Key Insights

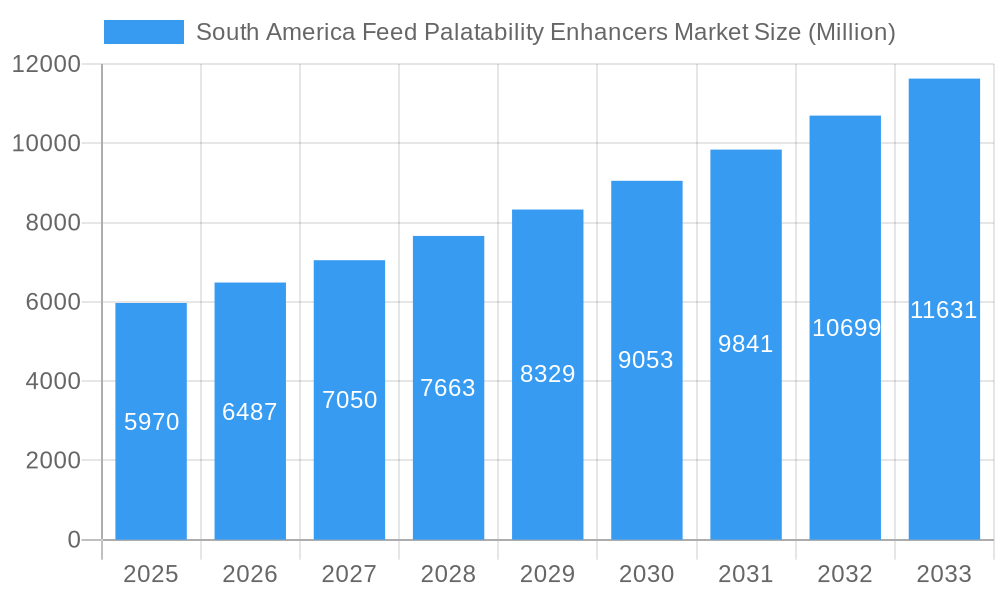

The South America Feed Palatability Enhancers Market is poised for significant expansion, projecting a market size of USD 5.97 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.7% throughout the forecast period of 2025-2033. Several key drivers are fueling this upward trajectory, including the escalating demand for enhanced animal nutrition to improve livestock productivity and health, driven by a growing global population and increased meat consumption in South America. Furthermore, the continuous innovation in palatability enhancer technologies, focusing on natural and sustainable ingredients, is attracting a wider customer base. The poultry and ruminant segments are expected to be major contributors to market revenue, owing to their substantial presence in the region's agricultural landscape. Advancements in feed formulation and processing techniques that leverage these enhancers to overcome feed refusal issues in challenging environmental conditions are also critical growth factors.

South America Feed Palatability Enhancers Market Market Size (In Billion)

Despite the optimistic outlook, certain restraints could temper the market's full potential. Fluctuations in raw material prices, particularly for natural ingredients, can impact the cost-effectiveness of palatability enhancers. Stringent regulatory landscapes concerning feed additives in different South American countries might also present challenges, requiring manufacturers to navigate complex approval processes. However, the market is actively addressing these concerns through strategic partnerships, backward integration for raw material sourcing, and a focus on developing cost-efficient solutions. The evolving consumer preference for ethically produced and high-quality animal products further incentivizes the adoption of feed palatability enhancers that contribute to healthier livestock and improved end-product quality, thus creating a favorable environment for sustained market growth.

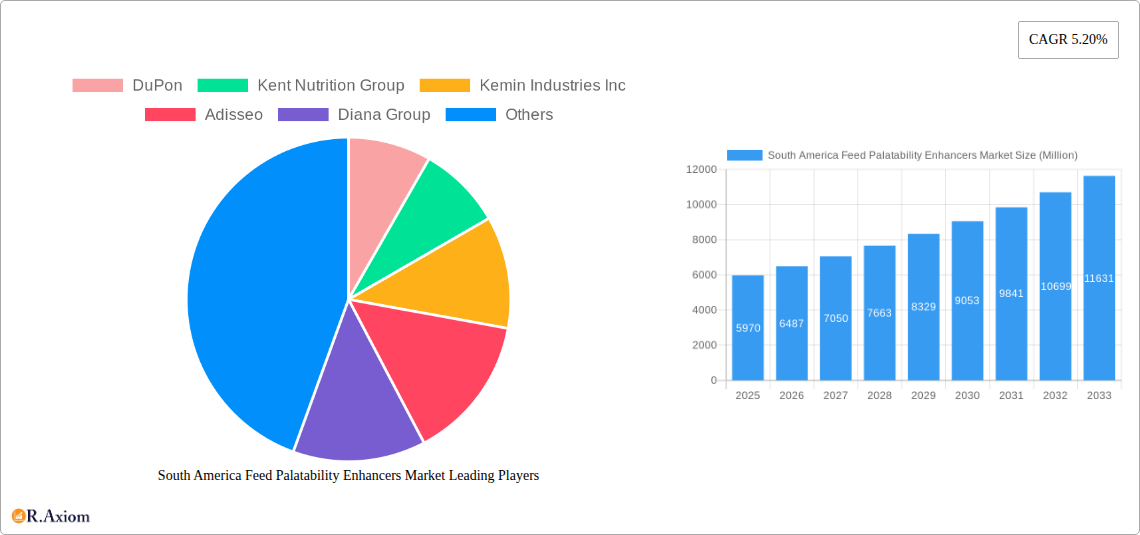

South America Feed Palatability Enhancers Market Company Market Share

This in-depth market research report offers a detailed examination of the South America Feed Palatability Enhancers Market, providing critical insights into its current landscape, historical performance, and future trajectory. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report is an indispensable tool for stakeholders seeking to understand market dynamics, identify growth opportunities, and devise effective strategies. The report leverages high-traffic keywords such as "animal feed additives," "feed ingredients," "poultry feed enhancers," "swine feed palatability," "ruminant feed supplements," "aquaculture feed solutions," and "South America animal nutrition" to ensure maximum search visibility.

The global feed palatability enhancers market is experiencing robust growth driven by increasing demand for high-quality animal protein and advancements in animal nutrition. South America, with its significant livestock population and growing agricultural sector, represents a crucial and expanding market for these essential feed additives. This report delves into the intricate workings of this market, analyzing key segments, influential players, and prevailing trends.

South America Feed Palatability Enhancers Market Market Concentration & Innovation

The South America Feed Palatability Enhancers Market exhibits a moderate level of concentration, with a few key global players dominating significant market share alongside several regional and specialized manufacturers. DuPont, Kent Nutrition Group, Kemin Industries Inc., Adisseo, Diana Group, Pancosma, Kerry Inc., and Tanke International Group are prominent companies shaping the competitive landscape. Innovation remains a critical driver, fueled by a growing understanding of animal physiology and the increasing emphasis on feed efficiency and animal welfare. Regulatory frameworks, while evolving, are generally supportive of feed additive advancements aimed at improving animal health and reducing environmental impact. Product substitutes exist, primarily in the form of alternative feed formulations or management practices, but the efficacy and cost-effectiveness of dedicated palatability enhancers often give them a competitive edge. End-user trends are increasingly geared towards natural and sustainable feed solutions, pushing manufacturers to develop novel, high-performance products. Mergers and acquisitions (M&A) activity, with reported deal values in the range of hundreds of millions to billions of dollars, indicates strategic consolidation and expansion efforts by leading entities to enhance their product portfolios and geographical reach. The market share of the top players is estimated to be between 55% and 65% in 2025, highlighting the competitive dynamics.

South America Feed Palatability Enhancers Market Industry Trends & Insights

The South America Feed Palatability Enhancers Market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% projected for the forecast period. This expansion is primarily fueled by the burgeoning demand for animal protein across the region, driven by population growth, rising disposable incomes, and evolving dietary preferences. Farmers are increasingly recognizing the critical role of feed palatability in optimizing feed intake, improving nutrient absorption, and consequently, enhancing animal growth rates and overall health. Technological disruptions, including advancements in sensory science and the development of novel flavoring and sweetening agents, are continuously reshaping product offerings, making them more effective and tailored to specific animal needs. Consumer preferences are also indirectly influencing the market, with a growing awareness of animal welfare and sustainable farming practices encouraging the adoption of feed solutions that promote healthier animals and reduce waste. Competitive dynamics are intensifying, with established players investing heavily in research and development to introduce innovative products that offer superior palatability, improved digestibility, and enhanced nutritional value. Market penetration is expected to deepen across all animal segments, with significant opportunities in poultry and swine production, which are central to South America's agricultural output. The estimated market size in 2025 is approximately $1.8 billion, with projections to reach over $3.5 billion by 2033. The increasing focus on feed conversion ratios (FCR) and the economic benefits derived from improved animal performance are compelling drivers for the adoption of feed palatability enhancers. Furthermore, the development of specific enhancers for aquaculture and ruminants, catering to the unique dietary requirements of these animals, is contributing to market diversification.

Dominant Markets & Segments in South America Feed Palatability Enhancers Market

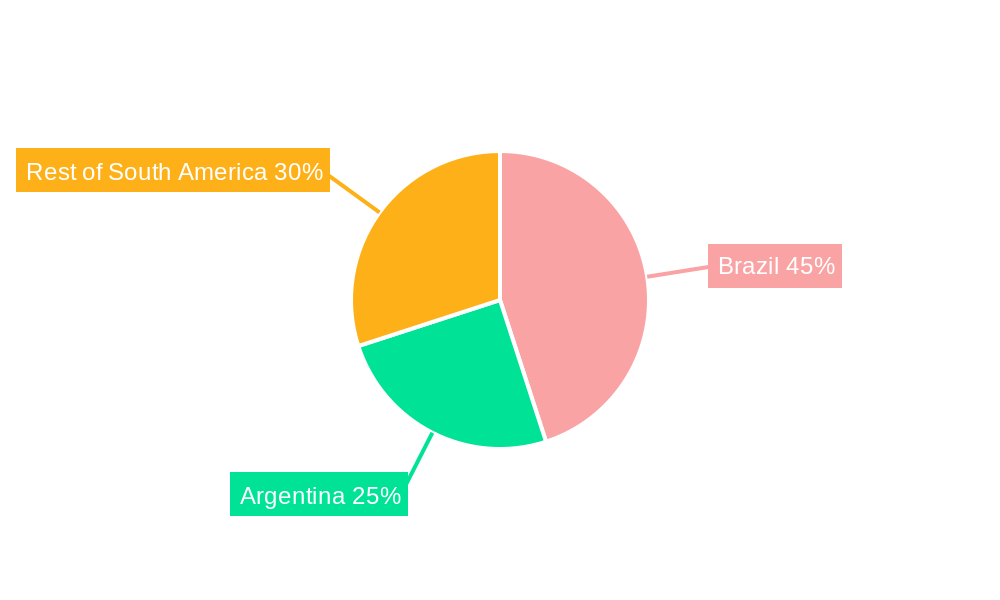

Dominant Region and Country: Brazil is anticipated to be the dominant market within South America for feed palatability enhancers, owing to its extensive livestock population, particularly in poultry and swine production, and its status as a major global exporter of agricultural commodities. Argentina also presents a significant market, driven by its strong beef and dairy industries, and increasing poultry production. The "Rest of South America" segment, encompassing countries like Colombia, Peru, and Chile, is expected to exhibit robust growth as their animal agriculture sectors mature.

Dominant Segments:

Type: Flavors: Flavors are projected to hold the largest market share, accounting for an estimated 45% of the market in 2025. Their broad applicability across various animal types and their ability to mask off-flavors in feed ingredients make them a cornerstone of palatability enhancement.

- Key Drivers: Increasing demand for species-specific flavor profiles, advancements in encapsulation technologies for sustained release, and the development of natural flavoring agents.

Type: Sweeteners: Sweeteners are expected to capture a significant market share of approximately 35% in 2025. They play a crucial role in improving the palatability of feed, particularly for young animals and those with developing palates.

- Key Drivers: Growing adoption of cost-effective artificial sweeteners and the trend towards natural sweeteners derived from sources like stevia and monk fruit, driven by consumer demand for cleaner labels.

Type: Aroma Enhancers: Aroma enhancers, while a smaller segment at around 20% market share in 2025, are gaining traction due to their ability to stimulate appetite and improve feed intake, especially in challenging feed conditions or for stressed animals.

- Key Drivers: Innovations in creating more potent and attractive aroma compounds, and their increasing use in specialized feed formulations for critical life stages of animals.

Animal Type: Poultry: Poultry is expected to be the largest animal segment, comprising an estimated 40% of the market in 2025. The high volume of poultry production in South America and the industry's focus on feed efficiency and rapid growth make it a prime market for palatability enhancers.

- Key Drivers: Intense competition in the poultry sector driving the need for optimized feed intake, advancements in starter feeds requiring high palatability, and the economic benefits of improved FCR.

Animal Type: Swine: Swine represent the second-largest segment, accounting for approximately 30% of the market in 2025. Similar to poultry, the efficiency and profitability of swine farming are heavily reliant on optimal feed consumption.

- Key Drivers: Focus on improving sow productivity, enhancing piglet growth rates, and managing feed intake during critical nursery and finishing phases.

Animal Type: Ruminants: The ruminant segment, including cattle and sheep, is a significant and growing market, projected to hold around 15% share in 2025. Palatability enhancers are crucial for improving forage intake and the efficiency of concentrate feeding.

- Key Drivers: Increasing demand for beef and dairy products, strategies to improve feed utilization in extensive grazing systems, and the development of specialized enhancers for calf and dairy cow diets.

Animal Type: Aquaculture: Aquaculture is an emerging segment with high growth potential, expected to represent 10% of the market in 2025. As aquaculture operations expand in South America, the demand for specialized feed solutions, including palatability enhancers, is rising.

- Key Drivers: Growth in farmed fish and shrimp production, the need for high-quality feed to ensure rapid growth and disease resistance, and the development of species-specific enhancers.

Animal Type: Other Animal Types: This segment, including pets and other minor livestock, is anticipated to account for around 5% of the market in 2025, with potential for niche growth.

South America Feed Palatability Enhancers Market Product Developments

Product development in the South America Feed Palatability Enhancers Market is characterized by a focus on natural ingredients, enhanced efficacy, and tailored solutions for specific animal needs. Innovations in microencapsulation technology are enabling sustained release of flavors and aromas, ensuring prolonged palatability and improved feed intake. Companies are also investing in research to understand the complex sensory perceptions of different animal species, leading to the development of highly targeted flavor profiles and aroma compounds. The demand for cleaner label products is driving the exploration of natural sweeteners and flavor enhancers derived from plant-based sources. These advancements contribute to improved animal performance, reduced feed wastage, and ultimately, greater profitability for farmers, while also aligning with growing consumer interest in sustainable and ethically produced animal products.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the South America Feed Palatability Enhancers Market, segmented by Type, Animal Type, and Geography.

- Segmentation by Type: The market is analyzed across Flavors, Sweeteners, and Aroma Enhancers. Each segment's growth trajectory, market size projections, and competitive dynamics are meticulously detailed. The Flavors segment is expected to lead, followed by Sweeteners and Aroma Enhancers.

- Segmentation by Animal Type: The analysis covers Ruminants, Poultry, Swine, Aquaculture, and Other Animal Types. Poultry and Swine are identified as the dominant animal segments due to the scale of their production. Growth projections and market penetration for each animal type are provided.

- Segmentation by Geography: The report focuses on Brazil, Argentina, and the Rest of South America, offering granular insights into the market dynamics within these key geographical regions. Market sizes and growth rates are estimated for each country and sub-region.

Key Drivers of South America Feed Palatability Enhancers Market Growth

The growth of the South America Feed Palatability Enhancers Market is propelled by several key factors. Firstly, the expanding global demand for animal protein, driven by population growth and increasing disposable incomes in emerging economies, directly translates to higher demand for livestock feed and, consequently, feed additives. Secondly, a growing awareness among livestock producers about the economic benefits of optimized feed intake, such as improved feed conversion ratios (FCR), faster growth rates, and reduced mortality, encourages the adoption of palatability enhancers. Technological advancements in developing more effective, species-specific, and cost-efficient palatability enhancers further fuel market expansion. Moreover, the increasing emphasis on animal welfare and sustainable farming practices aligns with the use of feed additives that promote animal health and reduce waste. Regulatory support for feed additive safety and efficacy in many South American countries also plays a crucial role.

Challenges in the South America Feed Palatability Enhancers Market Sector

Despite the promising growth prospects, the South America Feed Palatability Enhancers Market faces several challenges. Fluctuations in raw material prices, particularly for key ingredients used in the formulation of enhancers, can impact profitability and pricing strategies. Stringent and evolving regulatory landscapes in some countries regarding the approval and use of feed additives can create hurdles for market entry and product expansion. Intense competition from both global and local players necessitates continuous innovation and cost optimization. Supply chain disruptions, exacerbated by logistical complexities in vast geographical regions and occasional political instability, can affect the timely delivery of products and raw materials. Furthermore, a lack of widespread awareness or understanding among smaller-scale farmers regarding the benefits and proper application of feed palatability enhancers can limit market penetration in certain segments.

Emerging Opportunities in South America Feed Palatability Enhancers Market

The South America Feed Palatability Enhancers Market is ripe with emerging opportunities. The rapidly expanding aquaculture sector across the region presents a significant untapped market for specialized feed palatability enhancers tailored to the unique needs of various fish and shrimp species. The growing consumer demand for natural and sustainably sourced animal products is driving innovation towards the development of natural palatability enhancers derived from plant-based sources and fermentation by-products. Increased investment in research and development to create multifunctional feed additives that offer not only palatability but also health benefits, such as improved gut health or immune support, offers a significant avenue for growth. Furthermore, the digitalization of agriculture and the rise of precision farming present opportunities for developing data-driven solutions for feed optimization, including personalized palatability enhancement strategies. Expansion into underserved regions within South America and strategic partnerships with local feed manufacturers can unlock new market potential.

Leading Players in the South America Feed Palatability Enhancers Market Market

- DuPont

- Kent Nutrition Group

- Kemin Industries Inc.

- Adisseo

- Diana Group

- Pancosma

- Kerry Inc.

- Tanke International Group

Key Developments in South America Feed Palatability Enhancers Market Industry

- 2023/09: DuPont launched a new range of natural flavor solutions for animal feed, addressing growing demand for sustainable ingredients.

- 2023/05: Kemin Industries Inc. expanded its research and development facility in Brazil to focus on innovative animal nutrition solutions for the South American market.

- 2022/11: Adisseo announced a strategic partnership with a regional feed manufacturer to enhance its market presence in Argentina's poultry sector.

- 2022/07: Diana Group introduced a novel sweetener technology for young animal feeds, aiming to improve early growth and survival rates.

- 2021/12: Pancosma unveiled a new aroma enhancer designed to boost feed intake in challenging climatic conditions prevalent in some South American regions.

Strategic Outlook for South America Feed Palatability Enhancers Market Market

The strategic outlook for the South America Feed Palatability Enhancers Market is overwhelmingly positive, characterized by sustained growth and evolving innovation. Key growth catalysts include the region's robust animal agriculture expansion, driven by both domestic consumption and export demand. Companies that focus on developing natural, sustainable, and highly effective palatability enhancers will be well-positioned to capture market share. Strategic investments in research and development, coupled with targeted market penetration strategies, particularly in the burgeoning aquaculture and specialized ruminant segments, will be crucial. Furthermore, leveraging digital technologies for data-driven insights into animal nutrition and optimizing supply chains will enhance competitiveness. The market is expected to see continued consolidation and strategic alliances as players seek to broaden their product portfolios and geographical reach, ensuring long-term success in this dynamic sector.

South America Feed Palatability Enhancers Market Segmentation

-

1. Type

- 1.1. Flavors

- 1.2. Sweeteners

- 1.3. Aroma Enhancers

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Palatability Enhancers Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Palatability Enhancers Market Regional Market Share

Geographic Coverage of South America Feed Palatability Enhancers Market

South America Feed Palatability Enhancers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Animal Sourced Proteins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.2. Sweeteners

- 5.1.3. Aroma Enhancers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flavors

- 6.1.2. Sweeteners

- 6.1.3. Aroma Enhancers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flavors

- 7.1.2. Sweeteners

- 7.1.3. Aroma Enhancers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flavors

- 8.1.2. Sweeteners

- 8.1.3. Aroma Enhancers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 DuPon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Kent Nutrition Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kemin Industries Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Adisseo

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Diana Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Pancosma

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kerry Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tanke International Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 DuPon

List of Figures

- Figure 1: South America Feed Palatability Enhancers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Palatability Enhancers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Palatability Enhancers Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the South America Feed Palatability Enhancers Market?

Key companies in the market include DuPon, Kent Nutrition Group, Kemin Industries Inc, Adisseo, Diana Group, Pancosma, Kerry Inc, Tanke International Group.

3. What are the main segments of the South America Feed Palatability Enhancers Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Animal Sourced Proteins.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Palatability Enhancers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Palatability Enhancers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Palatability Enhancers Market?

To stay informed about further developments, trends, and reports in the South America Feed Palatability Enhancers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence