Key Insights

The South American nutraceuticals market is poised for significant expansion. Projected to reach $523.2 billion by 2025, the market is driven by heightened consumer health awareness, growing disposable incomes, and an aging demographic. With a projected Compound Annual Growth Rate (CAGR) of 10.4% from 2025 to 2033, sustained market growth is anticipated. Key growth catalysts include the increasing incidence of chronic conditions such as diabetes and cardiovascular disease, stimulating demand for preventative health solutions. The expanding availability of functional foods, beverages, dietary supplements, and e-commerce platforms further enhances market accessibility and sales. Brazil and Argentina are identified as primary market contributors due to their substantial economies and populations. However, market expansion may face headwinds from regional economic volatility and evolving regulatory frameworks for product claims and ingredient approvals. Market segmentation by product category (functional foods, beverages, supplements) and distribution channels (specialty outlets, retail, online) offers strategic opportunities for targeted product development and marketing initiatives to address diverse consumer needs.

South America Nutraceuticals Market Market Size (In Billion)

The forecast period from 2025 to 2033 indicates a robust growth trajectory for the South American nutraceuticals sector. Strategic market expansions by key industry participants, combined with escalating consumer understanding of nutraceutical benefits, are expected to drive market expansion. Manufacturers must adeptly manage diverse regulatory environments and cater to consumer preferences for natural and sustainably sourced ingredients. Prioritizing research and development for innovative product formulations and leveraging digital marketing strategies are vital for enduring success in this dynamic market. The escalating focus on preventative healthcare and personalized nutrition will continue to shape the future of this burgeoning market segment.

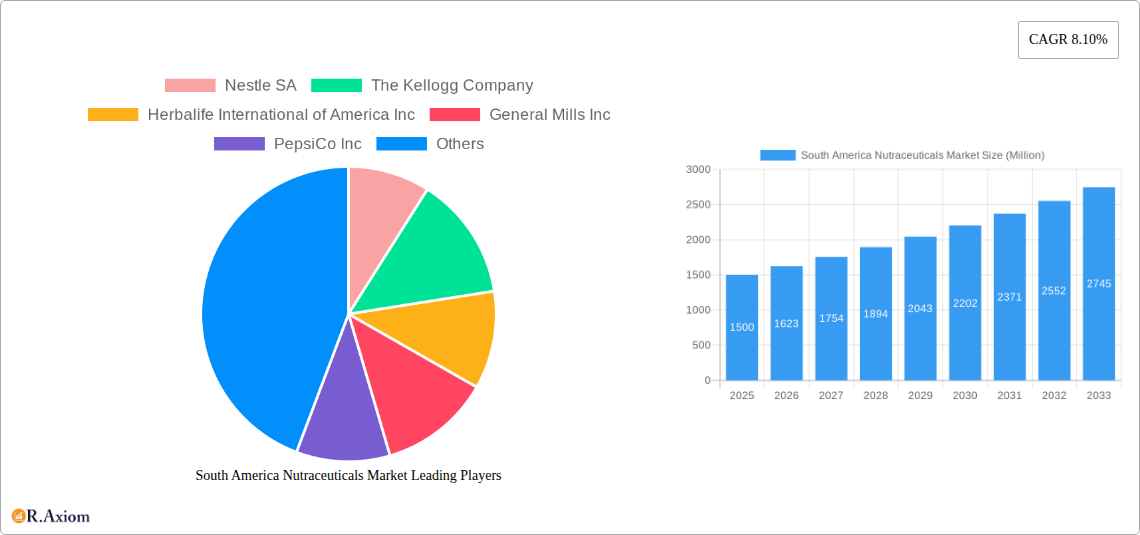

South America Nutraceuticals Market Company Market Share

South America Nutraceuticals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Nutraceuticals Market, offering invaluable insights for stakeholders seeking to navigate this dynamic and rapidly growing sector. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. Key players analyzed include Nestle SA, The Kellogg Company, Herbalife International of America Inc, General Mills Inc, PepsiCo Inc, Red Bull GmbH, Amway Corp, Pfizer Inc, and others. The market is segmented by product type (Functional Food, Functional Beverages, Dietary Supplements) and distribution channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels).

South America Nutraceuticals Market Market Concentration & Innovation

The South American nutraceuticals market exhibits a moderately concentrated landscape, with a few large multinational corporations holding significant market share. Nestle SA and PepsiCo Inc., for example, command approximately xx% and xx% respectively, driven by their established brand recognition and extensive distribution networks. However, a considerable number of smaller, regional players also contribute significantly to the overall market size, particularly in the dietary supplement segment. Innovation is primarily driven by consumer demand for specialized products catering to specific health needs, such as immunity boosting supplements and products targeting digestive health.

The regulatory framework varies across South American countries, influencing product registration and labeling requirements. This creates both opportunities and challenges for companies. While some nations have stringent regulations, others provide a more lenient environment for market entry. Product substitutes, mainly in the form of traditional herbal remedies and functional foods, exert competitive pressure. Furthermore, M&A activities are increasing, with deal values averaging around $xx Million in recent years, signaling consolidation within the industry. This activity is fueled by the desire to expand product portfolios, access new markets, and enhance brand presence.

- Market Share: Nestle SA (xx%), PepsiCo Inc. (xx%), Others (xx%)

- Average M&A Deal Value (2019-2024): $xx Million

- Key Innovation Drivers: Growing consumer health awareness, increasing demand for specialized products, technological advancements in product formulation.

South America Nutraceuticals Market Industry Trends & Insights

The South American nutraceuticals market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This expansion is propelled by several key factors. Rising disposable incomes, especially in urban areas, are enabling consumers to spend more on health and wellness products. Increasing awareness about the benefits of nutraceuticals for disease prevention and improved well-being is also driving market demand. Technological advancements, particularly in product formulation and delivery systems, are leading to the development of more effective and appealing products.

Consumer preferences are shifting towards natural and organic products, as well as products with specific functional benefits, like enhanced immunity or improved cognitive function. This is creating opportunities for companies that can offer products meeting these criteria. The competitive landscape is dynamic, with both established players and emerging brands vying for market share. Market penetration of nutraceuticals is still relatively low compared to developed nations, representing a substantial growth opportunity. Digital marketing and e-commerce platforms are transforming the way nutraceuticals are marketed and sold, leading to increased accessibility and convenience for consumers. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular diseases, further fuels the demand for nutraceuticals.

Dominant Markets & Segments in South America Nutraceuticals Market

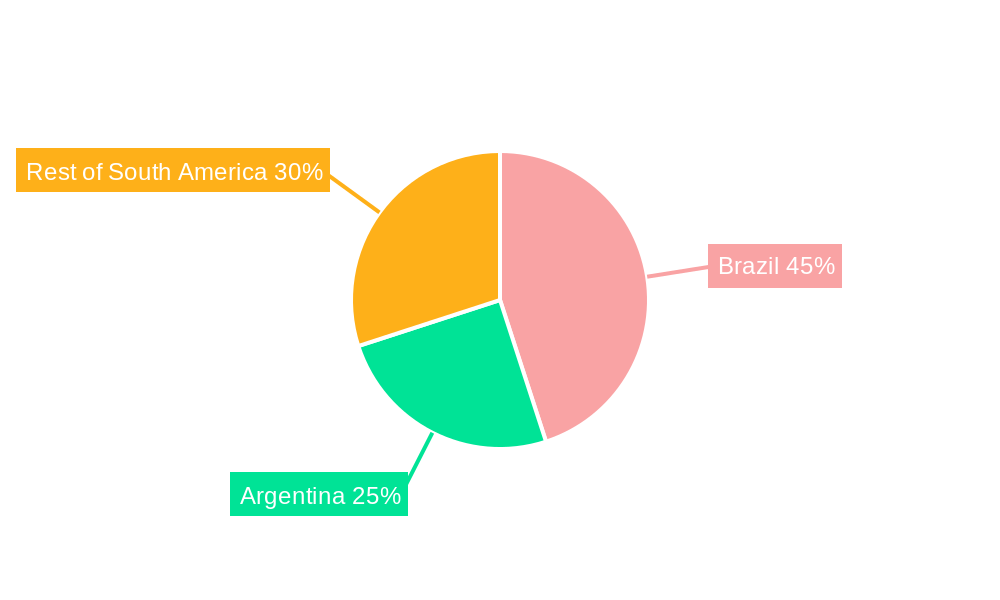

Brazil stands as the dominant market within South America, accounting for approximately xx% of the total market value. Its large population, rising middle class, and relatively developed healthcare infrastructure contribute to this dominance. Other significant markets include Argentina, Colombia, and Chile, but growth rates in Peru and Mexico show significant upward trends.

- Dominant Segment (Type): Functional Beverages are showing the highest growth rates.

- Dominant Segment (Distribution Channel): Supermarkets/Hypermarkets maintain the largest share due to ease of access.

Key Drivers for Brazil's Dominance:

- Large and growing population

- Increasing disposable incomes

- Favorable government regulations

- Well-established distribution networks

Other Countries: Argentina, Colombia, and Chile exhibit robust growth based on increasing awareness of health benefits. Peru and Mexico present significant emerging opportunities due to rapid economic expansion and rising health consciousness.

South America Nutraceuticals Market Product Developments

Recent product innovations focus on improved bioavailability, enhanced taste and texture, and customized formulations targeting specific demographics and health needs. Functional beverages, in particular, are witnessing significant innovation with the incorporation of novel ingredients and delivery systems (e.g., functional shots, powdered mixes). Technological advancements such as nanotechnology and precision fermentation are enabling the creation of more effective and personalized nutraceutical products. The increasing emphasis on natural and organic ingredients enhances market fit and caters to consumer preferences.

Report Scope & Segmentation Analysis

This report segments the South America nutraceuticals market by product type (Functional Food, Functional Beverages, Dietary Supplements) and distribution channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores, Other Distribution Channels).

- Functional Food: This segment shows steady growth driven by increased awareness of healthy eating habits.

- Functional Beverages: This segment is growing fastest due to consumer preference for convenient formats.

- Dietary Supplements: This segment experiences moderate growth driven by demand for targeted health benefits.

- Specialty Stores: This channel demonstrates high average order values due to its specialized nature.

- Supermarkets/Hypermarkets: This remains the dominant distribution channel due to its accessibility.

- Convenience Stores: Show consistent growth in high-traffic areas.

- Drug Stores/Pharmacies: Growth is steady, driven by the health-conscious consumers who seek expert advice.

- Online Retail Stores: The e-commerce sector exhibits high growth, with expanding platforms offering broader product selection and home delivery.

- Other Distribution Channels: This segment includes smaller retailers and direct-to-consumer sales.

Each segment's market size, growth projections, and competitive dynamics are extensively analyzed in the full report.

Key Drivers of South America Nutraceuticals Market Growth

Several factors fuel the South America nutraceuticals market's growth. Firstly, the rising prevalence of chronic diseases necessitates preventive healthcare measures, boosting demand for nutraceuticals. Secondly, increasing disposable incomes provide greater purchasing power among the population. Thirdly, shifting consumer preferences towards convenient and health-conscious choices are driving adoption. Finally, technological advancements continuously enhance product efficacy and appeal.

Challenges in the South America Nutraceuticals Market Sector

The South American nutraceuticals market faces challenges, including regulatory variations across countries, creating compliance complexities. Supply chain issues can impact product availability and pricing, particularly for imported ingredients. Intense competition from both established multinational companies and smaller local players requires strong branding and product differentiation. Lastly, consumer skepticism towards certain product claims may hinder market penetration.

Emerging Opportunities in South America Nutraceuticals Market

Emerging opportunities exist in the growth of personalized nutrition, targeting specific genetic profiles or dietary needs. The growing demand for products with proven efficacy will drive innovation in product formulations and clinical studies. The expansion of e-commerce and digital marketing provides new avenues for reaching consumers. Finally, focusing on sustainable and ethically sourced ingredients enhances market appeal and brand image.

Leading Players in the South America Nutraceuticals Market Market

Key Developments in South America Nutraceuticals Market Industry

- January 2023: Nestle SA launched a new line of plant-based protein shakes targeting the health-conscious consumer.

- March 2022: PepsiCo Inc. acquired a local functional beverage company in Brazil, expanding its market presence.

- June 2021: Herbalife International of America Inc. invested in a new manufacturing facility in Colombia to increase production capacity.

- (Further key developments will be included in the full report)

Strategic Outlook for South America Nutraceuticals Market Market

The South America nutraceuticals market presents significant long-term growth potential. Continued investment in research and development, coupled with effective marketing strategies targeting health-conscious consumers, will be crucial for success. The increasing adoption of e-commerce and the focus on personalized nutrition will shape market trends. Companies that adapt to evolving consumer preferences and effectively address regulatory hurdles will be well-positioned to capitalize on this promising market.

South America Nutraceuticals Market Segmentation

-

1. Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverages

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Nutraceuticals Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Nutraceuticals Market Regional Market Share

Geographic Coverage of South America Nutraceuticals Market

South America Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Low-Sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Rising Demand for Functional Snacks in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverages

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Functional Food

- 6.1.1.1. Cereals

- 6.1.1.2. Bakery and Confectionery

- 6.1.1.3. Dairy

- 6.1.1.4. Snacks

- 6.1.1.5. Other Functional Foods

- 6.1.2. Functional Beverages

- 6.1.2.1. Energy Drinks

- 6.1.2.2. Sports Drinks

- 6.1.2.3. Fortified Juice

- 6.1.2.4. Dairy and Dairy Alternative Beverages

- 6.1.2.5. Other Functional Beverages

- 6.1.3. Dietary Supplements

- 6.1.3.1. Vitamins

- 6.1.3.2. Minerals

- 6.1.3.3. Botanicals

- 6.1.3.4. Enzymes

- 6.1.3.5. Fatty Acids

- 6.1.3.6. Proteins

- 6.1.3.7. Other Dietary Supplements

- 6.1.1. Functional Food

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Specialty Stores

- 6.2.2. Supermarkets/Hypermarkets

- 6.2.3. Convenience Stores

- 6.2.4. Drug Stores/Pharmacies

- 6.2.5. Online Retail Stores

- 6.2.6. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Functional Food

- 7.1.1.1. Cereals

- 7.1.1.2. Bakery and Confectionery

- 7.1.1.3. Dairy

- 7.1.1.4. Snacks

- 7.1.1.5. Other Functional Foods

- 7.1.2. Functional Beverages

- 7.1.2.1. Energy Drinks

- 7.1.2.2. Sports Drinks

- 7.1.2.3. Fortified Juice

- 7.1.2.4. Dairy and Dairy Alternative Beverages

- 7.1.2.5. Other Functional Beverages

- 7.1.3. Dietary Supplements

- 7.1.3.1. Vitamins

- 7.1.3.2. Minerals

- 7.1.3.3. Botanicals

- 7.1.3.4. Enzymes

- 7.1.3.5. Fatty Acids

- 7.1.3.6. Proteins

- 7.1.3.7. Other Dietary Supplements

- 7.1.1. Functional Food

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Specialty Stores

- 7.2.2. Supermarkets/Hypermarkets

- 7.2.3. Convenience Stores

- 7.2.4. Drug Stores/Pharmacies

- 7.2.5. Online Retail Stores

- 7.2.6. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Functional Food

- 8.1.1.1. Cereals

- 8.1.1.2. Bakery and Confectionery

- 8.1.1.3. Dairy

- 8.1.1.4. Snacks

- 8.1.1.5. Other Functional Foods

- 8.1.2. Functional Beverages

- 8.1.2.1. Energy Drinks

- 8.1.2.2. Sports Drinks

- 8.1.2.3. Fortified Juice

- 8.1.2.4. Dairy and Dairy Alternative Beverages

- 8.1.2.5. Other Functional Beverages

- 8.1.3. Dietary Supplements

- 8.1.3.1. Vitamins

- 8.1.3.2. Minerals

- 8.1.3.3. Botanicals

- 8.1.3.4. Enzymes

- 8.1.3.5. Fatty Acids

- 8.1.3.6. Proteins

- 8.1.3.7. Other Dietary Supplements

- 8.1.1. Functional Food

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Specialty Stores

- 8.2.2. Supermarkets/Hypermarkets

- 8.2.3. Convenience Stores

- 8.2.4. Drug Stores/Pharmacies

- 8.2.5. Online Retail Stores

- 8.2.6. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 The Kellogg Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Herbalife International of America Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 General Mills Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 PepsiCo Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Red Bull GmbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Amway Corp *List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Pfizer Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: South America Nutraceuticals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Nutraceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: South America Nutraceuticals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Nutraceuticals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Nutraceuticals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Nutraceuticals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Nutraceuticals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Nutraceuticals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Nutraceuticals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Nutraceuticals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Nutraceuticals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Nutraceuticals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Nutraceuticals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Nutraceuticals Market?

The projected CAGR is approximately 10.4%.

2. Which companies are prominent players in the South America Nutraceuticals Market?

Key companies in the market include Nestle SA, The Kellogg Company, Herbalife International of America Inc, General Mills Inc, PepsiCo Inc, Red Bull GmbH, Amway Corp *List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the South America Nutraceuticals Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 523.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Low-Sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Rising Demand for Functional Snacks in the Region.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the South America Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence