Key Insights

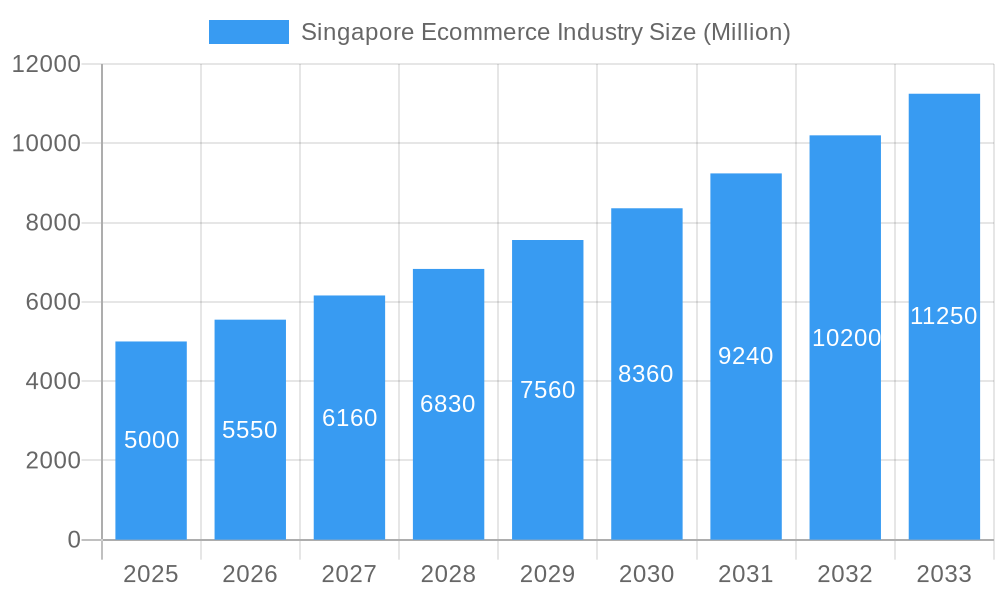

The Singaporean e-commerce market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a burgeoning tech-savvy population, rising smartphone penetration, and increasing preference for online shopping convenience. A compound annual growth rate (CAGR) of 11% from 2025 to 2033 indicates a significant expansion in market size, reaching an estimated $YY million by 2033 (Note: 'YY' represents a calculated value based on the provided CAGR of 11% and a 2025 base value of $XX million; a specific value for XX is needed to calculate YY accurately. For the purpose of illustration, let's assume the 2025 value is $5 billion; this will yield a 2033 value that is approximately $15 billion. However, the actual values should be inserted once available.). This growth is fueled by several key factors, including the widespread adoption of digital payment methods, increasing availability of reliable logistics and delivery services, and the proliferation of e-commerce platforms catering to diverse consumer needs. Furthermore, the government's supportive initiatives towards digitalization further bolster the sector's expansion.

Singapore Ecommerce Industry Market Size (In Billion)

Key players like Shopee, Lazada, Carousell, and Amazon are intensely competing for market share, leading to innovative strategies in areas such as personalized recommendations, enhanced customer service, and strategic partnerships. While the market is experiencing considerable expansion, challenges remain. These include managing logistics complexities, ensuring data security and privacy, and navigating evolving consumer preferences and expectations. Furthermore, regulatory compliance and the need for sustainable practices within the industry pose ongoing considerations for all stakeholders. Successful navigation of these factors will be crucial for continued and sustainable growth within the Singaporean e-commerce sector.

Singapore Ecommerce Industry Company Market Share

Singapore Ecommerce Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore ecommerce industry, covering market size, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for businesses, investors, and policymakers seeking to understand and navigate this dynamic market. We leverage high-traffic keywords like "Singapore ecommerce market," "e-commerce Singapore growth," "Singapore online retail," and "Southeast Asia ecommerce," to ensure maximum search visibility.

Singapore Ecommerce Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory environment, and competitive dynamics within the Singapore ecommerce sector. The analysis includes an assessment of market share among key players, M&A activity, and the impact of technological advancements on the industry.

Market Concentration: The Singapore ecommerce market demonstrates a high level of concentration, with a few dominant players controlling a significant market share. Shopee and Lazada, for example, hold a substantial portion, while other players like Carousell and Qoo10 occupy niche segments. Precise market share figures for 2025 are estimated at xx Million for Shopee, xx Million for Lazada, and xx Million collectively for other significant players. Future projections indicate a continuing trend of consolidation.

Innovation Drivers: The industry’s innovation is fueled by advancements in mobile commerce, artificial intelligence (AI) for personalized recommendations, and the rise of social commerce platforms. The integration of fintech solutions, such as digital payments and buy-now-pay-later options, further drives innovation.

Regulatory Framework: The Singaporean government actively shapes the ecommerce landscape through regulations designed to protect consumers and foster fair competition. The introduction of the E-commerce Marketplace Transaction Safety Ratings (TSR) in May 2022 exemplifies this regulatory focus.

Product Substitutes: The primary substitutes for online retail are traditional brick-and-mortar stores and direct-to-consumer (DTC) brands bypassing online marketplaces.

End-User Trends: Consumers in Singapore are increasingly digitally savvy and demand seamless online shopping experiences with personalized services, fast delivery, and secure payment options.

M&A Activities: The Singapore ecommerce sector has witnessed significant M&A activity in recent years, with deal values reaching xx Million in 2024. This consolidation is expected to continue, driving further market concentration and shaping the competitive landscape.

Singapore Ecommerce Industry Industry Trends & Insights

This section delves into the major trends and insights shaping the Singapore ecommerce industry, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics.

The Singaporean ecommerce market is experiencing robust growth, driven by rising internet and smartphone penetration, increasing consumer spending power, and a supportive government policy environment. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%, exceeding the historical CAGR (2019-2024) of xx%. Market penetration is expected to reach xx% by 2033, indicating significant room for expansion. Key technological disruptions include the adoption of AI-powered personalization, the rise of live-streaming commerce, and the increasing importance of omnichannel strategies. Consumer preferences are shifting towards convenience, personalized experiences, and sustainable practices, influencing how businesses operate and compete. The competitive dynamics are marked by intense rivalry among major players, with a constant push for innovation and differentiation.

Dominant Markets & Segments in Singapore Ecommerce Industry

This section identifies the leading segments within the Singapore ecommerce market, analyzing the key drivers behind their dominance. Our analysis is primarily based on Market Segmentation - by Application.

Key Drivers for Dominant Segments:

- Robust Digital Infrastructure: Singapore's advanced digital infrastructure, including high-speed internet and reliable logistics networks, supports rapid ecommerce growth.

- Government Initiatives: Government policies promoting digitalization and innovation create a favorable environment for the sector.

- High Smartphone Penetration: High smartphone ownership among the population fuels mobile commerce adoption.

- Favorable Demographics: A young and tech-savvy population readily embraces online shopping.

Dominance Analysis: The dominant segments will be identified and analyzed in detail within the full report. This will include factors contributing to their leading market positions, including market size, growth rates, and competitive advantages.

Singapore Ecommerce Industry Product Developments

Recent product innovations focus on enhancing customer experience through personalized recommendations, seamless payment gateways, and faster delivery options. The integration of augmented reality (AR) and virtual reality (VR) technologies is gaining traction, providing immersive shopping experiences. These advancements cater to the evolving consumer preferences for convenience and personalization, giving businesses a competitive edge.

Report Scope & Segmentation Analysis

This report segments the Singapore ecommerce market by application, providing a comprehensive analysis of each segment's size, growth rate, and competitive dynamics. Growth projections for each segment are included, along with a detailed breakdown of market share among key players. (Specific segmentation details and projections to be included in the complete report).

Key Drivers of Singapore Ecommerce Industry Growth

The growth of Singapore's ecommerce sector is driven by several key factors: rapidly increasing internet and smartphone penetration, a rising middle class with greater disposable income, and the government's pro-digitalization policies. The efficient logistics infrastructure and the adoption of innovative technologies, such as AI and big data analytics, are also contributing to the sector's growth. Furthermore, the emergence of social commerce platforms and the increasing preference for convenient online shopping experiences propel this expansion.

Challenges in the Singapore Ecommerce Industry Sector

The Singapore ecommerce sector faces challenges including intense competition, particularly from regional giants, the need for robust cybersecurity measures to combat fraud, and ensuring efficient last-mile delivery in a densely populated urban environment. The rising cost of logistics and maintaining competitive pricing also pose significant challenges. Furthermore, regulatory compliance and evolving consumer expectations continuously demand adaptation. These factors can impact the profitability and sustainability of businesses in the sector.

Emerging Opportunities in Singapore Ecommerce Industry

Emerging opportunities lie in the growth of niche markets, the expansion of cross-border ecommerce, and the adoption of innovative technologies like blockchain for supply chain transparency. The increasing demand for personalized shopping experiences and sustainable practices also presents significant opportunities for businesses to differentiate themselves and attract customers. The integration of omnichannel strategies and the exploration of new marketing avenues will also prove crucial for success.

Leading Players in the Singapore Ecommerce Industry Market

- Carousell

- Alibaba Group Holding Ltd

- Sephora

- Lazada

- EZbuy

- E Bay

- Flipkart

- Amazon com Inc

- Shopee

- RedMart

Key Developments in Singapore Ecommerce Industry Industry

- May 2022: Introduction of the E-commerce Marketplace Transaction Safety Ratings (TSR) to enhance consumer protection and combat online scams. This significantly impacted market dynamics by pushing platforms to improve their security measures.

- May 2022: Temasek Holdings increased its investments in Amazon.com Inc and Pinduoduo, signaling growing confidence in the global ecommerce market and its potential for returns. This influenced investor sentiment and potentially spurred further investment in the sector.

- June 2023: TikTok launched an e-commerce training program for small businesses in Singapore's heartlands. This initiative is expected to significantly boost the participation of smaller businesses in the online retail space, increasing competition and potentially altering the market share dynamics.

Strategic Outlook for Singapore Ecommerce Industry Market

The Singapore ecommerce market presents a promising outlook, driven by continued digitalization, increasing consumer adoption, and supportive government policies. The focus on enhancing customer experience, leveraging innovative technologies, and addressing challenges like cybersecurity will be crucial for future success. Opportunities exist in expanding into niche markets, focusing on sustainable practices, and exploring cross-border ecommerce. The market's growth potential remains significant, offering substantial rewards for businesses that adapt to the ever-evolving landscape.

Singapore Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market Size (GMV) for the Period of 2022-2029

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty and Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion and Apparel

- 1.2.4. Food and Beverage

- 1.2.5. Furniture and Home

- 1.2.6. Other Applications (Toys, DIY, Media, etc.)

- 2. Market Size (GMV) for the Period of 2022-2029

-

3. Application

- 3.1. Beauty and Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion and Apparel

- 3.4. Food and Beverage

- 3.5. Furniture and Home

- 3.6. Other Applications (Toys, DIY, Media, etc.)

- 4. Beauty and Personal Care

- 5. Consumer Electronics

- 6. Fashion and Apparel

- 7. Food and Beverage

- 8. Furniture and Home

- 9. Other Applications (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size (GMV) for the Period of 2022-2029

Singapore Ecommerce Industry Segmentation By Geography

- 1. Singapore

Singapore Ecommerce Industry Regional Market Share

Geographic Coverage of Singapore Ecommerce Industry

Singapore Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Penetration Across the Country; Increased Adoption of Smartphones

- 3.3. Market Restrains

- 3.3.1. Security Flaw Related to Hacking of Password Managers

- 3.4. Market Trends

- 3.4.1. Internet Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Ecommerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Size (GMV) for the Period of 2022-2029

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty and Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion and Apparel

- 5.1.2.4. Food and Beverage

- 5.1.2.5. Furniture and Home

- 5.1.2.6. Other Applications (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market Size (GMV) for the Period of 2022-2029

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty and Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion and Apparel

- 5.3.4. Food and Beverage

- 5.3.5. Furniture and Home

- 5.3.6. Other Applications (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food and Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.9. Market Analysis, Insights and Forecast - by Other Applications (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size (GMV) for the Period of 2022-2029

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carousell

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alibaba Group Holding Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sephora

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lazada

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EZbuy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 E Bay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flipkart

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon com Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shopee

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RedMart*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carousell

List of Figures

- Figure 1: Singapore Ecommerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Ecommerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Singapore Ecommerce Industry Revenue Million Forecast, by Market Size (GMV) for the Period of 2022-2029 2020 & 2033

- Table 3: Singapore Ecommerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Singapore Ecommerce Industry Revenue Million Forecast, by Beauty and Personal Care 2020 & 2033

- Table 5: Singapore Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Singapore Ecommerce Industry Revenue Million Forecast, by Fashion and Apparel 2020 & 2033

- Table 7: Singapore Ecommerce Industry Revenue Million Forecast, by Food and Beverage 2020 & 2033

- Table 8: Singapore Ecommerce Industry Revenue Million Forecast, by Furniture and Home 2020 & 2033

- Table 9: Singapore Ecommerce Industry Revenue Million Forecast, by Other Applications (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Singapore Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Singapore Ecommerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Singapore Ecommerce Industry Revenue Million Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Singapore Ecommerce Industry Revenue Million Forecast, by Market Size (GMV) for the Period of 2022-2029 2020 & 2033

- Table 14: Singapore Ecommerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Singapore Ecommerce Industry Revenue Million Forecast, by Beauty and Personal Care 2020 & 2033

- Table 16: Singapore Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Singapore Ecommerce Industry Revenue Million Forecast, by Fashion and Apparel 2020 & 2033

- Table 18: Singapore Ecommerce Industry Revenue Million Forecast, by Food and Beverage 2020 & 2033

- Table 19: Singapore Ecommerce Industry Revenue Million Forecast, by Furniture and Home 2020 & 2033

- Table 20: Singapore Ecommerce Industry Revenue Million Forecast, by Other Applications (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Singapore Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Singapore Ecommerce Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Ecommerce Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Singapore Ecommerce Industry?

Key companies in the market include Carousell, Alibaba Group Holding Ltd, Sephora, Lazada, EZbuy, E Bay, Flipkart, Amazon com Inc, Shopee, RedMart*List Not Exhaustive.

3. What are the main segments of the Singapore Ecommerce Industry?

The market segments include B2C E-commerce, Market Size (GMV) for the Period of 2022-2029, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, Furniture and Home, Other Applications (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Penetration Across the Country; Increased Adoption of Smartphones.

6. What are the notable trends driving market growth?

Internet Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Security Flaw Related to Hacking of Password Managers.

8. Can you provide examples of recent developments in the market?

May 2022: Singapore introduced a rating system that evaluates e-commerce marketplaces based on anti-scam policies. Its technical rules for online transactions were modified to include more information on avoiding scams. The E-commerce Marketplace Transaction Safety Ratings (TSR) were created to assess the extent to which these platforms had adopted anti-scam procedures that ensured, among other things, user authenticity, transaction safety, and the availability of loss-recovery channels for customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Singapore Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence