Key Insights

The South American probiotic market, valued at approximately $3.49 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 9.1% from 2025 to 2033. This expansion is driven by increasing consumer awareness of gut health and its link to overall well-being, alongside the rising prevalence of digestive disorders and the adoption of functional foods. Enhanced product accessibility through diverse retail channels further supports market growth. Brazil and Argentina are key markets due to their substantial populations and growing disposable incomes. Food and beverages dominate product segments, followed by dietary supplements and animal feed. Innovations in formulations and strategic partnerships are expected to fuel future expansion.

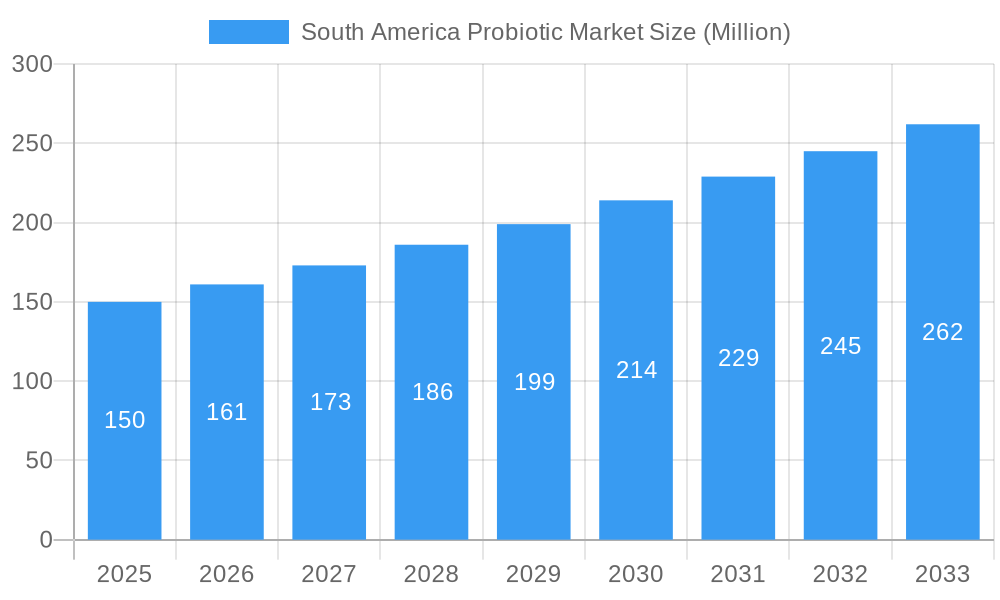

South America Probiotic Market Market Size (In Billion)

Potential challenges include the premium pricing of probiotic products and concerns regarding efficacy and safety, compounded by varied regulatory landscapes. Despite these hurdles, the burgeoning health and wellness sector in South America, coupled with mounting scientific validation of probiotic benefits, indicates a promising market trajectory. Expanding distribution networks, particularly in underserved regions, and targeted marketing emphasizing health advantages will be critical for sustained success.

South America Probiotic Market Company Market Share

South America Probiotic Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America probiotic market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report meticulously examines market dynamics, segmentation, competitive landscape, and future growth potential, leveraging robust data and forecasting methodologies. It offers actionable intelligence to navigate the complexities of this rapidly evolving market.

South America Probiotic Market Market Concentration & Innovation

This section analyzes the competitive landscape of the South America probiotic market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderate level of concentration, with key players like Nestlé SA, Danone, and Yakult Honsha Co Ltd holding significant market share. However, smaller, specialized companies are also emerging, particularly focusing on niche probiotic applications.

- Market Share: Nestlé SA holds an estimated xx% market share in 2025, followed by Danone with xx% and Yakult Honsha with xx%. The remaining market share is distributed among other players including FrieslandCampina, Fonterra and PepsiCo (Kevita) .

- Innovation Drivers: Growing consumer awareness of gut health, increasing demand for functional foods and beverages, and advancements in probiotic strain development are driving innovation.

- Regulatory Framework: The regulatory environment varies across South American countries, influencing product approvals and labeling requirements. Harmonization efforts are underway but inconsistencies remain.

- Product Substitutes: Other dietary supplements focusing on gut health, prebiotics, and certain functional foods pose some level of substitution threat.

- End-User Trends: Consumers are increasingly seeking probiotics with specific health benefits, such as improved immunity, digestive health, and mental well-being.

- M&A Activities: The past five years have witnessed xx M&A deals in the South American probiotic market, totaling approximately xx Million in value. These deals primarily involved acquisitions of smaller probiotic companies by larger food and beverage conglomerates.

South America Probiotic Market Industry Trends & Insights

The South American probiotic market exhibits robust growth, driven by factors such as rising disposable incomes, increasing health consciousness, and expanding distribution networks. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration of probiotic products is currently estimated at xx% and is expected to increase significantly over the forecast period, primarily driven by increased consumer awareness regarding the benefits of probiotics for overall wellness and gut health. Technological disruptions, such as advancements in microencapsulation and strain identification, are improving the efficacy and shelf life of probiotic products. This report also examines shifts in consumer preferences, such as increasing demand for organic and natural probiotics, impacting product development strategies. The competitive dynamics involve intense rivalry, with established players and emerging companies vying for market share through product innovation, branding, and strategic partnerships.

Dominant Markets & Segments in South America Probiotic Market

Brazil is the dominant market within South America for probiotics, representing approximately xx% of the total market value in 2025. This dominance is attributed to factors including its large population, high growth potential in the consumer food and beverage industry, and the increasing purchasing power of its middle class. Other significant markets include Argentina, Colombia, and Chile. The Food and Beverage segment leads the product type category with a market share of approximately xx% in 2025, reflecting the ease of integration of probiotics into many common food items. Supermarkets/Hypermarkets are the leading distribution channel, capturing over xx% of sales in 2025 due to their extensive reach and brand recognition, facilitating greater access for the consumer base.

- Key Drivers for Brazil:

- Large and growing middle class

- Increasing health awareness

- Robust food and beverage industry

- Expanding distribution networks

- Key Drivers for Supermarkets/Hypermarkets:

- Wide reach and accessibility

- Established brand presence

- Consumer familiarity and trust

South America Probiotic Market Product Developments

Recent product innovations in the South America probiotic market include the development of novel probiotic strains with enhanced efficacy and stability, as well as the incorporation of probiotics into a wider range of food and beverage products, including yogurts, fermented drinks, and functional foods. Technological advancements such as microencapsulation are improving probiotic survival during processing and shelf life, expanding product applications and addressing previous limitations. These developments are leading to increased consumer acceptance and expanding market penetration for probiotic products.

Report Scope & Segmentation Analysis

This report segments the South America probiotic market based on product type (Food and Beverage, Dietary Supplements, Animal Feed) and distribution channel (Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Others). The Food and Beverage segment is projected to witness the highest growth rate, driven by the increasing demand for functional foods and beverages. Dietary Supplements are expected to follow a similar upward trajectory fueled by the growing awareness of health benefits. The Animal Feed segment shows modest growth potential in line with increased demand for animal health products. Supermarkets/Hypermarkets are expected to maintain their dominant position within the distribution channel due to their accessibility and scale, while e-commerce channels show an increase in growth potential.

Key Drivers of South America Probiotic Market Growth

The South American probiotic market's growth is fueled by several key factors. Rising health consciousness among consumers is driving demand for products with added health benefits. The increasing prevalence of digestive disorders and the growing understanding of the gut-brain axis are boosting interest in probiotic products. Government initiatives promoting health and wellness further support market expansion. Technological advancements in probiotic strain development and product formulation enhance the efficacy and shelf life of products, thereby bolstering consumer confidence and market growth.

Challenges in the South America Probiotic Market Sector

The South American probiotic market faces challenges such as regulatory variations across different countries, creating complexities in product approvals and labeling. Supply chain inefficiencies and infrastructure limitations can hamper product distribution and availability, particularly in remote areas. Intense competition among established players and emerging companies necessitates continuous innovation and strong marketing strategies to maintain market share. The high cost of research and development of new probiotic strains can be an entry barrier, particularly for smaller companies.

Emerging Opportunities in South America Probiotic Market

Significant opportunities exist in expanding into less penetrated markets within South America. Growing demand for personalized nutrition and functional foods offers potential for specialized probiotic products tailored to specific health needs and consumer segments. The integration of probiotics into innovative food and beverage formats, such as plant-based products and beverages, offers avenues for growth. Technological advancements, particularly in areas such as microencapsulation and precision fermentation, present opportunities for enhancing the efficacy and stability of probiotic products.

Leading Players in the South America Probiotic Market Market

Key Developments in South America Probiotic Market Industry

- 2022 Q4: Nestlé SA launched a new line of probiotic yogurts in Brazil, targeting the health-conscious consumer segment.

- 2023 Q1: Danone acquired a small probiotic company in Argentina, expanding its product portfolio and distribution network.

- 2023 Q3: A new regulation on probiotic labeling was implemented in Chile, impacting marketing and product claims. (Further details on specific developments throughout the historical and forecast period would be included in the full report)

Strategic Outlook for South America Probiotic Market Market

The South America probiotic market is poised for substantial growth, driven by favorable demographic trends, rising health awareness, and technological advancements. Strategic investments in research and development, expansion into new markets, and focus on innovative product development are crucial for success. Companies need to leverage effective marketing and branding strategies to build consumer trust and drive sales. The increasing adoption of e-commerce channels presents opportunities to reach broader consumer segments and expand market reach. A focus on sustainability and natural ingredients will also increase consumer preference and brand loyalty.

South America Probiotic Market Segmentation

-

1. Product Type

-

1.1. Food and Beverage

- 1.1.1. Dairy Products

- 1.1.2. Fermented Food Products

- 1.1.3. Non-Alcoholic Beverages

- 1.1.4. Other Products

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

1.1. Food and Beverage

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Probiotic Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Probiotic Market Regional Market Share

Geographic Coverage of South America Probiotic Market

South America Probiotic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Functional Food and Beverage Serve the Largest Probiotic Market in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food and Beverage

- 5.1.1.1. Dairy Products

- 5.1.1.2. Fermented Food Products

- 5.1.1.3. Non-Alcoholic Beverages

- 5.1.1.4. Other Products

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.1.1. Food and Beverage

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Food and Beverage

- 6.1.1.1. Dairy Products

- 6.1.1.2. Fermented Food Products

- 6.1.1.3. Non-Alcoholic Beverages

- 6.1.1.4. Other Products

- 6.1.2. Dietary Supplements

- 6.1.3. Animal Feed

- 6.1.1. Food and Beverage

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Pharmacies/Health Stores

- 6.2.3. Convenience Stores

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Food and Beverage

- 7.1.1.1. Dairy Products

- 7.1.1.2. Fermented Food Products

- 7.1.1.3. Non-Alcoholic Beverages

- 7.1.1.4. Other Products

- 7.1.2. Dietary Supplements

- 7.1.3. Animal Feed

- 7.1.1. Food and Beverage

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Pharmacies/Health Stores

- 7.2.3. Convenience Stores

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Food and Beverage

- 8.1.1.1. Dairy Products

- 8.1.1.2. Fermented Food Products

- 8.1.1.3. Non-Alcoholic Beverages

- 8.1.1.4. Other Products

- 8.1.2. Dietary Supplements

- 8.1.3. Animal Feed

- 8.1.1. Food and Beverage

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Pharmacies/Health Stores

- 8.2.3. Convenience Stores

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Fonterra Cooperative Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Groupe Danone

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Yakult Honsha Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Friesland Campina

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 PepsiCo Inc (Kevita)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Chr Hansen

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: South America Probiotic Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Probiotic Market Share (%) by Company 2025

List of Tables

- Table 1: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Probiotic Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Probiotic Market?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the South America Probiotic Market?

Key companies in the market include Nestle SA, Fonterra Cooperative Group, Groupe Danone, Yakult Honsha Co Ltd, Friesland Campina, PepsiCo Inc (Kevita), Chr Hansen.

3. What are the main segments of the South America Probiotic Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Functional Food and Beverage Serve the Largest Probiotic Market in the region.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Probiotic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Probiotic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Probiotic Market?

To stay informed about further developments, trends, and reports in the South America Probiotic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence