Despite the positive outlook, the Singapore automotive engine oils market faces several challenges:

- Intense Competition: The market is highly competitive, with numerous global and regional players vying for market share, leading to price pressures and the need for continuous product differentiation.

- Maturity of the Automotive Sales Market: While the vehicle parc is growing, the rate of new vehicle sales in Singapore is relatively mature, meaning a significant portion of demand comes from existing vehicles and replacements.

- Economic Volatility and Cost Sensitivity: Fluctuations in the global economy can impact consumer spending on premium automotive products, making some segments more cost-sensitive.

- Emergence of Electric Vehicles (EVs): The long-term shift towards electric mobility poses a potential threat to the traditional engine oil market, although hybrid vehicles will continue to require engine oils for some time.

- Counterfeit Products: The presence of counterfeit engine oils in the market can damage brand reputation and mislead consumers, posing a significant challenge to legitimate businesses.

Emerging Opportunities in Singapore Automotive Engine Oils Market

The Singapore automotive engine oils market presents several emerging opportunities:

- Growth in Synthetic and High-Performance Lubricants: The increasing consumer awareness of the benefits of synthetic and semi-synthetic engine oils offers a significant opportunity for market expansion.

- Specialized Lubricants for Hybrid Vehicles: As hybrid technology gains traction, there will be a growing demand for specialized engine oils designed for these dual-powertrain systems.

- Focus on Sustainability and Eco-Friendly Formulations: Development and marketing of biodegradable or lower-impact engine oils can appeal to environmentally conscious consumers and meet evolving regulatory demands.

- Digitalization of Sales and Distribution: Leveraging e-commerce platforms and digital marketing strategies can open new sales channels and enhance customer engagement.

- Fleet Management Solutions: Offering bundled services or IoT-enabled lubricant monitoring solutions for commercial fleets can create value-added propositions and secure long-term contracts.

Leading Players in the Singapore Automotive Engine Oils Market Market

- ExxonMobil Corporation

- ENEOS Corporation

- Motul

- Repsol

- Royal Dutch Shell Plc

- Chevron Corporation

- Idemitsu Kosan Co Ltd

- TotalEnergie

- AP Oil

- BP Plc (Castrol)

Key Developments in Singapore Automotive Engine Oils Market Industry

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- September 2021: ExxonMobil Asia Pacific Pte Ltd established the MobilSM Fleet Care (MFC) program for its lubricant clients, which provides fleet owners and operators with a holistic picture of their fleet's operating performance.

- May 2021: Suzuki Singapore partnered with Motul to unveil the all-new Suzuki Swift Sports Car with Motul's high-performance lubricants. Customers would receive a complimentary upgrade to Motul's engine oils for an entire year.

Strategic Outlook for Singapore Automotive Engine Oils Market Market

The strategic outlook for the Singapore automotive engine oils market is positive, driven by an increasing demand for premium, high-performance lubricants and a growing awareness of their long-term benefits. The transition towards more fuel-efficient vehicles and the sustained popularity of motorcycles will continue to bolster demand. Opportunities lie in embracing technological advancements, such as the development of specialized lubricants for hybrid powertrains, and in leveraging digital channels for sales and customer engagement. Companies that focus on sustainability, innovation in additive technology, and robust distribution networks are best positioned to capitalize on the evolving market landscape and achieve sustained growth throughout the forecast period. The market's resilience is underpinned by its role as a critical hub for the automotive aftermarket in Southeast Asia.

Singapore Automotive Engine Oils Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

- 2. Product Grade

Singapore Automotive Engine Oils Market Segmentation By Geography

- 1. Singapore

Singapore Automotive Engine Oils Market Regional Market Share

Geographic Coverage of Singapore Automotive Engine Oils Market

Singapore Automotive Engine Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for New Automotive Vehicles; Active Ship Building and Repair Industry

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Electric Vehicles; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Automotive Engine Oils Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ENEOS Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Motul

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Repsol

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Dutch Shell Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Idemitsu Kosan Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AP Oil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BP Plc (Castrol)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Singapore Automotive Engine Oils Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Automotive Engine Oils Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Singapore Automotive Engine Oils Market Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2020 & 2033

- Table 4: Singapore Automotive Engine Oils Market Volume Million Forecast, by Product Grade 2020 & 2033

- Table 5: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Singapore Automotive Engine Oils Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Singapore Automotive Engine Oils Market Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2020 & 2033

- Table 10: Singapore Automotive Engine Oils Market Volume Million Forecast, by Product Grade 2020 & 2033

- Table 11: Singapore Automotive Engine Oils Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Singapore Automotive Engine Oils Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Automotive Engine Oils Market?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Singapore Automotive Engine Oils Market?

Key companies in the market include ExxonMobil Corporation, ENEOS Corporation, Motul, Repsol, Royal Dutch Shell Plc, Chevron Corporation, Idemitsu Kosan Co Ltd, TotalEnergie, AP Oil, BP Plc (Castrol).

3. What are the main segments of the Singapore Automotive Engine Oils Market?

The market segments include Vehicle Type, Product Grade.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for New Automotive Vehicles; Active Ship Building and Repair Industry.

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Passenger Vehicles</span>.

7. Are there any restraints impacting market growth?

Growing Adoption of Electric Vehicles; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.September 2021: ExxonMobil Asia Pacific Pte Ltd established the MobilSM Fleet Care (MFC) program for its lubricant clients, which provides fleet owners and operators with a holistic picture of their fleet's operating performance.May 2021: Suzuki Singapore partnered with Motul to unveil the all-new Suzuki Swift Sports Car with Motul's high-performance lubricants. Customers would receive a complimentary upgrade to Motul's engine oils for an entire year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Automotive Engine Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Automotive Engine Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Automotive Engine Oils Market?

To stay informed about further developments, trends, and reports in the Singapore Automotive Engine Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence