Key Insights

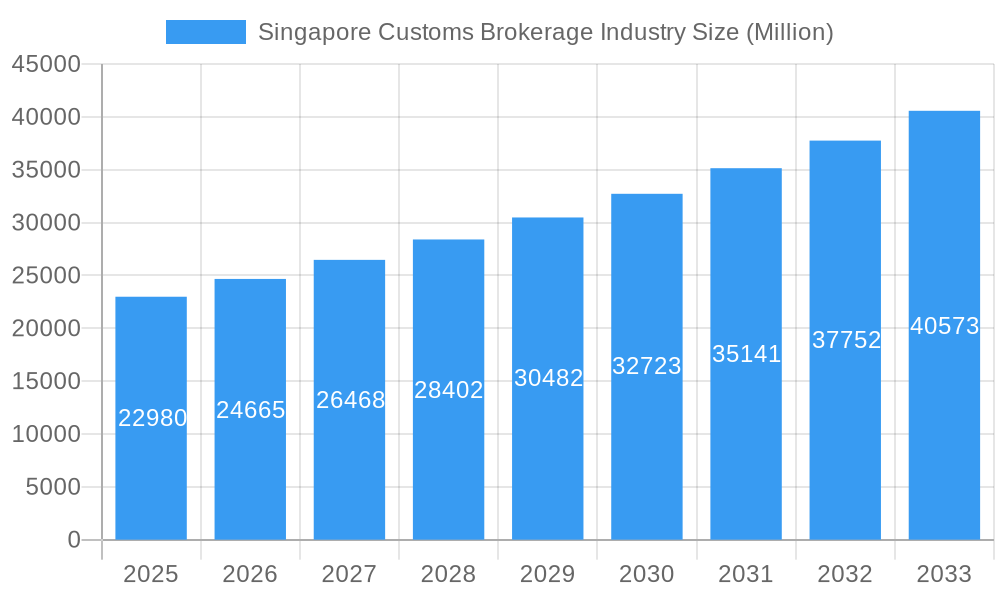

The Singapore Customs Brokerage Industry is poised for significant expansion, projecting a robust market size of $22.98 billion in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.44% extending through 2033. This impressive growth trajectory is primarily propelled by the increasing volume of international trade flowing through Singapore's strategic hub. Key drivers include the nation's status as a premier transshipment point, its sophisticated logistics infrastructure, and the continuous growth of e-commerce, which necessitates efficient and compliant cross-border movement of goods. The industry is witnessing a surge in demand for streamlined customs clearance processes, driven by businesses aiming to reduce lead times and mitigate potential delays. Emerging technologies like AI-powered document processing and blockchain for enhanced transparency are also playing a crucial role in optimizing brokerage services and fostering greater efficiency.

Singapore Customs Brokerage Industry Market Size (In Billion)

The industry's expansion is further characterized by evolving trends such as the increasing adoption of digital platforms for real-time tracking and communication, and a growing emphasis on specialized brokerage services catering to specific industries like pharmaceuticals and perishables. While the market presents substantial opportunities, certain restraints need to be addressed. These include the complexity of evolving trade regulations and compliance requirements across different jurisdictions, and the potential for geopolitical instability to disrupt global supply chains. Nevertheless, the dominant segments within this market are expected to be sea freight, followed by air freight, due to Singapore's prominent role in global maritime trade and its status as a major air cargo hub. Cross-border land transport, while important, represents a smaller but growing segment. Major players like DHL, UPS, FedEx, and Kuehne + Nagel are actively investing in technology and service expansion to capture market share within this dynamic environment.

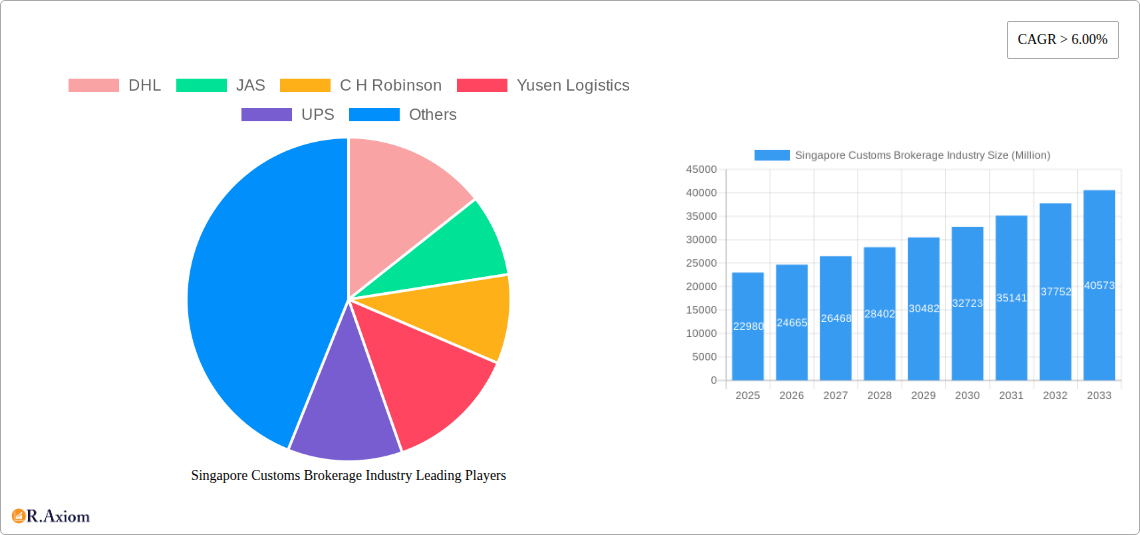

Singapore Customs Brokerage Industry Company Market Share

Singapore Customs Brokerage Industry Market Concentration & Innovation

The Singapore Customs Brokerage industry, a vital cog in the nation's thriving trade ecosystem, exhibits a moderate to high level of market concentration. Key players like DHL, JAS, C H Robinson, Yusen Logistics, UPS, FedEx, M&P International Freight, Kuehne + Nagel, Janio, SeaLand Maersk, Rhenus Logistics, and Geodis (list not exhaustive) command significant market share, driven by their extensive global networks, technological investments, and established relationships with regulatory bodies. Innovation within this sector is primarily fueled by the imperative to streamline and digitize customs processes. Drivers include the adoption of Artificial Intelligence (AI) for automated document processing and risk assessment, the implementation of blockchain technology for enhanced transparency and traceability, and the development of advanced analytics for predictive customs clearance. Regulatory frameworks, overseen by Singapore Customs, continuously evolve to facilitate trade while ensuring compliance, thereby shaping the innovation landscape. Product substitutes, while limited, can include in-house customs management solutions for very large enterprises or the direct engagement with freight forwarders who may offer integrated customs services. End-user trends are increasingly leaning towards faster, more efficient, and transparent customs clearance, pushing service providers to invest heavily in technology. Mergers and acquisitions (M&A) activity is expected to remain robust, with estimated deal values in the billions of Singapore Dollars, as larger entities seek to consolidate market share, acquire technological capabilities, and expand their service offerings. This consolidation will further influence market dynamics and competitive intensity.

Singapore Customs Brokerage Industry Industry Trends & Insights

The Singapore Customs Brokerage industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This robust expansion is underpinned by a confluence of dynamic market growth drivers, technological disruptions, evolving consumer preferences, and intense competitive dynamics. The strategic location of Singapore as a global trade and logistics hub, coupled with its robust free trade agreements and efficient port infrastructure, acts as a primary growth catalyst. Technological advancements are revolutionizing the industry, with the increasing adoption of digitalization, automation, and AI transforming traditional customs brokerage processes. These technologies are enabling faster clearance times, reducing errors, and enhancing transparency, thereby improving overall supply chain efficiency. Consumer preferences are shifting towards seamless, end-to-end logistics solutions, compelling customs brokerage firms to offer integrated services that extend beyond mere clearance. This includes value-added services like consultancy, compliance management, and supply chain optimization. The competitive landscape is characterized by a mix of large, established global players and agile, technology-driven niche providers. This dynamic interplay fosters innovation and drives service differentiation. Market penetration is expected to deepen as more businesses, particularly Small and Medium-sized Enterprises (SMEs), leverage the expertise and technology of customs brokers to navigate complex international trade regulations. The ongoing investment in advanced logistics infrastructure and the government's commitment to fostering a pro-business environment further bolster the industry's growth trajectory. The market size is projected to reach billions of Singapore Dollars by 2033.

Dominant Markets & Segments in Singapore Customs Brokerage Industry

Within the Singapore Customs Brokerage Industry, the Sea mode of transport currently dominates, driven by Singapore's status as one of the world's busiest container ports. This segment's dominance is bolstered by several key drivers:

- Economic Policies: Singapore's open trade policies and its role as a transshipment hub for regional and global trade naturally favor sea freight, which handles the vast majority of global cargo volumes.

- Infrastructure: The world-class efficiency of the Port of Singapore, with its advanced container terminals, extensive warehousing facilities, and integrated logistics networks, makes sea freight the most cost-effective and scalable option for many businesses.

- Trade Volume: The sheer volume of goods moving through Singapore via sea, destined for both domestic consumption and onward transit, ensures a continuous demand for customs brokerage services.

- Cost-Effectiveness for Bulk Cargo: For large shipments and raw materials, sea freight remains the most economically viable option, making it a cornerstone of the industry.

While sea freight leads, the Air mode of transport is experiencing significant growth, particularly for high-value, time-sensitive goods. Key drivers for air freight's ascendance include:

- Speed and Urgency: For e-commerce, perishables, pharmaceuticals, and electronics, the speed of air cargo is paramount, driving demand for rapid customs clearance.

- Technological Advancements: Improved air cargo handling technologies and integrated digital platforms are streamlining processes, making air freight more competitive.

- Growing E-commerce Sector: The burgeoning e-commerce market in Southeast Asia directly fuels the demand for fast and efficient air cargo delivery, requiring expedited customs brokerage.

Cross-border Land Transport also plays a crucial, albeit more regional, role. This segment is significantly influenced by:

- Regional Connectivity: Singapore's strategic position allows for robust land connectivity with Malaysia and other ASEAN nations, facilitating the movement of goods through trucking.

- Free Trade Agreements: Regional FTAs reduce tariffs and streamline customs procedures for land-borne trade, further encouraging its use.

- Specific Industry Needs: Industries reliant on just-in-time inventory management for goods moving between Singapore and its immediate neighbors benefit greatly from efficient land customs clearance.

The overall market size for each segment is substantial, with sea freight accounting for an estimated xx billion Singapore Dollars in 2025, air freight at xx billion, and cross-border land transport at xx billion. These figures are projected to see steady growth through 2033, with air and land segments potentially showing higher relative growth rates due to technological adoption and evolving trade patterns.

Singapore Customs Brokerage Industry Product Developments

Product developments in the Singapore Customs Brokerage industry are increasingly focused on leveraging advanced technologies to enhance efficiency and transparency. Innovations include AI-powered platforms for automated document verification and classification, reducing manual errors and processing times. Blockchain integration is emerging for secure and traceable customs declarations, building greater trust and visibility across the supply chain. Furthermore, predictive analytics are being employed to forecast potential customs delays and proactively address issues. These developments offer competitive advantages by enabling faster clearance, minimizing compliance risks, and providing clients with real-time visibility into their shipments, ultimately optimizing their supply chain operations and reducing costs.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Singapore Customs Brokerage Industry, segmented by mode of transport. The Sea freight segment is projected to maintain its leadership position, with an estimated market size of xx billion Singapore Dollars in 2025, growing to xx billion by 2033. This growth is driven by Singapore's status as a global maritime hub and the continued reliance on sea for bulk and containerized cargo. The Air freight segment is forecast to witness robust growth, with a market size of xx billion in 2025, expanding to xx billion by 2033. This upward trajectory is attributed to the increasing demand for rapid delivery of high-value goods and the booming e-commerce sector. Cross-border Land Transport is expected to reach xx billion in 2025 and grow to xx billion by 2033, supported by enhanced regional connectivity and trade agreements. Competitive dynamics within each segment vary, with larger players dominating sea freight, while specialized firms and technology-driven entrants are making inroads in air and land segments.

Key Drivers of Singapore Customs Brokerage Industry Growth

The Singapore Customs Brokerage Industry is propelled by several critical growth drivers. Technologically, the relentless push towards digitalization and automation, including the adoption of AI and blockchain, is streamlining processes and reducing operational costs. Economically, Singapore's status as a global trade and logistics hub, coupled with its robust economic growth and expanding trade agreements, creates a consistently high volume of international shipments requiring customs clearance. Regulatory-wise, the government's commitment to facilitating trade through efficient customs procedures and proactive policy updates encourages businesses to operate and expand within Singapore, thereby increasing the demand for brokerage services. The growth of e-commerce and the increasing complexity of global supply chains also necessitate specialized customs expertise, further fueling industry expansion.

Challenges in the Singapore Customs Brokerage Industry Sector

Despite its strong growth prospects, the Singapore Customs Brokerage Industry faces several challenges. Regulatory hurdles, though generally streamlined, can still present complexities with evolving international trade laws and compliance requirements, demanding continuous adaptation and investment in expertise. Supply chain disruptions, such as port congestion, geopolitical tensions, and natural disasters, can lead to unpredictable delays and increased operational costs for brokers and their clients. Competitive pressures are intense, with a mix of large global players and smaller, specialized firms vying for market share, often leading to price sensitivities. Furthermore, the continuous need to invest in and adopt new technologies to remain competitive requires significant capital outlay and skilled personnel, posing a challenge for some smaller entities.

Emerging Opportunities in Singapore Customs Brokerage Industry

The Singapore Customs Brokerage Industry is ripe with emerging opportunities. The burgeoning e-commerce sector presents a significant avenue for growth, with demand for expedited and specialized customs clearance for online retail shipments. Technological advancements, particularly in AI and data analytics, offer opportunities for service differentiation through predictive insights and enhanced efficiency. The increasing complexity of global supply chains and the demand for end-to-end logistics solutions create space for brokers to offer value-added services beyond traditional clearance. Furthermore, opportunities exist in emerging markets within the ASEAN region, where Singapore's expertise can be leveraged to facilitate trade for businesses expanding into these territories. Sustainability initiatives within the logistics sector also present opportunities for brokers to offer eco-friendly customs solutions.

Leading Players in the Singapore Customs Brokerage Industry Market

- DHL

- JAS

- C H Robinson

- Yusen Logistics

- UPS

- FedEx

- M&P International Freight

- Kuehne + Nagel

- Janio

- SeaLand Maersk

- Rhenus Logistics

- Geodis

Key Developments in Singapore Customs Brokerage Industry Industry

- 2023: Launch of enhanced digital trade platforms by Singapore Customs, aiming to further streamline customs processes and improve data interoperability.

- 2023: Significant investment by major logistics players in AI-driven automation for customs documentation and clearance.

- 2023: Increased adoption of blockchain technology for enhanced transparency and security in cross-border trade declarations.

- 2022: Merger activity intensified, with larger firms acquiring smaller, specialized customs brokerage and technology providers to expand service offerings and market reach.

- 2022: Introduction of new initiatives to support SMEs in navigating complex customs procedures, fostering broader market participation.

- 2021: Focus on improving cross-border land transport facilitation with neighboring countries through digital solutions and policy harmonization.

- 2020: Accelerated digitalization of customs brokerage services driven by the need for remote operations and contactless processes during the pandemic.

Strategic Outlook for Singapore Customs Brokerage Industry Market

The strategic outlook for the Singapore Customs Brokerage Industry remains exceptionally positive, driven by its pivotal role in facilitating global trade. Continued investment in advanced technologies such as AI, machine learning, and blockchain will be crucial for enhancing efficiency, accuracy, and transparency. The industry is expected to move towards offering more integrated, end-to-end logistics solutions, positioning customs brokers as strategic partners rather than mere service providers. The growing e-commerce sector and the ongoing expansion of regional trade will create sustained demand. Strategic partnerships and potential M&A activities will likely reshape the competitive landscape, leading to a consolidation of market share and the emergence of more sophisticated, technology-enabled service offerings. Singapore's commitment to innovation and trade facilitation will ensure its continued prominence in the global customs brokerage arena.

Singapore Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-border Land Transport

Singapore Customs Brokerage Industry Segmentation By Geography

- 1. Singapore

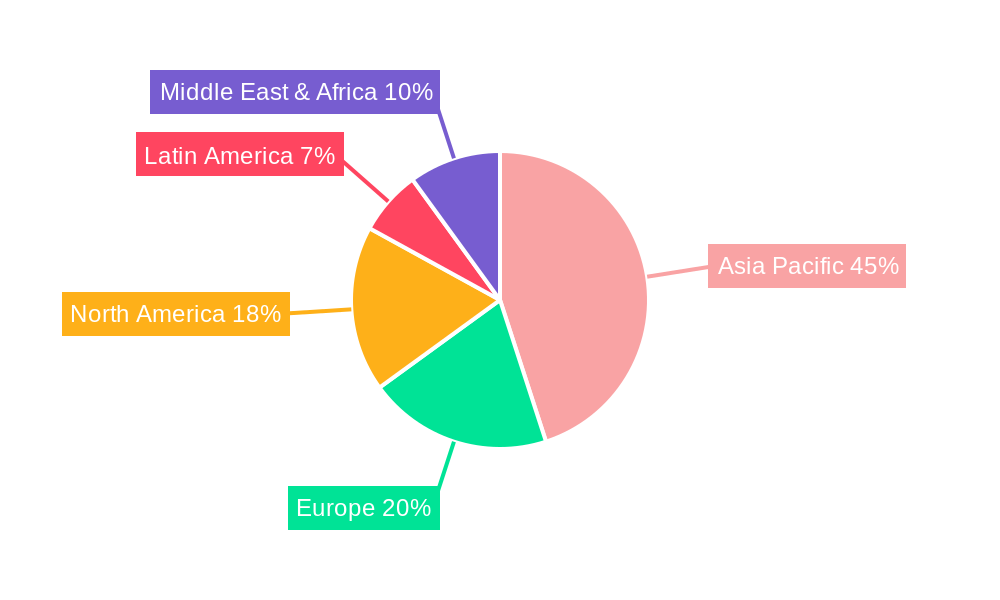

Singapore Customs Brokerage Industry Regional Market Share

Geographic Coverage of Singapore Customs Brokerage Industry

Singapore Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing need for simple and effective supply chain systems; Increase in demand for household appliances

- 3.3. Market Restrains

- 3.3.1. 4.; Drivers Availability

- 3.4. Market Trends

- 3.4.1. Singapore Surge in Imports and Exports Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Robinson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M&P International Freight

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Janio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SeaLand Maersk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rhenus Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geodis**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Singapore Customs Brokerage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Singapore Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 2: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 4: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Customs Brokerage Industry?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Singapore Customs Brokerage Industry?

Key companies in the market include DHL, JAS, C H Robinson, Yusen Logistics, UPS, FedEx, M&P International Freight, Kuehne + Nagel, Janio, SeaLand Maersk, Rhenus Logistics, Geodis**List Not Exhaustive.

3. What are the main segments of the Singapore Customs Brokerage Industry?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing need for simple and effective supply chain systems; Increase in demand for household appliances.

6. What are the notable trends driving market growth?

Singapore Surge in Imports and Exports Driving the Market.

7. Are there any restraints impacting market growth?

4.; Drivers Availability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Singapore Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence