Key Insights

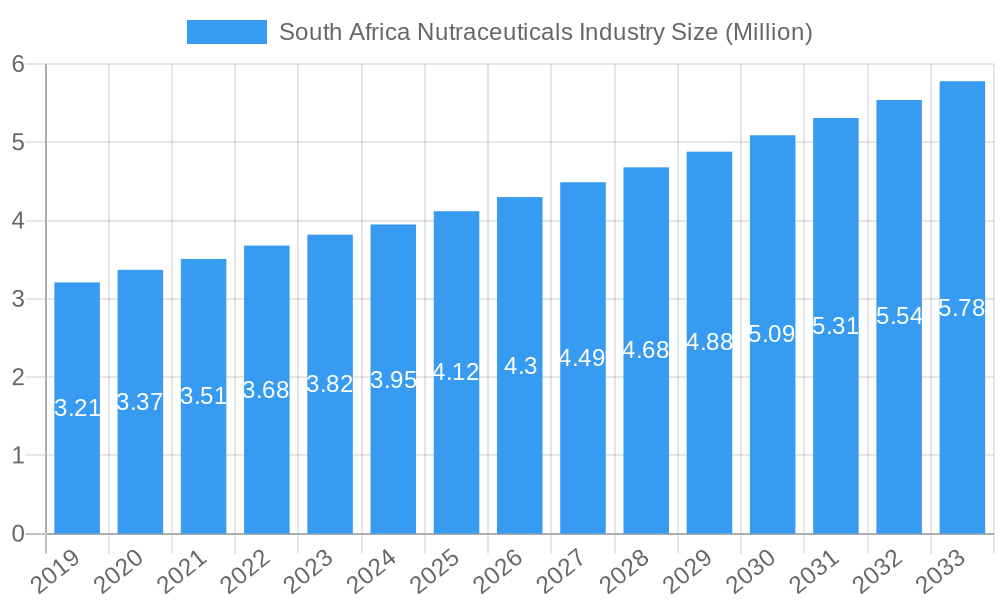

The South African nutraceuticals market is poised for robust expansion, projected to reach a significant valuation by 2033, driven by an increasing consumer focus on preventative healthcare and wellness. With a Compound Annual Growth Rate (CAGR) of 4.60%, this dynamic sector is expected to experience steady growth from its current market size of approximately 3.95 million value units. This upward trajectory is underpinned by several key drivers, including a rising prevalence of lifestyle diseases, a growing awareness of the health benefits associated with functional foods and dietary supplements, and an expanding middle class with increased disposable income to invest in health and well-being. Furthermore, the industry is witnessing a surge in demand for personalized nutrition solutions and products catering to specific health concerns such as immunity boosting, cognitive function, and sports nutrition. The competitive landscape features major global players like Nestle SA, The Coca-Cola Company, and GlaxoSmithKline PLC, alongside prominent local entities, all vying for market share through product innovation, strategic partnerships, and targeted marketing campaigns.

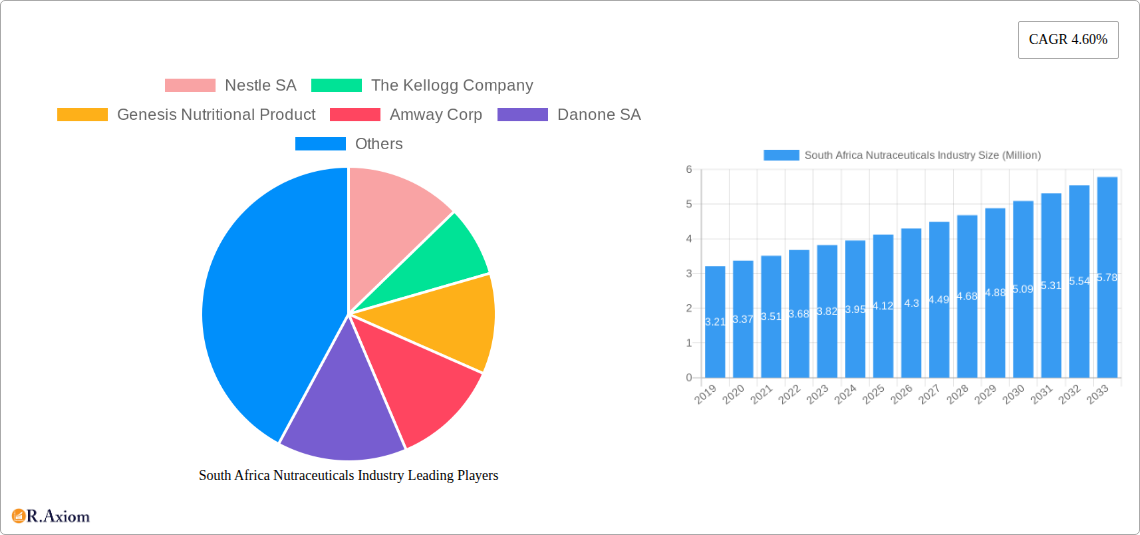

South Africa Nutraceuticals Industry Market Size (In Million)

The South African nutraceuticals market is characterized by a diverse range of segments, encompassing production, consumption, imports, exports, and price trends. Production analysis indicates a growing domestic manufacturing capacity, driven by investments in research and development and the utilization of local agricultural resources. Consumption patterns reveal a shift towards natural and organic products, with consumers actively seeking out supplements and fortified foods that offer tangible health benefits. Import and export dynamics highlight the global interconnectedness of the market, with South Africa importing specialized ingredients and finished products while also exporting certain nutraceuticals. Price trend analysis suggests a generally stable to moderately increasing price environment, influenced by raw material costs, supply chain efficiencies, and the perceived value of premium health products. Key restrains to growth, while present, are being addressed through innovation and strategic market penetration. These include, but are not limited to, regulatory hurdles and the need for greater consumer education regarding the efficacy and safety of nutraceutical products.

South Africa Nutraceuticals Industry Company Market Share

South Africa Nutraceuticals Industry Market Concentration & Innovation

The South African nutraceuticals market is characterized by a moderate to high level of market concentration, with a few major multinational corporations and a growing number of domestic players vying for market share. Leading companies such as Nestle SA, The Kellogg Company, Danone SA, and Herbalife Nutrition hold significant influence due to their established brand recognition, extensive distribution networks, and substantial R&D investments. Innovation is a critical differentiator, driven by increasing consumer demand for scientifically-backed health solutions, preventative healthcare, and personalized nutrition. Key innovation drivers include advancements in ingredient technology (e.g., probiotics, prebiotics, plant-based proteins), novel delivery systems, and the integration of digital health platforms. Regulatory frameworks, overseen by bodies like the South African Department of Health, play a pivotal role in shaping product development and market entry, with a focus on safety, efficacy, and labeling.

- Market Share Snapshot: While specific current market share figures fluctuate, major players like Nestle and Danone consistently command substantial portions of the fortified foods and beverages segments, estimated to be in the hundreds of millions of US dollars for their South African operations.

- M&A Activities: Merger and acquisition activities, while not as frequent as in more mature markets, are on the rise as larger companies seek to acquire innovative startups and gain access to niche segments or advanced technologies. Recent M&A deals in the broader African health and wellness sector have ranged from tens of millions to hundreds of millions of US dollars, indicating potential for significant consolidation within South Africa's nutraceuticals landscape.

- Product Substitutes: Substitutes include traditional foods rich in natural nutrients, prescription medications for specific health conditions, and a growing array of conventional health supplements. The competitive edge lies in the perceived efficacy, convenience, and value proposition of nutraceuticals.

- End-User Trends: Growing awareness of chronic diseases, an aging population, and a desire for proactive health management are fueling demand. Consumers are increasingly seeking products that offer specific benefits, such as immune support, digestive health, and cognitive enhancement.

- Innovation Focus Areas: Functional ingredients, personalized nutrition solutions powered by AI and genetic profiling, and sustainable sourcing are key areas of R&D focus.

South Africa Nutraceuticals Industry Industry Trends & Insights

The South African nutraceuticals industry is poised for robust growth, driven by a confluence of evolving consumer behaviors, a growing health-conscious populace, and increasing disposable incomes in certain segments. This dynamic market is experiencing a Compound Annual Growth Rate (CAGR) estimated at approximately 8-10% during the forecast period. Market penetration is steadily increasing, moving beyond urban centers to semi-urban and even rural areas, reflecting a broader societal shift towards prioritizing well-being. The industry is witnessing significant technological disruptions, with the integration of digital health technologies, AI-powered personalized nutrition platforms, and advanced manufacturing processes enhancing product development and consumer engagement.

Consumer preferences are increasingly leaning towards natural, plant-based, and sustainably sourced ingredients. There's a pronounced demand for functional foods and beverages that offer tangible health benefits beyond basic nutrition, such as enhanced immunity, improved gut health, stress management, and cognitive function. This demand is fueled by rising awareness of diet-related chronic diseases like diabetes, cardiovascular conditions, and obesity.

Competitive dynamics are intensifying, with both multinational giants and agile local players vying for market share. Companies like Nestle SA, The Kellogg Company, Danone SA, Amway Corp, and Herbalife Nutrition continue to dominate with their established portfolios and strong distribution networks. However, smaller, innovative companies are emerging, focusing on niche segments like specialized supplements, personalized formulations, and natural remedies, leveraging digital marketing and direct-to-consumer models. The influence of celebrity endorsements and influencer marketing is also a significant factor in shaping consumer choices.

The regulatory landscape, while evolving, presents both opportunities and challenges. Compliance with stringent quality control and labeling standards is paramount, but it also builds consumer trust and confidence in the safety and efficacy of nutraceutical products. Furthermore, the increasing accessibility of health information through online channels empowers consumers to make more informed purchasing decisions, creating a demand for transparency and scientifically validated claims. The economic outlook, while subject to fluctuations, generally supports a growing middle class with a greater capacity to invest in health and wellness products. This upward trend in consumer spending power directly correlates with increased demand for premium and specialized nutraceutical offerings.

Dominant Markets & Segments in South Africa Nutraceuticals Industry

The South African nutraceuticals industry showcases distinct dominance across various segments, driven by a combination of economic policies, evolving consumer demographics, and robust infrastructure in key areas.

Production Analysis:

- Dominant Region: The Gauteng province, being the economic hub of South Africa, dominates nutraceutical production. Its advanced industrial infrastructure, access to skilled labor, and proximity to major transportation networks facilitate efficient manufacturing and distribution.

- Key Drivers: Availability of raw materials, presence of contract manufacturers, favorable business environment, and established industrial zones are critical drivers of production concentration in Gauteng. The value of production in this segment is estimated to be in the billions of South African Rand annually, with specific growth drivers including investment in new production facilities and technology upgrades.

Consumption Analysis:

- Dominant Consumer Segment: The urban population, particularly in major metropolitan areas like Johannesburg, Cape Town, and Durban, represents the largest consumer base for nutraceuticals. This is attributed to higher disposable incomes, greater access to information about health and wellness, and a more prevalent health-conscious lifestyle.

- Key Drivers: Rising awareness of preventive healthcare, the prevalence of lifestyle diseases, and the influence of global wellness trends contribute significantly to consumption patterns. The market size for nutraceutical consumption is projected to reach several billion South African Rand by 2025, with an anticipated CAGR of around 9% during the forecast period.

Import Market Analysis (Value & Volume):

- Dominant Importing Countries: While South Africa has a growing domestic production capacity, it remains a significant importer of specialized ingredients, advanced formulations, and certain finished products. Europe (e.g., Germany, the UK) and North America (USA) are major sources of these imports, owing to their advanced manufacturing capabilities and extensive product portfolios.

- Key Drivers: The demand for high-purity ingredients, patented formulations, and scientifically validated products that may not be readily available domestically drives import volumes. The value of nutraceutical imports is estimated to be in the hundreds of millions of US dollars annually, with volumes supporting this high value due to the premium nature of imported goods.

Export Market Analysis (Value & Volume):

- Dominant Export Destinations: South Africa is increasingly exporting its domestically produced nutraceuticals, primarily to other African nations (e.g., Nigeria, Kenya, Zambia), leveraging its established trade routes and understanding of the regional market. Certain specialized products also find markets in emerging economies in Asia.

- Key Drivers: Competitive pricing, growing demand for affordable health solutions in neighboring countries, and the development of unique regional product offerings are fueling export growth. The value of South African nutraceutical exports is estimated to be in the tens of millions of US dollars annually, with significant potential for expansion.

Price Trend Analysis:

- Dominant Price Segment: The mid-to-premium price segment for nutraceuticals is experiencing the most significant growth. This reflects the increasing consumer willingness to invest in higher-quality, scientifically backed products that offer specific health benefits.

- Key Drivers: Ingredient costs, research and development expenditure, brand perception, and marketing investments are the primary drivers of price trends. Price inflation for raw materials is estimated to be around 3-5% annually, impacting the final product pricing. The perceived value and efficacy of a product play a crucial role in price acceptance.

South Africa Nutraceuticals Industry Product Developments

South Africa's nutraceutical sector is witnessing a surge in product innovations driven by a focus on personalized nutrition and preventative health. Key developments include fortified foods with enhanced immune-boosting ingredients like Vitamin D and Zinc, and probiotics for improved gut health. Companies are increasingly exploring plant-based protein supplements and functional beverages targeting specific demographic needs, such as energy and cognitive enhancement for young professionals, and bone health for the aging population. Competitive advantages are being built on scientific validation, natural ingredient sourcing, and convenient delivery formats, aligning with evolving consumer demand for efficacy and transparency.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the South African nutraceuticals industry from 2019 to 2033, with a base year of 2025. The market is segmented by Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Each segment's growth projections, estimated market sizes, and competitive dynamics are detailed. For Production Analysis, projected growth is approximately 7-9% CAGR, with an estimated market size of USD 1.5 Billion by 2025. Consumption Analysis shows a similar growth trajectory, with an estimated market size of USD 2.0 Billion by 2025. Import Market Analysis is projected at USD 500 Million annually, with growth driven by specialized ingredients. Export Market Analysis is estimated at USD 150 Million annually, with significant potential in the African region. Price Trend Analysis indicates a shift towards mid-to-premium segments.

Key Drivers of South Africa Nutraceuticals Industry Growth

The South African nutraceuticals industry's growth is propelled by several key factors. A significant driver is the increasing consumer awareness of health and wellness, fueled by a rising incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions. This awareness translates into a greater demand for preventive healthcare solutions. Technologically, advancements in ingredient innovation and product formulation, including the development of novel delivery systems and scientifically validated compounds, are creating new market opportunities. Economically, a growing middle class with increased disposable income is more inclined to invest in health-promoting products. Furthermore, supportive government initiatives and regulatory frameworks that promote the development and marketing of safe and effective nutraceuticals also play a crucial role in fostering industry expansion.

Challenges in the South Africa Nutraceuticals Industry Sector

Despite its growth potential, the South African nutraceuticals industry faces several challenges. Stringent and evolving regulatory landscapes can create barriers to market entry and product development, requiring significant investment in compliance. Price sensitivity among a portion of the consumer base can limit the adoption of premium products, especially in lower-income segments. Supply chain disruptions and logistical complexities, particularly in accessing raw materials and distributing finished goods across the vast country, pose ongoing hurdles. Intense competition from both established global players and emerging local brands necessitates continuous innovation and effective marketing strategies to maintain market share. Finally, misinformation and a lack of standardized consumer education regarding the efficacy and appropriate use of nutraceuticals can sometimes hinder market growth.

Emerging Opportunities in South Africa Nutraceuticals Industry

Emerging opportunities within the South African nutraceuticals industry are diverse and promising. There is a significant opportunity in personalized nutrition, leveraging advancements in genomics and AI to offer tailor-made supplement plans. The growing demand for plant-based and sustainable products presents a strong avenue for innovation, aligning with global environmental consciousness. Furthermore, the burgeoning e-commerce and digital health platforms offer a direct channel to reach a wider consumer base and provide accessible health information. Expansion into untapped rural markets and the development of affordable, region-specific formulations can unlock significant growth potential. Finally, strategic partnerships and collaborations with healthcare professionals and research institutions can enhance credibility and drive further innovation.

Leading Players in the South Africa Nutraceuticals Industry Market

- Nestle SA

- The Kellogg Company

- Genesis Nutritional Product

- Amway Corp

- Danone SA

- Red Bull GmbH

- Herbalife Nutrition

- The Coca-Cola Company

- Ascendis Health

- GlaxoSmithKline PLC

Key Developments in South Africa Nutraceuticals Industry Industry

- 2023: Increased investment in local R&D for plant-based protein supplements and functional beverages.

- 2023: Launch of new product lines focusing on immune support and mental well-being in response to ongoing health concerns.

- 2024: Growing adoption of sustainable sourcing practices and eco-friendly packaging by leading manufacturers.

- 2024: Emergence of smaller, agile companies specializing in personalized nutrition and direct-to-consumer models.

- 2024 (Q4): Significant increase in digital marketing campaigns and e-commerce sales, expanding market reach.

- 2025 (Q1): Expected regulatory updates focusing on enhanced product labeling and safety standards.

- 2025 (Q2): Potential for strategic acquisitions and partnerships to consolidate market share and access new technologies.

Strategic Outlook for South Africa Nutraceuticals Industry Market

The strategic outlook for the South African nutraceuticals market is exceptionally positive, driven by sustained consumer interest in health and wellness and ongoing product innovation. Key growth catalysts include the continued expansion of the middle class, a greater focus on preventative healthcare, and the integration of digital technologies for personalized solutions. Companies are strategically focusing on diversifying product portfolios to cater to niche health needs, expanding distribution channels, and investing in scientifically validated formulations. The ongoing trend towards natural and sustainable ingredients will also shape future product development. By capitalizing on these trends and navigating regulatory landscapes effectively, the South African nutraceuticals industry is well-positioned for significant and sustained growth in the coming years.

South Africa Nutraceuticals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Nutraceuticals Industry Segmentation By Geography

- 1. South Africa

South Africa Nutraceuticals Industry Regional Market Share

Geographic Coverage of South Africa Nutraceuticals Industry

South Africa Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rising Healthcare Costs and Focus on Preventive Health Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kellogg Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genesis Nutritional Product

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Red Bull GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Herbalife Nutrition

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascendis Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Nutraceuticals Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Nutraceuticals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the South Africa Nutraceuticals Industry?

Key companies in the market include Nestle SA, The Kellogg Company, Genesis Nutritional Product, Amway Corp, Danone SA, Red Bull GmbH, Herbalife Nutrition, The Coca-Cola Company, Ascendis Health*List Not Exhaustive, GlaxoSmithKline PLC.

3. What are the main segments of the South Africa Nutraceuticals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rising Healthcare Costs and Focus on Preventive Health Management.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the South Africa Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence